- Delivers Revenue of $1.068 Billion

- Posts GAAP Diluted EPS of $1.00 and Non-GAAP Diluted EPS of

$1.60

- Generates Operating Cash Flow of $377 Million (35% Operating

Cash Flow Margin) and Free Cash Flow of $338 Million (32% Free Cash

Flow Margin)

Skyworks Solutions, Inc. (Nasdaq: SWKS), a leading developer,

manufacturer and provider of analog and mixed-signal semiconductors

and solutions for numerous applications, today reported results for

the fiscal quarter ended Dec. 27, 2024.

Revenue for the first fiscal quarter of 2025 was $1.068 billion.

On a GAAP basis, operating income for the first fiscal quarter was

$181 million with diluted earnings per share of $1.00. On a

non-GAAP basis, operating income was $285 million with non-GAAP

diluted earnings per share of $1.60.

“Skyworks started the new fiscal year with solid results,

growing revenue 4% sequentially and surpassing the midpoint of our

guidance,” said Liam K. Griffin, chief executive officer and

president of Skyworks. “We have observed consistent improvement in

demand indicators within Broad Markets, while we have successfully

supported multiple new product launches in Mobile. Furthermore, we

posted another quarter of impressive free cash flow with margins

exceeding 30%.”

First Fiscal Quarter Business Highlights

- Secured 5G content for premium Android smartphones for Samsung

Galaxy, Xiaomi, and Asus

- Supported Gemtek’s launch of the first AI router with

voice-enabled AI-Powered healthcare service

- Enabled Asus’s award-winning, quad-band Wi-Fi 7 gaming

routers

- Expanded our design win pipeline in automotive with cellular

connectivity and power management solutions

Second Fiscal Quarter 2025 Outlook

We provide earnings guidance on a non-GAAP basis because certain

information necessary to reconcile such guidance to GAAP is

difficult to estimate and dependent on future events outside of our

control. Please refer to the attached Discussion Regarding the Use

of Non-GAAP Financial Measures in this earnings release for a

further discussion of our use of non-GAAP measures, including

quantification of known expected adjustment items.

“For the March quarter, we expect revenue between $935 million

to $965 million, with non-GAAP diluted earnings per share of $1.20

at the mid-point of the revenue range,” said Kris Sennesael, senior

vice president and chief financial officer of Skyworks. “We

anticipate a mid-to-high teens sequential decline in mobile,

consistent with historical seasonal patterns. In broad markets, we

expect additional sequential and year-over-year growth.”

“In addition, our board of directors has approved a new $2

billion stock repurchase program as part of our disciplined capital

allocation strategy.”

Stock Repurchase Program

Skyworks’ board of directors has authorized the repurchase of up

to $2 billion of the Company’s common stock from time to time

through Feb. 3, 2027, on the open market or in privately negotiated

transactions, in compliance with applicable securities laws and

other legal requirements. This newly authorized stock repurchase

program succeeds in its entirety the stock repurchase program that

was approved by the board of directors on Jan. 31, 2023.

The timing and amount of any shares of the Company’s common

stock that are repurchased under the new repurchase program will be

determined by the Company’s management based on its evaluation of

market conditions and other factors. The repurchase program may be

suspended or discontinued at any time.

The Company currently expects to fund the repurchase program

using the Company’s working capital. As of Dec. 27, 2024, the

Company had cash and marketable securities of approximately $1.75

billion.

Dividend Payment

Skyworks’ board of directors also declared a cash dividend of

$0.70 per share of the Company’s common stock. The dividend is

payable on Mar. 17, 2025, to stockholders of record at the close of

business on Feb. 24, 2025.

Skyworks’ First Quarter 2025 Conference Call

Skyworks will host a conference call with analysts to discuss

its first quarter fiscal 2025 results and business outlook on Feb.

5, 2025, at 4:30 p.m. EST.

To listen to the conference call, please visit the investor

relations section of Skyworks’ website at

https://investors.skyworksinc.com/events-presentations. Playback of

the conference call will be available on Skyworks’ website at

www.skyworksinc.com/investors beginning at 9 p.m. EST on Feb. 5,

2025. Additionally, a transcript of the Company’s prepared remarks

will be made available on our website promptly after their

conclusion during the call.

About Skyworks

Skyworks Solutions, Inc. is empowering the wireless networking

revolution. We are a leading developer, manufacturer and provider

of analog and mixed-signal semiconductors and solutions for

numerous applications, including aerospace, automotive, broadband,

cellular infrastructure, connected home, defense, entertainment and

gaming, industrial, medical, smartphone, tablet and wearables.

Skyworks is a global company with engineering, marketing,

operations, sales and support facilities located throughout Asia,

Europe and North America and is a member of the S&P 500® market

index (Nasdaq: SWKS). For more information, please visit Skyworks’

website at: www.skyworksinc.com.

Safe Harbor Statement

This earnings release includes “forward-looking statements”

intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include information relating to future

events, prospects, expectations and results of Skyworks (e.g.,

certain projections and business trends, as well as plans for

dividend payments and stock repurchases). Forward-looking

statements can often be identified by words such as “anticipates,”

“estimates,” “expects,” “forecasts,” “intends,” “believes,”

“plans,” “may,” “will” or “continue,” and similar expressions and

variations or negatives of these words. All such statements are

subject to certain risks, uncertainties and other important factors

that could cause actual results to differ materially and adversely

from those projected and may affect our future operating results,

financial position and cash flows.

These risks, uncertainties and other important factors include:

the susceptibility of the semiconductor industry and the markets

addressed by our, and our customers’, products to economic cycles

or changes in economic conditions, including inflation and

recession; our reliance on a small number of key customers for a

large percentage of our sales; decreased gross margins and loss of

market share as a result of increased competition; our ability to

obtain design wins from customers; market acceptance of our

products and our customers’ products, including market acceptance

of new, emerging technologies such as AI; the risks of doing

business internationally, including increased import/export

restrictions and controls (e.g., our ability to sell products to

certain specified foreign entities only pursuant to a limited

export license from the U.S. Department of Commerce or our ability

to obtain foreign-sourced raw materials), imposition of trade

protection measures (e.g., tariffs or taxes), security and health

risks, possible disruptions in transportation networks,

fluctuations in foreign currency exchange rates, and other

economic, social, military and geopolitical conditions in the

countries in which we, our customers or our suppliers operate,

including the conflicts in Ukraine and the Middle East; delays in

the deployment of commercial 5G networks or in consumer adoption of

5G-enabled devices; the volatility of our stock price; changes in

laws, regulations and/or policies that could adversely affect our

operations and financial results, the economy and our customers’

demand for our products, or the financial markets and our ability

to raise capital; fluctuations in our manufacturing yields due to

our complex and specialized manufacturing processes; our ability to

develop, manufacture and market innovative products, avoid product

obsolescence, reduce costs in a timely manner, transition our

products to smaller geometry process technologies and achieve

higher levels of design integration; the quality of our products

and any defect remediation costs; our products’ ability to perform

under stringent operating conditions; the availability and pricing

of third-party semiconductor foundry, assembly and test capacity,

raw materials, including rare earth and similar minerals, supplier

components, equipment and shipping and logistics services,

including limits on our customers’ ability to obtain such services

and materials; disruptions to our manufacturing processes,

including relating to any relocation of our key facilities; the

risk that our chief executive officer transition is not successful

for any reason; our ability to retain, recruit and hire key

executives or the departure of any such executives, technical

personnel and other employees in the positions and numbers, with

the experience and capabilities, and at the compensation levels

needed to implement our business and product plans; the timing,

rescheduling or cancellation of significant customer orders and our

ability, as well as the ability of our customers, to manage

inventory; reduced flexibility in operating our business as a

result of the indebtedness incurred in connection with the

transaction with Silicon Laboratories Inc.; the effects of global

health crises on business conditions in our industry, including in

the risk of significant disruptions to our business operations, as

well as negative impacts to our financial condition; our ability to

prevent theft of our intellectual property, disclosure of

confidential information or breaches of our information technology

systems; uncertainties of litigation, including potential disputes

over intellectual property infringement and rights, as well as

payments related to the licensing and/or sale of such rights; our

ability to continue to grow and maintain an intellectual property

portfolio and obtain needed licenses from third parties; our

ability to make certain investments and acquisitions, integrate

companies we acquire and/or enter into strategic alliances with;

and other risks and uncertainties, including those detailed from

time to time in our filings with the Securities and Exchange

Commission.

The forward-looking statements contained in this earnings

release are made only as of the date hereof, and we undertake no

obligation to update or revise the forward-looking statements,

whether as a result of new information, future events or

otherwise.

Note to Editors: Skyworks and the Skyworks symbol are trademarks

or registered trademarks of Skyworks Solutions, Inc., or its

subsidiaries in the United States and other countries. Third-party

brands and names are for identification purposes only and are the

property of their respective owners.

SKYWORKS SOLUTIONS,

INC.

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

Three Months Ended

(in millions, except per share

amounts)

December 27, 2024

December 29, 2023

Net revenue

$

1,068.5

$

1,201.5

Cost of goods sold

626.6

694.9

Gross profit

441.9

506.6

Operating expenses:

Research and development

176.4

153.1

Selling, general, and administrative

82.6

78.8

Amortization of intangibles

0.2

0.2

Restructuring, impairment, and other

charges

1.6

16.2

Total operating expenses

260.8

248.3

Operating income

181.1

258.3

Interest expense

(6.8

)

(10.0

)

Other income, net

16.1

3.4

Income before income taxes

190.4

251.7

Provision for income taxes

28.4

20.4

Net income

$

162.0

$

231.3

Earnings per share:

Basic

$

1.01

$

1.45

Diluted

$

1.00

$

1.44

Weighted average shares:

Basic

160.4

159.9

Diluted

161.4

161.0

SKYWORKS SOLUTIONS,

INC.

UNAUDITED RECONCILIATIONS OF

NON-GAAP FINANCIAL MEASURES

Three Months Ended

(in millions)

December 27, 2024

December 29, 2023

GAAP gross profit

$

441.9

$

506.6

Share-based compensation expense [a]

7.3

8.8

Amortization of acquisition-related

intangibles

40.0

41.6

Restructuring and other charges

7.9

—

Non-GAAP gross profit

$

497.1

$

557.0

GAAP gross margin %

41.4

%

42.2

%

Non-GAAP gross margin %

46.5

%

46.4

%

Three Months Ended

(in millions)

December 27, 2024

December 29, 2023

GAAP operating income

$

181.1

$

258.3

Share-based compensation expense [a]

51.1

53.3

Acquisition-related expenses

0.1

0.1

Amortization of acquisition-related

intangibles

40.2

41.9

Settlements, gains, losses, and

impairments

(0.5

)

12.1

Restructuring and other charges

12.8

—

Non-GAAP operating income

$

284.8

$

365.7

GAAP operating margin %

16.9

%

21.5

%

Non-GAAP operating margin %

26.7

%

30.4

%

Three Months Ended

(in millions)

December 27, 2024

December 29, 2023

GAAP net income

$

162.0

$

231.3

Share-based compensation expense [a]

51.1

53.3

Acquisition-related expenses

0.1

0.1

Amortization of acquisition-related

intangibles

40.2

41.9

Settlements, gains, losses, and

impairments

(0.5

)

12.1

Restructuring and other charges

12.8

—

Tax adjustments

(7.4

)

(21.7

)

Non-GAAP net income

$

258.3

$

317.0

Three Months Ended

December 27, 2024

December 29, 2023

GAAP net income per share, diluted

$

1.00

$

1.44

Share-based compensation expense [a]

0.32

0.33

Acquisition-related expenses

—

—

Amortization of acquisition-related

intangibles

0.25

0.26

Settlements, gains, losses, and

impairments

—

0.07

Restructuring and other charges

0.08

—

Tax adjustments

(0.05

)

(0.13

)

Non-GAAP net income per share, diluted

$

1.60

$

1.97

Three Months Ended

(in millions)

December 27, 2024

December 29, 2023

GAAP net cash provided by operating

activities

$

377.2

$

774.9

Capital expenditures

(39.0

)

(22.2

)

Non-GAAP free cash flow

$

338.2

$

752.7

GAAP net cash provided by operating

activities margin %

35.3

%

64.5

%

Non-GAAP free cash flow margin %

31.7

%

62.6

%

SKYWORKS SOLUTIONS, INC. DISCUSSION

REGARDING THE USE OF NON-GAAP FINANCIAL MEASURES

Our earnings release contains some or all of the following

financial measures that have not been calculated in accordance with

United States Generally Accepted Accounting Principles (“GAAP”):

(i) non-GAAP gross profit and gross margin, (ii) non-GAAP operating

income and operating margin, (iii) non-GAAP net income, (iv)

non-GAAP diluted earnings per share, and (v) non-GAAP free cash

flow and free cash flow margin. As set forth in the “Unaudited

Reconciliations of Non-GAAP Financial Measures” table found above,

we derive such non-GAAP financial measures by excluding certain

expenses and other items from the respective GAAP financial measure

that is most directly comparable to each non-GAAP financial

measure. Management uses these non-GAAP financial measures to

evaluate our operating performance and compare it against past

periods, make operating decisions, forecast for future periods,

compare our operating performance against peer companies, and

determine payments under certain compensation programs. These

non-GAAP financial measures provide management with additional

means to understand and evaluate the operating results and trends

in our ongoing business by eliminating certain non-recurring

expenses and other items that management believes might otherwise

make comparisons of our ongoing business with prior periods and

competitors more difficult, obscure trends in ongoing operations,

or reduce management’s ability to make forecasts.

We provide investors with non-GAAP gross profit and gross

margin, non-GAAP operating income and operating margin, non-GAAP

net income, non-GAAP diluted earnings per share, and non-GAAP free

cash flow and free cash flow margin because we believe it is

important for investors to be able to closely monitor and

understand changes in our ability to generate income from ongoing

business operations. We believe these non-GAAP financial measures

give investors an additional method to evaluate historical

operating performance and identify trends, an additional means of

evaluating period-over-period operating performance and a method to

facilitate certain comparisons of our operating results to those of

our peer companies. We believe that providing non-GAAP operating

income and operating margin allows investors to assess the extent

to which our ongoing operations impact our overall financial

performance. We also believe that providing non-GAAP net income and

non-GAAP diluted earnings per share allows investors to assess the

overall financial performance of our ongoing operations by

eliminating the impact of share-based compensation expense,

acquisition-related expenses, amortization of acquisition-related

intangibles, settlements, gains, losses, and impairments,

restructuring-related charges, and certain tax items which may not

occur in each period presented and which may represent non-cash

items unrelated to our ongoing operations. We further believe that

providing non-GAAP free cash flow and free cash flow margin provide

insight into our liquidity, our cash-generating capability, and the

amount of cash potentially available to return to shareholders. We

believe that disclosing these non-GAAP financial measures

contributes to enhanced financial reporting transparency and

provides investors with added clarity about complex financial

performance measures.

We calculate non-GAAP gross profit by excluding from GAAP gross

profit, share-based compensation expense, amortization of

acquisition-related intangibles, and restructuring and other

charges. We calculate non-GAAP operating income by excluding from

GAAP operating income, share-based compensation expense,

acquisition-related expenses, amortization of acquisition-related

intangibles, settlements, gains, losses, and impairments, and

restructuring-related charges. We calculate non-GAAP net income and

diluted earnings per share by excluding from GAAP net income and

diluted earnings per share, share-based compensation expense,

acquisition-related expenses, amortization of acquisition-related

intangibles, settlements, gains, losses, and impairments,

restructuring-related charges, and certain tax items. We calculate

non-GAAP free cash flow by deducting capital expenditures from GAAP

net cash provided by operating activities. We exclude certain items

identified above from the respective non-GAAP financial measure

referenced above for the reasons set forth with respect to each

such excluded item below:

Share-Based Compensation Expense - because (1) the total amount

of expense is partially outside of our control because it is based

on factors such as stock price volatility and interest rates, which

may be unrelated to our performance during the period in which the

expense is incurred, (2) it is an expense based upon a valuation

methodology premised on assumptions that vary over time, and (3)

the amount of the expense can vary significantly between companies

due to factors that can be outside of the control of such

companies.

Acquisition-Related Expenses and Amortization of

Acquisition-Related Intangibles - including such items as, when

applicable, fair value adjustments to contingent consideration,

fair value charges incurred upon the sale of acquired inventory,

acquisition-related expenses, and amortization of acquired

intangible assets because they are not considered by management in

making operating decisions and we believe that such expenses do not

have a direct correlation to our future business operations and

thereby including such charges does not necessarily reflect the

performance of our ongoing operations for the period in which such

charges or reversals are incurred.

Settlements, Gains, Losses, and Impairments - because such

settlements, gains, losses, and impairments (1) are not considered

by management in making operating decisions, (2) are infrequent in

nature, (3) are generally not directly controlled by management,

(4) do not necessarily reflect the performance of our ongoing

operations for the period in which such charges are recognized,

and/or (5) can vary significantly in amount between companies and

make comparisons less reliable.

Restructuring and Other Charges - because these charges have no

direct correlation to our future business operations and including

such charges or reversals does not necessarily reflect the

performance of our ongoing operations for the period in which such

charges or reversals are incurred.

Certain Income Tax Items - including certain deferred tax

charges and benefits that do not result in a current tax payment or

tax refund and other adjustments, including but not limited to,

items unrelated to the current fiscal year or that are not

indicative of our ongoing business operations.

The non-GAAP financial measures presented in the table above

should not be considered in isolation and are not an alternative

for the respective GAAP financial measure that is most directly

comparable to each such non-GAAP financial measure. Investors are

cautioned against placing undue reliance on these non-GAAP

financial measures and are urged to review and consider carefully

the adjustments made by management to the most directly comparable

GAAP financial measures to arrive at these non-GAAP financial

measures. Non-GAAP financial measures may have limited value as

analytical tools because they may exclude certain expenses that

some investors consider important in evaluating our operating

performance or ongoing business performance. Further, non-GAAP

financial measures may have limited value for purposes of drawing

comparisons between companies as a result of different companies

potentially calculating similarly titled non-GAAP financial

measures in different ways because non-GAAP measures are not based

on any comprehensive set of accounting rules or principles.

Our earnings release contains forward-looking estimates of

non-GAAP diluted earnings per share for the second quarter of our

2025 fiscal year (“Q2 2025”). We provide this non-GAAP measure to

investors on a prospective basis for the same reasons (set forth

above) that we provide it to investors on a historical basis. We

are unable to provide a reconciliation of our forward-looking

estimate of Q2 2025 GAAP diluted earnings per share to a

forward-looking estimate of Q2 2025 non-GAAP diluted earnings per

share because certain information needed to make a reasonable

forward-looking estimate of GAAP diluted earnings per share for Q2

2025 (other than estimated share-based compensation expense of

$0.20 to $0.40 per diluted share, estimated amortization of

intangibles of $0.20 to $0.30 per diluted share and certain tax

items of -$0.15 to $0.20 per diluted share) is difficult to predict

and estimate and is often dependent on future events that may be

uncertain or outside of our control. Such events may include

unanticipated changes in our GAAP effective tax rate, unanticipated

one-time charges related to asset impairments (fixed assets,

inventory, intangibles, or goodwill), unanticipated

acquisition-related expenses, unanticipated settlements, gains,

losses, and impairments, and other unanticipated non-recurring

items not reflective of ongoing operations. The probable

significance of these unknown items, in the aggregate, is estimated

to be in the range of $0.00 to $0.15 in quarterly earnings per

diluted share on a GAAP basis. Our forward-looking estimates of

both GAAP and non-GAAP measures of our financial performance may

differ materially from our actual results and should not be relied

upon as statements of fact.

[a] The following table summarizes the expense recognized in

accordance with ASC 718 - Compensation, Stock Compensation (in

millions):

Three Months Ended

December 27, 2024

December 29, 2023

Cost of goods sold

$

7.3

$

8.8

Research and development

25.6

25.4

Selling, general, and administrative

18.2

19.1

Total share-based compensation

$

51.1

$

53.3

SKYWORKS SOLUTIONS,

INC.

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

As of

(in millions)

December 27, 2024

September 27, 2024

Assets

Cash, cash equivalents, and marketable

securities

$

1,754.8

$

1,574.1

Accounts receivable, net

520.0

508.8

Inventory

699.7

784.8

Property, plant, and equipment, net

1,247.0

1,280.3

Goodwill and intangible assets, net

3,060.7

3,077.2

Other assets

1,048.9

1,058.1

Total assets

$

8,331.1

$

8,283.3

Liabilities and Equity

Accounts payable

$

147.2

$

171.8

Accrued and other liabilities

788.5

780.5

Debt

994.7

994.3

Stockholders’ equity

6,400.7

6,336.7

Total liabilities and equity

$

8,331.1

$

8,283.3

SKYWORKS SOLUTIONS,

INC.

UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Three Months Ended

(in millions)

December 27, 2024

December 29, 2023

Cash flows from operating

activities:

Net income

$

162.0

$

231.3

Adjustments to reconcile net income to net

cash provided by operating activities:

Share-based compensation

51.1

53.3

Depreciation

67.6

64.7

Amortization of intangible assets

48.4

48.1

Deferred income taxes

(0.5

)

(2.6

)

Asset impairment charges

—

16.1

Amortization of debt discount and issuance

costs

0.5

1.9

Other, net

(3.1

)

(4.4

)

Changes in assets and liabilities:

Receivables, net

(11.2

)

204.9

Inventory

86.9

192.2

Accounts payable

(19.9

)

(18.7

)

Other current and long-term assets and

liabilities

(4.6

)

(11.9

)

Net cash provided by operating

activities

377.2

774.9

Cash flows from investing

activities:

Capital expenditures

(39.0

)

(22.2

)

Purchased intangibles

(9.8

)

(7.6

)

Purchases of marketable securities

(150.7

)

(1.1

)

Sales and maturities of marketable

securities

204.9

3.2

Other

2.1

4.2

Net cash provided by (used in)

investing activities

7.5

(23.5

)

Cash flows from financing

activities:

Repurchase of common stock - payroll tax

withholdings on equity awards

(38.3

)

(32.7

)

Dividends paid

(112.5

)

(108.9

)

Net proceeds from exercise of stock

options

—

1.1

Payments of debt

—

(300.0

)

Net cash used in financing

activities

(150.8

)

(440.5

)

Net increase in cash and cash

equivalents

233.9

310.9

Cash and cash equivalents at beginning of

period

1,368.6

718.8

Cash and cash equivalents at end of

period

$

1,602.5

$

1,029.7

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205704087/en/

Media Relations: Constance Griffiths (949) 230-4867

Constance.Griffiths@skyworksinc.com

Investor Relations: Raji Gill (949) 508-0973

Raji.Gill@skyworksinc.com

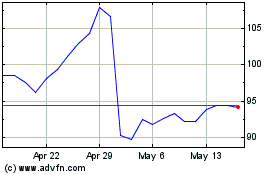

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Jan 2025 to Feb 2025

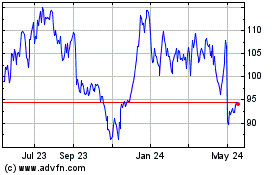

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Feb 2024 to Feb 2025