Sol-Gel Technologies, Ltd. (NASDAQ: SLGL), a clinical-stage

dermatology company focused on identifying, developing and

commercializing branded and generic topical drug products for the

treatment of skin diseases, today announced financial results for

the full year ended December 31, 2020 and provided corporate

updates.

“I am very pleased with the major milestones that were

achieved by Sol-Gel last year. After announcing positive data from

Phase 3 trials of Epsolay and Twyneo and submitting NDAs to

the FDA within guided timelines, 2020 was highlighted by positive

acceptances of both NDAs and allocated PDUFA dates,”

commented Dr. Alon Seri-Levy, Chief Executive Officer of

Sol-Gel.

“Given the competitive landscape of the dermatology market and

the significant capital that would be needed to directly

commercialize our products, our current operational model assumes

we will partner with a dermatology company that has a strong market

presence. This would enable us to capture market share more

quickly without the need to invest in building our own marketing

and sales force and would allow us to further invest in the

development of our pipeline of products with larger potential

markets,” continued Dr. Seri-Levy.

Corporate Highlights and Recent

Developments

- Sol-Gel announced the U.S. Food and

Drug Administration’s (FDA) acceptance of New Drug Application

(NDA) for Epsolay (benzoyl peroxide, 5%, cream) with a Prescription

Drug User Fee Act (PDUFA) goal date set for April 26, 2021. If

approved, Epsolay has the potential to be the first FDA-approved,

single-agent benzoyl peroxide prescription drug product for the

treatment of inflammatory lesions of rosacea.

- Sol-Gel announced FDA acceptance of

NDA for Twyneo (benzoyl peroxide, 3%, and tretinoin, 0.1%, cream)

with a PDUFA goal date set for August 1, 2021. If approved, Twyneo

has the potential to be the first FDA-approved acne treatment

that contains fixed-dose combination of benzoyl peroxide and

tretinoin.

- Sol-Gel is in discussions with

potential partners regarding the commercialization of Epsolay and

Twyneo in the United States to occur if the product candidates

receive regulatory approval from the FDA.

- In preparation for commercial launch

of proprietary products the Company has opened a US headquarters in

Whippany, NJ.

- Sol-Gel was informed by its

collaboration partner that the launch of an FDA-approved generic

drug is expected in the second quarter of 2021. Annual sales of the

brand name product exceeded $180 million in the United States in

2019.

- In 2020, Sol-Gel signed four

additional collaboration agreements with Perrigo for the

development, manufacture, and commercialization of new generic

product candidates, bringing the total number of collaborations

between the companies to 12.

- Pre-clinical testing of erlotinib

(an epidermal growth factor receptor inhibitor), tapinarof (an

investigational aryl hydrocarbon receptor modulator), and

roflumilast (an investigational phosphodiesterase 4 inhibitor) is

progressing for various new pharmaceutical indications. A total of

25 provisional patent applications for these project candidates

have been submitted to date.

- The enrollment of patients in the

Phase 1 proof-of-concept study with SGT-210 (erlotinib gel) in

patients with palmoplantar keratoderma has been slowed by the

COVID-19 pandemic. The Company expects to report top-line data in

the third quarter of 2021.

- In 2020, the Company completed

financings totaling $28.0 million in gross proceeds,

including the proceeds of the February underwritten public offering

of $23.0 million and from the $5.0 million invested

in April by Sol-Gel’s controlling shareholder, M. Arkin

Dermatology Ltd.

Financial Results for the

Year Ended December

31, 2020

Revenue in 2020 was $8.8 million. The revenue was mainly due to

sales of a generic product from a collaboration arrangement with

Perrigo.

Research and development expenses were $27.9 million in 2020

compared to $40.6 million during the same period in 2019. The

decrease of $12.7 million was mainly attributed to a decrease of

$17.9 million in clinical trial expenses, mainly due to the

completion of the clinical trials of Epsolay and Twyneo towards the

end of 2019, a decrease of $0.4 million in other expenses, mainly

due to the purchase of raw material for manufacturing, partially

offset by an increase of $5.4 million in manufacturing

expenses.

General and administrative expenses were $11.1 million in 2020

compared to $8.3 million in 2019. The increase of $2.8 million was

mainly attributed to an increase of $3.0 million in

commercialization expenses and an increase of $0.4 million in

patent related expenses, partially offset by a decrease of $0.7

million in stock based compensation expenses.

Sol-Gel reported a loss of $29.3 million for the full year of

2020 compared to loss of $24.6 million for the same period in

2019.

As of December 31, 2020, Sol-Gel had $28.5 million in cash, cash

equivalents and deposits, and $21.7 million in marketable

securities for a total balance of $50.2 million. Sol-Gel expects

its existing cash resources will enable funding of operational and

capital expenditure requirements into the third quarter of

2022.

About Sol-Gel Technologies

Sol-Gel is a clinical-stage dermatology company focused on

identifying, developing and commercializing branded and generic

topical drug products for the treatment of skin

diseases. Sol-Gel leverages its proprietary

microencapsulation technology platform for the development of

Twyneo, under investigation for the treatment of acne vulgaris, and

Epsolay, under investigation for the treatment of inflammatory

lesions of rosacea. The Company’s pipeline also includes SGT-210

(erlotinib gel), under investigation for the treatment

of palmoplantar keratoderma, and three pre-clinical assets –

erlotinib, tapinarof and roflumilast – currently being tested for

various pharmaceutical indications. For additional information,

please visit www.sol-gel.com.

About

Epsolay®

Epsolay is an investigational topical cream containing

encapsulated benzoyl peroxide, 5%, for the treatment of

papulopustular rosacea. Epsolay utilizes a patented technology

process to encapsulate benzoyl peroxide within silica-based

microcapsules to create a barrier between the medication and the

skin. The slow migration of medication from the microcapsules is

designed to deliver an effective dose of benzoyl peroxide onto the

skin, while reducing the ability of benzoyl peroxide to induce skin

irritation, such as erythema, burning and stinging. If approved,

Epsolay has the potential to be the first FDA-approved

single-active benzoyl peroxide prescription drug product. Epsolay

is not approved by the FDA and the safety and efficacy has not been

established.

About Papulopustular Rosacea

Papulopustular rosacea is a chronic and recurrent inflammatory

skin disorder that affects nearly 5 million Americans. The

condition is common, especially in fair-skinned people of Celtic

and northern European heritage. Onset is usually after age 30 and

typically begins as flushing and subtle redness on the cheeks,

nose, chin or forehead. If left untreated, rosacea can slowly

worsen over time. As the condition progresses the redness becomes

more persistent, blood vessels become visible and pimples often

appear. Other symptoms may include burning, stinging, dry skin,

plaques and skin thickening.

About

Twyneo®

Twyneo is an investigational, fixed-dose combination of

encapsulated benzoyl peroxide, 3%, and encapsulated tretinoin,

0.1%, cream for the treatment of acne vulgaris. If approved, it

will be the first acne treatment that contains a fixed-dose

combination of benzoyl peroxide and tretinoin, which are separately

encapsulated in silica using Sol-Gel’s proprietary

microencapsulation technology. Tretinoin and benzoyl peroxide are

widely prescribed separately as a combination treatment for acne;

however, benzoyl peroxide causes degradation of the tretinoin

molecule, thereby potentially reducing its effectiveness if used at

the same time or combined in the same formulation. The silica-based

microcapsule is designed to protect tretinoin from oxidative

decomposition by benzoyl peroxide, thereby enhancing the stability

of the active drug ingredients. The silica-based shell is also

designed to release the ingredients slowly over time to provide a

favorable efficacy and safety profile. Twyneo is not approved by

the FDA and the safety and efficacy has not been established.

About Acne Vulgaris

Acne vulgaris is a common multifactorial skin disease that

according to the American Academy of Dermatology affects

approximately 40 to 50 million people in the United States. The

disease occurs most frequently during childhood and adolescence

(affecting 80% to 85% of all adolescents) but it may also appear in

adults. Acne patients suffer from the appearance of lesions on

areas of the body with a large concentration of oil glands, such as

the face, chest, neck and back. These lesions can be inflamed

(papules, pustules, nodules) or non-inflamed (comedones). Acne can

have a profound effect on the quality of life of those suffering

from the disease. In addition to carrying a substantial risk of

permanent facial scarring, the appearance of lesions may cause

psychological strain, social withdrawal and lowered

self-esteem.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, but not limited to,

statements regarding the PDUFA goal dates for Epsolay (benzoyl

peroxide, 5%, cream) and Twyneo, the timing of commercialization of

Epsolay and Twyneo, the timing and expected launch of an

FDA-approved generic drug in the second quarter of 2021, and the

timing of the Phase 1 data readout of SGT-210. These

forward-looking statements include information about possible or

assumed future results of our business, financial condition,

results of operations, liquidity, plans and objectives. In some

cases, you can identify forward-looking statements by terminology

such as “believe,” “may,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “expect,” “predict,” “potential,” or

the negative of these terms or other similar expressions.

Forward-looking statements are based on information we have when

those statements are made or our management’s current expectation

and are subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in

or suggested by the forward-looking statements. Important factors

that could cause such differences include, but are not limited to,

risks relating to the effects of COVID-19 (coronavirus) as well as

the following factors: (i) the adequacy of our financial and other

resources, particularly in light of our history of recurring losses

and the uncertainty regarding the adequacy of our liquidity to

pursue our complete business objectives; (ii) our ability to

complete the development of our product candidates; (iii) our

ability to find suitable co-development partners; (iv) our ability

to obtain and maintain regulatory approvals for our product

candidates in our target markets, the potential delay in receiving

such regulatory approvals and the possibility of adverse regulatory

or legal actions relating to our product candidates even if

regulatory approval is obtained; (v) our ability to commercialize

our pharmaceutical product candidates; (vi) our ability to obtain

and maintain adequate protection of our intellectual property;

(vii) our ability to manufacture our product candidates in

commercial quantities, at an adequate quality or at an acceptable

cost; (viii) our ability to establish adequate sales, marketing and

distribution channels; (ix) acceptance of our product candidates by

healthcare professionals and patients; (x) the possibility that we

may face third-party claims of intellectual property infringement;

(xi) the timing and results of clinical trials that we may conduct

or that our competitors and others may conduct relating to our or

their products; (xii) intense competition in our industry, with

competitors having substantially greater financial, technological,

research and development, regulatory and clinical, manufacturing,

marketing and sales, distribution and personnel resources than we

do; (xiii) potential product liability claims; (xiv) potential

adverse federal, state and local government regulation in the

United States, Europe or Israel; and (xv) loss or

retirement of key executives and research scientists. These and

other important factors discussed in the Company's Annual Report on

Form 20-F to be filed with the Securities and Exchange

Commission (“SEC”) on March 4, 2021 and our other reports

filed with the SEC could cause actual results to differ

materially from those indicated by the forward-looking statements

made in this press release. Any such forward-looking statements

represent management’s estimates as of the date of this press

release. Except as required by law, we undertake no obligation to

update publicly any forward-looking statements after the date of

this press release to conform these statements.

SOL-GEL TECHNOLOGIES LTD.

CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share and per

share data)

|

|

|

|

December 31

|

|

|

Assets

|

|

|

|

2019

|

|

|

|

|

2020

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

9,412

|

|

|

|

|

$

|

7,122

|

|

|

|

Bank deposits

|

|

|

|

-

|

|

|

|

|

|

21,400

|

|

|

|

Marketable securities

|

|

|

|

40,966

|

|

|

|

|

|

21,652

|

|

|

|

Receivables from collaborative arrangements

|

|

|

|

4,120

|

|

|

|

|

|

2,153

|

|

|

|

Prepaid expenses and other current assets

|

|

|

|

1,293

|

|

|

|

|

|

1,074

|

|

|

|

TOTAL CURRENT ASSETS

|

|

|

|

55,791

|

|

|

|

|

|

53,401

|

|

|

|

NON-CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted long-term deposits and cash

|

|

|

|

472

|

|

|

|

|

|

1,293

|

|

|

|

Property and equipment, net

|

|

|

|

2,314

|

|

|

|

|

|

1,817

|

|

|

|

Operating lease right-of-use assets

|

|

|

|

2,040

|

|

|

|

|

|

1,896

|

|

|

|

Funds in respect of employee rights upon retirement

|

|

|

|

684

|

|

|

|

|

|

754

|

|

|

|

TOTAL NON-CURRENT ASSETS

|

|

|

|

5,510

|

|

|

|

|

|

5,760

|

|

|

|

TOTAL ASSETS

|

|

|

$

|

61,301

|

|

|

|

|

$

|

59,161

|

|

|

|

Liabilities and shareholders' equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

$

|

1,710

|

|

|

|

|

$

|

1,203

|

|

|

|

Other accounts

payable

|

|

|

|

4,123

|

|

|

|

|

|

4,088

|

|

|

|

Current maturities of operating leases

|

|

|

|

672

|

|

|

|

|

|

673

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

|

6,505

|

|

|

|

|

|

5,964

|

|

|

|

LONG-TERM LIABILITIES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating leases liabilities

|

|

|

|

1,373

|

|

|

|

|

|

1,299

|

|

|

|

Liability for employee rights upon retirement

|

|

|

|

958

|

|

|

|

|

|

1,049

|

|

|

|

TOTAL LONG-TERM LIABILITIES

|

|

|

|

2,331

|

|

|

|

|

|

2,348

|

|

|

|

COMMITMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

|

8,836

|

|

|

|

|

|

8,312

|

|

|

|

SHAREHOLDERS' EQUITY:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares, NIS 0.1 par value – authorized: 50,000,000 as

of December 31, 2019 and 2020, respectively; issued and

outstanding: 20,402,800 and 23,000,782 as of December 31, 2019 and

December 31, 2020,

respectively

|

|

|

|

561

|

|

|

|

|

|

635

|

|

|

|

Additional paid-in capital

|

|

|

|

203,977

|

|

|

|

|

|

231,577

|

|

|

|

Accumulated deficit

|

|

|

|

(152,073

|

)

|

|

|

|

|

(181,363

|

)

|

|

|

TOTAL SHAREHOLDERS' EQUITY

|

|

|

|

52,465

|

|

|

|

|

|

50,849

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

|

|

|

$

|

61,301

|

|

|

|

$

|

59,161

|

|

|

|

SOL-GEL TECHNOLOGIES LTD.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(U.S. dollars in thousands, except share and per

share data)

| |

|

Year ended December 31,

|

|

| |

|

2018

|

|

|

|

2019

|

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLLABORATION REVENUES

|

|

$

|

129

|

|

|

|

$

|

22,904

|

|

|

|

$

|

8,771

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and Development

|

|

|

28,146

|

|

|

|

|

40,578

|

|

|

|

|

27,913

|

|

|

|

General and

Administrative

|

|

|

5,504

|

|

|

|

|

8,276

|

|

|

|

|

11,091

|

|

|

|

TOTAL OPERATING LOSS

|

|

|

33,521

|

|

|

|

|

25,950

|

|

|

|

|

30,233

|

|

|

|

FINANCIAL INCOME, net

|

|

|

(1,318

|

)

|

|

|

|

(1,374

|

)

|

|

|

|

(943

|

)

|

|

|

LOSS BEFORE INCOME TAXES

|

|

|

32,203

|

|

|

|

|

24,576

|

|

|

|

|

29,290

|

|

|

|

INCOME TAXES

|

|

|

-

|

|

|

|

|

33

|

|

|

|

|

-

|

|

|

|

LOSS FOR THE YEAR

|

|

$

|

32,203

|

|

|

|

$

|

24,609

|

|

|

|

$

|

29,290

|

|

|

|

BASIC AND DILUTED LOSS PER ORDINARY SHARE

|

|

$

|

1.80

|

|

|

|

$

|

1.26

|

|

|

|

$

|

1.30

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING USED IN

COMPUTATION OF BASIC AND DILUTED LOSS PER SHARE

|

|

|

17,867,589

|

|

|

|

|

19,534,562

|

|

|

|

|

22,574,688

|

|

|

For further information, please contact:

Sol-Gel Contact:Gilad MamlokChief Financial

Officer+972-8-9313433

Investor Contact:Michael LevitanSolebury

Trout+1-646-378-2920mlevitan@soleburytrout.com

Source: Sol-Gel Technologies Ltd.

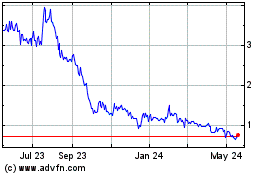

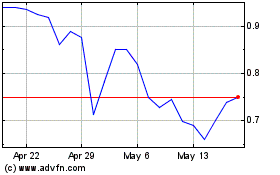

Sol Gel Technologies (NASDAQ:SLGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sol Gel Technologies (NASDAQ:SLGL)

Historical Stock Chart

From Feb 2024 to Feb 2025