Archer Closes PIPE As Part Of $230M In Capital Raised Since End Of Q2, Giving It One Of The Strongest Liquidity Positions In Its Industry

August 22 2024 - 8:00AM

Business Wire

- Archer Aviation today announced the closing of the PIPE

investment it previously announced as part of its Q2’24 earnings,

with participation by longtime strategic investors United Airlines

and Stellantis, as well as institutional investors.

- This additional capital gives Archer one of the strongest

liquidity positions in its industry and brings Archer’s aggregate

funding to over $1.5B to date

- Archer also recently announced it reached the key terms of an

agreement with Stellantis for the contribution of significant

capital in the form of labor and capital expenditures to help scale

Archer’s Midnight manufacturing. This strategic funding arrangement

is intended to give Archer the ability to access up to an

additional $400M in capital in exchange for Archer equity at future

stock prices with the goal of minimizing dilution

Archer Aviation this week announced that it has now closed on

$220M of this $230M of additional capital raised since the end of

Q2, with $10M remaining in the form of a committed investment from

Stellantis that remains subject to shareholder approval which is

expected to occur later this year.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240822860929/en/

Archer Aviation today announced the

closing of the PIPE investment it previously announced as part of

its Q2’24 earnings, with participation by longtime strategic

investors United Airlines and Stellantis, as well as institutional

investors. (Photo: Business Wire)

When combined with the $360M of cash on hand at the end of

Q2’24, Archer now maintains one of the strongest liquidity

positions in the industry as it rapidly advances its

industrialization and commercialization.

This is United Airlines’ third time investing in Archer,

originally investing in 2021 in connection with the signing of its

conditional aircraft purchase agreement. In 2022, United Airlines

made a pre-delivery payment for the first 100 of those

aircraft.

Along with this additional capital, Archer also recently

announced it had reached the key terms of an agreement with

Stellantis for the contribution of significant capital in the form

of labor and capital expenditures to help scale the manufacturing

of Archer’s aircraft, Midnight. This strategic funding arrangement

is intended to give Archer the ability to access up to an

additional $400M in capital in exchange for Archer equity at future

stock prices with the goal of minimizing dilution.

Archer’s high-volume manufacturing facility in Covington, GA, is

scheduled to open by the end of the year.

“As we advance towards commercialization, this renewed equity

support from partners like United Airlines and Stellantis is a

powerful endorsement that solidifies Archer’s position as one of

the most well-capitalized in the industry,” said Archer CEO and

Founder Adam Goldstein.

With this capital and the expanded manufacturing partnership

with Stellantis, Archer is now well-positioned to execute its

planned path to reach commercialization of its electric vertical

take-off and landing aircraft, Midnight. Moelis & Company acted

as the sole placement agent for the transaction, providing

strategic advice and support throughout the process.

This capital raise announcement follows Archer’s planned network

in Los Angeles and its recently announced developments with

Southwest Airlines and United Airlines. It also follows major

milestones, such as a successful transition flight, certification

to begin operating as a commercial airline and the recent delivery

of its first aircraft to the United States Air Force.

*The key terms of the contract manufacturing relationship with

Stellantis is based on an agreement in principle that contemplate

the parties to enter into future definitive agreements related

thereto

About Archer

Archer is a leader in the electrification of aviation. We are

designing and developing the key enabling technologies and aircraft

necessary to power the next great transportation revolution. Our

goal is for our proprietary technology to deliver unprecedented

connectivity to the people and places across the most congested

cities in the world.

To learn more, visit www.archer.com.

Source: Archer Text: ArcherIR

Forward-Looking Statements

This press release contains forward-looking statements regarding

Archer’s future business plans and expectations, including

statements regarding our business strategy and plans, aircraft

performance, the design and target specifications of our aircraft,

the pace at which we intend to design, develop, certify, conduct

test flights, manufacture and commercialize our planned eVTOL

aircraft, business opportunities, future equity issuances, and the

timing of the completion of our manufacturing facility. In

addition, this press release refers to agreements with Stellantis

on certain key terms which are conditioned on the future execution

by the parties of additional binding definitive agreements

incorporating those terms, which definitive agreements may not be

completed or may contain different terms. These forward-looking

statements are only predictions and may differ materially from

actual results due to a variety of factors. The risks and

uncertainties that could cause actual results to differ from the

results predicted are more fully detailed in our filings with the

Securities and Exchange Commission (SEC), including our most recent

Annual Report on Form 10-K and most recent Quarterly Report on Form

10-Q, which are or will be available on our investor relations

website at investors.archer.com and on the SEC website at

www.sec.gov . In addition, please note that any forward-looking

statements contained herein are based on assumptions that we

believe to be reasonable as of the date of this press release. We

undertake no obligation to update these statements as a result of

new information or future events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240822860929/en/

For Investors investors@archer.com

For Media The Brand Amp Archer@TheBrandAmp.com

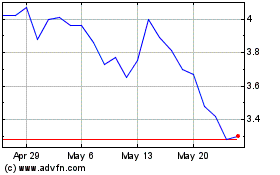

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Mar 2025 to Apr 2025

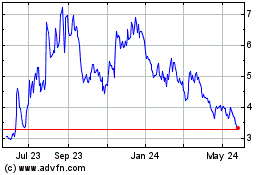

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Apr 2024 to Apr 2025