false

0001682149

0001682149

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): May 15, 2024

WISA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38608 |

|

30-1135279 |

(State or other jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

15268 NW Greenbrier Pkwy

Beaverton, OR |

|

97006 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

(408) 627-4716

(Registrant’s telephone

number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

WISA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange

Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On May 15, 2024, WiSA Technologies,

Inc., a Delaware corporation (the “Company”), entered into a securities purchase agreement (the “Purchase

Agreement”) with certain purchasers, pursuant to which the Company agreed to issue and sell to such purchasers (a) in a

registered direct offering, 675,000 shares (the “Shares”) of common stock, par value $0.0001 per share (the

“Common Stock”), of the Company, at an offering price of $3.61 per share, and (b) in a concurrent private placement,

common stock purchase warrants (the “Warrants”) exercisable for an aggregate of up to 675,000 shares of Common Stock, at

an exercise price of $3.48 per share (the “Warrant Shares”), for aggregate gross proceeds of approximately $2,437,000 (such offerings, the “Offerings”). The Offerings are expected to close on May 17, 2024, subject to customary closing

conditions.

Private Placement Warrants

The Warrants will be exercisable upon issuance

and expire on the fifth anniversary of the issuance date of the Warrants. Once issued, the Warrants may be exercised, in certain circumstances,

on a cashless basis pursuant to the formula contained in the Warrants. The holder of a Warrant may also effect an “alternative cashless

exercise” on or after the date that stockholder approval is obtained for such “alternative cashless exercise” feature.

In such event, the aggregate number of shares of Common Stock issuable in such alternative cashless exercise pursuant to any given notice

of exercise electing to effect an alternative cashless exercise shall equal the product of (x) the aggregate number of shares of Common

Stock that would be issuable upon exercise of the Warrant in accordance with the terms of the Warrant if such exercise were by means of

a cash exercise rather than a cashless exercise and (y) 0.65.

Obligations under the Purchase Agreement

Pursuant to the Purchase Agreement, the Company

agreed to, among other things:

| |

(a) |

subject to certain exceptions, (i) not offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of its shares of Common Stock or securities convertible into Common Stock until 30 days after the closing date of the Offerings, and (ii) not issue certain securities if the issuance would constitute a Variable Rate Transaction (as such term is defined in the Purchase Agreement) for a period of six months from the closing date of the Offerings, in each case unless the Company is required to complete a financing prior to the applicable date in order to satisfy Nasdaq’s continued listing requirements; and |

| |

(b) |

as soon as practicable (and in any event by June 14, 2024), file a registration statement on Form S-1 or another appropriate form providing for the resale of the Warrant Shares, use commercially reasonable efforts to cause such registration statement to become effective within 90 days of the closing date of the Offerings, and keep such registration statement effective at all times until no purchaser owns any Warrants or Warrant Shares issuable upon exercise thereof; and |

| |

|

|

| |

(c) |

hold a meeting of stockholders of the Company for the purpose of approving the “alternative cashless exercise” feature in the Warrants, which meeting shall be held on or before September 30, 2024. |

In addition, pursuant to the Purchase Agreement, the purchasers and

the Company agreed to amend the filing date deadline for the registration statement on Form S-1 to June 14, 2024 (originally May 30, 2024),

for the resale by the purchasers of warrants issued in private placement transactions pursuant to those certain securities purchase agreements,

dated as of March 26, 2024, April 17, 2024, April 19, 2024, April 26, 2024 and May 13, 2024.

Placement Agency Agreement

In connection with the Offerings, on May 15,

2024, the Company entered into a placement agency agreement (the “Placement Agency Agreement”) with Maxim Group LLC (the “Placement

Agent”), pursuant to which the Placement Agent agreed to act as placement agent on a “reasonable best efforts” basis

in connection with the Offerings. The Company paid the Placement Agent an aggregate fee equal to 8.0% of the gross proceeds raised in

the Offerings. The Company reimbursed the Placement Agent $50,000 for expenses in connection with the Offerings.

Pursuant to the Placement

Agency Agreement, the Company agreed, among other things and subject to certain exceptions, not to, without the prior written consent

of the Placement Agent, offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of its shares of Common Stock

or securities convertible into Common Stock until 30 days after the closing date of the Offerings.

The Placement Agency Agreement and the Purchase

Agreement each contains customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification

obligations of the Company, the Placement Agent, or the purchasers in the Offerings, as the case may be, other obligations of the parties

and termination provisions.

The Shares to be issued in the registered direct offering were offered

pursuant to the Company’s registration statement on Form S-3 (File No. 333-267211), initially filed by the Company with the Securities

and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), on September

1, 2022 and declared effective on September 13, 2022.

The Warrants (and the shares of Common Stock

issuable upon the exercise of the Warrants) are not being registered under the Securities Act, and were offered pursuant to an exemption

from the registration requirements of the Securities Act provided in Section 4(a)(2) thereof and/or Rule 506(b) promulgated thereunder.

Item 3.02. Unregistered Sales of Equity Securities.

The applicable information set forth in Item 1.01 of this Form 8-K

with respect to the Warrants and Warrant Shares to be issued pursuant to the Purchase Agreement is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 15, 2024 |

WISA TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Brett Moyer |

| |

|

Name: |

Brett Moyer |

| |

|

Title: |

Chief Executive Officer |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

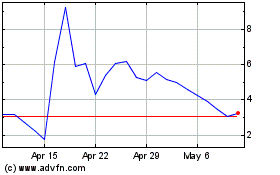

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Oct 2024 to Nov 2024

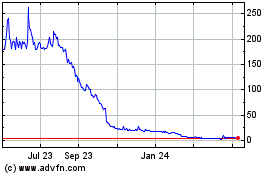

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Nov 2023 to Nov 2024