Pyxis Oncology Provides Corporate Update and Reports Financial Results for Third Quarter 2024

November 12 2024 - 6:30AM

Pyxis Oncology, Inc. (Nasdaq: PYXS), a clinical stage company

focused on developing next generation therapeutics to target

difficult-to-treat cancers, today reported financial results for

the third quarter ended September 30, 2024, and provided a

corporate update. The Company ended the third quarter of 2024 with

$146.3 million in cash, cash equivalents, restricted cash, and

short-term investments, which is expected to provide a cash runway

into the second half of 2026 and enable the Company to fund the

next phase of PYX-201 clinical development.

“At Pyxis Oncology, our team has been working diligently to

deliver preliminary data from our first-in-patient clinical trial

of PYX-201. Investigator enthusiasm around our novel mechanism of

action, along with our clinical development team’s operational

execution, has kept us on track to provide the preliminary clinical

findings from our ongoing dose escalation study,” said Lara S.

Sullivan, M.D., President and CEO of Pyxis Oncology.

Dr. Sullivan continued, “We have now enrolled 80 patients in the

PYX-201 trial across multiple tumor types, and I am thrilled to

present the Phase 1 dose escalation data next Wednesday in New York

City at our first-ever Pyxis Oncology Investor Event.”

Recent Clinical Program Updates

PYX-201

PYX-201 is an antibody-drug conjugate (ADC) that

is designed to uniquely target Extradomain-B Fibronectin (EDB+FN),

which is believed to be a key structural component of the tumor

extracellular matrix. PYX-201 is the Company’s lead clinical

program being evaluated in an ongoing Phase 1 trial in multiple

types of solid tumors.

- To date, 80 subjects have been

dosed with PYX-201 in this Phase 1 trial. Dose escalation and

safety monitoring remain ongoing for the trial.

- The Company will

present preliminary data from the Phase 1 dose escalation trial of

PYX-201, including efficacy, safety, and pharmacokinetics (PK). The

Company will provide an update on future development plans at a

Company hosted investor event in New York City on Wednesday,

November 20, 2024, at 4:30 p.m. ET. Additional information about

the event can be found here.

PYX-106

PYX-106, a fully human Siglec-15-targeting

antibody designed to block suppression of T-cell proliferation and

function, is being evaluated in an ongoing Phase 1 clinical study

in multiple types of solid tumors.

- Dose escalation

of PYX-106 and safety monitoring is ongoing with 45 subjects dosed

to date in the Phase 1 trial.

- The Company

expects to report preliminary data from the Phase 1 trial of

PYX-106, including PK/pharmacodynamic results, by year-end

2024.

Third Quarter 2024 Financial Results

- As of September 30, 2024, Pyxis

Oncology had cash and cash equivalents, including restricted cash

and short-term investments of $146.3 million. The Company believes

that its current cash, cash equivalents, and short-term investments

will be sufficient to fund its operations into the second half of

2026.

- Research and development expenses

were $17.7 million for the quarter ended September 30, 2024,

compared to $14.7 million for the quarter ended September 30, 2023.

The period-over-period increase was primarily due to increased

clinical trial-related expenses, including manufacturing of drug

product and drug substance for our ongoing Phase 1 clinical trials

of PYX-201 and PYX-106.

- General and administrative expenses

were $6.0 million for the quarter ended September 30, 2024,

compared to $10.7 million for the quarter ended September 30, 2023.

The period-over-period decline was primarily due to lower legal,

professional and consulting fees.

- Net loss was $21.2 million, or

($0.35) per common share, for the quarter ended September 30, 2024,

compared to $23.0 million, or ($0.56) per common share, for the

quarter ended September 30, 2023. Net losses for the quarters ended

September 30, 2024, and 2023 included $3.0 million and $5.2

million, respectively, related to non-cash stock-based compensation

expense.

- As of November 12, 2024, the

outstanding number of shares of common stock of Pyxis Oncology was

59,465,729.

About Pyxis Oncology, Inc.Pyxis

Oncology, Inc. is a clinical stage company focused on defeating

difficult-to-treat cancers. The company is efficiently building

next generation therapeutics that hold the potential for mono and

combination therapies. PYX-201, an antibody-drug conjugate (ADC)

that uniquely targets EDB+FN, a non-cellular structural component

of the tumor extracellular matrix, and PYX-106, a fully human

Siglec-15-targeting antibody designed to block suppression of

T-cell proliferation and function, are being evaluated in ongoing

Phase 1 clinical studies in multiple types of solid tumors. Pyxis

Oncology’s therapeutic candidates are designed to directly kill

tumor cells and to address the underlying pathologies created by

cancer that enable its uncontrollable proliferation and immune

evasion. Pyxis Oncology’s ADC and immuno-oncology (IO) programs

employ novel and emerging strategies to target a broad range of

solid tumors resistant to current standards of care. To learn more,

visit www.pyxisoncology.com or follow us

on Twitter and LinkedIn.

Forward-Looking StatementsThis

press release contains forward-looking statements for the purposes

of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

These statements are often identified by the use of words such as

“anticipate,” “believe,” “can,” “continue,” “could,” “estimate,”

“expect,” “intend,” “likely,” “may,” “might,” “objective,”

“ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “to

be,” “will,” “would,” or the negative or plural of these words, or

similar expressions or variations, although not all forward-looking

statements contain these words. We cannot assure you that the

events and circumstances reflected in the forward-looking

statements will be achieved or occur and actual results could

differ materially from those expressed or implied by these

forward-looking statements. Factors that could cause or contribute

to such differences include, but are not limited to, those

identified herein, and those discussed in the section titled “Risk

Factors” set forth in Part II, Item 1A. of the Company’s Quarterly

Report on Form 10-Q filed with SEC on November 12, 2024, and our

other filings, each of which is on file with the Securities and

Exchange Commission. These risks are not exhaustive. New risk

factors emerge from time to time, and it is not possible for our

management to predict all risk factors, nor can we assess the

impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements. In addition, statements that “we believe” and similar

statements reflect our beliefs and opinions on the relevant

subject. These statements are based upon information available to

us as of the date hereof and while we believe such information

forms a reasonable basis for such statements, such information may

be limited or incomplete, and our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all potentially available relevant information. These

statements are inherently uncertain, and investors are cautioned

not to unduly rely upon these statements. Except as required by

law, we undertake no obligation to update any forward-looking

statements to reflect events or circumstances after the date of

such statements.

Pyxis Oncology ContactPamela

ConnealyCFO and COOir@pyxisoncology.com

|

PYXIS ONCOLOGY, INC. Condensed

Consolidated Statements of Operations and Comprehensive

Loss(In thousands, except share and per share

amounts)(Unaudited) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty revenues |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

8,146 |

|

|

$ |

— |

|

|

Sale of royalty rights |

|

|

— |

|

|

|

— |

|

|

|

8,000 |

|

|

|

— |

|

|

Total revenues |

|

|

— |

|

|

|

— |

|

|

|

16,146 |

|

|

|

— |

|

| Costs and operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

— |

|

|

|

— |

|

|

|

475 |

|

|

|

— |

|

|

Research and development |

|

|

17,741 |

|

|

|

14,687 |

|

|

|

44,723 |

|

|

|

37,979 |

|

|

General and administrative |

|

|

6,013 |

|

|

|

10,667 |

|

|

|

20,339 |

|

|

|

26,450 |

|

|

Total costs and operating expenses |

|

|

23,754 |

|

|

|

25,354 |

|

|

|

65,537 |

|

|

|

64,429 |

|

| Loss from operations |

|

|

(23,754 |

) |

|

|

(25,354 |

) |

|

|

(49,391 |

) |

|

|

(64,429 |

) |

| Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and investment income |

|

|

1,846 |

|

|

|

1,707 |

|

|

|

5,419 |

|

|

|

5,036 |

|

|

Sublease income |

|

|

705 |

|

|

|

598 |

|

|

|

2,212 |

|

|

|

1,200 |

|

|

Total other income, net |

|

|

2,551 |

|

|

|

2,305 |

|

|

|

7,631 |

|

|

|

6,236 |

|

| Net loss |

|

$ |

(21,203 |

) |

|

$ |

(23,049 |

) |

|

$ |

(41,760 |

) |

|

$ |

(58,193 |

) |

| Net loss per common share - basic

and diluted |

|

$ |

(0.35 |

) |

|

$ |

(0.56 |

) |

|

$ |

(0.73 |

) |

|

$ |

(1.52 |

) |

| Weighted average shares of common

stock outstanding - basic and diluted |

|

|

60,715,041 |

|

|

|

41,331,806 |

|

|

|

57,511,997 |

|

|

|

38,379,401 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PYXIS ONCOLOGY, INC. Condensed

Consolidated Balance Sheets(In thousands, except

per share amounts)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,056 |

|

|

$ |

9,664 |

|

|

Marketable debt securities, short-term |

|

|

132,762 |

|

|

|

109,634 |

|

|

Restricted cash |

|

|

1,472 |

|

|

|

1,472 |

|

|

Prepaid expenses and other current assets |

|

|

2,578 |

|

|

|

3,834 |

|

|

Total current assets |

|

|

148,868 |

|

|

|

124,604 |

|

| Property and equipment, net |

|

|

10,396 |

|

|

|

11,872 |

|

| Intangible assets, net |

|

|

23,619 |

|

|

|

24,308 |

|

| Right-of-use asset |

|

|

12,428 |

|

|

|

12,942 |

|

| Total

assets |

|

$ |

195,311 |

|

|

$ |

173,726 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,870 |

|

|

$ |

3,896 |

|

|

Accrued expenses and other current liabilities |

|

|

14,057 |

|

|

|

12,971 |

|

|

Operating lease liabilities, current portion |

|

|

1,393 |

|

|

|

1,232 |

|

|

Deferred revenues |

|

|

— |

|

|

|

7,660 |

|

|

Total current liabilities |

|

|

20,320 |

|

|

|

25,759 |

|

| Operating lease liabilities, net

of current portion |

|

|

19,030 |

|

|

|

20,099 |

|

| Financing lease liabilities, net

of current portion |

|

|

117 |

|

|

|

— |

|

| Deferred tax liability, net |

|

|

2,164 |

|

|

|

2,164 |

|

|

Total liabilities |

|

|

41,631 |

|

|

|

48,022 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $0.001 per share |

|

|

— |

|

|

|

— |

|

|

Common stock, par value $0.001 per share |

|

|

59 |

|

|

|

45 |

|

|

Additional paid-in capital |

|

|

481,255 |

|

|

|

411,821 |

|

|

Accumulated other comprehensive income |

|

|

351 |

|

|

|

63 |

|

|

Accumulated deficit |

|

|

(327,985 |

) |

|

|

(286,225 |

) |

|

Total stockholders’ equity |

|

|

153,680 |

|

|

|

125,704 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

195,311 |

|

|

$ |

173,726 |

|

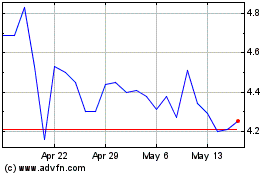

Pyxis Oncology (NASDAQ:PYXS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pyxis Oncology (NASDAQ:PYXS)

Historical Stock Chart

From Dec 2023 to Dec 2024