Mesa Laboratories, Inc. (NASDAQ:MLAB), a global leader in the

design and manufacture of life science tools and critical quality

control solutions, today announced results for its fourth fiscal

quarter (“4Q24”) and fiscal year (“FY24”) ended March 31, 2024

(amounts in thousands).

Fourth quarter FY24 compared to fourth quarter FY23:

- Revenues increased 6% and

increased 10.2% vs 3Q24

- Non-GAAP core organic revenues1

decreased 3.5%

- Operating (loss) was $(271,284)

which included a $274,533 non-cash impairment charge

- Non-GAAP adjusted operating income

excluding unusual items2 increased 26.3% and was 25.4% as a

percentage of revenues

Full FY24 compared to full FY23:

- Revenues decreased 1.3%

- Non-GAAP core organic revenues decreased 5.4%

- Operating (loss) was $(272,075) which included a $274,533

non-cash impairment charge

- Non-GAAP adjusted operating income excluding unusual items

increased 0.7% and was 23.4% as a percentage of revenues

We operate our business in four divisions: Sterilization and

Disinfection Control (“SDC”), Clinical Genomics (“CG”),

Biopharmaceutical Development (“BPD”), and Calibration Solutions

(“CS”).

Effective 4Q24 we changed our definition of non-GAAP adjusted

operating income3 (“AOI”) and non-GAAP adjusted operating income

excluding unusual items to also exclude depreciation expense.

Please see the reconciliation of those measures to GAAP operating

(loss) income below. All prior periods have been restated to

exclude depreciation expense from these non-GAAP measures.

Executive Commentary (amounts in thousands)

“Several significant strategic milestones were attained in 4Q24

including: 1) closing the acquisition of the GKE China entity on

December 31, 2023; 2) extending and expanding our bank credit

facility to $200,000 which enabled us to repurchase $75,000, or

43%, of our outstanding 2025 Convertible Notes and ensure that we

have the cash available to complete the full repurchase at

maturity, if not sooner; 3) executing a restructuring in our

Clinical Genomics division to better align our cost structure with

the current revenue headwinds; and 4) reducing inventory (excluding

the impact of GKE) by 19.4% versus FY23 via our improved

procurement processes and the normalization of supply chain

delivery times,” said Gary Owens, Chief Executive Officer of

Mesa.

“Revenues of $58,904 for the quarter increased 6.0% as compared

to 4Q23, an increase that was driven by $5,452 from GKE, partially

offset by a core organic decline of 3.5%. Sequentially, revenues

increased by 10.2% from 3Q24 with strong sequential growth from

both BPD and SDC, which more than offset a sequential contraction

in CG. In 4Q24, revenue headwinds related to biopharmaceutical

capital spending in BPD lessened as revenues from hardware and

software increased 93% sequentially from 3Q24 and SDC benefitted

from strong orders and a full quarter of GKE revenues vs 3Q24 while

the ongoing economic slowdown in China continued to impact

performance in CG,” added Mr. Owens.

“Annual revenues of $216,187 decreased by 1.3% versus the prior

year, driven by a decline in core organic revenues of 5.4%,

partially offset by GKE revenues of $9,289. Core organic headwinds

were primarily in BPD and CG which offset growth in both SDC and

CS. Specifically, BPD faced the softening of demand for capital

equipment in the biopharmaceutical vertical, while CG incurred

headwinds from the previously announced loss of Sema4 as a customer

at the end of the second quarter in FY23 and the ongoing impact of

the economic slowdown in China,” added Mr. Owens.

“Profitability as measured by our primary metric of AOI

excluding unusual items was $14,938 in 4Q24, an increase of 26.3%

versus the same period in the prior year and 24.7% sequentially.

For the full year, the same metric increased to $50,505, an

increase of 0.7% versus the prior year, and as a percentage of

revenues expanded by 50 bps. Strong profit growth versus the prior

year was primarily due to the acquisition of GKE, partially offset

by lower sales volumes and increased labor expenses in legacy Mesa.

The effect of these adverse changes were mitigated by cost control

efforts, lower variable compensation, and increased prices.” added

Mr. Owens.

“Looking forward, we are driving several key initiatives

including deepening our presence in the Asia Pacific region and

realizing synergies from our acquisition of GKE. While we are

excited by the moderating headwinds in capital expenditures within

the biopharmaceutical vertical we saw in 4Q24 and continue to see

in 1Q25, it is too early to call a sustained recovery. We will also

need to be prepared to refine our business strategy for CG to adapt

to changes in FDA regulations of lab developed tests that were

announced on April 29th 2024. We are still working to determine if

there will be any implications to Mesa or any customers acquired

after the effective date of the regulation; however, sales of

consumables to our existing customers are not expected to be

affected. Given our high gross profit percentages, we remain biased

for organic growth and have expanded sales and marketing by 80 bps

as a percentage of revenues while simultaneously expanding AOI

excluding unusual items percentages as described earlier. Given our

expanded options for organic growth while facing ongoing

macroeconomic and regulatory uncertainty, we will continue to

leverage the Mesa Way, our Lean based operating model, to stay

nimble in FY25,” concluded Mr. Owens.

Financial Results (unaudited, amounts in

thousands, except per share data)

Fourth Quarter Fiscal Year 2024 Total revenues were $58,904, an

increase of 6% compared to 4Q23. Operating (loss) was $(271,284)

which included a $274,533 non-cash impairment of goodwill and

long-lived assets charge. Net (loss) was $(254,583), or $(47.20)

per diluted share of common stock.

On a non-GAAP basis, core organic revenues decreased 3.5% and

AOI increased 6.7% to $12,336 or $2.29 per diluted share of common

stock compared to 4Q23. As detailed in the Unusual Items table

below, AOI for 4Q24 and 4Q23 was negatively impacted by unusual

items totaling $2,602 and $268, respectively. Excluding the unusual

items for 4Q24 and 4Q23, AOI would have increased 26.3% to

$14,938. A reconciliation of non-GAAP measures is

provided in the tables below.

Full Fiscal Year 2024

Total revenues were $216,187, a decrease of 1.3% compared to

FY23. Operating (loss) was $(272,075) which included a $274,533

non-cash impairment of goodwill and long-lived assets charge. Net

(loss) was $(254,246), or $(47.20) per diluted share of common

stock.

On a non-GAAP basis, core organic revenues decreased 5.4% and

AOI decreased 6.2% to $45,968 or $8.53 per diluted share of common

stock compared to FY23. As detailed in the Unusual Items table

below, AOI for FY24 and FY23 was negatively impacted by unusual

items totaling $4,537 and $1,142, respectively. Excluding the

unusual items for FY24 and FY23, AOI would have increased 0.7% to

$50,505. A reconciliation of non-GAAP measures is provided in the

tables below.

|

Division Performance |

|

|

| |

|

|

|

| |

Revenues |

Organic Revenues Growth4 |

Core Organic Revenues Growth |

| |

|

|

|

|

|

|

| (Amounts in thousands) |

Three Months Ended March 31, 2024 |

Year Ended March 31, 2024 |

Three Months Ended March 31, 2024 |

Year Ended March 31, 2024 |

Three Months Ended March 31, 2024 |

Year Ended March 31, 2024 |

| SDC |

$ 22,779 |

$ 75,124 |

4.5% |

|

1.9% |

|

4.2% |

|

0.6% |

|

|

CG |

|

11,124 |

|

52,588 |

(19.2)% |

|

(15.6)% |

|

(18.1)% |

|

(14.2)% |

|

| BPD |

|

12,186 |

|

40,712 |

(3.3)% |

|

(14.3)% |

|

(2.6)% |

|

(13.4)% |

|

| CS |

|

12,815 |

|

47,763 |

1.5% |

|

6.6% |

|

1.4% |

|

6.6% |

|

| Total reportable segments |

$ 58,904 |

$ 216,187 |

(3.8)% |

|

(5.6)% |

|

(3.5)% |

|

(5.4)% |

|

| |

|

|

|

|

|

|

Sterilization and Disinfection Control (39% of

revenues in 4Q24) revenues were $22,779 for the quarter which

resulted in core organic revenues growth of 4.2% versus 4Q23. For

the year, core organic revenues growth was 0.6%. The acquisition of

GKE, which is now fully reflected in our 4Q24 numbers, drove

overall quarterly growth to 37.3% and the full year growth rate was

16.3%. Revenues from GKE are trending slightly above the

expectations that were announced at acquisition close. Quarterly

growth benefitted from strong orders in our life sciences vertical,

and to a lesser extent, a reduction in our past due backlog as

certain operational constraints eased. Gross profit percentage for

the quarter contracted by 490 bps versus the prior year period

primarily due to the impact of non-cash inventory step-up purchase

accounting charges from GKE flowing through cost of

revenues. For the full year, gross profit percentage

contracted by 110 bps driven by the same factors. Absent the impact

of the inventory step-up purchase accounting charges, gross profit

percentage for the full year would have expanded by 60 bps versus

the prior year as efficiency gains and revenues growth more than

offset increased labor costs.

Calibration Solutions (22% of revenues in 4Q24)

revenues were $12,815 which resulted in core organic revenues

growth of 1.4% for the quarter and 6.6% for the year. Annual growth

was driven by the reduction of past due backlog as supply chain

constraints eased throughout the year and an increase in our

commercial team’s engagement with net new customers that led to

solid bookings growth. Relative to the prior year, gross profit

percentage expanded by 320 bps for both 4Q24 and the full year.

This expansion was primarily driven by increased revenues on a

partially fixed cost base and new product introductions in our

continuous monitoring product line, which more than offset

increased labor costs.

Biopharmaceutical Development (20% of revenues

in 4Q24) revenues were $12,186 which yielded a core organic

revenues decrease of 2.6% for the quarter versus the prior year but

a sequential increase of 29.2% versus 3Q24. Annual core

organic revenues decline was 13.4% vs the prior year. Throughout

the year, revenues were strongly impacted by the global contraction

in biopharmaceutical spending on capital equipment, partially

offset by strong double-digit growth in consumables. Gross profit

percentages contracted by 370 bps in the quarter and 170 bps for

the full year as volume contraction and labor costs more than

offset the mix shift toward consumables and our cost reduction

efforts.

Driven by the market changes noted above and the significantly

increased discount rates used in our fair value valuation models,

we recorded a $38,151 impairment charge to goodwill associated with

this division.

Clinical Genomics (19% of revenues in 4Q24)

revenues were $11,124 for the quarter, which resulted in a core

organic revenues decline of 18.1% for the quarter and 14.2% for the

full year. As we exited the year with negligible COVID related

revenues, this will be the last quarter we include COVID related

revenues in our core organic growth calculation. Quarterly revenues

were strongly impacted by ongoing headwinds in China and lower

systems placements in North America. Full year figures were

impacted by the previously announced customer loss of Sema4 in the

first half of the year and the China headwinds, which primarily

impacted our business in the back half of the fiscal year.

During 4Q24 we restructured the Clinical Genomics division by

installing a new general manager, eliminating 17 positions, and

adjusting our businesses strategy to better position the division

to drive future growth in an evolving global regulatory climate.

These position eliminations are expected to result in ~ $3,000 of

annual savings with little of this benefit realized in 4Q24. As a

result of the restructuring, the revenue headwinds mentioned above,

significantly increased discount rates used in our fair value

valuation models, and persistently high interest rates which strain

our customers’ ability to purchase capital equipment, in 4Q24 we

recorded a $236,382 impairment charge to goodwill and intangible

assets associated with this division. As a result, in fiscal year

2025, we expect a net decrease in non-cash amortization expense of

approximately $3,700 to be recognized within cost of revenues and

$6,800 within operating expenses for the division.

Gross profit percentage expanded by 1230 bps in the quarter but

contracted by 70bps for the full year. Quarterly and annual gross

profit percentage was impacted by a reduction in amortization

expense running through cost of revenues resulting from the

impairment charge that was recorded at the beginning of 4Q24.

Absent all non-cash amortization expenses in both years, gross

profit percentage would have increased by 360 bps for the quarter,

with improved mix and cost containment actions more than overcoming

volume decreases. For the full year, gross profit percentage absent

all non-cash amortization expenses would have contracted by 130bps

with volume declines offsetting our cost containment actions.

Use of Non-GAAP Financial Measures

Adjusted operating income, adjusted operating income excluding

unusual items, organic revenues growth and core organic revenues

growth are non-GAAP measures that exclude or adjust for certain

items, as detailed within the tables in “Supplemental Information

Regarding Non-GAAP Financial Measures.” As noted below, we now

include depreciation expense as a non-cash addback in the

definition of adjusted operating income as it better aligns with

presentations of other companies within our industry. All prior

period amounts have been restated to conform with the current

presentation.

1 Core organic revenues growth, a non-GAAP measure, is defined

as reported revenues growth excluding the impact of acquisitions,

currency translation and COVID related revenues.

2 The non-GAAP measures of adjusted operating income excluding

unusual items and adjusted operating income excluding unusual items

per diluted share are defined to exclude the non-cash impact of

amortization of intangible assets acquired in a business

combination, stock-based compensation, depreciation, impairment of

goodwill and long-lived assets and unusual items. Unusual items are

disclosed to highlight costs that are not ongoing and are incurred

as a direct result of a specific transaction, such as the

consummation of an acquisition, and are identified to allow

investors to understand the Company’s expectation on an ongoing

basis, following the completion of acquisition and integration

activities. A reconciliation of these non-GAAP measures

to their GAAP counterparts is set forth below, along with

additional information regarding their use.

3 The non-GAAP measures of adjusted operating income and

adjusted operating income per diluted share are defined to exclude

the non-cash impact of amortization of intangible assets acquired

in a business combination, stock-based compensation, depreciation

and impairment of goodwill and long-lived assets. A reconciliation

of these non-GAAP measures to their GAAP counterparts is set forth

below, along with additional information regarding their use.

4 Organic revenues growth, a non-GAAP measure, is defined as

reported revenues growth excluding the impact of acquisitions.

About Mesa Laboratories, Inc.

Mesa is a global leader in the design and manufacture of life

science tools and critical quality control solutions for regulated

applications in the pharmaceutical, healthcare and medical device

industries. Mesa offers products and services to help our customers

ensure product integrity, increase patient and worker safety, and

improve the quality of life throughout the world.

For more information about Mesa, please visit its website at

www.mesalabs.com.

Forward Looking Statements

This press release contains forward-looking statements regarding

our future business expectations. Any statements

contained herein that are not statements of historical fact may be

forward-looking statements, including statements relating to future

financial results, business conditions and strategic initiatives.

Words such as “expect,” “seek,” “plan” “anticipate,” “intend,”

“believe,” “could,” “should,” “estimate,” “may,” “target,”

“project,” and similar expressions may also identify

forward-looking statements. However, the absence of these words or

similar expressions does not mean that a statement is not

forward-looking. The forward-looking statements are made based on

expectations and beliefs concerning future events affecting us and

are subject to risks and uncertainties relating to our operations

and business environments, all of which are difficult to predict

and many of which are beyond our control. Risks and uncertainties

that could cause actual results to differ materially from our

historical experience and present expectations or projections

include those relating to: our ability to successfully grow our

business, including as a result of acquisitions; the results on

operations of acquisitions; our ability to consummate acquisitions

at our historical rate and at appropriate prices; our ability to

effectively integrate acquired businesses and achieve desired

results; the market acceptance of our products; reduced demand for

our products that adversely impacts our future revenues, cash

flows, results of operations and financial condition; conditions in

the global economy and the particular markets we serve; significant

developments or uncertainties stemming from actions of the U.S.

government, including changes in U.S. trade policies and medical

device regulations; the timely development and commercialization,

and customer acceptance, of enhanced and new products and services;

the inherent uncertainty of projections of revenues, growth,

operating results, profit margins, expenses, earnings, margins, tax

rates, tax provisions, cash flows, liquidity, demand, and

competition; the effects of additional actions taken to become more

efficient or reduce costs; restructuring activities; laws

regulating fraud and abuse in the health care industry and the

privacy and security of health and personal information;

outstanding claims, legal proceedings, tax audits and assessments

and other contingent liabilities; foreign currency exchange rates

and fluctuations in those rates; and general economic, industry,

and capital markets conditions. These risks and uncertainties also

include, but are not limited to, those described in our filings

with the Securities and Exchange Commission including our Annual

Report on Form 10-K for the year ended March 31, 2023 and our

subsequent Quarterly Reports on Form 10-Q. We assume no obligation

to update the information in this press release.

The numbers presented in this press release as of and for the

three months and year ended March 31, 2024 are unaudited and

subject to change based upon the completion of the audit.

Mesa Laboratories Contacts: Gary Owens; President and CEO, John

Sakys; CFO1-303-987-8000investors@mesalabs.com

Financial Summary (Unaudited except for the

information as of and for the year ended March 31, 2023)

|

Condensed Consolidated Statements of

Operations |

| |

| (Amounts in thousands, except per

share data) |

Three Months Ended March 31, |

Year Ended March 31, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenues |

$ |

58,904 |

|

$ |

55,591 |

|

$ |

216,187 |

|

$ |

219,080 |

|

| Cost of revenues |

|

22,348 |

|

|

22,390 |

|

|

82,937 |

|

|

85,387 |

|

| Gross profit |

|

36,556 |

|

|

33,201 |

|

|

133,250 |

|

|

133,693 |

|

| Operating expenses excluding

impairment |

|

33,307 |

|

|

32,684 |

|

|

130,792 |

|

|

130,373 |

|

| Impairment of goodwill and

long-lived assets |

|

274,533 |

|

|

-- |

|

|

274,533 |

|

|

-- |

|

| Operating (loss) income |

|

(271,284 |

) |

|

517 |

|

|

(272,075 |

) |

|

3,320 |

|

| Nonoperating expense

(income) |

|

4,048 |

|

|

794 |

|

|

3,573 |

|

|

3,709 |

|

| Loss before income taxes |

|

(275,332 |

) |

|

(277 |

) |

|

(275,648 |

) |

|

(389 |

) |

| Income tax (benefit)

provision |

|

(20,749 |

) |

|

(888 |

) |

|

(21,402 |

) |

|

(1,319 |

) |

| Net (loss) income |

$ |

(254,583 |

) |

$ |

611 |

|

$ |

(254,246 |

) |

$ |

930 |

|

| |

|

|

|

|

| (Loss) earnings per share

(basic) |

$ |

(47.20 |

) |

$ |

0.11 |

|

$ |

(47.20 |

) |

$ |

0.17 |

|

| (Loss) earnings per share

(diluted) |

|

(47.20 |

) |

|

0.11 |

|

|

(47.20 |

) |

|

0.17 |

|

| |

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

| Basic |

|

5,394 |

|

|

5,349 |

|

|

5,386 |

|

|

5,321 |

|

| Diluted |

|

5,394 |

|

|

5,381 |

|

|

5,386 |

|

|

5,361 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Condensed Balance Sheets |

| (Amounts in thousands) |

March 31, 2024 |

March 31, 2023 |

|

Cash and cash equivalents |

$ 28,214 |

$ 32,910 |

|

Other current assets |

|

81,138 |

|

86,065 |

|

Total current assets |

|

109,352 |

|

118,975 |

| Property, plant and equipment,

net |

|

31,766 |

|

28,149 |

| Other assets |

|

303,655 |

|

514,708 |

|

Total assets |

$ 444,773 |

$ 661,832 |

| |

|

|

| Liabilities |

$ 299,380 |

$ 268,352 |

| Stockholders’ equity |

|

145,393 |

|

393,480 |

|

Total liabilities and stockholders’ equity |

$ 444,773 |

$ 661,832 |

|

Reconciliation of Non-GAAP Measures |

|

(Unaudited) |

|

GAAP Operating (Loss) Income to Non-GAAP Adjusted Operating

Income (“AOI”) |

| |

|

|

| (Amounts in thousands, except per

share data) |

Three Months Ended March 31, |

Year Ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

|

| Operating (loss) income

(GAAP) |

$ |

(271,284 |

) |

$ |

517 |

$ |

(272,075 |

) |

$ |

3,320 |

|

| Amortization of intangible

assets |

|

4,961 |

|

|

7,248 |

|

27,341 |

|

|

28,821 |

|

| Stock-based compensation

expense |

|

2,792 |

|

|

2,679 |

|

11,936 |

|

|

12,538 |

|

| Depreciation expense |

|

1,334 |

|

|

1,117 |

|

4,233 |

|

|

4,313 |

|

| Impairment of goodwill and

long-lived assets |

|

274,533 |

|

|

-- |

|

274,533 |

|

|

-- |

|

| AOI (non-GAAP) |

$ |

12,336 |

|

$ |

11,561 |

$ |

45,968 |

|

$ |

48,992 |

|

| |

|

|

|

|

|

| Unusual items – before

tax |

|

|

|

|

|

| Non-cash GKE inventory

step-up1 |

$ |

817 |

|

$ |

-- |

$ |

1,229 |

|

$ |

-- |

|

| GKE acquisition costs2 |

|

-- |

|

|

-- |

|

835 |

|

|

-- |

|

| GKE integration costs3 |

|

960 |

|

|

-- |

|

1,400 |

|

|

|

| Restructuring costs |

|

825 |

|

|

-- |

|

1,073 |

|

|

-- |

|

| Agena integration costs4 |

|

-- |

|

|

268 |

|

-- |

|

|

970 |

|

| Belyntic acquisition costs5 |

|

-- |

|

|

-- |

|

-- |

|

|

172 |

|

| Total impact of unusual items on

AOI – before tax |

$ |

2,602 |

|

$ |

268 |

$ |

4,537 |

|

$ |

1,142 |

|

| |

|

|

|

|

|

| AOI excluding unusual items

(non-GAAP) |

$ |

14,938 |

|

$ |

11,829 |

$ |

50,505 |

|

$ |

50,134 |

|

| |

|

|

|

|

|

| AOI per share - basic

(non-GAAP) |

$ |

2.29 |

|

$ |

2.16 |

$ |

8.53 |

|

$ |

9.21 |

|

| AOI per share - diluted

(non-GAAP) |

|

2.29 |

|

|

2.15 |

|

8.53 |

|

|

9.14 |

|

| |

|

|

|

|

|

| AOI excluding unusual items per

share – basic (non -GAAP) |

|

2.77 |

|

|

2.21 |

|

9.38 |

|

|

9.42 |

|

| AOI excluding unusual items per

share – diluted (non-GAAP) |

|

2.77 |

|

|

2.20 |

|

9.38 |

|

|

9.35 |

|

| |

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

| Basic |

|

5,394 |

|

|

5,349 |

|

5,386 |

|

|

5,321 |

|

| Diluted |

|

5,394 |

|

|

5,381 |

|

5,386 |

|

|

5,361 |

|

| |

|

|

|

|

|

1 Non-cash cost of revenues expense associated with the step up

to fair value of GKE inventory due to application of purchase

accounting2 GKE acquisition costs primarily consist of legal

services related to the stock purchase agreement, professional

services for due diligence procedures and quality of earnings

report, and various other consultants.3 GKE integration costs

primarily consist of consulting costs for the integration of the

acquiree, including the implementation of the enterprise resource

planning tool, professional accounting and valuation services, and

legal costs related to employee contracts and managing director

appointments.4 Agena integration costs primarily consist of

consulting costs for the integration of the acquiree, including the

implementation of the enterprise resource planning tool and

professional accounting and valuation services.5 Belyntic

acquisition costs primarily consist of legal services related to

the stock purchase agreement.

| Organic and

Core Organic Revenues Growth (Unaudited) |

| |

| |

Three Months Ended March 31, 2024 |

Year Ended March 31, 2024 |

|

Total revenues growth |

6.0% |

|

(1.3)% |

|

| Impact of acquisitions |

(9.8)% |

|

(4.3)% |

|

| Organic revenues

growth (non-GAAP) |

(3.8)% |

|

(5.6)% |

|

| Currency translation |

0.3% |

|

--% |

|

| COVID related revenues |

--% |

|

0.2% |

|

| Core organic revenues

growth (non-GAAP) |

(3.5)% |

|

(5.4)% |

|

| |

|

|

|

|

Supplemental Information Regarding Non-GAAP Financial

Measures

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), we provide

non-GAAP adjusted operating income, non-GAAP adjusted operating

income per share amounts, non-GAAP adjusted operating income

excluding unusual items, non-GAAP adjusted operating income

excluding unusual items per share amounts, non-GAAP organic

revenues growth, and non-GAAP core organic revenues growth in order

to provide meaningful supplemental information regarding our

operational performance. We believe that the use of these non-GAAP

financial measures, in addition to GAAP financial measures, helps

investors to gain a better understanding of our operating results,

consistent with how management measures and forecasts its operating

performance, especially when comparing such results to previous

periods and to the performance of our competitors. Such measures

are also used by management in their financial and operating

decision-making and for compensation purposes. This

information facilitates management's internal comparisons to our

historical operating results as well as to the operating results of

our competitors. Since management finds this measure to be useful,

we believe that our investors can benefit by evaluating both GAAP

and non-GAAP results.

The non-GAAP measures of adjusted operating income and adjusted

operating income per share presented in the reconciliation above

are defined to exclude the non-cash impact of amortization of

intangible assets acquired in a business combination, stock-based

compensation, depreciation and impairment of goodwill and

long-lived assets. To calculate adjusted operating income, we

exclude, as applicable:

- Impairments of

long-lived assets as such charges are outside of our normal

operations and in most cases are difficult to accurately

forecast.

- Stock-based

compensation expense as it is a non-cash charge and costs

calculated for this expense vary in accordance with the stock price

on the date of grant.

- Depreciation expense

as it is a non-cash charge.

- The expense

associated with the amortization of acquisition-related intangible

assets as a significant portion of the purchase price for

acquisitions may be allocated to intangible assets that have lives

of up to 20 years. Exclusion of amortization expense allows

comparisons of operating results that are consistent over time for

both our newly acquired and long-held businesses and with both

acquisitive and non-acquisitive peer companies.

The non-GAAP measures of adjusted operating income and adjusted

operating income per share presented in the reconciliation above

are defined as Adjusted Operating Income less unusual items that

are not on-going and are related to a specific transaction. We

exclude these unusual items as they are outside of normal

operations and are not on-going.

Our management recognizes that items such as amortization of

intangible assets, stock-based compensation expense, depreciation

expense and impairment losses on goodwill and long-lived assets can

have a material impact on our operating and net income. To gain a

complete picture of all effects on our profit and loss from any and

all events, management does (and investors should) rely on the GAAP

consolidated statements of operations. The non-GAAP numbers focus

instead on our core operating business.

Readers are reminded that non-GAAP measures are merely a

supplement to, and not a replacement for, or superior to, financial

measures prepared according to GAAP. They should be evaluated in

conjunction with the GAAP financial measures. Our non-GAAP

information may be different from the non-GAAP information provided

by other companies.

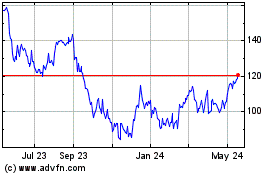

Mesa Laboratories (NASDAQ:MLAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

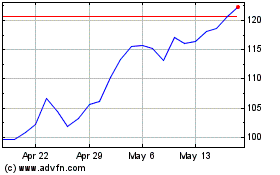

Mesa Laboratories (NASDAQ:MLAB)

Historical Stock Chart

From Mar 2024 to Mar 2025