-- Total revenues increased 47% compared to

prior year --

-- Total operating expenses declined 32%

year-over-year --

-- GoodWheat™ pasta in over

1200 stores within 7 months of launch --

Arcadia Biosciences, Inc.® (Nasdaq: RKDA), a producer and

marketer of innovative, plant-based health and wellness products,

today released its financial and business results for the fourth

quarter and full year of 2022.

“Arcadia has made tremendous progress over the last year,” said

Stan Jacot, president and CEO. “We’ve streamlined the business by

exiting less profitable brands, and we’re focused on the most

compelling opportunities that will build long-term value for our

shareholders.

“As a result, we’ve increased sales and gross margins while

lowering our operating expenses and cash burn,” said Jacot. “For

the full year 2022, our revenues increased 47% compared to 2021,

our reported gross margins were positive for the first time in the

company’s history, and our cash used in operations declined by

nearly 50%.”

“Most importantly, we’ve laid out a long-term strategy for the

future success of the company with Project Greenfield, our 3-year

plan to unlock the company’s potential and create a path to

profitability,” Jacot added. “Building on the successful launch of

GoodWheat, we’re focused on launching or acquiring new categories,

building distribution, and supporting our retail customers and

partners.”

2022 Key Operating and Business Highlights

- Arcadia Successfully Launches

GoodWheat™ Pasta. Arcadia launched its non-GMO GoodWheat

pasta both in retail and online in Q2 of 2022. Made with just one

simple ingredient – Arcadia’s superior wheat grain, carefully

cultivated over 16 years – GoodWheat pasta has four times the fiber

of regular pasta and nine grams of protein per serving. The initial

launch included five of the best-selling pasta varieties – penne,

spaghetti, fettuccine, elbow and rotini – and within 7 months of

launch, GoodWheat pasta was in more than 1,200 stores nationwide,

outperforming expectations.

- Strategic Plan for Long-Term Growth and

Profitability. In Q2, Arcadia introduced Project Greenfield,

a 3-year plan that aligns the company’s resources around solid,

achievable goals to drive shareholder value, including GoodWheat’s

retail expansion, driving growth of core brands and partnerships,

as well as maintaining an agile organization to cultivate next

generation wellness products that make every body feel good, inside

and out.

- Streamlined Operations and Improved

Margins. In Q3, Arcadia took measures to streamline the

business and focus on its higher-margin brands, which included

divesting its legacy manufacturing facility, as well as the Saavy

Naturals body care brand. As a result, the company increased

product margins, and improved operating costs, laying the

groundwork for higher quality revenues and long-term growth.

- HB4® Soybeans Approved in China. In Q2, Arcadia’s

former joint venture partner Bioceres (Nasdaq: BIOX) announced the

approval by China’s Ministry of Agriculture of soybeans produced

using Bioceres’ HB4 technology for import and use as food and feed.

The approval triggered four quarterly milestone payments to Arcadia

totaling $2 million. Arcadia will also receive 6% royalties on

future Bioceres HB4 net revenue, up to $10 million.

- Arcadia Names Stan Jacot as CEO.

In the first quarter of 2022, veteran consumer goods leader Stan

Jacot joined Arcadia as chief executive officer. Jacot has an

impressive track record of implementing transformational business

strategies and profitably driving growth, most recently at Jane’s

Dough Foods where he achieved a double-digit compound annual growth

rate during his six-year tenure. Previously, Jacot held senior

marketing and operations roles at Mission Foods, Borden Dairy

Company, ConAgra Foods and Kellogg Company across the U.S. and

Canada. Jacot was selected after a nationwide search to lead

Arcadia through its next phase and drive aggressive growth for the

company’s existing and emerging better-for-you consumer

brands.

Recent Highlights

- GoodWheat Pasta Certified as “Heart

Healthy” by American Heart Association (AHA). GoodWheat

pasta recently received the AHA’s Heart-Check certification for all

five varieties of its single ingredient noodles. With its high

fiber, lower sodium and zero saturated fat, GoodWheat meets the

AHA’s stringent standards for a heart-healthy pasta and provides

consumers with a better-for-you option that delivers superior

nutrition with the taste and texture of traditional pasta.

Consumers who are looking for heart-healthy wheat pasta can now

enjoy great taste along with 8g of fiber and 9g of protein per

serving.

Arcadia Biosciences,

Inc.

Financial Snapshot

(Unaudited)

($ in thousands)

Three months ended Dec

31

Twelve months ended Dec

31

2022

2021

Favorable/

(Unfavorable)

2022

2021

Favorable/

(Unfavorable)

$

%

$

%

Total Revenues

1,000

2,171

(1,171

)

(54)%

9,956

6,780

3,176

47%

Total Operating Expenses

6,830

15,975

9,145

57%

28,771

42,306

13,535

32%

(Loss) Income From Operations

(5,830

)

(13,804

)

7,974

58%

(18,815

)

(35,526

)

16,711

47%

Net (Loss) Income Attributable to

Common Stockholders

(4,244

)

(9,282

)

5,038

54%

(15,376

)

(14,660

)

(716

)

(5)%

More detailed financial statements are included in the Form 8-K

filed today, available in the Investors section of the company’s

website under SEC Filings.

Revenues

Arcadia’s 2022 revenues were primarily related to sales of

coconut water and body care products, along with GoodWheat pasta

and grain. Arcadia’s revenues for 2021 were primarily related to

sales of coconut water and body care products, as well as GoodWheat

grain and GoodHemp™ seeds. As expected, revenues from legacy

sources continued to wind down during the year and revenues from

GoodWheat products are poised for growth in 2023.

In the fourth quarter of 2022, revenues were $1.0 million,

compared to $2.2 million during the same period 2021 driven

primarily by lower body care sales. Annual revenues for 2022

increased by $3.2 million compared to 2021 driven by higher coconut

water and body care products, along with GoodWheat pasta and grain

sales.

Operating Expenses

Operating expenses for the fourth quarter and year ended

December 31, 2022, were $6.8 million and $28.8 million,

respectively, compared to $16.0 million and $42.3 million during

the same periods in 2021. The quarter-over-quarter decrease in

operating expenses were primarily driven by lower cost of revenues,

lower write-downs of intangible assets, lower selling, general and

administrative expenses (“SG&A”), and the absence of goodwill

impairment in the fourth quarter of 2022. The year-over-year

decrease in operating expenses is primarily attributable to lower

research and development costs (“R&D”), lower write-downs of

intangible and fixed assets, lower SG&A, the absence of

goodwill impairment and a gain on sale of Verdeca in 2022.

Cost of revenues were $1.6 million in the fourth quarter of 2022

compared to $3.8 million during the same period in 2021. The

quarter-over-quarter decrease in cost of revenues is primarily due

to lower sales in the fourth quarter of 2022. Cost of revenues were

$9.8 million for the year ended December 31, 2022 compared to $8.7

million in 2021. The year-over-year increase in cost of revenues is

primarily due to higher sales in 2022.

R&D spending of $501,000 and $1.5 million in the fourth

quarter and year ended December 31, 2022, respectively, decreased

by $59,000 and $2.4 million compared to the same periods in 2021,

primarily due to the increased focus on commercialization versus

R&D activities.

SG&A expenses of $4.2 million and $18.0 million for the

fourth quarter and year ended December 31, 2022, respectively, were

$2.0 million and $4.9 million lower than the same periods in 2021,

primarily driven by lower employee expenses, lease expense and

consulting fees in 2022.

Net Loss Attributable to Common Stockholders

Net loss for the fourth quarter of 2022 was $4.2 million, or a

loss of $6.31 per share, compared to the net loss of $9.3 million

in the fourth quarter of 2021. Net loss for 2022 was $15.4 million,

or a loss of $25.65 per share, compared to the net loss of $14.7

million in 2021. Gains of $10.2 million were realized on the sale

of Bioceres stock in 2021, and there were no similar realized gains

during 2022. The change in the fair value of the common stock

warrant liabilities for 2022 was a non-cash gain of $3.2 million

compared to a non-cash gain of $8.9 million in 2021.

Conference Call and Webcast

The company has scheduled a conference call for 4:30 p.m.

Eastern time (1:30 p.m. Pacific time) today, March 30 to discuss

fourth-quarter and year-end results and the year’s key strategic

achievements. Interested participants can join the conference call

using the following options:

- An audio-only webcast of the conference call will be available

in the Investors section of Arcadia’s website.

- To join the live call, please register here, and a dial-in

number and unique PIN will be provided.

Following completion of the call, a recorded replay will be

available on the company’s investor website.

About Arcadia Biosciences, Inc.

Since 2002, Arcadia Biosciences (Nasdaq: RKDA) has been

innovating crops to provide high-value, healthy ingredients to meet

consumer demands for healthier choices. With its roots in

agricultural innovation, Arcadia cultivates next-generation

wellness products that make every body feel good, inside and out.

The company’s food, beverage and body care products include

GoodWheat™, Zola® coconut water, ProVault™ topical pain relief and

SoulSpring™ bath and body care. For more information, visit

www.arcadiabio.com.

Safe Harbor Statement

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release and the accompanying

conference call contain forward-looking statements about the

company and its products, including statements relating to the

company’s growth, financial performance and commercialization of

products. Forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially,

and reported results should not be considered as an indication of

future performance. These risks and uncertainties include, but are

not limited to: the company’s and its partners’ and affiliates’

ability to develop and sell commercial products incorporating its

traits and to complete the regulatory review process for such

products; the company’s compliance with laws and regulations that

impact the company’s business, including the sale of products

containing CBD, and changes to such laws and regulations; the

growth of the global wheat market; our ability to continue to make

acquisitions and execute on divestitures in accordance with our

business strategy or effectively manage the growth from

acquisitions; and the company’s future capital requirements and

ability to satisfy its capital needs. Further information regarding

these and other factors that could affect the company’s financial

results is included in filings the company makes with the

Securities and Exchange Commission from time to time, including the

section entitled “Risk Factors” and additional information that

will be set forth in its Form 10-K for the year ended December 31,

2022, and other filings. These forward-looking statements speak

only as of the date hereof, and Arcadia Biosciences, Inc.

undertakes no duty to update this information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230330005715/en/

Arcadia Biosciences Contact: T.J. Schaefer

ir@arcadiabio.com

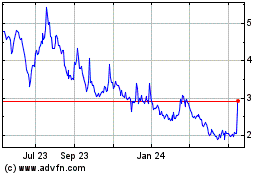

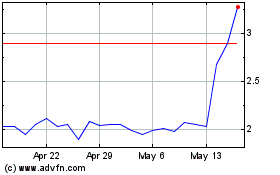

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Feb 2024 to Feb 2025