false

0001659617

0001659617

2023-12-18

2023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): December 18, 2023

MOLECULIN BIOTECH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37758

|

47-4671997

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification

No.)

|

5300 Memorial Drive, Suite 950, Houston, TX 77007

(Address of principal executive offices and zip code)

(713) 300-5160

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

MBRX

|

The NASDAQ Stock Market LLC

|

|

Item 7.01

|

Regulation FD Disclosure

|

On December 18, 2023, Moleculin Biotech, Inc. (the “Company”), held a virtual investor call with the Company’s Chairman and Chief Executive Officer, Walter Klemp. The call can be viewed via the following link: https://www.virtualinvestorco.com/wtm-mbrx-aml-data.

A copy of the script is attached to this report as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be “filed” for the purpose of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (“Securities Act”), unless specifically identified therein as being incorporated by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

104

|

Cover page Interactive Data File (formatted as Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MOLECULIN BIOTECH, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

Date:

|

December 18, 2023

|

|

| |

|

|

|

| |

By:

|

/s/ Jonathan P. Foster

|

|

| |

|

Jonathan P. Foster

|

|

Exhibit 99.1

Virtual Investor: What this Means – Positive Interim Data from Phase 1B/2 Clinical Trial in AML at Meeting with KOL’s in Conjunction with ASH Annual Meeting

Participants:

| |

●

|

Wally Klemp, Chairman and Chief Executive Officer

|

Moleculin Bio (Nasdaq: MBRX)

Jenene Introduction:

| |

●

|

Welcome back for another Virtual Investor – What This Means Segment. My name is Jenene Thomas, CEO of JTC IR, and I will be today’s moderator.

|

Today we are featuring Moleculin Biotech and I am pleased to be joined by Walter Klemp, Chairman and Chief Executive Officer of the Company.

Before we get started, I just want to inform our audience that Moleculin Bio is listed on the Nasdaq and trades under the ticker M B R X. During today’s discussion, the Company will be making forward-looking statements and actual results could differ materially from these forward-looking statements. Some of the factors that could cause actual results to differ materially from these contemplated by such forward-looking statements are discussed in the periodic reports Moleculin files with the Securities and Exchange Commission. These documents are available in the Investors section of the Company's website and on the Securities and Exchange Commission's website. We encourage you to review these documents carefully.

Moderated questions

| |

1.

|

Wally, you recently announced positive interim data from your Phase 1B/2 clinical trial in AML at a meeting with KOL’s in conjunction with the ASH Annual Meeting. Can you provide a high-level overview of the data you announced?

|

Sure, Jenene. As you know, this update came relatively quickly after our last earnings call, but the recruiting is going so quickly that we actually had new data to disclose with our presentation at last week’s ASH Annual Meeting. That’s the American Society of Hematology and it’s really one of the world’s biggest venues for new AML-related data sharing.

So, now we’ve gotten to 16 patients recruited, with 9 of those being completely dosed per protocol and 4 of those showing a complete response or CR, so a 44% CR rate on patients treated.

We are careful to point out that statistically, we must also include 2 patients who weren’t fully treated due to allergic reactions, so on an Intent to Treat basis, the CR rate is 36% but as the trial fully recruits, we would expect that this intent to treat percentage will come closer to that realized through treatment per protocol. Regardless, even the 36% is impressive, especially considering that all of these patients had some prior therapy.

For comparison purposes, Venetoclax in combination with Cytarabine, only delivered a 21% CR rate for its approval and this was in first line, meaning patients who had no prior therapy. And our intent to treat percentage approximates the CR rate for Venetoclax in combination with azacytidine or the well-known “Ven-Aza" therapy. But again, the Ven-Aza CR rate was only on first line patients whereas we’re getting this level of response in patients who are 2nd line or later.

| |

2.

|

You mentioned the allergic reactions. Could you elaborate on the significance of those reactions?

|

I’m glad you asked about that. One of these patients had an allergic reaction to cytarabine, the drug we are being combined with. Because of the structure of this Phase 2 expansion, this patient was simply withdrawn from the trial because of their reaction to cytarabine. So, they never got a chance to be fully treated with Annamycin.

In our next trial, which we expect to be our pivotal approval trial, that patient would be continued on Annamycin without cytarabine. And, we know that in our single agent trial, we were seeing a 60% composite CR rate so instead of losing this patient to a technicality, they would be given a strong chance for responding to Annamycin.

The other patient actually had a reaction to Annamycin, and this is the first one we’ve had in 70 patients treated, and it’s not unexpected that a handful of patients will have this kind of reaction. So, even though it reads right now as 1 patient out of 11 in the current Phase 2, we believe in the larger approval trial it’s more likely this type of event will be infrequent enough that it really doesn’t make a big difference in the intent to treat CR rates.

One thing that is really important for investors to understand is that these are cancer patients with rapidly progressing tumors. This means they are in a weakened state and highly prone to a wide range of maladies like sepsis or pneumonia that could take them out at any time. In fact, it’s sadly not uncommon for cancer patients to die during a clinical trial because of their frailty. And, it’s all the more reason we feel so fortunate to have a drug like Annamycin showing such strong results in 2nd and 3rd line patients.

| |

3.

|

Well, this distinction between first line and pretreated patients seems to be important. Can you elaborate on WHAT THIS MEANS related to your data set?

|

It is super important, Jenene. To be clear, the best time to catch these patients is when they are first diagnosed. The best chance to succeed with AML patients is first line and statistically, with every following line of therapy, their chances go down.

By the time they’ve had 3 or 4 lines of therapy, their marrow reserves are becoming depleted, and the disease has started to take a toll on their entire system. This usually gets worse with each line of therapy. One of the patients in our trial, for example, that didn’t respond to Annamycin had 10 prior lines of therapy.

A very important insight here is that the responses we are seeing are mostly where Annamycin is the 2nd or 3rd line for patients. So far in this trial, the patients with 3 or more lines of prior therapy account for the vast majority of nonresponders.

Said another way, of the nine patients who were dosed per protocol, 5 of those had 2 or fewer prior lines of therapy, and 4 of those were CR’s. That’s a complete response rate of 80%.

Again, at this point the “n” is still small, but here’s why this is so important: for our pivotal approval trial, we hope to only be enrolling 1st or 2nd line patients so we should be going into our discussions with the FDA and the approval trial with a lot of confidence. And, at the rate we’re recruiting, we shouldn’t have to keep apologizing for a small “n” for much longer.

| |

4.

|

Why do you think enrollment is advancing so quickly in this AML trial?

|

We think enrollment is advancing quickly for several reasons. For one, the type of patients we are recruiting, which specifically are those who are considered “unfit” for intensive therapy, really don’t have a lot of options.

Even though there are a lot of AML clinical trials out there, most of those are for gene-targeted therapies, which are only relevant to a small percentage of AML patients who happen to have that particular mutation.

So, when it comes to unfit patients who either don’t respond to or don’t qualify for targeted therapy, there aren’t a lot of promising clinical trial options. For example - in the CR’s we’ve seen so far in the MB-106 trial, there are patients who were relapsed from or refractory to Ven-Aza. Well, these patients just don’t have much left terms of alternative treatment options.

Additionally, with Annamycin showing no cardiotoxicity in our trials, physicians have been able to use our drug in multiple cycles to maintain CR durability in cases where a bone marrow transplant is either delayed or inappropriate. This is especially important for elderly patients who often are not candidates for a bone marrow transplant.

Another big driver for recruitment is the fact that Annamycin is starting to show real traction in terms of efficacy and now that our Principal Investigators are seeing this, they are becoming much more enthusiastic about enrolling any patients who qualify.

When you cut through it all, physicians want what’s best for their patients and the numbers are showing that Annamycin may just be the best option in more and more situations.

| |

5.

|

What can we expect in Q1 of 2024 for your AML trial?

|

What investors should be looking for is our next round of data. At the rate things are progressing, we believe we will be fully recruited sometime in first quarter – hopefully in time for our March earnings call covering fiscal year ‘23. And, an important timing aspect for AML trials like ours is that you usually know if you have a CR within just a month from treatment.

Now, we believe getting into the 20s in terms of the number of patients treated is a kind of critical mass threshold for the financial community and for prospective partners and we think we will be there by next quarter.

That data set will become the foundation for what we present to the FDA. Importantly, depending on the results, it has the potential to represent a massive amount of “de-risking” to our plan and it should signal to the market and to potential partners that the upside opportunity for Annamycin is real.

Remember, Ventoclax generates a half a billion a year in revenue for Abbvie. Biotech valuations are in the range of 2 to 10 times annual revenue, so you don’t have to be a math genius to see the potential for where our valuation could be headed!

Jenene Closing:

| |

●

|

With that, this concludes the Virtual Investor What this Means segment with Moleculin. I would like to thank Wally Klemp, Chairman and CEO of Moleculin for joining us today.

|

| |

●

|

I would also like to thank our viewers for your time and attention. As a reminder, you can access the webcast replay from today’s event at: www.virtualinvestorco.com.

|

v3.23.4

Document And Entity Information

|

Dec. 18, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLECULIN BIOTECH, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 18, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37758

|

| Entity, Tax Identification Number |

47-4671997

|

| Entity, Address, Address Line One |

5300 Memorial Drive, Suite 950

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77007

|

| City Area Code |

713

|

| Local Phone Number |

300-5160

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MBRX

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001659617

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

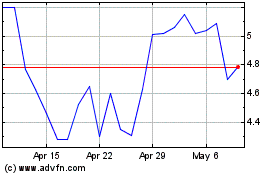

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2024 to May 2024

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From May 2023 to May 2024