Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-283182

PROSPECTUS

SUPPLEMENT

(To

the Prospectus Dated November 20, 2024)

Up

to $7,730,973 Shares of Common Stock

352,176

Shares of Common Stock

This

prospectus supplement relates to the issuance and sale of up to $7,730,973 in shares of our common stock, par value $0.0005 per share

(the “Common Stock”), to Keystone Capital Partners, LLC (“Keystone”) from time to time, in one or more transactions

in amounts, at prices, and on terms that will be determined at the time these securities are offered, pursuant to the common stock purchase

agreement, dated as of January 29, 2025 (the “Purchase Agreement”), that we have entered into with Keystone, whereby Keystone

has committed to purchase up to $7,730,973 of our Common Stock (the “Purchase Shares”), and we have agreed to issue to Keystone

352,176 shares of our Common Stock as commitment shares (the “Commitment Shares”).

This

prospectus supplement and the accompanying prospectus also cover the resale of these shares by Keystone to the public. See “Description

of Transactions and Securities Offered” for a description of the Purchase Agreement and additional information regarding Keystone.

Keystone is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities

Act.

The

purchase price for the Purchase Shares will be based upon formulas set forth in the Purchase Agreement depending on the type of Purchase

Notice we submit to Keystone from time to time. We will pay the expenses incurred in connection with the issuance of the shares of our

Common Stock, including expenses incurred by Keystone up to $25,000. See “Description of Transactions and Securities Offered.”

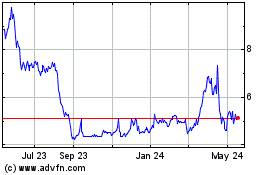

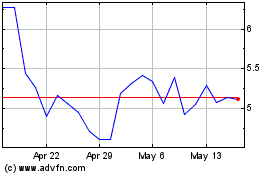

Our

common stock is traded on The Nasdaq Capital Market under the symbol “PRPH”. On January 28, 2025, the last reported sale

price of our common stock on the Nasdaq Capital Market was $0.46 per share.

As

of January 28, 2025, the aggregate market value of our public float, calculated according to General Instructions I.B.6. of Form S-3,

is approximately $23,666,244.80, based on 29,874,029 shares of common stock outstanding as of January 28, 2025, of which 26,893,460 shares

of our common stock are held by non-affiliates. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3

during the prior 12 calendar month period that ends on, and includes, the date of this prospectus. Pursuant to General Instruction I.B.6

of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of our

public float in any 12-month period so long as our public float remains below $75,000,000.

Investing

in our securities involves a high degree of risk. Please read “Risk Factors” beginning on page S-6 of this prospectus supplement

and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus

supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is January 30, 2025

TABLE

OF CONTENTS

You

should rely only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus

and in any free writing prospectus that we have authorized for use in connection with this offering. We have not authorized anyone to

provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that

the information in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus

supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this

offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and

prospects may have changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents

incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have

authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and

consider the information in the documents to which we have referred you in the sections of this prospectus supplement entitled “Information

Incorporated by Reference” and “Where You Can Find More Information.”

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities

and Exchange Commission (the “SEC”), using a “shelf” registration process. This document contains two parts.

The first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part,

the accompanying prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer

only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may add, update or change information

contained in the accompanying prospectus. To the extent that any statement we make in this prospectus supplement is inconsistent with

statements made in the accompanying prospectus or any documents incorporated by reference herein or therein, the statements made in this

prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated

by reference herein and therein.

Unless

the context otherwise requires, all references to the terms “we,” “us,” “our,” and the “company”

throughout this prospectus supplement mean ProPhase Labs, Inc. and its subsidiaries.

All

references in this prospectus supplement to our financial statements include, unless the context indicates otherwise, the related notes.

The

information contained in this prospectus supplement or the accompanying prospectus is accurate only as of the date of this prospectus

supplement or the accompanying prospectus, as applicable, regardless of the time of delivery of this prospectus supplement, the accompanying

prospectus or of any sale of the securities. We further note that the representations, warranties and covenants made by us in any agreement

that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary of our business highlights some of the information contained elsewhere in or incorporated by reference into this prospectus

supplement. Because this is only a summary, however, it does not contain all of the information that may be important to you. You should

carefully read this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference, which are

described under “Information Incorporated by Reference” and “Where You Can Find More Information” in this prospectus

supplement. You should also carefully consider the matters discussed in the section entitled “Risk Factors” in this prospectus

supplement, in the accompanying prospectus and in other periodic reports incorporated herein by reference.

Overview

We

are a growth oriented and diversified next generation biotech, genomics and diagnostics company that develops and commercializes novel

drugs, dietary supplements, and compounds.

We

offer whole genome sequencing and related services through our wholly-owned subsidiary, DNA Complete, Inc. (“DNA Complete”).

Our

wholly owned subsidiary, ProPhase BioPharma, Inc. (“PBIO”) is focused on the licensing, development and commercialization

of novel drugs, dietary supplements, and compounds. We also develop and market dietary supplements under the TK Supplements® brand.

Previously

we offered a broad array of COVID-19 related clinical diagnostic and testing services including polymerase chain reaction (“PCR”)

testing for COVID-19 and Influenza A and B as well as rapid antigen testing for COVID-19 through our wholly-owned subsidiary, ProPhase

Diagnostics, Inc. (“ProPhase Diagnostics”). ProPhase Diagnostics’ two CLIA- (Clinical Laboratory Improvement Amendments)

certified laboratories are located in Old Bridge, New Jersey and Garden City, New York, respectively.

BE-Smart

Esophageal Pre-Cancer Diagnostics Screening Test

We

own the worldwide exclusive rights to the BE-Smart Esophageal Pre-Cancer diagnostics screening test and related intellectual property

assets. The BE-Smart test is aimed at early detection of esophageal cancer. It remains under development but has already been tested

by an independent test lab, mProbe, Inc. (“mProbe”), on over 200 human samples. Although further clinical tests are required,

the available initial data demonstrates promising potential for early detection of esophageal cancer risk. mProbe, Inc., a precision

health and medicine company utilizing clinical proteomics in the oncology space in conjunction with Dr. Christopher Hartley of the prestigious

Mayo Clinic, has been utilizing a small sample of tissue collected during endoscopies to help us confirm and optimize the BE-Smart Test.

The initial data appears to demonstrate accuracy and reproducibility as well as identification of potential biomarkers for therapeutic

drug discovery to treat esophageal cancer. We are continuing to study and develop the BE-Smart test.

In

March 2023, we announced a collaboration with mProbe and Dr. Christopher Hartley of Mayo Clinic for the continued development of our

BE-Smart Esophageal Pre-Cancer diagnostic screening test. Currently, we plan to commercialize the BE-Smart test as a Laboratory Developed

Test (“LDT”). However, on April 29, 2024, United States Food and Drug Administration (“FDA”) released a final

rule that classified LDTs as in vitro diagnostics that are regulated by FDA as medical devices under the federal Food, Drug, and Cosmetic

Act. Under this approach, FDA proposed to phase out its general enforcement discretion approach for LDTs under a four-year period subject

to certain continuing enforcement discretion policies. The final rule was published on May 6, 2024, and in the absence of a successful

legal challenge, will become effective after a year, after which medical device regulatory requirements such as medical device reporting,

registration and listing, quality system regulation requirements, and premarket authorization requirements, among others, will become

applicable eventually. We plan to comply with such requirements, including that of premarket authorization, in partnership with Forward

Healthcare Consultants (“FHC”), as described below, if the final rule is not modified or rescinded.

In

August 2024, we announced a collaboration with FHC to assist in the approval and commercialization of BE-Smart. The experts at FHC will

assist with securing market access by focusing on clinical validation and commercialization planning, to include coverage, pricing, and

coding. Additionally, FHC will bring its vast relationships with physician networks to drive commercialization success. FHC has already

completed the first two phases of its plan for advancing towards commercialization. This plan includes publishing a peer reviewed paper

as well as a comprehensive dossier on the BE-Smart test. In addition, we have initiated certain discussions in coordination with FHC

with respect to a potential strategic partnership or sale for the BE-Smart test.

According

to the National Institute of Health Chapter 24: Indications and Outcomes of Gastrointestinal Endoscopy, over 20 million endoscopies are

performed every year in the United States; approximately seven million of these procedures are done on patients with higher risk for

contracting Esophageal Adeno Carcinoma. Two million of these patients have Barret’s Esophagus, which is a condition in which the

flat pink lining of the swallowing tube that connects the mouth to the stomach (esophagus) becomes damaged by acid reflux, which causes

the lining to thicken and become red. In patients with Barrett’s Esophagus, one in two hundred will develop esophageal adenocarcinoma.

Esophageal cancer is highly lethal and deemed as the sixth cause of cancer death worldwide according to Cancer State Facts, with the

overall five-year survival rate less than 20%. We estimate that the reimbursement rate for the test will range between $1,000 to $2,000

per test, giving it a total potential addressable market of $7 billion to $14 billion dollars per year.

The

BE-Smart test is being developed to provide health care providers and patients with data to help determine treatment options, including

whether patients not believed to be at risk for esophageal cancer should continue to be monitored or, alternatively, to provide patients

who might otherwise have been undiagnosed early treatment before esophageal cells become cancerous. The goal of widespread adoption of

the BE-Smart test would allow health care providers to initiate potentially lifesaving early treatment processes such as an ablation

procedure to remove the precancerous cells. This diagnostic test, once fully validated, could also significantly reduce unnecessary endoscopies

as well as offer peace of mind to patients who are suffering with Barret’s syndrome who are at greater risk of esophageal cancer.

DNA

Complete

DNA

Complete focuses on genomics testing technologies, a comprehensive method for analyzing entire genomes, including the genes and chromosomes

in deoxyribonucleic acid (“DNA”). The data obtained from genomic sequencing may help to identify inherited disorders and

tendencies, predict disease risk, identify expected drug response, and characterize genetic mutations, including those that drive cancer

progression. We currently offer DNA Complete’s whole genome sequencing products direct-to-consumers online with plans to sell in

food, drug and mass (“FDM”) retail stores and to provide testing for universities conducting genomic research. DNA Complete

offers three tiers of DNA testing, Essential, Pro, and Elite, which differ in the amount of DNA analyzed (1x whole genome sequencing

(“WGS”), 30x WGS, and 100x WGS, respectively), the level of accuracy, the number of reports per month that consumers would

receive, and the total of personalized health reports included (more than 175 reports, more than 250 reports, and more than 350 reports,

respectively). The DNA Complete tests include the first year of membership. The DNA Complete platform offers both ancestry and personalized

health reports covering a number of health dispositions, such as longevity, mental health, cancer, and more. In addition, DNA Complete

offers subscription services to ensure ongoing customer engagement by providing regular updates and new insights. DNA Complete sequences

specimens at Nebula, a wholly owned subsidiary of ours, as well as at other laboratories.

DNA

Complete also offers DNA Expand, a platform that allows consumers to upload their DNA data from previous DNA tests obtained from other

service providers to discover 50x more data points derived from over 35 million genetic variants, and to obtain in-depth health and wellness

reports that are based on the latest scientific discoveries. DNA Expand’s database was created from WGS tests that were obtained

from 130 countries and are equivalent to roughly 150 million ancestry single nucleotide polymorphisms based tests.

ProPhase

BioPharma

We

formed PBIO in June 2022 to assist in the licensing, development and commercialization of novel drugs, dietary supplements and compounds.

Licensed compounds under development currently include Equivir (a dietary supplement candidate) and Equivir G (prescription drug (“Rx”)

candidate), and two broad-based candidates. We also own the exclusive rights to the BE-Smart Esophageal Pre-Cancer Diagnostic Screening

test, which is in development as described above, and related intellectual property (“IP”) assets.

Equivir

(dietary supplement candidate) and Equivir G (Rx candidate)

We

have exclusive worldwide rights to develop and commercialize Equivir (a dietary supplement candidate) and Equivir G (a Rx drug candidate)

pursuant to a license agreement with Global BioLife, Inc. (“Global BioLife”), a wholly-owned subsidiary of DSS, Inc.

Equivir

is a blend of polyphenols, which are substances found in many nuts, vegetables and berries. The composition is projected to come in capsule

form and be taken daily like a multivitamin. The composition is believed to support the human body’s immune function, and improve

the quality of lives for users. We plan to commercialize Equivir as a dietary supplement, leveraging our distribution in over 40,000

FDM retail stores and online direct to consumers.

In

March 2023, we commenced patient enrollment in a randomized, placebo-controlled clinical trial of Equivir to evaluate its effect in supporting

immune system functions. Vedic Lifesciences, a leading clinical research organization, was contracted to run the multi-arm trial. Vedic

produced interim results in February of 2024 which showed enough data to continue the trial to completion.

TK

Supplements

Our

TK Supplements® product line is dedicated to supporting better health, energy and sexual vitality. Each of our herbal

supplements is researched to determine the optimum blend of ingredients to ensure our customers receive premium quality products. To

achieve this, we formulate with the highest quality ingredients derived from nature and ingredients enhanced by science. Our TK Supplements®

product line includes Legendz XL®, a sexual health formula product intended for men, and Triple Edge XL®,

an energy and stamina support product.

Legendz

XL® has distribution in Rite Aid, Walgreens, CVS, Walmart and other retailers, and via ecommerce.

In

2022, we restaged Triple Edge XL from a 56 ct to a 20 ct at CVS, making the retail price more in line with competition. The result was

a double digit increase in consumer sales and a 40% expansion increase in the number of stores carrying the item between the restaging

of the product in September 2022 and January 2023. In January 2024, Triple Edge XL was reviewed by CVS and, based on its 2022 and 2023

sales, CVS has determined to maintain authorization for its fiscal year ending December 31, 2024. We also presented Triple Edge XL 20

ct at Walgreens and other major pharmacies and we are waiting on final decisions on whether those pharmacies will agree to carry Triple

Edge XL 20 ct. In the event all of the pharmacies at which we presented Triple Edge XL 20 ct accept the same of such product, we believe

that such acceptances will increase demand for product inventory by over 100% in the 12-month period following all of the acceptances.

We

also expect to launch our Equivir daily supplement that supports users’ immune functions. The trial in India has been completed,

and the final statistical analysis report is being compiled.

ProPhase

Diagnostics

Our

wholly-owned subsidiary, ProPhase Diagnostics, which was formed in October 2020, offered a broad array of COVID-19 related clinical diagnostic

and testing services including PCR testing for COVID-19 and Influenza A and B as well as rapid antigen testing for COVID-19 at its two

CLIA-certified laboratories, located in Old Bridge, New Jersey and Garden City, New York, respectively.

Recent

Events

Sale

of PMI and PREH

On

January 16, 2025, we entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with JL Projects, Inc., a Delaware

corporation (“JL Projects”), pursuant to which JL Projects purchased all of the right, title, and interest in and to all

of the issued and outstanding shares of capital stock of our wholly-owned subsidiaries, Pharmaloz Manufacturing, Inc. (“PMI”)

and Pharmaloz Real Estate Holdings, Inc. (“PREH”). The transaction closed concurrently with the execution of the Stock Purchase

Agreement on January 16, 2025.

PMI

is in the business of developing, manufacturing, packaging, and warehousing of non-prescription drug and dietary supplement products,

including organic and natural cough drops and lozenges, at a facility located at 500 North 15th Avenue, Lebanon, Pennsylvania 17046 (the

“Facility”). PREH owned the Facility prior to the consummation of the sale contemplated by the Stock Purchase Agreement.

As

part of the transaction, JL Projects provided approximately $2 million in cash payments to the Company and extinguished approximately

$10 million of the Company’s debt. Additionally, JL Projects assumed (i) the existing $3.3 million mortgage on PMI’s manufacturing

facility, (ii) nearly $2 million in capital leases, and (iii) approximately $3 million in current and accrued payables, and paid down

$200,000 on an existing loan from affiliates of JL Projects. The transaction also resulted in the cancellation of approximately $300,000

in accrued interest related to the retired debt. Furthermore, the Company avoided approximately $3 million of upcoming capital expenditures

that JL Projects will now be responsible for. The transaction also transferred over $600,000 in employee annual overhead from the Company

to PMI.

Term

Note Agreement

On

October 22, 2024, we entered into a term note agreement with an individual investor for cash proceeds of $500,000 (the “Term Note”).

The Term Note has an implicit interest rate of 15%. The Term Note has a term of 12 months and requires us to make interest only monthly

payments in the amount of $6,250 with a $506,250 balloon payment at end of term. There are no warrants or convertible features associated

with this note.

Change

of the Company’s Independent Registered Public Accounting Firm

On

September 30, 2024, Morison Cogen LLP (“Morison”), our independent registered public accounting firm, decided to exit the

PCAOB audit business. Based on this decision, the firm circulated a letter to the audit committee (the “Audit Committee”)

of our board of directors notifying them of such. The firm has therefore resigned as our independent registered public accounting firm,

effective as of September 30, 2024.

On

October 18, 2024, we engaged Fruci & Associates II, PLLC (the “New Accountant”) as our new independent registered public

accounting firm for the fiscal year ending December 31, 2024.

Resignation

of a Director

On

September 20, 2024, Eleanor McBrier notified our board of directors of her intention to resign as director of the Company, effective

immediately. Ms. McBrier’s resignation was not the result of any dispute or disagreement with us or the board of directors on any

matter relating to the Company but because of a conflict with the policies of her existing employer. We expressed our gratitude to Ms.

McBrier for her service and contributions during her time on the board of directors. In connection with Ms. McBrier’s resignation,

we have initiated a search for her replacement, with a focus on director candidates in the gastroenterology field and related sciences

to assist us in the development of our BE-Smart esophageal cancer test.

Failure

to Satisfy the Nasdaq Listing Rule

On

September 23, 2024, we notified the Nasdaq Stock Market LLC (“Nasdaq”) that we were not in compliance with the audit committee

requirement under Nasdaq Listing Rule 5605(c)(2)(A) solely due to a vacancy on the Audit Committee of our board of directors resulting

from Eleanor McBrier’s resignation from the board of directors.

On

September 26, 2024, we received a notice from Nasdaq indicating that we no longer comply with the audit committee requirements as set

forth in Nasdaq Listing Rule 5605 and confirming our opportunity to regain compliance within the cure period provided in Nasdaq Listing

Rule 5605(c)(4), which is the earlier of our next annual meeting of stockholders or September 20, 2025, or if the next annual stockholders’

meeting is held before March 19, 2025, then we must evidence compliance no later than March 19, 2025. We are evaluating the membership

of the Audit Committee and intends to regain compliance with Nasdaq Listing Rule 5605(c)(2)(A) prior to the expiration of the applicable

cure period described above.

Notice

of Delisting

On

December 26, 2024, we received a letter from the Listing Qualifications Staff (the “Staff”) of Nasdaq indicating that the

bid price for the Company’s common stock for the last 30 consecutive business days had closed below the minimum $1.00 per share

required for continued listing under Nasdaq Listing Rule 5550(a)(2).

Under

Nasdaq Listing Rule 5810(c)(3)(A), we have been granted a 180 calendar day grace period, or until June 24, 2025, to regain compliance

with the minimum bid price requirement. The continued listing standard will be met if we evidence a closing bid price of at least $1.00

per share for a minimum of 10 consecutive business days during the 180 calendar day grace period. In order for Nasdaq to consider granting

us additional time beyond June 24, 2025, we would be required, among other things, to meet the continued listing requirement for market

value of publicly held shares as well as all other standards for initial listing on Nasdaq, with the exception of the minimum bid price

requirement. In the event that we do not regain compliance with the $1.00 bid price requirement by June 24, 2025, eligibility for Nasdaq’s

consideration of a second 180 day grace period would be determined on our compliance with the above referenced criteria on June 24, 2025.

We

are diligently working to evidence compliance with the minimum bid price requirement for continued listing on Nasdaq; however, there

can be no assurance that we will be able to regain compliance or that Nasdaq will grant us a further extension of time to regain compliance,

if necessary. If we fail to regain compliance with the Nasdaq continued listing standards, our common stock will be subject to delisting

from Nasdaq.

2024

Third Future Receipts Financing

On

August 1, 2024, we entered into an agreement of sale of future receipts (“Third Future Receipts Financing Agreement”) with

RDM Capital Funding (“RDM”) by which RDM purchased from us our future accounts and contract rights arising from the sale

of goods or rendition of services to our customers. The purchase price was $500,000, which was paid to us on August 2, 2024, net of $17,500

origination fee. We also incurred $17,500 brokerage fee. The Third Future Receipts Financing Agreement requires 32 weekly payments of

$21,094 for a total repayment of $675,000 over the term of the agreement.

2024

Second Future Receipts Financing

On

June 27, 2024, we entered into an agreement of sale of future receipts (“Second Future Receipts Financing Agreement”) with

Slate Advance (“Slate”) by which Slate purchased from us our future accounts and contract rights arising from the sale of

goods or rendition of services to our customers. The purchase price was approximate $1.5 million, which was paid to us on June 28, 2024,

net of $42,000 origination fee. We also incurred $22,000 brokerage fee which was paid subsequently in July 2024. The Second Future Receipts

Financing Agreement required 32 weekly payments of $60,718 for a total repayment of approximately $1.9 million over the term of the agreement.

During

the three and six months ended June 30, 2024, the Company recognized $9,000 interest expense from the amortization of debt discount using

the effective interest rate method, respectively. As of June 30, 2024, the outstanding balance under the Second Future Receipts Financing

Agreement was $1.4 million, net of debt discount of $548,000.

On

November 5, 2024, we entered into an agreement with Slate (the “Amended Second Future Receipts Financing Agreement”) pursuant

to which the original Second Future Receipts Financing Agreement was amended by increasing the receivables purchased amount to approximately

$2.1 million and the purchase price to approximately $1.6 million, less the origination fees of $35,000 and the outstanding balance of

approximately $1.0 million under the agreement, resulting in net proceeds to us of $527,000. The Amended Second Future Receipts Financing

Agreement shall be repaid by us in 24 weekly installments of $89,000.

2024

Agreement of the Sale of Future Receipts

On

February 14, 2024, we entered into an agreement of the sale of future receipts (“Future Receipts Financing Agreement”) with

Libertas Funding, LLC pursuant to which we sold, in exchange for a purchase price of approximately $2.5 million, all of our rights in

20% of our future receipts of approximately $4.45 million until approximately $2.96 million, plus fees, is delivered to Libertas Funding,

LLC. As of June 30, 2024, the outstanding balance under the Future Receipts Financing Agreement was $1.9 million, net of debt discount

of $210,000.

Corporate

Information

We

were initially organized in Nevada in July 1989. Effective June 18, 2015, we changed our state of incorporation from the State of Nevada

to the State of Delaware. Our principal executive offices are located at 711 Stewart Ave, Suite 200, Garden City, NY 11530 and our telephone

number is 215-345-0919.

The

Offering

| Common

stock offered by us |

|

Up

to $7,730,973 of shares of Common Stock that we may sell to Keystone, from time to time at our sole discretion over the next twenty-four

months in accordance with the Purchase Agreement; and 352,176 shares of Common Stock, which are being issued for no cash consideration

as a fee for Keystone’ execution of the Purchase Agreement (the “Commitment Shares”). We will not receive any cash

proceeds from the issuance of the Commitment Shares. |

| |

|

|

| Common

stock outstanding immediately prior to this offering |

|

29,874,029

shares. |

| |

|

|

| Common

stock outstanding after this offering |

|

47,023,481

shares of Common Stock, assuming the sale of 16,806,463 shares (which would be the full amount offered under this prospectus supplement

at a price of $0.46 per share, which was the closing price of our Common Stock on the Nasdaq Capital Market on January 28, 2025,

and the Commitment Shares. The actual number of shares issued will vary depending on the sales prices in this offering, but will

not, unless prior stockholder approval is obtained, be greater than 5,971,818 shares of common stock, which number of shares is equal

to 19.99% of the shares of the common stock outstanding immediately prior to the execution of the Purchase Agreement (the “Exchange

Cap”), unless we obtain stockholder approval to issue shares of common stock in excess of the Exchange Cap in accordance with

applicable Nasdaq rules. |

| |

|

|

| Use

of proceeds: |

|

We

intend to use the proceeds from this offering for working capital and general corporate purposes, which may include capital expenditures,

product development and commercialization expenditures, and acquisitions of companies, businesses, technologies and products within

and outside the diagnostic services, genomics and consumer products industry; provided, however, that such use of proceeds shall

include a commitment from us to use 30% of the net proceeds from any sale of Common Stock in this offering towards the redemption

of any preferred stock issued by the Company during the period commencing on the date this prospectus supplement is filed and expiring

on the date the Purchase Agreement is terminated pursuant to the terms of the Purchase Agreement (the “Investment Period”)

in accordance with the terms of such preferred stock, at a premium of 20% of the greater of (i) the outstanding principal face value

of such securities, including accrued and unpaid dividends and (ii) the intrinsic underlying value of such securities. See “Use

of Proceeds” on page S-11 of this prospectus supplement. |

| |

|

|

| Risk

factors: |

|

This

investment involves a high degree of risk. See the information contained in or incorporated by reference under “Risk Factors”

beginning on page S-6 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement. |

| |

|

|

| Nasdaq

Capital Market Symbol: |

|

Our

common stock is listed on The Nasdaq Capital Market under the symbol “PRPH.” |

The

number of shares of our common stock to be outstanding after this offering is based on 29,874,029 shares of common stock outstanding

as of January 28, 2025 and excludes the following:

| |

● |

3,913,750

shares of common stock issuable upon the exercise of stock options outstanding under our equity compensation plans and inducement

stock option awards, with a weighted-average exercise price of $ 6.64 per share; |

| |

● |

615,775

shares of common stock issuable upon the exercise of warrants with a weighted average exercise price of $5.93 per share; |

| |

● |

372,035

shares of common stock reserved for future issuance under our 2022 Equity Compensation Plan (the “2022 Plan”); and |

| |

● |

300,000

shares of common stock reserved for future issuance under our 2022 Directors’ Equity Compensation Plan (the “2022 Directors’

Plan”). |

Except

as otherwise indicated herein, all information in this prospectus supplement assumes:

| |

● |

no

issuance of shares of common stock valued at $2.0 million which are issuable to Stella Diagnostics Inc. (“Stella”) and

Stella DX, LLC (“Stella DX” and, together with Stella, the “Stella Sellers”), pursuant to the Asset Purchase

Agreement, dated December 15, 2022, by and between us and the Stella Sellers (the “Stella Purchase Agreement”), upon

the Commercialization Event (as defined in the Stella Purchase Agreement). |

RISK

FACTORS

An

investment in our shares of common stock involves a high degree of risk. Before deciding whether to invest in our securities, you should

carefully consider the risks discussed under the sections captioned “Risk Factors” contained in our Annual Report on Form

10-K for the fiscal year ended December 31, 2023, as amended (the “Form 10-K”), any subsequently filed Quarterly Report on

Form 10-Q and in other documents that we subsequently file with the SEC, all of which are incorporated by reference in this prospectus

supplement and the accompanying prospectus in their entirety, together with other information in this prospectus supplement, the accompanying

prospectus, the information and documents incorporated by reference herein and therein, and in any free writing prospectus that we have

authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results

of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in

a loss of all or part of your investment.

Risks

Relating to this Offering and Ownership of Our Common Stock

It

is not possible to predict the actual number of shares of our Common Stock, if any, we will sell under the Purchase Agreement, or the

actual gross proceeds resulting from those sales or the dilution to you from those sales.

Pursuant

to the Purchase Agreement, Keystone shall purchase from us up to $7,730,973 of shares of our Common Stock. Sales of our Common Stock,

if any, to Keystone under the Purchase Agreement will depend upon market conditions and other factors to be determined by us. We may

ultimately decide to sell to Keystone all, some or none of the Common Stock that may be available for us to sell to Keystone pursuant

to the Purchase Agreement. Accordingly, we cannot guarantee that we will be able to sell all of the $7,730,973 of shares or how much

in proceeds we may obtain under the Purchase Agreement. If we cannot sell securities pursuant to the Purchase Agreement, we may be required

to utilize more costly and time-consuming means of accessing the capital markets, which could have a material adverse effect on our liquidity

and cash position.

Because

the purchase price per share of Common Stock to be paid by Keystone for the Common Stock that we may elect to sell to Keystone under

the Purchase Agreement, if any, will fluctuate based on the market prices of our Common Stock at the time we make such election, it is

not possible for us to predict, as of the date of this prospectus and prior to any such sales, the number of shares of Common Stock that

we will sell to Keystone under the Purchase Agreement, the purchase price per share that Keystone will pay for shares of Common Stock

purchased from us under the Purchase Agreement, or the aggregate gross proceeds that we will receive from those purchases by Keystone

under the Purchase Agreement.

Keystone

will pay less than the then-prevailing market price for our Common Stock, which could cause the price of our Common Stock to decline.

The

purchase price of our Common Stock to be sold to Keystone under the Purchase Agreement is derived from the market price of our Common

Stock on Nasdaq. Shares to be sold to Keystone pursuant to the Purchase Agreement will be purchased at a discounted price.

For

example, we may effect sales to Keystone pursuant to a Fixed Purchase Notice (as defined below) at a purchase price equal to the lesser

of 90% of (i) the daily VWAP (as defined below) of the Common Stock for the five trading days immediately preceding the applicable Fixed

Purchase Date (as defined below) and (ii) the lowest traded price of a share of Common Stock on the applicable Fixed Purchase Date during

the full trading day on such applicable Purchase Date. See “The Committed Equity Financing” for more information.

As

a result of this pricing structure, Keystone may sell the shares they receive immediately after receipt of such shares, which could cause

the price of our Common Stock to decrease.

Investors

who buy shares of Common Stock from Keystone at different times will likely pay different prices.

Pursuant

to the Purchase Agreement, we have discretion, to vary the timing, price and number of shares of Common Stock we sell to Keystone. If

and when we elect to sell shares of Common Stock to Keystone pursuant to the Purchase Agreement, after Keystone has acquired such shares,

Keystone may resell all, some or none of such shares at any time or from time to time in its sole discretion and at different prices.

As a result, investors who purchase shares from Keystone in this offering at different times will likely pay different prices for those

shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in their investment

results. Investors may experience a decline in the value of the shares they purchase from Keystone in this offering as a result of future

sales made by us to Keystone at prices lower than the prices such investors paid for their shares in this offering. In addition, if we

sell a substantial number of shares to Keystone under the Purchase Agreement, or if investors expect that we will do so, the actual sales

of shares or the mere existence of our arrangements with Keystone may make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise wish to effect such sales.

You

may experience dilution as a result of future equity offerings.

In

order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. The price per share

at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions

may be lower than the price per share paid by investors in this offering.

We

have a limited number of shares of Common Stock available for future issuance which could adversely affect our ability to raise capital

or consummate strategic transactions.

We

are currently authorized to issue $7,730,973 shares of Common Stock under our Certificate of Incorporation. As of January 28, 2025 and

prior to commencement of this offering, we had approximately 14,924,411 shares of Common Stock unreserved and available for issuance.

Due to the limited number of authorized shares available for issuance and the decreased price of our Common Stock in recent months, we

may not able to raise additional equity capital or complete a merger or other business combination unless we increase the number of shares

we are authorized to issue. We would need to seek stockholder approval to increase the number of our authorized shares of Common Stock,

and we can provide no assurance that we would succeed in amending our Certificate of Incorporation to increase the number of shares of

Common Stock we are authorized to issue which could negatively impact our business, prospects and results of operations.

Our

shares of Common Stock could be delisted from the Nasdaq Capital Market which could result in, among other things, a decline in the price

of our Common Stock and less liquidity for holders of shares of our Common Stock.

Our

Common Stock is listed on the Nasdaq, which imposes, among other requirements, a minimum $1.00 per share bid price requirement for continued

inclusion on the Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”). The closing bid price for

our Common Stock must remain at or above $1.00 per share to comply with the Bid Price Requirement for continued listing. On December

26, 2024 we received a deficiency letter from the Staff of the Nasdaq notifying us that, for the preceding 30 consecutive trading days,

the closing bid price for shares of our Common Stock was below $1.00 per share and that we had failed to comply with the Bid Price Requirement.

In

accordance with Nasdaq rules, we have been provided an initial period of 180 calendar days, or until June 24, 2025 (the “Compliance

Date”), to regain compliance with the Bid Price Requirement. If, at any time before the Compliance Date, the closing bid price

for shares of our Common Stock is at least $1.00 for a minimum of 10 consecutive business days, the Staff will provide us written confirmation

of compliance with the Bid Price Requirement. If we do not regain compliance with the Bid Price Requirement by the Compliance Date, we

may be eligible for an additional 180 calendar day compliance period. To qualify, we would be required to meet the continued listing

requirement for market value of publicly held shares and other initial listing standards for Nasdaq, with the exception of the Bid Price

Requirement, and would need to provide written notice of our intention to cure the deficiency during the second 180 calendar day compliance

period, by effecting a reverse stock split, if necessary. If we do not regain compliance with the Bid Price Requirement by the Compliance

Date and are not eligible for the additional 180 calendar day compliance period at that time, the Staff will provide written notification

to us that shares of our Common Stock will be subject to delisting. At that time, we may appeal the Staff’s delisting determination

to a Nasdaq Hearing Panel. There can be no assurance that we will regain compliance with the Bid Price Requirement within any compliance

period, we will be eligible for an additional 180 calendar day compliance period, any appeal to the Nasdaq Hearing Panel will be successful

or that we will otherwise maintain compliance with any of the other Nasdaq listing requirements.

Delisting

from the Nasdaq could make trading our Common Stock more difficult for investors, potentially leading to declines in our share price

and liquidity. If our Common Stock is delisted by Nasdaq, our Common Stock may be eligible to trade on an over-the-counter quotation

system, where an investor may find it more difficult to sell our stock or obtain accurate quotations as to the market value of our Common

Stock. We cannot assure you that our Common Stock, if delisted from Nasdaq, will be listed on another national securities exchange or

quoted on an over-the counter quotation system.

The

terms of the Purchase Agreement limit the amount of shares of Common Stock we may issue to Keystone, which may have an adverse effect

on our liquidity.

The

Purchase Agreement includes restrictions on our ability to sell shares of our common stock to Keystone, including, subject to specified

limitations, if a sale would cause Keystone and its affiliates to beneficially own more than 4.99% of our issued and outstanding common

stock. Sales under the Purchase Agreement may also be limited by the Exchange Cap as discussed in the section of this prospectus supplement

entitled “The Offering.” Accordingly, we cannot guarantee that we will be able to sell all $7,730,973 of shares of common

stock in this offering. If we cannot sell the full amount of the shares that Keystone has committed to purchase because of these limitations,

we may be required to utilize more costly and time-consuming means of accessing the capital markets, which could materially adversely

affect our liquidity and cash position.

If

we sell shares of our Common Stock under the Purchase Agreement, our existing stockholders will experience immediate dilution and, as

a result, our stock price may go down.

Pursuant

to the Purchase Agreement, we have agreed to sell up to $7,730,973 of shares of our common stock at our option and subject to certain

limitations. For additional details on this financing arrangement, please refer to “Plan of Distribution” located elsewhere

in this prospectus supplement. The sale of shares of our Common Stock pursuant to the Purchase Agreement will have a dilutive impact

on our existing stockholders. Keystone may resell some or all of the shares we issue to it under the Purchase Agreement and such sales

could cause the market price of our Common Stock to decline, which decline could be significant. We cannot predict the effect that future

sales of our Common Stock or other equity-related securities would have on the market price of our Common Stock.

Future

sales of a significant number of our shares of Common Stock in the public markets, or the perception that such sales could occur, could

depress the market price of our shares of Common Stock or cause it to be highly volatile.

A

substantial number of shares of Common Stock will be available for issuance under the Purchase Agreement, and we cannot predict if and

when these shares of Common Stock will be resold in the public markets. We cannot predict the number of these shares that might be resold

nor the effect that future sales of our shares of Common Stock would have on the market price of our shares of Common Stock. We may issue

additional shares of Common Stock at a discount from the current trading price of our Common Stock. As a result, our stockholders would

experience immediate dilution upon the issuance of any shares of our Common Stock at such discount or as a result of such adjustment.

In addition, as opportunities present themselves, we may enter into financing or similar arrangements in the future, including the issuance

of debt securities, preferred stock or Common Stock. Sales of a substantial number of our shares of Common Stock in the public markets,

or the perception that such sales could occur, could depress the market price of our shares of Common Stock or cause it to be highly

volatile and impair our ability to raise capital through the sale of additional equity securities.

Our

stock price is and may continue to be volatile and you may not be able to resell our securities at or above the

price

you pay for such securities.

The

market price for our Common Stock is volatile and may fluctuate significantly in response to a number of factors, many of which we cannot

control, such as quarterly fluctuations in financial results, the timing and our ability to advance the development of our product candidates

or changes in securities analysts’ recommendations, any of which could cause the price of our Common Stock to fluctuate substantially.

Each of these factors, among others, could harm your investment in our securities and could result in your being unable to resell any

of our securities that you purchase at a price equal to or above the price you paid.

In

the past, when the market price of a stock has been volatile, holders of that stock have sometimes instituted securities class action

litigation against the issuer. If any of our stockholders were to bring such a lawsuit against us, we could incur substantial costs defending

the lawsuit and the attention of our management would be diverted from the operation of our business.

As

an investor, you may lose all of your investment.

Investing

in our securities involves a high degree of risk. As an investor, you may never recoup all, or even part, of your investment and you

may never realize any return on your investment. You must be prepared to lose all of your investment.

Management

will have broad discretion as to the use of proceeds from this offering and may not use them effectively.

Our

management will have broad discretion as to the application of the net proceeds from this offering and our stockholders will not have

the opportunity as part of their investment decisions to assess whether the net proceeds are being used appropriately. You may not agree

with our decisions, and our use of the proceeds may not yield any return on your investment. Because of the number and variability of

factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently

intended use. Our failure to apply the net proceeds of this offering effectively could compromise our ability to pursue our growth strategy

and we might not be able to yield a significant return, if any, in our investment of these net proceeds. You will not have the opportunity

to influence our decisions on how to use our net proceeds from this offering.

Risks

Related to Our Business Generally

FDA’s

finalized regulations on laboratory-developed tests may impact our operations adversely, and we may not be able to comply with the requirements.

We

market our genetic tests as laboratory-developed tests (“LDT”), and plan to also initially market our BE-Smart Esophageal

Pre-Cancer as an LDT. Until recently, the FDA has exercised enforcement discretion on LDTs that are marketed in the United States, provided

that the LDTs can meet certain conditions that the FDA has outlined. However, on May 6, 2024, the FDA issued a final rule aimed at helping

to ensure the safety and effectiveness of laboratory developed tests (LDTs). The rule amends the FDA’s regulations to make explicit

that in vitro diagnostic products (“IVD”) are medical devices under the Federal Food, Drug, and Cosmetic Act (FD&C Act)

including when the manufacturer of the IVD is a laboratory. Along with this amendment, the FDA is finalizing a policy under which the

FDA will provide greater oversight of IVDs offered as LDTs through a phaseout of its general enforcement discretion approach for LDTs

over the course of four years, as well as targeted enforcement discretion policies for certain categories of IVDs manufactured by laboratories.

As a result of the final regulations, premarket review, clearance, or approvals may be required by FDA for the products that we are currently

marketing or plan to market as LDTs. Our business and operations may be adversely affected because we may be required to cease sales

of such products and be required to expend significant resources into collecting data from clinical trials, ensuring compliance with

the applicable requirements for medical devices, and preparing and submitting premarket applications for the FDA’s review. We may

not be able to complete the required clinical trials to enable marketing of our tests due to resource constraints, or we may not be able

to complete them in a timely manner. We also may not be able to comply with the associated regulatory requirements including those of

premarket authorization, medical device reporting, quality system regulations, and others. In addition, even if we are able to comply

with such requirements or complete the clinical trials in a timely manner, there is no guarantee that FDA will clear or approve our products.

FDA may also determine that our tests are not safe or effective, and that they must be removed from the market. The FDA may bring enforcement

actions against LDTs that are on the market by sending warning letters, untitled letters, it-has-come-to-our-attention letters, or through

other actions such as seizure, recalls, civil monetary penalties, injunction, and import refusals and import alerts, among others. If

we cannot obtain the required premarket review, clearance, or approval, we may be forced to stop the marketing of our products, which

will impact our operations and financial conditions adversely.

Servicing

our debt will require a significant amount of cash, and we may not have sufficient cash flow from our business to pay our debt.

Our

ability to make scheduled payments of the principal of, to pay interest on or to refinance our indebtedness depends on our future performance,

which is subject to economic, financial, competitive and other factors beyond our control. We had, as of September 30, 2024, approximately

(i) $13.5 million in working capital, (ii) $1.1 million in cash and cash equivalents, and (iii) $17.2 million of outstanding indebtedness,

net of discounts. Our business may not generate cash flow from operations in the future sufficient to service our debt obligations and

make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives,

such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our

ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. We may not be able

to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations.

Our

projections of future performance may not be indicative of actual results

From

time to time, we may provide statements to the marketplace in the form of press releases that contain projections related to our future

performance. These include statements relating to our projected revenues, our projected collection of receivables, our estimates of future

operating and financial results and our planned strategic initiatives including our potential discussions regarding strategic partnerships

and M&A activity. Although this information reflects the good faith expectations and estimates of our management based on the information

available at the time that such statements were made, there can be no assurance that our actual performance and results will not differ

materially from those contained in these projections. Investors are cautioned not to place undue reliance on any projections that may

be provided by us.

Cautionary

Note Regarding Forward-Looking Statements

This

prospectus supplement (including any documents incorporated by reference herein) contains statements with respect to us which constitute

‘‘forward-looking statements’’ within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and

are intended to be covered by the ‘‘safe harbor’’ created by those sections. Forward-looking statements, which

are based on certain assumptions and reflect our plans, estimates and beliefs, can generally be identified by the use of forward-looking

terms such as “believes,” “expects,” “may,” “will,” “should,” “could,”

“seek,” “intends,” “plans,” “estimates,” “anticipates” or other comparable

terms. These forward-looking statements include, but are not limited to, statements concerning future events, our future financial performance,

business strategy, product development strategy, and plans and objectives of management for future operations. Our actual results could

differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences

include those discussed in “Risk Factors” in this prospectus supplement and the documents incorporated by reference herein.

We

caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made.

We disclaim any obligation, except as specifically required by law and the rules of the SEC, to publicly update or revise any such statements

to reflect any change in company expectations or in events, conditions or circumstances on which any such statements may be based, or

that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

You

should read this prospectus supplement, the accompanying prospectus, and the documents that we incorporate by reference herein and therein

and have filed as exhibits to the registration statement of which this prospectus supplement is part, completely and with the understanding

that our actual future results may be materially different from what we expect. You should assume that the information appearing in this

prospectus supplement is accurate as of the date on the cover of this prospectus supplement only. Our business, financial condition,

results of operations and prospects may change. We may not update these forward-looking statements, even though our situation may change

in the future, unless we have obligations under the federal securities laws to update and disclose material developments related to previously

disclosed information. We qualify all of the information presented in this prospectus supplement, and particularly our forward-looking

statements, by these cautionary statements.

USE

OF PROCEEDS

The

proceeds (if any) from this offering will vary depending on the number of shares that we offer and the offering price per share. We may

receive gross proceeds of up to $7,730,973 over the term of the Purchase Agreement. We may sell fewer than all of the shares offered

by this prospectus supplement, in which case our net offering proceeds will be less, and we may raise less than the maximum $7,730,973

in gross offering proceeds permitted by this prospectus supplement.

We

intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include capital expenditures,

product development and commercialization expenditures, and acquisitions of companies, businesses, technologies and products within and

outside the diagnostic services, genomics and consumer products industry; provided, however, that such use of proceeds shall include

a commitment from us to use 30% of the net proceeds from any sale of Common Stock in this offering towards the redemption of any preferred

stock issued by the Company during the Investment Period in accordance with the terms of such preferred stock, at a premium of 20% of

the greater of (i) the outstanding principal face value of such securities, including accrued and unpaid dividends and (ii) the intrinsic

underlying value of such securities.

Pending

our use of the net proceeds from this offering, we intend to maintain the net proceeds as cash deposits or cash management instruments,

such as U.S. government securities or money market mutual funds.

DESCRIPTION

OF TRANSACTIONS AND SECURITIES OFFERED

General

On

January 29, 2025, we entered into the Purchase Agreement with Keystone, pursuant to which Keystone has agreed to purchase from us, at

our direction from time to time, in our sole discretion, from and after the date of this prospectus supplement, shares of our Common

Stock having a total maximum aggregate purchase price to Keystone of $7,730,973 (subject to certain limitations contained in the Purchase

Agreement), upon the terms and subject to the conditions contained in the Purchase Agreement. Terms not defined in this section have

the meanings given to them in the Purchase Agreement.

Pursuant

to the terms of the Purchase Agreement, on the date of this prospectus, we are issuing 352,176 Commitment Shares to Keystone on

the date of this prospectus supplement as an initial fee for its commitment to purchase shares of our Common Stock under the Purchase

Agreement.

We

may, from time to time and at our sole discretion, direct Keystone to purchase shares of our Common Stock upon the satisfaction of certain

conditions set forth in the Purchase Agreement at a purchase price per share based on the market price of our Common Stock at the time

of sale as computed under the Purchase Agreement. We will control the timing and amount of any sales of our Common Stock to Keystone,

and Keystone has no right to require us to sell any shares to it under the Purchase Agreement. Keystone may not assign or transfer its

rights and obligations under the Purchase Agreement.

The

Purchase Agreement prohibits us from directing Keystone to purchase any shares of our Common Stock if those shares of our Common Stock,

when aggregated with all other shares of our Common Stock then beneficially owned by Keystone and its affiliates, would result in Keystone

having beneficial ownership, at any single point in time, of more than 4.99% of the outstanding shares of our Common Stock, as calculated

pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, and Rule 13d-3 thereunder (the “Beneficial Ownership

Limitation”) and the Exchange Cap.

We

have agreed to reimburse Keystone for the reasonable legal fees and disbursements of its counsel in an amount not to exceed $25,000.

Purchase

of Shares under the Purchase Agreement

Fixed

Purchases

Under

the Purchase Agreement, subject to certain conditions, we may direct Keystone on any date (the “Purchase Date”) to purchase

(a “Fixed Purchase”) a specified amount of Common Stock, provided that Keystone’s maximum purchase commitment under

any single Fixed Purchase may not exceed the lesser of $100,000 or 100,000 shares of Common Stock.

The

purchase price per share for each such Fixed Purchase will be equal to 90% of the lesser of:

●

the daily volume weighted average price of our Common Stock on the Nasdaq, as reported by Bloomberg Financial LP using the AQR function

for the five Trading Days immediately preceding the applicable Fixed Purchase Date for such Fixed Purchase; and

●

the lowest traded price of a share of our Common Stock on the applicable Fixed Purchase Date for such Fixed Purchase during the full

Trading Day on the Nasdaq following such applicable Purchase Date.

VWAP

Purchase

In

addition to Fixed Purchases, we also have the right to direct Keystone, on any Purchase Date on which we have properly submitted to Keystone

a notice for the maximum amount of shares we are then permitted to sell in a Fixed Purchase, to purchase (a “VWAP Purchase”)

an additional amount of our Common Stock on the immediately following trading day (the “VWAP Purchase Date”), of up to the

lesser of:

●

300% of the number of shares to be purchased pursuant to the corresponding Fixed Purchase; and

●

30% of the aggregate shares of our Common Stock traded during the trading day, beginning at the commencement of regular trading on

the VWAP Purchase Date and ending at the close of regular trading on such VWAP Purchase Date, or, if certain trading volume or

market price thresholds specified in the Purchase Agreement are crossed prior to the close of regular trading on the applicable VWAP

Purchase Date, ending at such earlier time that any one of such thresholds is crossed (the “VWAP Purchase

Period”).

The

purchase price per share for each such VWAP Purchase will be equal to 90% of the lesser of:

●

the volume-weighted average price (VWAP) of our Common Stock during the applicable VWAP Purchase Period on the applicable VWAP

Purchase Date; and

●

the closing sale price of our Common Stock on the applicable VWAP Purchase Date.

Additional

VWAP Purchases

We

also have the right to direct Keystone, prior to 1:00 p.m., Eastern time, on any VWAP Purchase Date for which the applicable VWAP Purchase

Period has ended, to purchase additional shares of our Common Stock in another VWAP Purchase (an “Additional VWAP Purchase”)

on the same trading day (the “Additional VWAP Purchase Date”), of up to the lesser of:

●

300% of the number of shares purchased pursuant to the applicable corresponding Fixed Purchase; and

●

30% of the trading volume in our Common Stock on the Nasdaq during the applicable VWAP Purchase Period on the applicable VWAP

Purchase Date.

We

may, in our sole discretion, submit multiple Additional VWAP Purchase Notices to Keystone on a single Additional VWAP Purchase Date,

provided that (i) such Additional VWAP Purchase Notice is received by Keystone prior to 2:00 p.m., Eastern time, on such Additional VWAP

Purchase Date and (ii) all prior Fixed Purchases, VWAP Purchases and Additional VWAP Purchases (collectively, “Purchases”)

(including those that have occurred earlier on the same trading day) have been completed, and all of the Purchase Shares to be purchased

thereunder have theretofore been properly delivered to Keystone in accordance with the Purchase Agreement.

The

purchase price per share for each such Additional VWAP Purchase will be equal to 90% of the lesser of:

●

the lowest traded price of the Common Stock on the applicable VWAP Purchase Date; and

●

the VWAP during the applicable VWAP Purchase Period.

In

the case of any Purchases, the purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash

dividend, stock split, reverse stock split or other similar transaction occurring during the business days used to compute the purchase

price.

Other

than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the

timing and amount of any sales of our Common Stock to Keystone.

Conditions

to Commencement and for Delivery of Purchase Notices

The

Company’s ability to deliver Purchase Notices to Keystone under the Purchase Agreement are subject to the satisfaction, both at

the time of Commencement and at the time of delivery by the Company of any Purchase Notice to Keystone, of certain conditions, including

the following:

●

the accuracy in all material respects of the representations and warranties of the Company included in the Purchase

Agreement;

●

the accuracy in all material respects of the representations and warranties of Keystone included in the Purchase

Agreement;

●

the Company having performed, satisfied and complied in all material respects with all covenants, agreements and conditions required

by the Purchase Agreement to be performed, satisfied or complied with by the Company;

●

the registration statement to which this prospectus supplement relates remains effective under the Securities Act, and Keystone

being able to utilize this prospectus supplement to resell all of the shares of common stock included in this prospectus

supplement;

●

none of the following events shall have occurred and be continuing: a) the SEC or any other federal or state governmental authority

requested receipt for any additional information relating to this prospectus supplement, or the prospectus or any prospectus

supplement, or for any amendment of or supplement to this prospectus supplement, the prospectus or any prospectus supplement, b) the

SEC or any other federal or state government authority issued any stop order suspending the effectiveness of the registration

statement to which this prospectus supplement relates or prohibiting or suspending the use of this prospectus supplement, or c) the

occurrence of any event, condition, or fact that renders statements in this prospectus supplement, any post-effective amendment, any

registration statement or post-effective amendment, or the prospectus materially untrue or misleading;

●

this prospectus supplement, in final form, shall have been filed with the SEC under Rule 424(b) under the Securities Act within the

applicable time period under Rule 424(b), and all reports, schedules, registrations, forms, statements, information and other

documents required to have been filed by the Company with the SEC pursuant to the reporting requirements of the Exchange Act shall

have been filed with the SEC;

●

trading in the common stock shall not have been suspended by the SEC or the trading market, trading in securities generally on the

Nasdaq shall not have been suspended or limited;

●

the Company shall have complied in all material respects with all applicable federal, state and local governmental laws, rules,

regulations and ordinances in connection with the execution, delivery and performance of the Purchase Agreement and the other

Transaction Documents;

●

the absence of any statute, regulation, order, decree, writ, ruling or injunction by any court or governmental authority of

competent jurisdiction which prohibits the consummation of or that would materially modify or delay any of the transactions

contemplated by the Purchase Agreement;

●

the absence of any action, suit or proceeding before any arbitrator or any court or governmental authority seeking to restrain,

prevent or change the transactions contemplated by the Purchase Agreement, or seeking material damages in connection with such

transactions;

●

the shares of common stock issued pursuant to a Purchase Notice have been duly authorized by all necessary action of the Company and

are issued to Keystone as DWAC shares;

●

all of the shares of common stock that that have been and may be issued pursuant to the Purchase Agreement shall have been approved

for listing or quotation on the Nasdaq Capital Market, subject only to notice of issuance;

●

no condition, occurrence, state of facts or event constituting a Material Adverse Effect shall have occurred and be

continuing;

●

no Person shall have commenced a proceeding against the Company pursuant to or within the meaning of any Bankruptcy Law;

●

the Company shall have timely delivered all Commitment Shares to Keystone as DWAC shares;

●

the Company shall have delivered the Irrevocable Transfer Agent Instructions and Notice of Effectiveness.

●

the Company shall have reserved out of its authorized and unissued Common Stock, 5,500,000 shares of Common Stock solely for the

purpose of effecting Fixed Purchases, VWAP Purchases, and Additional VWAP Purchases;

●

the receipt by Keystone of the opinions, bring-down opinions and negative assurances from outside counsel to the Company in the

forms mutually agreed to by the Company and Keystone prior to the date of the Purchase Agreement; and

●

the receipt by Keystone of the closing certificate from the Company.

Termination

of the Purchase Agreement

Unless

earlier terminated as provided in the Purchase Agreement, the Purchase Agreement will terminate automatically on the earliest to occur

of:

●

expiration of the Registration Statement pursuant to Rule 415(a)(5) of the Securities Act;

●

the date on which Keystone shall have purchased an aggregate of $7,730,973 of shares of common stock pursuant to the Purchase

Agreement;

●

the date on which the common stock shall have failed to be listed or quoted on the Nasdaq Capital Market or any other Eligible

Market;

●

the 30th trading day next following the date on which the Company commences a voluntary bankruptcy case or any third party commences

a bankruptcy proceeding against the Company; and

●

the date on which a custodian is appointed for the Company in a bankruptcy proceeding for all or substantially all of its property

or the Company makes a general assignment for the benefit of its creditors.

The

Purchase Agreement may be terminated by the mutual written consent of the parties, effective as of the date of such mutual written consent

unless otherwise provided in such written consent. In addition, we have the right to terminate the Purchase Agreement at any time after

Commencement, at no cost or penalty, effective upon one trading day’s prior written notice to Keystone, provided we have issued

all Commitment Shares to Keystone, paid all required fees and amounts to Keystone (the “Investor Expense Reimbursement”),

and prior to issuing any press release or making any public statement or announcement with respect to termination, have consulted with

Keystone and obtained Keystone’ consent to the form and substance of such press release or disclosure..

Keystone

may terminate the Purchase Agreement effective upon three trading days’ prior written notice to us if:

●

any condition, occurrence, state of facts or event constituting a “Material Adverse Effect” (as defined in the Purchase

Agreement) has occurred and is continuing;

●

a “Fundamental Transaction” (as defined in the Purchase Agreement) shall have occurred;

●

this prospectus supplement and any New Registration Statement is not filed by the applicable Filing Deadline therefor or declared

effective by the SEC by the applicable Effectiveness Deadline therefor;

●

While the Registration Statement, or any post-effective amendment thereto, is required to be maintained effective and Keystone holds

any Registrable Securities, the effectiveness of the registration statement to which this prospectus supplement relates, or any

post-effective amendment thereto, lapses for any reason (including, without limitation, the issuance of a stop order by the SEC) or

the registration statement or any post-effective amendment thereto, the prospectus contained therein, or any prospectus supplement

otherwise becomes unavailable to Keystone for the resale of all of the securities included therein, and such lapse or unavailability

continues for a period of 20 consecutive trading days;

●