Comscore, Inc. (Nasdaq: SCOR), a trusted partner for planning,

transacting and evaluating media across platforms, today reported

financial results for the fourth quarter and full year ended

December 31, 2024.

FY 2024

Financial Highlights

- Revenue for 2024

was $356.0 million compared to $371.3 million in 2023

- Net loss of $60.2 million compared

to $79.4 million in 2023, resulting primarily from non-cash

goodwill impairment charges of $63.0 million and $78.2 million,

respectively

- Adjusted EBITDA1 of $42.4 million

compared to $44.0 million in 2023

- FX adjusted EBITDA of $40.9 million

compared to $46.9 million in 2023

- Cash, cash equivalents and

restricted cash of $33.5 million versus $22.9 million as

of December 31, 2023

Q4 2024

Financial Highlights

- Revenue for the

fourth quarter was $94.9 million compared to $95.1 million in Q4

2023

- Net income of $3.1 million

compared to net loss of $28.4 million in Q4 2023, resulting

primarily from a non-cash goodwill impairment charge of $34.1

million in Q4 2023

- Adjusted EBITDA of $17.2 million

compared to $16.4 million in Q4 2023

- FX adjusted EBITDA of $14.2 million

compared to $18.7 million in Q4 2023

2025 Financial

Outlook

- Full year revenue

expected to be between $360 million and $370 million

- Adjusted EBITDA margin expected to

be between 12% and 15% for the year

"We made solid progress in Q4 to establish

Comscore as a leading source for cross-platform planning and

measurement," said Jon Carpenter, CEO. "Our cross-platform audience

solution, Proximic, continued to accelerate, and our cross-platform

measurement products also scaled nicely within programmatic

advertising environments as we came down the stretch in 2024. We

believe this progress and the leadership additions we've made in

recent months position us well for growth in 2025."

Fourth Quarter Summary

Results

Revenue in the fourth quarter was $94.9 million,

down 0.2% from $95.1 million in Q4 2023. Content & Ad

Measurement revenue increased 1.0% compared to the prior-year

quarter, driven by an increase in our cross-platform revenue, which

grew 21.7% over Q4 2023. This growth was partially offset by lower

revenue from our syndicated audience offerings, primarily related

to our national TV and syndicated digital products. Research &

Insight Solutions revenue declined 6.5% from Q4 2023, primarily due

to lower deliveries of certain custom digital products.

____________________________1 Adjusted EBITDA,

adjusted EBITDA margin and FX Adjusted EBITDA are non-GAAP measures

defined in the "Fourth Quarter Summary Results" section and are

reconciled to net income (loss) and net income (loss) margin in the

addendum of this release. As described in the "2025 Outlook"

section, we are unable to provide a reconciliation of adjusted

EBITDA or adjusted EBITDA margin on a forward-looking basis because

we cannot predict with reasonable certainty our future stock-based

compensation expense, fair value adjustments, variable interest

expense, litigation and restructuring expense and any unusual items

without reasonable effort.

Our core operating expenses, which include cost

of revenues, sales and marketing, research and development and

general and administrative expenses, were $90.3 million for the

quarter, up 7.6% compared to $83.9 million in Q4 2023, primarily

due to higher employee compensation and data licensing costs.

Net income for the quarter was

$3.1 million, compared to net loss of $28.4 million in Q4

2023, resulting in net income (loss) margins of 3.3% and (29.9)% of

revenue, respectively. Included in net loss for Q4 2023 was a

non-cash impairment charge of $34.1 million related to goodwill.

After accounting for dividends on our convertible preferred stock,

loss per share attributable to common shares in Q4 2024 was

$(0.27), compared to loss per share of $(6.69) in Q4 2023.

Non-GAAP adjusted EBITDA for the quarter was

$17.2 million, compared to $16.4 million in Q4 2023,

resulting in adjusted EBITDA margins of 18.1% and 17.3%,

respectively. Excluding the impact of foreign currency

transactions, FX adjusted EBITDA for the quarter was

$14.2 million, compared to $18.7 million in Q4 2023.

Adjusted EBITDA and adjusted EBITDA margin exclude depreciation and

amortization, net interest expense, income taxes, impairment of

goodwill, stock-based compensation expense, transformation costs,

impairment of right-of-use and long-lived assets, restructuring

costs, change in fair value of contingent consideration liability

and other items as presented in the accompanying tables. FX

adjusted EBITDA excludes these items as well as gain/loss from

foreign currency transactions.

Full-Year Summary Results

Revenue for 2024 was $356.0 million, down 4.1%

compared to $371.3 million in 2023. Content & Ad Measurement

revenue declined 2.8% compared to 2023, driven by lower revenue

from our syndicated audience offerings (primarily related to

national TV and syndicated digital products), partially offset by

an increase in our cross-platform revenue, which grew 19.7% over

2023. Research & Insight Solutions revenue declined 10.6% from

2023, primarily due to lower deliveries of certain custom digital

products.

Our core operating expenses, which include cost

of revenues, sales and marketing, research and development and

general and administrative expenses, were $347.1 million, down 1.9%

compared to $353.8 million in 2023, primarily driven by a decline

in employee compensation and lower cloud computing costs, partially

offset by higher data licensing costs.

Net loss for the year was $60.2 million,

compared to $79.4 million in 2023, resulting in net loss margins of

(16.9)% and (21.4)% of revenue, respectively. Included in net loss

for 2024 and 2023 were non-cash impairment charges of $63.0 million

and $78.2 million, respectively, related to goodwill. After

accounting for dividends on our convertible preferred stock, loss

per share attributable to common shares in 2024 was $(15.53),

compared to loss per share of $(19.88) in 2023.

Non-GAAP adjusted EBITDA for the year was $42.4

million compared to $44.0 million in 2023, resulting in adjusted

EBITDA margins of 11.9% for both years. Excluding the impact of

foreign currency transactions, FX adjusted EBITDA for 2024 was

$40.9 million, compared to $46.9 million in 2023.

Balance Sheet and Liquidity

As of December 31, 2024, cash, cash

equivalents and restricted cash totaled $33.5 million.

On December 31, 2024, we entered into a senior

secured financing agreement with Blue Torch Finance LLC. The Blue

Torch facility provides a borrowing capacity of $60.0 million,

consisting of a $45.0 million term loan that was fully funded at

closing and a $15.0 million revolving credit facility that was

unfunded at closing. We used initial proceeds from the term loan to

resolve our aged accounts payable, cash collateralize our

outstanding letter of credit, pay transaction fees and expenses,

and strengthen our cash position in order to invest in future

growth.

Prior to entering the new facility, we repaid

the outstanding principal balance under our prior credit agreement

with Bank of America, N.A. On December 31, 2024, we terminated the

Bank of America facility and (as described above) used a portion of

proceeds from the Blue Torch term loan to cash collateralize our

outstanding letters of credit with Bank of America.

Finally, on December 31, 2024, we entered into

an amendment to our Data License Agreement with Charter

Communications Operating, LLC. The amendment provides us with an

estimated minimum $35 million reduction in cash license fees over

the remaining term of the Data License Agreement, in addition to

the previously disclosed $7 million in license fee credits provided

by Charter for prior periods. The amendment was conditioned upon

our payment of arrears due to Charter under the Data License

Agreement, which we paid in full on December 31, 2024.

2025

Outlook

Based on current trends and expectations, we

believe 2025 revenue will be between $360 million and $370 million,

driven primarily by growth in Content & Ad Measurement revenue

from our local TV offering and our cross-platform products. We

expect our adjusted EBITDA margin for 2025 to be between 12% and

15% as we continue to invest in areas of the business that we

believe have the greatest opportunity to drive revenue growth or

operational efficiencies. We anticipate that our national TV and

syndicated digital revenue will continue to be challenged, and that

demand for custom digital products will continue to be

unpredictable due to the macroeconomic environment. We expect

revenue in the first quarter of 2025 to be roughly flat compared to

Q1 2024, with a return to growth in subsequent quarters as demand

for our cross-platform products continues to rise.

We do not provide GAAP net income (loss) or net

income (loss) margin on a forward-looking basis because we are

unable to predict with reasonable certainty our future stock-based

compensation expense, fair value adjustments, variable interest

expense, litigation and restructuring expense and any unusual gains

or losses without unreasonable effort. These items are uncertain,

depend on various factors, and could be material to results

computed in accordance with GAAP. For this reason, we are unable

without unreasonable effort to provide a reconciliation of adjusted

EBITDA or adjusted EBITDA margin to the most directly comparable

GAAP measure, GAAP net income (loss) and net income (loss) margin,

on a forward-looking basis.

Conference Call Information for

Today, Tuesday,

March 4, 2025 at 5:00 p.m.

ET

Management will host a conference call to

discuss the results on Tuesday, March 4, 2025, at 5:00 p.m.

ET. The live audio webcast along with supplemental information will

be accessible at ir.comscore.com/events-presentations. Participants

can obtain dial-in information by registering for the call at the

same web address and are advised to register in advance of the call

to avoid delays. Following the conference call, a replay will be

available via webcast at ir.comscore.com/events-presentations.

About Comscore

Comscore is a global, trusted partner

for planning, transacting and evaluating media across platforms.

With a data footprint that combines digital, linear TV,

over-the-top and theatrical viewership intelligence with advanced

audience insights, Comscore empowers media buyers and sellers

to quantify their multiscreen behavior and make meaningful

business decisions with confidence. A proven leader in

measuring digital and TV audiences and advertising at scale,

Comscore is the industry's emerging, third-party source for

reliable and comprehensive cross-platform measurement.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of federal and state securities laws,

including, without limitation, our expectations, forecasts, plans

and opinions regarding expected revenue and adjusted EBITDA margin

for 2025, a return to growth in 2025, revenue drivers, future

investments in growth and operational efficiencies, demand for our

products, and economic and industry trends. These statements

involve risks and uncertainties that could cause actual events to

differ materially from expectations, including, but not limited to,

changes in our business and customer, partner and vendor

relationships; external market conditions and competition;

continued changes or declines in ad spending or other macroeconomic

factors; evolving privacy and regulatory standards; product

adoption rates; and our ability to achieve our expected strategic,

financial and operational plans. For additional discussion of risk

factors, please refer to our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q, and other filings that we make from time to

time with the U.S. Securities and Exchange Commission (the "SEC"),

which are available on the SEC's website (www.sec.gov).

Investors are cautioned not to place undue

reliance on our forward-looking statements, which speak only as of

the date such statements are made. We do not intend or undertake,

and expressly disclaim, any duty or obligation to publicly update

any forward-looking statements to reflect events, circumstances or

new information after the date of this press release, or to reflect

the occurrence of unanticipated events.

Use of Non-GAAP Financial

Measures

To provide investors with additional information

regarding our financial results, we are disclosing in this press

release adjusted EBITDA, adjusted EBITDA margin and FX adjusted

EBITDA, which are non-GAAP financial measures used by our

management to understand and evaluate our core operating

performance and trends. We believe that these non-GAAP financial

measures provide useful information to investors and others in

understanding and evaluating our operating results, as they permit

our investors to view our core business performance using the same

metrics that management uses to evaluate our performance.

Nevertheless, our use of these non-GAAP financial measures has

limitations as an analytical tool, and investors should not

consider these measures in isolation or as a substitute for

analysis of our results as reported under GAAP. Instead, you should

consider these measures alongside GAAP-based financial performance

measures, net income (loss), net income (loss) margin, various cash

flow metrics, and our other GAAP financial results. Set forth below

are reconciliations of these non-GAAP financial measures to their

most directly comparable GAAP financial measures, net income (loss)

and net income (loss) margin. These reconciliations should be

carefully evaluated.

MediaMarie ScoutasComscore,

Inc.press@comscore.com

InvestorsJohn TinkerComscore,

Inc.212-203-2129jtinker@comscore.com

| |

| |

|

COMSCORE, INC.CONSOLIDATED BALANCE

SHEETS(In thousands, except share and per share

data) |

| |

| |

As of December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

29,937 |

|

|

$ |

22,750 |

|

|

Restricted cash |

|

3,531 |

|

|

|

186 |

|

|

Accounts receivable, net of allowances of $462 and $614,

respectively |

|

64,266 |

|

|

|

63,826 |

|

|

Prepaid expenses and other current assets |

|

10,323 |

|

|

|

11,228 |

|

|

Total current assets |

|

108,057 |

|

|

|

97,990 |

|

| Property and equipment,

net |

|

47,116 |

|

|

|

41,574 |

|

| Operating right-of-use

assets |

|

13,173 |

|

|

|

18,628 |

|

| Deferred tax assets |

|

2,624 |

|

|

|

2,588 |

|

| Intangible assets, net |

|

5,058 |

|

|

|

8,115 |

|

| Goodwill |

|

246,010 |

|

|

|

310,360 |

|

| Other non-current assets |

|

8,209 |

|

|

|

12,040 |

|

|

Total assets |

$ |

430,247 |

|

|

$ |

491,295 |

|

| Liabilities,

Convertible Redeemable Preferred Stock and Stockholders' Equity

(Deficit) |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

16,471 |

|

|

$ |

30,551 |

|

|

Accrued expenses |

|

35,013 |

|

|

|

34,422 |

|

|

Contract liabilities |

|

45,464 |

|

|

|

48,912 |

|

|

Revolving line of credit |

|

— |

|

|

|

16,000 |

|

|

Accrued dividends |

|

8,962 |

|

|

|

24,132 |

|

|

Customer advances |

|

9,566 |

|

|

|

11,076 |

|

|

Current operating lease liabilities |

|

8,598 |

|

|

|

7,982 |

|

|

Other current liabilities |

|

7,230 |

|

|

|

9,486 |

|

|

Total current liabilities |

|

131,304 |

|

|

|

182,561 |

|

| Secured term loan |

|

40,718 |

|

|

|

— |

|

| Non-current operating lease

liabilities |

|

14,805 |

|

|

|

23,003 |

|

| Non-current portion of accrued

data costs |

|

33,551 |

|

|

|

32,833 |

|

| Deferred tax liabilities |

|

891 |

|

|

|

1,321 |

|

| Other non-current

liabilities |

|

9,771 |

|

|

|

7,589 |

|

|

Total liabilities |

|

231,040 |

|

|

|

247,307 |

|

| Commitments and

contingencies |

|

|

|

| Convertible redeemable

preferred stock, $0.001 par value; 100,000,000 shares authorized as

of December 31, 2024 and December 31, 2023; 95,784,903

shares and 82,527,609 shares issued and outstanding as of

December 31, 2024 and December 31, 2023, respectively;

aggregate liquidation preference of $245,732 as of

December 31, 2024 and $228,132 as of December 31,

2023 |

|

207,470 |

|

|

|

187,885 |

|

| Stockholders' equity

(deficit): |

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized as

of December 31, 2024 and December 31, 2023; no shares

issued or outstanding as of December 31, 2024 or 2023 |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 13,750,000 shares authorized as of

December 31, 2024 and 2023; 5,228,814 shares issued and

4,890,575 shares outstanding as of December 31, 2024, and

5,093,380 shares issued and 4,755,141 shares outstanding as of

December 31, 2023 |

|

5 |

|

|

|

5 |

|

|

Additional paid-in capital |

|

1,714,052 |

|

|

|

1,696,612 |

|

|

Accumulated other comprehensive loss |

|

(18,068 |

) |

|

|

(14,110 |

) |

|

Accumulated deficit |

|

(1,474,268 |

) |

|

|

(1,396,420 |

) |

|

Treasury stock, at cost, 338,239 shares as of December 31,

2024 and 2023 |

|

(229,984 |

) |

|

|

(229,984 |

) |

|

Total stockholders' equity (deficit) |

|

(8,263 |

) |

|

|

56,103 |

|

|

Total liabilities, convertible redeemable preferred stock and

stockholders' equity (deficit) |

$ |

430,247 |

|

|

$ |

491,295 |

|

|

|

|

COMSCORE, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS(In

thousands, except share and per share data) |

|

|

|

|

Years Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenues |

$ |

356,047 |

|

|

$ |

371,343 |

|

|

$ |

376,423 |

|

| |

|

|

|

|

|

| Cost of revenues (1) (2) |

|

208,708 |

|

|

|

205,580 |

|

|

|

205,294 |

|

| Selling and marketing (1)

(2) |

|

57,622 |

|

|

|

63,322 |

|

|

|

68,453 |

|

| Research and development (1)

(2) |

|

33,066 |

|

|

|

33,701 |

|

|

|

36,987 |

|

| General and administrative (1)

(2) |

|

47,679 |

|

|

|

51,192 |

|

|

|

61,200 |

|

| Amortization of intangible

assets |

|

3,057 |

|

|

|

5,213 |

|

|

|

27,096 |

|

| Impairment of goodwill |

|

63,000 |

|

|

|

78,200 |

|

|

|

46,300 |

|

| Impairment of right-of-use and

long-lived assets |

|

1,397 |

|

|

|

1,502 |

|

|

|

156 |

|

| Restructuring |

|

1,027 |

|

|

|

6,234 |

|

|

|

5,810 |

|

| Total expenses from

operations |

|

415,556 |

|

|

|

444,944 |

|

|

|

451,296 |

|

| Loss from operations |

|

(59,509 |

) |

|

|

(73,601 |

) |

|

|

(74,873 |

) |

| Interest expense, net |

|

(1,883 |

) |

|

|

(1,445 |

) |

|

|

(915 |

) |

| Other income, net |

|

651 |

|

|

|

42 |

|

|

|

9,785 |

|

| Gain (loss) from foreign

currency transactions |

|

1,417 |

|

|

|

(2,824 |

) |

|

|

1,166 |

|

| Loss before income taxes |

|

(59,324 |

) |

|

|

(77,828 |

) |

|

|

(64,837 |

) |

| Income tax provision |

|

(924 |

) |

|

|

(1,533 |

) |

|

|

(1,724 |

) |

| Net loss |

$ |

(60,248 |

) |

|

$ |

(79,361 |

) |

|

$ |

(66,561 |

) |

| Net loss available to common

stockholders |

|

|

|

|

|

| Net loss |

|

(60,248 |

) |

|

|

(79,361 |

) |

|

|

(66,561 |

) |

| Convertible redeemable

preferred stock dividends |

|

(17,600 |

) |

|

|

(16,270 |

) |

|

|

(15,513 |

) |

| Total net loss available to

common stockholders |

$ |

(77,848 |

) |

|

$ |

(95,631 |

) |

|

$ |

(82,074 |

) |

| Net loss per common share

(3): |

|

|

|

|

|

|

Basic and diluted |

$ |

(15.53 |

) |

|

$ |

(19.88 |

) |

|

$ |

(17.71 |

) |

| Weighted-average number of

shares used in per share calculation - Common Stock (3): |

|

|

|

|

|

|

Basic and diluted |

|

5,014,049 |

|

|

|

4,811,233 |

|

|

|

4,634,178 |

|

| Comprehensive loss: |

|

|

|

|

|

| Net loss |

$ |

(60,248 |

) |

|

$ |

(79,361 |

) |

|

$ |

(66,561 |

) |

| Other comprehensive loss: |

|

|

|

|

|

|

Foreign currency cumulative translation adjustment |

|

(3,958 |

) |

|

|

1,830 |

|

|

|

(3,842 |

) |

| Total comprehensive loss |

$ |

(64,206 |

) |

|

$ |

(77,531 |

) |

|

$ |

(70,403 |

) |

| |

|

|

|

|

|

|

(1) Excludes amortization of intangible assets, which is presented

separately in the Consolidated Statements of Operations and

Comprehensive Loss. |

|

(2) Stock-based compensation expense is included in the line items

above as follows: |

| |

Years Ended December 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2022 |

|

| Cost of revenues |

$ |

221 |

|

|

$ |

533 |

|

|

$ |

1,144 |

|

| Selling and marketing |

|

126 |

|

|

|

380 |

|

|

|

1,021 |

|

| Research and development |

|

161 |

|

|

|

411 |

|

|

|

827 |

|

| General and

administrative |

|

2,683 |

|

|

|

3,211 |

|

|

|

5,186 |

|

| Total stock-based compensation

expense |

$ |

3,191 |

|

|

$ |

4,535 |

|

|

$ |

8,178 |

|

| |

|

(3) Adjusted retroactively for a 1-for-20 reverse split of our

common stock effected on December 20, 2023. |

|

|

|

COMSCORE, INC.CONSOLIDATED STATEMENTS OF CASH

FLOWS(In thousands) |

|

|

|

|

Years Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating

activities: |

|

|

|

|

|

| Net loss |

$ |

(60,248 |

) |

|

$ |

(79,361 |

) |

|

$ |

(66,561 |

) |

| Adjustments to reconcile net

loss to net cash provided by operating activities: |

|

|

|

|

|

|

Impairment of goodwill |

|

63,000 |

|

|

|

78,200 |

|

|

|

46,300 |

|

|

Depreciation |

|

22,087 |

|

|

|

19,778 |

|

|

|

16,828 |

|

|

Non-cash operating lease expense |

|

5,240 |

|

|

|

5,456 |

|

|

|

6,060 |

|

|

Amortization expense of finance leases |

|

3,651 |

|

|

|

1,929 |

|

|

|

2,364 |

|

|

Stock-based compensation expense |

|

3,191 |

|

|

|

4,535 |

|

|

|

8,178 |

|

|

Amortization of intangible assets |

|

3,057 |

|

|

|

5,213 |

|

|

|

27,096 |

|

|

Impairment of right-of-use and long-lived assets |

|

1,397 |

|

|

|

1,502 |

|

|

|

156 |

|

|

Change in fair value of warrant liability |

|

(669 |

) |

|

|

(49 |

) |

|

|

(9,802 |

) |

|

Deferred tax provision |

|

(841 |

) |

|

|

(35 |

) |

|

|

(475 |

) |

|

Other |

|

2,008 |

|

|

|

2,297 |

|

|

|

4,468 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(1,649 |

) |

|

|

4,781 |

|

|

|

2,596 |

|

|

Prepaid expenses and other assets |

|

1,987 |

|

|

|

2,185 |

|

|

|

(805 |

) |

|

Accounts payable, accrued expenses, and other liabilities |

|

(10,570 |

) |

|

|

(4,121 |

) |

|

|

7,396 |

|

|

Contract liability and customer advances |

|

(4,739 |

) |

|

|

(5,517 |

) |

|

|

(1,587 |

) |

|

Operating lease liabilities |

|

(8,798 |

) |

|

|

(7,867 |

) |

|

|

(7,275 |

) |

| Net cash provided by operating

activities |

|

18,104 |

|

|

|

28,926 |

|

|

|

34,937 |

|

| |

|

|

|

|

|

| Investing

activities: |

|

|

|

|

|

| Capitalized internal-use

software costs |

|

(23,249 |

) |

|

|

(22,206 |

) |

|

|

(16,685 |

) |

| Purchases of property and

equipment |

|

(813 |

) |

|

|

(1,580 |

) |

|

|

(1,137 |

) |

| Net cash used in investing

activities |

|

(24,062 |

) |

|

|

(23,786 |

) |

|

|

(17,822 |

) |

| |

|

|

|

|

|

| Financing

activities: |

|

|

|

|

|

| Proceeds from secured term

loan |

|

45,000 |

|

|

|

— |

|

|

|

— |

|

| Proceeds from insurance

financing |

|

2,118 |

|

|

|

— |

|

|

|

— |

|

| Payments for dividends on

convertible redeemable preferred stock |

|

— |

|

|

|

— |

|

|

|

(15,512 |

) |

| Principal payments on

insurance financing |

|

(2,122 |

) |

|

|

— |

|

|

|

— |

|

| Principal payments on finance

leases |

|

(2,852 |

) |

|

|

(2,066 |

) |

|

|

(2,519 |

) |

| Contingent consideration

payment at initial value |

|

(3,704 |

) |

|

|

(1,037 |

) |

|

|

— |

|

| Payments of debt issuance

costs |

|

(4,551 |

) |

|

|

— |

|

|

|

— |

|

| Payments of line of

credit |

|

(16,000 |

) |

|

|

— |

|

|

|

— |

|

| Other |

|

(266 |

) |

|

|

(291 |

) |

|

|

(101 |

) |

| Net cash provided by (used in)

financing activities |

|

17,623 |

|

|

|

(3,394 |

) |

|

|

(18,132 |

) |

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

(1,133 |

) |

|

|

748 |

|

|

|

(820 |

) |

| Net increase (decrease) in

cash, cash equivalents and restricted cash |

|

10,532 |

|

|

|

2,494 |

|

|

|

(1,837 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

|

22,936 |

|

|

|

20,442 |

|

|

|

22,279 |

|

| Cash, cash equivalents and

restricted cash at end of period |

$ |

33,468 |

|

|

$ |

22,936 |

|

|

$ |

20,442 |

|

| |

As of December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2022 |

|

| Cash and cash equivalents |

$ |

29,937 |

|

|

$ |

22,750 |

|

|

$ |

20,044 |

|

| Restricted cash |

|

3,531 |

|

|

|

186 |

|

|

|

398 |

|

| Total cash, cash equivalents and

restricted cash |

$ |

33,468 |

|

|

$ |

22,936 |

|

|

$ |

20,442 |

|

Reconciliation of Non-GAAP Financial

Measures

The following table presents a reconciliation of

GAAP net loss and net loss margin to non-GAAP adjusted EBITDA,

adjusted EBITDA margin and non-GAAP FX adjusted EBITDA for each of

the periods identified:

|

|

Years Ended December 31, |

| |

2024 |

|

2023 |

|

2022 |

| (In thousands) |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

GAAP net loss |

$ |

(60,248 |

) |

|

|

$ |

(79,361 |

) |

|

|

$ |

(66,561 |

) |

|

| |

|

|

|

|

|

| Depreciation |

|

22,087 |

|

|

|

|

19,778 |

|

|

|

|

16,828 |

|

|

| Amortization expense of

finance leases |

|

3,651 |

|

|

|

|

1,929 |

|

|

|

|

2,364 |

|

|

| Amortization of intangible

assets |

|

3,057 |

|

|

|

|

5,213 |

|

|

|

|

27,096 |

|

|

| Interest expense, net |

|

1,883 |

|

|

|

|

1,445 |

|

|

|

|

915 |

|

|

| Income tax provision |

|

924 |

|

|

|

|

1,533 |

|

|

|

|

1,724 |

|

|

| EBITDA |

|

(28,646 |

) |

|

|

|

(49,463 |

) |

|

|

|

(17,634 |

) |

|

| |

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

Impairment of goodwill |

|

63,000 |

|

|

|

|

78,200 |

|

|

|

|

46,300 |

|

|

|

Stock-based compensation expense |

|

3,191 |

|

|

|

|

4,535 |

|

|

|

|

8,178 |

|

|

|

Transformation costs (1) |

|

1,547 |

|

|

|

|

1,283 |

|

|

|

|

460 |

|

|

|

Amortization of cloud-computing implementation costs |

|

1,420 |

|

|

|

|

1,439 |

|

|

|

|

1,435 |

|

|

|

Impairment of right-of-use and long-lived assets |

|

1,397 |

|

|

|

|

1,502 |

|

|

|

|

156 |

|

|

|

Restructuring |

|

1,027 |

|

|

|

|

6,234 |

|

|

|

|

5,810 |

|

|

|

Change in fair value of contingent consideration liability |

|

89 |

|

|

|

|

350 |

|

|

|

|

2,558 |

|

|

|

Loss on asset disposition |

|

6 |

|

|

|

|

— |

|

|

|

|

7 |

|

|

|

Other income, net (2) |

|

(669 |

) |

|

|

|

(49 |

) |

|

|

|

(9,802 |

) |

|

| Non-GAAP adjusted EBITDA |

$ |

42,362 |

|

|

|

$ |

44,031 |

|

|

|

$ |

37,468 |

|

|

| Net loss margin (3) |

|

(16.9 |

) |

% |

|

|

(21.4 |

) |

% |

|

|

(17.7 |

) |

% |

| Non-GAAP adjusted EBITDA

margin (4) |

|

11.9 |

|

% |

|

|

11.9 |

|

% |

|

|

10.0 |

|

% |

| |

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

(Gain) Loss from foreign currency transactions |

|

(1,417 |

) |

|

|

|

2,824 |

|

|

|

|

(1,166 |

) |

|

| Non-GAAP FX adjusted

EBITDA |

$ |

40,945 |

|

|

|

$ |

46,855 |

|

|

|

$ |

36,302 |

|

|

| |

|

(1) Transformation costs represent: (1) expenses incurred prior to

formal launch of identified strategic projects with anticipated

long-term benefits to the company, generally relating to

third-party professional fees and non-capitalizable technology

costs tied directly to the identified projects and (2) severance

costs associated with the reorganization of our teams in connection

with the identified projects. We added transformation costs as an

adjustment in 2023 for greater transparency around these costs and

have applied the adjustment to prior periods for comparison. |

|

(2) Adjustments to other income, net reflect non-cash changes in

the fair value of warrants liability included in other income, net

on our Consolidated Statements of Operations and Comprehensive

Loss. |

|

(3) Net loss margin is calculated by dividing net loss by revenues

reported on our Consolidated Statements of Operations and

Comprehensive Loss for the applicable period. |

|

(4) Non-GAAP Adjusted EBITDA margin is calculated by dividing

adjusted EBITDA by revenues reported on our Consolidated Statements

of Operations and Comprehensive Loss for the applicable

period. |

|

|

|

COMSCORE, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE

LOSS(Unaudited)(In thousands, except share

and per share data) |

|

|

|

|

Three Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

$ |

94,936 |

|

|

$ |

95,101 |

|

| |

|

|

|

| Cost of revenues (1) (2) |

|

54,683 |

|

|

|

50,220 |

|

| Selling and marketing (1)

(2) |

|

14,931 |

|

|

|

14,338 |

|

| Research and development (1)

(2) |

|

8,654 |

|

|

|

7,909 |

|

| General and administrative (1)

(2) |

|

12,016 |

|

|

|

11,416 |

|

| Amortization of intangible

assets |

|

692 |

|

|

|

801 |

|

| Restructuring |

|

59 |

|

|

|

779 |

|

| Impairment of goodwill |

|

— |

|

|

|

34,100 |

|

| Total expenses from

operations |

|

91,035 |

|

|

|

119,563 |

|

| Income (loss) from

operations |

|

3,901 |

|

|

|

(24,462 |

) |

| Interest expense, net |

|

(443 |

) |

|

|

(304 |

) |

| Other expense, net |

|

— |

|

|

|

(383 |

) |

| Gain (loss) from foreign

currency transactions |

|

2,925 |

|

|

|

(2,280 |

) |

| Income (loss) before income

taxes |

|

6,383 |

|

|

|

(27,429 |

) |

| Income tax provision |

|

(3,239 |

) |

|

|

(970 |

) |

| Net income (loss) |

$ |

3,144 |

|

|

$ |

(28,399 |

) |

| Net loss available to common

stockholders: |

|

|

|

| Net income (loss) |

|

3,144 |

|

|

|

(28,399 |

) |

| Convertible redeemable

preferred stock dividends |

|

(4,538 |

) |

|

|

(4,287 |

) |

| Total net loss available to

common stockholders |

$ |

(1,394 |

) |

|

$ |

(32,686 |

) |

| Net loss per common

share: |

|

|

|

|

Basic and diluted |

$ |

(0.27 |

) |

|

$ |

(6.69 |

) |

| Weighted-average number of

shares used in per share calculation - Common Stock: |

|

|

|

|

Basic and diluted |

|

5,096,459 |

|

|

|

4,888,089 |

|

| Comprehensive loss: |

|

|

|

| Net income (loss) |

$ |

3,144 |

|

|

$ |

(28,399 |

) |

| Other comprehensive loss: |

|

|

|

|

Foreign currency cumulative translation adjustment |

|

(4,786 |

) |

|

|

2,699 |

|

| Total comprehensive loss |

$ |

(1,642 |

) |

|

$ |

(25,700 |

) |

| |

|

|

|

|

(1) Excludes amortization of intangible assets, which is presented

separately in the Consolidated Statements of Operations and

Comprehensive Loss. |

|

(2) Stock-based compensation expense is included in the line items

above as follows: |

| |

Three Months Ended December 31, |

| |

|

2024 |

|

|

|

2023 |

|

| Cost of revenues |

$ |

103 |

|

|

$ |

98 |

|

| Selling and marketing |

|

55 |

|

|

|

(31 |

) |

| Research and development |

|

69 |

|

|

|

78 |

|

| General and

administrative |

|

697 |

|

|

|

571 |

|

| Total stock-based compensation

expense |

$ |

924 |

|

|

$ |

716 |

|

Reconciliation of Non-GAAP Financial

Measures

The following table presents a reconciliation of

GAAP net income (loss) and net income (loss) margin to non-GAAP

adjusted EBITDA, adjusted EBITDA margin and non-GAAP FX adjusted

EBITDA for each of the periods identified:

| |

Three Months Ended December 31, |

| |

2024 |

|

2023 |

| (In thousands) |

(Unaudited) |

|

(Unaudited) |

|

GAAP net income (loss) |

$ |

3,144 |

|

|

|

$ |

(28,399 |

) |

|

| |

|

|

|

| Depreciation |

|

5,893 |

|

|

|

|

5,165 |

|

|

| Income tax provision |

|

3,239 |

|

|

|

|

970 |

|

|

| Amortization expense of

finance leases |

|

960 |

|

|

|

|

661 |

|

|

| Amortization of intangible

assets |

|

692 |

|

|

|

|

801 |

|

|

| Interest expense, net |

|

443 |

|

|

|

|

304 |

|

|

| EBITDA |

|

14,371 |

|

|

|

|

(20,498 |

) |

|

| |

|

|

|

| Adjustments: |

|

|

|

|

Transformation costs (1) |

|

1,472 |

|

|

|

|

530 |

|

|

|

Stock-based compensation expense |

|

924 |

|

|

|

|

716 |

|

|

|

Amortization of cloud-computing implementation costs |

|

345 |

|

|

|

|

361 |

|

|

|

Restructuring |

|

59 |

|

|

|

|

779 |

|

|

|

Impairment of goodwill |

|

— |

|

|

|

|

34,100 |

|

|

|

Change in fair value of contingent consideration liability |

|

— |

|

|

|

|

98 |

|

|

|

Other expense, net (2) |

|

— |

|

|

|

|

358 |

|

|

| Non-GAAP adjusted EBITDA |

$ |

17,171 |

|

|

|

$ |

16,444 |

|

|

| Net income (loss) margin

(3) |

|

3.3 |

|

% |

|

|

(29.9 |

) |

% |

| Non-GAAP adjusted EBITDA

margin (4) |

|

18.1 |

|

% |

|

|

17.3 |

|

% |

| |

|

|

|

| Adjustments: |

|

|

|

|

(Gain) Loss from foreign currency transactions |

|

(2,925 |

) |

|

|

|

2,280 |

|

|

| Non-GAAP FX adjusted

EBITDA |

$ |

14,246 |

|

|

|

$ |

18,724 |

|

|

| |

|

(1) Transformation costs represent: (1) expenses incurred prior to

formal launch of identified strategic projects with anticipated

long-term benefits to the company, generally relating to

third-party professional fees and non-capitalizable technology

costs tied directly to the identified projects and (2) severance

costs associated with the reorganization of our teams in connection

with the identified projects. |

|

(2) Adjustments to other expense, net reflect non-cash changes in

the fair value of warrants liability included in other expense, net

on our Consolidated Statements of Operations and Comprehensive

Loss. |

|

(3) Net income (loss) margin is calculated by dividing net income

(loss) by revenues reported on our Consolidated Statements of

Operations and Comprehensive Loss for the applicable period. |

|

(4) Non-GAAP Adjusted EBITDA margin is calculated by dividing

adjusted EBITDA by revenues reported on our Consolidated Statements

of Operations and Comprehensive Loss for the applicable

period. |

Revenues

Revenues from our offerings of products and

services are as follows:

| |

Years Ended December 31, |

|

|

|

|

|

|

| (In thousands) |

|

2024 |

|

|

% of Revenue |

|

|

2023 |

|

|

% of Revenue |

|

$ Variance |

|

% Variance |

|

Content & Ad Measurement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Syndicated Audience (1) |

$ |

260,654 |

|

|

73.2 |

|

% |

|

$ |

276,101 |

|

|

74.4 |

|

% |

|

$ |

(15,447 |

) |

|

(5.6 |

) |

% |

|

Cross-Platform |

|

40,470 |

|

|

11.4 |

|

% |

|

|

33,803 |

|

|

9.1 |

|

% |

|

|

6,667 |

|

|

19.7 |

|

% |

|

Total Content & Ad Measurement |

|

301,124 |

|

|

84.6 |

|

% |

|

|

309,904 |

|

|

83.5 |

|

% |

|

|

(8,780 |

) |

|

(2.8 |

) |

% |

|

Research & Insight Solutions |

|

54,923 |

|

|

15.4 |

|

% |

|

|

61,439 |

|

|

16.5 |

|

% |

|

|

(6,516 |

) |

|

(10.6 |

) |

% |

| Total revenues |

$ |

356,047 |

|

|

100.0 |

|

% |

|

$ |

371,343 |

|

|

100.0 |

|

% |

|

$ |

(15,296 |

) |

|

(4.1 |

) |

% |

| |

|

(1) Syndicated Audience revenue includes revenue from our movies

business, which grew from $35.3 million in the year ended

December 31, 2023 to $37.1 million in the year ended

December 31, 2024. |

| |

Three Months Ended December 31, |

|

|

|

|

|

|

| (In thousands) |

2024(Unaudited) |

|

% of Revenue |

|

2023(Unaudited) |

|

% of Revenue |

|

$ Variance |

|

% Variance |

|

Content & Ad Measurement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Syndicated Audience (1) |

$ |

66,823 |

|

|

70.4 |

|

% |

|

$ |

68,550 |

|

|

72.1 |

|

% |

|

$ |

(1,727 |

) |

|

(2.5 |

) |

% |

|

Cross-Platform |

|

14,218 |

|

|

15.0 |

|

% |

|

|

11,686 |

|

|

12.3 |

|

% |

|

|

2,532 |

|

|

21.7 |

|

% |

|

Total Content & Ad Measurement |

|

81,041 |

|

|

85.4 |

|

% |

|

|

80,236 |

|

|

84.4 |

|

% |

|

|

805 |

|

|

1.0 |

|

% |

|

Research & Insight Solutions |

|

13,895 |

|

|

14.6 |

|

% |

|

|

14,865 |

|

|

15.6 |

|

% |

|

|

(970 |

) |

|

(6.5 |

) |

% |

| Total revenues |

$ |

94,936 |

|

|

100.0 |

|

% |

|

$ |

95,101 |

|

|

100.0 |

|

% |

|

$ |

(165 |

) |

|

(0.2 |

) |

% |

| |

|

(1) Syndicated Audience revenue includes revenue from our movies

business, which grew from $9.1 million in the fourth quarter

of 2023 to $9.4 million in the fourth quarter of 2024. |

| |

Three Months Ended (Unaudited) |

|

Year Ended |

|

|

| (In thousands) |

March 31, 2024 |

|

June 30, 2024 |

|

September 30, 2024 |

|

December 31, 2024 |

|

December 31, 2024 |

|

% of Total 2024

Revenue |

|

Content & Ad Measurement |

|

|

|

|

|

|

|

|

|

|

|

|

Syndicated Audience |

$ |

64,600 |

|

|

$ |

64,189 |

|

|

$ |

65,042 |

|

|

$ |

66,823 |

|

|

$ |

260,654 |

|

|

73.2 |

|

% |

|

Cross-Platform |

|

8,020 |

|

|

|

8,000 |

|

|

|

10,232 |

|

|

|

14,218 |

|

|

|

40,470 |

|

|

11.4 |

|

% |

|

Total Content & Ad Measurement |

|

72,620 |

|

|

|

72,189 |

|

|

|

75,274 |

|

|

|

81,041 |

|

|

|

301,124 |

|

|

84.6 |

|

% |

|

Research & Insight Solutions |

|

14,175 |

|

|

|

13,648 |

|

|

|

13,205 |

|

|

|

13,895 |

|

|

|

54,923 |

|

|

15.4 |

|

% |

| Total revenues |

$ |

86,795 |

|

|

$ |

85,837 |

|

|

$ |

88,479 |

|

|

$ |

94,936 |

|

|

$ |

356,047 |

|

|

100.0 |

|

% |

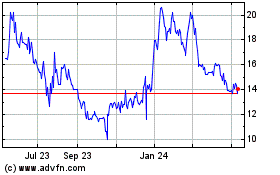

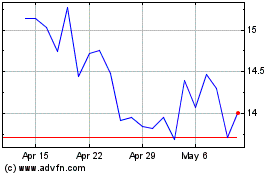

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Feb 2025 to Mar 2025

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Mar 2024 to Mar 2025