Woodward, Inc. (NASDAQ: WWD) today reported financial results for

its first quarter of fiscal year 2025.

All amounts are presented on an as reported (U.S. GAAP) basis

unless otherwise indicated. All per share amounts are presented on

a fully diluted basis. All comparisons are made to the same period

of the prior year unless otherwise stated. All references to years

are references to the Company’s fiscal year unless otherwise

stated.

First Quarter Overview

|

|

First Quarter 2025 |

| Net sales |

$773M, -2% |

| Net earnings |

$87M, -3% |

| Adjusted net earnings¹ |

$83M, -8% |

| Earnings per share (EPS) |

$1.42, -3% |

| Adjusted EPS¹ |

$1.35, -7% |

| Cash from operations |

$35M, -26% |

| Free cash flow¹ |

$1M, -81% |

“We’re pleased with our strong start to 2025, as our first

quarter results were in line with our expectations. Our Aerospace

segment performed well with growth in both sales and margin despite

a pause in deliveries for some Boeing product lines and a reduced

delivery rate in others,” said Chip Blankenship, Chairman and Chief

Executive Officer. “High aircraft utilization continued to drive

both commercial and defense aftermarket demand. As anticipated,

increased smart defense demand contributed to strong sales in the

quarter. In Industrial, broad-based strength in power generation,

oil & gas, and marine transportation was offset by an expected

decline in sales related to China on-highway natural gas

trucks.

“First quarter results reflect the effective execution of our

strategy, reinforcing our confidence in our ability to achieve our

full-year guidance. We remain committed to operational excellence,

innovation and delivering profitable growth to build a stronger,

more focused Woodward.”

First Quarter Fiscal Year 2025 Company

Results

|

Total Company Results |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

| Dollars

in millions, except per share amounts |

|

2024 |

|

2023 |

|

Year over Year |

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

Total Sales |

|

$ |

773 |

|

|

$ |

787 |

|

|

|

-2 |

% |

|

Net Earnings |

|

|

87 |

|

|

|

90 |

|

|

|

-3 |

% |

|

Adjusted Net Earnings |

|

|

83 |

|

|

|

90 |

|

|

|

-8 |

% |

|

EPS |

|

$ |

1.42 |

|

|

$ |

1.46 |

|

|

|

-3 |

% |

|

Adjusted EPS |

|

$ |

1.35 |

|

|

$ |

1.45 |

|

|

|

-7 |

% |

|

EBIT |

|

|

113 |

|

|

|

120 |

|

|

|

-6 |

% |

|

Adjusted EBIT¹ |

|

|

107 |

|

|

|

119 |

|

|

|

-10 |

% |

|

Effective Tax Rate |

|

|

14.5 |

% |

|

|

17.9 |

% |

|

-340 |

bps |

|

Adjusted Effective Tax Rate¹ |

|

|

14.0 |

% |

|

|

17.7 |

% |

|

-370 |

bps |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Cash Flow and

Financial Position |

|

|

|

|

|

|

|

|

|

|

Cash from operating activities |

|

$ |

35 |

|

|

$ |

47 |

|

|

|

-26 |

% |

|

Free cash flow |

|

|

1 |

|

|

|

5 |

|

|

|

-81 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Dividends Paid |

|

$ |

15 |

|

|

$ |

13 |

|

|

|

12 |

% |

|

Share Repurchases |

|

|

35 |

|

|

|

- |

|

|

|

100 |

% |

|

Total Debt |

|

902 |

|

|

719 |

|

|

25 |

% |

|

EBITDA Leverage |

|

1.5x |

|

|

1.3x |

|

|

|

|

Segment Results

|

Aerospace |

| |

|

Three Months Ended December 31, |

| Dollars

in millions |

|

2024 |

|

2023 |

|

Year over Year |

|

Commercial OEM |

|

$ |

154 |

|

|

$ |

171 |

|

|

|

-10 |

% |

|

Commercial Aftermarket |

|

|

164 |

|

|

|

138 |

|

|

|

19 |

% |

|

Defense OEM |

|

|

113 |

|

|

|

93 |

|

|

|

21 |

% |

|

Defense Aftermarket |

|

|

63 |

|

|

|

58 |

|

|

|

8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

494 |

|

|

|

461 |

|

|

|

7 |

% |

|

Segment Earnings |

|

|

95 |

|

|

|

79 |

|

|

|

20 |

% |

|

Segment Margin % |

|

|

19.2 |

% |

|

|

17.2 |

% |

|

200 |

bps |

The increase in Aerospace segment earnings in the first quarter

was primarily a result of price realization, partially offset by

inflation, unfavorable mix, and lower volumes.

|

Industrial |

| |

|

Three Months Ended December 31, |

| Dollars

in millions |

|

2024 |

|

2023 |

|

Year over Year |

|

Transportation |

|

$ |

117 |

|

|

$ |

174 |

|

|

|

-33 |

% |

|

Power generation |

|

|

105 |

|

|

|

98 |

|

|

|

7 |

% |

|

Oil and gas |

|

|

57 |

|

|

|

53 |

|

|

|

7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

279 |

|

|

|

326 |

|

|

|

-15 |

% |

|

Segment Earnings |

|

|

40 |

|

|

|

67 |

|

|

|

-40 |

% |

|

Segment Margin % |

|

|

14.4 |

% |

|

|

20.5 |

% |

|

-610 |

bps |

The decrease in Industrial segment earnings in the first quarter

was primarily a result of lower volume and unfavorable mix,

partially offset by price realization and favorable foreign

currency exchange rates.

|

Nonsegment |

| |

|

Three Months Ended December 31, |

| Dollars

in millions |

|

2024 |

|

2023 |

|

Year over Year |

|

Nonsegment Expense |

|

$ |

(22 |

) |

|

$ |

(26 |

) |

|

|

-16 |

% |

|

Adjusted Nonsegment Expenses |

|

|

(28 |

) |

|

|

(27 |

) |

|

|

4 |

% |

Fiscal Year 2025 Guidance

Woodward reaffirms its 2025 guidance with the exception of

adjusted effective tax rate and adjusted earnings per share. Based

on the favorable tax rate in the first quarter, the adjusted

effective tax rate is now expected to be approximately 19 percent.

As a result, the Company narrowed its adjusted earnings per share

range to $5.85-6.25.

|

Woodward, Inc. and Subsidiaries |

|

Revised Guidance |

|

(In millions, except per share amount and

percentages) |

|

|

|

|

|

Prior |

|

Revised |

|

|

|

FY25 Guidance issued on |

|

FY25 Guidance issued on |

| |

|

November 25, 2024 |

|

February 3, 2025 |

| Total

Company |

|

|

|

|

| Sales |

|

$3,300 - $3,500 |

|

No change |

| Adjusted Effective Tax

Rate |

|

~20% |

|

~19% |

| Free Cash Flow |

|

$350 - $400 |

|

No change |

| Capital Expenditures |

|

~$115 |

|

No change |

| Shares |

|

~61.5 |

|

No change |

| Adjusted EPS |

|

$5.75 - $6.25 |

|

$5.85 - $6.25 |

| |

|

|

|

|

| Segment

Data |

|

|

|

|

|

Aerospace |

|

|

|

|

| Sales Growth |

|

Up 6% to 13% |

|

No change |

| Segment Earnings (% of

Sales) |

|

20% - 21% |

|

No change |

|

Industrial |

|

|

|

|

| Sales Growth |

|

Down 7% to 11% |

|

No change |

| Segment Earnings (% of

Sales) |

|

13% - 14% |

|

No change |

Conference Call

Woodward will hold an investor conference call at 5:00 p.m. ET,

February 3, 2025, to provide an overview of the financial

performance for its first quarter of fiscal year 2025 ending

December 31, 2024, business highlights, and guidance for fiscal

2025. You are invited to listen to the live webcast of our

conference call, or a recording, and view or download accompanying

presentation slides at our website, www.woodward.com².

You may also listen to the call by dialing 1-800-715-9871

(domestic) or 1-646-307-1963 (international). Participants should

call prior to the start time to allow for registration; the

Conference ID is 4675940. The call and presentation will be

available on the website by selecting “Investors/Events &

Presentations” from the menu and will remain accessible on the

company’s website for one year.

About Woodward, Inc.

Woodward is the global leader in the design, manufacture, and

service of energy conversion and control solutions for the

aerospace and industrial equipment markets. Our purpose is to

design and deliver energy control solutions our partners count on

to power a clean future. Our innovative fluid, combustion,

electrical, propulsion and motion control systems perform in some

of the world’s harshest environments. Woodward is a global company

headquartered in Fort Collins, Colorado, USA. Visit our website at

www.woodward.com.

Cautionary Statement

Information in this press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainties, including,

but not limited to, our focus on and commitment to growth,

operational excellence and innovation, including whether such focus

ultimately leads to profitable growth and long-term term success,

and statements regarding our business, expectations and guidance

for fiscal year 2025, including our guidance for sales, segment

sales as compared to the prior fiscal year, adjusted earnings per

share, segment earnings margin, adjusted effective tax rate, free

cash flow, capital expenditures, and diluted weighted average

shares outstanding, as well as our assumptions regarding our

guidance and our progress toward achieving it, and anticipated

trends in our business and markets. Factors that could cause actual

results and the timing of certain events to differ materially from

the forward-looking statements include, but are not limited to: (1)

global economic uncertainty and instability, including in the

financial markets that affect Woodward, its customers, and its

supply chain; (2) risks related to constraints and disruptions in

the global supply chain and labor markets; (3) Woodward’s long

sales cycle; (4) risks related to Woodward’s concentration of

revenue among a relatively small number of customers; (5)

Woodward’s ability to implement and realize the intended effects of

any restructuring efforts; (6) Woodward’s ability to successfully

manage competitive factors including expenses and fluctuations in

sales; (7) changes and consolidations in the aerospace market; (8)

Woodward’s financial obligations including debt obligations and tax

expenses and exposures; (9) risks related to Woodward’s U.S.

government contracting activities including potential changes in

government spending patterns; (10) Woodward’s ability to protect

its intellectual property rights and avoid infringing the

intellectual property rights of others; (11) changes in the

estimates of fair value of reporting units or of long-lived assets;

(12) environmental risks; (13) Woodward’s continued access to a

stable workforce and favorable labor relations with its employees;

(14) Woodward’s ability to manage various regulatory and legal

matters; (15) risks from operating internationally; (16)

cybersecurity and other technological risks; and other risk factors

and risks described in Woodward's filings with the Securities and

Exchange Commission, including its Annual Report on Form 10-K for

the fiscal year ended September 30, 2024, as well as its Quarterly

Report on Form 10-Q, which we expect to file shortly, and other

risks described in Woodward’s filings with the Securities and

Exchange Commission. The forward-looking statements contained in

this press release are made as of the date hereof and Woodward

assumes no obligation to update such statements, except as required

by applicable law.

|

Woodward, Inc. and Subsidiaries |

|

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS |

|

(Unaudited – in thousands, except per share

amounts) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

|

Net sales |

|

$ |

772,725 |

|

|

$ |

786,730 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

Cost of goods sold |

|

|

583,091 |

|

|

|

582,381 |

|

|

Selling, general, and administrative expenses |

|

|

69,696 |

|

|

|

74,511 |

|

|

Research and development costs |

|

|

30,207 |

|

|

|

30,794 |

|

|

Interest expense |

|

|

12,341 |

|

|

|

11,436 |

|

|

Interest income |

|

|

(1,377 |

) |

|

|

(1,473 |

) |

|

Other (income) expense, net |

|

|

(23,087 |

) |

|

|

(20,639 |

) |

| Total costs and expenses |

|

|

670,871 |

|

|

|

677,010 |

|

| Earnings before income

taxes |

|

|

101,854 |

|

|

|

109,720 |

|

| Income taxes |

|

|

14,763 |

|

|

|

19,676 |

|

| Net

earnings |

|

$ |

87,091 |

|

|

$ |

90,044 |

|

| |

|

|

|

|

|

|

| Earnings per share

amounts: |

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

1.47 |

|

|

$ |

1.50 |

|

| Diluted earnings per

share |

|

$ |

1.42 |

|

|

$ |

1.46 |

|

| Weighted average

common shares outstanding: |

|

|

|

|

|

|

| Basic |

|

|

59,216 |

|

|

|

60,021 |

|

| Diluted |

|

|

61,141 |

|

|

|

61,846 |

|

| |

|

|

|

|

|

|

| Cash dividends paid per

share |

|

$ |

0.25 |

|

|

$ |

0.22 |

|

|

Woodward, Inc. and Subsidiaries |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited – in thousands) |

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

September 30, |

| |

|

2024 |

|

2024 |

| Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

283,726 |

|

|

$ |

282,270 |

|

|

Accounts receivable |

|

|

692,599 |

|

|

|

770,066 |

|

|

Inventories |

|

|

632,002 |

|

|

|

609,092 |

|

|

Assets held for sale |

|

|

32,047 |

|

|

|

- |

|

|

Income taxes receivable |

|

|

16,268 |

|

|

|

22,016 |

|

|

Other current assets |

|

|

67,954 |

|

|

|

60,167 |

|

|

Total current assets |

|

|

1,724,596 |

|

|

|

1,743,611 |

|

|

Property, plant, and equipment, net |

|

|

925,471 |

|

|

|

940,715 |

|

|

Goodwill |

|

|

781,928 |

|

|

|

806,643 |

|

|

Intangible assets, net |

|

|

404,417 |

|

|

|

440,419 |

|

|

Deferred income tax assets |

|

|

87,488 |

|

|

|

84,392 |

|

|

Other assets |

|

|

357,482 |

|

|

|

353,135 |

|

| Total

assets |

|

$ |

4,281,382 |

|

|

$ |

4,368,915 |

|

| |

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Short-term debt |

|

$ |

258,000 |

|

|

$ |

217,000 |

|

|

Current portion of long-term debt |

|

|

160,975 |

|

|

|

85,719 |

|

|

Accounts payable |

|

|

224,035 |

|

|

|

287,457 |

|

|

Income taxes payable |

|

|

38,742 |

|

|

|

40,692 |

|

|

Liabilities held for sale |

|

|

4,322 |

|

|

|

- |

|

|

Accrued liabilities |

|

|

228,748 |

|

|

|

292,642 |

|

|

Total current liabilities |

|

|

914,822 |

|

|

|

923,510 |

|

|

Long-term debt, less current portion |

|

|

483,199 |

|

|

|

569,751 |

|

|

Deferred income tax liabilities |

|

|

115,984 |

|

|

|

121,858 |

|

|

Other liabilities |

|

|

558,956 |

|

|

|

577,380 |

|

|

Total liabilities |

|

|

2,072,961 |

|

|

|

2,192,499 |

|

|

Stockholders’ equity |

|

|

2,208,421 |

|

|

|

2,176,416 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

4,281,382 |

|

|

$ |

4,368,915 |

|

|

Woodward, Inc. and Subsidiaries |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(Unaudited – in thousands) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

|

Net cash provided by operating activities |

|

$ |

34,516 |

|

|

$ |

46,789 |

|

| |

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

| Payments for purchase of

property, plant, and equipment |

|

|

(33,574 |

) |

|

|

(41,812 |

) |

| Proceeds from sale of assets

and short-term investments |

|

|

36 |

|

|

|

36 |

|

| Proceeds from business

divestiture |

|

|

1,438 |

|

|

|

- |

|

| Net cash used in

investing activities |

|

|

(32,100 |

) |

|

|

(41,776 |

) |

| |

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

| Cash dividends paid |

|

|

(14,781 |

) |

|

|

(13,209 |

) |

| Proceeds from sales of

treasury stock |

|

|

28,876 |

|

|

|

15,267 |

|

| Payments for repurchases of

common stock |

|

|

(35,473 |

) |

|

|

- |

|

| Borrowings on revolving lines

of credit and short-term borrowings |

|

|

668,300 |

|

|

|

728,600 |

|

| Payments on revolving lines of

credit and short-term borrowings |

|

|

(627,300 |

) |

|

|

(663,500 |

) |

| Payments of long-term debt and

finance lease obligations |

|

|

(236 |

) |

|

|

(75,249 |

) |

| Net cash provided by

(used in) financing activities |

|

|

19,386 |

|

|

|

(8,091 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

(20,346 |

) |

|

|

9,979 |

|

| Net change in cash and

cash equivalents |

|

|

1,456 |

|

|

|

6,901 |

|

| Cash and cash equivalents at

beginning of year |

|

|

282,270 |

|

|

|

137,447 |

|

| Cash and cash equivalents at

end of period |

|

$ |

283,726 |

|

|

$ |

144,348 |

|

|

Woodward, Inc. and Subsidiaries |

|

SEGMENT NET SALES AND NET EARNINGS |

|

(Unaudited – in thousands) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

| Net

sales: |

|

|

|

|

|

|

|

Aerospace |

|

$ |

493,882 |

|

|

$ |

460,756 |

|

| Industrial |

|

|

278,843 |

|

|

|

325,974 |

|

| Total consolidated net

sales |

|

$ |

772,725 |

|

|

$ |

786,730 |

|

| Segment

earnings*: |

|

|

|

|

|

|

| Aerospace |

|

$ |

94,725 |

|

|

$ |

79,002 |

|

| As a percent of segment net

sales |

|

|

19.2 |

% |

|

|

17.2 |

% |

| Industrial |

|

|

40,197 |

|

|

|

66,881 |

|

| As a percent of segment net

sales |

|

|

14.4 |

% |

|

|

20.5 |

% |

| Total segment

earnings |

|

|

134,922 |

|

|

|

145,883 |

|

| Nonsegment expenses |

|

|

(22,104 |

) |

|

|

(26,200 |

) |

| EBIT |

|

|

112,818 |

|

|

|

119,683 |

|

| Interest expense, net |

|

|

(10,964 |

) |

|

|

(9,963 |

) |

| Consolidated earnings

before income taxes |

|

$ |

101,854 |

|

|

$ |

109,720 |

|

| |

|

|

|

|

|

|

| *This schedule

reconciles segment earnings, which exclude certain costs, to

consolidated earnings before taxes. |

| |

|

|

|

|

|

|

| Payments for property,

plant and equipment |

|

$ |

33,574 |

|

|

$ |

41,812 |

|

| Depreciation

expense |

|

$ |

20,962 |

|

|

$ |

20,226 |

|

|

Woodward, Inc. and Subsidiaries |

|

|

RECONCILIATION OF NET EARNINGS TO ADJUSTED NET

EARNINGS1 |

|

|

(Unaudited – in thousands, except per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

| |

|

Net Earnings |

|

Earnings Per Share |

|

Net Earnings |

|

Earnings Per Share |

|

Net earnings (U.S. GAAP) |

|

$ |

87,091 |

|

|

$ |

1.42 |

|

|

$ |

90,044 |

|

|

$ |

1.46 |

|

| Non-U.S. GAAP

adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product rationalizationa |

|

|

(9,361 |

) |

|

|

(0.15 |

) |

|

|

- |

|

|

|

- |

|

|

Business development activitiesb |

|

|

3,518 |

|

|

|

0.06 |

|

|

|

4,238 |

|

|

|

0.07 |

|

|

Non-recurring gain related to a previous acquisitiona |

|

|

- |

|

|

|

- |

|

|

|

(4,803 |

) |

|

|

(0.09 |

) |

|

Tax effect of Non-U.S. GAAP net earnings adjustments |

|

|

1,319 |

|

|

|

0.02 |

|

|

|

332 |

|

|

|

0.01 |

|

| Total non-U.S. GAAP

adjustments |

|

|

(4,524 |

) |

|

|

(0.07 |

) |

|

|

(233 |

) |

|

|

(0.01 |

) |

| Adjusted net earnings

(Non-U.S. GAAP) |

|

$ |

82,567 |

|

|

$ |

1.35 |

|

|

$ |

89,811 |

|

|

$ |

1.45 |

|

| |

| a. Presented

in the line item "Other (income) expense, net" in Woodward's

Condensed Consolidated Statement of Earnings. |

| b. Presented

in item "Selling, general and administrative" expenses in

Woodward's Condensed Consolidated Statement of Earnings. |

|

Woodward, Inc. and Subsidiaries |

|

RECONCILIATION OF INCOME TAX EXPENSE TO ADJUSTED INCOME TAX

EXPENSE¹ |

|

(Unaudited – in thousands) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

|

Income tax expense (U.S. GAAP) |

|

$ |

14,763 |

|

|

$ |

19,676 |

|

| Tax effect of Non-U.S. GAAP

net income adjustments |

|

|

(1,319 |

) |

|

|

(332 |

) |

| Adjusted income tax

expense (Non-U.S. GAAP) |

|

$ |

13,444 |

|

|

$ |

19,344 |

|

| Adjusted effective tax

rate (Non-U.S. GAAP) |

|

|

14.0 |

% |

|

|

17.7 |

% |

|

Woodward, Inc. and Subsidiaries |

|

RECONCILIATION OF NET EARNINGS TO EBIT¹AND

ADJUSTED EBIT¹ |

|

(Unaudited – in thousands) |

| |

|

|

|

| |

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

|

Net earnings (U.S. GAAP) |

|

$ |

87,091 |

|

|

$ |

90,044 |

|

| Income tax expense |

|

|

14,763 |

|

|

|

19,676 |

|

| Interest expense |

|

|

12,341 |

|

|

|

11,436 |

|

| Interest income |

|

|

(1,377 |

) |

|

|

(1,473 |

) |

| EBIT (Non-U.S.

GAAP) |

|

|

112,818 |

|

|

|

119,683 |

|

| Total non-U.S. GAAP

adjustments* |

|

|

(5,843 |

) |

|

|

(565 |

) |

| Adjusted EBIT

(Non-U.S. GAAP) |

|

$ |

106,975 |

|

|

$ |

119,118 |

|

| |

|

|

|

|

|

|

| *See

Reconciliation of Net Earnings to Adjusted Net Earnings¹ table

above for the list of Non-U.S. GAAP adjustments made in the

applicable periods. |

|

Woodward, Inc. and Subsidiaries |

|

RECONCILIATION OF NET EARNINGS TO

EBITDA1 AND ADJUSTED

EBITDA1 |

|

(Unaudited – in thousands) |

| |

|

|

|

| |

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

|

Net earnings (U.S. GAAP) |

|

$ |

87,091 |

|

|

$ |

90,044 |

|

| Income tax expense |

|

|

14,763 |

|

|

|

19,676 |

|

| Interest expense |

|

|

12,341 |

|

|

|

11,436 |

|

| Interest income |

|

|

(1,377 |

) |

|

|

(1,473 |

) |

| Amortization of intangible

assets |

|

|

6,914 |

|

|

|

8,599 |

|

| Depreciation expense |

|

|

20,962 |

|

|

|

20,226 |

|

| EBITDA (Non-U.S.

GAAP) |

|

|

140,694 |

|

|

|

148,508 |

|

| Total non-U.S. GAAP

adjustments* |

|

|

(5,843 |

) |

|

|

(565 |

) |

| Adjusted EBITDA

(Non-U.S. GAAP) |

|

$ |

134,851 |

|

|

$ |

147,943 |

|

| |

|

|

|

|

|

|

| *See

Reconciliation of Net Earnings to Adjusted Net Earnings¹ table

above for the list of Non-U.S. GAAP adjustments made in the

applicable periods. |

|

Woodward, Inc. and Subsidiaries |

|

RECONCILIATION OF NONSEGMENT EXPENSES TO ADJUSTED

NONSEGMENT EXPENSES¹ |

|

(Unaudited – in thousands) |

|

|

| |

|

Three-Months Ended December 31, |

| |

|

2024 |

|

2023 |

|

Nonsegment expenses (U.S. GAAP) |

|

$ |

(22,104 |

) |

|

$ |

(26,200 |

) |

| Product rationalization |

|

(9,361 |

) |

|

|

- |

|

| Business development

activities |

|

3,518 |

|

|

|

4,238 |

|

| Non-recurring gain related to

a previous acquisition |

|

- |

|

|

|

(4,803 |

) |

| Adjusted nonsegment

expenses (Non-U.S. GAAP) |

|

$ |

(27,947 |

) |

|

$ |

(26,765 |

) |

|

Woodward, Inc. and Subsidiaries |

|

RECONCILIATION OF CASH FLOW FROM OPERATING ACTIVITIES TO

FREE CASH FLOW¹ |

|

(Unaudited – in thousands) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

| |

|

2024 |

|

2023 |

|

Net cash provided by operating activities (U.S. GAAP) |

|

$ |

34,516 |

|

|

$ |

46,789 |

|

| Payments for property, plant,

and equipment |

|

|

(33,574 |

) |

|

|

(41,812 |

) |

| Free cash flow

(Non-U.S. GAAP) |

|

$ |

942 |

|

|

$ |

4,977 |

|

¹Adjusted and Non-U.S. GAAP Financial Measures: Adjusted net

earnings, adjusted earnings per share, adjusted EBIT, adjusted

EBITDA, adjusted effective tax rate, and adjusted nonsegment

expenses exclude, as applicable, (i) a non-recurring gain related

to a previous acquisition, (ii) costs related to business

development activities, and (iii) gains related to product

rationalization activities. The product rationalization adjustment

pertains to gains related to the elimination of certain product

lines. The Company believes that these excluded items are

short‐term in nature, not directly related to the ongoing

operations of the business, and therefore, the exclusion of them

illustrates more clearly how the underlying business of Woodward is

performing.

EBIT (earnings before interest and taxes), EBITDA (earnings

before interest, taxes, depreciation and amortization), free cash

flow, adjusted net earnings, adjusted earnings per share, adjusted

EBIT, adjusted EBITDA, adjusted effective tax rate, and adjusted

nonsegment expenses are financial measures not prepared and

presented in accordance with accounting principles generally

accepted in the United States of America (U.S. GAAP). Management

uses EBIT and adjusted EBIT to evaluate Woodward’s operating

performance without the impacts of financing and tax related

considerations. Management uses EBITDA and adjusted EBITDA in

evaluating Woodward’s operating performance, making business

decisions, including developing budgets, managing expenditures,

forecasting future periods, and evaluating capital structure

impacts of various strategic scenarios. Management also uses free

cash flow, which is derived from net cash provided by or used in

operating activities less payments for property, plant, and

equipment, in reviewing the financial performance of Woodward’s

various business segments and evaluating cash generation levels.

Securities analysts, investors, and others frequently use EBIT,

EBITDA, free cash flow, in their evaluation of companies,

particularly those with significant property, plant, and equipment,

and intangible assets that are subject to amortization. The use of

any of these non-U.S. GAAP financial measures is not intended to be

considered in isolation of, or as a substitute for, the financial

information prepared and presented in accordance with U.S. GAAP.

Because adjusted net earnings, adjusted earnings per share, EBIT,

EBITDA, adjusted EBIT, and adjusted EBITDA exclude certain

financial information compared with net earnings, the most

comparable U.S. GAAP financial measure, users of this financial

information should consider the information that is excluded. Free

cash flow do not necessarily represent funds available for

discretionary use and is not necessarily a measure of our ability

to fund our cash needs. Woodward’s calculations of EBIT, EBITDA,

adjusted net earnings, adjusted earnings per share, adjusted EBIT,

adjusted EBITDA, adjusted effective tax rate, adjusted nonsegment

expenses, and free cash flow may differ from similarly titled

measures used by other companies, limiting their usefulness as

comparative measures.

²Website, Facebook, X: Woodward has used, and intends to

continue to use, its Investor Relations website, LinkedIn page,

Facebook page, and X handle as means of disclosing material

non-public information and for complying with its disclosure

obligations under Regulation FD.

|

Contact: |

Dan Provaznik Director, Investor

Relations970-498-3849Dan.Provaznik@woodward.com |

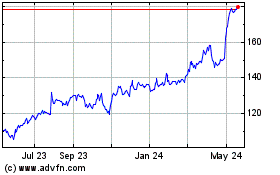

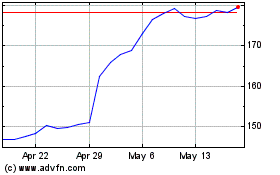

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Feb 2024 to Feb 2025