U.S. Energy Corporation (NASDAQ: USEG, “

U.S.

Energy” or the “

Company”) today announced

that the Company has closed a transaction (the

“

Agreement”) with Synergy Offshore, LLC

(“

Synergy” or “

SOG”) for the

acquisition of operated acreage targeting helium and other

industrial gas production across the Kevin Dome structure in Toole

County, Montana (the “

SOG Asset”).

HIGHLIGHTS

- The SOG Asset includes:

- Approximately 24,000 net acres strategically positioned across

the core of the Kevin Dome.

- Multiple prospective industrial gas pay zones, primarily

composed of carbon dioxide (CO2) and nitrogen heavy formations

enriched with significant helium concentrations.

- Industry leading low environmental footprint focusing on the

production of non-hydrocarbon-based helium and other industrial

gases.

- SOG Asset expected to be seamlessly integrated into U.S.

Energy’s existing operations.

- The SOG Asset’s highly contiguous location to U.S. Energy’s

existing position enhances the Company’s industrial gas operations

within the Kevin Dome region.

- The Asset will be immediately incorporated into U.S. Energy’s

2025 development program, accelerating value creation.

- Initiation of carbon sequestration business significantly

expands opportunity.

- The acquisition marks a significant milestone in advancing U.S.

Energy’s carbon management solutions, leveraging the SOG Asset to

expand into the Company’s carbon sequestration business.

- Development plans align closely with local, state, and federal

legislation, positioning U.S. Energy as a leader in sustainable

industrial gas production.

MANAGEMENT COMMENTARY

“With U.S. Energy’s acquisition of the Synergy

Assets, encompassing a substantial position across the core of

Montana’s Kevin Dome structure, we are confident that the Company

is well-positioned to capitalize on what we believe to be a

transformational resource and economic opportunity across multiple

industrial gas streams,” said Ryan Smith, U.S. Energy’s Chief

Executive Officer. He added, “The Kevin Dome structure represents

immense resource potential, with full-cycle helium and industrial

gas economics that are competitive with any location in North

America.”

Mr. Smith continued, “Global

industries—including aerospace, semiconductors, medical

applications, and food and beverage production—are facing

significant challenges in meeting the growing demand for helium and

CO₂. These challenges are exacerbated by risks associated with

foreign supply chains, including shipping disruptions and trade

restrictions. The Synergy Asset acquisition strengthens our ability

to provide reliable, clean, and domestically sourced industrial

gases.

“We are positioned to begin operations on the

acquired acreage immediately, integrating it into our 2025

development program. Additionally, U.S. Energy is proud to advance

our carbon sequestration initiatives. We have entered the planning

and permitting phase to leverage our existing infrastructure for

CO₂ sequestration. This approach not only aligns with our

commitment to greening the industrial gas production process but

also takes full advantage of recent state and federal legislation.

This is a win for all stakeholders, and we remain dedicated to

pursuing this sustainable growth strategy.”

OVERVIEW OF ASSETS

The collective assets encompass approximately

24,000 net acres strategically located within the core of the Kevin

Dome, a prominent geological structure historically recognized for

its robust resource extraction potential. These assets are highly

contiguous and complementary to U.S. Energy’s existing portfolio

and development program. Recent drilling activity in the area has

demonstrated significant success, particularly in helium production

from multiple formations, predominantly composed of carbon dioxide

and nitrogen.

Synergy Asset:

The SOG Asset, encompassing 24,000 net acres, is

strategically located at the center of the Kevin Dome structure.

The primary target for helium production within the asset is the

Duperow formation, known for its carbon dioxide-dominated gas

systems and recent data indicating economically viable helium

concentrations. Notably, the acquisition includes an active well

within the SOG Asset, with recent gas analysis confirming

significant helium production from the Duperow formation.

U.S. Energy plans to prioritize its carbon

sequestration initiatives within the SOG Asset, leveraging the

area’s strategic potential. Synergy is controlled by Duane H. King,

Chief Executive Officer of Synergy and a member of U.S. Energy’s

Board of Directors, along with John A. Weinzierl, Chairman of U.S.

Energy.

TRANSACTION CONSIDERATION

DETAILS

Synergy Consideration:

Under the terms of the Agreement, SOG will

assign to U.S. Energy 80.0% of their interests in the SOG Asset for

the following consideration:

- $2.0mm in

cash.

- 1,400,000 shares

of U.S. Energy restricted common stock.

- $20.0mm carried

working interest for which U.S. Energy commits to pay Synergy’s

exploration, drilling, and completion costs attributable to

Synergy’s 20.0% retained working interest for a period of 78

months.

- An Area of

Mutual Interest (the “SOG AMI”) under which Synergy will have the

right to participate for its proportionate interest of 20.0% in any

new leases with any leasing amounts being deducted from the carried

working interest.

- 18.0% of future

amounts realized by U.S. Energy in connection with tax credits

obtained from carbon sequestration on the SOG AMI.

- 18.0% of any

future gain, after deducting U.S. Energy’s unrecovered capital

costs, in connection with U.S. Energy’s initial CO2 processing

plant located on the SOG AMI.

UPCOMING DRILLING AND DEVELOPMENT

CATALYSTS

U.S. Energy has committed to a two-well drilling

program as part of its acquisition of the SOG Assets. These

commitments will be seamlessly integrated into the Company’s

existing 2025 development program. The initial drilling efforts

will target the Duperow formation, which boasts significant well

control and has demonstrated highly economic helium concentrations,

along with CO₂ levels comprising less than 90% of the overall gas

composition.

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating

high-quality energy and industrial gas assets in the United States

with the potential to optimize production and generate free cash

flow through low-risk development while maintaining an attractive

shareholder returns program. We are committed to being a

leader in reducing our carbon footprint in the areas in which we

operate. More information about U.S. Energy Corp. can be found

at www.usnrg.com.

INVESTOR RELATIONS CONTACT

Mason McGuire

IR@usnrg.com(303) 993-3200www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this

communication which are not statements of historical fact

constitute forward-looking statements within the meaning of the

federal securities laws, including the Private Securities

Litigation Reform Act of 1995, that involve a number of risks and

uncertainties. Words such as “strategy,” “expects,” “continues,”

“plans,” “anticipates,” “believes,” “would,” “will,” “estimates,”

“intends,” “projects,” “goals,” “targets” and other words of

similar meaning are intended to identify forward-looking statements

but are not the exclusive means of identifying these

statements.

Important factors that may cause actual results

and outcomes to differ materially from those contained in such

forward-looking statements include, without limitation, risks

associated with the integration of the recently acquired assets;

the Company’s ability to recognize the expected benefits of the

acquisitions and the risk that the expected benefits and synergies

of the acquisition may not be fully achieved in a timely manner, or

at all; the amount of the costs, fees, expenses and charges related

to the acquisitions; the Company’s ability to comply with the terms

of its senior credit facilities; the ability of the Company to

retain and hire key personnel; the business, economic and political

conditions in the markets in which the Company operates;

fluctuations in oil and natural gas prices, uncertainties inherent

in estimating quantities of oil and natural gas reserves and

projecting future rates of production and timing of development

activities; competition; operating risks; acquisition risks;

liquidity and capital requirements; the effects of governmental

regulation; adverse changes in the market for the Company’s oil and

natural gas production; dependence upon third-party vendors; risks

associated with COVID-19, the global efforts to stop the spread of

COVID-19, potential downturns in the U.S. and global economies due

to COVID-19 and the efforts to stop the spread of the virus, and

COVID-19 in general; economic uncertainty relating to increased

inflation and global conflicts; the lack of capital available on

acceptable terms to finance the Company’s continued

growth; the review and evaluation of potential strategic

transactions and their impact on stockholder value; the process by

which the Company engages in evaluation of strategic transactions;

the outcome of potential future strategic transactions and the

terms thereof; and other risk factors included from time to time in

documents U.S. Energy files with the Securities and Exchange

Commission, including, but not limited to, its Form 10-Ks, Form

10-Qs and Form 8-Ks. Other important factors that may cause actual

results and outcomes to differ materially from those contained in

the forward-looking statements included in this communication are

described in the Company’s publicly filed reports, including, but

not limited to, the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023. These reports and filings are

available at www.sec.gov.

The Company cautions that the foregoing list of

important factors is not complete. All subsequent written and oral

forward-looking statements attributable to the Company or any

person acting on behalf of any Sale Agreement Parties are expressly

qualified in their entirety by the cautionary statements referenced

above. Other unknown or unpredictable factors also could have

material adverse effects on U.S. Energy’s future results. The

forward-looking statements included in this press release are made

only as of the date hereof. U.S. Energy cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, U.S. Energy undertakes no

obligation to update these statements after the date of this

release, except as required by law, and takes no obligation to

update or correct information prepared by third parties that are

not paid for by U.S. Energy. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

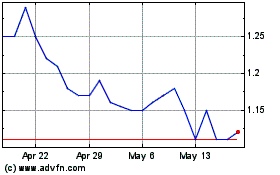

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Dec 2024 to Jan 2025

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Jan 2024 to Jan 2025