NuCana plc (NASDAQ: NCNA) announced financial results for the third

quarter ended September 30, 2024 and provided an update on its

clinical development program with its two lead anti-cancer

medicines.

“We announced encouraging data from our ongoing

clinical studies of both NUC-7738 and NUC-3373, underscoring the

potential of our pipeline,” said Hugh S. Griffith, NuCana’s Founder

and Chief Executive Officer. “At the European Society for Medical

Oncology (ESMO) Congress 2024 in September, we presented promising

data on NUC-7738, a novel agent that profoundly impacts gene

expression in cancer cells and targets multiple aspects of the

tumor microenvironment. The data from the Phase 2 part of the

NuTide:701 study in PD-1 inhibitor-resistant melanoma showed that 9

of the 12 patients achieved disease control when treated with

NUC-7738 in combination with pembrolizumab. One of these patients,

who had received two prior lines of PD-1 inhibitor-based therapy

and had progressed on their latest treatment of ipilimumab plus

nivolumab within two months, achieved a 55% reduction in tumor

volume. Given the typically poor outcomes in this patient

population, with a median progression-free survival of just two to

three months under current standard care, we are highly encouraged

by the results showing a median progression-free survival of over

five months for patients receiving NUC-7738 plus

pembrolizumab.”

Mr. Griffith added, “We also announced the

issuance of a new patent by the United States Patent and Trademark

Office covering NUC-7738’s composition of matter. This patent

(US12,054,510) is expected to serve as a key component of the

intellectual property protection for NUC-7738, which currently

consists of over 80 issued patents worldwide.”

Mr. Griffith continued, “We recently announced

initial data from the ongoing Phase 1b/2 NuTide:303 study of

NUC-3373, a targeted thymidylate synthase inhibitor with immune

modulating properties, in a manuscript authored by the study’s lead

investigators. In this study, NUC-3373 is being combined with

pembrolizumab in patients with advanced solid tumors and with

docetaxel in patients with lung cancer. Results from the study

indicate that NUC-3373 may promote an anti-tumor immune response

and potentiate the activity of immune checkpoint inhibitors. We

were particularly encouraged to see significant tumor volume

reductions and prolonged progression free survival, including a

patient with urothelial bladder cancer who achieved 100% reduction

in their target lesions. While we were disappointed with the

previously announced discontinuation of the NuTide:323 study in

patients with metastatic colorectal cancer, we remain optimistic

about the potential of NUC-3373.”

Mr. Griffith concluded, “Our unwavering

commitment to improving treatment outcomes for patients with cancer

drives our relentless pursuit of the development of new anti-cancer

agents. We look forward to progressing these exciting new medicines

and sharing future development plans for NUC-7738 and

NUC-3373.”

2025 Anticipated Milestones

- NUC-7738

- Initiate an expansion of the Phase

1/2 study (NuTide:701) of NUC-7738 in combination with

pembrolizumab in patients with melanoma;

- Announce data from the Phase 1/2

expansion study (NuTide:701) of NUC-7738 in combination with

pembrolizumab; and

- Obtain regulatory guidance from the

U.S. Food and Drug Administration on pivotal study design for

NUC-7738 in melanoma.

- NUC-3373

- Initiate an expansion of the Phase

1b/2 modular study (NuTide:303) of NUC-3373 in combination with

pembrolizumab in patients with solid tumors; and

- Announce data from the Phase 1b/2

modular study (NuTide:303) of NUC-3373 in combination with

pembrolizumab in patients with solid tumors.

Third Quarter 2024 Financial Highlights

and Cash Position

As of September 30, 2024, NuCana had cash and

cash equivalents of £11.4 million compared to £11.6 million as of

June 30, 2024 and £17.2 million at December 31, 2023. The reduction

in cash and cash equivalents during the third quarter was primarily

the result of cash used in operating activities, partially offset

by £4.7 million in net proceeds raised through its at-the-market

(ATM) offering. Subsequent to September 30, 2024, NuCana has raised

an additional £1.8 million in net proceeds through its ATM

offering. NuCana expects that its cash and cash equivalents as of

September 30, 2024, together with amounts raised through its ATM

offering subsequent to that date, will be sufficient to fund its

planned operations into Q2 2025.

NuCana continues to advance its clinical

programs and reported a net loss of £4.5 million for the quarter

ended September 30, 2024, as compared to a net loss of £6.7 million

for the quarter ended September 30, 2023. Basic and diluted loss

per ordinary share was £0.07 for the quarter ended September 30,

2024, as compared to £0.13 per ordinary share for the comparable

quarter ended September 30, 2023.

About NuCana

NuCana is a clinical-stage biopharmaceutical

company focused on significantly improving treatment outcomes for

patients with cancer by applying our ProTide technology to

transform some of the most widely prescribed chemotherapy agents,

nucleoside analogs, into more effective and safer medicines. While

these conventional agents remain part of the standard of care for

the treatment of many solid and hematological tumors, they have

significant shortcomings that limit their efficacy and they are

often poorly tolerated. Utilizing our proprietary technology, we

are developing new medicines, ProTides, designed to overcome the

key limitations of nucleoside analogs and generate much higher

concentrations of anti-cancer metabolites in cancer cells. NuCana’s

pipeline includes NUC-3373 and NUC-7738. NUC-3373 is a new chemical

entity derived from the nucleoside analog 5-fluorouracil, a widely

used chemotherapy agent. NUC-3373 is currently being evaluated in a

Phase 1b/2 modular study (NuTide:303) of NUC-3373 in combination

with the PD-1 inhibitor pembrolizumab for patients with advanced

solid tumors and in combination with docetaxel for patients with

lung cancer. NUC-7738 is a novel anti-cancer agent that disrupts

RNA polyadenylation, profoundly impacts gene expression in cancer

cells and targets multiple aspects of the tumor microenvironment.

NUC-7738 is in the Phase 2 part of a Phase 1/2 study which is

evaluating NUC-7738 as a monotherapy in patients with advanced

solid tumors and in combination with pembrolizumab in patients with

melanoma.

Forward-Looking StatementsThis

press release may contain “forward-looking” statements within the

meaning of the Private Securities Litigation Reform Act of 1995

that are based on the beliefs and assumptions and on information

currently available to management of NuCana plc (the “Company”).

All statements other than statements of historical fact contained

in this press release are forward-looking statements, including

statements concerning the Company’s planned and ongoing clinical

studies for the Company’s product candidates and the potential

advantages of those product candidates, including NUC-3373 and

NUC-7738; the initiation, enrollment, timing, progress, release of

data from and results of those planned and ongoing clinical

studies; the Company’s goals with respect to the development,

regulatory pathway and potential use, if approved, of each of its

product candidates; the utility of prior non-clinical and clinical

data in determining future clinical results; and the sufficiency of

the Company’s current cash and cash equivalents to fund its planned

operations into Q2 2025. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other comparable terminology. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the Company’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. These risks and uncertainties include,

but are not limited to, the risks and uncertainties set forth in

the “Risk Factors” section of the Company’s Annual Report on Form

20-F for the year ended December 31, 2023 filed with the Securities

and Exchange Commission (“SEC”) on March 20, 2024, and subsequent

reports that the Company files with the SEC. Forward-looking

statements represent the Company’s beliefs and assumptions only as

of the date of this press release. Although the Company believes

that the expectations reflected in the forward-looking statements

are reasonable, it cannot guarantee future results, levels of

activity, performance or achievements. Except as required by law,

the Company assumes no obligation to publicly update any

forward-looking statements for any reason after the date of this

press release to conform any of the forward-looking statements to

actual results or to changes in its expectations.

Unaudited Condensed Consolidated

Statements of Operations

| |

|

For the Three Months EndedSeptember

30, |

|

For the Nine Months EndedSeptember

30, |

| |

|

|

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

| |

|

(in thousands, except per share data) |

| |

|

£ |

|

£ |

|

|

£ |

|

£ |

|

| Research and development

expenses |

|

(3,736 |

) |

(7,439 |

) |

|

(17,288 |

) |

(18,203 |

) |

| Administrative expenses |

|

(1,358 |

) |

(1,375 |

) |

|

(4,448 |

) |

(4,777 |

) |

| Net foreign exchange (losses)

gains |

|

(229 |

) |

562 |

|

|

(208 |

) |

(697 |

) |

| Operating

loss |

|

(5,323 |

) |

(8,252 |

) |

|

(21,944 |

) |

(23,677 |

) |

| Finance income |

|

72 |

|

152 |

|

|

283 |

|

617 |

|

| Loss before

tax |

|

(5,251 |

) |

(8,100 |

) |

|

(21,661 |

) |

(23,060 |

) |

| Income tax credit |

|

740 |

|

1,404 |

|

|

3,317 |

|

3,083 |

|

| Loss for the period

attributable to equity holders of the Company |

|

(4,511 |

) |

(6,696 |

) |

|

(18,344 |

) |

(19,977 |

) |

| |

|

|

|

|

|

|

| Basic and diluted loss per

ordinary share |

|

(0.07 |

) |

(0.13 |

) |

|

(0.32 |

) |

(0.38 |

) |

Unaudited Condensed Consolidated

Statements of Financial Position As At

|

|

|

September 30,2024 |

|

December 31, 2023 |

|

|

|

|

(in thousands) |

|

|

|

£ |

|

£ |

|

|

Assets |

|

|

|

|

Non-current assets |

|

|

|

|

Intangible assets |

|

2,230 |

|

|

2,128 |

|

|

Property, plant and equipment |

|

253 |

|

|

521 |

|

| Deferred

tax asset |

|

169 |

|

|

143 |

|

|

|

|

2,652 |

|

|

2,792 |

|

|

Current assets |

|

|

|

|

Prepayments, accrued income and other receivables |

|

1,141 |

|

|

2,671 |

|

| Current

income tax receivable |

|

4,390 |

|

|

5,123 |

|

| Cash and

cash equivalents |

|

11,351 |

|

|

17,225 |

|

|

|

|

16,882 |

|

|

25,019 |

|

| Total

assets |

|

19,534 |

|

|

27,811 |

|

|

|

|

|

|

|

Equity and liabilities |

|

|

|

|

Capital and reserves |

|

|

|

| Share

capital and share premium |

|

149,607 |

|

|

143,420 |

|

| Other

reserves |

|

78,400 |

|

|

79,173 |

|

|

Accumulated deficit |

|

(223,659 |

) |

|

(207,706 |

) |

| Total equity

attributable to equity holders of the Company |

|

4,348 |

|

|

14,887 |

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

Provisions |

|

28 |

|

|

58 |

|

| Lease

liabilities |

|

136 |

|

|

190 |

|

|

|

|

164 |

|

|

248 |

|

|

Current liabilities |

|

|

|

| Trade

payables |

|

6,043 |

|

|

3,375 |

|

| Payroll

taxes and social security |

|

157 |

|

|

155 |

|

| Accrued

expenditure |

|

8,707 |

|

|

8,940 |

|

| Lease

liabilities |

|

85 |

|

|

206 |

|

|

Provisions |

|

30 |

|

|

- |

|

|

|

|

15,022 |

|

|

12,676 |

|

| Total

liabilities |

|

15,186 |

|

|

12,924 |

|

| Total equity and

liabilities |

|

19,534 |

|

|

27,811 |

|

| |

|

|

|

Unaudited Condensed Consolidated

Statements of Cash Flows

|

|

For the Nine Months EndedSeptember

30, |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

£ |

|

£ |

|

| Cash flows from

operating activities |

|

|

| Loss for the period |

(18,344 |

) |

|

(19,977 |

) |

| Adjustments for: |

|

|

| Income tax credit |

(3,317 |

) |

|

(3,083 |

) |

| Amortization and

depreciation |

407 |

|

|

434 |

|

| Movement in provisions |

- |

|

|

(4,109 |

) |

| Finance income |

(283 |

) |

|

(617 |

) |

| Interest expense on lease

liabilities |

14 |

|

|

23 |

|

| Share-based payments |

1,667 |

|

|

3,073 |

|

| Net foreign exchange

losses |

244 |

|

|

661 |

|

|

|

(19,612 |

) |

|

(23,595 |

) |

| Movements in working

capital: |

|

|

| Decrease in prepayments,

accrued income and other receivables |

1,500 |

|

|

531 |

|

| Increase in trade

payables |

2,668 |

|

|

371 |

|

| Decrease in payroll taxes,

social security and accrued expenditure |

(234 |

) |

|

(3,667 |

) |

| Movements in working

capital |

3,934 |

|

|

(2,765 |

) |

| Cash used in

operations |

(15,678 |

) |

|

(26,360 |

) |

| Net income tax received

(paid) |

4,015 |

|

|

(2 |

) |

| Net cash used in

operating activities |

(11,663 |

) |

|

(26,362 |

) |

| Cash flows from

investing activities |

|

|

| Interest received |

299 |

|

|

620 |

|

| Payments for property, plant

and equipment |

(3 |

) |

|

(4 |

) |

| Payments for intangible

assets |

(239 |

) |

|

(377 |

) |

| Repayment of other current

assets |

- |

|

|

2,596 |

|

| Net cash from

investing activities |

57 |

|

|

2,835 |

|

| Cash flows from

financing activities |

|

|

| Payments for lease

liabilities |

(188 |

) |

|

(207 |

) |

| Proceeds from issue of share

capital – exercise of share options |

7 |

|

|

3 |

|

| Proceeds from issue of share

capital |

6,371 |

|

|

224 |

|

| Share issue expense |

(191 |

) |

|

(30 |

) |

| Net cash from (used

in) financing activities |

5,999 |

|

|

(10 |

) |

| Net decrease in cash and cash

equivalents |

(5,607 |

) |

|

(23,537 |

) |

| Cash and cash

equivalents at beginning of period |

17,225 |

|

|

41,912 |

|

| Effect of exchange rate

changes on cash and cash equivalents |

(267 |

) |

|

(572 |

) |

| Cash and cash

equivalents at end of period |

11,351 |

|

|

17,803 |

|

| |

|

|

For more information, please contact:

NuCana plcHugh S. GriffithChief Executive Officer +44

131-357-1111 info@nucana.com

ICR WestwickeChris Brinzey+1

339-970-2843chris.brinzey@westwicke.com

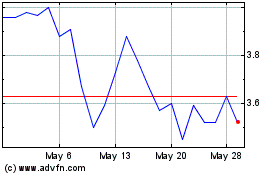

NuCana (NASDAQ:NCNA)

Historical Stock Chart

From Nov 2024 to Dec 2024

NuCana (NASDAQ:NCNA)

Historical Stock Chart

From Dec 2023 to Dec 2024