United Bankshares, Inc. (NASDAQ: UBSI) (“United”), today

reported earnings for the fourth quarter of 2024 of $94.4 million,

or $0.69 per diluted share. Fourth quarter of 2024 results produced

annualized returns on average assets, average equity, and average

tangible equity, a non-GAAP measure, of 1.25%, 7.48%, and 12.03%,

respectively. Earnings for the year of 2024 were $373.0 million, or

$2.75 per diluted share, and returns on average assets, average

equity, and average tangible equity were 1.26%, 7.61%, and 12.43%,

respectively.

“UBSI capped off a successful 2024 with another high quality

quarter,” stated Richard M. Adams, Jr., United’s Chief Executive

Officer. “Strong earnings, credit, and capital continue to be the

story, and we also received regulatory approval of our acquisition

in Atlanta. As we turn our sights towards 2025, we are excited

about the opportunities we see in front of us.”

Earnings for the third quarter of 2024 were $95.3 million, or

$0.70 per diluted share, and annualized returns on average assets,

average equity, and average tangible equity were 1.28%, 7.72%, and

12.59%, respectively. Earnings for the fourth quarter of 2023 were

$79.4 million, or $0.59 per diluted share, and annualized returns

on average assets, average equity, and average tangible equity were

1.08%, 6.70%, and 11.27%, respectively. Earnings for the year of

2023 were $366.3 million, or $2.71 per diluted share, and returns

on average assets, average equity, and average tangible equity were

1.25%, 7.87%, and 13.33%, respectively. The fourth quarter of 2023

included approximately $12.0 million of noninterest expense for the

Federal Deposit Insurance Corporation’s (“FDIC”) special assessment

levied on banking organizations to recover losses to the Deposit

Insurance Fund.

On January 10, 2025, United consummated its acquisition of

Atlanta-based Piedmont Bancorp, Inc. (“Piedmont”). As of January

10, 2025, Piedmont had total assets of approximately $2.4 billion,

total loans of approximately $2.1 billion, total liabilities of

approximately $2.2 billion, total deposits of approximately $2.1

billion, and total shareholders’ equity of approximately $202

million. Merger-related expenses for the fourth quarter and year of

2024 were $1.3 million and $2.9 million, respectively.

Fourth quarter of 2024 compared to the third quarter of

2024

Earnings for the fourth quarter of 2024 were $94.4 million, or

$0.69 per diluted share, as compared to earnings of $95.3 million,

or $0.70 per diluted share, for the third quarter of 2024.

Net interest income for the fourth quarter of 2024 was $232.6

million, an increase of $2.4 million, or 1%, from the third quarter

of 2024. Tax-equivalent net interest income, a non-GAAP measure

which adjusts for the tax-favored status of income from certain

loans and investments, of $233.4 million for the fourth quarter of

2024 increased $2.3 million, or 1%, from the third quarter of 2024.

The increase in net interest income and tax-equivalent net interest

income was mainly due to a lower average rate paid on deposits and

an increase in average earning assets that was largely funded by

deposit growth. This increase in net interest income and

tax-equivalent net interest income was partially offset by a lower

yield on average net loans and loans held for sale. The yield on

average interest-bearing deposits decreased 26 basis points from

the third quarter of 2024. Average earning assets increased $556.2

million, or 2%, from the third quarter of 2024 due to a $419.7

million increase in average short-term investments, a $121.5

million increase in average net loans and loans held for sale, and

a $14.9 million increase in average investment securities. The

yield on average net loans and loans held for sale decreased 18

basis points from the third quarter of 2024. The net interest

margin was 3.49% for the fourth quarter of 2024 as compared to

3.52% for the third quarter of 2024.

The provision for credit losses was $6.7 million for the fourth

quarter of 2024 as compared to $6.9 million for the third quarter

of 2024.

Noninterest income for the fourth quarter of 2024 was $29.3

million, a decrease of $2.6 million, or 8%, from the third quarter

of 2024 driven by decreases in mortgage loan servicing income of

$7.4 million and income from mortgage banking activities of $2.2

million partially offset by lower net losses on investment

securities of $6.0 million and increases in several other

categories of noninterest income, none of which were significant.

During the third quarter of 2024, United sold its remaining

mortgage servicing rights (“MSRs”) at a gain of $7.1 million. The

decrease in income from mortgage banking activities was mainly due

to lower mortgage loan sale volume and a lower quarter-end

valuation of mortgage derivatives and mortgage loans held for sale.

Net losses on investment securities were $688 thousand for the

fourth quarter of 2024 compared to $6.7 million for the third

quarter of 2024. During the fourth quarter of 2024, $2.4 million of

losses on sales of $170.9 million of available for sale (“AFS”)

investment securities were partially offset by net unrealized fair

value gains on equity securities of $1.7 million. During the third

quarter of 2024, United sold $196.7 million of AFS investment

securities at a loss of $6.9 million.

Noninterest expense for the fourth quarter of 2024 of $134.2

million was flat from the third quarter of 2024, decreasing $1.2

million, or less than 1%. The slight decrease in noninterest

expense was driven by decreases in several categories of

noninterest expense, none of which were significant. Within other

noninterest expense, an increase in merger-related expenses was

mostly offset by lower amounts of certain general operating

expenses. Merger-related expenses for the fourth quarter of 2024

were $1.3 million as compared to $332 thousand for the third

quarter of 2024.

For the fourth quarter of 2024, income tax expense was $26.7

million as compared to $24.6 million for the third quarter of 2024.

The increase was driven by a higher effective tax rate and slightly

higher pre-tax earnings. United’s effective tax rate was 22.0% and

20.6% for the fourth quarter of 2024 and third quarter of 2024,

respectively. The higher effective tax rate was primarily due to

the impact of provision to return adjustments in the fourth quarter

of 2024.

Fourth quarter of 2024 compared to the fourth quarter of

2023

Earnings for the fourth quarter of 2024 were $94.4 million, or

$0.69 per diluted share, as compared to earnings of $79.4 million,

or $0.59 per diluted share, for the fourth quarter of 2023.

Net interest income for the fourth quarter of 2024 was $232.6

million, an increase of $2.9 million, or 1%, from the fourth

quarter of 2023. Tax-equivalent net interest income for the fourth

quarter of 2024 increased $2.8 million, or 1%, from the fourth

quarter of 2023. The increase in net interest income and

tax-equivalent net interest income was primarily due to an increase

in average short-term investments, a decrease in average long-term

borrowings, and loan growth. This increase in net interest income

and tax-equivalent net interest income was partially offset by a

lower yield on average short-term investments, an increase in

average interest-bearing deposits, and a decrease in average

investment securities. Average earning assets for the fourth

quarter of 2024 increased $812.0 million, or 3%, from the fourth

quarter of 2023 due to a $987.8 million increase in average

short-term investments and a $418.0 million increase in average net

loans and loans held for sale partially offset by a $593.7 million

decrease in average investment securities. Average long-term

borrowings decreased $854.1 million, or 61%, from the fourth

quarter of 2023. The yield on average short-term investments

decreased 78 basis points from the fourth quarter of 2023. Average

interest-bearing deposits increased $1.5 billion, or 9%, from the

fourth quarter of 2023. The net interest margin for the fourth

quarter of 2024 and 2023 was 3.49% and 3.55%, respectively.

The provision for credit losses was $6.7 million for the fourth

quarter of 2024 as compared to $6.9 million for the fourth quarter

of 2023.

Noninterest income for the fourth quarter of 2024 was $29.3

million, which was a decrease of $4.4 million, or 13%, from the

fourth quarter of 2023. This decrease in noninterest income was

driven by decreases in other noninterest income of $3.3 million and

income from mortgage banking activities of $2.4 million partially

offset by an increase in income from bank-owned life insurance

(“BOLI”) of $1.4 million. Other noninterest income for the fourth

quarter of 2023 included a $2.7 million gain from the payoff of a

fixed rate commercial loan that had an associated interest rate

swap derivative. The decrease in income from mortgage banking

activities was mainly due to lower mortgage loan origination and

sale volume. The increase in BOLI income was primarily due to the

impact of higher market values of underlying investments and higher

amounts of death benefits recognized in the fourth quarter of

2024.

Noninterest expense for the fourth quarter of 2024 decreased

$18.1 million, or 12%, from the fourth quarter of 2023. The

decrease in noninterest expense was driven by decreases in FDIC

insurance expense of $12.7 million, the expense for the reserve for

unfunded loan commitments of $4.0 million, and other noninterest

expense of $4.0 million partially offset by increases in employee

benefits of $3.9 million. FDIC insurance expense for the fourth

quarter of 2023 included $12.0 million for the FDIC special

assessment. The decrease in the expense for the reserve for

unfunded loan commitments was mainly due to a decrease in loan

commitments. The decrease in other noninterest expense was

primarily driven by a decrease in certain general operating

expenses and an impairment recognized during the fourth quarter of

2023 of trade name intangibles partially offset by merger-related

expenses recognized during the fourth quarter of 2024. The increase

in employee benefits was driven by higher health insurance costs

and higher postretirement benefit costs.

For the fourth quarter of 2024, income tax expense was $26.7

million as compared to $24.8 million for the fourth quarter of

2023. The increase was driven by higher pre-tax earnings partially

offset by a lower effective tax rate. United’s effective tax rate

was 22.0% and 23.8% for the fourth quarter of 2024 and fourth

quarter of 2023, respectively. The effective tax rates for the

fourth quarter of 2024 and 2023 reflect the impact of provision to

return adjustments during each period.

Year of 2024 compared to the year of 2023

Earnings for the year of 2024 were $373.0 million, or $2.75 per

diluted share, as compared to earnings of $366.3 million, or $2.71

per diluted share, for the year of 2023.

Net interest income for the year of 2024 decreased $8.9 million,

or 1%, from the year of 2023. Tax-equivalent net interest income

for the year of 2024 decreased $9.5 million, or 1%, from the year

of 2023. The decrease in net interest income and tax-equivalent net

interest income was primarily due to a higher average rate paid on

deposits, an increase in average interest-bearing deposits, a

decrease in average investment securities, and a decrease in

acquired loan accretion income. These decreases were partially

offset by a higher yield on average net loans and loans held for

sale, loan growth, a decrease in average long-term borrowings, and

an increase in average short-term investments. The yield on average

interest-bearing deposits increased 66 basis points from the year

of 2023. Average interest-bearing deposits increased $1.4 billion

from the year of 2023. Average investment securities decreased

$790.7 million from the year of 2023. Acquired loan accretion

income for the year of 2024 of $9.3 million was a decrease of $2.3

million from the year of 2023. The yield on average earning assets

increased 33 basis points from the year of 2023 to 5.74% driven by

an increase in the yield on average net loans and loans held for

sale of 28 basis points. Average net loans and loans held for sale

increased $683.7 million from the year of 2023. Average long-term

borrowings decreased $906.1 million from the year of 2023. Average

short-term investments increased $353.8 million from the year of

2023. The net interest margin for the year of 2024 and 2023 was

3.49% and 3.56%, respectively.

The provision for credit losses was $25.2 million for the year

of 2024 as compared to $31.2 million for the year of 2023.

Noninterest income for the year of 2024 was $123.7 million,

which was a decrease of $11.6 million, or 9%, from the year of

2023. Income from mortgage banking activities decreased $10.5

million from the year of 2023 mainly due to lower mortgage loan

origination and sale volume. Mortgage loan servicing income for the

year of 2024 of $9.0 million included a $7.1 million gain on the

sale of MSRs while mortgage loan servicing income for the year of

2023 of $13.7 million included $8.3 million in gains on sales of

MSRs with the remainder of the decrease due to lower serviced loan

balances. Other noninterest income decreased $3.3 million from the

year of 2023 primarily due to the aforementioned $2.7 million gain

from the payoff of a fixed rate commercial loan that had an

associated interest rate swap derivative in the fourth quarter of

2023. Fees from brokerage services increased $3.4 million from the

year of 2023 primarily due to higher volume. BOLI income increased

$2.9 million from the year of 2023 mainly due to higher market

values of underlying investments and higher amounts of death

benefits recognized during the year of 2024. Net losses on

investment securities of $7.7 million for the year of 2024 included

$16.0 million in losses on sales of AFS investment securities

partially offset by a $6.9 million gain on the VISA share exchange

and $1.7 million net unrealized fair value gains on equity

securities. Net losses on investment securities of $7.6 million for

the year of 2023 were driven by a $7.2 million loss on sale of AFS

investment securities during the second quarter of 2023.

Noninterest expense for the year of 2024 was $545.0 million, a

decrease of $15.2 million, or 3%, from the year of 2023 driven by

decreases in FDIC insurance expense of $10.6 million, the expense

for the reserve for unfunded loan commitments of $8.3 million,

mortgage loan servicing expense of $3.2 million, and amortization

of intangibles of $1.5 million. These decreases in noninterest

expense were partially offset by increases in employee benefits of

$5.3 million and employee compensation of $3.8 million. The

decrease in FDIC insurance expense was driven by $12.0 million in

expense recognized for the FDIC special assessment in 2023 as

compared to $1.5 million in 2024. The decrease in the expense for

the reserve for unfunded loan commitments was driven by decreases

in loan commitments. The decrease in mortgage loan servicing

expense was driven by the aforementioned sales of MSRs in 2023 and

2024. The decrease in the amortization of intangibles was due to

lower core deposit intangible balances. The increase in employee

benefits was primarily due to higher postretirement benefit costs.

The increase in employee compensation was driven by higher employee

incentives and base salaries, as well as employee severance

associated with the previously announced mortgage delivery channel

consolidation partially offset by lower employee commissions and

incentives related to mortgage banking production.

For the year of 2024, income tax expense was $91.6 million as

compared to $97.5 million for the year of 2023. The decrease was

primarily due to the impact of discrete tax benefits recognized in

the second quarter of 2024 and the impact of higher provision to

return adjustments recognized in the fourth quarter of 2023 as

compared to the fourth quarter of 2024. United’s effective tax rate

was 19.7% for the year of 2024 and 21.0% for the year of 2023.

Credit Quality

United’s asset quality continues to be sound. At December 31,

2024, non-performing loans (“NPLs”) were $73.4 million, or 0.34% of

loans & leases, net of unearned income. Total non-performing

assets (“NPAs”) were $73.7 million, including other real estate

owned (“OREO”) of $327 thousand, or 0.25% of total assets at

December 31, 2024. At September 30, 2024, NPLs were $65.2 million,

or 0.30% of loans & leases, net of unearned income. Total NPAs

were $65.4 million, including OREO of $169 thousand, or 0.22% of

total assets at September 30, 2024. At December 31, 2023, NPLs were

$45.5 million, or 0.21% of loans & leases, net of unearned

income. Total NPAs were $48.1 million, including OREO of $2.6

million, or 0.16% of total assets at December 31, 2023.

As of December 31, 2024, the allowance for loan & lease

losses was $271.8 million, or 1.25% of loans & leases, net of

unearned income. At September 30, 2024, the allowance for loan

& lease losses was $270.8 million, or 1.25% of loans &

leases, net of unearned income. At December 31, 2023, the allowance

for loan & lease losses was $259.2 million, or 1.21% of loans

& leases, net of unearned income.

Net charge-offs were $5.6 million, or 0.10% on an annualized

basis as a percentage of average loans & leases, net of

unearned income for the fourth quarter of 2024. Net charge-offs

were $3.6 million, or 0.07% on an annualized basis as a percentage

of average loans & leases, net of unearned income for the third

quarter of 2024. Net charge-offs were $2.5 million, or 0.05% on an

annualized basis as a percentage of average loans & leases, net

of unearned income for the fourth quarter of 2023. Net charge-offs

were $12.5 million for the year of 2024 compared to $6.7 million

for the year of 2023. Net charge-offs as a percentage of average

loans & leases, net of unearned income were 0.06% and 0.03% for

the years of 2024 and 2023, respectively.

Capital

United continues to be well-capitalized based upon regulatory

guidelines. United’s estimated risk-based capital ratio is 16.5% at

December 31, 2024, while estimated Common Equity Tier 1 capital,

Tier 1 capital, and leverage ratios are 14.2%, 14.2%, and 11.7%,

respectively. The December 31, 2024 ratios reflect United’s

election of a five-year transition provision, allowed by the

Federal Reserve Board and other federal banking agencies in

response to the COVID-19 pandemic, to delay for two years the full

impact of CECL on regulatory capital, followed by a three-year

transition period. The regulatory requirements for a

well-capitalized financial institution are a risk-based capital

ratio of 10.0%, a Common Equity Tier 1 capital ratio of 6.5%, a

Tier 1 capital ratio of 8.0%, and a leverage ratio of 5.0%. United

did not repurchase any shares of its common stock during 2024 or

2023.

About United Bankshares, Inc.

As of December 31, 2024, United had consolidated assets of

approximately $30 billion and is the 41st largest banking company

in the U.S. based on market capitalization. United is the parent

company of United Bank, which comprises more than 225 offices

located throughout Washington, D.C., Virginia, West Virginia,

Maryland, North Carolina, South Carolina, Ohio, Pennsylvania, and

Georgia. United’s stock is traded on the NASDAQ Global Select

Market under the quotation symbol "UBSI".

Cautionary Statements

The Company is required under generally accepted accounting

principles to evaluate subsequent events through the filing of its

December 31, 2024 consolidated financial statements on Form 10-K.

As a result, the Company will continue to evaluate the impact of

any subsequent events on critical accounting assumptions and

estimates made as of December 31, 2024 and will adjust amounts

preliminarily reported, if necessary.

Use of non-GAAP Financial

Measures

This press release contains certain financial measures that are

not recognized under U.S. generally accepted accounting principles

("GAAP"). Generally, United has presented these “non-GAAP”

financial measures because it believes that these measures provide

meaningful additional information to assist in the evaluation of

United’s results of operations or financial position. Presentation

of these non-GAAP financial measures is consistent with how

United’s management evaluates its performance internally and these

non-GAAP financial measures are frequently used by securities

analysts, investors, and other interested parties in the evaluation

of companies in the banking industry.

Specifically, this press release contains certain references to

financial measures identified as tax-equivalent (FTE) net interest

income, average tangible equity, return on average tangible equity,

and tangible book value per share. Management believes these

non-GAAP financial measures to be helpful in understanding United’s

results of operations or financial position.

Net interest income is presented in this press release on a

tax-equivalent basis. The tax-equivalent basis adjusts for the

tax-favored status of income from certain loans and investments.

Although this is a non-GAAP measure, United’s management believes

this measure is more widely used within the financial services

industry and provides better comparability of net interest income

arising from taxable and tax-exempt sources. United uses this

measure to monitor net interest income performance and to manage

its balance sheet composition. The tax-equivalent adjustment

combines amounts of interest income on federally nontaxable loans

and investment securities using the statutory federal income tax

rate of 21%.

Tangible equity is calculated as GAAP total shareholders’ equity

minus total intangible assets. Tangible equity can thus be

considered the most conservative valuation of the company. Tangible

equity is also presented on a per common share basis and

considering net income, a return on average tangible equity.

Management provides these amounts to facilitate the understanding

of as well as to assess the quality and composition of United’s

capital structure. By removing the effect of intangible assets that

result from merger and acquisition activity, the “permanent” items

of equity are presented. These measures, along with others, are

used by management to analyze capital adequacy and performance.

Where non-GAAP financial measures are used, the comparable GAAP

financial measure, as well as reconciliation to that comparable

GAAP financial measure can be found in the attached financial

information tables to this press release. Investors should

recognize that United’s presentation of these non-GAAP financial

measures might not be comparable to similarly titled measures at

other companies. These non-GAAP financial measures should not be

considered a substitute for GAAP basis measures and United strongly

encourages a review of its condensed consolidated financial

statements in their entirety.

Forward-Looking Statements

In this report, we have made various statements regarding

current expectations or forecasts of future events, which speak

only as of the date the statements are made. These statements are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are also made from time-to-time in press releases and in

oral statements made by the officers of the Company.

Forward-looking statements can be identified by the use of the

words “expect,” “may,” “could,” “intend,” “project,” “estimate,”

“believe,” “anticipate,” and other words of similar meaning. Such

forward-looking statements are based on assumptions and estimates,

which although believed to be reasonable, may turn out to be

incorrect. Therefore, undue reliance should not be placed upon

these estimates and statements. United cannot assure that any of

these statements, estimates, or beliefs will be realized and actual

results may differ from those contemplated in these

“forward-looking statements.” The following factors, among others,

could cause the actual results of United’s operations to differ

materially from its expectations: uncertainty in U.S. fiscal and

monetary policies, including the interest rate policies of the

Federal Reserve Board; volatility and disruptions in global capital

and credit markets, interest rate, securities market and monetary

supply fluctuations; increasing rates of inflation and slower

growth rates; the nature, extent, timing, and results of

governmental actions, examinations, reviews, reforms, regulations,

and interpretations, including those involving the Federal Reserve,

FDIC, and CFPB; the effect of changes in the level of checking or

savings account deposits on United’s funding costs and net interest

margin; future provisions for credit losses on loans and debt

securities; changes in nonperforming assets; risks relating to the

merger with Piedmont, including the successful integration of

operations of Piedmont; competition; changes in legislation or

regulatory requirements; and the impact of natural disasters,

extreme weather events, military conflict (including the

Russia/Ukraine conflict, the conflict in Israel and surrounding

areas, the possible expansion of such conflicts and potential

geopolitical consequences), terrorism or other geopolitical events.

For more information about factors that could cause actual results

to differ materially from United’s expectations, refer to its

reports filed with the Securities and Exchange Commission,

including the discussion under “Risk Factors” in the Annual Report

on Form 10-K for the year ended December 31, 2023, as filed with

the Securities and Exchange Commission and available on its website

at www.sec.gov. Further, any forward-looking statement speaks only

as of the date on which it is made, and United undertakes no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future events, or

otherwise. You are advised to consult further disclosures United

may make on related subjects in our filings with the SEC.

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Three Months Ended

Year Ended

EARNINGS

SUMMARY:

December 2024

December 2023

September 2024

December 2024

December 2023

Interest income

$

376,034

$

369,175

$

382,723

$

1,502,121

$

1,401,320

Interest expense

143,426

139,485

152,467

591,053

481,396

Net interest income

232,608

229,690

230,256

911,068

919,924

Provision for credit losses

6,691

6,875

6,943

25,153

31,153

Noninterest income

29,318

33,675

31,942

123,695

135,258

Noninterest expense

134,176

152,287

135,339

545,031

560,224

Income before income taxes

121,059

104,203

119,916

464,579

463,805

Income taxes

26,651

24,813

24,649

91,583

97,492

Net income

$

94,408

$

79,390

$

95,267

$

372,996

$

366,313

PER COMMON

SHARE:

Net income:

Basic

$

0.70

$

0.59

$

0.70

$

2.76

$

2.72

Diluted

0.69

0.59

0.70

2.75

2.71

Cash dividends

$

0.37

$

0.37

0.37

1.48

1.45

Book value

36.74

36.89

35.36

Closing market price

$

37.10

$

37.55

$

37.55

Common shares outstanding:

Actual at period end, net of treasury

shares

135,220,770

135,346,628

134,949,063

Weighted average-basic

135,235,641

134,691,360

135,158,476

134,947,592

134,505,058

Weighted average-diluted

135,732,069

134,984,970

135,504,911

135,225,417

134,753,820

FINANCIAL

RATIOS:

Return on average assets

1.25

%

1.08

%

1.28

%

1.26

%

1.25

%

Return on average shareholders’ equity

7.48

%

6.70

%

7.72

%

7.61

%

7.87

%

Return on average tangible equity

(non-GAAP)(1)

12.03

%

11.27

%

12.59

%

12.43

%

13.33

%

Average equity to average assets

16.72

%

16.11

%

16.64

%

16.57

%

15.89

%

Net interest margin

3.49

%

3.55

%

3.52

%

3.49

%

3.56

%

PERIOD END

BALANCES:

December 31

2024

December 31

2023

September 30

2024

June 30 2024

Assets

$

30,023,545

$

29,926,482

$

29,863,262

$

29,957,418

Earning assets

26,650,661

26,623,652

26,461,342

26,572,087

Loans & leases, net of unearned

income

21,673,493

21,359,084

21,621,968

21,598,727

Loans held for sale

44,360

56,261

46,493

66,475

Investment securities

3,259,296

4,125,754

3,538,415

3,650,582

Total deposits

23,961,859

22,819,319

23,828,345

23,066,440

Shareholders’ equity

4,993,223

4,771,240

4,967,820

4,856,633

Note: (1) See

information under the “Selected Financial Ratios” table for a

reconciliation of non-GAAP measure.

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Consolidated

Statements of Income

Three Months Ended

Year Ended

December

December

September

June

December

December

2024

2023

2024

2024

2024

2023

Interest & Loan Fees Income

(GAAP)

$

376,034

$

369,175

$

382,723

$

374,184

$

1,502,121

$

1,401,320

Tax equivalent adjustment

795

866

828

867

3,362

4,014

Interest & Fees Income (FTE)

(non-GAAP)

376,829

370,041

383,551

375,051

1,505,483

1,405,334

Interest Expense

143,426

139,485

152,467

148,469

591,053

481,396

Net Interest Income (FTE) (non-GAAP)

233,403

230,556

231,084

226,582

914,430

923,938

Provision for Credit Losses

6,691

6,875

6,943

5,779

25,153

31,153

Noninterest Income:

Fees from trust services

5,156

4,508

4,904

4,744

19,450

18,318

Fees from brokerage services

4,978

4,360

5,073

4,959

20,277

16,911

Fees from deposit services

9,473

9,107

9,413

9,326

37,183

37,076

Bankcard fees and merchant discounts

2,056

1,923

1,775

1,355

7,059

7,013

Other charges, commissions, and fees

868

924

890

869

3,485

3,861

Income from bank-owned life insurance

3,226

1,855

3,032

2,549

11,225

8,330

Income from mortgage banking

activities

2,314

4,746

4,544

3,901

16,057

26,593

Mortgage loan servicing income

-

783

7,385

783

8,957

13,746

Net (losses) gains on investment

securities

(688

)

276

(6,715

)

(218

)

(7,720

)

(7,646

)

Other noninterest income

1,935

5,193

1,641

1,955

7,722

11,056

Total Noninterest Income

29,318

33,675

31,942

30,223

123,695

135,258

Noninterest Expense:

Employee compensation

58,343

57,829

58,481

58,501

234,618

230,809

Employee benefits

13,719

9,771

13,084

12,147

53,621

48,368

Net occupancy

11,070

11,690

11,271

11,400

46,084

46,426

Data processing

7,437

7,261

7,456

7,290

29,646

29,395

Amortization of intangibles

910

1,279

909

910

3,639

5,116

OREO expense

45

188

104

268

576

1,355

Net losses (gains) on the sale of OREO

properties

10

(126

)

(34

)

32

(75

)

(60

)

Equipment expense

7,474

7,539

7,811

7,548

29,686

29,731

FDIC insurance expense

3,884

16,621

4,338

5,058

19,735

30,376

Mortgage loan servicing expense and

impairment

-

962

403

1,011

2,429

5,596

Expense for the reserve for unfunded loan

commitments

(3,062

)

940

(2,766

)

(2,177

)

(9,795

)

(1,483

)

Other noninterest expense

34,346

38,333

34,282

32,786

134,867

134,595

Total Noninterest Expense

134,176

152,287

135,339

134,774

545,031

560,224

Income Before Income Taxes (FTE)

(non-GAAP)

121,854

105,069

120,744

116,252

467,941

467,819

Tax equivalent adjustment

795

866

828

867

3,362

4,014

Income Before Income Taxes

(GAAP)

121,059

104,203

119,916

115,385

464,579

463,805

Taxes

26,651

24,813

24,649

18,878

91,583

97,492

Net Income

$

94,408

$

79,390

$

95,267

$

96,507

$

372,996

$

366,313

MEMO: Effective Tax Rate

22.01

%

23.81

%

20.56

%

16.36

%

19.71

%

21.02

%

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Consolidated

Balance Sheets

December 2024

December 2023

December 31

December 31

September 30

Q-T-D Average

Q-T-D Average

2024

2023

2024

Cash & Cash Equivalents

$

2,036,079

$

1,073,118

$

2,292,244

$

1,598,943

$

1,908,832

Securities Available for Sale

3,245,428

3,710,447

2,959,719

3,786,377

3,239,501

Less: Allowance for credit losses

-

-

-

-

-

Net available for sale securities

3,245,428

3,710,447

2,959,719

3,786,377

3,239,501

Securities Held to Maturity

1,020

1,020

1,020

1,020

1,020

Less: Allowance for credit losses

(19

)

(18

)

(18

)

(17

)

(19

)

Net held to maturity securities

1,001

1,002

1,002

1,003

1,001

Equity Securities

9,012

8,598

21,058

8,945

9,082

Other Investment Securities

288,453

311,922

277,517

329,429

288,831

Total Securities

3,543,894

4,031,969

3,259,296

4,125,754

3,538,415

Total Cash and Securities

5,579,973

5,105,087

5,551,540

5,724,697

5,447,247

Loans held for sale

45,143

53,499

44,360

56,261

46,493

Commercial Loans & Leases

16,093,104

15,510,282

16,152,453

15,535,204

16,015,679

Mortgage Loans

4,709,802

4,576,046

4,702,720

4,728,374

4,722,997

Consumer Loans

873,961

1,156,339

825,325

1,109,607

892,377

Gross Loans

21,676,867

21,242,667

21,680,498

21,373,185

21,631,053

Unearned income

(8,862

)

(16,722

)

(7,005

)

(14,101

)

(9,085

)

Loans & Leases, net of unearned

income

21,668,005

21,225,945

21,673,493

21,359,084

21,621,968

Allowance for Loan & Lease Losses

(270,751

)

(255,032

)

(271,844

)

(259,237

)

(270,767

)

Net Loans

21,397,254

20,970,913

21,401,649

21,099,847

21,351,201

Mortgage Servicing Rights

-

4,573

-

4,554

-

Goodwill

1,888,889

1,888,889

1,888,889

1,888,889

1,888,889

Other Intangibles

9,446

14,569

8,866

12,505

9,776

Operating Lease Right-of-Use Asset

82,505

80,622

81,742

86,986

82,114

Other Real Estate Owned

190

2,885

327

2,615

169

Bank-Owned Life Insurance

495,839

484,987

497,181

486,895

495,784

Other Assets

513,487

558,122

548,991

563,233

541,589

Total Assets

$

30,012,726

$

29,164,146

$

30,023,545

$

29,926,482

$

29,863,262

MEMO: Interest-earning Assets

$

26,687,835

$

25,875,812

$

26,650,661

$

26,623,652

$

26,461,342

Interest-bearing Deposits

$

17,871,685

$

16,414,152

$

17,826,446

$

16,670,239

$

17,790,247

Noninterest-bearing Deposits

6,099,264

6,175,309

6,135,413

6,149,080

6,038,098

Total Deposits

23,970,949

22,589,461

23,961,859

22,819,319

23,828,345

Short-term Borrowings

180,070

198,453

176,090

196,095

181,969

Long-term Borrowings

540,247

1,394,361

540,420

1,789,103

540,091

Total Borrowings

720,317

1,592,814

716,510

1,985,198

722,060

Operating Lease Liability

87,935

85,063

86,771

92,885

88,464

Other Liabilities

214,456

199,128

265,182

257,840

256,573

Total Liabilities

24,993,657

24,466,466

25,030,322

25,155,242

24,895,442

Preferred Equity

-

-

-

-

-

Common Equity

5,019,069

4,697,680

4,993,223

4,771,240

4,967,820

Total Shareholders' Equity

5,019,069

4,697,680

4,993,223

4,771,240

4,967,820

Total Liabilities & Equity

$

30,012,726

$

29,164,146

$

30,023,545

$

29,926,482

$

29,863,262

MEMO: Interest-bearing

Liabilities

$

18,592,002

$

18,006,966

$

18,542,956

$

18,655,437

$

18,512,307

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Three Months Ended

Year Ended

December

December

September

June

December

December

Quarterly/Year-to-Date Share Data:

2024

2023

2024

2024

2024

2023

Earnings Per Share:

Basic

$

0.70

$

0.59

$

0.70

$

0.71

$

2.76

$

2.72

Diluted

$

0.69

$

0.59

$

0.70

$

0.71

$

2.75

$

2.71

Common Dividend Declared Per

Share

$

0.37

$

0.37

$

0.37

$

0.37

$

1.48

$

1.45

High Common Stock Price

$

44.43

$

38.74

$

39.93

$

36.08

$

44.43

$

42.45

Low Common Stock Price

$

35.31

$

25.35

$

31.47

$

30.68

$

30.68

$

25.35

Average Shares Outstanding (Net of

Treasury Stock):

Basic

135,235,641

134,691,360

135,158,476

135,137,901

134,947,592

134,505,058

Diluted

135,732,069

134,984,970

135,504,911

135,314,785

135,225,417

134,753,820

Common Dividends

$

50,259

$

50,066

$

50,213

$

50,204

$

200,889

$

196,120

Dividend Payout Ratio

53.24

%

63.06

%

52.71

%

52.02

%

53.86

%

53.54

%

December 31

December 31

September 30

June 30

EOP Share

Data:

2024

2023

2024

2024

Book Value Per Share

$

36.89

$

35.36

$

36.74

$

35.92

Tangible Book Value Per Share (non-GAAP)

(1)

$

22.87

$

21.27

$

22.70

$

21.87

52-week High Common Stock Price

$

44.43

$

42.45

$

39.93

$

38.74

Date

11/25/24

2/3/23

7/31/24

12/14/23

52-week Low Common Stock Price

$

30.68

$

25.35

$

25.35

$

25.35

Date

06/11/24

10/24/23

10/24/23

10/24/23

EOP Shares

Outstanding (Net of Treasury Stock):

135,346,628

134,949,063

135,220,770

135,195,704

Memorandum

Items:

Employees (full-time equivalent)

2,591

2,736

2,651

2,644

Note:

(1) Tangible Book Value Per Share:

Total Shareholders' Equity (GAAP)

$

4,993,223

$

4,771,240

$

4,967,820

$

4,856,633

Less: Total Intangibles

(1,897,755

)

(1,901,394

)

(1,898,665

)

(1,899,574

)

Tangible Equity (non-GAAP)

$

3,095,468

$

2,869,846

$

3,069,155

$

2,957,059

÷ EOP Shares Outstanding (Net of Treasury

Stock)

135,346,628

134,949,063

135,220,770

135,195,704

Tangible Book Value Per Share

(non-GAAP)

$

22.87

$

21.27

$

22.70

$

21.87

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Three Months Ended

December 2024

Three Months Ended

December 2023

Three Months Ended

September 2024

Selected Average

Balances and Yields:

Average

Average

Average

Average

Average

Average

ASSETS:

Balance

Interest(1)

Rate(1)

Balance

Interest(1)

Rate(1)

Balance

Interest(1)

Rate(1)

Earning Assets:

Federal funds sold and securities

purchased under agreements to resell and other short-term

investments

$

1,807,207

$

21,876

4.82

%

$

819,431

$

11,570

5.60

%

$

1,387,462

$

19,241

5.52

%

Investment securities:

Taxable

3,242,979

29,244

3.61

%

3,836,498

35,710

3.72

%

3,218,258

30,797

3.83

%

Tax-exempt

195,252

1,374

2.81

%

195,471

1,471

3.01

%

205,080

1,461

2.85

%

Total securities

3,438,231

30,618

3.56

%

4,031,969

37,181

3.69

%

3,423,338

32,258

3.77

%

Loans and loans held for sale, net of

unearned income (2)

21,713,148

324,335

5.95

%

21,279,444

321,290

6.00

%

21,588,333

332,052

6.12

%

Allowance for loan losses

(270,751

)

(255,032

)

(267,457

)

Net loans and loans held for sale

21,442,397

6.02

%

21,024,412

6.07

%

21,320,876

6.20

%

Total earning assets

26,687,835

$

376,829

5.62

%

25,875,812

$

370,041

5.68

%

26,131,676

$

383,551

5.85

%

Other assets

3,324,891

3,288,334

3,371,648

TOTAL ASSETS

$

30,012,726

$

29,164,146

$

29,503,324

LIABILITIES:

Interest-Bearing Liabilities:

Interest-bearing deposits

$

17,871,685

$

135,690

3.02

%

$

16,414,152

$

122,132

2.95

%

$

17,399,368

$

143,313

3.28

%

Short-term borrowings

180,070

1,630

3.60

%

198,453

1,998

3.99

%

191,954

2,048

4.24

%

Long-term borrowings

540,247

6,106

4.50

%

1,394,361

15,355

4.37

%

748,608

7,106

3.78

%

Total interest-bearing liabilities

18,592,002

143,426

3.07

%

18,006,966

139,485

3.07

%

18,339,930

152,467

3.31

%

Noninterest-bearing deposits

6,099,264

6,175,309

5,957,184

Accrued expenses and other liabilities

302,391

284,191

297,344

TOTAL LIABILITIES

24,993,657

24,466,466

24,594,458

SHAREHOLDERS’ EQUITY

5,019,069

4,697,680

4,908,866

TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY

$

30,012,726

$

29,164,146

$

29,503,324

NET INTEREST INCOME

$

233,403

$

230,556

$

231,084

INTEREST RATE SPREAD

2.55

%

2.61

%

2.54

%

NET INTEREST MARGIN

3.49

%

3.55

%

3.52

%

Notes:

(1) The interest income and the yields on

federally nontaxable loans and investment securities are presented

on a tax-equivalent basis using the statutory federal income tax

rate of 21%.

(2) Nonaccruing loans are included in the

daily average loan amounts outstanding.

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Year Ended

December 2024

Year Ended

December 2023

Selected Average

Balances and Yields:

Average

Average

Average

Average

ASSETS:

Balance

Interest(1)

Rate(1)

Balance

Interest(1)

Rate(1)

Earning Assets:

Federal funds sold and securities

purchased under agreements to resell and other short-term

investments

$

1,253,832

$

66,207

5.28

%

$

900,077

$

47,069

5.23

%

Investment securities:

Taxable

3,424,113

128,731

3.76

%

4,125,467

144,420

3.50

%

Tax-exempt

205,427

5,796

2.82

%

294,802

8,411

2.85

%

Total securities

3,629,540

134,527

3.71

%

4,420,269

152,831

3.46

%

Loans and loans held for sale, net of

unearned income (2)

21,612,707

1,304,749

6.04

%

20,909,248

1,205,434

5.77

%

Allowance for loan losses

(265,171

)

(245,386

)

Net loans and loans held for sale

21,347,536

6.11

%

20,663,862

5.83

%

Total earning assets

26,230,908

$

1,505,483

5.74

%

25,984,208

$

1,405,334

5.41

%

Other assets

3,349,451

3,311,450

TOTAL ASSETS

$

29,580,359

$

29,295,658

LIABILITIES:

Interest-Bearing Liabilities:

Interest-bearing deposits

$

17,171,286

$

539,805

3.14

%

$

15,782,761

$

391,094

2.48

%

Short-term borrowings

195,406

7,966

4.08

%

182,936

6,449

3.53

%

Long-term borrowings

1,017,823

43,282

4.25

%

1,923,924

83,853

4.36

%

Total interest-bearing liabilities

18,384,515

591,053

3.21

%

17,889,621

481,396

2.69

%

Noninterest-bearing deposits

5,994,009

6,475,051

Accrued expenses and other liabilities

300,766

276,883

TOTAL LIABILITIES

24,679,290

24,641,555

SHAREHOLDERS’ EQUITY

4,901,069

4,654,103

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

29,580,359

$

29,295,658

NET INTEREST INCOME

$

914,430

$

923,938

INTEREST RATE SPREAD

2.53

%

2.72

%

NET INTEREST MARGIN

3.49

%

3.56

%

Notes:

(1) The interest income and the yields on

federally nontaxable loans and investment securities are presented

on a tax-equivalent basis using the statutory federal income tax

rate of 21%.

(2) Nonaccruing loans are included in the

daily average loan amounts outstanding.

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Three Months Ended

Year Ended

December

December

September

June

December

December

Selected

Financial Ratios:

2024

2023

2024

2024

2024

2023

Return on Average Assets

1.25

%

1.08

%

1.28

%

1.32

%

1.26

%

1.25

%

Return on Average Shareholders’ Equity

7.48

%

6.70

%

7.72

%

7.99

%

7.61

%

7.87

%

Return on Average Tangible Equity

(non-GAAP) (1)

12.03

%

11.27

%

12.59

%

13.12

%

12.43

%

13.33

%

Efficiency Ratio

51.23

%

57.82

%

51.62

%

52.66

%

52.67

%

53.09

%

Price / Earnings Ratio

13.53

x

16.00

x

13.22

x

11.40

x

13.64

x

13.85

x

Note:

(1) Return on Average Tangible Equity:

(a) Net Income (GAAP)

$

94,408

$

79,390

$

95,267

$

96,507

$

372,996

$

366,313

(b) Number of Days

92

92

92

91

366

365

Average Total Shareholders' Equity

(GAAP)

$

5,019,069

$

4,697,680

$

4,908,866

$

4,857,893

$

4,901,069

$

4,654,103

Less: Average Total Intangibles

(1,898,335

)

(1,903,458

)

(1,899,261

)

(1,900,164

)

(1,899,704

)

(1,905,390

)

(c) Average Tangible Equity (non-GAAP)

$

3,120,734

$

2,794,222

$

3,009,605

$

2,957,729

$

3,001,365

$

2,748,713

Return on Average Tangible Equity

(non-GAAP) [(a) / (b)] x 366 or 365 / (c)

12.03

%

11.27

%

12.59

%

13.12

%

12.43

%

13.33

%

Selected

Financial Ratios:

December 31

2024

December 31

2023

September 30

2024

June 30 2024

Loans & Leases, net of unearned income

/ Deposit Ratio

90.45

%

93.60

%

90.74

%

93.64

%

Allowance for Loan & Lease Losses /

Loans & Leases, net of unearned income

1.25

%

1.21

%

1.25

%

1.24

%

Allowance for Credit Losses(2) / Loans

& Leases, net of unearned income

1.42

%

1.42

%

1.43

%

1.43

%

Nonaccrual Loans / Loans & Leases, net

of unearned income

0.26

%

0.14

%

0.24

%

0.25

%

90-Day Past Due Loans / Loans &

Leases, net of unearned income

0.08

%

0.07

%

0.06

%

0.06

%

Non-performing Loans / Loans & Leases,

net of unearned income

0.34

%

0.21

%

0.30

%

0.30

%

Non-performing Assets / Total Assets

0.25

%

0.16

%

0.22

%

0.23

%

Primary Capital Ratio

17.47

%

16.79

%

17.49

%

17.06

%

Shareholders' Equity Ratio

16.63

%

15.94

%

16.64

%

16.21

%

Price / Book Ratio

1.02

x

1.06

x

1.01

x

0.90

x

Note:

(2) Includes allowances for loan losses

and lending-related commitments.

UNITED BANKSHARES, INC. AND

SUBSIDIARIES

Washington, D.C. and

Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per

Share Data)

Three Months Ended

Year Ended

December 31

December 31

September 30

June 30

December 31

December 31

Mortgage Banking

Data: (1)

2024

2023

2024

2024

2024

2023

Loans originated

$

132,381

$

225,319

$

151,333

$

185,322

$

645,942

$

860,901

Loans sold

134,514

228,672

171,315

163,273

657,843

861,519

December 31

December 31

September 30

June 30

Mortgage Loan

Servicing Data: (2)

2024

2023

2024

2024

Balance of loans serviced

$

-

$

1,202,448

$

-

$

1,138,443

Number of loans serviced

-

12,419

-

11,853

December 31

December 31

September 30

June 30

Asset Quality

Data:

2024

2023

2024

2024

EOP Non-Accrual Loans

$

56,460

$

30,919

$

52,446

$

52,929

EOP 90-Day Past Due Loans

16,940

14,579

12,794

12,402

Total EOP Non-performing Loans

$

73,400

$

45,498

$

65,240

$

65,331

EOP Other Real Estate Owned

327

2,615

169

2,156

Total EOP Non-performing Assets

$

73,727

$

48,113

$

65,409

$

67,487

Three Months Ended

Year Ended

December 31

December 31

September 30

June 30

December 31

December 31

Allowance for

Loan & Lease Losses:

2024

2023

2024

2024

2024

2023

Beginning Balance

$

270,767

$

254,886

$

267,423

$

262,905

$

259,237

$

234,746

Gross Charge-offs

(6,509

)

(3,258

)

(4,903

)

(2,542

)

(17,530

)

(11,304

)

Recoveries

894

733

1,304

1,281

4,985

4,641

Net Charge-offs

(5,615

)

(2,525

)

(3,599

)

(1,261

)

(12,545

)

(6,663

)

Provision for Loan & Lease Losses

6,692

6,876

6,943

5,779

25,152

31,154

Ending Balance

$

271,844

$

259,237

$

270,767

$

267,423

$

271,844

$

259,237

Reserve for lending-related

commitments

34,911

44,706

37,973

40,739

34,911

44,706

Allowance for Credit Losses (3)

$

306,755

$

303,943

$

308,740

$

308,162

$

306,755

$

303,943

Notes:

(1) During the first quarter of 2024,

United completed its previously announced consolidation of its

mortgage delivery channels. Based on an evaluation performed in

accordance with ASC 280, Segment Reporting, beginning with the

periods as of March 31, 2024, United operates one reportable

business segment. Mortgage banking data above is presented on a

consolidated basis for all current and prior periods.

(2) As previously disclosed, United sold

its remaining mortgage servicing rights during the third quarter of

2024.

(3) Includes allowances for loan losses

and lending-related commitments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124255504/en/

W. Mark Tatterson Chief Financial Officer (800) 445-1347 ext.

8716

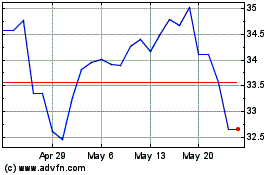

United Bankshares (NASDAQ:UBSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

United Bankshares (NASDAQ:UBSI)

Historical Stock Chart

From Jan 2024 to Jan 2025