Marin Software Incorporated (NASDAQ: MRIN) (“Marin”, “Marin

Software” or the “Company”), a leading provider of digital

marketing software for performance-driven advertisers and agencies,

today announced financial results for the third quarter ended

September 30, 2024.

“Marin is excited to deliver the next generation of AI-powered

performance marketing tools with our latest enhancement, Advisor,”

said Chris Lien, Marin Software’s CEO. “With this OpenAI-powered

virtual teammate, Marin users can interact with the platform in an

entirely new way – unlocking the collective knowledge of digital

marketing thought leaders and putting their best practices to work

with a simple prompt. This is another example of Marin delivering

innovations to help performance marketers save time and sell

more.”

Third Quarter 2024 Product and Business

Highlights:

- Launched Advisor, An AI-Powered Virtual Assistant: Our

new AI-powered virtual assistant allows marketers to streamline

their workflow by automating tasks and receiving actionable

insights. Powered by OpenAI and integrated with Marin’s entire

Knowledge Center, Advisor provides real-time performance analysis,

recommended actions, and step-by-step guidance, helping users

optimize their campaigns directly within Marin’s platform.

- Upgraded Reddit Integration: Our enhanced Reddit

integration now supports full campaign management, including

budgeting, forecasting, and automation—on top of our existing

omni-channel reporting capabilities. Marketers can manage their

Reddit campaigns with the same precision and ease they apply across

other platforms in Marin.

- Launched the Completed Episode Report: The new Completed

Episode report offers greater transparency by showcasing results

from the latest completed episode. This feature gives brands deeper

insights into the performance of their campaigns and highlights the

value delivered by the Marin platform.

- Improved Budget Management Controls: We’ve introduced

new budget floor controls, ensuring campaigns maintain a minimum

spend to maximize impact and avoid underperformance due to budget

shortfalls. These enhancements provide users with automated budget

management that adheres to both maximum and minimum thresholds

across all campaigns and publishers.

- Enhanced Client Grid Reporting: Marin’s in-app client

grid now offers expanded reporting options, including conversion

types and custom columns across publishers. This update gives

marketers more flexibility and deeper insights into their campaign

performance.

- Amazon S3 Integration: Users can now connect their

Amazon S3 buckets as a data source, enabling near real-time access

to critical campaign data such as revenue and conversions. This

integration ensures seamless cross-channel insights, particularly

for those leveraging Amazon’s data solutions.

- Launched Free Media Allocation Audit: For the first

time, we’re offering a complimentary media allocation audit. With

our decades of expertise and industry-leading analytics, this audit

helps performance marketers assess if their digital marketing

budgets are being invested optimally, providing valuable

recommendations to deliver growth and efficiency improvements.

- Search Ads Innovation Agreement with Google: In July

2024, we entered into a new three-year Search Ads Innovation

Agreement with Google that commenced on October 1, 2024, which is

substantially similar to the Revenue Share Agreement with Google

that expired on September 30, 2024, including the same minimum

quarterly payments.

Third Quarter 2024 Notable Client

Achievements:

- Fusion 92: Fusion 92, one of the Midwest’s largest

independent media agencies, utilized Marin’s budgeting platform to

transform budget compliance for their client, a dental services

organization with over 1,500 offices nationwide. In just under two

months, they improved budget compliance from 9% to 96%, saving over

15 hours of manual work per week.

Third Quarter 2024 Financial

Updates:

- Net revenue totaled $4.3 million, a year-over-year decrease of

4% when compared to $4.4 million for the third quarter of

2023.

- GAAP loss from operations was ($2.1) million, resulting in a

GAAP operating margin of (50%), as compared to a GAAP loss from

operations of ($5.1) million and a GAAP operating margin of (115%)

for the third quarter of 2023.

- Non-GAAP loss from operations was ($1.8) million, resulting in

a non-GAAP operating margin of (43%), as compared to a non-GAAP

loss from operations of ($2.9) million and a non-GAAP operating

margin of (65%) for the third quarter of 2023.

- Cash and cash equivalents were $5.6 million as of September 30,

2024.

Reconciliations of GAAP to non-GAAP financial measures have been

provided in the financial statement tables included in this press

release. An explanation of these measures is also included below,

under the heading “Non-GAAP Financial Measures.”

In October 2024, after the third quarter of September 30, 2024,

we commenced the implementation of an organizational restructuring

and reduction-in-force plan to reduce the Company’s operating costs

(the “2024 Restructuring Plan”), which is expected to result in the

reduction of our global employees by approximately 27 employees,

representing approximately 26% of our total headcount as of

September 30, 2024. We estimate that the 2024 Restructuring Plan

will result in estimated pre-tax annualized cost savings of

approximately $3.5 million to $3.7 million, all of which is related

to the reduction-in-force pursuant to the 2024 Restructuring Plan,

and we expect to begin realizing the cost savings from the 2024

Restructuring Plan during the three months ended December 31, 2024.

We estimate that we will incur between approximately $0.6 million

and $0.8 million of cash expenditures during the three months ended

December 31, 2024 in connection with the 2024 Restructuring Plan,

substantially all of which relates to severance costs, and we

expect to substantially complete the 2024 Restructuring Plan in the

same period.

Financial Outlook:

Marin is providing guidance for its fourth quarter of 2024, as

follows:

Forward-Looking

Guidance

In millions

Range of Estimate

From

To

Three Months Ending December 31,

2024

Revenue, net

$

4.0

$

4.2

Operating loss (Non-GAAP)

$

(1.4

)

$

(1.1

)

Non-GAAP loss from operations excludes the effects of

stock-based compensation expense, amortization of internally

developed software, impairment of long-lived assets, capitalization

of internally developed software, non-recurring costs associated

with restructurings, and certain professional fees that the Company

has incurred in responding to third-party subpoenas that the

Company has received related to governmental investigations of

Google and Meta.

Additionally, the Company does not reconcile its forward-looking

non-GAAP loss from operations, due to variability between revenue

and non-cash items such as stock-based compensation. The GAAP loss

from operations includes stock-based compensation expense, which is

affected by hiring and retention needs, as well as the future price

of Marin’s stock. As a result, a reconciliation of the

forward-looking non-GAAP financial measures to the corresponding

GAAP measures cannot be made without unreasonable effort.

Quarterly Results Conference

Call

Marin Software will host a conference call today at 2:00 PM

Pacific Time (5:00 PM Eastern Time) to review the Company’s

financial results for the quarter ended September 30, 2024, and its

outlook for the future. To access the call, please dial (800)

954-0684 in the United States or (212) 231-2929 internationally

with reference to conference ID 13742154. A live webcast of the

conference call will be accessible at

https://viavid.webcasts.com/starthere.jsp?ei=1639634&tp_key=333b2eee9c.

Following the completion of the call through 11:59 p.m. Eastern

Time on November 7, 2024, a recorded replay will be available on

the Company’s website at http://investor.marinsoftware.com/ and a

telephone replay will be available by dialing (844) 512-2921 in the

United States or (412) 317-6671 internationally with the recording

access code 13742154.

About Marin Software

Marin Software Incorporated’s (NASDAQ: MRIN) mission is to give

advertisers the power to drive higher efficiency and transparency

in their paid marketing programs that run on the world’s largest

publishers. Marin Software provides enterprise marketing software

for advertisers and agencies to integrate, align, and amplify their

digital advertising spend across the web and mobile devices. Marin

Software offers a unified SaaS advertising management platform for

search, social, and eCommerce advertising. The Company helps

digital marketers convert precise audiences, improve financial

performance, and make better decisions. Headquartered in San

Francisco with offices worldwide, Marin Software’s technology

powers marketing campaigns around the globe. For more information

about Marin Software, please visit www.marinsoftware.com.

Non-GAAP Financial

Measures

Marin uses certain non-GAAP financial measures in this release.

Marin uses these non-GAAP financial measures internally in

analyzing its financial results and believes they are useful to

investors, as a supplement to GAAP measures, in evaluating its

ongoing operational performance. Marin believes that the use of

these non-GAAP financial measures provides an additional tool for

investors to use in evaluating ongoing operating results and trends

and in comparing our financial results with other companies in our

industry, many of which present similar non-GAAP financial measures

to investors. Non-GAAP financial measures that Marin uses may

differ from measures that other companies may use.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. A reconciliation of the non-GAAP

financial measures to their most directly comparable GAAP measures

has been provided in the financial statement tables included below

in this press release. Investors are encouraged to review the

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP financial measures.

Non-GAAP expenses, measures and net loss per share. Marin

defines non-GAAP sales and marketing, non-GAAP research and

development, non-GAAP general and administrative, non-GAAP gross

profit, non-GAAP operating loss and non-GAAP net loss as the

respective GAAP balances, adjusted for stock-based compensation

expense, amortization of internally developed software and

intangible assets, capitalization of internally developed software,

non-recurring costs associated with restructurings, and certain

professional fees that the Company has incurred in responding to

third-party subpoenas that the Company has received related to

governmental investigations of Google and Meta. Non-GAAP net loss

per share is calculated as non-GAAP net loss divided by the

weighted average shares outstanding.

Adjusted EBITDA. Marin defines Adjusted EBITDA as net loss,

adjusted for stock-based compensation expense, depreciation,

amortization of internally developed software and intangible

assets, capitalization of internally developed software, benefit

from or provision for income taxes, other income, net,

non-recurring costs associated with restructurings, and certain

professional fees that the Company has incurred in responding to

third-party subpoenas that the Company has received related to

governmental investigations of Google and Meta. These amounts are

often excluded by other companies to help investors understand the

operational performance of their business. The Company uses

Adjusted EBITDA as a measurement of its operating performance

because it assists in comparing the operating performance on a

consistent basis by removing the impact of certain non-cash and

non-operating items. Adjusted EBITDA reflects an additional way of

viewing aspects of the operations that Marin believes, when viewed

with the GAAP results and the accompanying reconciliations to

corresponding GAAP financial measures, provide a more complete

understanding of factors and trends affecting its business.

Forward-Looking

Statements

This press release contains forward-looking statements

including, among other things, statements regarding Marin’s

business, impact of investments in product and technology on future

operating results, the increasing complexity in marketing, progress

on product development efforts, product capabilities, advertiser

and customer behavior, and future financial results, including its

outlook for the fourth quarter of 2024. These forward-looking

statements are subject to the safe harbor provisions created by the

Private Securities Litigation Reform Act of 1995. Actual results

could differ materially from those projected in the forward-looking

statements as a result of certain risk factors, including but not

limited to, our ability to reduce our expenses or raise additional

capital to meet our obligations as a going concern; our ability to

successfully implement a restructuring plan that we commenced in

October 2024 and the expected costs and savings from the

restructuring plan; the amount of digital advertising spend managed

by our customers using our products; the extent of customer

acceptance, adoption and usage of our MarinOne platform; the

productivity of our personnel and other aspects of our business;

our ability to maintain or grow sales to new and existing

customers; any adverse changes in our relationships with and access

to publishers and advertising agencies and strategic business

partners, including any adverse changes in our revenue sharing

agreement with Google; our ability to retain and attract qualified

management, technical and sales and marketing personnel; any delays

in the release of updates to our product platform or new features

or delays in customer deployment of any such updates or features;

competitive factors, including but not limited to pricing

pressures, entry of new competitors and new applications; quarterly

fluctuations in our operating results due to a number of factors;

inability to adequately forecast our future revenue, expenses,

Adjusted EBITDA, cash flows or other financial metrics; delays,

reductions or slower growth in the amount spent on online and

mobile advertising and the development of the market for

cloud-based software; progress in our efforts to update our

software platform; our ability to maintain or expand sales of our

solutions in channels other than search advertising; any slow-down

in the search advertising market generally; any shift in customer

digital advertising budgets from search to segments in which we are

not as deeply penetrated; the development of the market for digital

advertising; our ability to provide high-quality technical support

to our customers; material defects in our platform including those

resulting from any updates we introduce to our platform, service

interruptions at our single third-party data center or breaches in

our security measures; our ability to develop enhancements to our

platform; our ability to protect our intellectual property; our

ability to manage risks associated with international operations;

the impact of fluctuations in currency exchange rates, particularly

an increase in the value of the dollar; near term changes in sales

of our software services or spend under management may not be

immediately reflected in our results due to our subscription

business model; our ability to maintain the listing of our common

stock on the Nasdaq; and adverse changes in general economic or

market conditions. These forward-looking statements are based on

current expectations and are subject to uncertainties and changes

in condition, significance, value and effect as well as other risks

detailed in documents filed with the Securities and Exchange

Commission, including our most recent report on Form 10-K, recent

reports on Form 10-Q and current reports on Form 8-K, which we may

file from time to time, and all of which are available free of

charge at the SEC’s website at www.sec.gov. Any of these risks

could cause actual results to differ materially from expectations

set forth in the forward-looking statements. All forward-looking

statements in this press release reflect Marin’s expectations as of

October 31, 2024. Marin assumes no obligation to, and expressly

disclaims any obligation to update any such forward-looking

statements after the date of this release.

Marin Software Incorporated

Condensed Consolidated Balance

Sheets

(On a GAAP basis)

September 30,

December 31,

(Unaudited; in thousands, except par

value)

2024

2023

Assets:

Current assets:

Cash and cash equivalents

$

5,588

$

11,363

Accounts receivable, net

3,661

3,864

Prepaid expenses and other current

assets

1,479

1,548

Total current assets

10,728

16,775

Property and equipment, net

115

120

Right-of-use assets, operating leases

819

1,912

Other non-current assets

518

508

Total assets

$

12,180

$

19,315

Liabilities and Stockholders'

Equity:

Current liabilities:

Accounts payable

$

579

$

664

Accrued expenses and other current

liabilities

2,089

2,099

Operating lease liabilities

819

1,518

Total current liabilities

3,487

4,281

Operating lease liabilities,

non-current

—

394

Other long-term liabilities

1,015

1,001

Total liabilities

4,502

5,676

Stockholders’ equity:

Convertible preferred stock, $0.001 par

value

—

—

Common stock, $0.001 par value

3

3

Additional paid-in capital

359,718

358,884

Accumulated deficit

(351,006

)

(344,251

)

Accumulated other comprehensive loss

(1,037

)

(997

)

Total stockholders’ equity

7,678

13,639

Total liabilities and stockholders’

equity

$

12,180

$

19,315

Marin Software Incorporated

Condensed Consolidated Statements of

Operations

(On a GAAP basis)

Three Months Ended September

30,

Nine Months Ended September

30,

(Unaudited; in thousands, except per

share data)

2024

2023

2024

2023

Revenue, net

$

4,282

$

4,438

$

12,358

$

13,381

Cost of revenue

1,703

3,087

5,136

9,501

Gross profit

2,579

1,351

7,222

3,880

Operating expenses:

Sales and marketing

1,091

1,482

3,384

5,442

Research and development

1,760

2,860

5,440

8,599

General and administrative

1,860

2,119

5,144

6,897

Total operating expenses

4,711

6,461

13,968

20,938

Loss from operations

(2,132

)

(5,110

)

(6,746

)

(17,058

)

Other income, net

(176

)

158

66

598

Loss before income taxes

(2,308

)

(4,952

)

(6,680

)

(16,460

)

Provision for income taxes

18

2

75

194

Net loss

$

(2,326

)

$

(4,954

)

$

(6,755

)

$

(16,654

)

Net loss per common share, basic and

diluted

$

(0.74

)

$

(1.66

)

$

(2.19

)

$

(5.70

)

Weighted-average shares outstanding, basic

and diluted

3,135

2,985

3,089

2,920

Marin Software Incorporated

Condensed Consolidated Statements of

Cash Flows

(On a GAAP basis)

Nine Months Ended September

30,

(Unaudited; in thousands)

2024

2023

Operating activities:

Net loss

$

(6,755

)

$

(16,654

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation

5

17

Amortization of internally developed

software

—

1,278

Amortization of right-of-use assets

1,165

1,162

Amortization of deferred costs to obtain

and fulfill contracts

267

277

Loss on disposals of property and

equipment

—

2

Unrealized foreign currency losses

199

43

Stock-based compensation related to equity

awards

957

2,594

Provision for credit losses

(7

)

(388

)

Deferred income tax benefits

(3

)

—

Changes in operating assets and

liabilities

Accounts receivable

113

872

Prepaid expenses and other assets

(235

)

345

Accounts payable

(102

)

21

Accrued expenses and other liabilities

(85

)

(1,041

)

Operating lease liabilities

(1,165

)

(1,162

)

Net cash used in operating activities

(5,646

)

(12,634

)

Investing activities:

Capitalization of internally developed

software

—

(1,511

)

Net cash used in investing activities

—

(1,511

)

Financing activities:

Employee taxes paid for withheld shares

upon equity award settlement

(116

)

(199

)

Proceeds from employee stock purchase

plan, net

—

(3

)

Net cash provided by (used in) financing

activities

(116

)

(202

)

Effect of foreign exchange rate changes on

cash and cash equivalents

(13

)

(13

)

Net decrease in cash and cash

equivalents

(5,775

)

(14,360

)

Cash and cash equivalents:

Beginning of period

11,363

27,957

End of the period

$

5,588

$

13,597

Marin Software Incorporated

Reconciliation of GAAP to Non-GAAP

Expenses

Three Months Ended

Year Ended

Three Months Ended

Mar 31,

Jun 30,

Sep 30

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30

(Unaudited; in thousands)

2023

2023

2023

2023

2023

2024

2024

2024

Sales and marketing

$

2,025

$

1,935

$

1,482

$

1,078

$

6,520

$

1,250

$

1,043

$

1,091

Stock-based compensation

(165

)

(184

)

(88

)

(65

)

(502

)

(64

)

(60

)

(38

)

Restructuring related expenses

—

—

(122

)

—

(122

)

—

—

—

Sales and marketing (Non-GAAP)

$

1,860

$

1,751

$

1,272

$

1,013

$

5,896

$

1,186

$

983

$

1,053

Research and development

$

2,942

$

2,797

$

2,860

$

1,636

$

10,235

$

1,881

$

1,799

$

1,760

Stock-based compensation

(270

)

(305

)

(131

)

(119

)

(825

)

(127

)

(124

)

(86

)

Restructuring related expenses

—

—

(815

)

(22

)

(837

)

—

—

—

Capitalization of internally developed

software

579

578

354

296

1,807

—

—

—

Research and development (Non-GAAP)

$

3,251

$

3,070

$

2,268

$

1,791

$

10,380

$

1,754

$

1,675

$

1,674

General and administrative

$

2,336

$

2,442

$

2,119

$

1,974

$

8,871

$

1,684

$

1,600

$

1,860

Stock-based compensation

(473

)

(627

)

(85

)

(187

)

(1,372

)

(183

)

(109

)

(57

)

Restructuring related expenses

—

—

(189

)

—

(189

)

—

—

—

Third-party subpoena-related expenses

(84

)

(45

)

(36

)

(30

)

(195

)

(60

)

(81

)

(93

)

General and administrative (Non-GAAP)

$

1,779

$

1,770

$

1,809

$

1,757

$

7,115

$

1,441

$

1,410

$

1,710

Marin Software Incorporated

Reconciliation of GAAP to Non-GAAP

Measures

Three Months Ended

Year Ended

Three Months Ended

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30,

(Unaudited; in thousands)

2023

2023

2023

2023

2023

2024

2024

2024

Gross profit

$

1,343

$

1,186

$

1,351

$

2,216

$

6,096

$

2,288

$

2,355

$

2,579

Stock-based compensation

124

137

5

41

307

39

38

32

Amortization of internally developed

software

419

426

433

423

1,701

—

—

—

Restructuring related expenses

—

—

671

2

673

—

—

—

Gross profit (Non-GAAP)

$

1,886

$

1,749

$

2,460

$

2,682

$

8,777

$

2,327

$

2,393

$

2,611

Operating loss

$

(5,960

)

$

(5,988

)

$

(5,110

)

$

(5,748

)

$

(22,806

)

$

(2,527

)

$

(2,087

)

$

(2,132

)

Stock-based compensation

1,032

1,253

309

412

3,006

413

331

213

Amortization of internally developed

software

419

426

433

423

1,701

—

—

—

Restructuring related expenses

—

—

1,797

24

1,821

—

—

—

Capitalization of internally developed

software

(579

)

(578

)

(354

)

(296

)

(1,807

)

—

—

—

Third-party subpoena-related expenses

84

45

36

30

195

60

81

93

Impairment loss on long-lived assets

—

—

—

3,276

3,276

—

—

—

Operating loss (Non-GAAP)

$

(5,004

)

$

(4,842

)

$

(2,889

)

$

(1,879

)

$

(14,614

)

$

(2,054

)

$

(1,675

)

$

(1,826

)

Net loss

$

(5,783

)

$

(5,917

)

$

(4,954

)

$

(5,263

)

$

(21,917

)

$

(2,411

)

$

(2,018

)

$

(2,326

)

Stock-based compensation

1,032

1,253

309

412

3,006

413

331

213

Amortization of internally developed

software

419

426

433

423

1,701

—

—

—

Restructuring related expenses

—

—

1,797

24

1,821

—

—

—

Capitalization of internally developed

software

(579

)

(578

)

(354

)

(296

)

(1,807

)

—

—

—

Third-party subpoena-related expenses

84

45

36

30

195

60

81

93

Impairment loss on long-lived assets

—

—

—

3,276

3,276

—

—

—

Net loss (Non-GAAP)

$

(4,827

)

$

(4,771

)

$

(2,733

)

$

(1,394

)

$

(13,725

)

$

(1,938

)

$

(1,606

)

$

(2,020

)

Marin Software Incorporated

Calculation of Non-GAAP Earnings Per

Share

Three Months Ended

Year Ended

Three Months Ended

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30,

(Unaudited; in thousands, except per

share data)

2023

2023

2023

2023

2023

2024

2024

2024

Net loss (Non-GAAP)

$

(4,827

)

$

(4,771

)

$

(2,733

)

$

(1,394

)

$

(13,725

)

$

(1,938

)

$

(1,606

)

$

(2,020

)

Weighted-average shares outstanding, basic

and diluted

2,873

2,902

2,985

3,009

2,943

3,024

3,108

3,135

Net loss per share, basic and diluted

(Non-GAAP)

$

(1.68

)

$

(1.64

)

$

(0.92

)

$

(0.46

)

$

(4.66

)

$

(0.64

)

$

(0.52

)

$

(0.64

)

Marin Software Incorporated

Reconciliation of Net Loss to Adjusted

EBITDA

Three Months Ended

Year Ended

Three Months Ended

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30,

(Unaudited; in thousands)

2023

2023

2023

2023

2023

2024

2024

2024

Net loss

$

(5,783

)

$

(5,917

)

$

(4,954

)

$

(5,263

)

$

(21,917

)

$

(2,411

)

$

(2,018

)

$

(2,326

)

Depreciation

11

3

3

2

19

2

2

1

Amortization of internally developed

software

419

426

433

423

1,701

—

—

—

Provision for (benefit from) income

taxes

48

144

2

(344

)

(150

)

(12

)

69

18

Stock-based compensation

1,032

1,253

309

412

3,006

413

331

213

Capitalization of internally developed

software

(579

)

(578

)

(354

)

(296

)

(1,807

)

—

—

—

Restructuring related expenses

—

—

1,797

24

1,821

—

—

—

Impairment loss on long-lived assets

—

—

—

3,276

3,276

—

—

—

Other income, net

(225

)

(215

)

(158

)

(141

)

(739

)

(104

)

(138

)

176

Third-party subpoena-related expenses

84

45

36

30

195

60

81

93

Adjusted EBITDA

$

(4,993

)

$

(4,839

)

$

(2,886

)

$

(1,877

)

$

(14,595

)

$

(2,052

)

$

(1,673

)

$

(1,825

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031446878/en/

Investor Relations, Marin Software

ir@marinsoftware.com

Media Contact Wesley MacLaggan Marketing, Marin Software

(415) 399-2580 press@marinsoftware.com

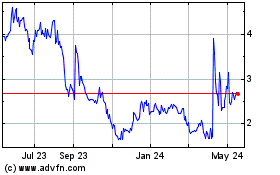

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

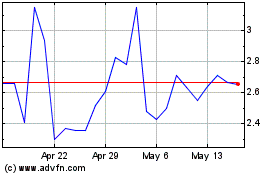

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Dec 2023 to Dec 2024