Opthea Limited (

Opthea or the

Company) (ASX:OPT; NASDAQ:OPT) is pleased to

announce the successful completion of the institutional component

of the capital raising announced on Thursday, 24 August 2023.

The non-underwritten institutional placement

(Placement) and the institutional component

(Institutional Entitlement Offer) of the fully

underwritten 1 for 3.07 pro-rata accelerated non-renounceable

entitlement offer (Entitlement Offer) together

raised approximately A$73.7m. Approximately 160.2m shares will be

issued under the Placement and the Institutional Entitlement Offer

(New Shares) at an offer price of A$0.46 per New

Share.

As a result of strong demand from both domestic

and overseas institutional investors Opthea accepted A$10.0 million

of oversubscriptions in the Placement, which raised approximately

A$20.0 million, increasing the capital raising to A$90m (US$57.6

million). The Institutional Entitlement Offer raised

approximately A$53.7m. Eligible institutional shareholders took up

approximately 47.0% of their entitlements with the shortfall placed

to both new and existing institutional shareholders. New Shares to

be issued under the Placement and the Institutional Entitlement

Offer will rank equally with existing OPT shares in all respects

from the date of issue.

Commenting on the outcome of the Placement and

Institutional Entitlement Offer, Opthea’s CEO & Managing

Director, Dr Megan Baldwin, said, “We appreciate the strong support

from our current shareholders who have participated in this

financing. We are also very pleased to welcome several new

investors onto the OPT share register, including U.S. and

international healthcare specialist institutional funds. This

financing enables the Company to continue advancing the Phase 3

clinical trials ShORe and COAST for our VEGF-C/D ‘trap’

sozinibercept (OPT-302) for the treatment of wet AMD. With

topline data expected when patients complete the 52-week dosing

period, we look forward to progressing these studies and bringing

OPT-302 closer to realizing its potential to improve vision

outcomes for patients with wet AMD for which there remains a

significant unmet need despite the availability of standard of care

anti-VEGF-A treatments.”

Settlement of New Shares issued under the

Placement and Institutional Entitlement Offer is expected to occur

on Friday, 1 September 2023. The issue of those New Shares is

expected to occur on Monday, 4 September 2023, with ordinary

trading commencing on the same day.

As announced on Thursday, 24 August 2023, the

proceeds from the capital raising will be used to advance the

clinical development of OPT-302 for the treatment of wet AMD,

including to progress the Phase 3 clinical program and for general

corporate purposes.

Fully Underwritten Retail Entitlement Offer

Retail shareholders who have a registered address in Australia

or New Zealand on the register as at 7:00pm (Melbourne time) on the

Record Date will be invited to participate in the Retail

Entitlement Offer at the same Offer Price and offer ratio as under

the Institutional Entitlement Offer.

The Retail Entitlement Offer is expected to open on Thursday, 31

August 2023 and close at 5:00pm (Melbourne time) on Thursday, 14

September 2023.

The Retail Entitlement Offer will be made under a transaction

specific prospectus issued under section 713 of the Corporations

Act 2001 (Cth) (Prospectus). The Prospectus was

lodged with ASIC and the ASX on Thursday, 24 August 2023 and will

be dispatched to eligible retail shareholders, along with

personalized application forms, on Thursday, 31 August 2023. The

Prospectus will provide details of how to participate in the Retail

Entitlement Offer. Eligible retail shareholders may opt to take up

all, part or none of their entitlement. Eligible retail

shareholders will also have the opportunity to apply for and be

allocated additional New Shares up to 25% of their entitlement

(subject to scale back at the sole discretion of Opthea).

Opthea may (in its absolute discretion) extend the Retail

Entitlement Offer to any Institutional Shareholder that was

eligible to, but was not invited to participate in, the

Institutional Entitlement Offer (subject to compliance with

relevant laws).

New Options

Participants in the Placement and Entitlement Offer will receive

1 option, each exercisable at A$0.80 per option and expiring on 31

August 2025 (New Options), for every 2 New Shares

issued under the Placement and Entitlement Offer. The offer of New

Options is made under the Prospectus.

All New Options are expected to be issued upon allotment of the

Retail Entitlement Offer and, subject to satisfying spread

requirements set out in ASX Listing Rule 2.5, condition 6, the

Options are intended to be quoted on the ASX.

The full terms and conditions of the New Options are set out in

the Prospectus. Copies of the Prospectus are available on the ASX

website and at www.opthea.com.

Timetable

The timetable below is indicative only and subject to change.

The Company reserves the right to alter the dates below in its full

discretion and without prior notice, subject to the ASX Listing

Rules and the Corporations Act.

|

Item |

Date |

|

Trading Halt and announcement of the Equity Raising, lodgement of

Offer Documents, including Prospectus with ASIC |

Thursday, August 24, 2023 |

|

Institutional Placement and Institutional Entitlement Offer

opens |

Thursday, August 24, 2023 |

|

Institutional Placement and Institutional Entitlement Offer

closes |

Friday, August 25, 2023 |

|

Announcement of completion of the Institutional Entitlement offer,

trading halt lifted, existing securities recommence trading |

Monday, August 28, 2023 |

|

Record Date Entitlement Offer |

Monday, August 28, 2023 |

|

Despatch of Offer Prospectus |

Thursday, August 31, 2023 |

|

Retail Entitlement Offer opens |

Thursday, August 31, 2023 |

|

Settlement of New Shares issued under the Institutional Entitlement

Offer and Placement |

Friday, September 1, 2023 |

|

Allotment of New Shares issued under the Institutional Entitlement

Offer and Placement |

Monday, September 4, 2023 |

|

Retail Entitlement Offer closes |

Thursday, September 14, 2023 |

|

Settlement of New Shares under the Retail Entitlement Offer and any

shortfall |

Wednesday, September 20, 2023 |

|

Announcement of results of the Retail Entitlement Offer and

notification of any shortfall |

Thursday, September 21, 2023 |

|

Allotment and issue of New Shares and Options under the Retail

Entitlement Offer, and New Options issued under the Institutional

Entitlement Offer and Placement |

Thursday, September 21, 2023 |

|

Trading commences on a normal basis for New Shares issued under the

Retail Entitlement Offer |

Friday, September 22, 2023 |

|

Despatch of holding statements for New Shares issued under the

Retail Entitlement Offer |

Monday, September 25, 2023 |

1 Assumes AUD/USD exchange rate of A$1.00/US$0.64

About Opthea Limited

Opthea (ASX:OPT; Nasdaq:OPT) is a

biopharmaceutical company developing novel therapies to address the

unmet need in the treatment of highly prevalent and progressive

retinal diseases, including wet age-related macular degeneration

(wet AMD) and diabetic macular edema (DME). Opthea’s lead product

candidate OPT-302 is in pivotal Phase 3 clinical trials and being

developed for use in combination with anti-VEGF-A monotherapies to

achieve broader inhibition of the VEGF family, with the goal of

improving overall efficacy and demonstrating superior vision gains

over that which can be achieved by inhibiting VEGF-A alone.

Inherent risks of Investment in

Biotechnology Companies

There are a number of inherent risks associated with the

development of pharmaceutical products to a marketable stage. The

lengthy clinical trial process is designed to assess the safety and

efficacy of a drug prior to commercialization and a significant

proportion of drugs fail one or both of these criteria. Other risks

include uncertainty of patent protection and proprietary rights,

whether patent applications and issued patents will offer adequate

protection to enable product development, the obtaining of

necessary drug regulatory authority approvals and difficulties

caused by the rapid advancements in technology. Companies such as

Opthea are dependent on the success of their research and

development projects and on the ability to attract funding to

support these activities. Investment in research and development

projects cannot be assessed on the same fundamentals as trading and

manufacturing enterprises. Therefore, investment in companies

specializing in drug development must be regarded as highly

speculative. Opthea strongly recommends that professional

investment advice be sought prior to such investments.

Forward-looking statements

This ASX announcement contains certain

forward-looking statements, including within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995. The words

"expect", "anticipate", "estimate", "intend", "believe",

"guidance", "should", "could", "may", "will", "predict", "plan" and

other similar expressions are intended to identify forward-looking

statements. Indications of, and guidance on, future financial

position and performance including the preliminary estimated

unaudited financial information and pro forma data, are also

forward-looking statements. Forward-looking statements in this ASX

announcement include statements regarding the timetable, conduct

and outcome of the Offer and the use of the proceeds thereof, the

therapeutic and commercial potential and size of estimated market

opportunity of the Company’s product in development, the viability

of future opportunities, future market supply and demand, the

expected receipt of payments (including the additional potential

increase of US$50 million of funding under the Development Funding

Agreement (“DFA”)) and the timing of such

payments, Opthea’s expected cash runway, the expected timing of

completion of patient enrollment under the clinical trials and

timing of top-line data, expectations about topline data and other

observations and expectations based on masked pooled data, the

financial condition, results of operations and businesses of

Opthea, certain plans, objectives and strategies of the management

of Opthea, including with respect to the current and planned

clinical trials of its product candidate, and the future

performance of Opthea. Forward-looking statements, opinions and

estimates provided in this ASX announcement are based on

assumptions and contingencies which are subject to change without

notice, as are statements about market and industry trends, which

are based on interpretations of current conditions.

Forward-looking statements, including

projections, guidance on the future financial position of the

Company including the preliminary estimated unaudited financial

information and pro forma data, are provided as a general guide

only and should not be relied upon as an indication or guarantee of

future performance. They involve known and unknown risks and

uncertainties and other factors, many of which are beyond the

control of Opthea and its directors and management and may involve

significant elements of subjective judgment and assumptions as to

future events that may or may not be correct. These statements may

be affected by a range of variables which could cause actual

results or trends to differ materially, including but not limited

to the availability of funding, the receipt of funding under the

DFA (including the additional potential increase of US$50 million

of funding under the DFA), future capital requirements, the

development, testing, production, marketing and sale of drug

treatments, regulatory risk and potential loss of regulatory

approvals, ongoing clinical studies to demonstrate OPT-302 safety,

tolerability and therapeutic efficacy, additional analysis of data

from Opthea’s Phase 3 clinical trials once unmasked, timing of

completion of Phase 3 clinical trial patient enrollment and CRO and

labor costs, intellectual property protections, the successful

completion of the Offer, completion of management’s and the

Company’s audit and risk committee’s review and the Company’s other

closing processes, and other factors that are of a general

nature which may affect the future operating and financial

performance of the Company. Actual results, performance or

achievement may vary materially from any projections and

forward-looking statements and the assumptions on which those

statements are based. Subject to any continuing obligations under

applicable law or any relevant ASX listing rules, Opthea disclaims

any obligation or undertaking to provide any updates or revisions

to any forward-looking statements in this ASX announcement to

reflect any change in expectations in relation to any

forward-looking statements or any change in events, conditions or

circumstances on which any such statement is based.

Not an offer

This ASX announcement is not a disclosure

document and should not be considered as investment advice. The

information contained in this ASX announcement is for information

purposes only and should not be considered an offer or an

invitation to acquire Company securities or any other financial

products and does not and will not form part of any contract for

the acquisition of New Shares.

In particular, this ASX announcement does not

constitute an offer to sell, or a solicitation of any offer to buy,

any securities in the United States or any other jurisdiction in

which such an offer would be illegal or impermissible. The

securities to be offered and sold in the Placement and SPP have not

been, and will not be, registered under the U.S. Securities Act of

1933, as amended (the “U.S. Securities Act”), or the securities

laws of any state or other jurisdiction of the United States. No

public offering of securities is being made in the United States.

Accordingly, the securities to be offered and sold in the Placement

and SPP may only be offered and sold outside the United States in

“offshore transactions” (as defined in Rule 902(h) under Regulation

S of the U.S. Securities Act (“Regulation S”)) in reliance on

Regulation S, unless they are offered and sold in a transaction

registered under, or exempt from, or in a transaction not subject

to, the registration requirements of, the U.S. Securities Act and

applicable U.S. state securities laws.

Authorized for release to ASX by Megan

Baldwin, CEO & Managing Director

Company & Media Enquiries:

| U.S.A.

& International: |

Australia: |

| Megan Baldwin, CEO |

Rudi Michelson |

| Opthea Limited |

Monsoon Communications |

| Tel: +61 447788674 |

Tel: +61 (0) 3 9620 3333 |

| Megan.baldwin@opthea.com |

|

Media:Hershel BerryBlueprint Life Science

GroupTel: +1 415 505 3749hberry@bplifescience.com

Join our email database to receive program

updates:

Tel: +61 (0) 3 9826 0399 Email: info@opthea.com Web:

www.opthea.com

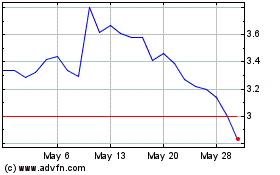

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

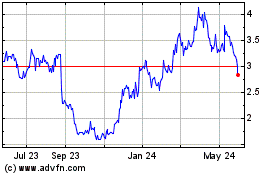

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Mar 2024 to Mar 2025