TFF Pharmaceuticals Reports Second Quarter Financial Results and Provides Corporate Update

August 14 2024 - 3:05PM

TFF Pharmaceuticals, Inc. (NASDAQ: TFFP) (“the Company”), a

clinical-stage biopharmaceutical company focused on developing and

commercializing innovative drug products based on its patented Thin

Film Freezing (TFF) technology platform, today reported financial

results for the second quarter 2024 and provided a corporate

update.

“Over the last several months, we have amassed a growing body of

positive safety, efficacy and confirmatory biomarker data from our

Phase 2 program that points towards TFF TAC becoming a significant

new advancement for the prevention of lung transplant rejection,”

said Harlan Weisman, M.D., Chief Executive Officer of TFF

Pharmaceuticals. “Given our current financial resources, we are

continuing to evaluate a number of different strategies to advance

the TFF TAC clinical program in the most efficient manner

possible.”

Recent Clinical

and Corporate

Highlights:

- The Company recently provided an

update from the ongoing Phase 2 trial of Tacrolimus Inhalation

Powder (TFF TAC) for the prevention of lung transplant rejection.

- Patient enrollment has accelerated with 13 patients now

enrolled

- TFF TAC at ~20% of the oral tacrolimus dose prevented acute

rejection and achieved >80% of the oral trough blood levels

leading to diminished drug burden

- 9 out of 9 (100%) patients who completed the 12-week treatment

period with TFF TAC chose to remain on the therapy by proceeding to

the long-term extension phase

- PK data indicate that TFF TAC dosing results in reduced

systemic variability of tacrolimus; the systemic tacrolimus trough

to peak concentration swings that occur with oral tacrolimus are

not present with TFF TAC, which is predicted to reduce the risk of

organ rejection and systemic toxicities such as chronic kidney

disease.

- Confirmatory biomarker data also remain positive:

- Updated biomarker data indicate a 6.5-fold reduction in the

number of abnormally expressed rejection-related gene sets after 12

weeks of treatment with TFF TAC compared to oral tacrolimus. These

data further suggest TFF TAC has the potential to provide

sufficient immunosuppression to prevent rejection; there was a

reduction in expression of rejection-related gene sets from 23%

abnormal while on oral tacrolimus to only 3.6% abnormal after

treatment with TFF TAC (an 85% reduction).

- New biomarker data exploring the presence of donor-specific

antibodies (DSA) are now available in the first 8 patients from the

study. DSA is known to drive antibody-mediated rejection and is

generated when there is insufficient immune suppression

systemically allowing the formation of antibodies in the lymph

nodes and the spleen against the transplanted (donor) organ. DSA

was negative for the first 8 patients on oral tacrolimus, and DSA

remained negative after 12 weeks of treatment with TFF TAC.

- With respect to TFF TAC safety and tolerability, there has been

no mortality. The majority of treatment emergent adverse events

were Grade 2 (moderate) or lower with no bronchospasm or wheezing

reported. Kidney function has been maintained.

- One patient was transitioned to a dose of TFF TAC that was too

low, which led to blood trough levels that were >50% below the

protocol-specified minimum. This patient experienced signs of acute

rejection (Grade A1, which is minimal severity based on

histopathology). TFF TAC was discontinued as required by the

protocol, and oral tacrolimus was resumed. The acute rejection

episode has resolved.

- TFF is finalizing the design of the next study with TFF TAC in

close collaboration with clinical investigators and is in

communication with regulatory authorities and plans to provide

additional updates on the program including a regulatory update

later in the fall.

- In June 2024, the Company announced

that it engaged Outcome Capital as a strategic advisor for the

purpose of evaluating potential corporate partnerships and

licensing opportunities.

- In May 2024, the Company announced

that the U.S. government will be advancing several next-generation

medical countermeasures (MCMs) formulated with its Thin Film

Freezing technology into advanced preclinical testing. TFF

Pharmaceuticals is collaborating with Leidos, a leading Fortune 500

information technology, engineering and science solutions and

services leader, to develop next-generation MCMs designed to

protect military and healthcare personnel against future chemical

and biological (CB) threats. The research is funded by the Defense

Advanced Research Projects Agency (DARPA) under a contract

through the Personalized Protective Biosystems (PPB) program.

- In May 2024, the Company announced

that, in collaboration with the Cleveland Clinic, TFF

Pharmaceuticals is advancing multiple multivalent universal

influenza vaccines to protect against seasonal and pandemic viruses

into preclinical testing. The decision to advance the vaccine

candidates into preclinical testing was based upon the successful

completion of formulation testing with stability data on the

combination of hemagglutinin (HA) antigens with four different

adjuvants. Based on these data, three HA antigen/adjuvant candidate

vaccines have been selected for testing in a pre-clinical model at

Cleveland Clinic Florida.

Second Quarter 2024 Financial

Results

Balance Sheet Highlights

- As of June

30, 2024, TFF Pharmaceuticals cash and cash equivalents were

approximately $4.4 million. On May 1, 2024, the Company

completed a registered direct offering, receiving gross proceeds of

$4.8 million before deducting offering expenses.

Operating Results

- Research and

Development (R&D) expenses were $2.6 million for the quarter

ended June 30, 2024, a decrease of $0.1 million, or 3%, compared to

$2.7 million for the quarter ended June 30, 2023. The net decrease

of $0.1 million was primarily related to a decrease of $0.3 million

in manufacturing and related expenses, offset by an increase of

$0.2 million in compensation-related expenses.

- General &

Administrative (G&A) expenses were $2.0 million for the quarter

ended June 30, 2024, a decrease of $0.7 million, or 24%, compared

to $2.7 million for the quarter ended June 30, 2023. The net

decrease of $0.7 million was primarily related to decreases of $0.5

million in compensation-related expenses and $0.2 million in

insurance expenses.

- Net

Loss: Net loss was $4.5 million for the quarter ended June 30,

2024, a decrease of $0.5 million, compared to a net loss

of $5.0 million for the quarter ended June 30, 2023.

ABOUT TFF PHARMACEUTICALS’ THIN FILM FREEZING (TFF)

TECHNOLOGYTFF Pharmaceuticals’ proprietary Thin Film

Freezing (TFF) technology allows for the transformation of both

existing compounds and new chemical entities into dry powder

formulations exhibiting unique characteristics and benefits. The

TFF process is a particle engineering process designed to generate

dry powder particles with advantageous properties for inhalation,

as well as parenteral, nasal, oral, topical and ocular routes of

administration. The process can be used to engineer powders for

direct delivery to the site of need, circumventing challenges of

systemic administration and leading to improved bioavailability,

faster onset of action, and improved safety and efficacy. The

ability to deliver therapies directly to the target organ, such as

the lung, allows TFF powders to be administered at lower doses

compared to oral drugs, reducing unwanted toxicities and side

effects. Laboratory data suggests the aerodynamic properties of the

powders created by TFF can deliver as much as 75% of the dose to

the deep lung. TFF does not introduce heat, shear stress, or other

forces that can damage more complex therapeutic components, such as

fragile biologics, and instead enables the reformulation of these

materials into easily stored and temperature-stable dry powders,

making therapeutics and vaccines more accessible for distribution

worldwide. The advantages of TFF can be used to enhance traditional

delivery or combined to enable next-generation pharmaceutical

products.

ABOUT TFF PHARMACEUTICALSTFF Pharmaceuticals,

Inc. is a clinical-stage biopharmaceutical company engaging

patented rapid freezing technology to develop and transform

medicines into potent dry powder formulations for better efficacy,

safety, and stability. The company’s versatile TFF technology

platform has broad applicability to convert most any drug,

including vaccines, small and large molecules, and biologics, into

an elegant dry powder highly advantageous for inhalation or for

topical delivery to the eyes, nose and skin.

SAFE HARBORThis press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements in this press release include, but are not limited to,

statements by the Company relating to the innovation and commercial

potential of the Company’s TFF TAC product candidates.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially, including (i) the risk that further data from

the Company’s ongoing Phase 2 trial of TFF TAC may not be

consistent with the positive preliminary data obtained to date,

(ii) the risk that the Company may not be able to obtain additional

working capital with which to continue its current operations and

clinical trials as and when needed, (iii) success in early phases

of pre-clinical and clinical trials do not ensure later clinical

trials will be successful; (iv) no drug product incorporating the

TFF platform has received FDA pre-market approval or otherwise been

incorporated into a commercial drug product, (v) the Company has no

current agreements or understandings with any large pharmaceutical

companies for the development of a drug product incorporating the

TFF Platform, and (vi) those other risks disclosed in the section

“Risk Factors” included in the Company’s Quarterly Report on Form

10-Q filed with the SEC on August 14, 2024. The

Company cautions readers not to place undue reliance on any

forward-looking statements. The Company does not undertake and

specifically disclaims any obligation to update or revise such

statements to reflect new circumstances or unanticipated events as

they occur, except as required by law.

Investor Relations

Contact:Jason NelsonCoreIRjason@coreir.com

|

TFF PHARMACEUTICALS, INC.UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

Three Months EndedJune 30, |

|

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

650,222 |

|

|

$ |

333,351 |

|

|

$ |

853,495 |

|

|

$ |

384,780 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

2,588,316 |

|

|

|

2,681,898 |

|

|

|

6,144,178 |

|

|

|

6,700,557 |

|

|

General and administrative |

|

2,024,473 |

|

|

|

2,670,363 |

|

|

|

4,462,777 |

|

|

|

5,789,579 |

|

|

Total operating expenses |

|

4,612,789 |

|

|

|

5,352,261 |

|

|

|

10,606,955 |

|

|

|

12,490,136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

(3,962,567 |

) |

|

|

(5,018,910 |

) |

|

|

(9,753,460 |

) |

|

|

(12,105,356 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

43,819 |

|

|

|

36,120 |

|

|

|

99,568 |

|

|

|

71,199 |

|

|

Change in fair value of note receivable |

|

(560,473 |

) |

|

|

(37,416 |

) |

|

|

(560,473 |

) |

|

|

(37,416 |

) |

| Total other income (expense),

net |

|

(516,654 |

) |

|

|

(1,296 |

) |

|

|

(460,905 |

) |

|

|

33,783 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(4,479,221 |

) |

|

$ |

(5,020,206 |

) |

|

$ |

(10,214,365 |

) |

|

$ |

(12,071,573 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and

diluted |

$ |

(1.22 |

) |

|

$ |

(3.47 |

) |

|

$ |

(3.37 |

) |

|

$ |

(8.34 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

3,667,264 |

|

|

|

1,447,723 |

|

|

|

3,027,585 |

|

|

|

1,447,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TFF PHARMACEUTICALS, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS |

|

|

June 30,2024 |

|

|

December 31,2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

4,387,198 |

|

|

$ |

5,478,113 |

|

| Research and development tax

incentive receivable |

|

400,881 |

|

|

|

433,852 |

|

| Prepaid assets and other

current assets |

|

1,092,096 |

|

|

|

1,678,353 |

|

| Total current assets |

|

5,880,175 |

|

|

|

7,590,318 |

|

| Operating lease right-of-use

asset, net |

|

78,924 |

|

|

|

119,529 |

|

| Property and equipment,

net |

|

1,759,611 |

|

|

|

1,999,781 |

|

| Investment in Vaxanix |

|

1,776,746 |

|

|

|

- |

|

| Note receivable -

Augmenta |

|

- |

|

|

|

2,310,000 |

|

| Other assets |

|

- |

|

|

|

7,688 |

|

| Total assets |

$ |

9,495,456 |

|

|

$ |

12,027,316 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

| Accounts payable |

$ |

1,358,876 |

|

|

$ |

958,442 |

|

| Accrued liabilities |

|

2,160,140 |

|

|

|

1,285,586 |

|

| Deferred research grant

revenue |

|

25,000 |

|

|

|

101,000 |

|

| Current portion of operating

lease liability |

|

74,124 |

|

|

|

83,512 |

|

| Total current liabilities |

|

3,618,140 |

|

|

|

2,428,540 |

|

| Operating lease liability, net

of current portion |

|

- |

|

|

|

31,742 |

|

| Total liabilities |

|

3,618,140 |

|

|

|

2,460,282 |

|

| |

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

| Common stock |

|

3,246 |

|

|

|

2,370 |

|

| Additional paid-in

capital |

|

134,604,851 |

|

|

|

128,044,509 |

|

| Accumulated other

comprehensive loss |

|

(184,763 |

) |

|

|

(148,192 |

) |

| Accumulated deficit |

|

(128,546,018 |

) |

|

|

(118,331,653 |

) |

| Total stockholders’

equity |

|

5,877,316 |

|

|

|

9,567,034 |

|

| Total liabilities and

stockholders’ equity |

$ |

9,495,456 |

|

|

$ |

12,027,316 |

|

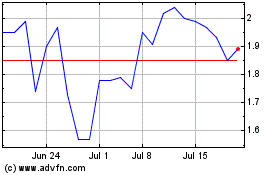

TFF Pharmaceuticals (NASDAQ:TFFP)

Historical Stock Chart

From Nov 2024 to Dec 2024

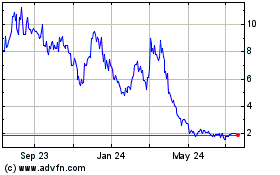

TFF Pharmaceuticals (NASDAQ:TFFP)

Historical Stock Chart

From Dec 2023 to Dec 2024