Nuwellis, Inc. Announces Second Quarter 2024 Financial Results

August 13 2024 - 7:00AM

Nuwellis, Inc. (Nasdaq: NUWE), a medical technology company focused

on transforming the lives of people with fluid overload, today

reported financial results for the second quarter ended June 30,

2024.

Highlights:

- Revenue of $2.2 million, a 6%

increase over the second quarter of 2023.

- Critical Care revenue growth of 28%

compared to the prior year quarter; Heart Failure consumables

utilization growth of 35% over the prior-year quarter.

- Gross margin of 67.2%, compared to

55.3% in the prior-year quarter.

- Total operating cost reduction of

38% compared to the prior-year quarter.

- Expanded Aquadex® to pediatric

patients at one of the largest hospital networks in Florida.

- Announced purchase agreement with a

50-hospital network in Texas for Aquadex Ultrafiltration

Therapy.

“Our second quarter 2024 results continue to

demonstrate market traction for our Aquadex ultrafiltration

therapy, with revenue growth driven by steady increases in

consumables utilization, particularly in Critical Care and Heart

Failure, supported by our growing body of clinical evidence that

highlights the benefits of Aquadex for patients experiencing fluid

overload who have not responded to traditional diuretic treatments.

Of note, our higher margin consumables business continues to fuel

manufacturing efficiencies, resulting in strong gross margin gains

compared to the year ago period,” said Nestor Jaramillo, President

and CEO of Nuwellis. “Bolstering our positive momentum in 2024, we

are also excited to now expand our Pediatric product offerings with

QUELIMMUNE™, providing our growing Pediatric network with a new

therapy for acute kidney injury (AKI) and sepsis. This novel

therapy comes to Nuwellis from our exclusive license and

distribution agreement with SeaStar Medical Holding

Corporation.”

Second Quarter 2024 Financial

Results

Revenue for the second quarter of 2024 was $2.2

million, a 6% increase compared to the prior-year quarter. The

year-over-year increase is attributable to a 30% increase in heart

failure and critical care consumables utilization. Pediatrics had a

25% decline in utilization due to patient census.

Gross margin was 67.2% for the second quarter of

2024, compared to 55.3% in the prior-year quarter. The increase was

primarily due to higher manufacturing volumes of consumables in the

current year period and lower fixed overhead manufacturing

expenses.

Selling, general and administrative expenses

(SG&A) for the second quarter of 2024 decreased to $3.2

million, compared to $4.7 million in the prior-year quarter. The

decrease in SG&A expense was primarily realized through

efficiency initiatives enacted in the second half of

2023.

Second quarter research and development

(R&D) expenses were $558 thousand, compared to $1.5 million in

the prior-year quarter. The decrease in R&D expense was

primarily due to reduced consulting fees and compensation-related

expenses.

Total operating expenses for the second quarter

of 2024 were $3.8 million, a 38% decrease compared to $6.2 million

in the prior-year quarter as we continue to realize savings from

operating efficiency initiatives enacted in the second half of

2023.

Operating loss for the second quarter of 2024

decreased to $2.3 million compared to an operating loss of $5.0

million in the prior-year quarter.

Net loss attributable to common shareholders for

the second quarter of 2024 was $7.7 million, or a loss of $18.85

per basic and diluted common share, compared to a net loss

attributable to common shareholders of $4.8 million, or a loss of

$127.65 per basic and diluted common share in the prior-year

quarter.

As of June 30, 2024, the Company had no debt,

cash and cash equivalents of approximately $1.0 million, and

approximately 516 thousand common shares outstanding. On July 25,

Nuwellis closed a registered direct offering and concurrent private

placement with gross proceeds of $2.0 million before deducting

placement agent fees and other offering expenses.

Webcast and Conference Call

Information

The Company will host a conference call and

webcast at 9:00 AM ET today to discuss its financial results and

provide an update on the Company’s performance.

To access the live webcast, please visit the

Investors page of the Nuwellis website at https://ir.nuwellis.com.

Alternatively, you may access the live conference call by dialing

1-800-267-6316 (U.S) or 1-203-518-9783 (international) and using

the conference ID: NUWEQ2. An audio archive of the webcast will be

available following the call on the Investors page at

https://ir.nuwellis.com.

About Nuwellis

Nuwellis, Inc. (Nasdaq: NUWE) is a medical

technology company dedicated to transforming the lives of patients

suffering from fluid overload through science, collaboration, and

innovation. The company is focused on commercializing the Aquadex

SmartFlow® system for ultrafiltration therapy. Nuwellis is

headquartered in Minneapolis, with a wholly owned subsidiary in

Ireland. For more information visit ir.nuwellis.com or visit us on

LinkedIn or X.

About the Aquadex SmartFlow®

System The Aquadex SmartFlow system

delivers clinically proven therapy using a simple, flexible and

smart method of removing excess fluid from patients suffering from

hypervolemia (fluid overload). The Aquadex SmartFlow system is

indicated for temporary (up to 8 hours) or extended (longer than 8

hours in patients who require hospitalization) use in adult and

pediatric patients weighing 20 kg or more whose fluid overload is

unresponsive to medical management, including diuretics. All

treatments must be administered by a health care provider, within

an outpatient or inpatient clinical setting, under physician

prescription, both having received training in extracorporeal

therapies.

Forward-Looking

StatementsCertain statements in this release may be

considered forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including without

limitation, statements regarding the new market opportunities and

anticipated growth in 2024 and beyond. Forward-looking statements

are predictions, projections and other statements about future

events that are based on current expectations and assumptions and,

as a result, are subject to risks and uncertainties. Many factors

could cause actual future events to differ materially from the

forward-looking statements in this release, including, without

limitation, those risks associated with our ability to execute on

our commercialization strategy, the possibility that we may be

unable to raise sufficient funds necessary for our anticipated

operations, our post-market clinical data collection activities,

benefits of our products to patients, our expectations with respect

to product development and commercialization efforts, our ability

to increase market and physician acceptance of our products,

potentially competitive product offerings, intellectual property

protection, our ability to integrate acquired businesses, our

expectations regarding anticipated synergies with and benefits from

acquired businesses, and other risks and uncertainties described in

our filings with the SEC. Forward-looking statements speak only as

of the date when made. Nuwellis does not assume any obligation to

publicly update or revise any forward-looking statements, whether

due to new information, future events or otherwise.

CONTACTS

INVESTORS: Vivian CervantesGilmartin Group

ir@nuwellis.com

| |

|

NUWELLIS, INC. AND SUBSIDIARYCondensed

Consolidated Balance Sheets(in thousands, except share and

per share amounts) |

| |

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

1,023 |

|

$ |

3,800 |

|

|

|

Accounts receivable |

|

1,292 |

|

|

1,951 |

|

|

|

Inventories, net |

|

1,967 |

|

|

1,997 |

|

|

|

Other current assets |

|

544 |

|

|

461 |

|

|

| Total

current assets |

|

4,826 |

|

|

8,209 |

|

|

|

Property, plant and equipment, net |

|

630 |

|

|

728 |

|

|

|

Operating lease right-of-use asset |

|

613 |

|

|

713 |

|

|

|

Other assets |

|

120 |

|

|

120 |

|

|

| TOTAL

ASSETS |

$ |

6,189 |

|

$ |

9,770 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’

EQUITY (DEFICIT) |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

3,028 |

|

$ |

2,380 |

|

|

|

Accrued compensation |

|

706 |

|

|

525 |

|

|

|

Current portion of operating lease liability |

|

226 |

|

|

216 |

|

|

|

Other current liabilities |

|

56 |

|

|

51 |

|

|

| Total

current liabilities |

|

4,016 |

|

|

3,172 |

|

|

|

Common stock warrant liability |

|

8,579 |

|

|

2,843 |

|

|

|

Operating lease liability |

|

428 |

|

|

544 |

|

|

|

Total liabilities |

|

13,023 |

|

|

6,559 |

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Mezzanine

Equity |

|

|

|

|

|

|

|

| Series J

Convertible Preferred Stock as of June 30, 2024 and December 31,

2023, par value $0.0001 per share; authorized 600,000 shares,

issued and outstanding 88 and 11,950, respectively |

|

2 |

|

|

221 |

|

|

| |

|

|

|

|

|

|

|

|

Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

| Series A junior

participating preferred stock as of June 30, 2024 and December 31,

2023, par value $0.0001 per share; authorized 30,000 shares, none

outstanding |

|

— |

|

|

— |

|

|

| Series F

convertible preferred stock as of June 30, 2024 and December 31,

2023, par value $0.0001 per share; authorized 18,000 shares, issued

and outstanding 127 shares |

|

— |

|

|

— |

|

|

| Preferred stock as

of June 30, 2024 and December 31, 2023, par value $0.0001 per

share; authorized 39,352,000 shares, none outstanding |

|

— |

|

|

— |

|

|

| Common stock as of

June 30, 2024 and December 31, 2023, par value $0.0001 per share;

authorized 100,000,000 shares, issued and outstanding 515,744 and

162,356, respectively |

|

— |

|

|

— |

|

|

| Additional paid‑in

capital |

|

292,887 |

|

|

290,647 |

|

|

| Accumulated other

comprehensive income: |

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

(42 |

) |

|

(31 |

) |

|

| Accumulated

deficit |

|

(299,681 |

) |

|

(287,626 |

) |

|

| Total

stockholders’ equity (deficit) |

|

(6,836 |

) |

|

2,990 |

|

|

| TOTAL

LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY

(DEFICIT) |

$ |

6,189 |

|

$ |

9,770 |

|

|

|

|

|

|

|

|

|

|

NUWELLIS, INC. AND SUBSIDIARYCondensed

Consolidated Statements of Operations and Comprehensive

Loss(Unaudited)(in thousands, except per

share amounts and weighted average shares outstanding) |

|

|

|

|

| |

|

|

Three months ended June 30 |

Six months endedJune 30 |

| |

|

|

2024 |

|

2023 |

|

|

2024 |

2023 |

|

|

Net sales |

|

$ |

2,194 |

|

$ |

2,075 |

|

$ |

4,051 |

|

$ |

3,901 |

|

|

|

Cost of goods sold |

|

|

720 |

|

|

928 |

|

|

1,386 |

|

|

1,687 |

|

|

|

Gross profit |

|

|

1,474 |

|

|

1,147 |

|

|

2,665 |

|

|

2,214 |

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

3,236 |

|

|

4,664 |

|

|

7,842 |

|

|

10,154 |

|

|

|

Research and development |

|

|

558 |

|

|

1,505 |

|

|

1,892 |

|

|

2,933 |

|

|

|

Total operating expenses |

|

|

3,794 |

|

|

6,169 |

|

|

9,734 |

|

|

13,087 |

|

|

|

Loss from operations |

|

|

(2,320 |

) |

|

(5,022 |

) |

|

(7,069 |

) |

|

(10,873 |

) |

|

| Other income

(expense), net |

|

|

6 |

|

|

179 |

|

|

(95 |

) |

|

302 |

|

|

| Financing

Expense |

|

|

(5,607 |

) |

|

— |

|

|

(5,607 |

|

|

— |

|

|

| Change in

fair value of warrant liability |

|

|

198 |

|

|

— |

|

|

720 |

|

|

(755 |

) |

|

|

Loss before income taxes |

|

|

(7,723 |

) |

|

(4,843 |

) |

|

(12,051 |

) |

|

(11,326 |

) |

|

|

Income tax expense |

|

|

(2 |

) |

|

(2 |

) |

|

(4 |

) |

|

(4 |

) |

|

|

Net loss |

|

$ |

(7,725 |

) |

$ |

(4,845 |

) |

$ |

(12,055 |

) |

$ |

(11,330 |

) |

|

| Deemed dividend

attributable to Series J Convertible Preferred Stock |

|

|

— |

|

|

— |

|

|

541 |

|

|

— |

|

|

|

Net loss attributable to common shareholders |

|

$ |

(7,725 |

) |

$ |

(4,845 |

) |

$ |

(11,514 |

) |

$ |

(11,330 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted loss per share |

|

$ |

(18.85 |

) |

$ |

(127.65 |

) |

$ |

(40.91 |

) |

$ |

(323.15 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding – basic and diluted |

|

|

409,690 |

|

|

37,949 |

|

|

294,649 |

|

|

35,060 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

$ |

(2 |

) |

$ |

1 |

|

$ |

(11 |

) |

$ |

(6 |

) |

|

| Total

comprehensive loss |

|

$ |

(7,727 |

) |

$ |

(4,844 |

) |

$ |

(12,066 |

) |

$ |

(11,336 |

) |

|

| |

| |

|

NUWELLIS, INC. AND SUBSIDIARYCondensed

Consolidated Statements of Cash

Flows(Unaudited)(in thousands) |

| |

|

|

|

Six months endedJune 30 |

|

|

|

|

2024 |

|

|

2023 |

|

|

Operating Activities: |

|

|

|

|

|

Net loss |

$ |

(12,055 |

) |

$ |

(11,330 |

) |

|

| Adjustments to reconcile net

loss to cash flows used in operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

151 |

|

|

169 |

|

|

|

Stock-based compensation expense |

|

273 |

|

|

378 |

|

|

|

Change in fair value of warrant liability |

|

(720 |

) |

|

755 |

|

|

|

Warrant financing costs |

|

5,607 |

|

|

— |

|

|

|

Net realized gain on marketable securities |

|

— |

|

|

(65 |

) |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

659 |

|

|

230 |

|

|

|

Inventory, net |

|

30 |

|

|

(72 |

) |

|

|

Other current assets |

|

(395 |

) |

|

(547 |

) |

|

|

Other assets and liabilities |

|

5 |

|

|

(20 |

) |

|

|

Accounts payable and accrued expenses |

|

829 |

|

|

(856 |

) |

|

| Net cash used in

operating activities |

|

(5,616 |

) |

|

(11,358 |

) |

|

| |

|

|

|

|

|

|

|

| Investing

Activities: |

|

|

|

|

|

|

|

|

Proceeds from sale of marketable securities |

|

— |

|

|

578 |

|

|

|

Additions to intangible assets |

|

— |

|

|

(99 |

) |

|

|

Purchases of property and equipment |

|

(53 |

) |

|

(64 |

) |

|

| Net cash provided by

(used in) investing activities |

|

(53 |

) |

|

415 |

|

|

| |

|

|

|

|

|

|

|

| Financing

Activities: |

|

|

|

|

|

|

|

|

Issuance of common stock from offering |

|

2,403 |

|

|

— |

|

|

|

Proceeds from the exercise of Series J

Convertible Preferred Warrants |

|

500 |

|

|

— |

|

|

|

Proceeds from ATM stock offerings, net |

|

— |

|

|

2,108 |

|

|

| Net cash provided by

financing activities |

|

2,903 |

|

|

2,108 |

|

|

| |

|

|

|

|

|

|

|

| Effect of exchange rate

changes on cash |

|

(11 |

) |

|

(6 |

) |

|

| Net decrease in cash and cash

equivalents |

|

(2,777 |

) |

|

(8,841 |

) |

|

| Cash and cash equivalents -

beginning of period |

|

3,800 |

|

|

17,737 |

|

|

| Cash and cash

equivalents - end of period |

$ |

1,023 |

|

$ |

8,896 |

|

|

|

|

|

|

|

|

|

|

|

| |

Supplemental cash flow information

| |

Issuance of Series J Preferred Stock for exercise of Warrants |

$ |

1,857 |

|

$ |

— |

|

|

| |

Issuance of Common Stock for

conversion of Series J Preferred Stock |

$ |

1,535 |

|

$ |

— |

|

|

| |

Deemed dividend on Series J

Preferred Stock |

$ |

(541 |

) |

$ |

— |

|

|

| |

Common stock offering costs

included in prepaids |

$ |

306 |

|

$ |

— |

|

|

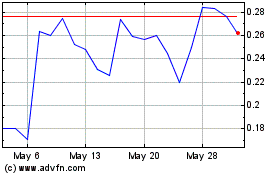

Newellis (NASDAQ:NUWE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Newellis (NASDAQ:NUWE)

Historical Stock Chart

From Feb 2024 to Feb 2025