false

0000890394

0000890394

2024-07-16

2024-07-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event Reported): July 16, 2024

| PERASO INC. |

| (Exact

Name of Registrant as Specified in Charter) |

000-32929

(Commission

File Number)

| Delaware |

|

77-0291941 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(I.R.S.

Employer

Identification

Number) |

2309 Bering Dr.

San Jose, California 95131

(Address

of principal executive offices, with zip code)

(408)

418-7500

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class | |

Trading Symbol(s) | |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | |

PRSO | |

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

July 16, 2024, Peraso Inc. (the “Company”) issued a press release providing a business update and announcing unaudited

preliminary revenue for the quarter ended June 30, 2024 (the “Press Release”). A copy of the Press Release is furnished hereto

as Exhibit 99.1 and is incorporated by reference herein.

The

information in Item 2.02 of this Current Report on Form 8-K, including the sections of the Press Release incorporated by reference herein,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”),

or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item

8.01 Other Events.

The

information set forth in the Press Release, solely to the extent such information references the Company’s expectation for the

preliminary revenue estimate for the quarter ended June 30, 2024, together with the paragraphs set forth under the heading “Forward-Looking

Statements,” is incorporated by reference into Item 8.01 of this Current Report on Form 8-K.

The

portions of the Press Release incorporated by reference into Item 8.01 of this Current Report on Form 8-K are being filed pursuant to

Item 8.01. The remaining portions of the Press Release are being furnished pursuant to Item 2.02 of this Current Report on Form 8-K and

shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that

Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall

be expressly set forth by specific reference in such filing.

Because

the Company’s financial statements as of and for the quarter ended June 30, 2024 have not yet been finalized or audited and remain

subject to change, the Company’s final results for such periods may differ materially from the unaudited preliminary financial

information included in the Press Release. Accordingly, you should not place undue reliance on the unaudited preliminary financial information

included in the Press Release.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

PERASO

INC. |

| |

|

|

| Date:

July 16, 2024 |

By: |

/s/

James Sullivan |

| |

|

James

Sullivan |

| |

|

Chief

Financial Officer |

2

Exhibit 99.1

Peraso Announces Preliminary Second Quarter

2024 Revenue Results Above Guidance

Stronger Than

Anticipated Revenue Included First Volume Production Order for mmWave DUNE Platform Solution

SAN JOSE, Calif., July 16, 2024 – Peraso

Inc. (NASDAQ: PRSO) (“Peraso” or the “Company”), a global leader in mmWave technology for 60 GHz unlicensed and

5G licensed networks, today announced preliminary revenue results for the second quarter ended June 30, 2024. Total net revenue for the

second quarter is anticipated to be approximately $4.2 million, exceeding the Company’s previous guidance of revenue to range between

$3.7 million and $4.0 million.

“Our stronger than expected preliminary

revenue results for the second quarter represent strong growth of over 50% sequentially and over 70% year-over-year,” stated Ron

Glibbery, CEO of Peraso. “The higher revenue for the quarter was primarily driven by increased shipments of our end-of life (“EOL”)

memory IC products, combined with a new volume production order for our mmWave antenna modules in support of the initial deployment of

our DUNE platform by a South African service provider. We expect additional incremental orders from this customer in the coming quarters,

together with a growing number of mmWave customer engagements targeting gigabit-speed fixed wireless access applications in dense urban

environments.”

Glibbery concluded, “The

further ramping of our mmWave shipments, as well as continued fulfillment of our sizable backlog orders of EOL memory products, gives

us increased confidence in the Company’s outlook for continued growth in the second half of 2024.”

All results presented in this press release are

preliminary and unaudited, and they are subject to adjustment during the Company’s standard quarterly closing process. Peraso will

report its complete financial results for the second quarter of 2024 in conjunction with the Company’s quarterly earnings conference

call, which is currently planned to be held in August.

Forward-Looking Statements

This press release contains

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, which are intended to be covered by the “safe harbor” created by those sections. All statements

in this release that are not based on historical fact are “forward-looking statements.” These statements may be identified by

words such as “estimates,” “anticipates,” “projects,” “plans,” “strategy,” “goal,”

or “planned,” “seeks,” “may,” “might”, “will,” “expects,” “intends,”

“believes,” “should,” and similar expressions, or the negative versions thereof, and which also may be identified

by their context. All statements that address customer relationships, as well as availability, operating performance, cost benefits, and

advantages of the products of Peraso, market acceptance of Peraso’ products, and anticipated acceptance and use of mmWave technology,

that are not otherwise historical facts, are forward-looking statements.

Forward-looking statements are based on certain

assumptions and expectations of future events that are subject to risks and uncertainties. Actual results and trends may differ materially

from historical results or those projected in any such forward-looking statements depending on a variety of factors. These factors include,

but are not limited to: the timing, receipt and fulfillment of customer orders associated with Peraso’s mmWave products and solutions;

anticipated use of mmWave by Peraso’s customers and intended users of Peraso’s products; the availability and performance

of Peraso’s products and solutions; the successful integration of Peraso’s products and technology with customer and third-party semiconductor;

antenna and system solutions; reliance on manufacturing partners to assist successfully with the fabrication of Peraso’s ICs and

antenna modules; availability of quantities of ICs supplied by Peraso’s manufacturing partners at a competitive cost; level of intellectual

property protection provided by Peraso’s patents; vigor and growth of markets served by Peraso’s customers and operations;

and other risks included in Peraso’s Securities and Exchange Commission filings. Peraso undertakes no obligation to update publicly

any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur

in the future.

About Peraso Inc.

Peraso Inc. (NASDAQ: PRSO) is a pioneer in high-performance

60 GHz unlicensed and 5G mmWave wireless technology, offering chipsets, antenna modules, software and IP. Peraso supports a variety of

applications, including fixed wireless access, immersive video and factory automation. In addition, Peraso’s solutions for data and telecom

networks focus on Accelerating Data Intelligence and Multi-Access Edge Computing, providing end-to-end solutions from the edge to the

centralized core and into the cloud. For additional information, please visit www.perasoinc.com.

Company Contact:

Jim Sullivan, CFO

Peraso Inc.

P: 408-418-7500

E: jsullivan@perasoinc.com

Investor Relations Contacts:

Shelton Group

Brett L. Perry | Leanne K. Sievers

P: 214-272-0070

E: sheltonir@sheltongroup.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

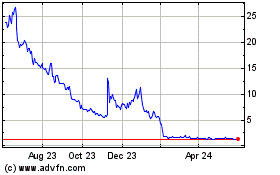

Peraso (NASDAQ:PRSO)

Historical Stock Chart

From Dec 2024 to Jan 2025

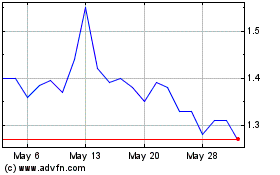

Peraso (NASDAQ:PRSO)

Historical Stock Chart

From Jan 2024 to Jan 2025