Portman Ridge Finance Corporation (NASDAQ: PTMN) (“Portman Ridge”

or “PTMN”) and Logan Ridge Finance Corporation (NASDAQ: LRFC)

(“Logan Ridge” or “LRFC”) (together, the “Companies”), business

development companies (“BDCs”) managed by affiliates of BC Partners

Advisors L.P. (“BC Partners”), announced today that they have

entered into an agreement under which LRFC will merge with and into

PTMN (the “Proposed Merger”), subject to the receipt of certain

shareholder approvals and the satisfaction of other closing

conditions. Pursuant to the Proposed Merger agreement, Portman

Ridge will be the surviving public entity and will continue to

trade on the Nasdaq under the symbol “PTMN.”

The Boards of Directors of both PTMN and LRFC, on the

recommendation of their respective Special Committees consisting

solely of certain independent directors, have unanimously approved

the Proposed Merger. In addition, the Board of Directors of LRFC

will recommend that shareholders of LRFC vote in favor of the

Proposed Merger, and the Board of Directors of PTMN will recommend

that shareholders of PTMN vote in favor of the issuance of PTMN

common stock in connection with the Proposed Merger, in each case,

subject to certain conditions.

Transaction Highlights

- Size & Scale:

The Proposed Merger will significantly increase the size and scale

of Portman Ridge, which is expected to translate into increased

trading volume and improved secondary liquidity, lower operating

expenses and potentially greater access to more diverse sources of

financing at a lower cost. The combined company will be externally

managed by Sierra Crest Investment Management LLC (“Sierra Crest”),

the current investment adviser to Portman Ridge, and is expected to

have total assets in excess of $600 million, and a net asset value

(“NAV”) of approximately $270 million, each based on the Companies’

September 30, 2024 balance sheets, adjusted for estimated

transaction expenses, but excluding the impact of the Tax

Distribution (as defined below).

- Portfolio Overlap:

The Proposed Merger will result in the acquisition of a known,

diversified portfolio with significant portfolio overlap between

the two Companies. PTMN and LRFC employ the same investment

strategy, and the BC Partners Credit Platform has been allocating

substantially similar or the same investments to both Companies

since Mount Logan Management, LLC (“Mount Logan”) became LRFC’s

external investment adviser on July 1, 2021. As a result, more than

70% of the investments in LRFC’s portfolio at fair value are

expected to be BC Partners-originated assets at the time of

closing, with over 60% of the portfolio overlapping with PTMN. The

combination of two known, complementary portfolios, originated and

managed by the BC Partners Credit Platform, is expected to

substantially mitigate integration risk.

- Accretive to NAV:

Expected to be immediately accretive to

PTMN’s NAV by 1.3% upon closing, based on the Companies’

September 30, 2024, NAVs and adjusted for estimated transaction

expenses but excluding the impact of the Tax Distribution.

- Accretive to Core Net

Investment Income (“NII”): Expected to be

immediately accretive to the Companies’ NII as

result of an expected $2.8 million of annual operating expense

efficiencies and the Incentive Fee Waiver (as defined below). Over

the longer term, management of the Companies expects the Proposed

Merger to provide further NII accretion through a lower cost of

debt and improved financing terms as well as further rotation out

of LRFC’s legacy non-yielding equity portfolio into

interest-earning assets originated by the BC Partners Credit

Platform.

- Increased Borrowing Capacity

& Optimized Debt Capital Structure: As a result of the

recent refinancing of LRFC’s credit facility with KeyBank National

Association (“KeyBank”), LRFC currently has additional available

borrowing base that can be used for future deployment at the

combined company. With LRFC’s refinanced credit facility with

KeyBank and PTMN’s existing senior secured revolving credit

facility with JPMorgan Chase Bank, National Association in place,

the combined company is expected to be able to further optimize its

debt capital structure based on differing eligibility requirements

and advance rates.

- Research Coverage:

The increase in Portman Ridge’s market capitalization is expected

to facilitate additional research coverage.

Fixed Exchange Ratio

In connection with the Proposed Merger, shareholders of LRFC

will receive 1.50 newly issued shares of PTMN common stock in

exchange for each share of common stock of LRFC (the “Fixed

Exchange Ratio”). Based on the Fixed Exchange Ratio, using PTMN’s

closing price of $16.68 per share on January 24, 2025 and excluding

the impact of the Tax Distribution, the merger consideration values

LRFC’s shares at $25.02 per share, which represents a 4% premium to

LRFC’s January 24, 2025, closing price of $24.00 per share and a

17% premium to LRFC’s closing price of $21.43 per share on

September 11, 2024 (which was the date immediately prior to the

announcement of LRFC’s successful exit of its investment in Nth

Degree Investment Group, LLC, an important catalyst for this

transaction).

In addition to approval by shareholders of both PTMN and LRFC,

the closing of the Proposed Merger is subject to customary

conditions. Further, the merger agreement provides each Special

Committee a termination right that allows for either Special

Committee to terminate the Proposed Merger if it has determined,

reasonably and in good faith, as a result of events or other

circumstances occurring or arising after the date of the signing of

the Proposed Merger agreement that were not known to the applicable

Board of Directors, that the interests of their respective

shareholders would be diluted within the meaning of Rule 17a-8

under the Investment Company Act of 1940, as amended (the “1940

Act”), as a result of the Proposed Merger.

The parties currently expect the Proposed Merger to be completed

in the second calendar quarter of 2025.

Additional Transaction Details

In connection with and in support of the transaction, only if

the Proposed Merger is consummated, PTMN's external investment

adviser, Sierra Crest, has agreed to waive up to $1.5 million of

incentive fees over eight consecutive quarters following the

closing of the Proposed Merger, subject to the satisfaction of

certain conditions set forth in the definitive documentation

executed between Sierra Crest and PTMN (the “Incentive Fee

Waiver”).

Prior to the anticipated closing of the Proposed Merger, PTMN

and LRFC intend to declare and pay ordinary course quarterly

dividends.

Subject to the approval of LRFC’s Board of Directors and

contingent upon the satisfaction of the closing conditions to the

Proposed Merger, LRFC will declare a dividend to LRFC’s

shareholders in an amount totaling no less than $1.0 million, but

otherwise equal to any undistributed 2024 NII of LRFC estimated to

be remaining as of the closing of the Proposed Merger, which

management of LRFC currently expects to be between approximately

$1.0 million and $1.5 million (the “Tax Distribution”).

Management Commentary

Ted Goldthorpe, President and Chief Executive Officer of PTMN

and LRFC and Head of the BC Partners Credit Platform, stated, “I am

incredibly proud to announce the proposed combination of PTMN and

LRFC. Based on the September 30, 2024 net assets value of each

company and inclusive of an estimated Tax Distribution, LRFC

shareholders will receive merger consideration equal to

approximately 98% of its September 30, 2024 net asset value. This

combination is the culmination of a journey we embarked upon over

three and half years ago, when shareholders of Logan Ridge placed

their trust and confidence in the management team and the BC

Partners Credit Platform by appointing Mount Logan to serve as the

investment adviser to Logan Ridge. During this time, we have

transformed LRFC’s investment portfolio by substantially reducing

the non-income producing legacy equity exposure, reducing

non-accruals, significantly increasing the portfolio’s

diversification and growing LRFC’s exposure to credits originated

by the BC Partners Credit Platform. Importantly, by the time this

transaction closes and barring any unexpected repayments, we expect

that more than 70% of Logan Ridge’s portfolio at fair value to be

in portfolio companies financed by the BC Partners Credit Platform.

Further, we have materially lowered Logan Ridge’s cost of debt

capital and lowered operating expenses. The collective result of

these efforts has been the stable and growing operating earnings

LRFC has generated over this time, which in turn has been used to

reward shareholders with a stable and growing dividend. More

importantly, LRFC’s management did all of this against the backdrop

of particularly challenging and uncertain market conditions. The

combination of these Companies is a marquee transaction for the

platform and a significant milestone for the BC Partners Credit

Platform. I couldn’t be more excited for the future of the combined

company.

We believe now is the right time to combine the Companies, as we

can finally do so in a manner that is expected to be accretive to

both sets of shareholders. The merger will significantly increase

the size and scale of Portman Ridge, which we believe will

translate into increased trading volume and improved secondary

liquidity, lower operating expenses and potentially greater access

to more diverse sources of financing at a lower cost.

Looking ahead, we will continue to execute our strategy of

targeting inorganic growth opportunities that we believe have the

potential to be earnings accretive for shareholders of both PTMN

and LRFC. I look forward to updating our shareholders on the work

management will be doing on this front over the course of

2025.”

Transaction Advisors

Keefe, Bruyette & Woods, A Stifel Company, is

serving as financial advisor to the Special Committee of PTMN in

connection with the transaction. Stradley Ronon Stevens &

Young, LLP is acting as the legal counsel to the Special Committee

of PTMN.

Houlihan Lokey is serving as financial advisor to the

Special Committee of LRFC in connection with the transaction.

Skadden, Arps, Slate, Meagher & Flom LLP is acting as the legal

counsel to the Special Committee of LRFC.

Simpson Thacher & Bartlett LLP is serving as legal counsel

to PTMN and LRFC with respect to the transaction. Dechert LLP

serves as legal counsel to PTMN and LRFC.

Conference Call Details

PTMN and LRFC will host a joint conference call on Thursday,

January 30, 2025, at 4:00 PM ET to discuss the transaction. All

interested persons are invited to attend the call and should dial

(646) 307-1963 approximately 10 minutes prior to the start of the

conference call and use the conference ID 4584554. A live audio

webcast of the conference call can be accessed via the Internet, on

a listen-only basis on both Company’s websites,

www.portmanridge.com, and www.loganridge.com, in the Investor

Relations sections under Events and Presentations. The webcast can

also be accessed by clicking the following link:

https://edge.media-server.com/mmc/p/sx9vwkih. The online archive of

the webcast will be available on the Company’s websites shortly

after the call.

The Companies will be utilizing an investor presentation as an

accompaniment to the live call, which will be available on LRFC’s

website at www.loganridgefinance.com and PTMN’s website at

www.portmanridge.com.

About Logan Ridge Finance Corporation

Logan Ridge Finance Corporation (NASDAQ: LRFC) is a BDC that

invests primarily in first lien loans and, to a lesser extent,

second lien loans and equity securities issued by lower

middle-market companies. LRFC invests in performing,

well-established middle-market businesses that operate across a

wide range of industries. It employs fundamental credit analysis,

targeting investments in businesses with relatively low levels of

cyclicality and operating risk. For more information, visit

www.loganridgefinance.com.

About Portman Ridge Finance Corporation

Portman Ridge Finance Corporation (NASDAQ: PTMN) is a publicly

traded, externally managed investment company that has elected to

be regulated as a BDC under the 1940 Act. Portman Ridge’s middle

market investment business originates, structures, finances and

manages a portfolio of term loans, mezzanine investments and

selected equity securities in middle market companies. Portman

Ridge’s investment activities are managed by its investment

adviser, Sierra Crest.Portman Ridge’s filings with the Securities

and Exchange Commission (the “SEC”), earnings releases, press

releases and other financial, operational and governance

information are available on Portman Ridge’s website at

www.portmanridge.com.

Forward-Looking Statements

Some of the statements in this document constitute

forward-looking statements because they relate to future events,

future performance or financial condition. The forward-looking

statements may include statements as to future operating results of

PTMN and LRFC, and distribution projections; business prospects of

PTMN and LRFC, and the prospects of their portfolio companies; and

the impact of the investments that PTMN and LRFC expect to make. In

addition, words such as “anticipate,” “believe,” “expect,” “seek,”

“plan,” “should,” “estimate,” “project” and “intend” indicate

forward-looking statements, although not all forward-looking

statements include these words. The forward-looking statements

contained in this document involve risks and uncertainties. Certain

factors could cause actual results and conditions to differ

materially from those projected, including the uncertainties

associated with (i) the ability of the parties to consummate the

merger on the expected timeline, or at all; (ii) the expected

synergies and savings associated with the merger; (iii) the ability

to realize the anticipated benefits of the merger, including the

expected elimination of certain expenses and costs due to the

merger; (iv) the percentage of PTMN shareholders and LRFC

shareholders voting in favor of the applicable Proposal (as defined

below) submitted for their approval; (v) the possibility that

competing offers or acquisition proposals will be made; (vi) the

possibility that any or all of the various conditions to the

consummation of the merger may not be satisfied or waived; (vii)

risks related to diverting management’s attention from ongoing

business operations; (viii) the combined company’s plans,

expectations, objectives and intentions, as a result of the merger;

(ix) any potential termination of the merger agreement; (x) the

future operating results and net investment income projections of

PTMN, LRFC or, following the closing of the merger, the combined

company; (xi) the ability of Sierra Crest to implement its future

plans with respect to the combined company; (xii) the ability of

Sierra Crest and its affiliates to attract and retain highly

talented professionals; (xiii) the business prospects of PTMN, LRFC

or, following the closing of the merger, the combined company, and

the prospects of their portfolio companies; (xiv) the impact of the

investments that PTMN, LRFC or, following the closing of the

merger, the combined company expect to make; (xv) the ability of

the portfolio companies of PTMN, LRFC or, following the closing of

the merger, the combined company to achieve their objectives; (xvi)

the expected financings and investments and additional leverage

that PTMN, LRFC or, following the closing of the merger, the

combined company may seek to incur in the future; (xvii) the

adequacy of the cash resources and working capital of PTMN, LRFC

or, following the closing of the merger, the combined company;

(xviii) the timing of cash flows, if any, from the operations of

the portfolio companies of PTMN, LRFC or, following the closing of

the merger, the combined company; (xix) the risk that stockholder

litigation in connection with the merger may result in significant

costs of defense and liability; and (xx) future changes in laws or

regulations (including the interpretation of these laws and

regulations by regulatory authorities). PTMN and LRFC have based

the forward-looking statements included in this document on

information available to them on the date hereof, and they assume

no obligation to update any such forward-looking statements.

Although PTMN and LRFC undertake no obligation to revise or update

any forward-looking statements, whether as a result of new

information, future events or otherwise, you are advised to consult

any additional disclosures that they may make directly to you or

through reports that PTMN and LRFC in the future may file with the

SEC, including the Joint Proxy Statement and Registration Statement

(in each case, as defined below), annual reports on Form 10-K,

quarterly reports on Form 10-Q and current reports on Form 8-K.

No Offer or Solicitation

This document is not, and under no circumstances is it to be

construed as, a prospectus or an advertisement and the

communication of this document is not, and under no circumstances

is it to be construed as, an offer to sell or a solicitation of an

offer to purchase any securities in PTMN, LRFC or in any fund or

other investment vehicle managed by BC Partners or any of its

affiliates.

Additional Information and Where to Find It

This document relates to the proposed merger and certain related

matters (the “Proposals”). In connection with the Proposals, PTMN

will file with the SEC and mail to its and LRFC’s respective

shareholders a combined joint proxy statement for PTMN and LRFC and

a prospectus of PTMN (the “Registration Statement”). The

Registration Statement will contain important information about

PTMN, LRFC and the Proposals. This communication does not

constitute an offer to sell or the solicitation of an offer to buy

any securities or a solicitation of any vote or approval. No offer

of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as

amended. SHAREHOLDERS OF PTMN AND LRFC ARE URGED TO READ

THE REGISTRATION STATEMENT, AND OTHER DOCUMENTS THAT ARE FILED OR

WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT PTMN, LRFC AND THE PROPOSALS. Investors

and security holders will be able to obtain the documents filed

with the SEC free of charge at the SEC’s website,

http://www.sec.gov or, for documents filed by PTMN, from PTMN’s

website at https://www.portmanridge.com, and, for documents filed

by LRFC, from LRFC’s website at

https://www.loganridgefinance.com.

Participants in the Solicitation

PTMN, its directors, certain of its executive officers and

certain employees and officers of Sierra Crest and its affiliates

may be deemed to be participants in the solicitation of proxies in

connection with the Proposals. Information about the directors and

executive officers of PTMN is set forth in its proxy statement for

its 2024 Annual Meeting of Stockholders, which was filed with the

SEC on April 29, 2024. LRFC, its directors, certain of its

executive officers and certain employees and officers of Mount

Logan and its affiliates may be deemed to be participants in the

solicitation of proxies in connection with the Proposals.

Information about the directors and executive officers of LRFC is

set forth in the proxy statement for its 2024 Annual Meeting of

Stockholders, which was filed with the SEC on April 29, 2024.

Information regarding the persons who may, under the rules of the

SEC, be considered participants in the solicitation of the PTMN and

LRFC shareholders in connection with the Proposals will be

contained in the Registration Statement, including the Joint Proxy

Statement included therein, and other relevant materials when such

documents become available. These documents may be obtained free of

charge from the sources indicated above.

Contacts:Portman Ridge Finance Corporation650 Madison Avenue,

3rd floorNew York, NY 10022info@portmanridge.com

Brandon SatorenChief Financial

OfficerBrandon.Satoren@bcpartners.com (212) 891-2880

The Equity Group Inc.Lena Catilcati@equityny.com (212)

836-9611

Val Ferrarovferraro@equityny.com (212) 836-9633

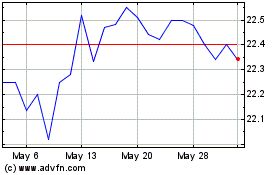

Logan Ridge Finance (NASDAQ:LRFC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Logan Ridge Finance (NASDAQ:LRFC)

Historical Stock Chart

From Mar 2024 to Mar 2025