Pursuant to this prospectus

supplement and the accompanying prospectus, we are offering to investors 2,576,600 ordinary shares of the Company (the “Shares”)

for a purchase price of $1.40 per share. This prospectus supplement and the accompanying prospectus cover the offer and sale

of Shares by the Company directly to five product distributors and business partners of the Company in China.

We expect that the delivery

of the securities being offered pursuant to this prospectus supplement and the accompanying prospectus will be made on or about October

25, 2022.

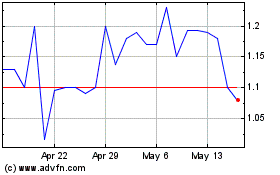

Our Ordinary Shares are listed

on the Nasdaq Capital Market under the symbol “JWEL”. On October 10, 2022, the last reported sale price of our ordinary shares

on Nasdaq was $1.49 per share.

We are an “emerging

growth company” as defined in the Jumpstart Our Business Act of 2012, as amended, and, as such, will be subject to reduced public

company reporting requirements.

We sell the securities offered

through this prospectus supplement and the accompanying prospectus directly to purchasers. See “Plan of Distribution” beginning

on page S-10 of this prospectus supplement for more information regarding these arrangements.

WHERE YOU CAN FIND

MORE INFORMATION

We are subject to the information

reporting requirements of the Exchange Act that are applicable to foreign private issuers, and, in accordance with these requirements,

we file annual and current reports and other information with the SEC. As a foreign private issuer, we are exempt from, among other things,

the rules under the Exchange Act prescribing the furnishing and content of proxy statements and our officers, directors and principal

shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act.

You may inspect, read (without charge) and copy the reports and other information we file with the SEC at the SEC’s Public Reference

Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room

by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website at www.sec.gov that contains our filed

reports and other information that we file electronically with the SEC.

This prospectus supplement

and the accompanying prospectus are only part of a registration statement on Form F-3 that we have filed with the SEC under the Securities

Act and therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the

registration statement that are excluded from this prospectus supplement and the accompanying prospectus, and you should refer to the

applicable exhibit or schedule for a complete description of any statement referring to any contract or other document. You may inspect

a copy of the registration statement, including the exhibits and schedules, without charge, at the public reference room or obtain a

copy from the SEC upon payment of the fees prescribed by the SEC.

We also maintain a website

at www.1juhao.com, through which you can access our SEC filings. The information contained on our website is not incorporated by reference

into, and does not form any part of, this prospectus supplement or the accompanying prospectus. We have included our website address

as a factual reference and do not intend it to be an active link to our website.

PROSPECTUS

Jowell Global Ltd.

$200,000,000

Ordinary Shares

Preferred Shares

Warrants

Rights and

Units

We may, from time to time

in one or more offerings, offer and sell up to $200,000,000 in the aggregate of Ordinary Shares, Preferred Shares, warrants to purchase

Ordinary Shares or Preferred Shares, rights or any combination of the foregoing, either individually or as units comprised of one or

more of the other securities. The prospectus supplement for each offering of securities will describe in detail the plan of distribution

for that offering. For general information about the distribution of securities offered, please see “Plan of Distribution”

in this prospectus.

This prospectus provides

a general description of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements

to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings.

The prospectus supplement and any related free writing prospectus may add, update or change information contained in this prospectus.

You should read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the

documents incorporated or deemed to be incorporated by reference, before you invest in any of our securities. This prospectus

may not be used to offer or sell any securities unless accompanied by the applicable prospectus supplement.

We are a Cayman Islands

holding company without material operations and our business is conducted by a variable interest entity (“VIE”) in China

and this structure involves unique risks to investors. We are not a Chinese operating company and that our business in China is conducted

through contractual arrangements with the VIE. However, the VIE agreements have not been truly tested in the courts in China. Chinese

regulatory authorities could disallow this structure, which would likely result in a material change in our operations and/or a material

change in the value of the securities that we are registering for sale, including that it could cause the value of such securities to

significantly decline or become worthless. See “Risk Factors— “If the Chinese government determines that

the contractual arrangements with the VIE do not comply with applicable regulations, our business could be adversely affected.”

and “Uncertainties and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance

notice could result in a material and negative impact on our business operations, decrease the value of our securities and limit the

legal protections available to you and us.”

There are legal and operational

risks associated with being based in and having our operations in China. Recently, the PRC government initiated a series of regulatory

actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities

in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure,

adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On July 6,

2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued

an announcement to crack down on illegal activities in the securities market and promote the high-quality development of the capital

market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement

and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system

of extraterritorial application of the PRC securities laws. On February 15, 2022, Cybersecurity Review Measures published by Cyberspace

Administration of China or the CAC, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry

of Public Security, Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State Administration

of Radio and Television, China Securities Regulatory Commission, State Secrecy Administration and State Cryptography Administration became

effective, which provides that, Critical Information Infrastructure Operators (“CIIOs”) that intend to purchase internet

products and services and Data Processing Operators (“DPOs”) engaging in data processing activities that affect or may affect

national security shall be subject to the cybersecurity review by the Cybersecurity Review Office. On November 14, 2021, CAC published

the Administration Measures for Cyber Data Security (Draft for Public Comments), or the “Cyber Data Security Measure (Draft)”,

which requires cyberspace operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity

review with the Office of Cybersecurity Review. On December 24, 2021, the CSRC released the Administrative Provisions of the State Council

Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) and the Management Rules Regarding

the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments). On April 2, 2022, the CSRC released the

Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies

(Draft for Comments), which provides that PRC issuers listing their securities on foreign stock exchanges need to file a notice to CSRC.

In the event that the above proposed provisions and rules are enacted, the relevant filing procedures of the CSRC and other governmental

authorities may be required in connection with this offering. As of the date of this prospectus, these new laws and guidelines have

not impacted the Company’s ability to conduct its business, accept foreign investments, or list and trade on a U.S. or other foreign

exchange as the Company has listed on Nasdaq before these laws take effect and the data processing activities by the VIE do not affect

national security; however, there are uncertainties in the interpretation and enforcement of these new laws and guidelines, which could

materially and adversely impact our business and financial outlook and may impact our ability to accept foreign investments or continue

to list on a U.S. or other foreign exchange. Any change in foreign investment regulations, and other policies in China or related enforcement

actions by China government could result in a material change in our operations and the value of our securities and could significantly

limit or completely hinder our ability to offer our securities to investors or cause the value of our securities to significantly decline

or be worthless. See “Risk Factors—Uncertainties and quick change in the interpretation and enforcement of Chinese laws

and regulations with little advance notice could result in a material and negative impact our business operations, decrease the value

of our securities and limit the legal protections available to you and us.”

The Holding Foreign Companies

Accountable Act, or the HFCA Act, was enacted on December 18, 2020. In accordance with the HFCA Act, trading in securities of any

registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited if

the PCAOB determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years beginning

in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On June 22, 2021, the U.S. Senate passed

the Accelerating Holding Foreign Companies Accountable Act (“Accelerating HFCAA”), which, if enacted, would amend the HFCA

Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject

to PCAOB inspections for two consecutive years instead of three. The Company’s auditor is headquartered in the U.S. and it is not

subject to the determinations announced by the Public Company Accounting Oversight Board (“PCAOB”)

on December 16, 2021, and Holding Foreign Companies Accountable Act and related regulations currently do not affect the Company as the

Company’s auditor is subject to PCAOB’s inspection on a regular basis. See “Risk Factors— The Holding Foreign

Companies Accountable Act, or the HFCA Act, and the related regulations including Accelerating HFCAA are evolving quickly. Further implementations

and interpretations of or amendments to the HFCA Act or the related regulations, or a PCOAB’s determination of its lack of sufficient

access to inspect our auditor, might pose regulatory risks to and impose restrictions on us because of our operations in mainland China.

A potential consequence is that our ordinary shares may be delisted by the exchange. The delisting of our ordinary shares, or the threat

of our ordinary shares being delisted, may materially and adversely affect the value of your investment. Additionally, the inability

of the PCAOB to conduct full inspections of our auditor deprives our investors of the benefits of such inspections.”

We are a holding

company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct a substantial

majority of our business through the operating VIE in China. The securities offered in this prospectus are securities of our Cayman

Islands holding company, and we do not have any equity ownership of the VIE, instead we are the primary beneficiary and receive the

economic benefits of the VIE’s business operations through certain contractual arrangements to consolidate financial results

of the VIE in our financial statements because we have satisfied conditions for consolidation of the VIE under U.S. GAAP, pursuant to which Shanghai Juhao is considered a VIE under the Statement

of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810 “Consolidation”,

because the equity investments in Shanghai Juhao no longer have the characteristics of a controlling financial interest, and the Company,

through Jowell Shanghai, is the primary beneficiary of Shanghai Juhao. A VIE is an entity that either has a total equity investment that is

insufficient to finance its activities without additional subordinated financial support, or whose equity investors lack the characteristics

of a controlling financial interest, such as through voting rights, right to receive the expected residual returns of the entity. The

variable interest holder, if any, that has a controlling financial interest in a VIE is deemed to be the primary beneficiary of, and must

consolidate, the VIE. Jowell Shanghai is deemed to have a controlling financial interest through a series of contractual arrangements

and be the primary beneficiary of Shanghai Juhao because it has both of the following characteristics: (1) the power to direct activities

at Shanghai Juhao that most significantly impact such entity’s economic performance and (2) the obligation to absorb losses of,

and the right to receive benefits from, Shanghai Juhao that could potentially be significant to such entity. Pursuant to the contractual

arrangements with Shanghai Juhao, Shanghai Juhao shall pay service fees equal to all of its net profit after tax payments to Jowell Shanghai.

Such contractual arrangements are designed so that the Shanghai Juhao would operate for the benefit of Jowell Shanghai and ultimately,

the Company. VIE

structure is used to provide investors with exposure to foreign investment in China-based companies where the business of the

operating companies in China might be prohibited or restricted for foreign investment now or in the future. The business operations

of the VIE include value-added telecommunication services and foreign ownership of value-added telecommunications services is

subject to restrictions under current PRC laws and regulations, which prohibit foreign investment to own more than 50% equity

interest of the value-added telecommunication companies and will prevent the holding company consolidating

the financial results of such entities under equity ownership structure. Investors of our ordinary shares will not own any equity interests in the

VIE and may never hold equity interests in our Chinese operating companies, but instead own shares of a Cayman Islands holding

company. We treat the VIE as our consolidated affiliated entities for accounting purposes under U.S. GAAP and not the entities in

which we own equity interest.

Under existing PRC foreign

exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange

transactions, can be made in foreign currencies without prior approval from State Administration of Foreign Exchange or SAFE by complying

with certain procedural requirements. Therefore, our WFOE is able to pay dividends in foreign currencies to us without prior approval

from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC

foreign exchange regulations, such as the overseas investment registrations by the shareholders of the Company who are PRC residents.

Approval from or registration with appropriate government authorities is, however, required where the RMB is to be converted into foreign

currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC

government may also at its discretion restrict access in the future to foreign currencies for current account transactions. For our Hong

Kong subsidiary and the holding company (“Non-PRC Entities”), there is no restrictions on foreign exchange for such entities

and they are able to transfer cash among these entities, across borders and to US investors. Also, there is no regulatory restrictions

and limitations on the abilities of Non-PRC Entities to distribute earnings from their businesses, including from subsidiaries to the

parent company or from the holding company to the U.S. investors as well as the abilities to settle amounts owed. However, to the extent

cash/assets in the business is in PRC/Hong Kong or our PRC/Hong Kong entity, the funds/assets may not be available to fund operations

or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability

of us, our subsidiaries, or the consolidated VIE by the PRC government to transfer cash/assets. See “Dividend Distribution and

Cash Transfer Between the Holding Company, Subsidiary and VIE.” on page 10, "Summary of risks related to our

corporate structure and having the majority of our operations in China” on page 15 and “Risk Factors—Uncertainties

and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance notice could result in a material

and negative impact our business operations, decrease the value of our securities and limit the legal protections available to you and

us.” on page 20. We are a holding company, and we may rely on dividends and other distributions on equity paid by our subsidiaries

for our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders

and service any debt we may incur. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing

the debt may restrict its ability to pay dividends or make other distributions to us. See “Item 3. Key Information — 3.D.

Risk Factors — Risks Related to Doing Business in China,” “— PRC regulation of loans to and

direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent

us from using the proceeds of our offerings and financings in the U.S. to make loans to or make additional capital contributions to our

PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand our business.,” and

“— We rely on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements

we may have, and any limitation on the ability of our PRC subsidiary to make payments to us could have a material adverse effect on our

ability to conduct our business.” in our annual report on Form 20-F for the year ended December 31, 2021, which is incorporated

in this prospectus by reference.

As

of the date of this prospectus, we do not have cash management policies and procedures in place that dictate how funds are transferred

through our organization. Rather, the funds can be transferred in accordance with the applicable PRC laws and regulations. See

“Dividend Distribution and Cash Transfer Between the Holding Company, Subsidiary and VIE.” on page 10

As of the date of this

prospectus, no dividends or distributions have been made between the holding company, its subsidiaries, and consolidated VIE, or to investors

including U.S. investors except that the VIE Shanghai Juhao made a cash dividend of $1.6 million to its shareholders in July 2019 before

we became a public company in March 2021. The holding company, its subsidiaries, and VIE do not have any plan to distribute dividend

or settle amounts owed under the VIE Agreements in the foreseeable future. The cash transfer among the holding company, its subsidiaries

and VIE is typically transferred through payment for investment, intercompany services or intercompany borrowing between holding company,

subsidiaries and VIE. Cash transfers have been made to date between the holding company, its subsidiaries, and consolidated VIE, include

the following: (1) the holding company made investment payment of US$24,330,000 to Jowell HK during the fiscal years ended December 31,

2021; (2) Jowell HK made investment payment of US$20,629,000 to Jowell Shanghai during the fiscal years ended December 31, 2021; (3)

Jowell HK loaned US$606,000 to VIE during the fiscal year ended December 31, 2021; (4) VIE paid US$12,462,715 to Jowell Shanghai for

purchase of products during the fiscal years ended December 31, 2021; and (5) the holding company loaned US$4,221,549 to VIE to pay for

expenses during the fiscal years ended December 31, 2021. See “Condensed and Consolidated Financial Statements” on

page 4, “Dividend Distribution and Cash Transfer Between the Holding Company, Subsidiary and VIE.” on page 10 and

“Risk Factor - Our contractual arrangements with the VIE may not be as effective in providing operational control as direct

ownership” on page 20.

The Company, JWEL, the

Registrant, the holding company, we, us, our company, and our are referred to Jowell Global Ltd. (“Jowell Global”), a holding

company incorporated under the laws of the Cayman Islands. We currently conduct our business through the VIE Shanghai Juhao Information

Technology Co., Ltd. (“Shanghai Juhao”) in China. Shanghai Juhao and its shareholders entered into a series of contractual

arrangements with Shanghai Jowell Information Technology Co., Ltd. (“WFOE” or “Jowell Shanghai”), a company incorporated

in China and a wholly owned subsidiary of Jowell Technology Limited (“Jowell HK”), which is a holding company incorporated

in Hong Kong and a wholly owned subsidiary of Jowell Global.

As a holding company,

we may rely on dividends and other distributions on equity paid by our subsidiaries in Hong Kong and China for our cash and financing

requirements. If any of our Hong Kong and Chinese subsidiaries incurs debt on its own behalf in the future, the instruments governing

such debt may restrict their ability to pay dividends to us. However, neither any of our subsidiaries or the VIE has made any dividends

or other distributions to our holding company or any U.S. investors as of the date of this prospectus. In the future, cash proceeds raised

from overseas financing activities, including this offering, may be transferred by us to our Hong Kong subsidiary and WFOE via capital

contribution or shareholder loans, as the case may be.

Our Ordinary Shares are listed

on the Nasdaq Capital Market under the symbol “JWEL.” The applicable prospectus supplement will contain information, where

applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the

prospectus supplement.

Investing in our

securities involves a high degree of risk. See “Risk Factors” on page 19 of this prospectus and in the documents

incorporated by reference in this prospectus, as updated in the applicable prospectus supplement, any related free writing

prospectus and other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this

prospectus, for a discussion of the factors you should consider carefully before deciding to purchase our securities.

We may sell these securities

directly to investors, through agents designated from time to time or to or through underwriters or dealers. For additional information

on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus. If any underwriters

are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and

any applicable commissions or discounts will be set forth in a prospectus supplement. The price to the public of such securities and

the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is _____, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, under the Securities Act of 1933,

as amended, or the Securities Act, using a “shelf” registration process. Under this shelf registration process, we may from

time to time sell Ordinary Shares, Preferred Shares, warrants to purchase Ordinary Shares or Preferred Shares, rights or any combination

of the foregoing, either individually or as units comprised of one or more of the other securities, in one or more offerings up to a

total dollar amount of $200,000,000. We have provided to you in this prospectus a general description of the securities we may offer.

Each time we sell securities under this shelf registration, we will, to the extent required by law, provide a prospectus supplement that

will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be

provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing

prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in

any documents that we have incorporated by reference into this prospectus. To the extent there is a conflict between the information

contained in this prospectus and the prospectus supplement or any related free writing prospectus, you should rely on the information

in the prospectus supplement or the related free writing prospectus; provided that if any statement in one of these documents is inconsistent

with a statement in another document having a later date – for example, a document filed after the date of this prospectus and

incorporated by reference into this prospectus or any prospectus supplement or any related free writing prospectus – the statement

in the document having the later date modifies or supersedes the earlier statement.

We have not authorized any

dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference

in this prospectus and any accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided

to you. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or an

accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided to you. This prospectus

and the accompanying prospectus supplement, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement constitute

an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such

offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of such document

or that any information we have incorporated by reference is correct on any date subsequent to the date of such document incorporated

by reference (as our business, financial condition, results of operations and prospects may have changed since that date), even though

this prospectus, any applicable prospectus supplement or any related free writing prospectus is delivered or securities are sold on a

later date.

As permitted by SEC rules

and regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this

prospectus. You may read the registration statement and the other reports we file with the SEC at its website or at its offices described

below under “Where You Can Find More Information.”

Unless the context otherwise

requires, all references in this prospectus to “Jowell Global”, “JWEL,” “the holding company,” “we,”

“us,” “our,” “the Company,” “our company,” “the “Registrant” or similar

words refer to Jowell Global Ltd. together with our subsidiaries and the VIE.

“China” or

the “PRC” are to the People’s Republic of China, excluding Taiwan and the special administrative regions

of Hong Kong and Macau for the purposes of this prospectus only.

PROSPECTUS SUMMARY

Overview

We were incorporated under

the laws of the Cayman Islands as an offshore holding company and we own 100% of the equity interest in Jowell Technology Limited (“Jowell

HK”), which was incorporated under the laws of Hong Kong.

Through Jowell HK, we

own 100% of the equity interest in Shanghai Jowell Information Technology Co., Ltd. (“WFOE” or “Jowell Shanghai”).

The WFOE entered into a series of agreements with Shanghai Juhao Information Technology Co., Ltd. (“Shanghai Juhao” or “VIE”)

and Shanghai Juhao’s shareholders, through which we are the primary beneficiary of Shanghai Juhao and derive all of the economic

interest and benefits from Shanghai Juhao. We treat Shanghai Juhao as our consolidated affiliated entities for accounting purposes under

U.S. GAAP and not the entities in which we own equity interest.

We, through the VIE Shanghai

Juhao, focuses on providing consumers with convenient and high-quality online retail experience through our retail platforms, www.1juhao.com,

and mobile app, as well as authorized retail stores. Shanghai Juhao also offers programs that enable third-party sellers to distribute

their products through our platforms. In an effort to differentiate our services, Shanghai Juhao focuses on and specialize in the online

retail of cosmetic products, health and nutritional supplements and household products.

In 2012, Shanghai Juhao started

its operation, which was among the first membership-based e-commerce platforms for online-to-offline sales of cosmetics, health and nutritional

supplements and household products in China. Today, Shanghai Juhao offer an online platform Juhao Mall which holds an EDI (Electronic

Data Interchange) certification approved by the Shanghai Communication Administration pursuant to the requirement of Ministry of Industry

and Information Technology of China, selling our own brand products manufactured by third parties as well as international and domestic

branded products.

Since August 2017, Shanghai Juhao has been also selling its products

in authorized retail stores all across China. Operating under the brand name “Love Home Store” or “LHH Store”,

the authorized retailers may operate as independent stores or store-in-shop (an integrated store), selling our products that they purchased

through Shanghai Juhao’s online platform under their special retailer accounts with us which provide them with major discounts.

As of December 31, 2021, Shanghai Juhao authorized 26,043 Love Home stores in 31 provinces of China, providing offline retail and wholesale

of our products.

On April 28, 2021, the

Company announced Shanghai Juhao has officially launched its “Juhao Best Choice” community group-buying store initiative

to continue growing its offline retail market presence. The community group-buying offline stores sell fresh produce, foods and daily

household consumer products in addition to the cosmetics and health and nutritional supplements currently sold in the Company’s

franchised LHH Stores. The community group-buying stores aim to provide a more convenient shopping experience and high-quality produce

and foods for consumers from local communities, towns and villages across China. Juhao Best Choice stores will be owned and operated

by Shanghai Juhao or third-party franchisee store owners which consolidate online and offline resources for store design and logistics

services and provide guidance and trainings for store owners with a unified system for store management, design, service criteria, SKU

management and product delivery. Shanghai Juhao also provides the store owners with live-streaming marketing skill training and upgrade

and expand certain existing LHH Stores to Juhao Best Choice stores. As of December 31, 2021, Shanghai

Juhao has opened seven self-operated Juhao Best Choice community group buying stores in various cities in China as the experimental and

demonstration stores for this development.

We are a holding

company incorporated in the Cayman Islands. Our securities offered in this prospectus are securities of our Cayman Islands holding

company. As a holding company with no material operations of our own, we conduct our business through the VIE in China. VIE

structure is used to provide investors with exposure to foreign investment in China-based companies where the business of the

operating companies in China might be prohibited or restricted for foreign investment now or in the future. The business operations

of Shanghai Juhao include value-added telecommunication services and foreign ownership of value-added telecommunications services is

subject to restrictions under current PRC laws and regulations which prohibit foreign investment to own more than 50% equity

interest of the value-added telecommunication companies and will prevent the holding company consolidating

the financial results of such entities under equity ownership structure. Investors of our ordinary shares will not own any equity interests in the

VIE and may never hold equity interests in our Chinese operating company, but instead own shares of a Cayman Islands holding

company. Neither we nor our subsidiaries own any shares in the VIE, Shanghai Juhao. Instead, we are the primary beneficiary and

receive the economic benefits of the business operations of Shanghai Juhao through a series of contractual arrangements (the

“VIE Agreements”). We evaluated the guidance in FASB ASC 810 and determined that Shanghai Juhao is a VIE. A VIE is an

entity that has either a total equity investment that is insufficient to permit the entity to finance its activities without

additional subordinated financial support, or whose equity investors lack the characteristics of a controlling financial interest,

such as through voting rights, right to receive the expected residual returns of the entity or obligation to absorb the expected

losses of the entity. Our WFOE has the power to direct activities at Shanghai Juhao that most significantly impact Shanghai

Juhao’s economic performance, and has the right to receive benefits from Shanghai Juhao. As such, the WFOE is the primary

beneficiary of the VIE, for accounting purposes, based upon such contractual arrangements. Accordingly, under U.S. GAAP, the

financial results of the VIE are consolidated in our financial statements. In addition, these VIE agreements have not been truly

tested in the courts in China. Investors of our securities of will not own any equity interests in the VIE, but instead own shares

of a Cayman holding company. Chinese regulatory authorities could disallow the VIE structure, which would likely result in a

material change in our operations and/or value of our securities, including that it could cause the value of our securities to

significantly decline or become worthless.

The VIE structure is subject

to various risks. For example, the contractual arrangements may not be as effective as direct ownership in providing us with exerting

the right over Shanghai Juhao. We expect to rely on the performance by the VIE shareholders of their respective obligations under the

contracts to consolidate financial results of the VIE in our financial statements under U.S. GAAP. The VIE shareholders may not act in

the best interests of our company or may not perform their obligations under these contracts. Such risks will exist throughout the period

in which we operate our business in China through the contractual arrangements. If any dispute relating to these contracts remains unresolved,

we will have to enforce our rights under these contracts through the operations of PRC law and arbitration, litigation or other legal

proceedings which could be a lengthy process and very costly.

Shanghai Juhao is incorporated

and operating in mainland China and it has received all required permissions from Chinese authorities to operate its current business

in China, including Business License, EDI (Electronic Data Interchange) Certificate, Retail License for Alcoholic Products, Food Business

License and International Trade Business Filing Form. Other than these permits, based on the advice of our PRC counsel Jiangsu Yiyou

Tianyuan Law Firm, we, our subsidiaries or VIE are not required to obtain permit and approval from Chinese authorities to operate our

business and to offer the securities being registered to foreign investors. We, our subsidiaries, or VIE are not covered by permissions

requirements from the China Securities Regulatory Commission (CSRC), Cyberspace Administration of China (CAC) or any other governmental

agency that is required to approve the VIE’s business and operations. As the VIE operates an e-commerce platforms for online-to-offline

sales of cosmetics, health and nutritional supplements and household products in China and our products and services do not pose national

security risks, based on the advice of our PRC counsel Jiangsu Yiyou Tianyuan Law Firm, we are not subject to the report requirement

under Cybersecurity Review Measures published by Cyberspace Administration of China, National Development and Reform Commission, Ministry

of Industry and Information Technology, Ministry of Public Security, Ministry of State Security, Ministry of Finance, Ministry of Commerce,

People’s Bank of China, State Administration of Radio and Television, China Securities Regulatory Commission, State Secrecy Administration

and State Cryptography Administration on December 28, 2021, which became effective on February 15, 2022. As of the date of this prospectus,

we (1) are not required to obtain permissions from any PRC authorities to issue our securities being registered for sale to foreign investors,

(2) are not subject to permission requirements from China Securities Regulatory Commission (the “CSRC”), Cyberspace Administration

of China (“CAC”) or any other authority that is required to approve of the VIE’s operations, and (3) have not

received or were denied such permissions by any PRC authorities. Nevertheless, the General Office of the Central Committee of the Communist

Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities

Activities According to Law,” or the Opinions, which were made available to the public on July 6, 2021. The Opinions emphasized

the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas

listings by Chinese companies. On December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the

Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) and the Management Rules Regarding the Overseas

Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments). On April 2, 2022, the CSRC released the Provisions on

Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for

Comments), which provides that PRC issuers listing their securities on foreign stock exchanges need to file a notice to CSRC. In the

event that the above proposed provisions and rules are enacted, the relevant filing procedures of the CSRC and other governmental authorities

may be required in connection with this offering. Given the current PRC regulatory environment, it is uncertain when and whether we,

WFOE or VIE, will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and when such permission

is obtained, whether it will be denied or rescinded. If we, our subsidiaries, or the VIE do not receive or maintain such permissions

or approvals, inadvertently conclude that such permissions or approvals are not required, or applicable laws, regulations, or interpretations

change and we are required to obtain such permissions or approvals in the future, it could significantly limit or completely hinder our

ability to offer or continue to offer our securities to investors and cause the value of our securities to significantly decline or become

worthless.

There are legal and operational

risks associated with being based in and having all our operations in China. These risks could result in a material change in our operations

and/or the value of our securities and could significantly limit or completely hinder our ability to offer or continue to offer securities

to investors and cause the value of such securities to significantly decline or be worthless. The enforcement of laws and that rules

and regulations in China can change quickly with little advance notice and the risk that the Chinese government may intervene or influence

our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China- based issuers,

could result in a material change in our operations and/or the value of our securities we are registering for sale. Any actions by the

Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based

issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the

value of such securities to significantly decline or be worthless. See “Risk Factors— “The Chinese government

exerts substantial influence over the manner in which we must conduct our business, and may intervene or influence our operations at

any time, which could result in a material change in our operations, significantly limit or completely hinder our ability to offer or

continue to offer our securities to investors and, and cause the value of our securities to significantly decline or be worthless.”

and “Uncertainties and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance

notice could result in a material and negative impact on our business operations, decrease the value of our securities and limit the

legal protections available to you and us.” Recently, the PRC government initiated a series of regulatory actions and statements

to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities

market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures

to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office

of the Communist Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack

down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other

things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation,

to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application

of the PRC securities laws. On February 15, 2022, Cybersecurity Review Measures published by Cyberspace Administration of China or the

CAC, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, Ministry

of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State Administration of Radio and Television,

China Securities Regulatory Commission, State Secrecy Administration and State Cryptography Administration became effective, which provides

that, Critical Information Infrastructure Operators (“CIIOs”) that intend to purchase internet products and services and

Data Processing Operators (“DPOs”) engaging in data processing activities that affect or may affect national security shall

be subject to the cybersecurity review by the Cybersecurity Review Office. On November 14, 2021, CAC published the Administration Measures

for Cyber Data Security (Draft for Public Comments), or the “Cyber Data Security Measure (Draft)”, which requires cyberspace

operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the Office

of Cybersecurity Review. As of the date of this prospectus, these new laws and guidelines have not impacted the Company’s ability

to conduct its business, accept foreign investments, or trade on Nasdaq Stock Market; however, there are uncertainties in the interpretation

and enforcement of these new laws and guidelines, which could materially and adversely impact our business and financial outlook. See

“Risk Factors – Uncertainties and quick change in the interpretation and enforcement of Chinese laws and regulations with

little advance notice could result in a material and negative impact our business operations, decrease the value of our securities and

limit the legal protections available to you and us.”

We are incorporated in

the Cayman Islands and conduct our operations primarily in China. All of our assets are located outside of the United States. In addition,

Mr. Zhiwei Xu, the Chairman, Chief Executive Officer and a major shareholder of the Company, Ms. Dan Zhao, a board member and vice president

of the Company, Mr. Haitao Wang, an independent director of the Company and other officers of the Company reside outside of the United

States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in the United

States in the event that you believe we have violated your rights, either under United States federal or state securities laws or otherwise,

or if you have a claim against us. Even if you are successful in bringing an action of this kind, the laws of the Cayman Islands and

of China may not permit you to enforce a judgment against our assets or the assets of our directors and officers.

It may also be difficult

for you or overseas regulators to conduct investigations or collect evidence within China. For example, in China, there are significant

legal and other obstacles to obtaining information needed for shareholder investigations or litigation outside China or otherwise with

respect to foreign entities. Although the authorities in China may establish a regulatory cooperation mechanism with its counterparts

of another country or region to monitor and oversee cross-border securities activities, such regulatory cooperation with the securities

regulatory authorities in the Unities States may not be efficient in the absence of practical cooperation mechanism. Furthermore, according

to Article 177 of the PRC Securities Law, or “Article 177,” which became effective in March 2020, no overseas securities

regulator is allowed to directly conduct investigation or evidence collection activities within the territory of the PRC. Article 177

further provides that Chinese entities and individuals are not allowed to provide documents or materials related to securities business

activities to foreign agencies without prior consent from the securities regulatory authority of the PRC State Council and the competent

departments of the PRC State Council. While detailed interpretation of or implementing rules under Article 177 have yet to be promulgated,

the inability for an overseas securities regulator to directly conduct investigation or evidence collection activities within China may

further increase difficulties faced by you in protecting your interests.

The Holding Foreign Companies

Accountable Act, or the HFCA Act, was enacted on December 18, 2020. In accordance with the HFCA Act, trading in securities of any

registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited if

the PCAOB determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years beginning

in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On June 22, 2021, the U.S. Senate passed

the Accelerating Holding Foreign Companies Accountable Act (“Accelerating HFCAA”), which, if enacted, would amend the HFCA

Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject

to PCAOB inspections for two consecutive years instead of three, thus reducing the time period before our securities may be prohibited

from trading or delisted if our auditor is unable to meet the PCAOB inspection requirement. Our independent registered public accounting

firm that issues the audit report included in our annual report which is incorporated by reference in this prospectus, as an auditor

of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States

pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Our auditor

is headquartered in New York City, and has been inspected by the PCAOB on a regular basis with the last inspection in June 2018 and is

not subject to the determinations announced by the PCAOB on December 16, 2021. However, the recent developments would add uncertainties

to our offering and we cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria

to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel

and training, or sufficiency of resources, geographic reach, or experience as it relates to our audit. If it is later determined that

the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign jurisdiction

or any other reasons, the lack of inspection could cause the trading in our securities to be prohibited under the Holding Foreign Companies

Accountable Act, and as a result Nasdaq may delist our securities. If our securities are unable to be listed on another securities exchange,

such a delisting would substantially impair your ability to sell or purchase our securities when you wish to do so, and the risk and

uncertainty associated with a potential delisting would have a negative impact on the price of our ordinary shares. Further, new laws

and regulations or changes in laws and regulations in both the United States and China could affect our ability to list and trade our

ordinary shares on Nasdaq, which could materially impair the market price for our securities.

Set forth below are condensed

consolidating statements that disaggregate the financial position and operations, including income (loss) and cash flows as of and for

the years ended December 31, 2021 and 2020, showing financial information for the Company (excluding the VIEs), the VIEs, eliminating

entries and consolidated information.

FOR THE YEAR ENDED

DEEMBER 31, 2021

| | |

JWEL | | |

HK

subsidiary | | |

Elimination | | |

Total

outside

PRC | | |

WFOE | | |

VIE | | |

Elimination | |

|

Total

inside

PRC | | |

Elimination | |

|

Consolidation | |

| Cash | |

$ | 9,838 | | |

$ | 2,935 | | |

$ | - | | |

$ | 12,773 | | |

$ | 19,559 | | |

$ | 18,217,405 | | |

$ | - | |

|

$ | 18,236,964 | | |

$ | - | |

|

$ | 18,249,737 | |

| Restricted

cash | |

$ | - | | |

$ | 2,999,990 | | |

$ | - | | |

$ | 2,999,990 | | |

$ | - | | |

$ | - | | |

$ | - | |

|

$ | - | | |

$ | - | |

|

$ | 2,999,990 | |

| Other

receivable - intercompany | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 236,442 | | |

$ | - | |

|

$ | 236,442 | | |

$ | (236,442 | )(d2) |

|

$ | - | |

| Other

receivable - VIE | |

$ | 4,221,549 | | |

$ | 606,000 | | |

$ | - | | |

$ | 4,827,549 | | |

$ | 30,319,344 | | |

$ | - | | |

$ | (30,319,344 | )(b)(d1) |

|

$ | - | | |

$ | (4,827,549 | )(d3) |

|

$ | - | |

| Total

current assets | |

$ | 4,335,177 | | |

$ | 3,608,925 | | |

$ | - | | |

$ | 7,944,102 | | |

$ | 31,616,514 | | |

$ | 42,129,500 | | |

$ | (30,319,344 | ) |

|

$ | 43,426,670 | | |

$ | (5,063,991 | ) |

|

$ | 46,306,781 | |

| Investment

in subsidiaries and VIE | |

$ | 35,584,716 | | |

$ | 16,269,799 | | |

$ | (19,878,724 | )(a) | |

$ | 31,975,791 | | |

$ | - | | |

$ | - | | |

$ | - | |

|

$ | - | | |

$ | (31,975,791 | )(c) |

|

$ | 0 | |

| Total

Assets | |

$ | 39,919,893 | | |

$ | 19,878,724 | | |

$ | (19,878,724 | ) | |

$ | 39,919,893 | | |

$ | 31,616,514 | | |

$ | 54,550,637 | | |

$ | (30,319,344 | ) |

|

$ | 55,847,807 | | |

$ | (37,039,782 | ) |

|

$ | 58,727,918 | |

| Other

payable - intercompany | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 35,166,443 | | |

$ | (29,979,619 | )(d1) |

|

$ | 5,186,824 | | |

$ | (5,186,824 | )(c)(d3) |

|

$ | - | |

| Other

payable - VIE | |

$ | 236,442 | | |

$ | - | | |

$ | - | | |

$ | 236,442 | | |

$ | - | | |

$ | - | | |

$ | - | |

|

$ | - | | |

$ | (236,442 | )(d2) |

|

$ | - | |

| Total

current liabilities | |

$ | 236,442 | | |

$ | - | | |

$ | - | | |

$ | 236,442 | | |

$ | (2 | ) | |

$ | 50,217,271 | | |

$ | (29,979,619 | ) |

|

$ | 20,237,650 | | |

$ | (5,423,266 | ) |

|

$ | 15,050,826 | |

| Total

liabilities | |

$ | 236,442 | | |

$ | - | | |

$ | - | | |

$ | 236,442 | | |

$ | (2 | ) | |

$ | 54,210,912 | | |

$ | (29,979,619 | ) |

|

$ | 24,231,291 | | |

$ | (5,423,266 | ) |

|

$ | 19,044,467 | |

| Total

Stockholders’ Equity | |

$ | 39,683,451 | | |

$ | 19,878,724 | | |

$ | (19,878,724 | )(a) | |

$ | 39,683,451 | | |

$ | 31,616,516 | | |

$ | 339,725 | | |

$ | (339,725 | )(b)

|

|

$ | 31,616,516 | | |

$ | (31,616,516 | )(c) |

|

$ | 39,683,451 | |

| Total

Liabilities and Stockholders’ Equity | |

$ | 39,919,893 | | |

$ | 19,878,724 | | |

$ | (19,878,724 | ) | |

$ | 39,919,893 | | |

$ | 31,616,514 | | |

$ | 54,550,637 | | |

$ | (30,319,344 | ) |

|

$ | 55,847,807 | | |

$ | (37,039,782 | ) |

|

$ | 58,727,918 | |

| (a) | to eliminate holding company’s investments in subsidiary outside

PRC. |

| (b) | to eliminate receivables as a result of contractual agreements between

WFOE and VIE. |

| (c) | to eliminate holding

company’s investment in WFOE. |

| (d) | to

eliminate intercompany balances: |

| | |

Due from | |

Due to | |

Amount | | |

|

| (1 | ) |

WFOE | |

VIE | |

$ | 29,979,619 | | |

intercompany balances as a result of intercompany revenue |

| (2 | ) |

VIE | |

JWEL | |

$ | 236,442 | | |

Intercompany balance |

| (3 | ) |

JWEL and HK Subsidiary | |

VIE | |

$ | 4,827,549 | | |

Intercompany balance |

FOR THE YEAR ENDED DECEMBER 31, 2021

| | |

JWEL | | |

HK

subsidiary | | |

Elimination | | |

Total

outside PRC | | |

WFOE | | |

VIE | | |

Elimination |

| |

Total

inside

PRC | | |

Elimination | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| |

| | |

| | |

| |

| Total Net

Revenues | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 30,992,095 | | |

$ | 170,911,999 | | |

$ | (30,992,095 |

)(d) | |

$ | 170,911,999 | | |

$ | - | | |

$ | 170,911,999 | |

| Operating

Expenses: | |

| (1,937,800 | ) | |

| (92,197 | ) | |

| - | | |

| (2,029,997 | ) | |

| (32,502,592 | ) | |

| (174,364,008 | ) | |

| 30,992,095 |

(d) | |

| (175,874,505 | ) | |

| - | | |

| (177,904,502 | ) |

| Income From Operations | |

| (1,937,800 | ) | |

| (92,197 | ) | |

| - | | |

| (2,029,997 | ) | |

| (1,510,497 | ) | |

| (3,452,009 | ) | |

| - |

| |

| (4,962,506 | ) | |

| - | | |

| (6,992,503 | ) |

| Other Income, net | |

| - | | |

| 122 | | |

| - | | |

| 122 | | |

| 1,711 | | |

| 411,078 | | |

| - |

| |

| 412,789 | | |

| - | | |

| 412,911 | |

| Benefit (Provision) for

Income Taxes | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 190,516 | | |

| - |

| |

| 190,516 | | |

| - | | |

| 190,516 | |

| Loss from VIE | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,850,415 | ) | |

| - | | |

| 2,850,415 |

(b) | |

| - | | |

| - | | |

| - | |

| Loss

from subsidiaries | |

| (4,451,276 | ) | |

| (4,359,201 | ) | |

| 4,359,201 | (a) | |

| (4,451,276 | ) | |

| - | | |

| - | | |

| - |

| |

| - | | |

| 4,451,276 | (c) | |

| - | |

| Net

loss | |

$ | (6,389,076 | ) | |

$ | (4,451,276 | ) | |

$ | 4,359,201 | | |

$ | (6,481,151 | ) | |

$ | (4,359,201 | ) | |

$ | (2,850,415 | ) | |

$ | 2,850,415 |

| |

$ | (4,359,201 | ) | |

$ | 4,451,276 | | |

$ | (6,389,076 | ) |

| (a) |

to

eliminate net loss by HK subsidiary. |

| (b) |

to

eliminate net loss by WFOE. |

| (c) |

to

eliminate net loss by JWEL. |

| (d) |

to

eliminate revenue and expenses for services provided by the WFOE to VIE. |

FOR THE YEAR ENDED DECEMBER 31, 2021

| | |

JWEL | | |

HK

subsidiary | | |

Elimination | | |

Total

outside PRC | | |

WFOE | | |

VIE | | |

Elimination |

| |

Total

inside PRC | | |

Elimination | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| |

| | |

| | |

| |

| Net cash used

in operating activities | |

$ | (778,390 | ) | |

$ | (92,075 | ) | |

$ | - | | |

$ | (870,465 | ) | |

$ | (2,768,576 | ) | |

$ | (14,394,918 | ) | |

$ | - |

| |

$ | (17,163,494 | ) | |

$ | - | | |

$ | (18,033,959 | ) |

| Net cash used in investing

activities | |

| (28,323,808 | ) | |

| (21,235,000 | ) | |

| 24,330,000 | (a) | |

| (25,228,808 | ) | |

| (17,860,944 | ) | |

| (1,987,258 | ) | |

| 17,810,602 |

(b) | |

| (2,037,600 | ) | |

| 20,629,000 | (c) | |

| (6,637,408 | ) |

| Net cash provided by financing

activities | |

| 24,509,792 | | |

| 24,330,000 | | |

| (24,330,000 | )(a) | |

| 24,509,792 | | |

| 20,629,000 | | |

| 20,555,262 | | |

| (17,852,916 |

)(b) | |

| 23,331,346 | | |

| (20,629,000 | )(c) | |

| 27,212,138 | |

| Effect

of exchange rate changes on cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| 20,079 | | |

| 402,507 | | |

| 42,314 |

(b) | |

| 464,900 | | |

| - | | |

| 464,900 | |

| Net increase (decrease)

in cash | |

| (4,592,405 | ) | |

| 3,002,925 | | |

| - | | |

| (1,589,480 | ) | |

| 19,559 | | |

| 4,575,593 | | |

| - |

| |

| 4,595,152 | | |

| - | | |

| 3,005,672 | |

| Cash,

beginning of year | |

| 4,602,243 | | |

| - | | |

| - | | |

| 4,602,243 | | |

| - | | |

| 13,641,812 | | |

| - |

| |

| 13,641,812 | | |

| - | | |

| 18,244,055 | |

| Cash,

end of year | |

$ | 9,838 | | |

$ | 3,002,925 | | |

$ | - | | |

$ | 3,012,763 | | |

$ | 19,559 | | |

$ | 18,217,405 | | |

$ | - |

| |

$ | 18,236,964 | | |

$ | - | | |

$ | 21,249,727 | |

| (a) | to eliminated JWEL investment

in HK subsidiary |

| (b) | to eliminated intercompany

borrowing between WFOE and VIE |

| (c) | to eliminated HK subsidiary

investment in WFOE |

FOR THE YEAR ENDED DEEMBER 31, 2020

| | |

JWEL | | |

HK

subsidiary | | |

Elimination | | |

Total

outside

PRC | | |

WFOE | | |

VIE | | |

Elimination | | |

Total

inside

PRC | | |

Elimination | | |

Consolidation | |

| Cash | |

$ | 4,602,243 | | |

$ | - | | |

$ | - | | |

$ | 4,602,243 | | |

$ | - | | |

$ | 13,641,812 | | |

$ | - | | |

$ | 13,641,812 | | |

$ | - | | |

$ | 18,244,055 | |

| Other receivable - VIE | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 15,034,773 | | |

$ | - | | |

$ | (15,034,773 | )(b) | |

$ | - | | |

$ | - | | |

$ | - | |

| Total current assets | |

$ | 4,894,243 | | |

$ | - | | |

$ | - | | |

$ | 4,894,243 | | |

$ | 15,034,773 | | |

$ | 25,120,401 | | |

$ | (15,034,773 | ) | |

$ | 25,120,401 | | |

$ | - | | |

$ | 30,014,644 | |

| Investment in subsidiaries

and VIE | |

$ | 15,034,773 | | |

$ | 15,034,773 | | |

$ | (15,034,773 | )(a) | |

$ | 15,034,773 | | |

$ | - | | |

$ | - | | |

| - | | |

$ | - | | |

$ | (15,034,773 | )(c) | |

$ | - | |

| Total Assets | |

$ | 19,929,016 | | |

$ | 15,034,773 | | |

$ | (15,034,773 | ) | |

$ | 19,929,016 | | |

$ | 15,034,773 | | |

$ | 28,970,611 | | |

$ | (15,034,773 | ) | |

$ | 28,970,611 | | |

$ | (15,034,773 | ) | |

$ | 33,864,854 | |

| Total current liabilities | |

$ | 1,184,272 | | |

$ | - | | |

$ | - | | |

$ | 1,184,272 | | |

$ | - | | |

$ | 10,968,645 | | |

$ | - | | |

$ | 10,968,645 | | |

$ | - | | |

$ | 12,152,917 | |

| Total liabilities | |

$ | 1,184,272 | | |

$ | - | | |

$ | - | | |

$ | 1,184,272 | | |

$ | - | | |

$ | 13,935,838 | | |

$ | - | | |

$ | 13,935,838 | | |

$ | - | | |

$ | 15,120,110 | |

| Total Stockholders’ Equity | |

$ | 18,744,744 | | |

$ | 15,034,773 | | |

$ | (15,034,773 | )(a) | |

$ | 18,744,744 | | |

$ | 15,034,773 | | |

$ | 15,034,773 | | |

$ | (15,034,773 | )(b) | |

$ | 15,034,773 | | |

$ | (15,034,773 | )(c) | |

$ | 18,744,744 | |

| Total Liabilities and

Stockholders’ Equity | |

$ | 19,929,016 | | |

$ | 15,034,773 | | |

$ | (15,034,773 | ) | |

$ | 19,929,016 | | |

$ | 15,034,773 | | |

$ | 28,970,611 | | |

$ | (15,034,773 | ) | |

$ | 28,970,611 | | |

$ | (15,034,773 | ) | |

$ | 33,864,854 | |

| (a) |

to

eliminate holding company’s investment in subsidiaries outside PRC. |

| (b) |

to

eliminate receivables as a result of contractual agreements between WFOE and VIE. |

| (c) |

to

eliminate holding company’s investment in WFOE. |

FOR THE YEAR ENDED DECEMBER 31, 2020

| | |

JWEL | | |

HK

subsidiary | | |

Elimination | | |

Total outside

PRC | | |

WFOE | | |

VIE | | |

Elimination | | |

Total

inside

PRC | | |

Elimination | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Total

Net Revenues | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 96,879,173 | | |

$ | - | | |

$ | 96,879,173 | | |

$ | - | | |

$ | 96,879,173 | |

| Operating

Expenses: | |

| (990,029 | ) | |

| - | | |

| - | | |

| (990,029 | ) | |

| - | | |

| (90,776,328 | ) | |

| - | | |

| (90,776,328 | ) | |

| - | | |

| (91,766,357 | ) |

| Income

From Operations | |

| (990,029 | ) | |

| - | | |

| - | | |

| (990,029 | ) | |

| - | | |

| 6,102,845 | | |

| - | | |

| 6,102,845 | | |

| - | | |

| 5,112,816 | |

| Other

Income, net | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,106 | | |

| - | | |

| 6,106 | | |

| - | | |

| 6,106 | |

| Provision

for Income Taxes | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,532,230 | ) | |

| - | | |

| (1,532,230 | ) | |

| - | | |

| (1,532,230 | ) |

| Income

from VIE | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,576,721 | | |

| - | | |

| (4,576,721 | )(b) | |

| - | | |

| - | | |

| - | |

| Income

from subsidiaries | |

| 4,576,721 | | |

| 4,576,721 | | |

| (4,576,721 | )(a) | |

| 4,576,721 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,576,721 | )(c) | |

| - | |

| Net

Income | |

$ | 3,586,692 | | |

$ | 4,576,721 | | |

$ | (4,576,721 | ) | |

$ | 3,586,692 | | |

$ | 4,576,721 | | |

$ | 4,576,721 | | |

$ | (4,576,721 | ) | |

$ | 4,576,721 | | |

$ | (4,576,721 | ) | |

$ | 3,586,692 | |

| (a) | to

eliminate outside PRC subsidiaries income from the holding company. |

| (b) | to eliminate VIE income by WFOE. |

| (c) | to

eliminate WFOE investment income by the holding company. |

FOR THE YEAR ENDED DECEMBER 31, 2020

| | |

JWEL | | |

HK

subsidiary | | |

Elimination | | |

Total outside

PRC | | |

WFOE | | |

VIE | | |

Elimination | | |

Total inside

PRC | | |

Elimination | | |

Consolidated | |

| Net

cash provided by (used in) operating activities | |

$ | (990,029 | ) | |

$ | - | | |

$ | - | | |

$ | (990,029 | ) | |

$ | - | | |

$ | 7,329,182 | | |

$ | - | | |

$ | 7,329,182 | | |

$ | - | | |

$ | 6,339,153 | |

| Net

cash used in investing activities | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (116,746 | ) | |

| - | | |

| (116,746 | ) | |

| - | | |

| (116,746 | ) |

| Net

cash provided by financing activities | |

| 5,592,272 | | |

| - | | |

| - | | |

| 5,592,272 | | |

| - | | |

| 5,752,534 | | |

| - | | |

| 5,752,534 | | |

| - | | |

| 11,344,806 | |

| Effect

of exchange rate changes on cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 665,331 | | |

| - | | |

| 665,331 | | |

| - | | |

| 665,331 | |

| Net

increase (decrease) in cash | |

| 4,602,243 | | |

| - | | |

| - | | |

| 4,602,243 | | |

| - | | |

| 13,630,301 | | |

| - | | |

| 13,630,301 | | |

| - | | |

| 18,232,544 | |

| Cash,

beginning of year | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 11,511 | | |

| - | | |

| 11,511 | | |

| - | | |

| 11,511 | |

| Cash,

end of year | |

$ | 4,602,243 | | |

$ | - | | |

$ | - | | |

$ | 4,602,243 | | |

$ | - | | |

$ | 13,641,812 | | |

$ | - | | |

$ | 13,641,812 | | |

$ | - | | |

$ | 18,244,055 | |

Dividend Distribution and Cash Transfer Between the Holding

Company, Subsidiary and VIE.

We, through the VIE, operates

an e-commerce platform for cosmetics, health and nutritional supplements and household products in China. The VIE also sells our products

through authorized retail stores all across China. Operating under the brand name of “Love Home Store” or “LHH Store”,

the authorized retailers may operate as independent stores or store-in-shop (an integrated store), selling products that they purchased

through our online platform LHH Mall under their retailers accounts which provide them with major discounts. The VIE also sells

products through its “Juhao Best Choice” community group-buying stores in China.

The VIE receives its revenue

in RMB. Under our current corporate structure, to fund any cash and financing requirements we may have, the Company may rely on certain

dividend payments from our WFOE in China. If our WFOE receives payments from VIE, pursuant to the VIE Agreements, WFOE may make distribution

of such payments to Jowell HK as dividends, however, WFOE currently has not received any payments from the VIE pursuant to the VIE Agreements

which are discussed in more details on page 13.

Under existing PRC foreign

exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange

transactions, can be made in foreign currencies without prior approval from State Administration of Foreign Exchange or SAFE by complying

with certain procedural requirements. Therefore, our WFOE is able to pay dividends in foreign currencies to us without prior approval

from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC

foreign exchange regulations, such as the overseas investment registrations by the shareholders of the Company who are PRC residents.

Approval from or registration with appropriate government authorities is, however, required where the RMB is to be converted into foreign

currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC

government may also at its discretion restrict access in the future to foreign currencies for current account transactions. For our Hong

Kong subsidiary and the holding company (“Non-PRC Entities”), there is no restrictions on foreign exchange for such entities

and they are able to transfer cash among these entities, across borders and to US investors. Also, there is no regulatory restrictions

and limitations on the abilities of Non-PRC Entities to distribute earnings from their businesses, including from subsidiaries to the

parent company or from the holding company to the U.S. investors as well as the abilities to settle amounts owed. However, to the extent

cash/assets in the business is in PRC/Hong Kong or our PRC/Hong Kong entity, the funds/assets may not be available to fund operations

or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability

of us, our subsidiaries, or the consolidated VIE by the PRC government to transfer cash/assets. See “Risk Factors—Uncertainties

and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance notice could result in a material

and negative impact our business operations, decrease the value of our securities and limit the legal protections available to you and

us.”

We are a holding company,

and we may rely on dividends and other distributions on equity paid by our subsidiaries for our cash and financing requirements, including

the funds necessary to pay dividends and other cash distributions to our shareholders and service any debt we may incur. If any of our

subsidiaries incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends

or make other distributions to us. Current PRC regulations permit our WFOE to pay dividends to the Company only out of its accumulated

profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, our WFOE and VIE in China are

required to set aside at least 10% of their after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches

50% of its registered capital. Each such entity in China is also required to further set aside a portion of its after-tax profits to

fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors.

Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess

of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

In addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable

to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC

central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant

to the tax agreement between mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the