NGM Bio Provides Recent Business Highlights and Reports Fourth Quarter and Full Year 2023 Financial Results

March 11 2024 - 3:05PM

NGM Biopharmaceuticals, Inc. (NGM Bio) (Nasdaq: NGM), a

biotechnology company focused on discovering and developing

transformative therapeutics for patients, today provided recent

business highlights and reported financial results for the fourth

quarter and full year ended December 31, 2023.

“In 2023, we made significant progress in patient enrollment in

trials of our solid tumor drug candidates. Most notably, we are

encouraged by the signals of activity observed in our NGM707 Phase

1b trial, particularly among MSS CRC patients whose lesions are

typically unresponsive to immuno-checkpoint therapies. We also made

progress in our discussions with the FDA regarding the design of a

potential registrational Phase 2 study of aldafermin in PSC using a

primary endpoint composed of surrogate biomarkers of PSC

progression and obtained orphan drug designation from the agency

for aldafermin for the treatment of PSC,” said David J. Woodhouse,

Ph.D., Chief Executive Officer at NGM Bio. “In 2024, we are focused

on completing patient enrollment for NGM707 with a potential

interim Phase 1b trial readout in the middle of the year,

initiating a potential Phase 2 proof-of-concept trial of NGM120 in

HG by the end of 2024, and, provided we have the financial

resources and agreement on trial design, initiating a

registrational Phase 2 trial of aldafermin in PSC patients. Our

priority remains to seek licensing and other business development

partners across all our wholly-owned product candidates and to

allocate our resources to the programs that we believe have the

greatest potential both in the near- and long-term.”

Key Fourth Quarter and Recent Highlights

Solid Tumor Oncology

- Disclosed in January 2024 encouraging findings in a Phase 1

Part 1b cohort of the ongoing Phase 1/2 trial evaluating NGM707 in

combination with pembrolizumab for the treatment of patients with

advanced or metastatic solid tumors, including MSS CRC patients. 46

patients were enrolled as of the November 6, 2023 data-cutoff and,

of the 37 response-evaluable patients (those completing at least

one on-treatment scan), there were four confirmed partial responses

across multiple indications, including one pathological complete

response, and 12 patients with stable disease (11% overall response

rate and 43% disease control rate). The combination of NGM707 and

pembrolizumab was generally well-tolerated at all four doses (200,

600, 1200, 1800 mg) of NGM707. The maximum tolerated dose was not

reached. NGM Bio expects to complete enrollment in the Phase 1 Part

1b cohort in the second quarter of 2024 and anticipates providing

an update in mid-2024 on the fully enrolled cohort and subsequent

next steps, including, provided sufficient financial resources, the

potential for additional cohorts, which NGM Bio expects will

include MSS CRC patients.

- Completed enrollment

in the Phase 1 Part 1b cohorts of the Phase 1/1b trials evaluating

NGM831, an ILT3 antagonist antibody product candidate, and NGM438,

a LAIR1 antagonist antibody product candidate, in combination with

pembrolizumab in patients with advanced solid tumors. NGM831 and

NGM438, alone and in combination with pembrolizumab, have been

generally well-tolerated and there have been no dose limiting

toxicities noted to date.

- Initiated an ongoing

Phase 1, Part 1c dose finding cohort evaluating the triplet

combination of NGM831, NGM438 and pembrolizumab. This cohort is

anticipated to complete enrollment in the first half of 2024.

Hyperemesis Gravidarum

- Announced in January

2024 potential development of NGM120 for the treatment of HG.

NGM120, a GFRAL antagonist antibody, is designed to block GDF15

signaling, the central cause of HG and, thereby, may potentially

have therapeutic benefit for treating pregnant women suffering from

HG. HG is a rare, serious condition that affects approximately

100,000 – 150,000 women in the United States each year during

pregnancy and is characterized by intractable nausea and vomiting,

which then results in dehydration, weight loss and malnutrition. HG

has a significant physical and psychosocial impact on patients and

leads to overall higher rates of fetal loss, preeclampsia, preterm

birth, low birth weight and fetal malnutrition. HG is the second

leading cause of hospitalization in pregnancy (second to preterm

labor) and typically recurs in subsequent pregnancies. There are

currently no FDA-approved therapies for this condition. Research1

has shown that GDF15 levels increase steadily in early pregnancy

and, on average, are higher in women who experience nausea and

vomiting in pregnancy and HG. The research also indicated that

women with GDF15 genetic variants associated with lower levels of

GDF15 in a non-pregnant state are predisposed to HG.

- NGM Bio’s goal is to

initiate a Phase 2 proof-of-concept study of NGM120 for the

treatment of HG by the end of 2024. NGM Bio is in the process of

producing a toxicology package to submit to regulatory authorities

in Australia or the United Kingdom that we hope will support

initiation of the trial.

Aldafermin

- Presented positive

Phase 2b results from the ALPINE 4 trial of aldafermin in

compensated cirrhosis (F4) due to NASH at AASLD The Liver Meeting

in November 2023.

- In January 2024,

announced U.S. Food and Drug Administration (FDA) granted orphan

drug designation to aldafermin, an engineered FGF19 analog, for the

treatment of PSC.

- NGM Bio plans to

further develop aldafermin for the treatment of PSC, a rare liver

disease that irreparably damages the bile ducts, leading to bile

acid dysregulation, which, ultimately, results in serious liver

damage. There are currently no FDA-approved therapies for PSC. NGM

Bio is continuing discussions with the FDA regarding the design of

a potential registrational trial of aldafermin in PSC, including on

the proposed utilization of a primary endpoint composed of

surrogate biomarkers with the goal of obtaining accelerated

approval from the FDA. NGM Bio plans to continue working towards

the goal of initiating a potential registrational trial contingent

upon further discussion with the FDA on trial design and obtaining

the additional capital necessary to conduct the study.

Corporate

- On February 26, 2024, NGM Bio announced that it had entered

into the Agreement and Plan of Merger (Merger Agreement) with Atlas

Neon Parent, Inc. (Parent) and Atlas Neon Merger Sub, Inc., a

wholly-owned subsidiary of Parent (Merger Sub). The Merger

Agreement provides for, among other things, (i) the acquisition of

NGM Bio by Parent through a cash tender offer (the Offer) by Merger

Sub for each issued and outstanding share of NGM Bio’s common stock

(other than certain rollover shares) for $1.55 per share (the Offer

Price), and (ii) the merger of Merger Sub with and into NGM Bio

(the Merger), with NGM Bio surviving the Merger as a privately held

company. Subject to the terms of the Merger Agreement, the Offer

Price will be paid subject to any applicable tax withholding and

without interest. Pursuant to the Merger Agreement, on March 8,

2024, Parent commenced the Offer. Additional details can be found

in NGM Bio’s recent filings with the United States Securities and

Exchange Commission (SEC).

- NGM Bio anticipates

that the Offer and the Merger contemplated under the Merger

Agreement will be consummated in the second quarter of 2024.

However, closing of the Merger is subject to customary closing

conditions, and there can be no assurance that the Offer and the

Merger contemplated by the Merger Agreement will be completed. If

the Merger is effected, NGM Bio’s common stock will be delisted

from The Nasdaq Stock Market LLC and NGM Bio will be privately

held.

Fourth Quarter and Full Year 2023

Financial Results

- NGM Bio reported a

net loss of $27.7 million and $142.4 million for the quarter and

year ended December 31, 2023, respectively, compared to a net

loss of $36.4 million and $162.7 million for the same periods in

2022.

- Related party

revenue from the collaboration with Merck Sharp & Dohme LLC, or

Merck, was $0.2 million and $4.4 million for the quarter and year

ended December 31, 2023, respectively, compared to $18.2

million and $55.3 million for the same periods in 2022. The

collaboration with Merck ends on March 31, 2024.

- Research and

development expenses were $21.9 million and $118.0 million for the

quarter and year ended December 31, 2023, respectively,

compared to $46.7 million and $181.1 million for the same periods

in 2022.

- General and

administrative expenses were $7.9 million and $37.8 million for the

quarter and year ended December 31, 2023, respectively,

compared to $9.8 million and $40.5 million for the same periods in

2022.

- Cash, cash

equivalents and short-term marketable securities were $144.2

million as of December 31, 2023.

About NGM Biopharmaceuticals, Inc.

NGM Bio is focused on discovering and developing novel,

life-changing medicines for people whose health and lives have been

disrupted by disease. The company’s biology-centric drug discovery

approach aims to seamlessly integrate interrogation of complex

disease-associated biology and protein engineering expertise to

unlock proprietary insights that are leveraged to generate

promising product candidates and enable their rapid advancement

into proof-of-concept studies. As explorers on the frontier of

life-changing science, NGM Bio aspires to operate one of the most

productive research and development engines in the

biopharmaceutical industry. All therapeutic candidates in the NGM

Bio pipeline have been generated by its in-house discovery engine,

always led by biology and motivated by unmet patient need. Visit us

at www.ngmbio.com for more information.

KEYTRUDA® is a registered trademark of Merck Sharp & Dohme

Corp., a subsidiary of Merck & Co., Inc., Rahway, NJ, USA.

Abbreviations (in Alphabetical Order)

F4=fibrosis stage 4; FGF19=fibroblast growth factor 19;

GDF15=growth differentiation factor 15; GFRAL=glial cell-derived

neurotrophic factor receptor alpha-like; HG=hyperemesis gravidarum;

NASH=nonalcoholic steatohepatitis; ILT2=immunoglobin-like

transcript 2; ILT3=immunoglobin-like transcript 3;

ILT4=immunoglobin-like transcript 4; LAIR1=leukocyte-associated

immunoglobulin-like receptor 1

Forward Looking Statements

Statements contained in this press release regarding matters

that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Words such as “encouraged”, “will,” “could,” “expect,”

“expected,” “promising,” “aspires,” “aims,” “hope” and similar

expressions (as well as other words or expressions referencing

future events, conditions or circumstances) are intended to

identify forward-looking statements. These statements include those

related to: the therapeutic potential of NGM Bio’s product

candidates; NGM Bio’s continued pipeline development, including

identification and engagement of third-party partners for potential

future business development arrangements, or the BD Arrangements,

across all NGM Bio’s wholly-owned product candidates and to

allocate its resources to the programs that it believes have the

greatest potential both in the near- and long-term and; research

and development and discovery engine output; the expected timing of

completion of enrollment of NGM Bio’s ongoing Phase 1 Part 1b

cohort of the Phase1/2 trial of NGM707 in combination with

KEYTRUDA® (pembrolizumab) and timing of anticipated updates on the

completed cohort and subsequent next steps, including the potential

for additional cohorts; timing of the potential start of NGM120 in

a proof-of-concept study for the treatment of HG; the design and

initiation of a potential registrational trial for aldafermin for

the treatment of PSC using surrogate endpoints; timing of

completion of enrollment of NGM Bio’s ongoing Phase 1, Part 1c dose

finding cohort evaluating the triplet combination of NGM831, NGM438

and pembrolizumab; the potential therapeutic benefit of NGM120 for

treating pregnant women suffering from HG; the ability of NGM Bio

and Atlas Neon Parent, Inc., a Delaware corporation (Parent), and

Atlas Neon Merger Sub, Inc., a Delaware corporation and a

wholly-owned subsidiary of Parent (together with Parent, the

Purchaser) to complete the transactions contemplated by the Merger

Agreement, including the parties’ ability to satisfy the conditions

to the consummation of the Offer and the other conditions set forth

in the Merger Agreement, statements about the expected timetable

for completing the transactions, NGM Bio’s and Purchaser’s beliefs

and expectations and statements about the benefits sought to be

achieved by Purchaser’s proposed acquisition of NGM Bio, the

possibility of any termination of the Merger Agreement, estimates

relating to NGM Bio’s past, current or future financial condition;

and other statements that are not historical fact. Because such

statements deal with future events and are based on NGM Bio’s

current expectations, they are subject to various risks and

uncertainties, and actual results, performance or achievements of

NGM Bio could differ materially from those described in or implied

by the statements in this press release. These forward-looking

statements are subject to risks and uncertainties, including,

without limitation, risks and uncertainties associated with the

costly and time-consuming pharmaceutical product development

process and the uncertainty of clinical success; risks related to

failure or delays in successfully initiating, enrolling, reporting

data from or completing clinical studies, as well as the risks that

results obtained in preclinical or clinical trials to date may not

be indicative of results obtained in future trials; the lack of

regulatory clarity regarding acceptable surrogate endpoints for PSC

and related development uncertainty; the vulnerable patient

population experiencing HG and risks associated with clinical

trials on such patient population; uncertainties inherent in the

preclinical development process of NGM120 in HG, including that

NGM120 in HG may never reach clinical development; NGM Bio’s

ability to identify, attract and engage third-party partners for BD

Arrangements for its wholly-owned programs; the time-consuming and

uncertain regulatory approval process; NGM Bio’s reliance on

third-party manufacturers for its product candidates and the risks

inherent in manufacturing and testing pharmaceutical products; the

sufficiency of NGM Bio’s cash resources and expected cash runway,

including the risk that NGM Bio could utilize its available capital

resources sooner than it currently expects and its need for

additional capital; macroeconomic conditions (such as the impacts

of global geopolitical conflict, global economic slowdown,

increased inflation, rising interest rates and recent and potential

future bank failures); the timing of the Offer and the subsequent

Merger; uncertainties as to how many of the unaffiliated

stockholders will tender their shares in the Offer; the risk that

competing offers or acquisition proposals will be made; the

possibility that various conditions to the consummation of the

Offer and the subsequent Merger may not be satisfied or waived; the

occurrence of any event, change or other circumstance that could

give rise to the termination of the Merger Agreement, including in

circumstances which would require NGM Bio to pay a termination fee;

the effects of disruption from the transactions contemplated by the

Merger Agreement; the risk that stockholder litigation in

connection with the Offer or the Merger may result in significant

costs of defense, indemnification and liability; and other risks

and uncertainties affecting NGM Bio and its development programs,

including those discussed in the section titled “Risk Factors” in

NGM Bio’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2023 filed with the SEC on November 2, 2023 and

future filings and reports that NGM Bio makes from time to time

with the SEC. Except as required by law, NGM Bio assumes no

obligation to update these forward-looking statements, or to update

the reasons if actual results differ materially from those

anticipated in the forward-looking statements.

| Investor

Contact:ir@ngmbio.com |

Media

Contact:media@ngmbio.com |

| |

|

1 Fejzo, M., Rocha, N., Cimino, I. et al. GDF15 linked to

maternal risk of nausea and vomiting during pregnancy. Nature

(2023). https://doi.org/10.1038/s41586-023-06921-9

|

NGM BIOPHARMACEUTICALS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In thousands, except

per share amounts)(Unaudited) |

| |

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022* |

|

| Related party revenue |

$ |

165 |

|

|

$ |

18,181 |

|

|

$ |

4,417 |

|

|

$ |

55,333 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

21,890 |

|

|

|

46,722 |

|

|

|

118,040 |

|

|

|

181,067 |

|

|

General and administrative |

|

7,938 |

|

|

|

9,756 |

|

|

|

37,840 |

|

|

|

40,515 |

|

|

Total operating expenses |

|

29,828 |

|

|

|

56,478 |

|

|

|

155,880 |

|

|

|

221,582 |

|

| Loss from operations |

|

(29,663 |

) |

|

|

(38,297 |

) |

|

|

(151,463 |

) |

|

|

(166,249 |

) |

| Interest income, net |

|

2,041 |

|

|

|

2,030 |

|

|

|

9,322 |

|

|

|

3,714 |

|

| Other expense, net |

|

(48 |

) |

|

|

(170 |

) |

|

|

(234 |

) |

|

|

(132 |

) |

| Net loss |

$ |

(27,670 |

) |

|

$ |

(36,437 |

) |

|

$ |

(142,375 |

) |

|

$ |

(162,667 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.33 |

) |

|

$ |

(0.45 |

) |

|

$ |

(1.73 |

) |

|

$ |

(2.03 |

) |

| Weighted average shares used

to compute net loss per share, basic and diluted |

|

82,803 |

|

|

|

81,787 |

|

|

|

82,496 |

|

|

|

79,950 |

|

___________ *

Derived from the audited consolidated financial statements.

|

NGM BIOPHARMACEUTICALS, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(In thousands)(Unaudited) |

| |

| |

December 31,2023 |

|

December 31,2022* |

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

55,816 |

|

|

$ |

73,456 |

|

|

Short-term marketable securities |

|

88,369 |

|

|

|

198,036 |

|

|

Related party receivable from collaboration |

|

58 |

|

|

|

7,580 |

|

|

Prepaid expenses and other current assets |

|

9,202 |

|

|

|

9,787 |

|

|

Restricted cash |

|

2,999 |

|

|

|

— |

|

|

Total current assets |

|

156,444 |

|

|

|

288,859 |

|

| Property and equipment, net |

|

7,033 |

|

|

|

8,496 |

|

| Operating lease right-of-use

asset |

|

— |

|

|

|

2,096 |

|

| Restricted cash |

|

2,455 |

|

|

|

3,954 |

|

| Other non-current assets |

|

2,936 |

|

|

|

3,997 |

|

| Total assets |

$ |

168,868 |

|

|

$ |

307,402 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

2,982 |

|

|

$ |

8,453 |

|

|

Accrued liabilities |

|

17,099 |

|

|

|

33,638 |

|

|

Operating lease liability, current |

|

— |

|

|

|

5,385 |

|

|

Contract liabilities |

|

— |

|

|

|

366 |

|

|

Total current liabilities |

|

20,081 |

|

|

|

47,842 |

|

| Other non-current

liabilities |

|

149 |

|

|

|

— |

|

| Total liabilities |

|

20,230 |

|

|

|

47,842 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

| Preferred stock, $0.001 par

value |

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value |

|

83 |

|

|

|

82 |

|

|

Additional paid-in capital |

|

872,545 |

|

|

|

841,413 |

|

|

Accumulated other comprehensive income (loss) |

|

18 |

|

|

|

(302 |

) |

|

Accumulated deficit |

|

(724,008 |

) |

|

|

(581,633 |

) |

| Total stockholders' equity |

|

148,638 |

|

|

|

259,560 |

|

| Total liabilities and

stockholders' equity |

$ |

168,868 |

|

|

$ |

307,402 |

|

___________ *

Derived from the audited consolidated financial statements.

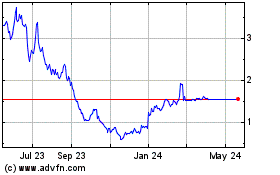

NGM Biopharmaceuticals (NASDAQ:NGM)

Historical Stock Chart

From Feb 2025 to Mar 2025

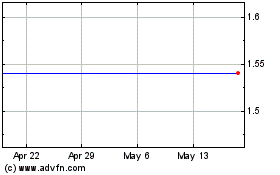

NGM Biopharmaceuticals (NASDAQ:NGM)

Historical Stock Chart

From Mar 2024 to Mar 2025