0000057515false00000575152024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2024

| | | | | | | | |

| | |

| Lancaster Colony Corporation |

| (Exact name of registrant as specified in its charter) |

| | |

| | | | | | | | |

| Ohio | 000-04065 | 13-1955943 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| |

| 380 Polaris Parkway | Suite 400 | |

| Westerville | Ohio | 43082 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | | | | |

| Registrant’s telephone number, including area code: | (614) | 224-7141 |

| | | | | | | | |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, without par value | LANC | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On October 31, 2024, Lancaster Colony Corporation issued a press release announcing its results for the three months ended September 30, 2024. The press release is attached as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | |

| (d) | Exhibits: |

| | | |

| 99.1 | | Press Release dated October 31, 2024 |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

INDEX TO EXHIBITS

| | | | | | | | | | | | | | |

| Exhibit Number | | Description | | Located at |

| | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) | | Filed herewith |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | LANCASTER COLONY CORPORATION |

| | | (Registrant) |

| | | | |

| Date: | October 31, 2024 | | By: | /s/ THOMAS K. PIGOTT |

| | | | Thomas K. Pigott |

| | | | Vice President, Chief Financial Officer |

| | | | and Assistant Secretary |

| | | | (Principal Financial and Accounting Officer) |

| | | | |

| | | | | | | | | | | | | | |

| | | | Exhibit 99.1 |

| | | | |

| FOR IMMEDIATE RELEASE | | | | SYMBOL: LANC |

| October 31, 2024 | | | | TRADED: Nasdaq |

LANCASTER COLONY REPORTS FIRST QUARTER SALES AND EARNINGS

WESTERVILLE, Ohio, October 31 - Lancaster Colony Corporation (Nasdaq: LANC) today reported results for the company’s fiscal first quarter ended September 30, 2024.

Summary

•Consolidated net sales increased 1.1% to a first quarter record $466.6 million. Retail segment net sales declined 1.1% to $239.6 million. Note that excluding all sales attributed to the perimeter-of-the-store bakery product lines we exited this past March, Retail segment net sales grew 1.4%. Foodservice segment net sales increased 3.5% to $227.0 million.

•Consolidated gross profit increased 1.9% to a first quarter record $110.8 million.

•Consolidated operating income decreased 1.6% to $55.9 million.

•Net income reached $1.62 per diluted share versus $1.59 per diluted share last year.

CEO David A. Ciesinski commented, “We were pleased to complete the quarter with record sales of $466.6 million and record gross profit of $110.8 million. In the Retail segment, we saw continued growth from our licensing program driven by the Subway® sauces we launched this past spring and expanding distribution for Texas Roadhouse® dinner rolls following a successful pilot test. Excluding the perimeter-of-the-store bakery product lines that we exited in March, Retail net sales increased 1.4% and Retail sales volume, measured in pounds shipped, increased 1.9%. In the Foodservice segment, despite industry-wide trends of slowing traffic, net sales grew 3.5% driven by increased demand from several of our national chain restaurant customers and volume gains for our branded Foodservice products.”

“Our reported gross profit margin reflects a sequential improvement of 220 basis points from our fiscal fourth quarter and an increase of 20 basis points compared to last year’s fiscal first quarter as our financial performance benefited from the higher sales volume and our ongoing cost savings initiatives.”

“Looking ahead to our fiscal second quarter and the remainder of our fiscal year, we anticipate Retail segment sales will continue to benefit from our growing licensing program, driven by new product introductions such as Subway sauces and Texas Roadhouse dinner rolls. Our newly launched New York BRAND® Bakery gluten-free garlic bread will also add to the Retail segment’s sales. In the Foodservice segment, we anticipate continued volume gains from select customers in our mix of national chain restaurant accounts.”

PAGE 2 / LANCASTER COLONY REPORTS FIRST QUARTER SALES AND EARNINGS

First Quarter Results

Consolidated net sales increased 1.1%, or $5.0 million, to a first quarter record $466.6 million. Retail segment net sales decreased 1.1%, or $2.6 million, to $239.6 million while the segment’s sales volume, measured in pounds shipped, increased 0.3%. Retail net sales reflect an increased and more normalized level of trade spending versus last year, as we invested more to support our brands and launch new items. Excluding the perimeter-of-the-store bakery product lines that we exited in March, specifically our Flatout® and Angelic Bakehouse® brands, Retail net sales increased 1.4% and Retail sales volume increased 1.9%. In the Foodservice segment, net sales increased 3.5%, or $7.6 million, to $227.0 million while the segment’s sales volume increased 3.1%.

Consolidated gross profit grew 1.9%, or $2.1 million, to a first quarter record $110.8 million. The increase in gross profit was driven by the higher sales volumes and our cost savings programs. As anticipated, our pricing net of commodity costs, or PNOC, was close to neutral.

SG&A expenses increased $3.0 million to $55.0 million in support of the continued growth of our business, including increased investments in personnel and IT, in addition to higher legal expenses.

Consolidated operating income declined $0.9 million to $55.9 million. Net income improved $0.7 million to $44.7 million, or $1.62 per diluted share, versus $44.0 million, or $1.59 per diluted share, last year.

Conference Call on the Web

The company’s first quarter conference call is scheduled for this morning, October 31, at 10:00 a.m. ET. Access to a live webcast of the call is available through a link on the company’s Internet home page at www.lancastercolony.com. A replay of the webcast will also be made available on the company’s website.

About the Company

Lancaster Colony Corporation is a manufacturer and marketer of specialty food products for the retail and foodservice channels.

Forward-Looking Statements

We desire to take advantage of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”). This news release contains various “forward-looking statements” within the meaning of the PSLRA and other applicable securities laws. Such statements can be identified by the use of the forward-looking words “anticipate,” “estimate,” “project,” “believe,” “intend,” “plan,” “expect,” “hope” or similar words. These statements discuss future expectations; contain projections regarding future developments, operations or financial conditions; or state other forward-looking information. Such statements are based upon assumptions and assessments made by us in light of our experience and perception of historical trends, current conditions, expected future developments; and other factors we believe to be appropriate. These forward-looking statements involve various important risks, uncertainties and other factors, many of which are beyond our control, which could cause our actual results to differ materially from those expressed in the forward-looking statements. Some of the key factors that could cause actual results to differ materially from those expressed in the forward-looking statements include:

•efficiencies in plant operations and our overall supply chain network;

•price and product competition;

•changes in demand for our products, which may result from changes in consumer behavior or loss of brand reputation or customer goodwill;

•the impact of customer store brands on our branded retail volumes;

PAGE 3 / LANCASTER COLONY REPORTS FIRST QUARTER SALES AND EARNINGS

•the impact of any regulatory matters affecting our food business, including any additional requirements imposed by the FDA or any state or local government;

•adequate supply of labor for our manufacturing facilities;

•stability of labor relations;

•adverse changes in freight, energy or other costs of producing, distributing or transporting our products;

•the reaction of customers or consumers to pricing actions we take to offset inflationary costs;

•inflationary pressures resulting in higher input costs;

•fluctuations in the cost and availability of ingredients and packaging;

•capacity constraints that may affect our ability to meet demand or may increase our costs;

•dependence on contract manufacturers, distributors and freight transporters, including their operational capacity and financial strength in continuing to support our business;

•dependence on key personnel and changes in key personnel;

•cyber-security incidents, information technology disruptions, and data breaches;

•the potential for loss of larger programs or key customer relationships;

•failure to maintain or renew license agreements;

•geopolitical events that could create unforeseen business disruptions and impact the cost or availability of raw materials and energy;

•the possible occurrence of product recalls or other defective or mislabeled product costs;

•the success and cost of new product development efforts;

•the lack of market acceptance of new products;

•the extent to which good-fitting business acquisitions are identified, acceptably integrated, and achieve operational and financial performance objectives;

•the effect of consolidation of customers within key market channels;

•maintenance of competitive position with respect to other manufacturers;

•the outcome of any litigation or arbitration;

•significant shifts in consumer demand and disruptions to our employees, communities, customers, supply chains, production planning, operations, and production processes resulting from the impacts of epidemics, pandemics or similar widespread public health concerns and disease outbreaks;

•changes in estimates in critical accounting judgments;

•the impact of fluctuations in our pension plan asset values on funding levels, contributions required and benefit costs; and

•risks related to other factors described under “Risk Factors” in other reports and statements filed by us with the Securities and Exchange Commission, including without limitation our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q (available at www.sec.gov).

Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update such forward-looking statements, except as required by law. Management believes these forward-looking statements to be reasonable; however, you should not place undue reliance on statements that are based on current expectations.

# # # #

| | | | | |

| FOR FURTHER INFORMATION: | Dale N. Ganobsik |

| Vice President, Corporate Finance and Investor Relations |

| Lancaster Colony Corporation |

| Phone: 614/224-7141 |

| Email: ir@lancastercolony.com |

PAGE 4 / LANCASTER COLONY REPORTS FIRST QUARTER SALES AND EARNINGS

LANCASTER COLONY CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(In thousands except per-share amounts)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, |

| | | | | 2024 | | 2023 |

| Net sales | | | | | $ | 466,558 | | | $ | 461,572 | |

| Cost of sales | | | | | 355,734 | | | 352,850 | |

| Gross profit | | | | | 110,824 | | | 108,722 | |

| Selling, general & administrative expenses | | | | | 54,960 | | | 51,947 | |

| | | | | | | |

| | | | | | | |

| Operating income | | | | | 55,864 | | | 56,775 | |

| Other, net | | | | | 2,019 | | | 857 | |

| Income before income taxes | | | | | 57,883 | | | 57,632 | |

| Taxes based on income | | | | | 13,182 | | | 13,681 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income | | | | | $ | 44,701 | | | $ | 43,951 | |

| | | | | | | |

| Net income per common share: (a) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | | | | | $ | 1.62 | | | $ | 1.60 | |

| Diluted | | | | | $ | 1.62 | | | $ | 1.59 | |

| | | | | | | |

| Cash dividends per common share | | | | | $ | 0.90 | | | $ | 0.85 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | | | | | 27,457 | | | 27,449 | |

| Diluted | | | | | 27,478 | | | 27,473 | |

(a) Based on the weighted average number of shares outstanding during each period.

PAGE 5 / LANCASTER COLONY REPORTS FIRST QUARTER SALES AND EARNINGS

LANCASTER COLONY CORPORATION

BUSINESS SEGMENT INFORMATION (Unaudited)

(In thousands) | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, |

| | | | | 2024 | | 2023 |

| NET SALES | | | | | | | |

| Retail | | | | | $ | 239,571 | | | $ | 242,184 | |

| Foodservice | | | | | 226,987 | | | 219,388 | |

| Total Net Sales | | | | | $ | 466,558 | | | $ | 461,572 | |

| | | | | | | |

| OPERATING INCOME | | | | | | | |

| Retail | | | | | $ | 56,175 | | | $ | 53,124 | |

| Foodservice | | | | | 24,309 | | | 26,633 | |

| | | | | | | |

| Corporate Expenses | | | | | (24,620) | | | (22,982) | |

| Total Operating Income | | | | | $ | 55,864 | | | $ | 56,775 | |

LANCASTER COLONY CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(In thousands) | | | | | | | | | | | |

| September 30,

2024 | | June 30,

2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and equivalents | $ | 135,058 | | | $ | 163,443 | |

| Receivables | 101,505 | | | 95,560 | |

| Inventories | 193,663 | | | 173,252 | |

| Other current assets | 22,361 | | | 11,738 | |

| Total current assets | 452,587 | | | 443,993 | |

| Net property, plant and equipment | 480,390 | | | 477,696 | |

| Other assets | 283,233 | | | 285,242 | |

| Total assets | $ | 1,216,210 | | | $ | 1,206,931 | |

| | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 109,236 | | | $ | 118,811 | |

| Accrued liabilities | 63,941 | | | 65,158 | |

| Total current liabilities | 173,177 | | | 183,969 | |

| Noncurrent liabilities and deferred income taxes | 97,981 | | | 97,190 | |

| Shareholders’ equity | 945,052 | | | 925,772 | |

| Total liabilities and shareholders’ equity | $ | 1,216,210 | | | $ | 1,206,931 | |

# # # #

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

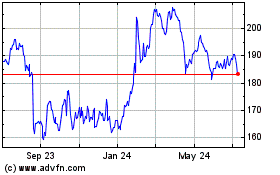

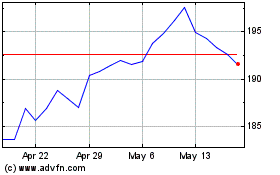

Lancaster Colony (NASDAQ:LANC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lancaster Colony (NASDAQ:LANC)

Historical Stock Chart

From Feb 2024 to Feb 2025