UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-40086

Portage Biotech Inc.

(Translation of registrant's name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

Clarence Thomas Building, P.O. Box 4649, Road Town, Tortola, British Virgin Islands, VG1110.

(Address of principal executive office)

c/o Portage Development Services Inc., Ian Walters, 203.221.7378

59 Wilton Road, Westport, Connecticut 06880

(Name, telephone, e-mail and/or facsimile number and Address of Company Contact Person)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

INCORPORATION BY REFERENCE

This report on Form 6-K (including the exhibits attached hereto) shall be deemed to be incorporated by reference into the registration statement on Form S-8 (File No. 333-275842) of Portage Biotech Inc. (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

On December 12, 2024, Portage Biotech Inc. (the “Company”) issued a press release announcing that it received notice from The Nasdaq Stock Market, LLC indicating that the Company was not in compliance with the minimum shareholders’ equity requirement for continued listing on The Nasdaq Capital Market. A copy of the press release is filed herewith as Exhibit 99.1.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Portage Biotech Inc. |

| | | (Registrant) |

| | | |

| | | |

| Date: December 12, 2024 | | /s/ Andrea Park |

| | | Andrea Park |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Portage Biotech Announces Receipt of Nasdaq Noncompliance Letter

- No impact at this time on the listing of the Company’s Ordinary Shares on Nasdaq

- Company intends to submit to Nasdaq a compliance plan

WESTPORT, Conn., Dec. 12, 2024 (GLOBE NEWSWIRE) -- Portage Biotech Inc. (“Portage” or the “Company”) (NASDAQ: PRTG), a clinical-stage immuno-oncology company with a portfolio of novel multi-targeted therapies for use as monotherapy and in combination, announced today that it received written notice (the “Notice”) from The Nasdaq Stock Market, LLC (“Nasdaq”) on December 10, 2024 indicating that the Company was not in compliance with the minimum shareholders’ equity requirement for continued listing on The Nasdaq Capital Market (the “Capital Market”) as set forth in Nasdaq Listing Rule 5550(b)(1) (the “Shareholders’ Equity Requirement”), because the Company’s shareholders’ equity of $695,000 as of September 30, 2024, as reported in the Company’s Report on Form 6-K containing unaudited condensed consolidated interim financial statements for the three and six months ended September 30, 2024, filed with the United States Securities and Exchange Commission (the “SEC”) on November 26, 2024, was below the required minimum of $2.5 million, and because, as of the date of the Notice (and as of the date of this press release), the Company did not meet either of the alternative continued listing standards for the Capital Market, relating to market value of listed securities of at least $35 million or net income from continuing operations of at least $500,000 in the most recently completed fiscal year or in two of the last three most recently completed fiscal years. The Notice has no effect at this time on the listing of the Company’s ordinary shares (the “Ordinary Shares”), which continue to trade on the Capital Market under the symbol “PRTG”.

As indicated in the Notice, the Company has a period of 45 calendar days from the date of the Notice, or until January 24, 2025, to submit to Nasdaq a plan to regain compliance with the Shareholders’ Equity Requirement or achieve compliance with an alternative continued listing standard for the Capital Market (the “Compliance Plan”). If Nasdaq accepts the Compliance Plan, Nasdaq may grant the Company an extension of up to 180 calendar days from the date of the Notice, or until June 8, 2025, to evidence compliance. If Nasdaq does not accept the Compliance Plan, then Nasdaq will provide written notice to the Company that the Ordinary Shares will be subject to delisting. At such time, the Company may appeal the delisting determination to a Nasdaq hearings panel.

The Company intends to submit a Compliance Plan by the January 24, 2025 deadline. There can be no assurance that the Company will be able to regain compliance with the Shareholders’ Equity Requirement, achieve compliance with an alternative continued listing standard for the Capital Market or maintain compliance with any other listing requirements under the Nasdaq Listing Rules.

About Portage Biotech Inc.

Portage is a clinical-stage immuno-oncology company with a portfolio of multi-targeted therapies to extend survival and significantly improve the lives of patients with cancer. The Company has made the decision to discontinue its sponsored trial for its the invariant natural killer T-cell (iNKT) program and pause further patient accrual to its sponsored adenosine trial program (ADPORT-601 trial) for its potentially best-in-class adenosine antagonists PORT-6 (adenosine 2A inhibitor) and PORT-7 (adenosine 2B inhibitor). The Company is exploring strategic alternatives, which may include finding a partner for one or more of its assets, a sale of the company, a merger, restructurings, both in and out of court, a company wind down, further financing efforts or other strategic actions. For more information, please visit www.portagebiotech.com or find us on LinkedIn at Portage Biotech Inc.

Forward-Looking Statements

This press release contains forward-looking statements, including, but not limited to, statements regarding the Company’s ability to regain compliance with the Shareholders’ Equity Requirement, achieve compliance with an alternative continued listing standard for the Capital Market or maintain compliance with any other listing requirements under the Nasdaq Listing Rules, the Company’s intentions to submit a Compliance Plan by the deadline, and the Company’s intention to take actions to regain compliance with the Shareholders’ Equity Requirement or achieve compliance with an alternative continued listing standard for the Capital Market. The Company’s actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, including the risk that the Company may not meet the Shareholders’ Equity Requirement during any compliance period or in the future, the risk that the Company may not otherwise meet the requirements for continued listing for the Capital Market or maintain compliance with any other listing requirements under the Nasdaq Listing Rules, the risk that Nasdaq may not grant the Company relief from delisting if necessary, the risk that the Company may not ultimately meet applicable Nasdaq requirements if any such relief is necessary, and other factors set forth in “Item 3 – Key Information – Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended March 31, 2024, filed with the SEC on August 14, 2024, and “Business Environment – Risk Factors” in the Company’s Management’s Discussion and Analysis for the Three and Six Months ended September 30, 2024 filed as Exhibit 99.2 to the Company’s Form 6-K, filed with the SEC on November 26, 2024. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them as actual results may differ materially from these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof, and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, except as required by law.

FOR MORE INFORMATION, PLEASE CONTACT:

Investor Relations:

ir@portagebiotech.com

Media Relations:

media@portagebiotech.com

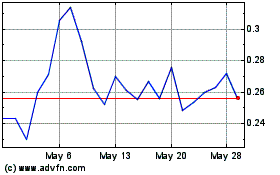

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Dec 2023 to Dec 2024