Perdoceo Education Corporation Signs Definitive Agreement to Acquire University of St. Augustine for Health Sciences

July 16 2024 - 9:03AM

Business Wire

Perdoceo Education Corporation (“Perdoceo” or the “Company”)

(NASDAQ: PRDO), a provider of postsecondary education, today

reported that it has signed a definitive agreement to acquire 100%

ownership of the University of St. Augustine for Health Sciences,

LLC (USAHS). The material terms of the transaction have been

described in the Company’s Current Report on Form 8-K filed with

the Securities and Exchange Commission today. Completion of the

acquisition is subject to customary closing conditions and

satisfactory regulatory approvals from the Accrediting Commission

for Senior Colleges and Universities of the Western Association of

Schools and Colleges (WASC), as well as other key regulatory

bodies, and receipt of a preacquisition review response from the US

Department of Education. The Company expects to complete the

acquisition in December 2024.

USAHS is one of the nation’s leading universities offering

graduate health sciences degrees, primarily in physical therapy,

occupational therapy, speech language therapy, nursing, as well as

continuing education programs. Founded in 1979, USAHS educates

students through its network of campuses in San Marcos, California;

St. Augustine and Miami, Florida; and Austin and Dallas, Texas; and

through its online programs. USAHS is accredited by the WASC.

Once completed, the Company expects that the acquisition will

support further growth and diversification of its academic program

offerings and will mark Perdoceo’s foray into health science

degrees in a meaningful way. With the current advances in

technology, including AI, the number of careers requiring a health

science degree has been growing and is expected to grow for the

foreseeable future. According to the U.S. Bureau of Labor

Statistics, jobs in the health sciences are expected to increase

13% by 2031, more than twice the average job growth rate across all

employment sectors.

The ownership transition is not expected to impact the current

academic programs of USAHS, and USAHS will remain fully committed

to serving and educating students and providing the same high

quality educational experience.

Commenting on the transaction, Todd Nelson, President and Chief

Executive Officer of Perdoceo, said, “I have been impressed with

the USAHS team for their hard work and dedication to serving and

educating students. USAHS has been recognized as one of the

nation’s leading graduate health sciences universities and I look

forward to having them join our organization. I believe Perdoceo’s

resources and capabilities will continue to support

transformational initiatives at USAHS that will focus on further

enhancing student experiences, while delivering sustainable and

responsible growth.”

Transaction Details

- Perdoceo expects to pay approximately $142 million to $144

million in cash at closing to acquire 100% ownership of USAHS. The

actual cash paid will depend on adjustments for cash, debt and

working capital based on the final closing balance sheet.

- Pursuant to the merger agreement, Perdoceo has purchased a

buyer-side representation and warranty insurance policy, which will

serve as the primary source of protection against certain risks

associated with representations and warranties made by the seller

and pre-closing tax liabilities. The representation and warranty

insurance policy is subject to customary conditions, exclusions and

deductibles and will survive for at least three years from the

closing.

- The boards of directors of both parties to the merger, the

USAHS board of directors, and the USAHS stockholders holding 100%

of the voting power over USAHS’ parent’s outstanding common stock,

each have unanimously approved the acquisition, and no other

stockholder or board approval is required to complete the

acquisition.

- The merger agreement may be terminated in certain specified,

limited circumstances. Upon such termination Perdoceo will be

required to pay the seller a termination fee of either $4 million,

$10 million or $20 million, depending on the circumstances.

- The acquisition is not subject to a financing condition.

Perdoceo plans to use cash on hand for the purchase.

- The acquisition is subject to regulatory clearances, including

receipt of required antitrust clearance and approval from WASC,

receipt of a preacquisition review response from the US Department

of Education, and other closing conditions specified in the merger

agreement. The transaction is expected to close in December

2024.

- For the year ended December 31, 2023, USAHS had revenues of

approximately $170 million, operating income of approximately $35

million and served approximately 4,500 graduate and post-graduate

students across multiple health sciences disciplines.

- Perdoceo expects the transaction to be accretive to the

Company’s adjusted operating income immediately beginning in 2025

and the transaction to provide further growth in adjusted operating

income in 2026.

- The acquisition of USAHS is consistent with Perdoceo’s balanced

capital allocation strategy of acquiring quality academic

institutions that are accretive acquisitions while also returning

capital to shareholders via dividends and share buybacks.

Affirming Outlook for Fiscal Year 2024

Perdoceo remains on track to achieve its full year adjusted

operating income outlook for $175 million to $190 million, as

provided in the Company’s previous quarterly earnings release,

subject to the assumptions and factors set forth therein.

ABOUT PERDOCEO EDUCATION CORPORATION

Perdoceo’s accredited academic institutions offer a quality

postsecondary education primarily online to a diverse student

population, along with campus-based and blended learning programs.

The Company’s academic institutions – Colorado Technical University

(“CTU”) and the American InterContinental University System (“AIUS”

or “AIU System”) – provide degree programs from the associate

through doctoral level as well as non-degree seeking and

professional development programs. Perdoceo’s academic institutions

offer students industry-relevant and career-focused academic

programs that are designed to meet the educational needs of today’s

busy adults. CTU and AIUS continue to show innovation in higher

education, advancing personalized learning technologies like their

intellipath® learning platform and using data analytics and

technology to serve and educate students while enhancing overall

learning and academic experiences. Perdoceo is committed to

providing quality education that closes the gap between learners

who seek to advance their careers and employers needing a qualified

workforce. For more information, please visit

www.perdoceoed.com.

Except for the historical and present factual information

contained herein, the matters set forth in this release, including

statements identified by words such as “believe,” “will,” “expect,”

“continue,” “outlook,” “remain,” “focused on,” “should” and similar

expressions, are forward-looking statements as defined in Section

21E of the Securities Exchange Act of 1934, as amended. These

statements are based on information currently available to us and

are subject to various assumptions, risks, uncertainties and other

factors that could cause our results of operations, financial

condition, cash flows, performance, business prospects and

opportunities to differ materially from those expressed in, or

implied by, these statements. Except as expressly required by the

federal securities laws, we undertake no obligation to update or

revise such factors or any of the forward-looking statements

contained herein to reflect future events, developments or changed

circumstances, or for any other reason. These risks and

uncertainties, the outcomes of which could materially and adversely

affect our financial condition and operations, include, but are not

limited to, the following: conditions to the completion of the

acquisition, such as required regulatory clearances, not being

satisfied; closing of the transaction being delayed or not

occurring at all; the occurrence of any event, change or other

circumstance or condition that could give rise to the termination

of the merger agreement; Perdoceo being unable to achieve the

anticipated benefits of the transaction; the acquired business not

performing as expected; Perdoceo assuming unexpected risks,

liabilities and obligations of the acquired business; significant

transaction costs associated with the transaction; the risk that

disruptions from the transaction will harm the parties’ businesses,

including current plans and operations; the ability of the parties

to retain and hire key personnel; potential adverse reactions or

changes to business relationships resulting from the announcement

or completion of the proposed transaction; and other factors

relating to Perdoceo’s operations and financial performance

discussed in its filings with the Securities and Exchange

Commission. Further information about these and other relevant

risks and uncertainties may be found in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023 and its

subsequent filings with the Securities and Exchange Commission.

About University of St. Augustine for Health Sciences

The University of St. Augustine for Health Sciences (USAHS) is a

graduate institution that offers degree programs in physical

therapy, occupational therapy, nursing, education and health

science, as well as continuing education programs. Founded in 1979,

USAHS has locations in San Marcos, California; St. Augustine and

Miami, Florida; Austin and Dallas, Texas; and offers degrees

through its online programs. USAHS is regionally accredited by the

Western Association of Schools and Colleges Senior College and

University Commission. For more information: www.usa.edu.

USAHS does not intend to comment further about the proposed

transaction. Any further inquiries should be directed to Alpha

IR.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240716368213/en/

Alpha IR Sam Gibbons (312) 445-2870 PRDO@alpha-ir.com

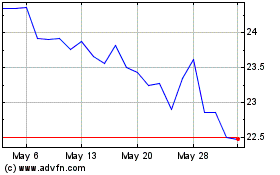

Perdoceo Education (NASDAQ:PRDO)

Historical Stock Chart

From Jun 2024 to Jul 2024

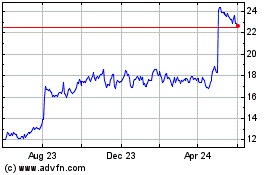

Perdoceo Education (NASDAQ:PRDO)

Historical Stock Chart

From Jul 2023 to Jul 2024