Impinj, Inc. (NASDAQ: PI), a leading RAIN RFID provider and

Internet of Things pioneer, today released its financial results

for the third quarter ended September 30, 2024.

“Our third-quarter results were strong, with revenue and

profitability well above our guidance,” said Chris Diorio, Impinj

co-founder and CEO. “These results again demonstrate the leverage

in our operating model. As we continue driving our bold vision to

connect every item in our everyday world, I remain confident in our

market position and energized by the opportunities ahead.”

Third Quarter 2024 Financial Summary

- Revenue of $95.2 million

- GAAP gross margin of 50.0%; non-GAAP gross margin of 52.4%

- GAAP net income of $0.2 million, or income of $0.01 per diluted

share using 29.7 million shares

- Adjusted EBITDA of $17.3 million

- Non-GAAP net income of $16.9 million, or income of $0.56 per

diluted share using 32.3 million shares

A reconciliation between GAAP and non-GAAP information is

contained in the tables below. Additionally, descriptions of these

non-GAAP financial measures are provided in the “Non-GAAP Financial

Measures” sections below.

Fourth Quarter 2024 Financial Outlook

Impinj provides guidance based on current market conditions and

expectations; actual results may differ materially. Please refer to

the comments below regarding forward-looking statements. The

following table presents Impinj’s financial outlook for the fourth

quarter of 2024 (in millions, except per share data):

Three Months Ending

December 31, 2024

Revenue

$91.0 to $94.0

GAAP Net loss

($3.8) to ($2.3)

Adjusted EBITDA income

$13.6 to $15.1

GAAP Weighted-average shares — basic and

diluted

28.4 to 28.6

GAAP Net loss per share — basic and

diluted

($0.14) to ($0.08)

Non-GAAP Net income

$13.4 to $14.9

Non-GAAP Weighted-average shares —

diluted(1)

32.6 to 32.8

Non-GAAP Net income per share —

diluted(1)

$0.45 to $0.49

(1) Non-GAAP diluted net income per share

includes the impact of our convertible debt using the if-converted

method, which assumes full share settlement. Interest expense is

added back to net income and weighted average shares includes total

shares issuable at conversion of 2.6 million.

A reconciliation between GAAP and non-GAAP financial measures is

provided in the "Non-GAAP Financial Measures" section below.

Conference Call Information

Impinj will host a conference call today, October 23, 2024 at

5:00 p.m. ET / 2:00 p.m. PT to discuss its third-quarter 2024

results, as well as its outlook for its fourth-quarter 2024.

Interested parties may access the call by dialing +1-412-317-1863.

A live webcast and replay will also be available on the company’s

website at investor.impinj.com. Following the call, a telephonic

replay will be available for five business days and may be accessed

by dialing +1-412-317-0088 and entering passcode 1320694.

Management’s prepared written remarks, along with quarterly

financial data, will be made available on Impinj’s website at

investor.impinj.com along with this release.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include statements regarding our strategy, investment

plans and prospects, statements regarding conditions in the markets

in which we compete as well as the broader economy, and our

financial guidance and considerations for the fourth quarter of

2024 and future periods.

Forward-looking statements are subject to known and unknown

risks and uncertainties and are based on potentially inaccurate

assumptions that could cause actual results to differ materially

from those expected or implied by the forward-looking statements.

Actual results may differ materially from the results predicted,

and reported results should not be considered as an indication of

future performance.

The potential risks and uncertainties that could cause actual

results to differ from the results predicted include, among others,

those risks and uncertainties included under the caption "Risk

Factors" and elsewhere in our annual report on Form 10-K and

quarterly reports on Form 10-Q filed with the U.S. Securities and

Exchange Commission. All information provided in this release and

in the attachments is as of the date hereof, and we undertake no

duty to update this information unless required by law.

About Impinj

Impinj (NASDAQ: PI) helps businesses and people analyze,

optimize, and innovate by wirelessly connecting billions of

everyday things — such as apparel, automobile parts, luggage, and

shipments — to the Internet. The Impinj platform uses RAIN RFID to

deliver timely data about these everyday things to business and

consumer applications, enabling a boundless Internet of Things.

www.impinj.com

Impinj is a registered trademark of Impinj, Inc. All other

trademarks are the property of their owners.

IMPINJ, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value, unaudited)

September 30, 2024

December 31, 2023

Assets:

Current assets:

Cash and cash equivalents

$

73,704

$

94,793

Short-term investments

96,551

18,440

Accounts receivable, net

64,378

54,919

Inventory

88,357

97,172

Prepaid expenses and other current

assets

6,097

4,372

Total current assets

329,087

269,696

Long-term investments

57,122

—

Property and equipment, net

49,908

44,891

Intangible assets, net

11,563

13,913

Operating lease right-of-use assets

7,817

9,735

Other non-current assets

1,117

1,478

Goodwill

19,833

19,696

Total assets

$

476,447

$

359,409

Liabilities and stockholders'

equity:

Current liabilities:

Accounts payable

$

20,504

$

8,661

Accrued compensation and employee related

benefits

18,043

8,519

Accrued and other current liabilities

3,702

8,614

Current portion of operating lease

liabilities

3,534

3,373

Current portion of long-term debt

283,081

—

Current portion of deferred revenue

2,231

1,713

Total current liabilities

331,095

30,880

Long-term debt

—

281,855

Operating lease liabilities, net of

current portion

6,660

9,360

Deferred tax liabilities, net

2,454

2,911

Deferred revenue, net of current

portion

139

272

Total liabilities

340,348

325,278

Stockholders' equity:

Common stock, $0.001 par value

28

27

Additional paid-in capital

522,100

463,900

Accumulated other comprehensive income

594

355

Accumulated deficit

(386,623

)

(430,151

)

Total stockholders' equity

136,099

34,131

Total liabilities and stockholders'

equity

$

476,447

$

359,409

IMPINJ, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data, unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenue

$

95,198

$

65,005

$

274,518

$

236,888

Cost of revenue

47,629

34,237

131,885

118,776

Gross profit

47,569

30,768

142,633

118,112

Operating expenses:

Research and development

25,492

21,588

72,935

67,426

Sales and marketing

9,888

10,073

29,891

30,678

General and administrative

12,452

13,532

39,040

45,098

Amortization of intangibles

506

1,409

2,411

3,555

Restructuring costs

—

—

1,812

—

Total operating expenses

48,338

46,602

146,089

146,757

Income (loss) from operations

(769

)

(15,834

)

(3,456

)

(28,645

)

Other income, net

2,416

1,090

5,830

3,620

Income from settlement of litigation

—

—

45,000

—

Interest expense

(1,219

)

(1,213

)

(3,652

)

(3,633

)

Income (loss) before income taxes

428

(15,957

)

43,722

(28,658

)

Income tax benefit (expense)

(207

)

195

(194

)

472

Net income (loss) per share attributable

to common stockholders:

$

221

$

(15,762

)

$

43,528

$

(28,186

)

Net income (loss) per share — basic

$

0.01

$

(0.59

)

$

1.57

$

(1.06

)

Net income (loss) per share — diluted

$

0.01

$

(0.59

)

$

1.48

(1)

$

(1.06

)

Weighted-average shares outstanding —

basic

28,168

26,920

27,805

26,639

Weighted-average shares outstanding —

diluted

29,727

26,920

31,918

(1)

26,639

(1) Diluted net income per share includes

the impact of our convertible debt using the if-converted method,

which assumes full share settlement. Interest expense is added back

to net income and weighted average shares includes total shares

issuable at conversion of 2.6 million.

IMPINJ, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands,

unaudited)

Nine Months Ended

September 30,

2024

2023

Operating activities:

Net income (loss)

$

43,528

$

(28,186

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

10,155

9,733

Stock-based compensation

41,336

35,679

Restructuring equity modification

expense

366

—

Accretion of discount or amortization of

premium on investments

(247

)

(1,600

)

Amortization of debt issuance costs

1,226

1,206

Deferred tax expense

(471

)

(662

)

Revaluation of acquisition-related

contingent consideration liability

986

—

Changes in operating assets and

liabilities, net of amounts acquired:

Accounts receivable

(9,438

)

2,683

Inventory

8,825

(59,239

)

Prepaid expenses and other assets

(610

)

1,407

Accounts payable

12,056

(10,054

)

Accrued compensation and employee related

benefits

9,515

(1,904

)

Accrued and other liabilities

1,268

1,677

Acquisition-related contingent

consideration liability

(2,556

)

—

Operating lease right-of-use assets

1,921

1,990

Operating lease liabilities

(2,542

)

(2,501

)

Deferred revenue

369

(1,038

)

Net cash provided by (used in) operating

activities

115,687

(50,809

)

Investing activities:

Purchases of investments

(154,331

)

—

Proceeds from sales of investments

—

13,372

Proceeds from maturities of

investments

18,605

127,449

Business acquisitions, net of cash

acquired

—

(23,357

)

Purchases of intangible assets

—

(250

)

Proceeds from sale of property and

equipment

—

234

Purchases of property and equipment

(12,979

)

(15,968

)

Net cash provided by (used in) investing

activities

(148,705

)

101,480

Financing activities:

Proceeds from exercise of stock options

and employee stock purchase plan

16,499

7,890

Payment of acquisition-related contingent

consideration

(4,602

)

—

Net cash provided by financing

activities

11,897

7,890

Effect of exchange rate changes on cash

and cash equivalents

32

(58

)

Net increase (decrease) in cash and cash

equivalents

(21,089

)

58,503

Cash and cash equivalents

Beginning of period

94,793

19,597

End of period

$

73,704

$

78,100

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements

prepared and presented in accordance with U.S. generally accepted

accounting principles, or GAAP, our key non-GAAP performance

measures include adjusted EBITDA, non-GAAP net income (loss), free

cash flow and adjusted free cash flow as defined below. We use

adjusted EBITDA and non-GAAP net income (loss) as key measures to

understand and evaluate our core operating performance and trends,

to prepare and approve our annual budget and to develop short- and

long-term operating plans. We use free cash flow and adjusted free

cash flow as key measures when assessing our sources of liquidity,

capital resources, and quality of earnings. We believe these

measures provide useful information for period-to-period

comparisons of our business to allow investors and others to

understand and evaluate our operating results in the same manner as

our management and board of directors. Our presentation of these

non-GAAP financial measures is not meant to be considered in

isolation or as a substitute for our financial results prepared in

accordance with GAAP, and our non-GAAP measures may be different

from similarly termed non-GAAP measures used by other

companies.

Adjusted EBITDA

We define adjusted EBITDA as net income (loss) determined in

accordance with GAAP, excluding, if applicable for the periods

presented, the effects of stock-based compensation; depreciation

and amortization; restructuring costs; settlement income and

related costs; induced conversion expense; other income, net;

interest expense; acquisition related expense and related purchase

accounting adjustments; and income tax benefit (expense). During

the year ended December 31, 2023, we revised our definition of

adjusted EBITDA to exclude acquisition related expenses, related

purchase accounting adjustments, and amortization of intangibles in

connection with our Voyantic Oy acquisition. During the three

months ended March 31, 2024, we further revised our definition of

adjusted EBITDA to exclude settlement income. We have excluded

these items because we do not believe they reflect our core

operations and us excluding them enables more consistent evaluation

of our operating performance. The revision to our definition of

adjusted EBITDA did not impact adjusted EBITDA for any previously

reported periods because there was no impact of a similar nature in

such prior periods affecting comparability.

Non-GAAP Net Income (Loss)

We define non-GAAP net income as net income (loss), excluding,

if applicable for the periods presented, the effects of stock-based

compensation; depreciation and amortization; restructuring costs;

settlement income and related costs; induced conversion expense;

acquisition related expense and related purchase accounting

adjustments; and the corresponding income tax impacts of

adjustments to net income (loss).

During the year ended December 31, 2023, we revised our

definition of non-GAAP net income to adjust for acquisition related

expenses, related purchase accounting adjustments, and amortization

of intangibles in connection with our Voyantic Oy acquisition.

During the three months ended March 31, 2024, we further revised

our definition of non-GAAP net income to exclude settlement income.

The revisions to our definition of non-GAAP net income did not

impact non-GAAP net income for any previously reported periods

because there was no impact of a similar nature in such prior

periods affecting comparability.

Additionally, during the year ended December 31, 2023, we

revised our definition of non-GAAP net income (loss) to adjust for

income tax effects of adjustments to net income (loss), calculated

at the statutory rate for current and historical periods. We have

revised the prior period amounts to conform to our current period

presentation.

Free cash flow

We define free cash flow as net cash provided by (used in)

operating activities, determined in accordance with GAAP, less

purchases of property and equipment. We define adjusted free cash

flow as free cash flow less cash received from gain on litigation

settlement.

IMPINJ, INC.

RECONCILIATIONS OF GAAP

FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

(in thousands, except

percentages, unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

GAAP Gross margin

50.0

%

47.3

%

52.0

%

49.9

%

Adjustments:

Depreciation and amortization

1.9

%

2.2

%

1.8

%

1.5

%

Purchase accounting adjustments

0.0

%

0.2

%

0.0

%

0.2

%

Stock-based compensation

0.5

%

0.8

%

0.5

%

0.6

%

Non-GAAP Gross margin

52.4

%

50.5

%

54.3

%

52.2

%

GAAP Net income (loss)

$

221

$

(15,762

)

$

43,528

$

(28,186

)

Adjustments:

Depreciation and amortization

3,247

3,668

10,155

9,734

Stock-based compensation

14,841

12,307

41,336

35,679

Restructuring costs

—

—

1,812

—

Acquisition related expenses

—

4

986

1,676

Purchase accounting adjustments

—

112

—

388

Other income, net

(2,416

)

(1,090

)

(5,830

)

(3,620

)

Income from settlement of litigation

—

—

(45,000

)

—

Interest expense

1,219

1,213

3,652

3,633

Income tax expense (benefit)

207

(195

)

194

(472

)

Adjusted EBITDA

$

17,319

$

257

$

50,833

$

18,832

GAAP Net income (loss)

$

221

$

(15,762

)

$

43,528

$

(28,186

)

Adjustments:

Depreciation and amortization

3,247

3,668

10,155

9,734

Stock-based compensation

14,841

12,307

41,336

35,679

Restructuring costs

—

—

1,812

—

Acquisition transaction expenses

—

4

986

1,676

Purchase accounting adjustments

—

112

—

388

Income from settlement of litigation

—

—

(45,000

)

—

Income tax effects of adjustments (1)

(1,410

)

(207

)

(4,434

)

(1,990

)

Non-GAAP Net income

$

16,899

$

122

$

48,383

$

17,301

Non-GAAP Net income per share —

diluted

$

0.56

(2)

$

0.00

$

1.63

(2)

$

0.61

GAAP Weighted-average shares — diluted

29,727

26,920

31,918

(3)

26,639

Dilutive shares from stock plans

—

1,196

—

1,758

Dilutive shares from convertible debt

2,589

—

—

—

Non-GAAP Weighted-average shares —

diluted

32,316

(2)

28,116

31,918

(2)

28,397

(1) The tax effects of the adjustments are

calculated using the statutory rate, taking into consideration the

nature of the item and relevant taxing jurisdictions.

(2) Diluted net income per share includes

the impact of our convertible debt using the if-converted method,

which assumes full share settlement. Interest expense is added back

to net income and weighted average shares includes total shares

issuable at conversion of 2.6 million.

(3) GAAP weighted average shares — diluted

includes the dilutive effect of convertible debt.

IMPINJ, INC.

RECONCILIATIONS OF GAAP

FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

(in thousands, except

percentages, unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

GAAP Net cash provided by (used in)

operating activities

$

10,068

$

(1,705

)

$

115,687

$

(50,809

)

Adjustments:

Purchases of property and equipment

(5,411

)

(2,770

)

(12,979

)

(15,968

)

Free cash flow

$

4,657

$

(4,475

)

$

102,708

$

(66,777

)

Adjustments:

Income from settlement of litigation

—

—

(45,000

)

—

Adjusted free cash flow

$

4,657

$

(4,475

)

$

57,708

$

(66,777

)

IMPINJ, INC.

RECONCILIATIONS OF GAAP

FINANCIAL OUTLOOK TO NON-GAAP FINANCIAL OUTLOOK

(in thousands, except per

share data, unaudited – calculated at the midpoint of the outlook

range)

Three Months Ending

December 31,

2024

GAAP Net loss

$

(3,178

)

Adjustments:

Forecasted Depreciation and

amortization

3,388

Forecasted Stock-based compensation

15,175

Forecasted Interest expense

1,215

Forecasted Other income, net

(2,400

)

Forecasted Income tax expense

100

Adjusted EBITDA

$

14,300

GAAP Net loss

$

(3,178

)

Adjustments:

Forecasted Depreciation and

amortization

3,388

Forecasted Stock-based compensation

15,175

Forecasted Income tax effects of

adjustments

(1,252

)

Non-GAAP Net income

$

14,133

GAAP Net loss per share — basic and

diluted

$

(0.11

)

Non-GAAP Net income per share —

diluted(1)

$

0.47

GAAP weighted-average shares — basic and

diluted

28,500

Dilutive shares

4,200

Non-GAAP weighted-average shares —

diluted(1)

32,700

(1) Non-GAAP diluted net income per share

includes the impact of our convertible debt using the if-converted

method, which assumes full share settlement. Interest expense is

added back to net income and weighted average shares includes total

shares issuable at conversion of 2.6 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023862833/en/

Investor Relations Andy Cobb, CFA Vice President, Strategic

Finance +1-206-315-4470 ir@impinj.com

Media Relations Jill West Vice President, Strategic

Communications +1-206-834-1110 jwest@impinj.com

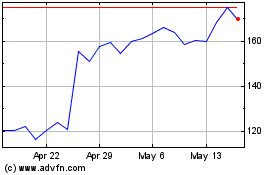

Impinj (NASDAQ:PI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Impinj (NASDAQ:PI)

Historical Stock Chart

From Dec 2023 to Dec 2024