Blue Owl Capital and Upstart Partner on Consumer Credit in $2 Billion Agreement

October 10 2024 - 1:33PM

Business Wire

Upstart (NASDAQ: UPST), the leading artificial intelligence (AI)

lending marketplace, today announced a programmatic purchase

commitment from funds managed by Blue Owl Capital Inc. (“Blue

Owl”). Blue Owl’s Alternative Credit strategy will purchase up to

$2 billion of consumer loans on the Upstart platform over 18

months. The transaction includes an initial acquisition of a $290

million personal loan portfolio, which closed in September.

"We are excited to support Upstart’s efforts to make the

consumer lending process dramatically more efficient for both

borrowers and lenders,” said David Aidi, Co-Head of Financial

Assets, Blue Owl Alternative Credit. “We are also proud to leverage

the Blue Owl Alternative Credit team's data science effort and deep

experience in the consumer space to join Upstart in this journey,"

said Ray Chan, Co-Head of Financial Assets, Blue Owl Alternative

Credit.

“We’re thrilled to partner with the Blue Owl team in one of our

largest purchase commitments ever,” said Sanjay Datta, CFO,

Upstart. “Blue Owl’s ambitious vision and long-term focus will

accelerate our efforts to expand access to affordable credit.”

The transaction was structured and closed by Atalaya Capital

Management LP (“Atalaya”), an alternative credit manager that

focused primarily on asset-based credit investments across consumer

and commercial finance, corporate, and real estate assets. Blue Owl

completed its acquisition of Atalaya on Sept. 30, representing a

significant expansion of Blue Owl’s alternative credit presence and

supplementing its market-leading position in direct lending.

ATLAS SP Partners, the warehouse finance and securitized

products business majority owned by Apollo funds, will provide the

debt financing for the loan purchases.

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace,

connecting millions of consumers to more than 100 banks and credit

unions that leverage Upstart’s AI models and cloud applications to

deliver superior credit products. With Upstart AI, lenders can

approve more borrowers at lower rates across races, ages, and

genders, while delivering the exceptional digital-first experience

customers demand. More than 80% of borrowers are approved

instantly, with zero documentation to upload. Founded in 2012,

Upstart’s platform includes personal loans, automotive retail and

refinance loans, home equity lines of credit, and small-dollar

“relief” loans. Upstart is based in San Mateo, California, and also

has offices in Columbus, Ohio and Austin, Texas.

About Blue Owl

Blue Owl (NYSE: OWL) is a leading asset manager that is

redefining alternatives. With over $192 billion in assets under

management as of June 30, 2024, we invest across three

multi-strategy platforms: Credit, GP Strategic Capital, and Real

Estate. Anchored by a strong permanent capital base, we provide

businesses with private capital solutions to drive long-term growth

and offer institutional investors, individual investors, and

insurance companies differentiated alternative investment

opportunities that aim to deliver strong performance, risk-adjusted

returns, and capital preservation. Together with over 820

experienced professionals, Blue Owl brings the vision and

discipline to create the exceptional. To learn more, visit

www.blueowl.com.

Forward Looking Statements Disclaimer

All forward-looking statements or information on this press

release are subject to risks and uncertainties that may cause

actual results to differ materially from those that Upstart

expected. Any forward-looking statements or information on this

site are only as of the date hereof. Upstart undertakes no

obligation to update or revise any forward-looking statements or

information on this press release as a result of new information,

future events or otherwise. More information about these risks and

uncertainties is provided in Upstart’s public filings with the

Securities and Exchange Commission, copies of which may be obtained

by visiting Upstart’s investor relations website at www.upstart.com

or the SEC’s website at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009387002/en/

Press: press@upstart.com Investors:

ir@upstart.com

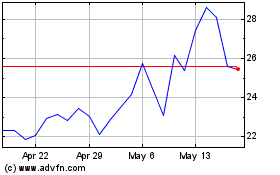

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Oct 2024 to Nov 2024

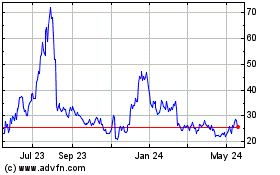

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Nov 2023 to Nov 2024