false

0001691936

0001691936

2025-02-06

2025-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 6, 2025

STRYVE

FOODS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38785 |

|

87-1760117 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

Number) |

Post

Office Box 864

Frisco,

TX |

|

75034 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (972) 987-5130

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

February 6, 2025, Stryve Foods, Inc. (the “Company”) entered into an agreement (the “Lease Termination Agreement”)

with Denali Texas 16240 Gateway Industrial, LLC (the “Landlord”) to terminate the lease for its distribution center located

at 16240 Gateway Path, Frisco, TX 75033 (the “Original Lease Agreement”). In order to terminate the Original Lease Agreement,

the Company issued an unsecured promissory note (“Note”) to the Landlord for the termination fee of $1.1 million.

As modified by the terms of the Lease Termination Agreement, the lease will expire on February 15, 2025. The Lease Termination Agreement

releases the Company from its remaining obligations under the Original Lease Agreement, which included payment obligations of approximately

$10.2 million, inclusive of future lease payments of approximately $7.6 million and common area maintenance charges of approximately

$2.6 million. The foregoing description of the terms of the Lease Termination Agreement are qualified

in their entirety by reference to the form agreement, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

In

connection with the Lease Termination Agreement, the Company issued a Note on February 6, 2025 to the Landlord for the amount of the

lease termination fee of $1.1 million. The Note bears interest at 0.0% and is to be repaid in sixty (60) monthly installments

maturing on April 1, 2030. The foregoing description of the terms of the Notes are qualified in their entirety by reference to the form

Note, which is attached hereto as Exhibit 10.2 and incorporated by reference herein.

Item

7.01 Regulation FD Disclosure.

On

February 11, 2025, the Company issued a press release announcing that the Company has completed a major network optimization project

which it expects to generate annual net savings of more than $1.0 million through improved operating efficiencies, reduced transportation

costs, and rent savings.. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The

information furnished under this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall

such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in

such filing.

Item

9.01(d) Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

February 12, 2025

| |

STRYVE FOODS, INC. |

| |

|

|

| |

By: |

/s/ R. Alex

Hawkins |

| |

Name: |

R. Alex Hawkins |

| |

Title: |

Chief Financial Officer |

Exhibit 10.1

Exhibit 10.2

Exhibit

99.1

Stryve

Foods, Inc. Completes Major Network Optimization, Unlocking Over $1 Million in Estimated Annual Savings

Eliminates

+$10 Million Future Lease Payments

Optimizes

Distribution & Fulfillment Network Estimated to Yield $1 Million Net Savings Annually

Continued

Execution of Management’s Productivity & Transformation Agenda

PLANO,

Texas, February 11, 2025 — Stryve Foods, Inc. (OTC: SNAX) (“Stryve” or the “Company”), a leader in high-protein,

better-for-you snacking, today announced the successful completion of a major network optimization initiative, marking another milestone

in the Company’s ongoing transformation. By transitioning fulfillment operations to a combination of redistribution partners, including

Dot Foods, distributors, and third-party logistics providers, Stryve has successfully exited its final distribution center lease—an

achievement expected to generate over $1 million in annual savings and drive significant operational efficiencies.

“This

is a game-changer for Stryve,” said Chris Boever, Chief Executive Officer. “By leveraging Dot Foods’ expansive

logistics network and optimizing our fulfillment strategy, we are not only reducing costs but also enhancing service levels for our retail

partners. This move allows us to focus on what we do best—innovating, manufacturing, and marketing our brands—while letting

best-in-class logistics partners handle distribution.”

Maximizing

Efficiency and Savings

This

transition delivers substantial financial and operational benefits to Stryve, including:

| ● | +

$1 million in expected annual net savings, achieved through improved operating efficiencies,

reduced transportation costs, and rent savings. |

| ● | Eliminating

+ $10 million in future lease obligations, freeing up capital for strategic investments and

growth. |

| ● | Enhanced

service levels for retail partners, leading to improved product availability and expanded

distribution reach. |

As

previously announced, Stryve’s partnership with Dot Foods has played a pivotal role in strengthening its supply chain. By leveraging

Dot’s expertise, the Company is now better positioned to support growing consumer demand while streamlining its operations.

Continuing

the Transformation

This

milestone follows a series of strategic initiatives that have bolstered Stryve’s financial health and operational agility. Recent

moves, such as the successful retirement of $8.7 million in debt and securing expanded retail distribution, underscore the Company’s

commitment to sustainable, profitable growth.

“As

we continue to execute our transformation, this optimization aligns perfectly with our mission to scale efficiently,” said Alex

Hawkins, Chief Financial Officer. “With a leaner, more focused infrastructure, we are positioned to accelerate growth while maintaining

financial discipline.”

Looking

Ahead

With

the lease termination effective February 15, 2025, and the Dot Foods relationship already fully operational, Stryve expects to begin

realizing savings from this network optimization in its Q1 2025 results. This initiative represents another critical step in the Company’s

journey toward long-term profitability and shareholder value creation.

About

Stryve Foods, Inc.

Stryve

is a premium air-dried meat snack company that is conquering the intersection of high protein, great taste, and health under the brands

of Braaitime®, Kalahari®, Stryve®, and Vacadillos®. Stryve sells highly differentiated healthy snacking and food products

in order to disrupt traditional snacking and CPG categories. Stryve’s mission is “to help Americans eat better and live happier,

better lives.” Stryve offers convenient products that are lower in sugar and carbohydrates and higher in protein than other snacks

and foods. Stryve’s current product portfolio consists primarily of air-dried meat snack products marketed under the Stryve®,

Kalahari®, Braaitime®, and Vacadillos® brand names. Unlike beef jerky, Stryve’s all-natural air-dried meat snack products

are made of beef and spices, are never cooked, contain zero grams of sugar*, and are free of monosodium glutamate (MSG), gluten, nitrates,

nitrites, and preservatives. As a result, Stryve’s products are Keto and Paleo diet friendly. Further, based on protein density

and sugar content, Stryve believes that its air-dried meat snack products are some of the healthiest shelf-stable snacks available today.

Stryve also markets and sells human-grade pet treats under the brands Two Tails and Primal Paws, made with simple, all-natural ingredients

and 100% real beef with no fillers, preservatives, or by-products.

Stryve

distributes its products in major retail channels, primarily in North America, including grocery, convenience store, mass merchants,

and other retail outlets, as well as directly to consumers through its ecommerce websites and through the Amazon and Wal*mart platforms.

For more information about Stryve, visit www.stryve.com or follow us on social media at @stryvebiltong.

*

All Stryve Biltong and Vacadillos products contain zero grams of added sugar, with the exception of the Chipotle Honey flavor of Vacadillos,

which contains one gram of sugar per serving.

Cautionary

Note Regarding Forward-Looking Statements

Certain

statements made herein are “forward-looking statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate”,

“may”, “will”, “would”, “could”, “intend”, “aim”, “believe”,

“anticipate”, “continue”, “target”, “milestone”, “expect”, “estimate”,

“plan”, “outlook”, “objective”, “guidance” and “project” and other similar

expressions that predict or indicate future events or trends or that are not statements of historical matters, including, but not limited

to, statements regarding Stryve’s plans, strategies, objectives, targets and expected financial performance. These forward-looking

statements reflect Stryve’s current views and analysis of information currently available. This information is, where applicable,

based on estimates, assumptions and analysis that Stryve believes, as of the date hereof, provide a reasonable basis for the information

and statements contained herein. These forward-looking statements involve various known and unknown risks, uncertainties and other factors,

many of which are outside the control of Stryve and its officers, employees, agents and associates. These risks, uncertainties, assumptions

and other important factors, which could cause actual results to differ materially from those described in these forward-looking statements,

include: (i) the inability to achieve profitability due to commodity prices, inflation, supply chain interruption, transportation costs

and/or labor shortages; (ii) the ability to meet financial and strategic goals, which may be affected by, among other things, competition,

supply chain interruptions, the ability to pursue a growth strategy and manage growth profitability, maintain relationships with customers,

suppliers and retailers and retain its management and key employees; (iii) the risk that retailers will choose to limit or decrease the

number of retail locations in which Stryve’s products are carried or will choose not to carry or not to continue to carry Stryve’s

products; (iv) the possibility that Stryve may be adversely affected by other economic, business, and/or competitive factors; (v) the

impacts of the transition from NASDAQ to OTC; (vi) the possibility that Stryve may not achieve its financial outlook; (vii) risks around

the Company’s ability to continue as a going concern and (viii) other risks and uncertainties described in the Company’s

public filings with the SEC. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections

and forward-looking statements and the assumptions on which those projections and forward-looking statements are based.

Investor

Relations Contact:

Investor

Relations

ir@stryve.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

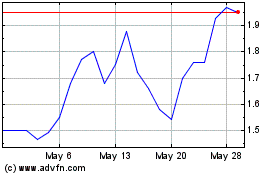

Stryve Foods (NASDAQ:SNAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Stryve Foods (NASDAQ:SNAX)

Historical Stock Chart

From Feb 2024 to Feb 2025