false000185213100018521312025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 28, 2025

Nextracker Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-41617 | | 36-5047383 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

6200 Paseo Padre Parkway, Fremont, California 94555

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (510) 270-2500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Class A Common Stock, par value $0.0001 | | NXT | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02

Results of Operations and Financial Condition.

On January 28, 2025, Nextracker Inc. (the “Company”) issued a press release announcing its results for the third fiscal quarter ended December 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information in this current report on Form 8-K and the exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Nextracker Inc. |

| |

| By: | /s/ Bruce Ledesma |

| Bruce Ledesma |

| Chief Legal & Compliance Officer |

Date: January 28, 2025

Exhibit 99.1

Nextracker Reports Q3 FY25 Financial Results

Reaffirms FY25 Revenue Outlook and Raises FY25 Profit Outlook

FREMONT, Calif. January 28, 2025 – Nextracker (Nasdaq: NXT), a global market leader of intelligent solar trackers, foundations, and software solutions, today announced financial results for the third quarter of fiscal year 2025, ended December 31, 2024.

Financial Summary

(In millions, except per share)

| | | | | | | | | | | |

| Q3 FY25* | Q2 FY25* | Q3 FY24 |

| Revenue | $679 | $636 | $710 |

| GAAP Gross Profit | $241 | $225 | $210 |

| GAAP Gross Margin | 35.5 | % | 35.4 | % | 29.5 | % |

| GAAP Net Income | $117 | $117 | $128 |

| GAAP Net Income Margin | 17.3 | % | 18.5 | % | 18.0 | % |

| GAAP Diluted EPS | $0.79 | $0.79 | $0.87 |

| | | |

| Adjusted Gross Profit | $245 | $228 | $212 |

| Adjusted Gross Margin | 36.0 | % | 35.9 | % | 29.9 | % |

| Adjusted EBITDA | $186 | $173 | $168 |

| Adjusted EBITDA Margin | 27.4 | % | 27.2 | % | 23.6 | % |

| Adjusted Net Income | $154 | $145 | $142 |

| Adjusted Diluted EPS | $1.03 | $0.97 | $0.96 |

*Q3 FY25 and Q2 FY25 GAAP and adjusted results include approximately $52 million and $51 million, respectively, of IRA 45X advanced manufacturing tax credit vendor rebates (“45X credits”). Q3 FY24 results do not include 45X credits.

Please refer to Nextracker’s most recent Quarterly Report on Form 10-Q and Annual Report on Form 10-K for more information on 45X credits and schedules III, IV and V attached to this press release for a reconciliation of non-GAAP to GAAP financial measures. Additional information can be found on the Investor Relations section of our website.

Business Highlights

•Record backlog increased to significantly greater than $4.5 billion, supported by robust demand in all key regions for the company with meaningful contributions from new products

•Expanded manufacturing and supply chain network to over 70 manufacturing partners operating more than 90 facilities across 19 countries, totaling over 50 GW/year of capacity, enabling local content with superior on-time delivery and customer satisfaction

•Shipped the first 100% U.S. domestic content solar trackers*

•Deployed newly launched products and features at scale, including:

◦NX Horizon Hail Pro™: Industry-leading 75-degree stow capability to mitigate against hail risk

◦NX Horizon Hail Pro™: Automated stowing software for proactive storm response

◦NX Horizon-XTR™: Feature doubles XTR's ability to conform to sloping terrain

◦NX-Anchor™: Advanced foundations solutions solving challenging geotechnical conditions

•Launched significant expansion of R&D and innovation capability:

◦Expanded U.S. R&D facility and Customer Center of Excellence

◦Partnered with UC Berkeley and launched CAL-NEXT Center for Solar Energy Research, a $6.5 million commitment to advance solar technology

◦Inaugurated the India R&D Center for Solar Excellence in Hyderabad

◦Expanded Center for Solar Excellence in Brazil

*Per U.S. Treasury Guidance

“We’re very pleased with the company’s execution, delivering record revenue and profit year-to-date driven by strong demand,” said Dan Shugar, founder and CEO of Nextracker. “In the quarter, we successfully deployed several of our newly launched products and features at scale, expanding our total addressable market. In addition, we continue to increase our investment in R&D to drive rapid customer centric innovation ensuring our solutions remain at the forefront of solar technology while driving value for stakeholders worldwide.”

“Our strong year-to-date financial performance, coupled with our growth in backlog enables us to raise our FY25 profit outlook,” said Chuck Boynton, CFO of Nextracker. “The company is on incredibly solid financial footing with $418 million of operating cash flow year-to-date, ending the quarter with over $693 million in cash and equivalents.”

FY2025 Annual Outlook

Reaffirms FY25 revenue outlook and raises FY25 profit outlook

| | | | | | | | |

| Updated Outlook | Previous Outlook |

| Revenue | $2.8 to $2.9 billion | $2.8 to $2.9 billion |

| GAAP Net Income | $467 to $497 million | $378 to $408 million |

| GAAP Diluted EPS | $3.11 to $3.31 | $2.50 to $2.70 |

| Adjusted EBITDA | $700 to $740 million | $625 to $665 million |

| Adjusted Diluted EPS | $3.75 to $3.95 | $3.10 to $3.30 |

Adjusted EBITDA and adjusted diluted EPS exclude approximately $120 million and $0.64, respectively, for stock-based compensation, acquisition related costs and net intangible amortization.

Q3 FY2025 Earnings Call

January 28, 2025

2:00 p.m. PT / 5:00 p.m. ET

Live webcast available on investors.nextracker.com

We encourage you to review our Q3 FY25 Shareholder Letter, which, along with this press release, is available on the Nextracker Investor Relations website and includes important information for Nextracker shareholders that supplements and expands on the information in this press release.

The webcast replay will be available on the Nextracker Investor Relations website following the conclusion of the event.

Upcoming Events

On March 4, Chuck Boynton, Nextracker Chief Financial Officer, will participate in a fireside chat at the Jefferies Power, Utilities and Clean Energy Conference.

About Nextracker

Nextracker is a leading provider of integrated solar trackers, foundations, and software solutions used in ground-mounted utility-scale and distributed generation solar projects around the world. Our product portfolio enables solar PV power plants to follow the sun’s movement across the sky and optimize plant performance. With power plants operating in more than forty countries worldwide, Nextracker offers solar tracker technologies that increase energy production while reducing costs for significant plant ROI. For more information, please visit www.nextracker.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the trends for future solar adoption, the expected benefits of the Ojjo, Inc. and Solar Pile International acquisitions, the expected benefits of our new product launches, such as Hail Pro-75, Hail Pro Automated Stowing, XTR 1.5 and NX-Anchor, our domestic content capabilities, the expected benefits from the expansion of our R&D facilities, initiatives and capabilities, and Nextracker’s outlook for fiscal 2025 and other periods. These forward-looking statements are based on various assumptions and on the current expectations of Nextracker’s management. These statements involve risks and uncertainties that could cause the actual results to differ materially from those anticipated by these forward-looking statements, including risks and uncertainties that are described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Nextracker’s most recent Quarterly Report on Form 10-Q, Annual Report on Form 10-K and other documents that Nextracker has filed or will file with the Securities and Exchange Commission. There may be additional risks that Nextracker is not aware of or that Nextracker currently believes are immaterial that could also cause actual results to differ from the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. Nextracker assumes no obligation to update these forward-looking statements.

Use of Adjusted Financial Information

An explanation and reconciliation of non-GAAP financial measures to GAAP financial measures is presented in Schedules III, IV and V attached to this press release, and can be found, along with other financial information including the Earnings Presentation, on the investor relations section of our website at investors.nextracker.com.

Channels for Disclosure of Information

Nextracker intends to announce material information to the public through the Nextracker Investor Relations website investors.nextracker.com, SEC filings, press releases, public conference calls, and public webcasts. Nextracker uses these channels to communicate with its investors, customers, and the public about the company, its offerings, and other issues. As such, Nextracker encourages investors, the media, and others to follow the channels listed above and to review the information disclosed through such channels.

Investor Contact:

Sarah Lee

Investor@nextracker.com

Media Contact:

Brandy Lee

Media@nextracker.com

Schedule I

Nextracker Inc.

Unaudited condensed consolidated statements of operations and comprehensive income

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | |

| Three-month periods ended | | |

| December 31, 2024 | | September 27, 2024 | | December 31, 2023 | | | | |

| Revenue | $ | 679,363 | | $ | 635,571 | | $ | 710,426 | | | | |

| Cost of sales | 438,460 | | 410,776 | | 500,701 | | | | |

| Gross profit | 240,903 | | 224,795 | | 209,725 | | | | |

| Selling, general and administrative expenses | 70,573 | | 72,127 | | 48,356 | | | | |

| Research and development | 20,094 | | 19,193 | | 12,897 | | | | |

| Operating income | 150,236 | | 133,475 | | 148,472 | | | | |

| Interest expense | 3,798 | | 3,665 | | 3,227 | | | | |

| Other income, net | (13,778) | | (7,382) | | (21,534) | | | | | |

| Income before income taxes | 160,216 | | 137,192 | | 166,779 | | | | |

| Provision for income taxes | 42,842 | | 19,928 | | 38,818 | | | | |

| Net income and comprehensive income | 117,374 | | 117,264 | | 127,961 | | | | |

| | | | | | | | | |

| Less: Net income attributable to non-controlling interests and redeemable non-controlling interests | 2,091 | | 1,873 | | 86,565 | | | | |

| Net income attributable to Nextracker Inc. | $ | 115,283 | | $ | 115,391 | | $ | 41,396 | | | | |

| | | | | | | | | |

| Earnings per share attributable to Nextracker Inc. common stockholders | | | | | | | | | |

| Basic | $ | 0.80 | | $ | 0.80 | | $ | 0.67 | | | | |

| Diluted | $ | 0.79 | | $ | 0.79 | | $ | 0.87 | | | | |

| Weighted-average shares used in computing per share amounts: | | | | | | | | | |

| Basic | 143,664 | | | 143,479 | | | 62,109 | | | | | |

| Diluted | 149,028 | | | 149,079 | | | 147,344 | | | | | |

Nextracker Inc.

Unaudited condensed consolidated statements of operations and comprehensive income (continued)

(In thousands, except per share data)

| | | | | | | | | | | | | |

| Nine-month periods ended |

| December 31, 2024 | | | | December 31, 2023 |

| Revenue | $ | 2,034,855 | | | | $ | 1,763,326 |

| Cost of sales | 1,331,717 | | | | 1,290,747 |

| Gross profit | 703,138 | | | | 472,579 |

| Selling, general and administrative expenses | 203,527 | | | | 126,865 |

| Research and development | 55,806 | | | | 29,270 |

| Operating income | 443,805 | | | | 316,444 |

| Interest expense | 10,743 | | | | 9,975 |

| Other income, net | (16,292) | | | | | (18,464) | |

| Income before income taxes | 449,354 | | | | 324,933 |

| Provision for income taxes | 89,922 | | | | 51,918 |

| Net income and comprehensive income | 359,432 | | | | 273,015 |

| | | | | |

| Less: Net income attributable to non-controlling interests and redeemable non-controlling interests | 7,058 | | | | 171,937 |

| Net income attributable to Nextracker Inc. | $ | 352,374 | | | | $ | 101,078 |

| | | | | |

| Earnings per share attributable to Nextracker Inc. common stockholders | | | | | |

| Basic | $ | 2.46 | | | | $ | 1.78 |

| Diluted | $ | 2.41 | | | | $ | 1.86 |

| Weighted-average shares used in computing per share amounts: | | | | | |

| Basic | 143,102 | | | | | 56,789 | |

| Diluted | 149,134 | | | | | 147,160 | |

Schedule II

Nextracker Inc.

Unaudited condensed consolidated balance sheets

(In thousands)

| | | | | | | | | | | |

| As of December 31, 2024 | | As of March 31, 2024 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 693,543 | | $ | 474,054 |

| Accounts receivable, net of allowance of $2,845 and $3,872, respectively | 457,918 | | 382,687 |

| Contract assets | 279,027 | | 397,123 |

| Inventories | 217,301 | | 201,736 |

| Other current assets | 346,732 | | 312,635 |

| Total current assets | 1,994,521 | | 1,768,235 |

| Property and equipment, net | 47,985 | | 9,236 |

| Goodwill | 370,613 | | 265,153 |

| Other intangible assets, net | 47,503 | | 1,546 |

| Deferred tax assets | 472,189 | | 438,272 |

| Other assets | 50,748 | | 36,340 |

| Total assets | $ | 2,983,559 | | $ | 2,518,782 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 377,466 | | $ | 456,639 |

| Accrued expenses | 72,863 | | 82,410 |

| Deferred revenue | 297,007 | | 225,539 |

| | | |

| Current portion of long-term debt | 6,563 | | 3,750 |

| Other current liabilities | 150,746 | | 123,148 |

| Total current liabilities | 904,645 | | 891,486 |

| Long-term debt, net of current portion | 138,770 | | 143,967 |

| Tax receivable agreement (TRA) liability | 375,002 | | 391,568 |

| Other liabilities | 140,182 | | 99,733 |

| Total liabilities | 1,558,599 | | 1,526,754 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total stockholders’ equity | 1,424,960 | | 992,028 |

| Total liabilities and stockholders’ equity | $ | 2,983,559 | | $ | 2,518,782 |

Schedule III

Nextracker Inc.

Unaudited condensed consolidated statements of cash flows

(In thousands)

| | | | | | | | | | | | | | | | | | | |

| | | Nine-month periods ended |

| | | | | | | December 31, 2024 | | | | December 31, 2023 |

| Cash flows from operating activities: | | | | | | | | | | | |

| Net income | | | | | | | $ | 359,432 | | | | | $ | 273,015 | |

| Depreciation and amortization of intangible assets | | | | | | | 8,299 | | | | | 3,138 | |

| Changes in working capital and other, net | | | | | | | 50,736 | | | | | 41,328 | |

| Net cash provided by operating activities | | | | | | | 418,467 | | | | | 317,481 | |

| Cash flows from investing activities: | | | | | | | | | | | |

| Purchases of property and equipment | | | | | | | (23,841) | | | | | (3,850) | |

| | | | | | | | | | | |

| Payment for business acquisitions, net of cash acquired | | | | | | | (144,675) | | | | | — | |

| | | | | | | | | | | |

| Net cash used in investing activities | | | | | | | (168,516) | | | | | (3,850) | |

| Cash flows from financing activities: | | | | | | | | | | | |

| Repayment of bank borrowings | | | | | | | (2,813) | | | | | (2,813) | |

| Net proceeds from issuance of Class A shares | | | | | | | — | | | | | 552,009 | |

| Purchase of LLC common units from Yuma, Inc. | | | | | | | — | | | | | (552,009) | |

| Payment of revolver issuance costs | | | | | | | (6,017) | | | | | — | |

| TRA payment | | | | | | | (15,520) | | | | | — | |

| Distribution to non-controlling interest holders | | | | | | | (6,112) | | | | | (64,365) | |

| Net transfers to Flex | | | | | | | — | | | | | (8,335) | |

| Other financing activities | | | | | | | — | | | | | (308) | |

| Net cash used in financing activities | | | | | | | (30,462) | | | | | (75,821) | |

| | | | | | | | | | | |

| Net increase in cash and cash equivalents | | | | | | | 219,489 | | | | | 237,810 | |

| Cash and cash equivalents beginning of period | | | | | | | 474,054 | | | | | 130,008 | |

| Cash and cash equivalents end of period | | | | | | | $ | 693,543 | | | | | $ | 367,818 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | Nine-month periods ended | | |

| Adjusted free cash flow | | | | | | | December 31, 2024 | | | | December 31, 2023 | | |

| Net cash provided by operating activities | | | | | | | $ | 418,467 | | | | | $ | 317,481 | | | |

| Purchases of property and equipment | | | | | | | (23,841) | | | | | (3,850) | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted free cash flow | | | | | | | $ | 394,626 | | | | | $ | 313,631 | | | |

Schedule IV

Nextracker Inc.

Reconciliation of GAAP to Non-GAAP financial measures

(In thousands, except percentages and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three-month periods ended | | | |

| December 31, 2024 | | September 27, 2024 | | December 31, 2023 | | | | | | | |

| GAAP gross profit & margin | $ | 240,903 | | | 35.5% | | $ | 224,795 | | | 35.4% | | $ | 209,725 | | | 29.5% | | | | | | | | | | | |

| Stock-based compensation expense | 3,084 | | | | | 2,481 | | | | | 2,497 | | | | | | | | | | | | | | |

| Intangible amortization | 880 | | | | | 896 | | | | | 63 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Adjusted gross profit & margin | $ | 244,867 | | | 36.0% | | $ | 228,172 | | | 35.9% | | $ | 212,285 | | | 29.9% | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| GAAP operating income & margin | $ | 150,236 | | | 22.1% | | $ | 133,475 | | | 21.0% | | $ | 148,472 | | | 20.9% | | | | | | | | | | | |

| Stock-based compensation expense | 26,980 | | | | | 29,885 | | | | | 13,037 | | | | | | | | | | | | | | |

| Intangible amortization | 1,780 | | | | | 1,875 | | | | | 63 | | | | | | | | | | | | | | |

Acquisition related costs | 1,038 | | | | | 2,177 | | | | | — | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Adjusted operating income & margin | $ | 180,034 | | | 26.5% | | $ | 167,412 | | | 26.3% | | $ | 161,572 | | | 22.7% | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| GAAP net income & margin | $ | 117,374 | | | 17.3% | | $ | 117,264 | | | 18.5% | | $ | 127,961 | | | 18.0% | | | | | | | | | | | |

| Stock-based compensation expense | 26,980 | | | | | 29,885 | | | | | 13,037 | | | | | | | | | | | | | | |

| Intangible amortization | 1,780 | | | | | 1,875 | | | | | 63 | | | | | | | | | | | | | | |

| Adjustment for taxes | 6,550 | | | | | (6,274) | | | | | 841 | | | | | | | | | | | | | | |

| Acquisition related costs | 1,038 | | | | | 2,177 | | | | | — | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Adjusted net income & margin | $ | 153,722 | | | 22.6% | | $ | 144,927 | | | 22.8% | | $ | 141,902 | | | 20.0% | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| GAAP net income & margin | $ | 117,374 | | | 17.3% | | $ | 117,264 | | | 18.5% | | $ | 127,961 | | | 18.0% | | | | | | | | | | | |

| Interest, net | (1,865) | | | | | 455 | | | | | (198) | | | | | | | | | | | | | | |

| Provision for income taxes | 42,842 | | | | | 19,928 | | | | | 38,818 | | | | | | | | | | | | | | |

| Depreciation expense | 2,636 | | | | | 1,067 | | | | | 1,055 | | | | | | | | | | | | | | |

| Intangible amortization | 1,780 | | | | | 1,875 | | | | | 63 | | | | | | | | | | | | | | |

| Stock-based compensation expense | 26,980 | | | | | 29,885 | | | | | 13,037 | | | | | | | | | | | | | | |

| Acquisition related costs | 1,038 | | | | | 2,177 | | | | | — | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Other tax related income, net | (4,413) | | | | | — | | | | | (12,945) | | | | | | | | | | | | | | |

| Adjusted EBITDA & margin | $ | 186,372 | | | 27.4% | | $ | 172,651 | | | 27.2% | | $ | 167,791 | | 23.6% | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | $ | 0.79 | | | | | $ | 0.79 | | | | | $ | 0.87 | | | | | | | | | | | | | | |

| Earnings per share attributable to Non-GAAP adjustments | 0.24 | | | | | 0.18 | | | | | 0.09 | | | | | | | | | | | | | | |

| Adjusted | $ | 1.03 | | | | | $ | 0.97 | | | | | $ | 0.96 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Diluted shares used in computing per share amounts | 149,028 | | | | | 149,079 | | | | | 147,344 | | | | | | | | | | | | | | |

Nextracker Inc.

Reconciliation of GAAP to Non-GAAP financial measures (continued)

(In thousands, except percentages and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine-month periods ended |

| December 31, 2024 | | December 31, 2023 |

| GAAP gross profit & margin | $ | 703,138 | | | 34.6% | | $ | 472,579 | | | 26.8% |

| Stock-based compensation expense | 9,345 | | | | | 7,668 | | | |

| Intangible amortization | 1,864 | | | | | 188 | | | |

| | | | | | | |

| Adjusted gross profit & margin | $ | 714,347 | | | 35.1% | | $ | 480,435 | | | 27.2% |

| | | | | | | |

| GAAP operating income & margin | $ | 443,805 | | | 21.8% | | $ | 316,444 | | | 17.9% |

| Stock-based compensation expense | 78,766 | | | | | 39,895 | | | |

| Intangible amortization | 3,743 | | | | | 188 | | | |

Acquisition related costs | 4,695 | | | | | — | | | |

| | | | | | | |

| | | | | | | |

| Adjusted operating income & margin | $ | 531,009 | | | 26.1% | | $ | 356,527 | | | 20.2% |

| | | | | | | |

| GAAP net income & margin | $ | 359,432 | | | 17.7% | | $ | 273,015 | | | 15.5% |

| Stock-based compensation expense | 78,766 | | | | | 39,895 | | | |

| Intangible amortization | 3,743 | | | | | 188 | | | |

| Adjustment for taxes | (9,368) | | | | | (4,040) | | | |

| Acquisition related costs | 4,695 | | | | | — | | | |

| | | | | | | |

| | | | | | | |

| Adjusted net income & margin | $ | 437,268 | | | 21.5% | | $ | 309,058 | | | 17.5% |

| | | | | | | |

| GAAP net income & margin | $ | 359,432 | | | 17.7% | | $ | 273,015 | | | 15.5% |

| Interest, net | (2,702) | | | | | 1,136 | | | |

| Provision for income taxes | 89,922 | | | | | 51,918 | | | |

| Depreciation expense | 4,556 | | | | | 2,950 | | | |

| Intangible amortization | 3,743 | | | | | 188 | | | |

| Stock-based compensation expense | 78,766 | | | | | 39,895 | | | |

| Acquisition related costs | 4,695 | | | | | — | | | |

| | | | | | | |

| Other tax related income, net | (4,413) | | | | | (7,259) | | | |

| Adjusted EBITDA & margin | $ | 533,999 | | | 26.2% | | $ | 361,843 | | | 20.5% |

| | | | | | | |

| Diluted earnings per share | | | | | | | |

| GAAP | $ | 2.41 | | | | | $ | 1.86 | | | |

| Earnings per share attributable to Non-GAAP adjustments | 0.52 | | | | | 0.24 | | | |

| Adjusted | $ | 2.93 | | | | | $ | 2.10 | | | |

| | | | | | | |

| Diluted shares used in computing per share amounts | 149,134 | | | | | 147,160 | | | |

See the accompanying notes on Schedule V attached to this press release

Schedule V

Nextracker Inc.

Notes

To supplement Nextracker’s unaudited selected financial data presented consistent with U.S. Generally Accepted Accounting Principles (“GAAP”), the Company discloses certain non-GAAP financial measures that exclude certain charges and gains, including adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”), adjusted EBITDA margin, adjusted gross profit, adjusted gross margin, adjusted operating income, adjusted net income, adjusted diluted earnings per share, and adjusted free cash flow. These supplemental measures exclude certain legal and other charges, stock-based compensation expense and intangible amortization, other discrete events as applicable and the related tax effects. These non-GAAP measures are not in accordance with or an alternative for GAAP and may be different from non-GAAP measures used by other companies. We believe that these non-GAAP measures have limitations in that they do not reflect all the amounts associated with Nextracker’s results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate Nextracker’s results of operations in conjunction with the corresponding GAAP measures. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measures. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of the Company’s performance.

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of the Company’s operating performance on a period-to-period basis because such items are not, in our view, related to the Company’s ongoing operational performance. We use non-GAAP measures to evaluate the operating performance of our business, for comparison with forecasts and strategic plans, for calculating return on investment, and for benchmarking performance externally against competitors. In addition, management’s incentive compensation is determined using certain non-GAAP measures. Since we find these measures to be useful, we believe that investors benefit from seeing results “through the eyes” of management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with the Company’s GAAP financials, provide useful information to investors by offering:

•the ability to make more meaningful period-to-period comparisons of the Company’s ongoing operating results;

•the ability to better identify trends in the Company’s underlying business and perform related trend analysis;

•a better understanding of how management plans and measures the Company’s underlying business; and

•an easier way to compare the Company’s operating results against analyst financial models and operating results of competitors that supplement their GAAP results with non-GAAP financial measures.

The following are explanations of each of the adjustments that we incorporate into non-GAAP measures, as well as the reasons for excluding each of these individual items in the reconciliations of these non-GAAP financial measures:

Stock-based compensation expense consists of non-cash charges for the estimated fair value of unvested restricted share unit and stock option awards granted to employees. The Company believes that the exclusion of these charges provides for more accurate comparisons of its operating results to peer companies due to the varying available valuation methodologies, subjective assumptions, and the variety of award types. In addition, the Company believes it is useful to investors to understand the specific impact stock-based compensation expense has on its operating results.

Intangible amortization consists primarily of non-cash charges that can be impacted by, among other things, the timing and magnitude of acquisitions. The Company considers its operating results without

these charges when evaluating its ongoing performance and forecasting its earnings trends, and therefore excludes such charges when presenting non-GAAP financial measures. The Company believes that the assessment of its operations excluding these costs is relevant to its assessment of internal operations and comparisons to the performance of its competitors.

The 45X Advanced Manufacturing Production Tax Credit (“45X Credit”) which was established as part of the Inflation Reduction Act (IRA), is a per-unit tax credit earned over time for each clean energy component domestically produced and sold by a manufacturer. The 45X Credit was eligible for domestic parts manufactured after January 1, 2023. The Company has executed agreements with certain suppliers to ramp up its U.S. manufacturing footprint. These suppliers produce 45X Credit eligible parts, including torque tubes, and structural fasteners, that will then be incorporated into a solar tracker. The Company has contractually agreed with these suppliers to share a portion of the credit related to Nextracker’s purchases. The Company accounts for these credits as a reduction of the purchase price of the parts acquired from the vendor and therefore a reduction of inventory until the part is sold, at which point the Company recognizes such credit as a reduction of cost of sales on the unaudited condensed consolidated statements of operations and comprehensive income. During the fourth quarter of fiscal 2024, the Company determined the amount of the 45X vendor rebates it expects to receive in accordance with the vendor contracts and recognized a cumulative reduction to cost of sales of $121.4 million related to 45X Credit vendor rebates earned on production of eligible components shipped to projects starting on January 1, 2023 through March 31, 2024. The Company believes that the assessment of its operations excluding the benefit from the vendor credits provides a more consistent comparison of its performance given the cumulative nature of the amount recorded in the fiscal fourth quarter. Beginning in the first quarter of fiscal year 2025, these 45X credit vendor rebates are not excluded from our non-GAAP financial measures.

Acquisition costs consist primarily of nonrecurring transaction costs for business acquisitions.

Adjustment for taxes relates to the tax effects of the various adjustments that we incorporate into non-GAAP measures to provide a more meaningful measure on non-GAAP net income and certain adjustments related to non-recurring settlements of tax contingencies or other non-recurring tax charges, when applicable.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

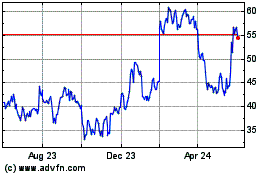

Nextracker (NASDAQ:NXT)

Historical Stock Chart

From Jan 2025 to Feb 2025

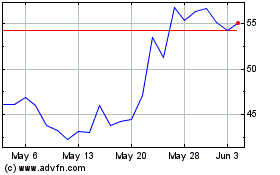

Nextracker (NASDAQ:NXT)

Historical Stock Chart

From Feb 2024 to Feb 2025