Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 31 2024 - 5:06AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2024

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its

charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd

Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

AMBEV S.A.

CNPJ [National Register of Legal Entities] No.

07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

MATERIAL FACT NOTICE

Ambev S.A. (“Company”)

informs that its Board of Directors, in a meeting held on October 30, 2024, approved, pursuant to article 30, Paragraph 1st,

“b”, of Law 6,404/76 and CVM Resolution 77/2022, a share buyback program for the repurchase of shares issued by the Company

up to the limit of 155,159,038 common shares (“Program”), with the primary purpose of cancelation, and the shares not canceled

may be held in treasury, transferred and/or used to cover any share delivery requirements contemplated in the Company's share-based compensation plans.

The Program will be in effect until April 30, 2026, as detailed in the Notice Regarding the Negotiation of Shares Issued by the Company,

prepared and disclosed today as provided on Exhibit G of CVM Resolution 80/2022. The Company clarifies that its previous share buyback

program for the repurchase of shares issued by the Company – approved in the Board of Directors’ meeting held on May 15 and

16, 2024, has ended, considering the achievement of the limit for the repurchase of common shares set forth therein.

The Company has 4,388,851,573

outstanding shares as defined in CVM Resolution 77/2022. The acquisition will be recorded as a debit on the capital reserve in the balance

sheet dated as of September 30, 2024. The transaction will be carried out through UBS Brasil Corretora de Câmbio, Títulos

e Valores Mobiliários S.A. (CNPJ No. 02.819.125/0001-73), Merrill Lynch S.A. Corretora de Títulos e Valores Mobiliários

(CNPJ No. 02.670.590/0001-95), Santander Corretora de Câmbio e Valores Mobiliários S.A. (CNPJ No. 51.014.223/0001-49),

and Itaú Corretora de Valores S/A (CNPJ No. 61.194.353/0001-64).

Additional information about

the Program is available to shareholders on the websites of the Brazilian Securities and Exchange Commission (https://www.gov.br/cvm/en?set_language=en),

B3 S.A. - Brasil, Bolsa, Balcão (https://www.b3.com.br/en_us/) and the Company (https://ri.ambev.com.br/en/).

São Paulo, October 30, 2024.

Ambev S.A.

Lucas Machado Lira

Chief Financial and Investor Relations

Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 30, 2024

| |

|

|

| |

AMBEV S.A. |

| |

|

|

| |

By: |

/s/ Lucas Machado Lira |

| |

Lucas Machado Lira

Chief Financial and Investor Relations Officer |

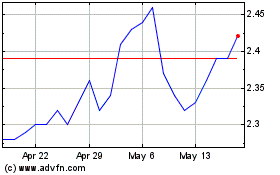

Ambev (NYSE:ABEV)

Historical Stock Chart

From Dec 2024 to Jan 2025

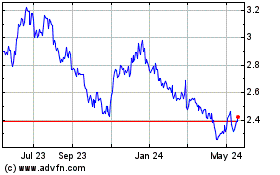

Ambev (NYSE:ABEV)

Historical Stock Chart

From Jan 2024 to Jan 2025