false

0001269026

0001269026

2024-11-18

2024-11-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 18, 2024

SINTX

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-33624 |

|

84-1375299 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1885

West 2100 South

Salt

Lake City, UT 84119

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code: (801) 839-3500

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s): |

|

Name

of each exchange on which registered: |

| Common

Stock, par value $0.01 per share |

|

SINT |

|

The

NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure

On

November 18, 2024, SINTX Technologies, Inc. issued a press release. A copy of the press release is attached as

Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

8.01 Other Events.

On

November 18, 2024, the Company announced that its Board of Directors authorized a share repurchase program that would allow the Company

to repurchase up to $500,000 of its common stock (the “Repurchase Program”). The Repurchase Program does not obligate the

Company to acquire any particular number of common shares, and the Repurchase Program may be suspended or discontinued at any time at

the Company’s discretion. The timing and amount of any share repurchases under the Repurchase Program will be determined by Company

management at its discretion based on ongoing assessments of the capital needs of the business, the market price of the Company’s

common stock, corporate and regulatory requirements, and general market conditions. Share repurchases under the program may be made through

a variety of methods, which may include open market purchases, in block trades, accelerated share repurchase transactions, exchange transactions,

the use of trading plans intended to qualify under Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, or any combination

of such methods.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

SINTX

Technologies, Inc. |

| |

|

|

|

|

| Date: |

November

18, 2024 |

|

By: |

/s/

Eric Olson |

| |

|

|

|

Eric

Olson |

| |

|

|

|

Chief

Executive Officer |

Exhibit

99.1

SINTX

Technologies Announces Stock Repurchase Program

Salt

Lake City, UT – November 18, 2024 – SINTX Technologies, Inc. (NASDAQ: SINT) (“SINTX” or the “Company”),

an advanced ceramics company that develops and commercializes materials, components, and technologies for medical and technical applications,

today announced that its Board of Directors has authorized a stock repurchase program to buy back up to $500,000 of the company’s

outstanding common stock over the next several quarters which equates to about 20% of total outstanding shares. The repurchases will

be conducted based on market conditions and other factors, reflecting SINTX’s confidence in its strategic direction and commitment

to enhancing shareholder value.

Strategic

Rationale

This

initiative aligns with SINTX’s strategic focus on optimizing its capital structure and delivering long-term value to shareholders.

By repurchasing shares, the company aims to reduce the number of outstanding shares, thereby increasing the ownership stake of remaining

shareholders and enhancing earnings per share. Similar to actions taken by other industry leaders, SINTX believes that a stock repurchase

program is an effective way to return capital to shareholders.

Management

Commentary

“We

believe that the current market undervalues SINTX’s potential,” said Eric Olson, CEO of SINTX Technologies. “This repurchase

program underscores our confidence in the company’s strategic initiatives and our commitment to delivering value to our shareholders.

By leveraging our strong balance sheet, we are taking a proactive approach to capital allocation, similar to other companies in our industry

that have successfully implemented share repurchase programs.”

Program

Details

The

stock repurchase program will be managed by Maxim Group, LLC, a recognized leader in investment banking and asset management. The repurchase

program does not obligate the Company to acquire any particular amount of common shares, and the repurchase program may be suspended

or discontinued at any time at the Company’s discretion. The timing and amount of any share repurchases under the share repurchase

program will be determined by SINTX’s management at its discretion based on ongoing assessments of the capital needs of the business,

the market price of the Company’s common stock, corporate and regulatory requirements, and general market conditions. Share repurchases

under the program may be made through a variety of methods, which may include open market purchases, in block trades, accelerated share

repurchase transactions, exchange transactions, the use of trading plans intended to qualify under Rule 10b5-1 under the Securities Exchange

Act of 1934, as amended, or any combination of such methods.

For

more information, please visit www.sintx.com

About

SINTX Technologies, Inc.

SINTX

Technologies is an advanced ceramics company that develops and commercializes materials, components, and technologies for medical and

technical applications. SINTX is a global leader in the research, development, and manufacturing of silicon nitride, and its products

have been implanted in humans since 2008. Over the past several years, SINTX has utilized strategic acquisitions and alliances to enter

into new markets. The Company has manufacturing and R&D facilities in Utah and Maryland. For more information on SINTX Technologies

or its materials platform, visit www.sintx.com.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”)

that are subject to a number of risks and uncertainties. Forward-looking statements can be identified by words such as: “anticipate,”

“believe,” “project,” “estimate,” “expect,” “strategy,” “future,”

“likely,” “may,” “should,” “will” and similar references to future periods. Examples

of forward-looking statements include, among others, statements we make regarding advancement of ceramic technologies and exploring new

avenues for growth and innovation, and the potential to pursue growth opportunities and explore strategic opportunities.

Readers

are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and

reflect management’s current estimates, projections, expectations and beliefs. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which

are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking

statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in

the forward-looking statements include, among others, difficulty in commercializing ceramic technologies and development of new product

opportunities. A discussion of other risks and uncertainties that could cause our actual results and financial condition to differ materially

from those indicated in the forward-looking statements can be found in SINTX’s Risk Factors disclosure in its Annual Report on

Form 10-K, filed with the SEC on March 27, 2024, and in SINTX’s other filings with the SEC. SINTX undertakes no obligation to publicly

revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report, except as

required by law.

Business

and Media Inquiries for SINTX:

SINTX

Technologies

801.839.3502

IR@sintx.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

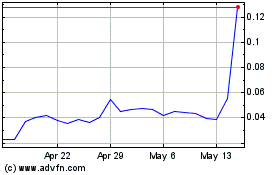

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jan 2025 to Feb 2025

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Feb 2024 to Feb 2025