false

0001730430

0001730430

2025-02-21

2025-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 21, 2025

Kiniksa

Pharmaceuticals International, plc

(Exact name of Registrant as Specified in Its

Charter)

| England and Wales |

|

001-730430 |

|

98-1795578 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

23 Old Bond Street, Floor 3

London, W1S 4PZ

England,

United Kingdom

(Address of principal executive

offices, including zip code)

(781)

431-9100

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Class A

Ordinary Shares, $0.000273235 nominal value |

|

KNSA |

|

The

Nasdaq Stock Market LLC |

| |

|

|

|

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.02. Termination of a Material Definitive Agreement.

On

February 21, 2025, a wholly-owned subsidiary of Kiniksa Pharmaceuticals International, plc (together, with its consolidated subsidiaries,

the “Company”) provided written notice to MedImmune,

Limited (“MedImmune”) that, in connection with the Company’s decision to terminate development of mavrilimumab, the

Company has elected to terminate the license agreement by and between the Company and MedImmune, dated as of December 21, 2017 (as

amended, the “MedImmune License Agreement”). The Company exercised its right to terminate the MedImmune License Agreement

for convenience and, in accordance with the terms of the MedImmune License Agreement, the termination will be effective on May 22,

2025 (the “Termination Effective Date”).

Under the terms of the MedImmune

License Agreement, MedImmune granted the Company an exclusive, sublicensable, worldwide license to certain intellectual property rights

to make, use, develop and commercialize mavrilimumab and any other product containing an antibody to the GM-CSF receptor alpha that is

covered by certain MedImmune patent rights for all indications, which license will terminate as of the Termination Effective Date.

The foregoing description of

the MedImmune License Agreement is subject to and qualified in its entirety by the full text of the agreement, which was filed as Exhibit 10.8

to the Company’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission (the “SEC”)

on April 27, 2018, and Amendment No. 1 to MedImmune License Agreement, dated July 9, 2020, which was filed as Exhibit 10.1

to the Company’s Current Report on Form 8-K filed with the SEC on July 15, 2020, each of which is incorporated by reference

into this Item 1.02.

Item 2.02. Results of Operations and Financial Condition.

On February 25, 2025, the

Company issued a press release announcing financial results for the fiscal year ended December 31, 2024. A copy of the press release

is furnished with this Current Report on Form 8-K as Exhibit 99.1.

Item 2.05. Costs Associated with Exit or Disposal Activities.

On February 24, 2025, in

light of the Company’s strategic reprioritization of its portfolio and certain capital allocation considerations, the Company committed

to a plan to discontinue its Phase 2b clinical trial of abiprubart in Sjögren’s Disease. The Company expects to immediately

end enrollment and initiate winddown activities for the clinical trial, with full completion of winddown activities expected to occur

by the end of 2025.

As a result of the termination

of the Phase 2b clinical trial, the Company has incurred approximately $19 million in expenses and expects to record approximately $14

million to $17 million in additional expenses, almost entirely consisting of expenses related to contract termination costs for the Company’s

clinical supply agreements for abiprubart, with additional de minimis costs related to trial closeout activities. The Company plans to

record such expenses as research and development expenses, and expects that the vast majority of these charges will be recorded in the

periods covering the fourth quarter of 2024 and the first half of 2025.

The costs that the Company expects

to incur in connection with the foregoing are subject to a number of assumptions, and actual results may materially differ. The Company

may also incur other costs or charges not currently contemplated as a result of, or associated with, the foregoing events.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

KINIKSA PHARMACEUTICALS INTERNATIONAL, PLC |

| |

|

| Date: February 25, 2025 |

By: |

/s/ Madelyn Zeylikman |

| |

|

Madelyn Zeylikman |

| |

|

Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Kiniksa Pharmaceuticals

Reports Fourth Quarter and Full Year 2024 Financial Results and Recent Portfolio Execution

–

ARCALYST® (rilonacept) Q4 2024 and full year 2024 net product revenue of $122.5 million and $417.0 million, respectively

–

– ARCALYST

2025 net product revenue expected to be $560 - $580 million –

–

KPL-387 Phase 2/3 clinical trial in recurrent pericarditis expected to initiate in mid-2025; Phase 2 data expected in 2H 2026 –

–

Abiprubart development in Sjögren’s Disease to be discontinued –

– Current

operating plan expected to remain cash flow positive on an annual basis –

–

Conference call and webcast scheduled for 8:30 am ET today –

London –

February 25, 2025 – Kiniksa Pharmaceuticals International, plc (Nasdaq: KNSA) (Kiniksa), a biopharmaceutical company

developing and commercializing novel therapies for diseases with unmet need, with a focus on cardiovascular indications, today reported

fourth quarter and full year 2024 financial results and recent portfolio execution.

“Strong commercial execution in 2024 resulted in 79% year-over-year

ARCALYST sales growth to $417.0 million. We believe substantial opportunity remains for ARCALYST, and expect 2025 sales of between $560

and $580 million,” said Sanj K. Patel, Chairman and Chief Executive Officer of Kiniksa. “Today, we are excited to announce

the development program for KPL-387, which we believe could expand the treatment options for recurrent pericarditis patients by enabling

a single monthly subcutaneous injection in a liquid formulation. We have interacted with the FDA and plan to initiate a Phase 2/3 clinical

trial of KPL-387 in recurrent pericarditis in mid-2025. In line with our prioritization of cardiovascular indications, we plan to discontinue

the development of abiprubart in Sjögren’s Disease. On behalf of our entire organization, I would like to thank the patients,

caregivers, and investigators who contributed to our study.”

Corporate Update

| · | Kiniksa

continues to focus development on diseases with unmet need, prioritizing cardiovascular indications. |

| | | |

| o | Kiniksa announced today the development of KPL-387 in recurrent pericarditis,

with a target profile of monthly subcutaneous (SC) dosing. KPL-387 is a fully human immunoglobulin

G2 (IgG2) monoclonal antibody that binds human interleukin-1 receptor 1 (IL-1R1), inhibiting

the signaling of the cytokines interleukin-1α (IL-1α) and interleukin-1β (IL-1β). |

| o | Kiniksa announced today that it is advancing KPL-1161 towards clinical

development with a target profile of quarterly SC dosing. KPL-1161 is an Fc-modified IgG2

monoclonal antibody that binds IL-1R1, inhibiting the signaling of the cytokines IL-1α

and IL-1β. |

| | | |

| o | Kiniksa announced today that it plans to discontinue abiprubart development

in Sjögren’s Disease. The company will explore strategic alternatives for the

asset. |

| | | |

| o | Kiniksa announced today that it has exercised its right to terminate

its exclusive license agreement for mavrilimumab with MedImmune. |

Portfolio Execution

ARCALYST (IL-1α and IL-1β cytokine trap)

| · | ARCALYST

net product revenue was $122.5 million and $417.0 million for the fourth quarter and full

year 2024, respectively. |

| | | |

| · | Since

launch, more than 2,850 prescribers have written ARCALYST prescriptions for recurrent pericarditis. |

| | | |

| · | As

of the end of the fourth quarter of 2024, average total duration of ARCALYST therapy in recurrent

pericarditis was approximately 27 months. |

| | | |

| · | As

of the end of the fourth quarter of 2024, approximately 13% of the target 14,000 multiple-recurrence

patients were actively on ARCALYST treatment. |

KPL-387 (monoclonal antibody IL-1 receptor antagonist)

| · | Kiniksa

is conducting a single ascending dose (SAD) and multiple ascending dose Phase 1 clinical

trial of KPL-387 in healthy volunteers. |

| | | |

| o | Topline data from the SAD portion of the Phase 1 trial support potential

monthly SC dosing in recurrent pericarditis. |

| | | |

| · | Kiniksa

has interacted with the U.S. Food and Drug Administration (FDA) and expects to initiate a

Phase 2/3 clinical trial of KPL-387 in recurrent pericarditis in mid-2025, with Phase 2 data

expected in the second half of 2026. |

KPL-1161 (Fc-modified monoclonal antibody IL-1 receptor antagonist)

| · | Kiniksa

is conducting Investigational New Drug (IND)-enabling development activities with a target

profile of quarterly SC dosing. |

Financial Results

| · | Total

revenue for the fourth quarter of 2024 was $122.5 million, compared to $83.4 million for

the fourth quarter of 2023. Total revenue for the full year 2024 was $423.2 million, compared

to $270.3 million for the full year 2023. |

| | | |

| — | Total

revenue for the fourth quarter of 2024 did not include any license and collaboration revenue,

compared to $12.2 million for the fourth quarter of 2023. |

| — | Total

revenue for the full year 2024 included $6.2 million in license and collaboration revenue,

compared to $37.1 million for the full year 2023. |

| | | |

| · | Total

operating expenses for the fourth quarter of 2024 were $141.8 million, compared to $83.3

million for the fourth quarter of 2023. Total operating expenses for the full year 2024 were

$468.9 million, compared to $295.5 million for the full year 2023. |

| | | |

| — | Total

operating expenses for the fourth quarter of 2024 included $48.2 million in collaboration

expenses, which are driven by ARCALYST collaboration profitability, compared to $16.9 million

for the fourth quarter of 2023. Total operating expenses for the full year 2024 included

$128.3 million in collaboration expenses, compared to $56.5 million for the full year 2023. |

| | | |

| — | Total

operating expenses for the fourth quarter of 2024 included $8.3 million in non-cash, share-based

compensation expense, compared to $7.8 million for the fourth quarter of 2023. Total operating

expenses for the full year 2024 included $30.7 million in non-cash, share-based compensation

expense, compared to $27.1 million for the full year 2023. |

| | | |

| · | Net

loss for the fourth quarter of 2024 was $8.9 million, compared to a net income of $25.2 million

for the fourth quarter of 2023. Net loss for the full year 2024 was $43.2 million, compared

to net income of $14.1 million for the full year 2023. |

| | | |

| — | Net

loss for the fourth quarter of 2024 included a tax benefit of $8.1 million, compared to a

tax benefit of $22.8 million for the fourth quarter of 2023, both primarily due to the treatment

of non-cash deferred tax assets. |

| | | |

| — | Net

loss for the full year 2024 included a tax expense of $7.0 million, compared to a tax benefit

of $30.7 million for the full year 2023, both primarily due to the treatment of non-cash

deferred tax assets. |

| | | |

| · | As

of December 31, 2024, Kiniksa had $243.6 million of cash, cash equivalents, and short-term

investments and no debt, compared to $206.4 million as of December 31, 2023. |

Financial Guidance

| · | Kiniksa

expects 2025 ARCALYST net product revenue of between $560 million and $580 million. |

| | | |

| · | Kiniksa

expects its current operating plan to remain cash flow positive on an annual basis. |

Conference Call Information

| · | Kiniksa

will host a conference call and webcast at 8:30 a.m. Eastern Time on Tuesday, February 25,

2025, to discuss fourth quarter and full year 2024 financial results and to provide a corporate

update. |

| | | |

| · | Individuals

interested in participating in the call via telephone may register here. Upon registration,

all telephone participants will receive a confirmation email detailing how to join the conference

call, including the dial-in number along with a unique passcode and registrant ID that can

be used to access the call. To access the webcast, please visit the Investors and Media section

of Kiniksa’s website. A replay of the event will also be available on Kiniksa’s

website within approximately 48 hours after the event. |

About Kiniksa

Kiniksa is a biopharmaceutical company dedicated to improving the

lives of patients suffering from debilitating diseases by discovering, acquiring, developing, and commercializing novel therapies for

diseases with unmet need, with a focus on cardiovascular indications. Kiniksa’s portfolio of assets is based on strong biologic

rationale or validated mechanisms and offers the potential for differentiation. For more information, please visit www.kiniksa.com.

About ARCALYST

ARCALYST is a weekly, subcutaneously injected recombinant dimeric

fusion protein that blocks interleukin-1 alpha (IL-1α) and interleukin-1 beta (IL-1β) signaling. ARCALYST was discovered by

Regeneron Pharmaceuticals, Inc. (Regeneron) and is approved by the U.S. Food and Drug Administration (FDA) for the treatment of recurrent

pericarditis (RP) and reduction in risk of recurrence in adults and children 12 years and older. ARCALYST is also approved by the FDA

for the treatment of Cryopyrin-Associated Periodic Syndromes (CAPS), including Familial Cold Autoinflammatory Syndrome (FCAS) and Muckle-Wells

Syndrome (MWS) in adults and children 12 years and older, and the maintenance of remission of Deficiency of Interleukin-1 Receptor Antagonist

(DIRA) in adults and pediatric patients weighing 10 kg or more. The FDA granted Orphan Drug Exclusivity to ARCALYST upon its approval

for recurrent pericarditis in 2021. The European Commission granted Orphan Drug Designation to ARCALYST for the treatment of idiopathic

pericarditis in 2021.

IMPORTANT SAFETY INFORMATION ABOUT ARCALYST

| · | ARCALYST

may affect your immune system and can lower the ability of your immune system to fight infections.

Serious infections, including life-threatening infections and death, have happened in patients

taking ARCALYST. If you have any signs of an infection, call your doctor right away. Treatment

with ARCALYST should be stopped if you get a serious infection. You should not begin treatment

with ARCALYST if you have an infection or have infections that keep coming back (chronic

infection). |

| | | |

| · | While

taking ARCALYST, do not take other medicines that block interleukin-1, such as Kineret®

(anakinra), or medicines that block tumor necrosis factor, such as Enbrel® (etanercept),

Humira® (adalimumab), or Remicade® (infliximab), as this may increase your risk of

getting a serious infection. |

| | | |

| · | Talk

with your doctor about your vaccine history. Ask your doctor whether you should receive any

vaccines before you begin treatment with ARCALYST. |

| | | |

| · | Medicines

that affect the immune system may increase the risk of getting cancer. |

| | | |

| · | Stop

taking ARCALYST and call your doctor or get emergency care right away if you have any symptoms

of an allergic reaction. |

| | | |

| · | Your

doctor will do blood tests to check for changes in your blood cholesterol and triglycerides. |

| | | |

| · | Common

side effects include injection-site reactions (which may include pain, redness, swelling,

itching, bruising, lumps, inflammation, skin rash, blisters, warmth, and bleeding at the

injection site), upper respiratory tract infections, joint and muscle aches, rash, ear infection,

sore throat, and runny nose. |

For more information about ARCALYST, talk to your doctor

and see the Product Information.

About KPL-387

KPL-387 is an independently developed, investigational, fully human

IgG2 monoclonal antibody that binds IL-1R1, inhibiting the signaling of the cytokines IL-1α and IL-1β. Kiniksa believes KPL-387

could expand the treatment options for recurrent pericarditis patients by enabling dosing with a single monthly SC injection in a liquid

formulation.

About KPL-1161

KPL-1161 is an independently developed, investigational, Fc-modified

IgG2 monoclonal antibody that binds IL-1R1, inhibiting the signaling of the cytokines IL-1α and IL-1β, with a target profile

of quarterly SC dosing. Kiniksa is currently engaging in IND-enabling development activities for KPL-1161.

About Abiprubart

Abiprubart is an investigational humanized monoclonal antibody that

binds to CD40 and is designed to inhibit the CD40-CD154 (CD40 ligand) interaction, a key T-cell co-stimulatory signal critical for B-cell

maturation and immunoglobulin class switching and Type 1 immune responses. Kiniksa believes disrupting the CD40-CD154 co-stimulatory

interaction is an attractive approach to addressing multiple autoimmune disease pathologies.

Forward-Looking Statements

This press release contains forward-looking statements. In some cases,

you can identify forward looking statements by terms such as “may,” “will,” “should,” “expect,”

“plan,” “anticipate,” “could,” “intend,” “target,” “project,”

“contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue”

or the negative of these terms or other similar expressions, although not all forward-looking statements contain these identifying words.

All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking

statements, including without limitation, statements regarding: our belief that substantial opportunity remains for ARCALYST and our

expectation that ARCALYST 2025 net product revenue will be between $560 million and $580 million; our plan to initiate a Phase 2/3 clinical

trial of KPL-387 in recurrent pericarditis in mid-2025, with Phase 2 data expected in the second half of 2026; our plan to discontinue

abiprubart development in Sjögren’s Disease and explore strategic alternatives for the asset; our expectation that our current

operating plan will remain cash flow positive on an annual basis; our plan to focus development on diseases with unmet need, prioritizing

cardiovascular indications; our belief that KPL-387 could expand the treatment options for recurrent pericarditis patients by enabling

a single monthly SC injection in a liquid formulation; our target profile of monthly and quarterly dosing for KPL-387 and KPL-1161, respectively;

our beliefs about the mechanisms of our assets and potential impact of their approach; and our belief that our portfolio of assets offers

the potential for differentiation.

These forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements, including without limitation, the following: delays or difficulty

in enrollment of patients in, and activation or continuation of sites for, our clinical trials; delays or difficulty in completing our

clinical trials as originally designed; potential for changes between final data and any preliminary, interim, top-line or other data

from clinical trials; our inability to replicate results from our earlier clinical trials or studies; impact of additional data from

us or other companies, including the potential for our data to produce negative, inconclusive or commercially uncompetitive results;

potential undesirable side effects caused by our products and product candidates; our inability to demonstrate safety and efficacy to

the satisfaction of applicable regulatory authorities; potential for applicable regulatory authorities to not accept our filings, delay

or deny approval of any of our product candidates or require additional data or trials to support approval; our reliance on third parties

as the sole source of supply of the drug substance and drug product used in our products and product candidates; raw material, important

ancillary product and drug substance and/or drug product shortages; our reliance on third parties to conduct research, clinical trials,

and/or certain regulatory activities for our product candidates; complications in coordinating requirements, regulations and guidelines

of regulatory authorities across jurisdictions for our clinical trials; business development activities and their impact on our financial

performance and strategy; changes in our operating plan, business development strategy or funding requirements; and existing or new competition.

These and other important factors discussed in our filings with the

U.S. Securities and Exchange Commission, including under the caption “Risk Factors” contained therein, could cause actual

results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking

statements represent management’s estimates as of the date of this press release. Except as required by law, we disclaim any intention

or obligation to update or revise any forward-looking statements. These forward-looking statements should not be relied upon as representing

our views as of any date subsequent to the date of this press release.

ARCALYST® is a registered trademark of Regeneron

Pharmaceuticals, Inc.

Every Second Counts! ®

Kiniksa Investor Contact

Jonathan Kirshenbaum

(781) 829-3949

jkirshenbaum@kiniksa.com

Kiniksa Media Contact

Tyler Gagnon

(781) 431-9100

tgagnon@kiniksa.com

| KINIKSA

PHARMACEUTICALS INTERNATIONAL, PLC |

| SELECTED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

| (In

thousands) |

| (Unaudited)

|

| | |

Three Months Ended | | |

Years Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product revenue, net | |

$ | 122,536 | | |

$ | 71,220 | | |

$ | 417,029 | | |

$ | 233,176 | |

| License and collaboration revenue | |

| — | | |

| 12,175 | | |

| 6,210 | | |

| 37,083 | |

| Total revenue | |

| 122,536 | | |

| 83,395 | | |

| 423,239 | | |

| 270,259 | |

| Costs and operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 17,896 | | |

| 9,584 | | |

| 60,910 | | |

| 33,407 | |

| Collaboration expenses | |

| 48,189 | | |

| 16,939 | | |

| 128,311 | | |

| 56,524 | |

| Research and development | |

| 35,215 | | |

| 20,052 | | |

| 111,623 | | |

| 76,097 | |

| Selling, general and administrative | |

| 40,535 | | |

| 36,739 | | |

| 168,011 | | |

| 129,427 | |

| Total operating expenses | |

| 141,835 | | |

| 83,314 | | |

| 468,855 | | |

| 295,455 | |

| Income (loss) from operations | |

| (19,299 | ) | |

| 81 | | |

| (45,616 | ) | |

| (25,196 | ) |

| Other income | |

| 2,320 | | |

| 2,369 | | |

| 9,464 | | |

| 8,544 | |

| Income (loss) before income taxes | |

| (16,979 | ) | |

| 2,450 | | |

| (36,152 | ) | |

| (16,652 | ) |

| Benefit (provision) for income taxes | |

| 8,091 | | |

| 22,787 | | |

| (7,041 | ) | |

| 30,736 | |

| Net income (loss) | |

$ | (8,888 | ) | |

$ | 25,237 | | |

$ | (43,193 | ) | |

$ | 14,084 | |

| Net income (loss) per share attributable to ordinary shareholders—basic | |

$ | (0.12 | ) | |

$ | 0.36 | | |

$ | (0.60 | ) | |

$ | 0.20 | |

| Net income (loss) per share attributable to ordinary shareholders—diluted | |

$ | (0.12 | ) | |

$ | 0.35 | | |

$ | (0.60 | ) | |

$ | 0.20 | |

| Weighted average ordinary shares outstanding—basic | |

| 72,319,129 | | |

| 70,371,601 | | |

| 71,424,159 | | |

| 70,058,952 | |

| Weighted average ordinary shares outstanding—diluted | |

| 72,319,129 | | |

| 72,660,171 | | |

| 71,424,159 | | |

| 71,922,915 | |

KINIKSA PHARMACEUTICALS

INTERNATIONAL, PLC

SELECTED CONSOLIDATED

BALANCE SHEET DATA

(In thousands)

(Unaudited)

| | |

As of | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Cash, cash equivalents, and short-term investments | |

$ | 243,627 | | |

$ | 206,371 | |

| Working capital | |

| 231,178 | | |

| 212,631 | |

| Total assets | |

| 580,553 | | |

| 526,322 | |

| Accumulated deficit | |

| (521,143 | ) | |

| (477,950 | ) |

| Total shareholders' equity | |

| 438,436 | | |

| 438,839 | |

v3.25.0.1

Cover

|

Feb. 21, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2025

|

| Entity File Number |

001-730430

|

| Entity Registrant Name |

Kiniksa

Pharmaceuticals International, plc

|

| Entity Central Index Key |

0001730430

|

| Entity Tax Identification Number |

98-1795578

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

23 Old Bond Street, Floor 3

|

| Entity Address, City or Town |

London

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

W1S 4PZ

|

| City Area Code |

781

|

| Local Phone Number |

431-9100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A

Ordinary Shares, $0.000273235 nominal value

|

| Trading Symbol |

KNSA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

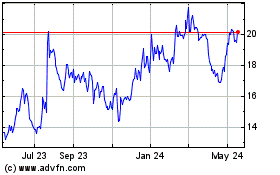

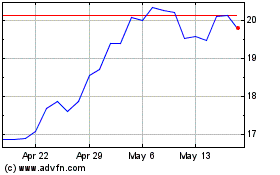

Kiniksa Pharmaceuticals (NASDAQ:KNSA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kiniksa Pharmaceuticals (NASDAQ:KNSA)

Historical Stock Chart

From Feb 2024 to Feb 2025