Standard Motor Beats Estimates - Analyst Blog

August 07 2012 - 11:59AM

Zacks

Standard Motor Product Inc. (SMP) posted a

20.4% rise in earnings to 59 cents in the second quarter of 2012

from 49 cents in the year-ago quarter, surpassing the Zacks

Consensus Estimate by 6 cents. Profits went up 19% to $13.6 million

from $11.4 million in the year-ago quarter.

Total revenues increased 10.2% to $268.9 million, beating the Zacks

Consensus Estimate of $257 million. Owing to the warm summer, sales

in the Temperature Control segment were strong in both June and

July.

Gross profit improved 10% to $69.3 million or 25.8% of sales from

$63.2 million or 25.9% of sales in the second quarter of 2011. Cost

of sales increased 10.3% to $199.5 million.

Selling, general and administrative expenses rose 16.5% to $46.6

million from $40.0 million in the year-ago quarter. However,

operating income fell 2.6% to $22.7 million or 8.4% of sales from

$23.3 million or 9.5% of sales in the first quarter of 2012.

Revenues from the Engine Management segment augmented 8% to $172.6

million from $159.9 million in the year-ago quarter. The segment

gross profit surged 15.7% to $46.3 million or 26.8% of sales from

$40.0 million or 25% of sales. Operating profit grew 32.1% to $17.9

million from $13.6 million in the corresponding quarter of last

year.

Revenues from the Temperature Control segment improved 16.7% to

$93.0 million from $79.7 million in the corresponding quarter last

year. Gross profit was $19.9 million or 21.4% of sales compared

with $19.6 million or 24.6% of sales. However, operating profits

fell 13% to $7.8 million from $8.9 million.

Standard Motors had $9.2 million in cash as of June 30, 2012, down

from $10.9 million as of December 31, 2011. Long-term debt of the

company was $246 thousand as of June 30, 2012, down from $299

thousand as of December 31, 2011.

The company will be paying a quarterly dividend of 9 cents per

share on the outstanding common stock, due on September 4, 2012 to

shareholders of record as of August 16, 2012.

Standard Motor, based in Long Island City in New York, was founded

in 1919. The company is one of the leading manufacturers,

distributors and marketers of automotive replacement parts in the

U.S. Further, it enjoys strong brand recognition globally.

Standard Motor is very optimistic about the recent acquisitions of

Forecast Trading and Compressor Works. The integration will

generate savings by optimizing the product costs and operating

expenses, mostly in 2013. However, strong competition from low cost

products puts pressure on the company’s margins.

Standard Motor’s competitors include Visteon Corp.

(VC). Currently, the company retains a Zacks #3 Rank, which

translates into a short-term (1 to 3 months) Hold rating.

STANDARD MOTOR (SMP): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

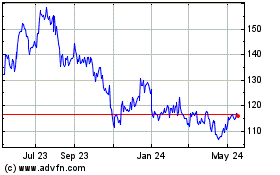

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

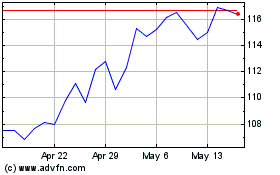

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024