Wintrust Financial Corporation Completes Integration with LPL Platform

January 28 2025 - 8:00AM

LPL Financial LLC, a subsidiary of LPL Financial Holdings Inc.

(Nasdaq: LPLA), today announced that Wintrust Financial Corporation

(Nasdaq: WTFC) has transitioned support of the wealth management

business of Wintrust Investments and certain private client

business at Great Lakes Advisors (collectively “Wintrust”) to LPL

Financial and its Institution Services platform.

“This strategic relationship with LPL Financial is a significant

step forward for Wintrust and our mission to provide exceptional

wealth management advice and superior service to our clients across

the country,” said Tom Zidar, Chairman and Chief Executive Officer

at Wintrust Wealth Management. “By leveraging LPL’s enhanced

platform, we will deliver a more streamlined and personalized

experience to our clients and a more intuitive, integrated

experience for our advisors.”

“Wintrust’s advisors now have the capabilities, technology and

centralized support to differentiate their service offering and

grow their practices,” said Christopher Cassidy, Senior Vice

President, Head of Institution Business Development at LPL. “This

strategic relationship reflects the value LPL brings to help

financial institutions scale their wealth management businesses and

deliver personalized experiences for their

clients.”

LPL and Wintrust Financial Corporation signed an agreement in

February 2024. On January 25, about $15 billion of brokerage and

advisory assets were onboarded to LPL. The remaining $1 billion of

assets are expected to onboard over the next several

months.

About Wintrust

Wintrust is a financial holding company with approximately $64.9

billion in assets whose common stock is traded on the NASDAQ Global

Select Market. Guided by its “Different Approach, Better Results®”

philosophy, Wintrust offers the sophisticated resources of a large

bank while providing a community banking experience to each

customer. Wintrust operates more than 200 retail banking locations

through 16 community bank subsidiaries in the greater Chicago,

southern Wisconsin, west Michigan, northwest Indiana, and southwest

Florida market areas. In addition, Wintrust operates various

non-bank business units, providing residential mortgage

origination, wealth management, commercial and life insurance

premium financing, short-term accounts receivable

financing/outsourced administrative services to the temporary

staffing services industry, and qualified intermediary services for

tax-deferred exchanges.

About LPL Financial

LPL Financial Holdings Inc. (Nasdaq: LPLA) is among the fastest

growing wealth management firms in the U.S. As a leader in the

financial advisor-mediated marketplace, LPL supports more than

28,000 financial advisors and the wealth management practices of

approximately 1,200 financial institutions, servicing and

custodying approximately $1.8 trillion in brokerage and advisory

assets on behalf of 6 million Americans. The firm provides a wide

range of advisor affiliation models, investment solutions, fintech

tools and practice management services, ensuring that advisors and

institutions have the flexibility to choose the business model,

services, and technology resources they need to run thriving

businesses. For further information about LPL, please visit

www.lpl.com.

Securities and advisory services offered through LPL

Financial (LPL), a registered investment advisor and broker dealer,

member FINRA/SIPC.

LPL Financial and its affiliated companies provide financial

services only from the United States. LPL Financial and Wintrust

are not affiliated.

Throughout this communication, the terms “financial advisors”

and “advisors” are used to refer to registered representatives

and/or investment advisor representatives affiliated with LPL

Financial.

We routinely disclose information that may be important to

shareholders in the “Investor Relations” or “Press Releases”

section of our website.

Forward-Looking Statements

Certain of the statements included in this release, such as

those regarding the expected onboarding of assets associated with

the strategic relationship and the benefits anticipated of the

relationship, constitute forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. Words such as “expects,” “believes,” “anticipates,” “plans,”

“assumes,” “estimates,” “projects,” “intends,” “should,” “will,”

“shall” or variations of such words are generally part of

forward-looking statements. Forward-looking statements are made

based on current expectations and beliefs concerning future

developments and their potential effects upon Wintrust, LPL or

both. In particular, no assurance can be provided that the assets

reported as serviced by financial advisors affiliated with Wintrust

will translate into assets serviced by LPL or that the benefits

that are expected to accrue to Wintrust, LPL and advisors as a

result of the strategic relationship will materialize. These

forward-looking statements are not a guarantee of future

performance and involve risks and uncertainties, including

economic, legislative, regulatory, competitive and other factors,

and there are certain important factors that could cause actual

results or the timing of events to differ, possibly materially,

from expectations or estimates expressed or implied in such

forward-looking statements. Important factors that could cause or

contribute to such differences include: difficulties or delays of

LPL in transitioning advisors affiliated with Wintrust, or in

onboarding Wintrust’s clients and businesses or transitioning their

assets from Wintrust’s current third-party custodian to LPL; the

inability of LPL to sustain revenue and earnings growth or to fully

realize revenue or expense synergies or the other expected benefits

of the transaction, which depend in part on LPL’s success in

onboarding assets currently served by Wintrust’s advisors;

disruptions to Wintrust’s or LPL’s businesses due to

transaction-related uncertainty or other factors making it more

difficult to maintain relationships with financial advisors and

clients, employees, other business partners or governmental

entities; the inability of LPL or Wintrust to implement onboarding

plans; the choice by clients of Wintrust-affiliated advisors not to

open brokerage and/or advisory accounts at LPL; changes in general

economic and financial market conditions, including retail investor

sentiment; fluctuations in the value of assets under custody; and

the effects of competition in the financial services industry,

including competitors’ success in recruiting Wintrust-affiliated

advisors. Certain additional important factors that could cause

actual results or the timing of events to differ, possibly

materially, from expectations or estimates expressed or implied in

such forward-looking statements can be found in the “Risk Factors”

and “Forward Looking Statements” (in the case of Wintrust) or the

“Risk Factors” and “Special Note Regarding Forward-Looking

Statements” (in the case of LPL) sections included in each of

Wintrust’s and LPL’s most recent Annual Report on Form 10-K. Except

as required by law, Wintrust and LPL do not undertake to update any

particular forward-looking statement included in this document as a

result of developments occurring after the date of this press

release.

Contacts

LPL Media Relations

media.relations@lplfinancial.com (704)

996-1840

LPL Investor Relations

investor.relations@lplfinancial.com

Wintrust David A. Dykstra Vice Chairman &

Chief Operating Officer (847) 939-9000 Tracking:

686437

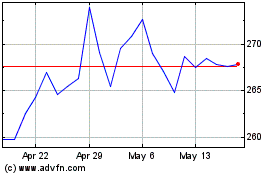

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Dec 2024 to Jan 2025

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Jan 2024 to Jan 2025