LGI Homes, Inc. (NASDAQ: LGIH) today announced financial results

for the second quarter 2022 and the six months ended June 30, 2022.

Second Quarter 2022 Highlights and

Comparisons to Second Quarter 2021

- Net Income

increased 4.4% to $123.4 million, or $5.24 Basic EPS and $5.20

Diluted EPS

- Net Income Before

Income Taxes increased 9.3% to $163.0 million

- Home Sales Revenues

decreased 8.6% to $723.1 million

- Home Closings

decreased 29.0% to 2,027 homes closed

- Average Sales Price

increased 28.7% to $356,719

- Gross Margin as a

Percentage of Homes Sales Revenues increased 500 basis points to

32.0%

- Adjusted Gross

Margin* as a Percentage of Home Sales Revenues increased 460 basis

points to 33.1%

- Active Selling

Communities at June 30, 2022 of 92

Six Months Ended June 30, 2022

Highlights and Comparisons to Six Months ended June 30,

2021

- Net Income

decreased 7.2% to $202.1 million, or $8.53 Basic EPS and $8.43

Diluted EPS

- Net Income Before

Income Taxes decreased 3.6% to $262.6 million

- Home Sales Revenues

decreased 15.2% to $1.3 billion

- Home Closings

decreased 33.1% to 3,626 homes closed

- Average Sales Price

increased 26.6% to $350,005

- Gross Margin as a

Percentage of Homes Sales Revenues increased 370 basis points to

30.7%

- Adjusted Gross

Margin* as a Percentage of Home Sales Revenues increased 340 basis

points to 31.9%

- Total Owned and

Controlled lots of 89,984

- Ending backlog of

1,266 homes valued at $445.1 million

*Non-GAAP

Please see “Non-GAAP Measures” for a

reconciliation of Adjusted Gross Margin (a non-GAAP measure) to

Gross Margin, the most directly comparable GAAP measure.

Balance Sheet Highlights

- Total liquidity of

$245.7 million at June 30, 2022, including cash and cash

equivalents of $42.0 million and $203.7 million of availability

under the Company’s revolving credit facility

- Net debt to

capitalization of 42.4% at June 30, 2022, compared to 35.1% at

December 31, 2021

- 417,861 shares of

common stock repurchased during the second quarter of 2022 for an

aggregate amount of $37.4 million

Management Comments

“I am pleased to announce the results of another

outstanding quarter that included record setting results in every

profitability metric we track,” stated Eric Lipar, Chairman and

Chief Executive Officer of LGI Homes.

“During the quarter we closed 2,027 homes,

resulting in $723.1 million dollars in revenue. Absorptions

continued to exceed our historical average, coming in at 7.4

closings, per community, per month. Despite fewer closings compared

to last year’s record comp, our commitment to executing on our

systems, combined with continued pricing power, enabled us to

deliver the most profitable quarter in our history. In addition to

new Company records in pre-tax income and net income, we delivered

a 500 basis point improvement in our gross margin to 32.0% and a

460 basis point improvement in our adjusted gross margin to an

impressive 33.1%.

“The interest rate hikes at the end of the second quarter caused

some buyers to pause and see if rates return to more familiar

levels. Given the uncertainty this and other macro events have

created, we are updating our full year guidance. We now expect to

close between 7,500 and 8,300 homes at an average sales price

between $345,000 and $360,000. SG&A as a percentage of revenue

is now expected in a range between 10.0% and 11.0% and we expect to

end the year with between 100 and 110 active communities. Finally,

we are maintaining our prior guidance for gross margins between

27.0% and 29.0%, adjusted gross margins between 28.5% and 30.5% and

an effective tax rate between 23.5% and 24.5%.”

Mr. Lipar concluded, “After a two-year boom

market unlike any other in history, the housing market sits at a

pivotal moment. The short-term view is that homes are more

expensive, consumer prices are up, and mortgage rates have nearly

doubled. However, the longer-term outlook reveals a solid

foundation for multi-year growth. Demographic trends remain

supportive of demand, strong labor markets are fueling wage growth,

tight rental supply is pushing up rents, and the inventory of homes

available for sale remains historically low. At LGI, we're taking

the long-term view and remain optimistic about our business. Our

operating model was built to thrive in challenging environments and

we believe our people, systems, culture and 100% spec-focused model

will continue to drive our success and differentiate our business,

regardless of market conditions, for many years to come.”

Full Year 2022 Outlook

Subject to the caveats in the Forward-Looking

Statements section of this press release, the Company is providing

the following updates to its guidance for the full year 2022. The

Company now believes:

-

Home closings between 7,500 and 8,300

- Active selling

communities at the end of 2022 between 100 and 110

- Average sales price

per home closed between $345,000 and $360,000

- Gross margin as a

percentage of home sales revenue between 27.0% and 29.0%

- Adjusted gross

margin (non-GAAP) as a percentage of home sales revenue between

28.5% and 30.5% with capitalized interest accounting for

substantially all the difference between gross margin and adjusted

gross margin as a percentage of home sales revenue

- SG&A as a

percentage of home sales revenue between 10.0% and 11.0%

- Effective tax rate

between 23.5% and 24.5%

This updated outlook assumes that general

economic conditions, including input costs, materials, product and

labor availability, interest rates and mortgage availability, in

the remainder of 2022 are similar to those experienced so far in

the third quarter 2022 and that construction costs, availability of

land, and land development costs in the remainder of 2022 are

consistent with the Company’s most recent experience. In addition,

this outlook assumes that governmental regulations relating to land

development, home construction and COVID-19 are similar to those

currently in place. Any further COVID-19 governmental restrictions

on land development, home construction or home sales could

negatively impact the Company’s ability to achieve this

guidance.

Earnings Conference Call

The Company will host a conference call via live

webcast for investors and other interested parties beginning at

12:30 p.m. Eastern Time on Tuesday, August 2, 2022 (the

“Earnings Call”). The Earnings Call will be hosted by Eric Lipar,

Chief Executive Officer and Chairman of the Board, and Charles

Merdian, Chief Financial Officer and Treasurer.

Participants may access the live webcast by

visiting the Investor Relations section of the Company’s website at

www.lgihomes.com.

An archive of the webcast will be available for

replay on the Company’s website for one year from the date of the

conference call.

About LGI Homes, Inc.

LGI Homes, Inc. is a pioneer in the homebuilding

industry, successfully applying an innovative and systematic

approach to the design, construction and sale of homes. As one of

America’s fastest growing companies, LGI Homes has a notable legacy

of more than 19 years of homebuilding excellence, over which time

it has closed more than 50,000 homes and has been profitable every

year. Headquartered in The Woodlands, Texas, LGI Homes has

operations across 35 markets in 20 states and, since 2018, has been

ranked as the 10th largest residential builder in the United States

based on units closed. Nationally recognized for its quality

construction and exceptional customer service, LGI Homes’

commitment to excellence extends to its more than 900 employees,

earning the Company numerous workplace awards at the local, state

and national level, including Top Workplaces USA’s 2022 Cultural

Excellence Award. For more information about LGI Homes and its

unique operating model focused on making the dream of homeownership

a reality for families across the nation, please visit the

Company’s website at www.lgihomes.com.

Forward-Looking Statements

Any statements made in this press release or on

the Earnings Call that are not statements of historical fact,

including statements about the Company’s beliefs and expectations,

are forward-looking statements within the meaning of the federal

securities laws, and should be evaluated as such. Forward-looking

statements include information concerning projected 2022 home

closings, active selling communities, average sales price per home

closed, gross margin as a percentage of home sales revenues,

adjusted gross margin as a percentage of homes sales revenues,

SG&A as a percentage of home sales revenue and effective tax

rate, and the impact of the COVID-19 pandemic and its effect on the

Company, its business, customers, subcontractors, and its markets,

as well as market conditions and possible or assumed future results

of operations, including descriptions of the Company's business

plan and strategies. These forward-looking statements can be

identified by the use of forward-looking terminology, including the

terms “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,”

“potential,” “predict,” “projection,” “should,” “will” or, in each

case, their negative, or other variations or comparable

terminology. For more information concerning factors that could

cause actual results to differ materially from those contained in

the forward-looking statements please refer to the “Risk Factors”

section in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2021, including the “Cautionary Statement

about Forward-Looking Statements” subsection within the “Risk

Factors” section, the “Risk Factors” and “Cautionary Statement

about Forward-Looking Statements” sections in the Company’s

Quarterly Report on Form 10-Q for the quarter ended March 31, 2022

and June 30, 2022 and subsequent filings by the Company with the

Securities and Exchange Commission. The Company bases these

forward-looking statements or projections on its current

expectations, plans and assumptions that it has made in light of

its experience in the industry, as well as its perceptions of

historical trends, current conditions, expected future developments

and other factors it believes are appropriate under the

circumstances and at such time. As you read and consider this press

release or listen to the Earnings Call, you should understand that

these statements are not guarantees of future performance or

results. The forward-looking statements and projections are subject

to and involve risks, uncertainties and assumptions and you should

not place undue reliance on these forward-looking statements or

projections. Although the Company believes that these

forward-looking statements and projections are based on reasonable

assumptions at the time they are made, you should be aware that

many factors could affect the Company’s actual results to differ

materially from those expressed in the forward-looking statements

and projections. The Company undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. If the Company does update

one or more forward-looking statements, there should be no

inference that it will make additional updates with respect to

those or other forward-looking statements.

LGI HOMES,

INC.CONSOLIDATED BALANCE

SHEETS(Unaudited)(In thousands,

except share data)

| |

|

June 30, |

|

December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

| ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

41,971 |

|

|

$ |

50,514 |

|

|

Accounts receivable |

|

|

52,106 |

|

|

|

57,909 |

|

|

Real estate inventory |

|

|

2,633,706 |

|

|

|

2,085,904 |

|

|

Pre-acquisition costs and deposits |

|

|

38,277 |

|

|

|

40,702 |

|

|

Property and equipment, net |

|

|

20,311 |

|

|

|

16,944 |

|

|

Other assets |

|

|

69,481 |

|

|

|

81,676 |

|

|

Deferred tax assets, net |

|

|

5,487 |

|

|

|

6,198 |

|

|

Goodwill |

|

|

12,018 |

|

|

|

12,018 |

|

|

Total assets |

|

$ |

2,873,357 |

|

|

$ |

2,351,865 |

|

| |

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

Accounts payable |

|

$ |

40,162 |

|

|

$ |

14,172 |

|

|

Accrued expenses and other liabilities |

|

|

163,811 |

|

|

|

136,609 |

|

|

Notes payable |

|

|

1,155,463 |

|

|

|

805,236 |

|

|

Total liabilities |

|

|

1,359,436 |

|

|

|

956,017 |

|

| |

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

| EQUITY |

|

|

|

|

| Common stock, par value $0.01,

250,000,000 shares authorized, 27,212,108 shares issued and

23,272,636 shares outstanding as of June 30, 2022 and 26,963,915

shares issued and 23,917,359 shares outstanding as of December 31,

2021 |

|

|

271 |

|

|

|

269 |

|

|

Additional paid-in capital |

|

|

302,688 |

|

|

|

291,577 |

|

|

Retained earnings |

|

|

1,565,984 |

|

|

|

1,363,922 |

|

| Treasury stock, at cost,

3,939,472 shares and 3,046,556 shares, respectively |

|

|

(355,022 |

) |

|

|

(259,920 |

) |

|

Total equity |

|

|

1,513,921 |

|

|

|

1,395,848 |

|

|

Total liabilities and equity |

|

$ |

2,873,357 |

|

|

$ |

2,351,865 |

|

LGI HOMES,

INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)(In

thousands, except share and per share data)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Home sales revenues |

|

$ |

723,069 |

|

|

$ |

791,512 |

|

|

$ |

1,269,119 |

|

|

$ |

1,497,465 |

|

| |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

491,710 |

|

|

|

577,433 |

|

|

|

879,353 |

|

|

|

1,093,437 |

|

| Selling expenses |

|

|

43,269 |

|

|

|

44,796 |

|

|

|

77,667 |

|

|

|

87,579 |

|

| General and

administrative |

|

|

29,084 |

|

|

|

23,276 |

|

|

|

57,373 |

|

|

|

47,999 |

|

|

Operating income |

|

|

159,006 |

|

|

|

146,007 |

|

|

|

254,726 |

|

|

|

268,450 |

|

| Loss on extinguishment of

debt |

|

|

— |

|

|

|

662 |

|

|

|

— |

|

|

|

662 |

|

| Other income, net |

|

|

(4,006 |

) |

|

|

(3,776 |

) |

|

|

(7,836 |

) |

|

|

(4,609 |

) |

| Net income before income

taxes |

|

|

163,012 |

|

|

|

149,121 |

|

|

|

262,562 |

|

|

|

272,397 |

|

| Income tax provision |

|

|

39,636 |

|

|

|

30,987 |

|

|

|

60,500 |

|

|

|

54,605 |

|

| Net income |

|

$ |

123,376 |

|

|

$ |

118,134 |

|

|

$ |

202,062 |

|

|

$ |

217,792 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

5.24 |

|

|

$ |

4.75 |

|

|

$ |

8.53 |

|

|

$ |

8.75 |

|

|

Diluted |

|

$ |

5.20 |

|

|

$ |

4.71 |

|

|

$ |

8.43 |

|

|

$ |

8.66 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

23,552,883 |

|

|

|

24,844,644 |

|

|

|

23,694,241 |

|

|

|

24,897,462 |

|

|

Diluted |

|

|

23,745,853 |

|

|

|

25,061,812 |

|

|

|

23,968,263 |

|

|

|

25,138,691 |

|

Non-GAAP Measures

In addition to the results reported in

accordance with accounting principles generally accepted in the

United States (“GAAP”), the Company has provided information in

this press release relating to adjusted gross margin, adjusted net

income and adjusted earnings per share.

Adjusted Gross Margin

Adjusted gross margin is a non-GAAP financial

measure used by management as a supplemental measure in evaluating

operating performance. The Company defines adjusted gross margin as

gross margin less capitalized interest and adjustments resulting

from the application of purchase accounting included in the cost of

sales. Management believes this information is useful because it

isolates the impact that capitalized interest and purchase

accounting adjustments have on gross margin. However, because

adjusted gross margin information excludes capitalized interest and

purchase accounting adjustments, which have real economic effects

and could impact results, the utility of adjusted gross margin

information as a measure of operating performance may be limited.

In addition, other companies may not calculate adjusted gross

margin information in the same manner that the Company does.

Accordingly, adjusted gross margin information should be considered

only as a supplement to gross margin information as a measure of

the Company’s performance.

The following table reconciles adjusted gross

margin to gross margin, which is the GAAP financial measure that

management believes to be most directly comparable (dollars in

thousands, unaudited):

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Home sales revenues |

|

$ |

723,069 |

|

|

$ |

791,512 |

|

|

$ |

1,269,119 |

|

|

$ |

1,497,465 |

|

| Cost of sales |

|

|

491,710 |

|

|

|

577,433 |

|

|

|

879,353 |

|

|

|

1,093,437 |

|

| Gross margin |

|

|

231,359 |

|

|

|

214,079 |

|

|

|

389,766 |

|

|

|

404,028 |

|

|

Capitalized interest charged to cost of sales |

|

|

5,735 |

|

|

|

10,442 |

|

|

|

10,248 |

|

|

|

21,115 |

|

|

Purchase accounting adjustments(1) |

|

|

2,026 |

|

|

|

1,446 |

|

|

|

4,308 |

|

|

|

2,258 |

|

| Adjusted gross margin |

|

$ |

239,120 |

|

|

$ |

225,967 |

|

|

$ |

404,322 |

|

|

$ |

427,401 |

|

| Gross margin %(2) |

|

|

32.0 |

% |

|

|

27.0 |

% |

|

|

30.7 |

% |

|

|

27.0 |

% |

| Adjusted gross margin

%(2) |

|

|

33.1 |

% |

|

|

28.5 |

% |

|

|

31.9 |

% |

|

|

28.5 |

% |

|

(1) |

Adjustments

result from the application of purchase accounting for acquisitions

and represent the amount of the fair value step-up adjustments

included in cost of sales for real estate inventory sold after the

acquisition dates. |

| (2) |

Calculated as a percentage of home sales revenues. |

Home Sales Revenues, Home Closings, Average Sales Price

Per Home Closed (ASP), Average Community Count, Average Monthly

Absorption Rates and Closing Community Count by Reportable

Segment

(Revenues in thousands,

unaudited)

| |

|

Three Months Ended June 30, 2022 |

|

As of June 30, 2022 |

| |

|

Revenues |

|

Home Closings |

|

ASP |

|

Average Community Count |

|

AverageMonthlyAbsorption

Rate |

|

Community Count at End of Period |

|

Central |

|

$ |

316,654 |

|

935 |

|

$ |

338,667 |

|

31.0 |

|

10.1 |

|

32 |

| Southeast |

|

|

117,569 |

|

361 |

|

|

325,676 |

|

19.7 |

|

6.1 |

|

20 |

| Northwest |

|

|

70,792 |

|

133 |

|

|

532,271 |

|

8.3 |

|

5.3 |

|

8 |

| West |

|

|

123,956 |

|

301 |

|

|

411,814 |

|

12.7 |

|

7.9 |

|

12 |

| Florida |

|

|

94,098 |

|

297 |

|

|

316,828 |

|

19.6 |

|

5.1 |

|

20 |

| Total |

|

$ |

723,069 |

|

2,027 |

|

$ |

356,719 |

|

91.3 |

|

7.4 |

|

92 |

| |

|

Three Months Ended June 30, 2021 |

|

As of June 30, 2021 |

| |

|

Revenues |

|

Home Closings |

|

ASP |

|

Average Community Count |

|

AverageMonthlyAbsorption

Rate |

|

Community Count at End of Period |

|

Central |

|

$ |

347,963 |

|

1,348 |

|

$ |

258,133 |

|

38.0 |

|

11.8 |

|

40 |

| Southeast |

|

|

159,714 |

|

632 |

|

|

252,712 |

|

25.7 |

|

8.2 |

|

25 |

| Northwest |

|

|

106,197 |

|

255 |

|

|

416,459 |

|

10.3 |

|

8.3 |

|

11 |

| West |

|

|

80,813 |

|

232 |

|

|

348,332 |

|

10.7 |

|

7.2 |

|

10 |

| Florida |

|

|

96,825 |

|

389 |

|

|

248,907 |

|

20.3 |

|

6.4 |

|

20 |

| Total |

|

$ |

791,512 |

|

2,856 |

|

$ |

277,140 |

|

105.0 |

|

9.1 |

|

106 |

| |

|

Six Months Ended June 30, 2022 |

| |

|

Revenues |

|

Home Closings |

|

ASP |

|

Average Community Count |

|

AverageMonthlyAbsorption

Rate |

|

Central |

|

$ |

578,952 |

|

1,779 |

|

$ |

325,437 |

|

30.5 |

|

9.7 |

| Southeast |

|

|

190,032 |

|

599 |

|

|

317,249 |

|

19.8 |

|

5.0 |

| Northwest |

|

|

173,666 |

|

334 |

|

|

519,958 |

|

9.3 |

|

6.0 |

| West |

|

|

179,539 |

|

443 |

|

|

405,280 |

|

11.3 |

|

6.5 |

| Florida |

|

|

146,930 |

|

471 |

|

|

311,953 |

|

19.3 |

|

4.1 |

| Total |

|

$ |

1,269,119 |

|

3,626 |

|

$ |

350,005 |

|

90.2 |

|

6.7 |

| |

|

Six Months Ended June 30, 2021 |

| |

|

Revenues |

|

Home Closings |

|

ASP |

|

Average Community Count |

|

Average MonthlyAbsorption

Rate |

|

Central |

|

$ |

636,713 |

|

2,475 |

|

$ |

257,258 |

|

37.6 |

|

11.0 |

| Southeast |

|

|

296,265 |

|

1,180 |

|

|

251,072 |

|

26.7 |

|

7.4 |

| Northwest |

|

|

224,388 |

|

551 |

|

|

407,238 |

|

10.5 |

|

8.7 |

| West |

|

|

161,961 |

|

481 |

|

|

336,717 |

|

10.7 |

|

7.5 |

| Florida |

|

|

178,138 |

|

730 |

|

|

244,025 |

|

20.2 |

|

6.0 |

| Total |

|

$ |

1,497,465 |

|

5,417 |

|

$ |

276,438 |

|

105.7 |

|

8.5 |

Owned and Controlled Lots

The table below shows (i) home closings by

reportable segment for the six months ended June 30, 2022 and

(ii) owned or controlled lots by reportable segment as of

June 30, 2022.

| |

|

Six Months Ended June 30, 2022 |

|

As of June 30, 2022 |

|

Reportable Segment |

|

Home Closings |

|

Owned(1) |

|

Controlled |

|

Total |

|

Central |

|

1,779 |

|

24,231 |

|

9,199 |

|

33,430 |

| Southeast |

|

599 |

|

16,591 |

|

5,186 |

|

21,777 |

| Northwest |

|

334 |

|

6,909 |

|

4,079 |

|

10,988 |

| West |

|

443 |

|

9,065 |

|

5,960 |

|

15,025 |

| Florida |

|

471 |

|

5,097 |

|

3,667 |

|

8,764 |

| Total |

|

3,626 |

|

61,893 |

|

28,091 |

|

89,984 |

|

(1) |

Of the 61,893

owned lots as of June 30, 2022, 49,595 were raw/under

development lots and 12,298 were finished lots. Finished lots

included 722 completed homes, including information centers, and

4,095 homes in progress. |

Backlog Data

As of the dates set forth below, the Company’s

net orders, cancellation rate and ending backlog homes and value

were as follows (dollars in thousands, unaudited):

| Backlog

Data |

|

Six Months Ended June 30, |

|

2022(4) |

|

2021(5) |

|

Net orders(1) |

|

|

2,837 |

|

|

|

7,254 |

|

| Cancellation rate(2) |

|

|

20.8 |

% |

|

|

14.8 |

% |

| Ending

backlog – homes(3) |

|

|

1,266 |

|

|

|

4,801 |

|

| Ending

backlog – value(3) |

|

$ |

445,120 |

|

|

$ |

1,434,382 |

|

|

(1) |

Net orders are new (gross) orders for the purchase of homes during

the period, less cancellations of existing purchase contracts

during the period. |

| (2) |

Cancellation rate for a period

is the total number of purchase contracts cancelled during the

period divided by the total new (gross) orders for the purchase of

homes during the period. |

| (3) |

Ending backlog consists of

homes at the end of the period that are under a purchase contract

that has been signed by homebuyers who have met preliminary

financing criteria but have not yet closed and wholesale contracts

for which vertical construction is generally set to occur within

the next six to twelve months. Ending backlog is valued at the

contract amount. |

| (4) |

As of June 30, 2022, the

Company had 412 units related to bulk sales agreements associated

with its wholesale business. |

| (5) |

As of June 30, 2021, the

Company had 940 units related to bulk sales agreements associated

with its wholesale business. |

CONTACT:Joshua D. FattorVice President of Investor

Relations(281) 210-2586investorrelations@lgihomes.com

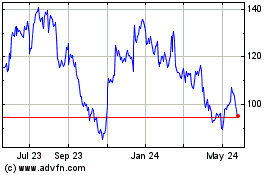

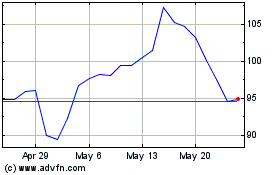

LGI Homes (NASDAQ:LGIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

LGI Homes (NASDAQ:LGIH)

Historical Stock Chart

From Jul 2023 to Jul 2024