Myriad Genetics, Inc. (NASDAQ: MYGN), a leader in genetic testing

and precision medicine, today announced select unaudited

preliminary results for the fourth quarter and full year ended

December 31, 2024, and provided full year 2025 financial guidance.

Select Preliminary Fourth Quarter and Full Year 2024

Financial ResultsThe company expects the following:

- Fourth quarter of 2024 total revenues to be between $209

million and $211 million, an increase of approximately 6% to 7%

compared to fourth quarter of 2023. Full year 2024 total revenues

to be between $836 million to $838 million, an increase of

approximately 11% compared to full year 2023.

- Fourth quarter of 2024 GAAP diluted loss per share to be

between $(0.72) and $(0.62) and adjusted diluted earnings per share

(EPS) to be between $0.03 and $0.04. Full year 2024 GAAP loss per

share to be between $(1.66) and $(1.56) and adjusted EPS to be

between $0.14 and $0.15.

- Fourth quarter of 2024 GAAP net loss to be between $(65.7)

million and $(56.8) million and adjusted EBITDA to be between

$10 million and $11 million. Full year 2024 GAAP loss to be between

$(151) million and $(142) million and adjusted EBITDA to be

between $40 million and $41 million.

- As of December 31, 2024, cash and

cash equivalents were approximately $102 million, an increase of $2

million from the end of third quarter of 2024.

These preliminary results will be included in a presentation

that will be made available through a live webcast in the investor

relations section of the Myriad Genetics website at

investor.myriad.com on Wednesday, January 15, 2025 at 3:45 p.m. PT

(6:45 p.m. ET) in connection with the company’s presentation at the

43rd Annual J.P. Morgan Healthcare Conference. An archived edition

of the presentation will be available later that day. Myriad

Genetics plans to release its actual financial results for the

fourth quarter and full year 2024 during its earnings call to be

held in February 2025.

The select financial results for the quarter and full year ended

December 31, 2024 set forth in this press release are preliminary

and subject to Myriad Genetics’ normal quarter and year-end

accounting procedures and external audit by the company’s

independent registered public accounting firm. As a result, these

select preliminary, unaudited financial results may change in

connection with the finalization of the company’s year-end closing

and reporting processes and financial statements for the quarter

and full year ended December 31, 2024 and may not represent the

actual financial results for the quarter and full year ended

December 31, 2024. In addition, these select preliminary unaudited

results are not a comprehensive statement of the company’s

financial results for the year ended December 31, 2024, should not

be viewed as a substitute for full, audited financial statements

prepared in accordance with generally accepted accounting

principles, and are not necessarily indicative of the company's

results for any future period.

2025 Full Year Financial GuidanceMyriad

Genetics does not provide forward-looking guidance on a GAAP basis

for the measures on which it provides forward-looking non-GAAP

guidance as the company is unable to provide a quantitative

reconciliation of forward-looking non-GAAP measures to the most

directly comparable forward-looking GAAP measure, without

unreasonable effort, because of the inherent difficulty in

accurately forecasting the occurrence and financial impact of the

various adjusting items necessary for such reconciliations that

have not yet occurred, are dependent on various factors, are out of

the company's control, or cannot be reasonably predicted. Such

adjustments include, but are not limited to, real estate

optimization and transformation initiatives, certain litigation

charges and loss contingencies, costs related to

acquisitions/divestitures and the related amortization, impairment

and related charges, and other adjustments. For example,

stock-based compensation may fluctuate based on the timing of

employee stock transactions and unpredictable fluctuations in the

company's stock price. Any associated estimate of these items and

its impact on GAAP performance could vary materially.

The company introduces the full year 2025 financial guidance in

the table below*.

|

(in millions, except per share amounts) |

|

FY 2025 Guidance |

|

FY 2025 Comments |

|

Revenue |

|

$840 - $860 |

|

Reflects an increase of

approximately 0% and 3% compared to preliminary 2024 revenue and an

increase of approximately 8% and 11% compared to preliminary 2024

revenue excluding approximately $45 million of 2024 GeneSight

revenue associated with UnitedHealthcare (UNH) commercial and

select managed Medicaid plans, approximately $10 million of 2024

revenue from UNH due to a change in estimated revenue related to

prior years, and approximately $6 million of 2024 EndoPredict

revenue outside the United States associated with the divestiture

of the EndoPredict business on August 1, 2024. |

|

Gross margin % |

|

69.5% - 70.5% |

|

|

|

Adjusted OPEX |

|

$575 - $595 |

|

|

|

Adjusted EBITDA** |

|

$25 - $35 |

|

|

|

Adjusted EPS*** |

|

$0.07 - $0.11 |

|

|

| * |

Assumes currency

rates as of January 15, 2025. |

| ** |

Adjusted EBITDA is

defined as Net Income (loss) plus income tax expense (benefit),

total other income (expense), non-cash operating expenses, such as

amortization of intangible assets, depreciation, impairment of

long-lived assets, and share-based compensation expense, and

one-time expenses such as expenses from real estate optimization

initiatives, transformation initiatives, legal settlements, and

divestitures and acquisitions. |

| *** |

Full-year 2025

adjusted EPS is based on a 94 million share count. |

|

|

|

|

|

|

|

These projections are forward-looking statements and are subject

to the risks summarized in the safe harbor statement at the end of

this press release.

About Myriad GeneticsMyriad Genetics is a

leading genetic testing and precision medicine company dedicated to

advancing health and well-being for all. Myriad Genetics develops

and offers genetic tests that help assess the risk of developing

disease or disease progression and guide treatment decisions across

medical specialties where genetic insights can significantly

improve patient care and lower healthcare costs. For more

information, visit www.myriad.com.

Safe Harbor Statement This press

release contains “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995, including the

company’s fourth quarter and full year 2024 preliminary revenue,

loss per share and adjusted EPS and the other preliminary financial

items included in the reconciliations below as well as the cash and

cash equivalents as of December 31, 2024, the company’s full year

2025 financial guidance, and the company's plan to release actual

financial results for the fourth quarter and full year 2024 in

February 2025. These “forward-looking statements” are management’s

present expectations of future events as of the date hereof and are

subject to known and unknown risks and uncertainties that could

cause actual results, conditions, and events to differ materially

and adversely from those anticipated.

These risks include, but are not limited to: the risk that sales

and profit margins of the company’s existing tests may decline; the

risk that the company may not be able to operate its business on a

profitable basis; risks related to changes in the company's

financial results from the preliminary results reported in this

press release resulting from the finalization of the company's

financial statements for the fourth quarter and full year 2024 and

the audit thereof; risks related to the company’s ability to

achieve certain revenue growth targets and generate sufficient

revenue from its existing product portfolio or in launching and

commercializing new tests to be profitable; risks related to

changes in governmental or private insurers’ coverage and

reimbursement levels for the company’s tests or the company’s

ability to obtain reimbursement for its new tests at comparable

levels to its existing tests, including with respect to UNH's

coverage decisions effective as of first quarter 2025; risks

related to increased competition and the development of new

competing tests; the risk that the company may be unable to develop

or achieve commercial success for additional tests in a timely

manner, or at all; the risk that the company may not successfully

develop new markets or channels for its tests; the risk that

licenses to the technology underlying the company’s tests and any

future tests are terminated or cannot be maintained on satisfactory

terms; risks related to delays or other problems with operating the

company’s laboratory testing facilities and the transition of such

facilities to the company's new laboratory testing facilities;

risks related to public concern over genetic testing in general or

the company’s tests in particular; risks related to regulatory

requirements or enforcement in the United States and foreign

countries and changes in the structure of the healthcare system or

healthcare payment systems; risks related to the company’s ability

to obtain new corporate collaborations or licenses and acquire or

develop new technologies or businesses on satisfactory terms, if at

all; risks related to the company’s ability to successfully

integrate and derive benefits from any technologies or businesses

that it licenses, acquires or develops; the risk that the company

is not able to secure additional financing to fund its business, if

needed, in a timely manner or on favorable terms, if it all; risks

related to the company’s projections or estimates about the

potential market opportunity for the company’s current and future

products; the risk that the company or its licensors may be unable

to protect or that third parties will infringe the proprietary

technologies underlying the company’s tests; the risk of

patent-infringement claims or challenges to the validity of the

company’s patents; risks related to changes in intellectual

property laws covering the company’s tests, or patents or

enforcement, in the United States and foreign countries; risks

related to security breaches, loss of data and other disruptions,

including from cyberattacks; risks of new, changing and competitive

technologies in the United States and internationally and that the

company may not be able to keep pace with the rapid technology

changes in its industry, or properly leverage new technologies to

achieve or sustain competitive advantages in its products; the risk

that the company may be unable to comply with financial operating

covenants under the company’s credit or lending agreements; the

risk that the company may not be able maintain effective disclosure

controls and procedures and internal control over financial

reporting; risks related to current and future investigations,

claims or lawsuits, including derivative claims, product or

professional liability claims, and risks related to the amount of

the company's insurance coverage limits and scope of insurance

coverage with respect thereto; and other factors discussed under

the heading “Risk Factors” contained in Item 1A of the company’s

Annual Report on Form 10-K filed with the U.S. Securities and

Exchange Commission (SEC) on February 28, 2024 as updated in the

company's Quarterly Reports on Form 10-Q filed with the SEC on May

8, 2024 and November 8, 2024 as well as any further updates to

those risk factors filed from time to time in the company’s future

filings with the SEC. Myriad Genetics is not under any obligation,

and it expressly disclaims any obligation, to update or alter any

forward-looking statements, whether as a result of new information,

future events or otherwise except as required by law.

Statement regarding use of non-GAAP financial

measuresIn this press release, the company’s preliminary

financial results and financial guidance are provided in accordance

with accounting principles generally accepted in the United States

(GAAP) and using certain non-GAAP financial measures. Management

believes that presentation of operating results using non-GAAP

financial measures provides useful supplemental information to

investors and facilitates the analysis of the company’s core

operating results and comparison of operating results across

reporting periods. Management also uses non-GAAP financial measures

to establish budgets and to manage the company’s business. A

reconciliation of the preliminary GAAP financial results to

preliminary non-GAAP financial results is included in the schedules

below and a description of the adjustments made to the preliminary

GAAP financial measures is included at the end of the

schedules.

The company encourages investors to carefully consider its

preliminary results under GAAP, as well as its supplemental

preliminary non-GAAP information and the reconciliation between

these presentations, to more fully understand its business.

Non-GAAP financial results are reported in addition to, and not as

a substitute for, or superior to, financial measures calculated in

accordance with GAAP.

The company does not forecast GAAP operating expenses, net

income (loss) or earnings per share because it cannot predict

certain elements that are included in reported GAAP results. Please

see above under “2025 Full Year Financial Guidance” for a full

explanation.

As set forth above, the company’s financial results for the

quarter and full year ended December 31, 2024 set forth in this

press release are preliminary and subject to Myriad Genetics’

normal quarter and year-end accounting procedures and external

audit by the company’s independent registered public accounting

firm and therefore subject to change.

Reconciliation of Preliminary GAAP to Preliminary

Non-GAAP Financial Measures

for the Three and Twelve Months Ended December 31,

2024

| |

Three Months EndedDecember 31,

2024 |

|

Twelve Months EndedDecember 31,

2024 |

| |

Low(1) |

|

High(2) |

|

Low(1) |

|

High(2) |

| Adjusted Net Income

(Loss)(3) |

|

|

|

|

|

|

|

|

Net Loss |

$ |

(65.7 |

) |

|

$ |

(56.8 |

) |

|

$ |

(150.5 |

) |

|

$ |

(141.6 |

) |

|

Acquisition - amortization of intangible assets |

|

10.0 |

|

|

|

10.0 |

|

|

|

41.5 |

|

|

|

41.5 |

|

|

Goodwill and long-lived asset impairment charges |

|

45.0 |

|

|

|

41.0 |

|

|

|

58.8 |

|

|

|

54.8 |

|

|

Equity compensation |

|

10.9 |

|

|

|

10.9 |

|

|

|

49.8 |

|

|

|

49.8 |

|

|

Real estate optimization |

|

1.7 |

|

|

|

1.7 |

|

|

|

7.2 |

|

|

|

7.2 |

|

|

Transformation initiatives |

|

— |

|

|

|

— |

|

|

|

6.6 |

|

|

|

6.6 |

|

|

Legal charges |

|

0.1 |

|

|

|

0.1 |

|

|

|

0.6 |

|

|

|

0.6 |

|

|

Other adjustments |

|

0.9 |

|

|

|

0.9 |

|

|

|

3.4 |

|

|

|

3.4 |

|

|

Tax adjustments |

|

0.3 |

|

|

|

(3.7 |

) |

|

|

(4.9 |

) |

|

|

(8.9 |

) |

| Adjusted Net Income |

$ |

3.2 |

|

|

$ |

4.1 |

|

|

$ |

12.5 |

|

|

$ |

13.4 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

91.1 |

|

|

|

91.1 |

|

|

|

90.6 |

|

|

|

90.6 |

|

|

Diluted |

|

92.1 |

|

|

|

92.1 |

|

|

|

92.1 |

|

|

|

92.1 |

|

| GAAP Net Loss Per Share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.72 |

) |

|

$ |

(0.62 |

) |

|

$ |

(1.66 |

) |

|

$ |

(1.56 |

) |

|

Diluted |

$ |

(0.72 |

) |

|

$ |

(0.62 |

) |

|

$ |

(1.66 |

) |

|

$ |

(1.56 |

) |

| Adjusted Earnings Per

Share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.04 |

|

|

$ |

0.05 |

|

|

$ |

0.14 |

|

|

$ |

0.15 |

|

|

Diluted |

$ |

0.03 |

|

|

$ |

0.04 |

|

|

$ |

0.14 |

|

|

$ |

0.15 |

|

| (1) Represents

the low end of the range of management’s expectations of 2024

fourth quarter and full year 2024 results. |

| (2) Represents

the high end of the range of management’s expectations of 2024

fourth quarter and full year 2024 results. |

| (3) To determine

Adjusted Earnings (Loss) Per Share, or adjusted EPS. |

| |

| |

Three Months EndedDecember 31,

2024 |

|

Twelve Months EndedDecember 31,

2024 |

| |

Low(1) |

|

High(2) |

|

Low(1) |

|

High(2) |

| Adjusted

EBITDA |

|

|

|

|

|

|

|

|

Net Loss |

$ |

(65.7 |

) |

|

$ |

(56.8 |

) |

|

$ |

(150.5 |

) |

|

$ |

(141.6 |

) |

|

Acquisition - amortization of intangible assets |

|

10.0 |

|

|

|

10.0 |

|

|

|

41.5 |

|

|

|

41.5 |

|

|

Depreciation expense |

|

4.7 |

|

|

|

4.7 |

|

|

|

17.9 |

|

|

|

17.9 |

|

|

Goodwill and long-lived asset impairment charges |

|

45.0 |

|

|

|

41.0 |

|

|

|

58.8 |

|

|

|

54.8 |

|

|

Equity compensation |

|

10.9 |

|

|

|

10.9 |

|

|

|

49.8 |

|

|

|

49.8 |

|

|

Real estate optimization(3) |

|

1.7 |

|

|

|

1.7 |

|

|

|

7.2 |

|

|

|

7.2 |

|

|

Transformation initiatives |

|

— |

|

|

|

— |

|

|

|

6.6 |

|

|

|

6.6 |

|

|

Legal charges |

|

0.1 |

|

|

|

0.1 |

|

|

|

0.6 |

|

|

|

0.6 |

|

|

Interest expense, net of interest income(4) |

|

(0.1 |

) |

|

|

(0.1 |

) |

|

|

0.6 |

|

|

|

0.6 |

|

|

Other adjustments |

|

0.2 |

|

|

|

0.2 |

|

|

|

3.8 |

|

|

|

3.8 |

|

|

Income tax expense(5) |

|

3.2 |

|

|

|

(0.8 |

) |

|

|

3.6 |

|

|

|

(0.4 |

) |

| Adjusted EBITDA |

$ |

10.0 |

|

|

$ |

10.9 |

|

|

$ |

39.9 |

|

|

$ |

40.8 |

|

| (1) Represents

the low end of the range of management’s expectations of 2024

fourth quarter and full year 2024 results. |

| (2) Represents

the high end of the range of management’s expectations of 2024

fourth quarter and full year 2024 results. |

| (3) Real estate

optimization includes depreciation expense of $0.3 million and

$1.6 million for the three and twelve months ended months ended

December 31, 2024, respectively, |

| (4) Derived from

interest expense and interest income from the Consolidated

Statements of Operations. |

| (5) Derived from

income tax (benefit) from the Consolidated Statement of

Operations. |

| |

Following is a description of the adjustments made to the

preliminary GAAP financial measures:

- Acquisition – amortization of intangible assets – represents

recurring amortization charges resulting from the acquisition of

intangible assets.

- Goodwill and long-lived asset impairment charges:

- For the three months ended December 31, 2024, consists of the

impairment of acquired technology intangible assets related to our

GeneSight Test.

- For the twelve months ended December 31, 2024, consists of the

impairment of acquired technology intangible assets related to our

GeneSight Test and the impairment of assets held for sale related

to the sale of the EndoPredict business to Eurobio Scientific.

- Equity compensation – non-cash equity-based compensation

provided to Myriad Genetics employees and directors.

- Real estate optimization – costs

related to real estate initiatives. These costs include additional

rent as a result of the build-out of our new laboratories in Salt

Lake City, Utah, and South San Francisco, California, while

maintaining our current laboratories in those locations and testing

and set-up costs for equipment in our new facilities, lease

termination gains, net of lease termination losses, impairment

charges and other abandonment costs.

- Transformation initiatives – costs related to transformation

initiatives including consulting and professional fees.

- Legal charges – one-time legal expenses.

- Other adjustments – other one-time non-recurring expenses

including a gain recognized on acquisition, changes in the fair

value of contingent consideration related to acquisitions from

prior years, the reclassifications of cumulative translation

adjustments to income upon liquidation of an investment in a

foreign entity, severance, and costs incurred in connection with

executive personnel changes.

- Tax adjustments – tax expense (benefit) due to non-GAAP

adjustments, differences between stock compensation recorded for

book purposes as compared to the allowable tax deductions, and

valuation allowance recognized against federal and state deferred

tax assets in the United States.

Investor ContactMatt Scalo(801)

584-3532IR@myriad.com

Media ContactGlenn Farrell(385)

318-3718PR@myriad.com

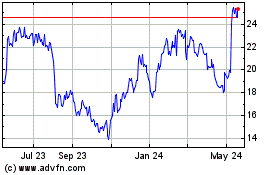

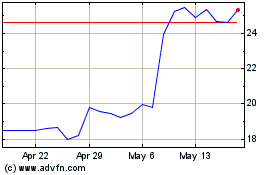

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Feb 2024 to Feb 2025