U.S. Energy Corporation (NASDAQ: USEG, “U.S. Energy” or the

“Company”), a growth-focused energy company engaged in the

development and operation of high-quality producing energy and

industrial gas assets, today reported financial and operating

results for the three months ended September 30, 2024.

THIRD QUARTER 2024

HIGHLIGHTS

- Initiated drilling operations on

U.S. Energy’s first industrial gas well, with independent

laboratory analysis confirming high-quality helium concentrations

of up to 1.5% in non-hydrocarbon-based gas streams.

- Closed divestiture of South Texas

properties for $6.5 million in July 2024.

- Closed divestiture of Kansas

properties for $1.2 million in October 2024.

- Fully repaid the outstanding

balance under the credit facility, positioning the Company as

debt-free.

- Net daily production of

1,149 barrels of oil equivalent per day (“Boe/d”) (58%

oil).

- Adjusted EBITDA of $1.8

million.

- Continued share repurchase program,

increasing program-to-date total to 0.9 million shares, or

approximately 3% of outstanding shares, at an average price of

$1.17 per share.

MANAGEMENT COMMENTS

“We are very pleased with the substantial

progress U.S. Energy made in the third quarter of 2024, driving

forward our strategic priorities,” said Ryan Smith, Chief Executive

Officer of U.S. Energy. “Our recent acquisition of industrial gas

assets in Montana and the successful launch of drilling and

development on these sites are pivotal achievements for our growth

strategy. These early results not only strengthen and diversify our

portfolio but also signal the beginning of a strategic plan to

harness the vast resource potential in a region where U.S. Energy

has a deep-rooted presence.

“Additionally, our efforts to divest non-core,

legacy assets E&P remain on track. With the successful

monetization of our South Texas assets and, after the quarter’s

close, our Kansas assets, we are not only pulling forward

meaningful value but enhancing our financial flexibility. These

actions reinforce our commitment to maintaining a strong,

conservative balance sheet while redirecting capital into Montana,

a high-return, scalable opportunity that aligns with our long-term

vision.

“As we move ahead, our industrial gas focus

remains on maximizing resource development and operational

efficiency within our asset base. We are committed to executing our

strategic initiatives with capital discipline and operational

agility, positioning U.S. Energy to capitalize on the significant

opportunities ahead.”

RECENT DEVELOPMENT ACTIVITY

U.S. Energy has made significant strides in

developing our recently acquired industrial gas assets in Montana.

From September through October, we successfully completed drilling

operations on our initial well, uncovering multiple productive

helium zones within non-hydrocarbon-based gas streams. Notably, the

highest helium concentrations were identified within a

nitrogen-based formation, with additional helium reserves

discovered in a CO2-based formation. These findings strategically

position us to capitalize on these assets for future industrial gas

development and planned carbon sequestration initiatives, aligning

with our broader vision for sustainable growth in the industrial

gas sector.

RECENT ASSET DIVESTITURES

The Company previously announced the successful

sale of its South Texas assets, which closed on July 31, 2024,

generating approximately $6.5 million in cash proceeds. Following

the quarter-end, we further streamlined our portfolio by divesting

our Kansas assets for $1.2 million in cash, with the transaction

closing on October 31, 2024.

Together, these sales of our South Texas and Kansas assets

yielded a combined $7.2 million in proceeds, which have been

strategically allocated to support acquisition and development

initiatives as well as to fully repay all outstanding debt. These

divestitures reinforce our commitment to strengthening our balance

sheet and optimizing capital deployment in high-growth

opportunities.

PRODUCTION UPDATE

During the third quarter of 2024, the

Company produced 105,699 Boe, or an average

of 1,149 Boe/d. The Company's South Texas divestiture

represented approximately 100 Boe/d production. When adjusting for

the South Texas transaction and other non-core divestitures made to

date, the Company realized sequential production increases over

both the first and second quarters of 2024. The Company's remains

focused on, and is having success, maintaining stable production

from its remaining legacy assets.

| |

|

Three months ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Sales

volume |

|

|

|

|

|

|

|

|

| Oil (Bbls) |

|

|

61,185 |

|

|

|

100,071 |

|

| Natural gas and liquids

(Mcfe) |

|

|

267,089 |

|

|

|

311,654 |

|

| BOE |

|

|

105,699 |

|

|

|

152,013 |

|

| Average daily production

(BOE/Day) |

|

|

1,149 |

|

|

|

1,652 |

|

| |

|

|

|

|

|

|

|

|

| Average sales

prices: |

|

|

|

|

|

|

|

|

| Oil (Bbls) |

|

$ |

71.50 |

|

|

$ |

78.05 |

|

| Natural gas and liquids

(Mcfe) |

|

$ |

2.18 |

|

|

$ |

2.98 |

|

| BOE |

|

$ |

46.90 |

|

|

$ |

57.50 |

|

| |

|

|

|

|

|

|

|

|

THIRD QUARTER 2024

FINANCIAL RESULTS

Total oil and gas sales for the third

quarter of 2024 were approximately $5.0 million, down

from $8.7 million in the same quarter of

2023. This decrease in revenue primarily reflects reduced

production volumes following our recent asset

divestitures. Oil sales accounted for 88% of total

revenue this quarter, compared to 89% in the third

quarter of 2023.

Lease operating expenses (LOE) for

the third quarter of 2024 were approximately $3.1

million, or $28.95 per Boe, as compared to $4.0 million,

or $26.31 per Boe, in the prior year. The overall

reduction in LOE is primarily attributable to fewer producing

assets as a result of our asset divestitures.

Cash general and administrative (G&A)

expenses for the third quarter of 2024 were

approximately $1.6 million, a decrease from the $2.2

million reported in the third quarter of 2023. This reduction

reflects our streamlined corporate overhead, offset by one-time

costs associated with our business development efforts in

Montana.

Adjusted EBITDA was $1.8 million in

the third quarter of 2024, compared to adjusted EBITDA

of $1.7 million in the third quarter of

2023. The Company reported a net loss of $2.2 million, or

a loss of $0.08 per diluted share, in the third

quarter of 2024.

BALANCE SHEET AND LIQUIDITY

UPDATE

During the third quarter, as reflected in the table below, U.S.

Energy successfully eliminated its entire $7.0 million debt balance

that was outstanding as of June 30, 2024. With this debt fully

repaid, U.S. Energy is now entirely debt-free, resulting in

approximately $21.2 million in available liquidity. This

strengthened financial position enables us to pursue growth

opportunities with agility and reinforces our commitment to

maintaining a strong, flexible balance sheet.

| |

|

Balance as of |

|

| |

|

June 30, 2024 |

|

|

September 30, 2024 |

|

|

Cash and debt balance: |

|

|

|

|

|

|

|

|

| Total debt outstanding |

|

$ |

7,000 |

|

|

$ |

- |

|

| Less: Cash balance |

|

$ |

2,223 |

|

|

$ |

1,155 |

|

| Net debt balance |

|

$ |

4,777 |

|

|

$ |

(1,155 |

) |

| |

|

|

|

|

|

|

|

|

|

Liquidity: |

|

|

|

|

|

|

|

|

| Cash balance |

|

$ |

2,223 |

|

|

$ |

1,155 |

|

| Plus Credit facility

availability |

|

$ |

13,000 |

|

|

$ |

20,000 |

|

| Total Liquidity |

|

$ |

15,223 |

|

|

$ |

21,155 |

|

| |

|

|

|

|

|

|

|

|

ABOUT U.S. ENERGY CORP.

We are a growth company focused on the development and operation

of high-quality energy and industrial gas assets in the United

States through low-risk development while maintaining an attractive

shareholder returns program. We are committed to being a

leader in reducing our carbon footprint in the areas in which we

operate. More information about U.S. Energy Corp. can be found at

www.usnrg.com.

INVESTOR RELATIONS CONTACT

Mason McGuire

IR@usnrg.com(303) 993-3200www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this

communication which are not statements of historical fact

constitute forward-looking statements within the meaning of the

federal securities laws, including the Private Securities

Litigation Reform Act of 1995, that involve a number of risks and

uncertainties. Words such as “strategy,” “expects,” “continues,”

“plans,” “anticipates,” “believes,” “would,” “will,” “estimates,”

“intends,” “projects,” “goals,” “targets” and other words of

similar meaning are intended to identify forward-looking statements

but are not the exclusive means of identifying these

statements.

Important factors that may cause actual results

and outcomes to differ materially from those contained in such

forward-looking statements include, without limitation: (1) the

ability of the Company to grow and manage growth profitably and

retain its key employees; (2) the ability of the Company to close

previously announced transactions and the terms of such

transactions; (3) risks associated with the integration of recently

acquired assets; (4) the Company’s ability to comply with the terms

of its senior credit facilities; (5) the ability of the Company to

retain and hire key personnel; (6) the business, economic and

political conditions in the markets in which the Company operates;

(7) the volatility of oil and natural gas prices; (8) the Company’s

success in discovering, estimating, developing and replacing oil

and natural gas reserves; (9) risks of the Company’s operations not

being profitable or generating sufficient cash flow to meet its

obligations; (10) risks relating to the future price of oil,

natural gas and NGLs; (11) risks related to the status and

availability of oil and natural gas gathering, transportation, and

storage facilities; (12) risks related to changes in the legal and

regulatory environment governing the oil and gas industry, and new

or amended environmental legislation and regulatory initiatives;

(13) risks relating to crude oil production quotas or other actions

that might be imposed by the Organization of Petroleum Exporting

Countries and other producing countries; (14) technological

advancements; (15) changing economic, regulatory and political

environments in the markets in which the Company operates; (16)

general domestic and international economic, market and political

conditions, including the military conflict between Russia and

Ukraine and the global response to such conflict; (17) actions of

competitors or regulators; (18) the potential disruption or

interruption of the Company’s operations due to war, accidents,

political events, severe weather, cyber threats, terrorist acts, or

other natural or human causes beyond the Company’s control;

(19) pandemics, governmental responses thereto, economic

downturns and possible recessions caused thereby; (20) inflationary

risks and recent changes in inflation and interest rates, and the

risks of recessions and economic downturns caused thereby or by

efforts to reduce inflation; (21) risks related to military

conflicts in oil producing countries; (22) changes in economic

conditions; limitations in the availability of, and costs of,

supplies, materials, contractors and services that may delay the

drilling or completion of wells or make such wells more expensive;

(23) the amount and timing of future development costs; (24) the

availability and demand for alternative energy sources; (25)

regulatory changes, including those related to carbon dioxide and

greenhouse gas emissions; (26) uncertainties inherent in estimating

quantities of oil and natural gas reserves and projecting future

rates of production and timing of development activities; (27)

risks relating to the lack of capital available on acceptable terms

to finance the Company’s continued growth; (28) the review and

evaluation of potential strategic transactions and their impact on

stockholder value and the process by which the Company engages in

evaluation of strategic transactions; and (29) other risk factors

included from time to time in documents U.S. Energy files with the

Securities and Exchange Commission, including, but not limited to,

its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other important factors

that may cause actual results and outcomes to differ materially

from those contained in the forward-looking statements included in

this communication are described in the Company’s publicly filed

reports, including, but not limited to, the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023 and Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024, and

future annual reports and quarterly reports. These reports and

filings are available at www.sec.gov. Unknown or unpredictable

factors also could have material adverse effects on the Company’s

future results.

The Company cautions that the foregoing list of

important factors is not complete, and does not undertake to update

any forward-looking statements except as required by applicable

law. All subsequent written and oral forward-looking statements

attributable to the Company or any person acting on behalf of the

Company are expressly qualified in their entirety by the cautionary

statements referenced above. Other unknown or unpredictable factors

also could have material adverse effects on the Company’s future

results. The forward-looking statements included in this

communication are made only as of the date hereof. The Company

cannot guarantee future results, levels of activity, performance or

achievements. Accordingly, you should not place undue reliance on

these forward-looking statements. Finally, the Company undertakes

no obligation to update these statements after the date of this

release, except as required by law, and takes no obligation to

update or correct information prepared by third parties that are

not paid for by the Company. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

FINANCIAL STATEMENTS

|

U.S. ENERGY CORP. AND

SUBSIDIARIESUNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS(in thousands, except share and per

share amounts) |

| |

| |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

|

Cash and equivalents |

|

$ |

1,155 |

|

|

$ |

3,351 |

|

|

Oil and natural gas sales receivables |

|

|

1,416 |

|

|

|

2,336 |

|

|

Marketable equity securities |

|

|

107 |

|

|

|

164 |

|

|

Commodity derivative asset |

|

|

- |

|

|

|

1,844 |

|

|

Other current assets |

|

|

708 |

|

|

|

527 |

|

|

Real estate assets held for sale, net of selling costs |

|

|

- |

|

|

|

150 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

3,386 |

|

|

|

8,372 |

|

| |

|

|

|

|

|

|

|

|

| Oil, natural gas and

helium properties under full cost method: |

|

|

|

|

|

|

|

|

|

Proved oil and natural gas properties |

|

|

163,554 |

|

|

|

176,679 |

|

|

Less accumulated depreciation, depletion and amortization |

|

|

(111,531 |

) |

|

|

(106,504 |

) |

| |

|

|

|

|

|

|

|

|

|

Net oil and natural gas properties |

|

|

52,023 |

|

|

|

70,175 |

|

| Unproved helium properties,

not subject to amortization |

|

|

6,931 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net oil, natural gas and helium properties |

|

|

58,954 |

|

|

|

70,175 |

|

| |

|

|

|

|

|

|

|

|

| Other

Assets: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

725 |

|

|

|

899 |

|

|

Right-of-use asset |

|

|

570 |

|

|

|

693 |

|

|

Other assets |

|

|

441 |

|

|

|

305 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

64,076 |

|

|

$ |

80,444 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

4,312 |

|

|

$ |

4,064 |

|

|

Accrued compensation and benefits |

|

|

610 |

|

|

|

702 |

|

|

Revenue and royalties payable |

|

|

4,769 |

|

|

|

4,857 |

|

|

Asset retirement obligations |

|

|

1,000 |

|

|

|

1,273 |

|

|

Current lease obligation |

|

|

193 |

|

|

|

182 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

10,884 |

|

|

|

11,078 |

|

| |

|

|

|

|

|

|

|

|

| Noncurrent

liabilities: |

|

|

|

|

|

|

|

|

|

Credit facility |

|

|

- |

|

|

|

5,000 |

|

|

Asset retirement obligations |

|

|

16,991 |

|

|

|

17,217 |

|

|

Long-term lease obligation, net of current portion |

|

|

466 |

|

|

|

611 |

|

|

Deferred tax liability |

|

|

1 |

|

|

|

16 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

28,342 |

|

|

|

33,922 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies (Note 8) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

equity: |

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value; 245,000,000 shares authorized;

28,035,613 and 25,333,870 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively |

|

|

280 |

|

|

|

253 |

|

|

Additional paid-in capital |

|

|

221,346 |

|

|

|

218,403 |

|

|

Accumulated deficit |

|

|

(185,892 |

) |

|

|

(172,134 |

) |

| |

|

|

|

|

|

|

|

|

|

Total shareholders’ equity |

|

|

35,734 |

|

|

|

46,522 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

$ |

64,076 |

|

|

$ |

80,444 |

|

|

U.S. ENERGY CORP. AND

SUBSIDIARIESUNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONSFOR THE

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

AND 2023(In thousands, except share and

per share amounts) |

| |

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

$ |

4,375 |

|

|

$ |

7,811 |

|

|

$ |

14,574 |

|

|

$ |

21,935 |

|

|

Natural gas and liquids |

|

|

582 |

|

|

|

930 |

|

|

|

1,820 |

|

|

|

3,057 |

|

|

Total revenue |

|

|

4,957 |

|

|

|

8,741 |

|

|

|

16,394 |

|

|

|

24,992 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating expenses |

|

|

3,060 |

|

|

|

3,999 |

|

|

|

9,322 |

|

|

|

12,147 |

|

|

Gathering, transportation and treating |

|

|

43 |

|

|

|

167 |

|

|

|

170 |

|

|

|

419 |

|

|

Production taxes |

|

|

298 |

|

|

|

596 |

|

|

|

1,008 |

|

|

|

1,654 |

|

|

Depreciation, depletion, accretion and amortization |

|

|

2,032 |

|

|

|

2,868 |

|

|

|

6,392 |

|

|

|

8,181 |

|

|

Impairment of oil and natural gas properties |

|

|

1,424 |

|

|

|

6,495 |

|

|

|

6,843 |

|

|

|

6,495 |

|

| Acquisition transaction

costs |

|

|

368 |

|

|

|

- |

|

|

|

368 |

|

|

|

- |

|

|

General and administrative expenses |

|

|

1,884 |

|

|

|

2,824 |

|

|

|

6,181 |

|

|

|

8,964 |

|

|

Total operating expenses |

|

|

9,109 |

|

|

|

16,949 |

|

|

|

30,284 |

|

|

|

37,860 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

(4,152 |

) |

|

|

(8,208 |

) |

|

|

(13,890 |

) |

|

|

(12,868 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commodity derivative gain (loss), net |

|

|

2,030 |

|

|

|

(504 |

) |

|

|

537 |

|

|

|

704 |

|

|

Interest (expense), net |

|

|

(93 |

) |

|

|

(306 |

) |

|

|

(344 |

) |

|

|

(864 |

) |

|

Other income (expense), net |

|

|

(52 |

) |

|

|

68 |

|

|

|

(67 |

) |

|

|

46 |

|

|

Total other income (expense) |

|

|

1,885 |

|

|

|

(742 |

) |

|

|

126 |

|

|

|

(114 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) before

income taxes |

|

$ |

(2,267 |

) |

|

$ |

(8,950 |

) |

|

$ |

(13,764 |

) |

|

$ |

(12,982 |

) |

| Income tax (expense)

benefit |

|

|

20 |

|

|

|

162 |

|

|

|

6 |

|

|

|

432 |

|

| Net income

(loss) |

|

$ |

(2,247 |

) |

|

$ |

(8,788 |

) |

|

$ |

(13,758 |

) |

|

$ |

(12,550 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted weighted

average shares outstanding |

|

|

28,052,356 |

|

|

|

25,428,874 |

|

|

|

26,304,200 |

|

|

|

25,265,662 |

|

| Basic and diluted income

(loss) per share |

|

$ |

(0.08 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.50 |

) |

|

U.S. ENERGY CORP. AND

SUBSIDIARIESUNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWSFOR THE

NINE MONTHS ENDED SEPTEMBER 30, 2024 AND

2023(in thousands) |

| |

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(13,758 |

) |

|

$ |

(12,550 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation, depletion, accretion, and amortization |

|

|

6,392 |

|

|

|

8,181 |

|

|

Impairment of oil and natural gas properties |

|

|

6,843 |

|

|

|

6,495 |

|

|

Deferred income taxes |

|

|

(14 |

) |

|

|

(452 |

) |

|

Total commodity derivatives (gains) losses, net |

|

|

(537 |

) |

|

|

(704 |

) |

|

Commodity derivative settlements received (paid) |

|

|

2,381 |

|

|

|

(642 |

) |

|

(Gains) losses on marketable equity securities |

|

|

57 |

|

|

|

(54 |

) |

|

Impairment and loss on real estate held for sale |

|

|

11 |

|

|

|

- |

|

|

Amortization of debt issuance costs |

|

|

37 |

|

|

|

37 |

|

|

Stock-based compensation |

|

|

950 |

|

|

|

1,951 |

|

|

Right of use asset amortization |

|

|

123 |

|

|

|

135 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Oil and natural gas sales receivable |

|

|

920 |

|

|

|

(292 |

) |

|

Other assets |

|

|

(174 |

) |

|

|

395 |

|

|

Accounts payable and accrued liabilities |

|

|

80 |

|

|

|

120 |

|

|

Accrued compensation and benefits |

|

|

(91 |

) |

|

|

(294 |

) |

|

Revenue and royalties payable |

|

|

(88 |

) |

|

|

927 |

|

|

Payments on operating lease liability |

|

|

(136 |

) |

|

|

(145 |

) |

|

Payments of asset retirement obligations |

|

|

(105 |

) |

|

|

(131 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

|

2,891 |

|

|

|

2,977 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

| Acquisition of helium

properties |

|

|

(2,368 |

) |

|

|

- |

|

| Helium capital

expenditures |

|

|

(1,599 |

) |

|

|

- |

|

|

Oil and natural gas capital expenditures |

|

|

(1,158 |

) |

|

|

(2,878 |

) |

|

Property and equipment expenditures |

|

|

(189 |

) |

|

|

(487 |

) |

|

Proceeds from sale of oil and natural gas properties, net |

|

|

5,866 |

|

|

|

- |

|

| Proceeds from sale of real

estate assets |

|

|

139 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities |

|

|

691 |

|

|

|

(3,365 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

| Borrowings on credit

facility |

|

|

2,000.0 |

|

|

|

500 |

|

| Payments on credit

facility |

|

|

(7,000 |

) |

|

|

(500 |

) |

|

Payments on insurance premium finance note |

|

|

(62 |

) |

|

|

(465 |

) |

|

Shares withheld to settle tax withholding obligations for

restricted stock awards |

|

|

(132 |

) |

|

|

(151 |

) |

|

Dividends paid |

|

|

- |

|

|

|

(1,192 |

) |

|

Repurchases of common stock |

|

|

(584 |

) |

|

|

(241 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities |

|

|

(5,778 |

) |

|

|

(2,049 |

) |

| |

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and equivalents |

|

|

(2,196 |

) |

|

|

(2,437 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash and equivalents, beginning of period |

|

|

3,351 |

|

|

|

4,411 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and equivalents, end of period |

|

$ |

1,155 |

|

|

$ |

1,974 |

|

|

|

ADJUSTED EBITDA RECONCILIATION

In addition to our results calculated under

generally accepted accounting principles in the United States

(“GAAP”), in this earnings release we also present Adjusted EBITDA.

Adjusted EBITDA is a “non-GAAP financial measure” presented as

supplemental measures of the Company’s performance. It is not

presented in accordance with accounting principles generally

accepted in the United States, or GAAP. The Company defines

Adjusted EBITDA as net income (loss), plus net interest expense,

net unrealized loss (gain) on change in fair value of derivatives,

income tax (benefit) expense, deferred income taxes, depreciation,

depletion, accretion and amortization, one-time costs associated

with completed transactions and the associated assumed derivative

contracts, non-cash share-based compensation, transaction related

expenses, transaction related acquired realized derivative loss

(gain), and loss (gain) on marketable securities. Company

management believes this presentation is relevant and useful

because it helps investors understand U.S. Energy’s operating

performance and makes it easier to compare its results with those

of other companies that have different financing, capital and tax

structures. Adjusted EBITDA is presented because we believe it

provides additional useful information to investors due to the

various noncash items during the period. Adjusted EBITDA has

limitations as an analytical tool, and you should not consider it

in isolation, or as a substitute for analysis of our operating

results as reported under GAAP. Some of these limitations are:

Adjusted EBITDA does not reflect cash expenditures, or future

requirements for capital expenditures, or contractual commitments;

Adjusted EBITDA does not reflect changes in, or cash requirements

for, working capital needs; Adjusted EBITDA does not reflect the

significant interest expense, or the cash requirements necessary to

service interest or principal payments, on debt or cash income tax

payments; although depreciation and amortization are noncash

charges, the assets being depreciated and amortized will often have

to be replaced in the future, and Adjusted EBITDA does not reflect

any cash requirements for such replacements; and other companies in

this industry may calculate Adjusted EBITDA differently than the

Company does, limiting its usefulness as a comparative measure.

The Company’s presentation of this measure

should not be construed as an inference that future results will be

unaffected by unusual or nonrecurring items. We compensate for

these limitations by providing a reconciliation of this non-GAAP

measure to the most comparable GAAP measure, below. We encourage

investors and others to review our business, results of operations,

and financial information in their entirety, not to rely on any

single financial measure, and to view this non-GAAP measure in

conjunction with the most directly comparable GAAP financial

measure.

| |

|

Three months ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Adjusted EBITDA Reconciliation |

|

|

|

|

|

|

|

|

| Net Income (Loss) |

|

$ |

(2,247 |

) |

|

$ |

(8,788 |

) |

| |

|

|

|

|

|

|

|

|

| Depreciation, depletion,

accretion and amortization |

|

|

2,074 |

|

|

|

2,908 |

|

| Non-cash loss (gain) on

commodity derivatives |

|

|

(173 |

) |

|

|

356 |

|

| Interest Expense, net |

|

|

93 |

|

|

|

306 |

|

| Income tax expense

(benefit) |

|

|

(20 |

) |

|

|

(162 |

) |

| Non-cash stock based

compensation |

|

|

274 |

|

|

|

617 |

|

| Transaction related

expenses |

|

|

368 |

|

|

|

- |

|

| Loss (gain) on marketable

securities |

|

|

52 |

|

|

|

(70 |

) |

| Impairment of oil and natural

gas properties |

|

|

1,424 |

|

|

|

6,495 |

|

| Total Adjustments |

|

|

4,092 |

|

|

|

10,450 |

|

| |

|

|

|

|

|

|

|

|

| Total Adjusted

EBITDA |

|

$ |

1,845 |

|

|

$ |

1,662 |

|

| |

|

|

|

|

|

|

|

|

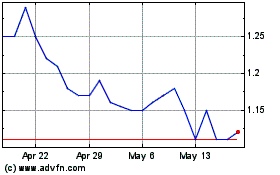

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Nov 2024 to Dec 2024

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Dec 2023 to Dec 2024