Omega Therapeutics, Inc. (Nasdaq: OMGA) (“Omega”), a clinical-stage

biotechnology company pioneering the development of a new class of

programmable epigenomic mRNA medicines, today announced financial

results for the fourth quarter and full year ended December 31,

2023, and a strategic prioritization initiative to focus resources

on near-term milestones to support long-term shareholder value.

“2023 was an important year for Omega where we executed to plan

and demonstrated clinical validation of an epigenomic controller to

regulate c-MYC in humans for the first time. These

proof-of-platform clinical data, coupled with our research

collaboration with Novo Nordisk in obesity, support the

ability of the OMEGA platform to potentially address epigenomic

regulation of almost all human genes across broad therapeutic areas

including cancer, cardiometabolic conditions and liver

regeneration,” said Mahesh Karande, President and Chief Executive

Officer of Omega Therapeutics. “Initial clinical data from our

ongoing Phase 1/2 MYCHELANGELO I trial of OTX-2002 demonstrated

controlled modulation of MYC expression levels, one of the most

challenging gene targets in oncology, and an encouraging disease

control rate and stable disease in heavily pre-treated, late-stage

HCC patients. We are within what we believe is a clinically

meaningful dose range and, as we continue to see a promising safety

profile for OTX-2002, have recently opened enrollment of Cohort 5.

We look forward to sharing additional updates from this program

throughout 2024.”

“Today we also announced a strategic prioritization, implemented

to ensure we have sufficient resources to advance our lead program

and maximize near- and long-term value creation from our platform.

As part of this initiative, we are taking difficult but necessary

actions to streamline our team and optimize our R&D efforts and

cost structure to extend our cash runway into the first quarter of

2025. These changes will unfortunately affect a number of our

colleagues, and we are grateful for their dedication and

contributions to our mission,” continued Mr. Karande. “As we

sharpen our focus, we look forward to the opportunities ahead to

generate meaningful clinical data for OTX-2002, continue to

demonstrate the broad potential of our platform, and establish

additional partnerships. We remain steadfast in our mission to

pioneer a new class of programmable epigenomic mRNA medicines to

transform the treatment of a broad range of diseases.”

Recent Highlights and Key Anticipated

Milestones

Development Pipeline and Platform

- Advanced the Phase 1/2

MYCHELANGELO™ I clinical trial evaluating OTX-2002 in patients with

hepatocellular carcinoma (HCC):

- OTX-2002 continues to advance in monotherapy dose

escalation.

- As of March 24, 2024, data from the first three cohorts (0.02

mg/kg – 0.06 mg/kg) showed:

- OTX-2002 continued to be generally well tolerated, with no

dose-limiting toxicities observed.

- Consistent dose-dependent pharmacokinetics with no drug

accumulation observed following repeat doses.

- All patients demonstrated controlled modulation and

downregulation of MYC mRNA expression, an important oncogene

regulating cell function and cell death.

- The interim disease control rate (DCR) for the target

population of HCC patients was 80%, reflecting 4 out of 5

efficacy-evaluable patients having a best overall response of

stable disease. These patients had an average of three or more

previous therapies and entered the trial with a life expectancy of

less than 12 weeks. The DCR for patients with non-HCC solid tumors

in the trial (n=5) was 40%, indicating the potential specificity of

OTX-2002 for HCC.

- The Company continues to evaluate patients with HCC in Cohort 4

at the 0.12 mg/kg dose level, which recently cleared the 28-day

dose limiting toxicity (DLT) window. Based on preclinical

experience and modeling, Omega believes this dose level is within

the expected active dose range. In March 2024, the Company opened

enrollment for Cohort 5 at a dose level of 0.3 mg/kg.

- Omega expects to report additional updated clinical data from

monotherapy dose escalation in mid-2024.

- The Company plans for expansion into monotherapy and

combination settings in mid-2024.

- Announced research

collaboration with Novo Nordisk to develop a novel therapeutic for

obesity management:

- The collaboration will leverage Novo Nordisk’s expertise in

research and development within cardiometabolic diseases and

Omega’s proprietary platform technology to develop an epigenomic

controller designed to enhance metabolic activity.

- Unlike traditional approaches focused on appetite suppression,

the program aims to leverage precision epigenomic control to

enhance thermogenesis, a naturally occurring metabolic process that

burns calories.

- Under the terms of the agreement, Novo Nordisk will reimburse

all R&D costs and has the right to select one target to advance

for clinical development. Omega and Flagship’s Pioneering Medicines

are eligible to receive up to $532 million in upfront, development

and commercial milestone payments, as well as tiered royalties on

annual net sales of a licensed product, which will be split equally

between the parties.

- Continued to advance and expand

OMEGA platform capabilities:

- Presented new preclinical data supporting the breadth of

Omega’s platform capabilities, including bidirectional and

multiplexed epigenomic control of gene expression in liver

inflammation and fibrosis at the American Association for the Study

of Liver Diseases’ (AASLD) The Liver Meeting® 2023.

- A HNF4A-targeting epigenomic controller led to a durable

increase in HNF4α expression, preferential upregulation of HNF4α P1

promoter isoforms, and reduced key measures of fibrosis both in

vitro and in vivo, supporting this development candidate’s

potential for the treatment of fibrotic liver disease.

- In preclinical models, liver-specific multiplexed targeting of

CXCL9, CXCL10 and CXCL11 via an epigenomic controller led to a

significant reduction in T-cell migration, a critical driver of

inflammation-induced liver injury, supporting the potential of this

approach as a novel treatment for inflammatory liver diseases.

Corporate

- Announced cost reduction and

strategic prioritization initiative to maximize near- and long-term

value creation opportunities:

- Following a strategic review, the Company has focused its

pipeline and reduced overall headcount by approximately 35%. These

fiscally disciplined actions are expected to extend the Company’s

cash runway into Q1 2025.

- Positions the Company to achieve key clinical data readouts

from the monotherapy dose escalation and dose expansion stages of

the MYCHELANGELO I clinical trial.

- The Company will prioritize certain preclinical programs and

platform efforts:

- Prioritized preclinical programs include OTX-2101 for non-small

cell lung cancer (NSCLC), the HNF4A program in liver regeneration,

and development of an epigenomic controller for obesity in

collaboration with Novo Nordisk.

- Core work on platform biology, epigenomic controllers, and

characterization of LNP delivery to the lung and other tissues will

continue.

- An updated corporate presentation is available on the Investors

section of the Company’s website at

https://ir.omegatherapeutics.com/.

Fourth Quarter and Full Year 2023 Financial

Results

As of December 31, 2023, the Company had cash, cash equivalents

and marketable securities totaling $73.4 million, which is expected

to fund operations into Q1 2025.

Research and development (R&D) expenses for the fourth

quarter of 2023 were $15.5 million, compared to $26.0 million for

the fourth quarter of 2022. R&D expenses for 2023 were $77.2

million compared to $81.2 million in 2022. The $4.0 million

decrease in R&D expenses in 2023 compared to 2022 was primarily

due to lower external research and manufacturing costs, consulting

and professional fees, and lab expenses, partially offset by an

increase in personnel-related expenses, including stock-based

compensation to support business growth, and facilities and other

costs.

General and administrative (G&A) expenses for the fourth

quarter of 2023 were $6.2 million, compared to $5.7 million for the

fourth quarter of 2022. G&A expenses for 2023 were $26.2

million, compared to $23.7 million in 2022. The $2.5 million

increase in G&A expenses in 2023 compared to 2022 was primarily

due to higher professional and consulting fees, and facilities and

other administrative costs.

Net loss for the fourth quarter of 2023 was $20.2 million,

compared to $30.8 million for the fourth quarter of 2022. Net loss

for the year ended December 31, 2023, was $97.4 million, compared

to a net loss of $102.7 million for the year ended December 31,

2022. The decrease in net loss for 2023 compared to 2022 was

primarily due to decreases in R&D expenses.

About Omega Therapeutics

Omega Therapeutics is a clinical-stage biotechnology company

pioneering the development of a new class of programmable

epigenomic mRNA medicines to treat or cure a broad range of

diseases. By pre-transcriptionally modulating gene expression,

Omega’s approach enables precision epigenomic control of nearly all

human genes, including historically undruggable and

difficult-to-treat targets, without altering native nucleic acid

sequences. Founded in 2017 by Flagship Pioneering following

breakthrough research by world-renowned experts in the field of

epigenetics, Omega is led by a seasoned and accomplished leadership

team with a track record of innovation and operational excellence.

The Company is committed to revolutionizing genomic medicine and

has a pipeline of therapeutic candidates derived from its OMEGA

platform spanning oncology, regenerative medicine, and multigenic

diseases including inflammatory and cardiometabolic conditions.

For more information, visit omegatherapeutics.com, or follow us

on X and LinkedIn.

About the OMEGA Platform

The OMEGA platform leverages the Company’s deep understanding of

gene regulation, genomic architecture and epigenetic mechanisms to

design programmable epigenomic mRNA medicines that precisely target

and modulate gene expression at the pre-transcriptional level.

Combining world-class data science capabilities with rational drug

design and customized delivery, the OMEGA platform enables control

of fundamental epigenetic processes and reprogramming of cellular

physiology to address the root cause of disease. Omega’s modular

and programmable mRNA medicines, called epigenomic controllers,

target specific genomic loci within insulated genomic domains with

high specificity to durably tune single or multiple genes to treat

and cure diseases through unprecedented precision epigenomic

control.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding the timing, progress and design of our ongoing Phase 1/2

MYCHELANGELOTM I clinical trial and our preclinical studies, as

well as the timing of announcements of data related thereto; the

potential of the OMEGA platform to engineer programmable epigenomic

mRNA therapeutics that successfully regulate gene expression by

targeting insulated genomic domains; expectations surrounding the

potential of our product candidates, including OTX-2002 and

OTX-2101; expectations regarding our pipeline, including trial

design, initiation of preclinical studies and advancement of

multiple preclinical development programs in oncology, immunology,

regenerative medicine, and select monogenic diseases; potential

franchise opportunities; our anticipated cash runway into the first

quarter of 2025; our prioritization of certain preclinical programs

and platform efforts; and our plans to ensure that we have

sufficient resources to advance our lead program, support long term

growth, and accomplish our mission. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements, including, but not

limited to, the following: the novel technology on which our

product candidates are based makes it difficult to predict the time

and cost of preclinical and clinical development and subsequently

obtaining regulatory approval, if at all; the substantial

development and regulatory risks associated with epigenomic

controllers due to the novel and unprecedented nature of this new

category of medicines; our limited operating history; the

incurrence of significant losses and the fact that we expect to

continue to incur significant additional losses for the foreseeable

future; our need for substantial additional financing; our

investments in research and development efforts that further

enhance the OMEGA platform, and their impact on our results;

uncertainty regarding preclinical development, especially for a new

class of medicines such as epigenomic controllers; potential delays

in and unforeseen costs arising from our clinical trials; the fact

that our product candidates may be associated with serious adverse

events, undesirable side effects or have other properties that

could halt their regulatory development, prevent their regulatory

approval, limit their commercial potential, or result in

significant negative consequences; the impact of increased demand

for the manufacture of mRNA and LNP based vaccines to treat

COVID-19 on our development plans; difficulties manufacturing the

novel technology on which our epigenomic controller candidates are

based; our ability to adapt to rapid and significant technological

change; our reliance on third parties for the manufacture of

materials; our ability to successfully acquire and establish our

own manufacturing facilities and infrastructure; our reliance on a

limited number of suppliers for lipid excipients used in our

product candidates; our ability to advance our product candidates

to clinical development; and our ability to obtain, maintain,

enforce and adequately protect our intellectual property rights.

These and other important factors discussed under the caption “Risk

Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2023, and our other filings with the SEC, could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, we disclaim

any obligation to do so, even if subsequent events cause our views

to change.

|

|

|

Omega Therapeutics, Inc.Consolidated

statements of operations and comprehensive loss

(Unaudited, In thousands except share and per share

data) |

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Collaboration revenue from related party |

$ |

989 |

|

|

$ |

735 |

|

|

$ |

3,094 |

|

|

$ |

2,073 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

15,531 |

|

|

|

25,968 |

|

|

|

77,169 |

|

|

|

81,167 |

|

|

General and administrative |

|

6,157 |

|

|

|

5,734 |

|

|

|

26,186 |

|

|

|

23,672 |

|

|

Total operating expenses |

|

21,688 |

|

|

|

31,702 |

|

|

|

103,355 |

|

|

|

104,839 |

|

| Loss from operations |

|

(20,699 |

) |

|

|

(30,967 |

) |

|

|

(100,261 |

) |

|

|

(102,766 |

) |

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

487 |

|

|

|

248 |

|

|

|

2,810 |

|

|

|

222 |

|

|

Other income (expense), net |

|

(2 |

) |

|

|

(107 |

) |

|

|

23 |

|

|

|

(157 |

) |

|

Total other income, net |

|

485 |

|

|

|

141 |

|

|

|

2,833 |

|

|

|

65 |

|

| Net loss |

$ |

(20,214 |

) |

|

$ |

(30,826 |

) |

|

$ |

(97,428 |

) |

|

$ |

(102,701 |

) |

| Net loss per common stock

attributable to common stockholders, basic and diluted |

$ |

(0.37 |

) |

|

$ |

(0.64 |

) |

|

$ |

(1.80 |

) |

|

$ |

(2.14 |

) |

| Weighted-average common stock

used in net loss per share attributable to common stockholders,

basic and diluted |

|

55,143,137 |

|

|

|

47,895,083 |

|

|

|

54,010,996 |

|

|

|

47,880,819 |

|

| Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(20,214 |

) |

|

$ |

(30,826 |

) |

|

$ |

(97,428 |

) |

|

$ |

(102,701 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on marketable securities |

|

72 |

|

|

|

438 |

|

|

|

465 |

|

|

|

(417 |

) |

| Comprehensive loss |

$ |

(20,142 |

) |

|

$ |

(30,388 |

) |

|

$ |

(96,963 |

) |

|

$ |

(103,118 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Omega Therapeutics, Inc.Condensed

Consolidated Balance Sheets(Unaudited, In

thousands) |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

68,443 |

|

|

$ |

70,615 |

|

|

Marketable securities |

|

4,986 |

|

|

|

54,063 |

|

|

Other assets |

|

130,937 |

|

|

|

21,320 |

|

|

Total assets |

$ |

204,366 |

|

|

$ |

145,998 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

Liabilities |

$ |

146,350 |

|

|

$ |

40,027 |

|

|

Stockholders’ equity |

|

58,016 |

|

|

|

105,971 |

|

|

Total liabilities and stockholders’ equity |

$ |

204,366 |

|

|

$ |

145,998 |

|

CONTACT

Investor contact:

Eva Stroynowski

617.949.4370

estroynowski@omegatx.com

Media contact:

Mollie Godbout, LifeSci Communications

646.847.1401

mgodbout@lifescicomms.com

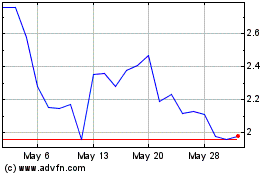

Omega Therapeutics (NASDAQ:OMGA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Omega Therapeutics (NASDAQ:OMGA)

Historical Stock Chart

From Dec 2023 to Dec 2024