Current Report Filing (8-k)

October 04 2022 - 3:37PM

Edgar (US Regulatory)

0000845877falseX100008458772022-09-282022-09-280000845877us-gaap:CommonClassAMember2022-09-282022-09-280000845877us-gaap:CommonClassCMember2022-09-282022-09-280000845877us-gaap:SeriesCPreferredStockMember2022-09-282022-09-280000845877us-gaap:SeriesDPreferredStockMember2022-09-282022-09-280000845877us-gaap:SeriesEPreferredStockMember2022-09-282022-09-280000845877us-gaap:SeriesFPreferredStockMember2022-09-282022-09-280000845877us-gaap:SeriesGPreferredStockMember2022-09-282022-09-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 28, 2022

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Federally chartered instrumentality of the United States | | 001-14951 | | 52-1578738 |

| | | | |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 1999 K Street, N.W., 4th Floor, | | 20006 |

| Washington, | DC | | |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (202) 872-7700

No change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Exchange on which registered |

| Class A voting common stock | | AGM.A | | New York Stock Exchange |

| Class C non-voting common stock | | AGM | | New York Stock Exchange |

| 6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C | | AGM.PRC | | New York Stock Exchange |

| 5.700% Non-Cumulative Preferred Stock, Series D | | AGM.PRD | | New York Stock Exchange |

| 5.750% Non-Cumulative Preferred Stock, Series E | | AGM.PRE | | New York Stock Exchange |

| 5.250% Non-Cumulative Preferred Stock, Series F | | AGM.PRF | | New York Stock Exchange |

| 4.875% Non-Cumulative Preferred Stock, Series G | | AGM.PRG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Compensatory Arrangements of Certain Officers

On September 28, 2022, the Federal Agricultural Mortgage Corporation (“Farmer Mac”) entered into the First Amendment to Amended Employment Agreement (“Amendment”) with Farmer Mac’s President and Chief Executive Officer, Bradford T. Nordholm, the terms of which were approved by Farmer Mac’s Board of Directors. The Amendment amends portions of the existing amended employment agreement between Farmer Mac and Mr. Nordholm dated December 23, 2020 (“Employment Agreement”), primarily in three ways:

•The Amendment extends Mr. Nordholm’s employment term as President and Chief Executive Officer through March 31, 2026, subject to earlier termination as provided in the Employment Agreement. The Employment Agreement previously provided for an initial term through March 31, 2024 with the ability to extend the term for up to two additional one-year periods upon mutual consent. The Amendment does not contemplate any extensions to the term beyond March 31, 2026.

•The Amendment clarifies that Mr. Nordholm shall not be entitled to receive an award of long-term incentive compensation in 2026 even though other senior executives of Farmer Mac may receive annual long-term incentive grants in 2026.

•The Amendment provides for the grant of a one-time incentive equity award designed to retain Mr. Nordholm as Farmer Mac’s President and Chief Executive Officer through the end of the new term (March 31, 2026), as well as to promote the achievement of specified performance goals. That special incentive equity award is contemplated to be made in March 2023 when Farmer Mac will grant to Mr. Nordholm a target amount of 15,000 restricted stock units (“RSUs”) of Farmer Mac’s Class C non-voting common stock under the terms of the restricted stock units award agreement attached as Exhibit B to the Amendment. The vesting date for the RSUs subject to this award will be March 31, 2026. The number of shares actually vested on that date will range between 0% and 200% of the 15,000 target amount depending on Farmer Mac’s 3-year average core earnings return on common equity (as defined in the award agreement) and Farmer Mac’s relative total stockholder return performance compared to the companies in the Standard & Poor’s 500 Diversified Financials Index during the performance period of January 1, 2023 through December 31, 2025. The award agreement does not include the provision customary for Farmer Mac’s grants of other RSU awards that the award will continue to vest as scheduled upon retirement from Farmer Mac after reaching the age of 55 and having a combination of age and service of at least 65. Thus, Mr. Nordholm will not vest in any portion of this award if his employment with Farmer Mac ends before January 1, 2026 (unless employment is terminated due to death or disability, in which case a pro rata portion of the target amount will vest).

The Amendment did not change any provisions in the Employment Agreement related to base salary or incentive salary during the new extended term. Except as specifically set forth in the Amendment, all other terms and conditions of the Employment Agreement remain unmodified and in full force and effect. The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is included as Exhibit 10.1 to this Current Report on Form 8‑K and is incorporated by reference in this report. The Employment Agreement was filed as Exhibit 10.1 to the Current Report on Form 8-K dated December 30, 2020 and is incorporated by reference in this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| |

| 104 | Cover Page Inline Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

By: /s/ Stephen P. Mullery

Name: Stephen P. Mullery

Title: Executive Vice President – General Counsel

Dated: October 4, 2022

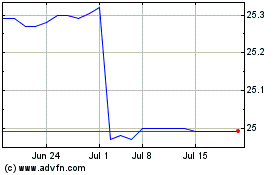

Federal Agricultural Mor... (NYSE:AGM-C)

Historical Stock Chart

From Jun 2024 to Jul 2024

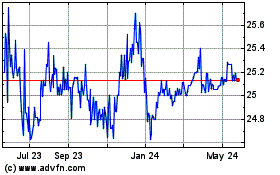

Federal Agricultural Mor... (NYSE:AGM-C)

Historical Stock Chart

From Jul 2023 to Jul 2024