UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 27, 2025

SEACOAST BANKING CORPORATION OF FLORIDA

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Florida | 000-13660 | 59-2260678 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 815 COLORADO AVENUE, | STUART | FL | | 34994 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (772) 287-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☑ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.10 par value | SBCF | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SEACOAST BANKING CORPORATION OF FLORIDA

Item 8.01 Other Events

On February 27, 2025, Seacoast Banking Corporation of Florida, a Florida corporation (“Seacoast” or the “Company”) issued a press release announcing that Seacoast and Seacoast’s wholly-owned subsidiary, Seacoast National Bank, a national banking association (“SNB”) have entered into an Agreement and Plan of Merger with Heartland Bancshares, Inc., parent company of Heartland National Bank. Under the terms of the Agreement and Plan of Merger, Heartland Bancshares, Inc. will merge with and into Seacoast, with Seacoast as the surviving company, and Heartland National Bank, a national banking association, will be merged with and into SNB. At the effective time of each of the merger, SNB will be the surviving bank.

Pursuant to General Instruction F to Form 8-K, a copy of the press release is attached hereto as Exhibit 99.1 and is incorporated into this Item 8.01 by this reference.

Seacoast will also discuss the transaction in a conference call on February 28, 2025 at 10:00 a.m. (Eastern Time) Pursuant to General Instruction F to Form 8-K, the slide show presentation related to the transaction and made available in connection with the conference call is attached hereto as Exhibit 99.1 and is incorporated into this Item 8.01 by this reference, and is also available on Seacoast’s Internet website.

All information included in the press release and the slide show presentation is presented as of the respective dates thereof, and Seacoast does not assume any obligation to correct or update such information in the future.

Additional Information

Seacoast and Heartland Bancshares, Inc. will be filing a proxy statement/prospectus relating to the transaction and other relevant documents concerning the transaction with the United States Securities and Exchange Commission (the “SEC”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors will be able to obtain these documents free of charge at the SEC’s website (https://www.sec.gov). In addition, documents filed with the SEC by Seacoast will be available free of charge by contacting Investor Relations at (772) 288-6085.

The directors, executive officers, and certain other members of management and employees of Heartland Bancshares, Inc. are participants in the solicitation of proxies in favor of the transaction from the Heartland Bancshares, Inc. shareholders.

Important Information for Investors and Shareholders

Seacoast will file with the SEC a registration statement on Form S-4 containing a proxy statement of Heartland Bancshares, Inc. and a prospectus of Seacoast, and Seacoast will file other documents with respect to the proposed transaction. A definitive proxy statement/prospectus will be mailed to shareholders of Heartland Bancshares, Inc. Investors and shareholders of Seacoast and Heartland Bancshares, Inc. are urged to read the entire proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and shareholders will be able to obtain free copies of the registration statement and proxy statement/prospectus (when available) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at https://www.sec.gov. Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast’s internet website or by contacting Seacoast.

Heartland Bancshares, Inc., its directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed merger. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Cautionary Notice Regarding Forward-Looking Statements

This current report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and is intended to be protected by the safe harbor provided by the same. These statements are subject to numerous risks and uncertainties. These risks and uncertainties include, but are not limited to, the following: failure to obtain the approval of shareholders of Heartland Bancshares, Inc. in connection with the merger; the timing to consummate the proposed merger; changes in Seacoast’s share price before closing; the risk that a condition to closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for either of the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of Seacoast and Heartland Bancshares, Inc., including unexpected transaction costs, including the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; the difficulties and risks inherent with entering new markets; other factors that may affect future results of Seacoast and Heartland Bancshares, Inc. including changes in asset quality and credit risk, the inability to sustain revenue and earnings growth, changes in interest rates and capital markets, inflation, customer borrowing, repayment, investment and deposit practices, the impact, extent and timing of technological changes, capital management activities and other actions of the Federal Reserve Board, legislative and regulatory actions and reforms and any other changes in general economic conditions. For additional information concerning factors that could cause actual conditions, events or results to materially differ from those described in the forward-looking statements, please refer to the factors set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Seacoast's most recent Form 10-K report, Form 10-Q report and to Seacoast's most recent Form 8-K reports, which are available online at www.sec.gov. No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of Seacoast and Heartland Bancshares, Inc.

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SEACOAST BANKING CORPORATION OF FLORIDA

| | | | | |

| Dated: February 27, 2025 | /s/ Tracey L. Dexter |

| | Tracey L. Dexter |

| | Chief Financial Officer |

Seacoast Announces the Acquisition of Heartland Bancshares, Inc.

Continues Seacoast’s Successful M&A Strategy, Expanding its Footprint in Central Florida

Adds a Seasoned Franchise with a History of High Profitability and Low-Cost Core Deposits

STUART, Fla., February 27, 2025 -- Seacoast Banking Corporation of Florida (“Seacoast” or the “Company”) (NASDAQ: SBCF), the holding company for Seacoast National Bank (“Seacoast Bank”), announced today that it has signed a definitive agreement to acquire Heartland Bancshares, Inc. (“Heartland”), parent company of Heartland National Bank based in Sebring, FL. The proposed transaction will expand Seacoast’s presence into this key Central Florida market.

Heartland operates four branches with deposits of approximately $641 million and loans of approximately $161 million as of December 31, 2024. The proposed transaction is a natural continuation of Seacoast’s M&A strategy and adds a stable, high-quality franchise in a growing market.

“Heartland has an outstanding reputation for exceptional service and strong financial performance, with a deep commitment to the communities it serves for over 25 years, and we look forward to continuing Heartland’s dedication to its customers, employees and shareholders. We see great opportunity in complementing Heartland’s strengths with Seacoast’s innovative products and breadth of offerings to grow our presence and expand our position in the state,” said Charles M. Shaffer, Seacoast’s Chairman and CEO. “The transaction is expected to be accretive to earnings in 2026 with modest dilution of tangible book value. We look forward to welcoming Heartland’s employees and customers to the Seacoast franchise.”

“Since its founding in 1999, Heartland has been committed to providing the very best banking experience for our customers. Now, in partnership with Seacoast, we are positioned to further accelerate this commitment, creating a best-in-class banking experience supported by a great team of professionals,” said James C. Clinard, Chief Executive Officer of Heartland Bancshares, Inc. and Heartland National Bank.“ We are delighted to join forces with Seacoast Bank, which shares our values and has been serving Florida consumers and businesses for nearly a century.”

The proposed transaction exemplifies Seacoast’s M&A focus on consolidation or entry into attractive markets, low concentration risks, high-quality relationship supported franchises, and ease of execution that does not distract from its organic growth strategy. Seacoast expects the transaction to be approximately 7% accretive to earnings per share in 2026, with modest dilution of tangible book value per share that it expects will be earned back in approximately 2.25 years.

Under the terms of the definitive agreement, each share of Heartland common stock will be converted at closing into the right to receive (i) $147.10 in cash, (ii) 4.9164 shares of Seacoast common stock (subject to certain potential adjustments) or (iii) a 50-50 combination of cash and common stock, or a total value of $141.96 per share of Heartland common stock. Shareholders will have the ability to elect to receive stock, cash, or a mix of 50% cash and 50% stock, with the final consideration mix being maintained at 50% cash and 50% stock. Based on Seacoast’s closing price of $27.83 as of February 26, 2025, the aggregate value of merger consideration to be paid by Seacoast would be approximately $110 million.

Closing of the transaction is expected in the third quarter of 2025, following receipt of approvals from regulatory authorities, the approval of Heartland shareholders, and the satisfaction of other customary closing conditions.

Piper Sandler & Co. served as financial advisor and Alston & Bird LLP served as legal counsel to Seacoast. Hovde Group, LLC served as financial advisor and Smith Mackinnon, PA served as legal counsel to Heartland.

Investor Conference Call

Seacoast will host a conference call on Friday, February 28, 2025 at 10:00 a.m. (Eastern Time) to discuss the acquisition. Investors may call in (toll-free) by dialing (800) 715-9871 (Conference ID: 5778023). Charts will be used during the conference call and may be accessed at Seacoast’s website at www.SeacoastBanking.com by selecting “Presentations” under the heading “News/Events.” Additionally, a recording of the call will be made available to individuals shortly after the conference call and can be accessed via a link at www.SeacoastBanking.com under the heading “Corporate Information.” The recording will be available for one year.

About Seacoast Banking Corporation of Florida (NASDAQ: SBCF)

Seacoast Banking Corporation of Florida (NASDAQ: SBCF) is one of the largest community banks headquartered in Florida with approximately $15.2 billion in assets and $12.2 billion in deposits as of December 31, 2024. Seacoast provides integrated financial services including commercial and consumer banking, wealth management, mortgage and insurance services to customers at 77 full-service branches across Florida, and through advanced mobile and online banking solutions. Seacoast National Bank is the wholly-owned subsidiary bank of Seacoast Banking Corporation of Florida. For more information about Seacoast, visit www.SeacoastBanking.com.

Important Information for Investors and Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Seacoast will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 containing a proxy statement of Heartland and a prospectus of Seacoast, and Seacoast will file other documents with the SEC with respect to the proposed merger. A definitive proxy statement/prospectus will be mailed to shareholders of Heartland. Investors and security holders of Seacoast and Heartland are urged to read the entire proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at https://www.sec.gov. Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast’s internet website or by contacting Seacoast.

Seacoast, Heartland, their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Seacoast is set forth in its proxy statement for its 2024 annual meeting of shareholders, which was filed with the SEC on April 8, 2024 and its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new

initiatives and for integration of banks that the Company has acquired, or expects to acquire, including Heartland Bancshares, Inc., as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast or Seacoast National Bank (“Seacoast Bank”) to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements.

All statements other than statements of historical fact could be forward-looking statements. You can identify these forward-looking statements through the use of words such as “may”, “will”, “anticipate”, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the impact of current or future economic and market conditions generally (including seasonality) and in the financial services industry, nationally and within Seacoast’s primary market areas, including the effects of inflationary pressures, changes in interest rates, slowdowns in economic growth, and the potential for high unemployment rates, as well as the financial stress on borrowers and changes to customer and client behavior and credit risk as a result of the foregoing; potential impacts of adverse developments in the banking industry, including those highlighted by high-profile bank failures, and resulting impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto (including increases in the cost of our deposit insurance assessments), the Company's ability to effectively manage its liquidity risk and any growth plans, and the availability of capital and funding; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes including overdraft and late fee caps (if implemented), and including those that impact the money supply and inflation; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; changes in accounting policies, rules and practices; changes in retail distribution strategies, customer preferences and behavior generally and as a result of economic factors, including heightened or persistent inflation; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate, especially as they relate to the value of collateral supporting the Company’s loans; the Company’s concentration in commercial real estate loans and in real estate collateral in Florida; Seacoast’s ability to comply with any regulatory requirements and the risk that the regulatory environment may not be conducive to or may prohibit or delay the consummation of future mergers and/or business combinations, may increase the length of time and amount of resources required to consummate such transactions, and may reduce the anticipated benefit; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of Seacoast’s investments due to market volatility or counterparty payment risk, as well as the effect of a decline in stock market prices on our fee income from our wealth management business; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including Seacoast’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions and realize expected revenues, revenue synergies and expense savings; changes in technology or products that may be more difficult, costly, or less effective than anticipated; the Company’s ability to identify and address increased cybersecurity risks, including those impacting vendors and other third parties which may be exacerbated

by developments in generative artificial intelligence; fraud or misconduct by internal or external parties, which Seacoast may not be able to prevent, detect or mitigate; inability of Seacoast’s risk management framework to manage risks associated with the Company’s business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms; reduction in or the termination of Seacoast’s ability to use the online- or mobile-based platform that is critical to the Company’s business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, including hurricanes in the Company’s footprint, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions and/or increase costs, including, but not limited to, property and casualty and other insurance costs; Seacoast’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company’s operations and tax planning strategies are less than currently estimated, the results of tax audit findings, challenges to our tax positions, or adverse changes or interpretations of tax laws; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non-bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions; the failure of assumptions underlying the establishment of reserves for expected credit losses; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding the federal budget and economic policy, including the impact of tariffs and trade policies; the risk that balance sheet, revenue growth, and loan growth expectations may differ from actual results; and other factors and risks described in any of the Company's subsequent reports filed with the SEC and available on its website at www.sec.gov.

The risks relating to the proposed Heartland Bancshares, Inc. merger include, without limitation, failure to obtain the approval of shareholders of Heartland Bancshares, Inc. in connection with the merger; the timing to consummate the proposed merger; the risk that a condition to the closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of Seacoast and Heartland Bancshares, Inc., including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; the difficulties and risks inherent with entering new markets.

All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10-K for the year ended December 31, 2024 under “Special Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in the Company’s SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet website at www.sec.gov.

###

CONTACT:

Chloe Swicegood

chloe@sachsmedia.com

(850) 702-9800

Acquisition of Heartland Bancshares, Inc. February 27, 2025 2025

2ACQUISITION OF HEARTLAND BANCSHARES, INC. Cautionary Notice Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in Seacoast Banking Corporation of Florida’s (the “Company”) markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired, or expects to acquire, including Heartland Bancshares, Inc. (“Heartland”), as well as statements with respect to the Company's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements. Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of the Company or Seacoast National Bank to be materially different from f u t u r e results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements. All statements other than statements of historical fact could be forward-looking statements. You can identify these forward- looking statements through the use of words such as "may", "will", "anticipate", "assume", "should", "support", "indicate", "would", "believe", "contemplate", "expect", "estimate", "continue", "further", "plan", "point to", "project", "could", "intend", "target" or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the impact of current or future economic and market conditions generally (including seasonality) and in the financial services industry, nationally and within the Company’s primary market areas, including the effects of inflationary pressures, changes in interest rates, slowdowns in economic growth, and the potential for high unemployment rates, as well as the financial stress on borrowers and changes to customer and client behavior and credit risk as a result of the foregoing; potential impacts of adverse developments in the banking industry including those highlighted by high-profile bank failures, and resulting impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto (including increases in the cost of our deposit insurance assessments), the Company's ability to effectively manage its liquidity risk and any growth plans, and the availability of capital and funding; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes including overdraft and late fee caps (if implemented), and including those that impact the money supply and inflation; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; changes in accounting policies, rules and practices; changes in retail distribution strategies, customer preferences and behavior generally and as a result of economic factors, including heightened or persistent inflation; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate, especially as they relate to the value of collateral supporting the Company’s loans; the Company’s concentration in commercial real estate loans and in real estate collateral in Florida; the Company’s ability to comply with any regulatory requirements and the risk that the regulatory environment may not be conducive to or may prohibit or delay the consummation of future mergers and/or business combinations, may increase the length of time and amount of resources required to consummate such transactions, and may reduce the anticipated benefit; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of the Company’s investments due to market volatility or counterparty payment risk, as well as the effect of a decline in stock market prices on our fee income from our wealth management business; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including the Company’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions and realize expected revenues, revenue synergies and expense savings; changes in technology or products that may be more difficult, costly, or less effective than anticipated; the Company’s ability to identify and address increased cybersecurity risks, including those impacting vendors and other third parties which may be exacerbated by developments in generative artificial intelligence; fraud or misconduct by internal or external parties, which the Company may not be able to prevent, detect or mitigate; inability of the Company’s risk management framework to manage risks associated with the Company’s business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms; reduction in or the termination of the Company’s ability to use the online- or mobile-based platform that is critical to the Company’s business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, including hurricanes in the Company’s footprint, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions and/or increase costs, including, but not limited to, property and casualty and other insurance costs; the Company’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company’s operations and tax planning strategies are less than currently estimated, the results of tax audit findings, challenges to our tax positions, or adverse changes or interpretations of tax laws; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non-bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions; the failure of assumptions underlying the establishment of reserves for expected credit losses; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding the federal budget and economic policy, including the impact of tariffs and trade policies; the risk that balance sheet, revenue growth, and loan growth expectations may differ from actual results; and other factors and risks described and in any of the Company's subsequent reports filed with the SEC and available on its website at www.sec.gov. The risks relating to the proposed Heartland merger include, without limitation, failure to obtain the approval of shareholders of Heartland in connection with the merger; the timing to consummate the proposed merger; the risk that a condition to the closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of the Company and Heartland, including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; the difficulties and risks inherent with entering new markets. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10-K for the year ended December 31, 2024 under “Special Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in the Company’s SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at www.sec.gov.

3ACQUISITION OF HEARTLAND BANCSHARES, INC. Important Information For Investors And Shareholders The Company will file with the SEC a registration statement on Form S-4 containing a proxy statement of Heartland and a prospectus of the Company, and the Company will file other documents with respect to the proposed transaction. A definitive proxy statement/prospectus will be mailed to shareholders of Heartland. Investors and shareholders of the Company and Heartland are urged to read the entire proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and shareholders will be able to obtain free copies of the registration statement and proxy statement/prospectus (when available) and other documents filed with the SEC by the Company through the website maintained by the SEC at https://www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s internet website or by contacting the Company. Heartland and its directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed merger. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

4ACQUISITION OF HEARTLAND BANCSHARES, INC. Florida Continues its Strong Economic Growth Trajectory Florida was the top state for net in-migration in 2024 #1 Florida’s population grew 7.7% from 2020 to 2025, the highest during that span 7.7% Projected household income growth from 2025 to 2030 in the state of Florida 10.7% Sources: US Census data as analyzed by National Association of Realtors; The Florida Legislature Office of Economic & Demographic Research; S&P Capital IQ Pro 38.9 31.2 23.2 19.4 13.012.511.811.211.110.1 CATXFLNYPAILOHGANCMI 6.5 6.06.0 5.6 5.04.94.84.8 4.64.4 IDSCFLTXDEUTMTNCSDAZ Population (Millions) Expected 2025-’30 Population Growth (%) As the largest publicly-traded community bank with a dedicated Florida footprint, Seacoast has developed the bank to meet the unique needs of all Floridians. Despite the historic net in-migration experienced in the wake of COVID-19, Florida is still poised for rapid expansion from continued economic and demographic trends. Legacy Wall Street firms are starting large operations in Tampa and Miami and Vanderbilt University is planning to build a new business school in West Palm Beach focused on key growth industries like fintech, cyber security, data analytics and AI. An investment in Heartland Bancshares, Inc. supports commitment to Floridians, where we leverage our deep set of retail and community banking expertise across Florida’s diversified markets.

5ACQUISITION OF HEARTLAND BANCSHARES, INC. “Pure Play” Florida Bank with Opportunities for Continued In-State Growth Florida Deposit Market Share¹ Branch Market Rank Deposits Count Share Institution (ST) (#) ($M) (#) (%) BankUnited Inc. 1 $21,512 50 19.2% SouthState Corp. 2 13,821 90 12.3% Pro Forma 12,749 81 11.3% Seacoast Banking Corp. of FL 3 12,121 77 10.8% Amerant Bancorp Inc. 4 7,321 20 6.5% Ocean Bankshares Inc. 5 5,562 24 5.0% First Federal Bancorp MHC 6 3,421 24 3.0% Villages Bancorp Inc. 7 3,269 20 2.9% Capital City Bank Group Inc. 8 3,239 55 2.9% Banesco USA 9 2,894 6 2.6% FineMark Holdings Inc. 10 2,679 10 2.4% … … … … … Heartland Bancshares Inc. 33 628 4 0.6% Total For Institutions In Market $112,329 687 100.0% Public and Private Florida Banks³ Asset Size Total Traded on NASDAQ & NYSE < $500M 35 0 $500M - $1B 19 1 $1B - $5B 18 4 $5B - $10B 2 1 $10B - $30B 1 1 > $30B 3 2 Total 78 9 Florida’s economic strength is evident. Individual and business migration to Florida has surged, and the economy has diversified across finance and technology. 1. Deposit market share for Florida-based banks as of June 30, 2024. Excludes EverBank Financial Corp. and Raymond James Financial Inc. 2. Includes US chartered subsidiaries of foreign banking organizations. 3. Defined as having all branch locations in the state of Florida. Sources: S&P Capital IQ Pro; FDIC 120 105 2

6ACQUISITION OF HEARTLAND BANCSHARES, INC. Continuing to Build a Florida Bank of Scale Through Successful M&A and Organic Growth 78% 94% 82% 85% 88% 100% 93% 94% 78% 82% 100% 95% 22% 6% 18% 15% 12% 7% 6% 22% 18% 5% $3.1 $3.5 $4.7 $5.8 $6.7 $7.1 $8.3 $9.7 $12.1 $14.6 $15.2 $15.9 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Pro Forma³ Mkt Share FL Mkt Share² #32 #10 #20 #4 #15 #3 Organic Assets ($B) M&A Acquired Assets ($B)¹ 1. Acquired assets reflects target’s publicly available financials from quarter prior to closing. 2. Deposit market share for Florida-based banks as of June 30 every year; Excludes EverBank Financial Corp. and Raymond James Financial Inc. 3. Pro forma for total assets in 2024Q4. Sources: S&P Capital IQ Pro; FDIC

7ACQUISITION OF HEARTLAND BANCSHARES, INC. Heartland Acquisition Establishes Highlands County Presence with #1 Deposit Market Share Heartland Branches (4) Highlands County Seacoast Branches (77) Counties with Seacoast Customers Counties with Seacoast Branches* * Seacoast maintains banking centers, ATMs, and/or loan production offices (LPOs) including an LPO in Atlanta, GA 1. Deposit data as of June 30, 2024 Sources: S&P Capital IQ Pro; FDIC Population Median HH Income County Proj. '25-'30 Growth Proj. '25-'30 Growth Highlands County, FL 3.6% 8.3% Florida 6.0% 10.7% Nationwide 2.4% 8.8% Highlands County, FL Deposit Market Share¹ Branch Market Rank Deposits Count Share Institution (ST) (#) ($000) (#) (%) Heartland Bancshares Inc. (FL) 1 $627,676 4 31.3% SouthState Corp. (FL) 2 267,916 3 13.4% Wells Fargo & Co. (CA) 3 247,829 2 12.4% Truist Financial Corp. (NC) 4 244,757 3 12.2% Crews Banking Corp. (FL) 5 241,821 2 12.1% Bank of America Corporation (NC) 6 221,826 1 11.1% The Toronto-Dominion Bank 7 90,550 1 4.5% FSBH Corp. (FL) 8 59,864 1 3.0% Total For Institutions In Market $2,002,239 17 100.0% Pro Forma Branch Footprint Highlands County, FL Deposit Market Share

• Heartland has achieved stable growth funded by consistent retained earnings without needing to raise capital since being established in 1999 • The bank is proud to support the community and local organizations • Organized by local business leaders, decisions affecting customers are made by directors and employees with deep roots in the communities they serve 8ACQUISITION OF HEARTLAND BANCSHARES, INC. Overview of Heartland Bancshares, Inc. $734 million Assets 1.63% ROAA 25% Loan / Deposit Ratio $161 million Loans 3.37% Net Interest Margin 0.04% NPAs / Assets $641 million Deposits 19.8% ROAE 1.67% Cost of Funds • Heartland Bancshares, Inc. was incorporated in 1999 and is the holding company for Heartland National Bank, headquartered in Sebring, Florida Heartland Financial Highlights¹ 1. Bank level call report data as of and for the year ended December 31, 2024. Source: S&P Capital IQ Pro • Experienced commercial and mortgage lending team with superior knowledge of local markets

9ACQUISITION OF HEARTLAND BANCSHARES, INC. Overview of Highlands County, FL Market Highlights • The major sectors for job opportunities in Highlands County are in the Healthcare and Social Assistance, Retail Trade, Construction and Educational Services fields. • More than 86 percent of Florida’s population is located within a two-hour radius of Highlands County (over 18 million people). • A talent pipeline of more than 22,000 students is available within a one-hour drive and more than 190,000 students are within a two-hour drive. Highlands County is home to South Florida State College and in close proximity to five other colleges / universities. • Overall cost of living advantage of 10 to 15 percent compared to nearby metro areas. Highlands County offers an advantage in low labor costs and competitive real estate options. Major Area Employers 7.1% Population Growth Since 2020 8.3% Projected Household Income Growth Source: Highlands County, FL Economic Development, S&P Capital IQ Pro

10ACQUISITION OF HEARTLAND BANCSHARES, INC. Historically Low Deposit Costs and Attractive Beta Throughout the Cycle 0.12 0.10 0.12 0.17 0.37 0.84 1.10 1.31 1.52 1.55 1.58 1.67 1.65 0.08 0.33 1.68 3.08 4.33 4.83 5.12 5.33 5.33 5.33 5.33 4.83 4.33 0.06 0.06 0.06 0.09 0.21 0.77 1.38 1.79 2.00 2.19 2.31 2.34 2.08 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2021 2022 2023 2024 Heartland Cost of Deposits (%) Fed Funds Rate (%) SBCF Cost of Deposits (%) ~$30,000 Average Deposit Account Balance ~22,000 Number of Deposit Accounts 1.65% Q4’24 Cost of Total Deposits 22.7% 24.3% 66.7% 63.7% 4.3% 4.7% 6.3% 7.3% 12/31/21 12/31/24 Noninterest Bearing Non-Time Interest Bearing CDs < $250K CDs > $250K Source: S&P Capital IQ Pro Heartland Deposit Beta: ~36% Seacoast Deposit Beta: ~48% Stable Deposit Mix with Limited Migration During Rate Cycle Further Improving Seacoast’s Strong Deposit Franchise Non-Time Deposits: 89.4% Non-Time Deposits: 88.0% ~36% Deposit Beta Heartland Deposit Portfolio Highlights ~9 Years Age of Average Non-time Deposit Account $0 Brokered Deposits

11ACQUISITION OF HEARTLAND BANCSHARES, INC. A Financially Compelling Acquisition that Fits with Established Seacoast M&A Strategy Strategic Rationale • Partnering with a bank with a shared philosophy and culture • Entering the Sebring market ranked #1 in deposit market share • Acquiring a strong core deposit franchise • Leveraging significant excess liquidity • Integrating an institution of easily digestible size • Maintaining a well capitalized balance sheet • Inheriting an exceptionally clean credit portfolio • Conservative modeling and balance sheet restructuring drives EPS accretion with low execution risk Structure and Deal Value • Consideration Mix: 50% Stock / 50% Cash • Deal Price per Share: $141.96 • Transaction Value: $109.7 million • Price / TBVPS: 163% • Price to LTM Earnings: 9.3x • Price to 2025E Earnings + Restructuring + Cost Saves: 5.3x ¹ Attractive Key Financial Results EPS and TBV per Share Impact Desirable Earnings Profile Standalone vs. Pro Forma Performance Remain Well Capitalized Estimated Ratios at Closing ~9.4% TCE / TA ~10.6% Leverage Ratio ~14.0% CET1 Ratio ~16.0% TRBC Ratio ~7.0% 2026E EPS Accretion ~6.9% 2027E EPS Accretion ~2.4% TBVPS Dilution at Close 2.25 Years TBVPS Earnback 2026E ROAA 2026E ROATCE 1.03% 1.08% Standalone Pro Forma 11.6% 12.7% Standalone Pro Forma 1. Reflects Seacoast management estimate of Heartland 2025 estimated earnings, fully-phased in cost savings of 25%, and incremental earnings benefit of anticipated balance sheet restructuring. Note: Pro forma impact is inclusive of all purchase accounting adjustments, merger costs, CECL provision expense, and balance sheet restructuring. Market data as of February 26, 2025. Source: S&P Capital IQ Pro ~25% Internal Rate of Return

Appendix 12ACQUISITION OF HEARTLAND BANCSHARES, INC.

13ACQUISITION OF HEARTLAND BANCSHARES, INC. Transaction Structure and Key Terms • Heartland Bancshares, Inc. and Heartland National Bank to merge with and into Seacoast Banking Corporation of Florida and Seacoast Bank • 50% stock / 50% cash consideration • Each share exchanged for stock to receive 4.9164 shares of Seacoast common stock • Each share exchanged for cash to receive $147.10 • Approximately 98% Seacoast / 2% Heartland ownership Structure and Consideration • Subject to Heartland shareholder approval and customary regulatory approvals • Anticipated closing in the third quarter of 2025Approvals and Timing Pre-tax, merger costs of $12.3 millionOne-Time Merger Costs Anticipated cost savings of 25% of Heartland’s non-interest expense base, 75% realized in Q4‘25Cost Savings $6.6 million (4.0%) gross loan mark on Heartland’s loan portfolio at close, consisting of the following components: • $3.7 million, interest rate mark at close (~2.3% of loan value) accreted into earnings over time • $2.4 million, non-PCD loan credit mark at close (~1.6% of loan value) accreted into earnings over time • $0.5 million, PCD loan credit mark at close recorded as allowance for credit losses Additional estimated $2.3 million for CECL Day 2 Provision for non-PCD loans Loan Mark and CECL Assumptions • Core deposit intangible assumed to equal 4.0% of Heartland’s core deposits, amortized SYD over 10 years • Fixed asset write-up of $2.5 million (benefit to equity) • Total liabilities write-down of $0.2 million (benefit to equity) Other Fair Value Market Adjustments • Balance sheet repositioning of approximately $550 million of Heartland cash and securities into higher yielding assets • $412 million of securities pre-purchased with taxable equivalent yield of 5.7%Securities Repositioning • 15% collar on fixed exchange ratio, based on Seacoast stock price performance relative to $29.92 benchmark stock price (illustrated on page 14) • Seacoast walkaway right if Seacoast stock falls more than 20% from benchmark stock price and Heartland doesn’t agree to fix the exchange ratioPrice Protection Collar

Collar Mechanism Provides Price Protection and Upside if SBCF Stock Price Improves 50% Stock / 50% Cash per Share % Change in SBCF Stock Price Implied SBCF Stock Price Applicable Exchange Ratio (100% Stock) Applicable Exchange Ratio (50% Stock) Stock Deal Price per Share Cash Deal Price per Share CIRCLE Deal Price per Share TBV Dilution at Closing EPS Accretion FY'26E TBV Dilution Earnback Period 25.0% $37.40 4.5231x 2.2616x $84.58 $73.55 $158.13 (2.2%) 7.2% Year 2.25 20.0% $35.90 4.7116x 2.3558x $84.58 $73.55 $158.13 (2.3%) 7.1% Year 2.25 15.0% $34.41 4.9164x 2.4582x $84.58 $73.55 $158.13 (2.4%) 7.0% Year 2.25 10.0% $32.91 4.9164x 2.4582x $80.90 $73.55 $154.45 (2.4%) 7.0% Year 2.25 5.0% $31.42 4.9164x 2.4582x $77.23 $73.55 $150.78 (2.4%) 7.0% Year 2.25 0.0% $29.92 4.9164x 2.4582x $73.55 $73.55 $147.10 (2.4%) 7.0% Year 2.25 (5.0%) $28.42 4.9164x 2.4582x $69.87 $73.55 $143.42 (2.4%) 7.0% Year 2.25 (10.0%) $26.93 4.9164x 2.4582x $66.20 $73.55 $139.75 (2.4%) 7.0% Year 2.25 (15.0%) $25.43 4.9164x 2.4582x $62.52 $73.55 $136.07 (2.4%) 7.0% Year 2.25 (20.0%) $23.94 5.2237x 2.6119x $62.52 $73.55 $136.07 (2.5%) 6.9% Year 2.50 (25.0%) $22.44 5.2237x 2.6119x $58.61 $73.55 $132.16 (2.5%) 6.9% Year 2.50 (30.0%) $20.94 5.2237x 2.6119x $54.70 $73.55 $128.25 (2.5%) 6.9% Year 2.50 (35.0%) $19.45 5.2237x 2.6119x $50.80 $73.55 $124.35 (2.5%) 6.9% Year 2.50 SBCF Stock Price is Above $34.41 Fixed Price, Floating Exchange SBCF Stock Price is $25.43 - $34.41 Fixed Exchange Ratio, Deal Price Fluctuates with SBCF Stock Price SBCF Stock Price is $23.94 - $25.42 Fixed Price, Floating Exchange SBCF Stock Price is Below $23.94 SBCF Termination Right if Heartland Does Not Fix Exchange Ratio 14ACQUISITION OF HEARTLAND BANCSHARES, INC.

Conservative Balance Sheet Poised for Accretive Repositioning Post-Closing 15ACQUISITION OF HEARTLAND BANCSHARES, INC. Lo an C om po si tio n D ep os it Co m po si tio n Transaction 49.2% Savings & MMDA 37.6% Retail Time 4.9% Jumbo Time 8.3% $12.2B 4Q’24 Cost: 2.08% Transaction 46.9% Savings & MMDA 41.1% Retail Time 4.7% Jumbo Time 7.3% $641M 4Q’24 Cost: 1.65% Transaction 49.1% Savings & MMDA 37.8% Retail Time 4.9% Jumbo Time 8.3% $12.9B 4Q’24 Cost: 2.06% 1. Does not include fair value / purchase accounting adjustments. Note: Financial data as of December 31, 2024. Seacoast loan and deposit totals, ratios, yields, and costs reflect GAAP data. SBCF loan and deposit compositions reflect bank level Call Report data. Heartland financial data reflects bank level Call Report data. Source: S&P Capital IQ Pro 1-4 Family 27.2% Multifamily 2.9% CRE 45.3% C&D 6.3% C&I 14.4% Consumer 2.0% Other 1.9% 4Q’24 Yield: 5.93% CRE Ratio: 224% $10.3B L/D: 84% 1-4 Family 35.5% Multifamily 1.6% CRE 29.9% C&D 6.3% C&I 8.7% Consumer 3.4% Other 14.6% 1-4 Family 27.3% Multifamily 2.8% CRE 45.1% C&D 6.3% C&I 14.4% Consumer 2.0% Other 2.1% $10.5B L/D: 81% Pro Forma¹ 4Q’24 Yield: 5.94% CRE Ratio: 222% 4Q’24 Yield: 6.59% CRE Ratio: 51% $161M L/D: 25%

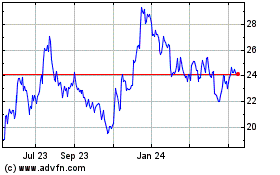

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Mar 2025 to Apr 2025

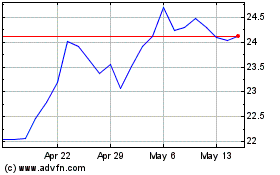

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Apr 2024 to Apr 2025