Revenue up 68% to $10.1 million in FY 2023

Received $30 Million Strategic Investment from

Tether Investments Limited

Planned Redomicile to U.S. to Position the

Company to Compete for U.S. Government and Allied Contracts

Satellogic Inc. (NASDAQ: SATL), a leader in sub-meter resolution

Earth Observation (“EO”) data collection, today provided financial

results for the year ended December 31, 2023, and a business

update.

“The second half of 2023 was highlighted by new partnerships,

continued revenue growth, and milestone accomplishments in our

strategy to capitalize on high-value opportunities in the U.S.,”

said Satellogic CEO, Emiliano Kargieman. “As the EO market and

macroeconomic environment continue to evolve, we are strategically

realigning our business to capture high value opportunities in the

U.S. With our focus on the U.S., we have taken two important steps.

First, we commenced the process of redomiciling to Delaware from

the British Virgin Islands, with an aim to completing the

conversion in the first half of 2024. As a result, once this

process is complete, we will report results on a quarterly basis

consistent with being a domestic filer. Second, in late 2023, we

were granted approval for a remote sensing license for our

constellation with the National Oceanic & Atmospheric

Administration (NOAA). The license results in Satellogic being

subject to NOAA’s oversight as we pivot operational control of our

satellite constellation to U.S. personnel and expand the Satellogic

ground station network to include U.S. based ground stations. These

actions are crucial in terms of satisfying requirements for

expanding business in the U.S. market and better positioning us to

compete for U.S. government and allied contracts. With these two

steps, we anticipate targeting new U.S. government contract

opportunities in 2024, in addition to our current pipeline of

international government and commercial opportunities.

“To support our new strategy, we recently announced a $30

million strategic investment from Tether Investments Limited, the

company behind the world's leading stablecoin. With this

transaction now completed, we are excited to continue advancing our

U.S. strategy, including our redomiciliation to Delaware.”

Matt Tirman, Satellogic President, added, “During the second

half of 2023 we had several compelling wins for our pipeline. With

Tata Advanced Systems Limited (“TASL”), we are establishing and

developing local space technology capabilities in India. Together

we developed a new satellite design and worked together to

integrate multiple payloads on a single satellite that will

generate a diverse range of data over India. This collaboration is

a first step in TASL’s satellite strategy and a significant

milestone as we enter the fast-growing Indian defense and

commercial markets. We also partnered with Uzma, a leading energy

and technology company, to evolve the landscape of satellite

imagery capabilities and geospatial services in Southeast Asia. The

agreement includes leveraging a state-of-the-art EO satellite

designed and manufactured by Satellogic that is planned to be

launched in the second half of 2024 as “UzmaSAT-1” aboard a SpaceX

Falcon 9 rocket, and extensive tasking access to the Satellogic

constellation.

“The results of our efforts were revenue growth of 68%

year-over-year primarily as a result of our Space Systems and Asset

Monitoring businesses gaining momentum. We have proven that it is

possible to provide high-quality satellite imagery through a

constellation of small, low-orbit satellites at what we believe to

be the lowest price, while retaining strong margins. We also

recently celebrated our 16th consecutive successful launch and the

continued expansion of our constellation, adding a NewSat Mark-V

satellite to our fleet in orbit on board SpaceX’s Transporter-10

mission to support our partners and growth. We are consistently

delivering more capacity, more reliability, and next-gen

capabilities for our customers.

“Looking ahead, we are highly focused on a plan to meet the

developing needs of our customers and the broader EO market, while

making our organization more streamlined and efficient. We are

closing in on the strategic realignment of our business to

capitalize on what we believe to be our highest growth

opportunities in the U.S.,” concluded Tirman.

Rick Dunn, Satellogic CFO, commented, “We ended 2023 with $23.5

million of cash on hand and significantly reduced our cash used in

operations by $18.9 million, or 28%. Our revenue grew 68% to $10.1

million and gross profit excluding depreciation increased 84% to

$5.0 million, with a corresponding 500 bps increase in gross margin

to 50%, for the full year 2023. As we move into 2024, we have seen

positive momentum in terms of revenue, backlog and pipeline with

over $12 million signed strategic contracts in the second half of

2023.

“While we are encouraged by our positive momentum, we

experienced slower than anticipated revenue growth. As a result, we

undertook cost and spending control measures in 2023. These actions

primarily related to the moderation of capital expenditures, a

reduction of certain discretionary spending, as well as a headcount

reduction, which represented approximately 25% of the total

headcount at the beginning of 2023. Cumulative reductions in

headcount are expected to result in approximately $7.5 million of

annual savings in 2024.

“We continue to expect that our revenue for 2024 will largely be

dependent on closing opportunities within our Space Systems line of

business, which we anticipate will contribute considerable per unit

cash flow and strong gross margin, although that revenue may be

heavily weighted to the second half of the year. As we look to 2024

and beyond, we are focused on executing on our strategic

realignment and growth opportunities in the U.S. market. We

continue to expect our revenue will be driven by our further growth

in Space Systems, Asset Monitoring, and

Constellation-as-a-Service.

“Lastly, our ability to accurately forecast annual revenue and

profitability relies on the speed and decision-making of our large

commercial partners. This sales cycle is often long and subject to

many variables beyond our control. For these reasons, the Company

is withdrawing its previously communicated guidance. We have no

current plans to publish guidance in the near term, but look

forward to providing periodic updates as we achieve strategic and

commercial milestones,” concluded Dunn.

Financial Results for the Year Ended December 31,

2023

- Revenue for the year ended December 31, 2023, increased

68% to $10.1 million, as compared to revenue of $6.0 million for

the year ended December 31, 2022. The increase was driven primarily

by Space Systems and Asset Monitoring lines of business.

- Gross profit, excluding depreciation expense, for the

year ended December 31, 2023, totalled $5.0 million, an 84%

increase, as compared to $2.7 million for the year ended December

31, 2022. Gross margin was 50% in the full year 2023, as compared

to 45% for the prior year period, due primarily to the year over

year increase in revenue.

- General and administrative expenses were $23.5 million

for the year ended December 31, 2023, as compared to $37.2 million

for the year ended December 31, 2022. The decrease was primarily

due to cost savings initiatives in 2023, lower professional fees

related to elevated merger activity during 2022, and lower

insurance and other administrative expenses.

- Research & Development expenses decreased to $10.7

million for the year ended December 31, 2023, as compared to $13.1

million for the year ended December 31, 2022. The decrease was

driven primarily by a decrease in other research and development

expenses and professional fees, as a result of cost control

measures implemented in 2023. Additionally, employee related

expenses decreased due to lower average headcount in 2023 as

compared to 2022.

- Net loss for the year ended December 31, 2023, increased

to $61.0 million, as compared to a net loss of $36.6 million for

the year ended December 31, 2022. The increase was primarily driven

by a decrease in the change in fair value of financial

instruments.

- Non-GAAP Adjusted EBITDA loss for the year ended

December 31, 2023, decreased to $44.1 million from an Adjusted

EBITDA loss of $56.0 million for the year ended December 31, 2022,

primarily due to an increase in revenue, as well as a decrease in

non-merger related costs and expenses and as a result of cost

control measures implemented in 2023.

- Cash was $23.5 million at December 31, 2023, as compared

to $76.5 million at December 31, 2022.

- Net cash used in operating activities decreased to $49.6

million for the year ended December 31, 2023, as compared to $68.5

million for the year ended December 31, 2022, primarily due to a

reduction in headcount, research and development expenses, and

professional fees.

Use of Non-GAAP Financial Measures

We monitor a number of financial performance and liquidity

measures on a regular basis in order to track the progress of our

business. Included in these financial performance and liquidity

measures are the non-GAAP measures, Non-GAAP EBITDA and Non-GAAP

Adjusted EBITDA. We believe these measures provide analysts,

investors and management with helpful information regarding the

underlying operating performance of our business, as they remove

the impact of items that we believe are not reflective of our

underlying operating performance. The non-GAAP measures are used by

us to evaluate our core operating performance and liquidity on a

comparable basis and to make strategic decisions. The non-GAAP

measures also facilitate company-to-company operating performance

comparisons by backing out potential differences caused by

variations such as capital structures, taxation, capital

expenditures and non-cash items (i.e., depreciation, embedded

derivatives, debt extinguishment and stock-based compensation)

which may vary for different companies for reasons unrelated to

operating performance. However, different companies may define

these terms differently and accordingly comparisons might not be

accurate. Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA are not

intended to be a substitute for any GAAP financial measure. For the

definitions of Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA and

reconciliations to the most directly comparable GAAP measure, net

loss, see below.

We define Non-GAAP EBITDA as net loss excluding interest, income

taxes, depreciation and amortization. We did not incur amortization

expense during the years ended December 31, 2023, 2022 and

2021.

We define Non-GAAP Adjusted EBITDA as Non-GAAP EBITDA further

adjusted for merger-related transaction costs and other income

(expense). Other income (expense) consists of foreign currency

gains and losses, changes in the fair value of financial

instruments, loss on extinguishment of debt and stock-based

compensation.

The following table presents a reconciliation of Non-GAAP

EBITDA and Non-GAAP Adjusted EBITDA to its net loss for the periods

indicated.

Year Ended December

31,

(in thousands of U.S. dollars)

2023

2022

2021

Net loss

$

(61,018

)

$

(36,641

)

$

(96,305

)

Plus interest expense

51

1,596

8,729

Plus income tax expense (benefit)

9,082

4,573

(232

)

Plus depreciation

17,256

14,326

10,728

Non-GAAP EBITDA

$

(34,629

)

$

(16,146

)

$

(77,080

)

Plus Merger transaction costs

—

11,188

16,236

Less other income, net (1)

(9,271

)

(1,140

)

(1,069

)

Less change in fair value of financial

instruments

(6,474

)

(58,311

)

(17,983

)

Plus loss on extinguishment of debt

—

—

37,216

Plus stock-based compensation

6,299

8,368

10,881

Non-GAAP Adjusted EBITDA

$

(44,075

)

$

(56,041

)

$

(31,799

)

Key Second Half 2023 and Subsequent Highlights

- In April 2024, entered into a Note Purchase Agreement, under

which the Company agreed to issue floating rate secured convertible

promissory notes in the aggregate principal amount of $30 million

to Tether Investments Limited, the company behind the world's

leading stablecoin.

- Signed strategic contract with Tata Advanced Systems (“TASL”),

India’s leading private sector player for aerospace and defense

solutions, to build LEO Satellites in India with TASL to establish

an Assembly, Integration, and Testing (“AIT”) facility for

satellites in India and co-develop a satellite design with

Satellogic. Following this collaboration, announced the successful

deployment of TASL’s TSAT-1A satellite aboard the Bandwagon-1

mission on April 7, 2024, via SpaceX’s Falcon 9 rocket launched

from Launch Complex 39A at Kennedy Space Center, Florida.

- Signed a Memorandum of Understanding with TAQNIA ETS to support

the advancement of geospatial technologies for The Saudi Technology

Development And Investment Company (TAQNIA) information

services.

- Signed a Memorandum of Understanding with OHB to explore

collaborative opportunities to develop advanced Earth Observation

data based services. The agreement underlines the joint commitment

to support the use of EO data and products for a greener and more

sustainable planet, including applications for day-to-day

decision-making in the fields of agriculture, forestry, energy,

critical infrastructures, and climate change mitigation.

- Granted a remote sensing license by the National Oceanic and

Atmospheric Administration (“NOAA”) as part of Satellogic’s

strategy to capitalize on high-value opportunities and redomicile

to the U.S., which is expected in the second quarter of 2024.

- NewSat-44, a Mark-V satellite successfully reached low-Earth

orbit following the launch of SpaceX’s Transporter-10 mission on

March 4, 2024 from Vandenberg Space Force Base, California.

- Signed multi-million dollar +3-year agreement with UZMA, a

leading energy and technology company, to advance geospatial

capabilities in Southeast Asia.

- Signed an agreement with Skyloom, a leader in space-based

telecommunications, detailing plans to integrate Skyloom’s Optical

Communications Terminal onto Satellogic satellites to test new

methods of high-resolution EO data delivery.

- Announced partnership and integration with SkyWatch, a leader

in the remote sensing data technology industry bringing

Satellogic’s highest resolution commercially available EO data to

EarthCache customers.

- Announced the integration of Satellogic's satellite imagery

archives into SkyFi's platform, bringing enhanced EO capabilities

to end users and supplementing the existing tasking capabilities

within the Satellogic constellation.

- Signed an agreement with Quant Data & Analytics, a leading

Saudi provider of Data & AI Products and Enterprise Solutions

focused on the real estate and retail sectors. This agreement

leverages Satellogic’s high-resolution satellite imagery to serve

and evolve the ever-expanding property tech landscape across the

Kingdom of Saudi Arabia and the Gulf region.

About Satellogic

Founded in 2010 by Emiliano Kargieman and Gerardo Richarte,

Satellogic (NASDAQ: SATL) is the first vertically integrated

geospatial company, driving real outcomes with planetary-scale

insights. Satellogic is creating and continuously enhancing the

first scalable, fully automated EO platform with the ability to

remap the entire planet at both high-frequency and high-resolution,

providing accessible and affordable solutions for customers.

Satellogic’s mission is to democratize access to geospatial data

through its information platform of high-resolution images to help

solve the world’s most pressing problems including climate change,

energy supply, and food security. Using its patented Earth imaging

technology, Satellogic unlocks the power of EO to deliver

high-quality, planetary insights at the lowest cost in the

industry.

With more than a decade of experience in space, Satellogic has

proven technology and a strong track record of delivering

satellites to orbit and high-resolution data to customers at the

right price point.

To learn more, please visit: http://www.satellogic.com

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the U.S. federal securities laws. The words

“anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”,

“intends”, “may”, “might”, “plan”, “possible”, “potential”,

“predict”, “project”, “should”, “would” and similar expressions may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. These

forward-looking statements are based on Satellogic’s current

expectations and beliefs concerning future developments and their

potential effects on Satellogic and include statements concerning

Satellogic’s strategies, including its plans to redomicile in the

U.S., Satellogic’s future opportunities and financial performance,

and the commercial and governmental applications for Satellogic’s

technology. Forward-looking statements are predictions, projections

and other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. These statements are based on various

assumptions, whether or not identified in this press release. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve, and must not be relied on by an

investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions. Many actual events and circumstances are

beyond the control of Satellogic. Many factors could cause actual

future events to differ materially from the forward-looking

statements in this press release, including but not limited to: (i)

our ability to generate revenue as expected, (ii) our ability to

effectively market and sell our EO services and to convert

contracted revenues and our pipeline of potential contracts into

actual revenues, (iii) risks related to the secured convertible

notes, (iv) the potential loss of one or more of our largest

customers, (v) the considerable time and expense related to our

sales efforts and the length and unpredictability of our sales

cycle, (vi) risks and uncertainties associated with defense-related

contracts, (vii) our ability to scale production of our satellites

as planned, (viii) unforeseen risks, challenges and uncertainties

related to our expansion into new business lines, (ix) our

dependence on third parties to transport and launch our satellites

into space, (x) our reliance on third party vendors and

manufacturers to build and provide certain satellite components,

products, or services, (xi) market acceptance of our EO services

and our dependence upon our ability to keep pace with the latest

technological advances, (xii) competition for EO services, (xiii)

unknown defects or errors in our products, (xiv) risk related to

the capital-intensive nature of our business and our ability to

raise adequate capital to finance our business strategies, (xv)

uncertainties beyond our control related to the production, launch,

commissioning, and/or operation of our satellites and related

ground systems, software and analytic technologies, (xvi) the

failure of the market for EO services to achieve the growth

potential we expect, (xvii) risks related to our satellites and

related equipment becoming impaired, (xviii) risks related to the

failure of our satellites to operate as intended, (xix) production

and launch delays, launch failures, and damage or destruction to

our satellites during launch and (xx) the impact of natural

disasters, unusual or prolonged unfavorable weather conditions,

epidemic outbreaks, terrorist acts and geopolitical events

(including the ongoing conflicts between Russia and Ukraine, in the

Gaza Strip and the Red Sea region) on our business and satellite

launch schedules. The foregoing list of factors is not exhaustive.

You should carefully consider the foregoing factors and the other

risks and uncertainties described in the “Risk Factors” section of

Satellogic’s Annual Report on Form 20-F and other documents filed

or to be filed by Satellogic from time to time with the Securities

and Exchange Commission. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Satellogic

assumes no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. Satellogic can give no assurance that

it will achieve its expectations.

SATELLOGIC INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

Year Ended December

31,

(in thousands of U.S. dollars, except

share and per share amounts)

2023

2022

2021

Revenue

$

10,074

$

6,012

$

4,247

Costs and expenses

Cost of sales, exclusive of depreciation

shown separately below

5,056

3,284

1,876

General and administrative expenses

23,500

37,191

36,640

Research and development

10,656

13,055

9,636

Depreciation expense

17,256

14,326

10,728

Other operating expenses

23,009

29,023

14,002

Total costs and expenses

79,477

96,879

72,882

Operating loss

(69,403

)

(90,867

)

(68,635

)

Other income (expense), net

Finance income (expense), net

1,722

(652

)

(9,738

)

Change in fair value of financial

instruments

6,474

58,311

17,983

Loss on extinguishment of debt

—

—

(37,216

)

Other income, net

9,271

1,140

1,069

Total other income (expense), net

17,467

58,799

(27,902

)

Loss before income tax

(51,936

)

(32,068

)

(96,537

)

Income tax (expense) benefit

(9,082

)

(4,573

)

232

Net loss available to

stockholders

$

(61,018

)

$

(36,641

)

$

(96,305

)

Other comprehensive loss

Foreign currency translation gain (loss),

net of tax

279

(226

)

(86

)

Comprehensive loss

$

(60,739

)

$

(36,867

)

$

(96,391

)

Basic loss per share for the period

attributable to stockholders

$

(0.68

)

$

(0.44

)

$

(5.78

)

Basic weighted-average common shares

outstanding

89,539,910

83,188,276

16,655,634

Diluted loss per share for the period

attributable to stockholders

$

(0.68

)

$

(0.66

)

$

(5.78

)

Diluted weighted-average common shares

outstanding

89,539,910

83,798,149

16,655,634

SATELLOGIC INC.

CONSOLIDATED BALANCE

SHEETS

December 31,

(in thousands of U.S. dollars, except

per share amounts)

2023

2022

ASSETS

Current assets

Cash and cash equivalents

$

23,476

$

76,528

Restricted cash

—

126

Accounts receivable, net of allowance of

$126 and $3,237, respectively

901

1,388

Prepaid expenses and other current

assets

2,173

3,198

Total current assets

26,550

81,240

Property and equipment, net

41,130

47,981

Operating lease right-of-use assets

3,195

8,171

Other non-current assets

5,507

6,463

Total assets

$

76,382

$

143,855

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

7,935

$

9,850

Warrant liabilities

2,795

8,335

Earnout liabilities

419

1,353

Operating lease liabilities

2,143

2,176

Contract liabilities

3,728

1,941

Accrued expenses and other liabilities

4,372

6,417

Total current liabilities

21,392

30,072

Operating lease liabilities

1,789

6,063

Contract liabilities

1,000

1,000

Other non-current liabilities

526

522

Total liabilities

24,707

37,657

Commitments and contingencies (Note

20)

Stockholders' equity

Preferred stock, $0.0001 par value

—

—

Ordinary Shares, $0.0001 par value,

unlimited shares authorized, 77,289,166 Class A ordinary shares

issued and 76,721,343 shares outstanding; and 13,582,642

convertible Class B ordinary shares issued and outstanding as of

December 31, 2023 and 76,180,618 Class A ordinary shares issued and

75,612,795 shares outstanding and 13,582,642 convertible Class B

ordinary shares issued and outstanding as of December 31, 2022

—

—

Treasury stock, at cost, 567,823 shares as

of December 31, 2023 and 567,823 shares as of December 31, 2022

(8,603

)

(8,603

)

Additional paid-in capital

344,144

337,928

Accumulated other comprehensive loss

(33

)

(312

)

Accumulated deficit

(283,833

)

(222,815

)

Total stockholders’ equity

51,675

106,198

Total liabilities and stockholders'

equity

$

76,382

$

143,855

SATELLOGIC INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

Year Ended December

31,

(in thousands of U.S. dollars)

2023

2022

2021

Cash flows from operating

activities:

Net loss

$

(61,018

)

$

(36,641

)

$

(96,305

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation expense

17,256

14,326

10,728

Operating lease expense

2,751

2,015

548

Deferred tax expense (benefit)

—

1,601

(1,619

)

Stock-based compensation

6,299

8,368

10,881

Interest expense

—

1,693

9,703

Change in fair value of financial

instruments

(6,474

)

(58,311

)

(17,983

)

Loss on debt extinguishment

—

—

37,216

Expenses related to Merger

—

9,859

—

Foreign exchange differences

(10,933

)

(4,578

)

(2,385

)

Expense for estimated credit losses on

accounts receivable

1,126

1,736

1,794

Non-cash change in contract

liabilities

1,188

—

—

Other, net

666

996

579

Changes in operating assets and

liabilities:

Accounts receivable

(385

)

(1,928

)

(4,691

)

Prepaid expenses and other current

assets

2,114

(1,855

)

21

Accounts payable

1,533

(3,202

)

1,421

Contract liabilities

598

1,006

480

Accrued expenses and other liabilities

(2,059

)

(1,562

)

21,622

Operating lease liabilities

(2,233

)

(1,985

)

(449

)

Net cash used in operating

activities

(49,571

)

(68,462

)

(28,439

)

Cash flows from investing

activities:

Purchases of property and equipment

(14,885

)

(27,252

)

(11,233

)

Proceeds from sale of property and

equipment

450

—

—

Equity investment in OS

—

(3,653

)

—

Other

—

53

3

Net cash used in investing

activities

(14,435

)

(30,852

)

(11,230

)

Cash flows from financing

activities:

Proceeds from issuance of redeemable

Series X preferred stock

—

—

20,332

Proceeds from issuance of debt

—

—

7,513

Repurchase of stock

—

(8,603

)

—

Tax withholding payments for vested

equity-based compensation awards

(458

)

—

—

Proceeds from exercise of Public

Warrants

—

5,291

—

Proceeds from sale of Ordinary Shares

—

167,504

—

Proceeds from exercise of stock

options

375

144

791

Net cash (used in) provided by

financing activities

(83

)

164,336

28,636

Net (decrease) increase in cash, cash

equivalents and restricted cash

(64,089

)

65,022

(11,033

)

Effect of foreign exchange rate

changes

10,900

4,237

2,299

Cash, cash equivalents and restricted cash

- beginning of period

77,792

8,533

17,267

Cash, cash equivalents and restricted

cash - end of period

$

24,603

$

77,792

$

8,533

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240415804224/en/

Investor Relations:

MZ Group Chris Tyson/Larry Holub (949) 491-8235

SATL@mzgroup.us

Media Relations:

Satellogic pr@satellogic.com

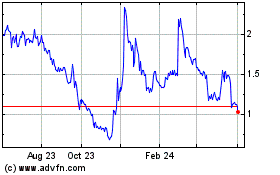

Satellogic (NASDAQ:SATL)

Historical Stock Chart

From Jan 2025 to Feb 2025

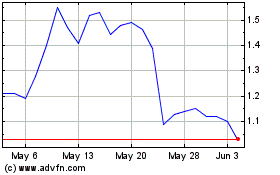

Satellogic (NASDAQ:SATL)

Historical Stock Chart

From Feb 2024 to Feb 2025