UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-35052

Adecoagro S.A.

(Translation of registrant’s name into English)

Vertigo Naos Building 6,

Rue Eugène Ruppert,

L-2453, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

TABLE OF CONTENTS

| | | | | |

| ITEM | |

| 99.1 | Press release dated May 16, 2024 related to the registrant’s results of operations for the three-month period ended March 31, 2024. |

| 99.2 | Unaudited condensed consolidated interim financial statements of the registrant as of and for the three-month period ended March 31, 2024. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | Adecoagro S.A. |

| | | |

| | | |

| | | | By: | /s/ Emilio Federico Gnecco |

| | | | | Name: | Emilio Federico Gnecco |

| | | | | Title: | Chief Financial Officer |

Date: May 16, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | | |

| | | Adjusted EBITDA of $90.1 million. Solid crushing pace and Farming yield normalization. $35 million cash dividend during 2024. | |

| | | |

| | | |

| 1Q24 Earning Release Conference Call | | | |

| | | | |

| English Conference Call | | | Luxembourg, May 16, 2024 - Adecoagro S.A. (NYSE: AGRO, Bloomberg: AGRO US, Reuters: AGRO.K), a leading sustainable production company in South America, announced today its results for the first quarter ended March 31, 2024. The financial information contained in this press release is based on consolidated financial statements presented in US dollars and prepared in accordance with International Financial Reporting Standards (IFRS) except for Non - IFRS measures. Please refer to page 22 for a definition and reconciliation to IFRS of the Non - IFRS measures used in this earnings release. | |

| May 17, 2024 | | | |

| 11 a.m. (US EST) | | | |

| 12 p.m. (Buenos Aires/Sao Paulo time) | | | |

| 5 p.m. (Luxembourg) | | | | | | | | | | |

| | | | Financial Performance - Highlights | | |

| | | |

| | | |

| Zoom ID: 834 4180 7006 | | | $ thousands | 1Q24 | 1Q23 | Chg % | |

| Passcode: 995202 | | | Gross Sales (1) | 253,799 | 247,273 | 2.6% | |

| | | | | | | | |

| | | Adj EBITDA (2) | | | | | |

| Investor Relations | | | Farming | 44,014 | 18,522 | 137.6% | |

| Emilio Gnecco | | | Sugar, Ethanol & Energy | 51,855 | 76,688 | (32.4)% | |

| CFO | | | Corporate Expenses | (5,753) | (6,048) | (4.9)% | |

| Victoria Cabello | | | Total Adj EBITDA | 90,116 | 89,162 | 1.1% | |

| IR Officer | | | Adj EBITDA Margin (2) | 36.0% | 36.4% | (0.9)% | |

| | | | Net Income | 47,344 | 23,006 | 105.8% | |

| Email | | | Adj Net Income (2) | 23,305 | 38,877 | (40.1)% | |

| ir@adecoagro.com | | | | Adjusted Net Income per Share | 0.22 | 0.36 | (38.2)% | |

| | | | | Net Debt(2) / LTM Adj EBITDA (x) | 1.3x | 1.9x | (29.7)% | |

| | | | | | | | | | | | |

| | | | | Operating Performance - Highlights | |

| | | | | Sugarcane milled (thousand tons) | 2,167 | 1,472 | 47.3% | |

| Website: | |

| Farming Planted Area (Hectares) | 279,100 | 268,385 | 4.0% | |

| www.adecoagro.com | | | Milk Produced (million liters) | 48.9 | 46.7 | 4.7% | |

| | |

| | | | | | | | |

| | | •Gross sales were 2.6% higher in 1Q24 due to (i) more sugarcane crushed, which enabled us to increase our sugar production and execute sales at solid prices; coupled with (ii) an increase in average selling prices in the Rice segment. •Adjusted EBITDA was $90.1 million, 1.1% above 1Q23, driven by an outperformance of all three segments of our Farming business. This, in turn, fully offset the decline reported in the Sugar, Ethanol & Energy business due to a year-over-year loss in the mark-to-market of our biological assets on price outlook. •Adjusted net income in 1Q24 amounted to $23.3 million, 40.1% lower than the previous year. •Net debt amounted to $639.2 million, a 23.0% year-over-year reduction, while net debt to LTM Adjusted EBITDA ratio reached 1.3x, 0.6x lower than 1Q23. | |

| | | |

| | | |

| | | | (1) Gross Sales are equal to Net Sales plus sales taxes related to sugar, ethanol and energy. (2) Please see “Reconciliation of Non-IFRS measures” starting on page 22 for a reconciliation of Adjusted EBITDA, Adjusted Net Income and Net Debt for the period. Adjusted EBITDA margin is calculated as a percentage of net sales.

|

| | | | | | | | | | | |

Sugar, Ethanol & Energy business

◦Crushing volumes during 1Q24 amounted to 2.2 million tons, 47.3% higher year-over-year and an all time record for a 1Q milling figure. This was mainly driven by greater sugarcane availability versus the previous period. Being able to crush cane year round, even during the traditional inter-harvest period, is one of our competitive advantages as we are able to supply new production into the market, maximizing the product that offers the highest marginal contribution. TRS equivalent produced was 56.8% higher than in 1Q23 and we diverted as much as 49% to produce sugar, which traded on average 48% above hydrous ethanol in Mato Grosso do Sul. In terms of ethanol, 91% of our production was hydrous ethanol given the active demand for this type of fuel, while we also continued to take advantage of our storage capacity and carried over 194 thousand m3 (69% higher than in 1Q23) into the following quarters, to profit from higher expected prices. Stored production can eventually be sold as hydrous ethanol, or dehydrated at any time and turned into anhydrous ethanol demanded in the domestic and export markets. Regarding energy, we focused on only producing the volume contracted, capturing a premium over spot prices and storing bagasse for more profitable uses. Furthermore, our unitary cost of production decreased 9.0% year-over-year given the higher volume crushed. Nevertheless, results were negatively impacted by (i) a year-over-year loss in the mark-to-market of our biological assets due to lower sugar prices (sugar #11 contracts) during 1Q24 compared to 1Q23, coupled with (ii) higher freight costs as we sold more sugar to profit from higher relative prices. Consequently, Adjusted EBITDA reached $51.9 million in 1Q24, 32.4% lower than the same period of last year.

◦As of the date of this report, we have 43% of our annual sugar production unhedged, whereas the balance was committed at an average price of 23.6 cts/lb. The evolution of sugar prices will mostly depend on Brazil's production and logistics. In terms of ethanol, by beginning of 2Q24 prices recovered by 30% compared to the lowest levels reported in early 2024. Consequently, in April we sold over 80 thousand cubic meters of ethanol (same volume sold during the first three months) at an average gross price of US$566/m3 (R$2,800/m3), profiting from the peak in prices to partially clear our tanks. We expect ethanol prices to continue increasing, due to the current low parity at pump vs. technical (65% vs. 70%). From an operational perspective, precipitations received by the beginning of 2Q24 enhanced the productivity of our sugarcane plantation. We expect to increase our crushing volume versus 2023, assuming normal weather, as we have sufficient sugarcane availability to use our industrial capacity due to the expansion planting activities conducted throughout the years. This, in turn, would result in a reduction in unitary cash cost, due to better dilution of fixed costs.

Farming business

◦In 1Q24, Adjusted EBITDA for the Farming business amounted to $44.0 million, $25.5 million higher compared to 1Q23. This was driven by an outperformance in all three segments. Our Rice business presented a year-over-year increase of $19.4 million, mainly explained by (i) a better campaign in terms of area, productivity and prices, leading to a $12.7 million year-over-year gain in the mark-to-market of our biological assets; coupled with (ii) our presence in both the export and domestic market which enabled us to conduct sales at attractive prices ($433/ton higher versus 1Q23) as we were the only rice producer with available stocks at a moment when rice supply was limited. In the case of Crops, the full recovery in yields of our main grains was the main reason behind the $5.8 million year-over-year

increase in results. In our Dairy business, Adjusted EBITDA was 5.3% higher than in 1Q23 mainly due to lower cost of feed (corn silage and soy pellets) as our in-house production recovered the volume lost.

◦As mentioned in prior releases, we are forecasting a full recovery in the volume produced of our main crops as we experienced normal weather conditions throughout their development stage. Harvesting activities are currently underway and we expect yields in all our crops to be in line with historical average, including corn - despite the impact caused by "siroplasma" bacteria. In our Rice segment we have a positive outlook due to (i) higher production on better yields and more planted area; (ii) our production capabilities to produce higher value added products; and (iii) our commercial flexibility to sell into the domestic and export market. In the case of Dairy, our outlook remains positive on the back of our continuous focus on achieving efficiencies in our vertically-integrated operations, and our ability to shift processing production to the product that offers the highest margin contribution.

2024 Shareholder Distribution

◦Our Annual Shareholder Meeting held on April 17th approved a cash dividend distribution of $35 million to be paid in two installments of $17.5 million each. The first installment represents approximately $0.1682 per share and will be paid on May 29th, 2024 to shareholders of the Company with record date May 14th, 2024. The second installment shall be payable in or about November 2024 in an equal cash amount.

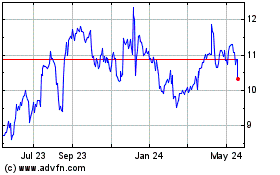

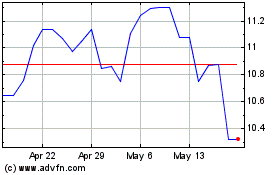

◦In addition, year-to-date we invested $26.6 million in repurchasing 2.6 million shares (2.4% of the company's equity) under our existing share buyback program, at an average price of $10.40 per share.

◦Dividend distribution and share repurchases are part of the company's distribution policy, which consists of a minimum distribution of 40% of the Adjusted Free Cash Flow from Operations (NCFO) generated during the previous year. In 2023, we generated $175.9 million of NCFO or $70.3 million to be distributed in 2024.

Farmland Sale at Premium to Independent Appraisal

◦In April 2024, we completed the sale of La Pecuaria farm located in the Province of Durazno, Uruguay, for a selling price of $20.7 million ($6,500/hectare) fully collected at the closing date. The transaction generated an Adjusted EBITDA of $15.3 million, which will be booked in our Crops segment in 2Q24.

"Fuel of the Future" bill in Brazil

◦On March 13th, 2024, the Brazilian Lower House approved the "Fuel of the Future" bill (Combustivel do futuro), which aims to regulate and set targets for the use of biofuels and renewable fuels. These initiatives will help to reduce carbon emissions related to fossil fuel usage and to switch to a low-carbon mobility. As of the date of this report, the bill is pending approval of the Senate.

◦The adoption of these measures should be extremely beneficial to our sector. We believe we are uniquely positioned to aid the country in its path towards a greener energy matrix, as we have a role to play in every one of these pillars:

▪Ethanol Blend: Raise from 18%-27.5% to 22%-35% the percentage of anhydrous ethanol blended into gasoline. This would imply an additional demand of anhydrous ethanol of 1.4 billion liters. AGRO's case: Not only our mills have the capacity to produce anhydrous ethanol, but we could also dehydrate 100% our hydrous stocks by using our own bagasse as fuel, if needed.

▪Biomethane: Natural gas producers and importers will have to purchase biomethane or certificates guaranteeing the production of biomethane (CGOB). By 2026, 1% of the current demand of natural gas should be replaced by biomethane, increasing up to 10% - pace to be established by the government based on the supply of biomethane. AGRO's case: Our biodigestor in Ivinhema mill has the capacity to produce 6,000 nm3/day of biomethane, which equals to an annual replacement of 2 million liters of diesel (with only 3% of our vinasse used). We already have 120+ light vehicles, 6 trucks, 1 tractor and 4 irrigation pumps running on biomethane. We are working towards expanding the number of biodigestors, whose layout has been modified to double the installed capacity. Lastly, we are analyzing to use our biomethane to fuel the freights that transport our sugar production to the railroad terminal in Maringá.

▪Sustainable Aviation Fuel (SAF): Progressive goals for blending SAF with conventional jet fuel, ranging from 1%-10% between 2027-2037. AGRO's case: The ethanol produced in Angelica mill complies with international requirements for SAF production, as certified by ISCC CORSIA Plus.

▪Carbon Capture Storage (CCS): Regulation of carbon dioxide capture and storage activities. AGRO's case: As ethanol producers, for each cubic meter of ethanol produced, 0.8 ton of CO2 is generated, which we could sequester and storage underground.

Appointment of Ms. Manuela Vaz Artigas to our Board of Directors

◦At our Annual Shareholder Meeting held on April 17th, 2024, Manuela Vaz Artigas was appointed as a member of the Board of Directors of the Company for a term of three years, replacing Mark Schachter. Ms. Artigas is an independent board member of the Company as well as of LWSA, Pague Menos SA, Solar Coca Cola and Banco BMG. Her previous roles include Partner of McKinsey & Company, where she focused on consumer products. Mr. Mark Schachter after 12 years serving at our board of directors is leaving office. We would like to thank Mr. Schachter for his commitment and contributions to the Company over the years.

| | |

| Sugar, Ethanol & Energy Segment - Operational Performance |

| | | | | | | | | | | | | | | | | | | | | | | |

| SUGAR, ETHANOL & ENERGY - SELECTED INFORMATION | | | |

| Operating Data | Metric | 1Q24 | 1Q23 | Chg % |

| Milling | | | | | | | |

| Sugarcane Milled | tons | 2,167,245 | 1,471,721 | 47.3% |

| Own Cane | tons | 2,107,499 | 1,434,921 | 46.9% |

| Third-Party Cane | tons | 59,746 | 36,800 | 62.4% |

| Production | | | | | | | |

| TRS Equivalent Produced | tons | 271,707 | 173,295 | 56.8% |

| Sugar | tons | 119,431 | 76,137 | 56.9% |

| Ethanol | M3 | 87,296 | 54,225 | 61.0% |

| Hydrous Ethanol | M3 | 79,791 | 15,604 | 411.4% |

Anhydrous Ethanol (1) | M3 | 7,505 | 38,621 | (80.6)% |

| Sugar mix in production | % | 49% | 49% | 0.5% |

| Ethanol mix in production | % | 51% | 51% | (0.4)% |

| Energy Exported (sold to grid) | MWh | 72,114 | 58,223 | 23.9% |

| Cogen efficiency (KWh sold/ton crushed) | KWh/ton | 33.3 | 39.6 | (15.9)% |

| Agricultural Metrics | | | | | | | |

| Harvested area | Hectares | 30,127 | 19,636 | 53.4% |

| Yield | tons/hectare | 70 | 73 | (4.3)% |

| TRS content | kg/ton | 117 | 112 | 4.6% |

| Area | | | | | | | |

| Sugarcane Plantation | hectares | 201,442 | 194,512 | 3.6% |

| Expansion Area | hectares | 2,695 | 1,525 | 76.7% |

| Renewal Area | hectares | 8,646 | 4,583 | 88.6% |

(1) Does not include 28,773 and 30,443 cubic meters of anhydrous ethanol that were converted by dehydrating our hydrous ethanol stocks during 1Q24 and 1Q23, respectively.

Having our Cluster based in the state of Mato Grosso do Sul, where rainfalls are better distributed throughout the whole year and thus TRS content is more stable, allows us to implement a continuous harvest model. This is a competitive advantage that we have, as we can crush cane during the traditional interharvest period of Brazil's Sugar & Ethanol industry, and therefore supply new products to the market, maximizing the one that offers the highest marginal contribution.

During the first three months of the year, crushing volume amounted to 2.2 million tons, 0.7 million tons higher compared to the same period of last year and an all time record for a 1Q milling figure. This was mainly explained by greater sugarcane availability driven by the expansion planting activities conducted throughout the years. In terms of productivity, TRS per hectare was flat. While TRS content presented a 4.6% improvement amounting to 117 kg/ton (versus 112 kg/ton in 1Q23), sugarcane yield reached 70 tons per hectare (versus 73 tons per hectare in 1Q23) as harvesting activities were concentrated in areas related to fourth cut and above, with limited growth potential.

During 1Q24, average sugar prices traded at a significant premium to both hydrous and anhydrous ethanol in Mato Grosso do Sul (48% and 30%, respectively). Consequently, we diverted as much as 49% of our TRS to sugar, in line with our strategy to maximize production of the product with the highest marginal contribution. Within our ethanol production 91% was hydrous ethanol, compared to 29% in 1Q23, as demand for this type of fuel significantly increased and gained market share in the Otto cycle. This high degree in flexibility constitutes one of our most important competitive advantages, since it allows us to make a more efficient use of our fixed assets and profit from higher relative prices. Moreover, we can dehydrate hydrous ethanol at any time and turn into anhydrous ethanol, which can be sold either to the domestic or export market, wherever the price premium is better.

Exported energy during the quarter totaled 72 thousand MWh, 23.9% higher compared to last year, even though crushing volume was up 47.3% year-over-year. This was explained by our commercial decision to prioritize our long term energy contracts and save our bagasse for more profitable alternatives rather than sell energy at low spot prices. Consequently, our cogeneration efficiency ratio was down 15.9% compared to the previous year.

| | |

| Sugar, Ethanol & Energy Segment - Financial Performance |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NET SALES BREAKDOWN | $ thousands | | Units | | ($/unit) |

| 1Q24 | 1Q23 | Chg % | | 1Q24 | 1Q23 | Chg % | | 1Q24 | 1Q23 | Chg % |

| Sugar (tons) | 63,141 | 47,496 | 32.9% | | 120,128 | 106,249 | 13.1% | | 526 | 447 | 17.6% |

| Ethanol (cubic meters) | 32,705 | 42,317 | (22.7)% | | 78,511 | 70,702 | 11.0% | | 417 | 599 | (30.4)% |

| Hydrous Ethanol (cubic meters) | 19,343 | 4,627 | 318.0% | | 48,052 | 9,430 | 409.6% | | 403 | 491 | (18.0)% |

| Anhydrous Ethanol (cubic meters) | 13,362 | 37,690 | (64.5)% | | 30,458 | 61,272 | (50.3)% | | 439 | 615 | (28.7)% |

Energy (Mwh) (2) | 2,253 | 2,535 | (11.1)% | | 90,950 | 104,528 | (13.0)% | | 25 | 24 | 2.1% |

| CBios | 1,656 | 2,345 | (29.4)% | | 88,761 | 146,401 | (39.4)% | | 19 | 16 | 16.5% |

Others (5) | 67 | 25 | 168.0% | | 65 | 25 | 160.0% | | 1,031 | 1,000 | 3.1% |

TOTAL (3) | 99,822 | 94,718 | 5.4% | | | | | | | | |

Cover Crops (tons) (4) | 3,572 | 1,968 | 81.5% | | 9,090 | 3,900 | 133.1% | | 393 | 505 | (22.1)% |

TOTAL NET SALES (1) | 103,394 | 96,686 | 6.9% | | | | | | | | |

| | | | | | | | | | | |

| HIGHLIGHTS - $ thousand | 1Q24 | 1Q23 | Chg % |

Net Sales (1) | 103,394 | 96,686 | 6.9% |

| Margin on Manufacturing and Agricultural Act. Before Opex | 48,541 | 75,260 | (35.5)% |

| Adjusted EBITDA | 51,855 | 76,688 | (32.4)% |

| Adjusted EBITDA Margin | 50.2% | 79.3% | (36.8)% |

(1) Net Sales are calculated as Gross Sales net of ICMS, PIS COFINS, INSS and IPI taxes; (2) Includes commercialization of energy from third parties; (3) Total Net Sales does not include the sale of soybean planted as cover crop during the implementation of the agricultural technique known as meiosis; (4) Corresponding to the sale of soybean planted as cover crop during the implementation of meiosis. (5) Diesel sold by Monte Alegre Distribuidora (MAC), our own fuel distributor located in UMA mill.

Adjusted EBITDA during 1Q24 amounted to $51.9 million, 32.4% lower year-over-year. This was mostly explained by a $25.1 million year-over-year loss in the mark-to-market of our biological assets, due to a greater improvement in the outlook of sugar prices (sugar #11 contracts) during 1Q23 compared to 1Q24. Furthermore, results were impacted by a $5.1 million year-over-year increase in selling expenses on higher freight costs as we sold more sugar to profit from higher relative prices. Results were also affected by a $2.6 million year-over-year loss in the mark-to-market of our commodity hedge position. On the other hand, lower results were partially mitigated by a $6.7 million year-over-year increase in net sales.

Net sales reached $103.4 million during 1Q24, 6.9% higher compared to 1Q23. This was mainly explained by higher average selling prices and higher selling volume of sugar, which, in turn, fully offset the year-over-year reduction in ethanol sales due to the decline in selling prices.

In the case of sugar, sales amounted to $63.1 million during 1Q24, $15.6 million higher compared to the same period of last year. This was mainly driven by a 17.6% year-over-year increase in the average selling price thanks to our hedging strategy which allowed us to captured the rally in global sugar prices caused by limited global supply. Moreover, selling volumes increased by 14 thousand tons versus the prior year due to the increase in production versus 1Q23, given the 47.3% increase in milling.

Ethanol sales were $32.7 million during 1Q24, down 22.7% compared to 1Q23. Although selling volumes were up 11.0% versus the prior year on higher demand for hydrous ethanol, overall sales were fully offset by a 30.4% decrease in the average selling price. Lower prices were explained by (i) an overall increase in ethanol production throughout 2023 on strong cane productivity in the Center-South region; coupled with

(ii) higher inventory levels carried into the interharvest period, which resulted in more supply of ethanol in the market. Nevertheless, ethanol prices started to improve by the end of 1Q24 driven by active demand given the low parity at the pump vs. technical level (70%). In terms of volume, we strategically conducted our sales throughout the quarter in order to profit from peak in prices, in line with our commercial strategy.

Due to the efficiency and sustainability in our operations, ranked among the highest in the industry, we have the right to issue carbon credits every time we sell ethanol. During the quarter, we sold $1.7 million worth of CBios, 29.4% lower than the previous year, at an average price of 92 BRL/CBio (19 $/CBio).

Net sales of energy reached $2.3 million during 1Q24, marking a 11.1% decrease versus the previous year. Despite presenting a 2.1% year-over-year increase in the selling price, lower revenues were explained by a a 13.0% reduction in selling volumes as we prioritized the volume contracted and saved our bagasse for more profitable alternatives rather than sell energy at low spot prices.

| | | | | | | | | | | | | | | | | | | | | | | |

SUGAR, ETHANOL & ENERGY - PRODUCTION COSTS (1) | | | | | | |

| Total Cost ($'000) | | Total Cost per Pound (cts/lbs) |

| 1Q24 | 1Q23 | Chg % | | 1Q24 | 1Q23 | Chg % |

| Industrial costs | 14,490 | 9,185 | 57.8% | | 2.7 | 2.6 | 2.4% |

| Industrial costs | 12,663 | 7,963 | 59.0% | | 2.4 | 2.3 | 3.3% |

| Third-party cane | 1,827 | 1,222 | 49.5% | | 0.3 | 0.4 | (2.9)% |

| Agricultural costs | 63,963 | 47,073 | 35.9% | | 12.0 | 13.6 | (11.8)% |

| Harvest costs | 20,889 | 15,218 | 69.8% | | 3.9 | 4.4 | (10.9)% |

| Cane depreciation | 15,845 | 9,334 | 69.8% | | 3.0 | 2.7 | 10.2% |

| Agricultural Partnership Costs | 9,781 | 5,223 | 87.3% | | 1.8 | 1.5 | 21.6% |

| Maintenance costs | 17,448 | 17,298 | 0.9% | | 3.3 | 5.0 | (34.5)% |

| Total Production Costs | 78,453 | 56,258 | 39.5% | | 14.7 | 16.2 | (9.4)% |

| Depreciation & Amortization PP&E | (32,315) | (23,331) | 38.5% | | (6.1) | (6.7) | (10.1)% |

| Total Production Costs (excl D&A) | 46,138 | 32,927 | 40.1% | | 8.6 | 9.5 | (9.0)% |

| | | | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1) Total production cost may differ from our COGS figure as the former refers to the cost of our goods produced, whereas the latter refers to the cost of our goods sold.Total production costs excluding depreciation and amortization reached 8.6 cts/lb in 1Q24, marking a 9.0% decrease compared to 1Q23. This was fully driven by the 56.8% year-over-year increase in total TRS equivalent produced, on account of higher crushing volumes. This enabled us to better dilute both our fixed and variable costs, especially agricultural costs which represent roughly 80% of our cost structure. As always, we continue to use concentrated vinasse and filter cake to replace 100% of our potash fertilizer requirements and 48% of total agricultural inputs needs, reducing our sourcing needs.

| | |

| Farming - Financial Performance |

| | | | | | | | | | | | | | | | | | | | |

FARMING - FINANCIAL HIGHLIGHTS (2) | | |

| $ thousands | 1Q24 | 1Q23 | Chg % |

| Gross Sales | | | | | | |

| Crops | 31,959 | 34,562 | (7.5)% |

| Rice | 57,939 | 55,357 | 4.7% |

| Dairy | 56,694 | 58,608 | (3.3)% |

| Total Sales | 146,592 | 148,527 | (1.3)% |

Adjusted EBITDA (1) | | | | | | |

| Crops | 4,782 | (1,001) | n.a |

| Rice | 32,785 | 13,401 | 144.6% |

| Dairy | 6,447 | 6,122 | 5.3% |

Total Adjusted EBITDA (1) | 44,014 | 18,522 | 137.6% |

| | | | | | |

| | | |

| | | |

| | | |

(1) Please see “Reconciliation of Non-IFRS measures” starting on page 22 for a reconciliation of Adjusted EBITDA. (2) Figures for 1Q23 differ from the ones previously reported in order to reflect the reclassification in reporting segments communicated in 4Q23's Earnings Release. Any profit derived from the disposition of farmland or a bargain purchase gain, which was previously reported under the Land Transformation segment is now reported within the operating segment where such farmland belongs. The same applies to results derived from our minor cattle activities, which were previously reported under the "All Other" segment.

Adjusted EBITDA in the Farming business totaled $44.0 million in 1Q24, marking a 137.6% increase compared to the same period of last year. This was driven by an improved performance in all three segments. The $19.4 million and a $5.8 million year-over-year increase in Adjusted EBITDA in our Rice and Crops segments, respectively, was explained by year-over-year gains in the mark-to-market of our biological assets. In the case of Rice, higher yields and higher rice prices at the moment of harvest were the main growth drivers; whereas in Crops, the recovery in yields and higher planted area drove the increase in results. During the quarter we achieved a $433/ton year-over-year increase in the average selling price of our rice due to limited global supply during the period. Lastly, our Dairy segment presented a 5.3% year-over-year increase in Adjusted EBITDA generation due to lower costs, mainly cow feed (corn silage and soy pellets).

For a more detailed explanation, please refer to the performance description of each business line starting next page.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| GROSS SALES BREAKDOWN | | Amount ($ '000) | | Volume | | $ per unit |

| Crops | | 1Q24 | | 1Q23 | | Chg % | | 1Q24 | | 1Q23 | | Chg % | | 1Q24 | | 1Q23 | | Chg % |

| Soybean | | 2,174 | | 269 | | 708.3% | | 6,978 | | 607 | | n.m | | 312 | | 443 | | (29.7)% |

Corn (1) | | 3,392 | | 2,434 | | 39.4% | | 18,973 | | 9,438 | | 101.0% | | 179 | | 258 | | (30.7)% |

Wheat (2) | | 8,729 | | 7,314 | | 19.3% | | 40,225 | | 25,486 | | 57.8% | | 217 | | 287 | | (24.4)% |

| Sunflower | | 2,789 | | 4,456 | | (37.4)% | | 5,284 | | 6,950 | | (24.0)% | | 528 | | 641 | | (17.7)% |

| Cotton Lint | | 1,062 | | 2,028 | | (47.6)% | | 772 | | 876 | | (11.9)% | | 1,376 | | 2,315 | | (40.5)% |

| Peanut | | 9,375 | | 15,085 | | (37.9)% | | 5,667 | | 11,187 | | (49.3)% | | 1,654 | | 1,348 | | 22.7% |

Others (3) | | 4,437 | | 2,976 | | 49.1% | | 689 | | 1,147 | | (39.9)% | | | | | | |

| Total | | 31,959 | | 34,562 | | (7.5)% | | 78,588 | | 55,691 | | 41.1% | | | | | | |

| | | | | | | | | | | | | | | | | | |

HIGHLIGHTS - $ thousand (4) | | 1Q24 | | 1Q23 | | Chg % |

| Gross Sales | | 31,959 | | 34,562 | | (7.5)% |

| Adjusted EBITDA | | 4,782 | | (1,001) | | n.a |

(1) Includes sorghum; (2) Includes barley; (3) Includes sale of certifications related to RTRS soybean (Round Table on Responsible Soy Association) and sales

related to our cattle activities; (4) Figures for 1Q23 differ from the ones previously reported in order to reflect the reclassification in reporting segments communicated in 4Q23's Earnings Release. Any profit derived from the disposition of farmland or a bargain purchase gain, which was previously reported under the Land Transformation segment is now reported within the operating segment where such farmland belongs. The same applies to results derived from our minor cattle activities, which were previously reported under the "All Other" segment.

In 1Q24, gross sales in our Crops segment amounted to $32.0 million, marking a 7.5% decrease compared to the same period of last year. Despite presenting a 41.1% year-over-year increase in selling volumes on greater production during the ongoing 2023/24 harvest season, the decline was mostly driven by the reduction in the average selling price of the commodities that we produce. This decrease is explained by a full recovery in Argentina's production, after a year in which extreme dry weather severely affected the country's production (40%-50% drop in volume in 2023). This, coupled with a normal-to-good campaign in other key producing countries, such as United States and Brazil, resulted in higher global supply whereas demand remained mostly unchanged. In the case of peanut, where prices much depend on negotiations between buyers and sellers, we achieved 22.7% higher prices. The year-over-year reduction in cotton prices is explained by an attractive price premium offered by the domestic market in 1Q23, which we were able to capture.

Adjusted EBITDA during 1Q24 amounted to $4.8 million, marking a $5.8 million increase compared to the same period of last year. This was mainly explained by a $6.9 million year-over-year gain in the mark-to-market of our biological assets and net realizable value of our agricultural produce after harvest due to (i) higher planted area versus the previous campaign; together with (ii) higher yields due to a normal development of our crops. Moreover, results were also positively impacted by a $3.1 million year-over-year gain in selling expenses due to the elimination of export taxes for peanut and sunflower, coupled with lower payments on lower selling prices (export taxes represent a % of the revenues generated).

| | | | | | | | | | | | | | | | | | | | | | | |

| RICE | | | | | | | |

Highlights (3) | metric | 1Q24 | 1Q23 | Chg % |

| Gross Sales | $ thousands | 57,939 | 55,357 | 4.7% |

| Sales of white rice | thousand tons(1) | 52 | 94 | (44.3)% |

| $ per ton | 953 | 520 | 83.4% |

| $ thousands | 49,842 | 48,783 | 2.2% |

| Sales of By-products | $ thousands | 8,097 | 6,574 | 23.2% |

| Adjusted EBITDA | $ thousands | 32,785 | 13,401 | 144.6% |

| | | | | | | |

| Rice Mills | | | | |

Total Processed Rough Rice(2) | thousand tons | 78 | 73 | 7.4% |

| Ending stock - White Rice | thousand tons | 49 | 36 | 35.0% |

(1) Includes the sale of 1k and 6k tons of white rice sold sourced from third-parties during 2024 and 2023, respectively; (2) Expressed in white rice equivalent. (3) Figures for 1Q23 differ from the ones previously reported in order to reflect the reclassification in reporting segments communicated in 4Q23's Earnings Release. Any profit derived from the disposition of farmland or a bargain purchase gain, which was previously reported under the Land Transformation segment is now reported within the operating segment where such farmland belongs. The same applies to results derived from our minor cattle activities, which were previously reported under the "All Other" segment.

Gross sales in our Rice segment amounted to $57.9 million in 1Q24, marking a 4.7% increase compared to 1Q23. This was fully explained by an 83.4% year-over-year increase in the average selling price, which stood at $953/ton (versus $520/ton in 1Q23), despite a 44.3% decrease in volumes sold. Lower volume was a consequence of low availability as we were at the tail of a weaker-than-normal campaign. Global prices continued to be impacted by the result of 2023's adverse weather conditions on rice production in some of the key producing countries. India, the world's largest rice exporter, maintained its ban on exports of long grain rice to secure domestic supply, therefore adding further pressure on the global trade balance. Throughout 1Q24 we continued to see limited supply both in the export and domestic market, leading to a significant increase in selling price. Having the flexibility to cater to both markets enabled us to profit from this price scenario.

Adjusted EBITDA was $32.8 million in 1Q24, 144.6% or $19.4 million higher than in the same period of last year. This increase was mainly explained by a $12.7 million year-over-year gain in the mark-to-market of our biological assets and agricultural produce due to (i) higher planted area versus the prior campaign; (ii) higher yields given better weather conditions throughout the development of our rice production; as well as to (iii) higher rice prices at the moment of harvest. Moreover, results were also positively impacted by the aforementioned increase in net sales and a $1.0 million year-over-year decrease in selling expenses due to the lower amount of volumes sold as well as to the elimination of export taxes on rice.

| | | | | | | | | | | | | | | | | | | | | | | | |

| DAIRY | | | | | | | |

| Highlights | | metric | 1Q24 | 1Q23 | Chg % |

| Gross Sales | | $ thousands (1) | 56,694 | 58,608 | (3.3)% |

| | million liters (2) (3) | 88.9 | 96.3 | (7.7)% |

| Adjusted EBITDA | | $ thousands | 6,447 | 6,122 | 5.3% |

| | | | |

| Dairy - Farm | | | | | | | | |

| Dairy Cows | average heads | 14,407 | 14,471 | (0.4)% |

| Cow Productivity | | liter/cow/day | 37.3 | 35.9 | 4.0% |

| Total Milk Produced | million liters | 48.9 | 46.7 | 4.7% |

| | | | | | | | |

| Dairy - Industry | | | | | | | | |

| Total Milk Processed | million liters | 81.3 | 76.7 | 5.9% |

(1) Includes sales of raw milk, processed dairy products, electricity and culled cows; (2) Includes sales of raw milk, fluid milk, powdered milk and cheese, among others; (3) The difference between volume processed and volume sold is explained by the sale of raw milk to third parties.

In 1Q24, milk production at the farm level was 48.9 million liters, 4.7% higher compared to the same period of last year. This was fully explained by a 4.0% increase in cow productivity, which reached 37.3 liters per cow per day, as we continue enhancing efficiencies in our free-stalls, which are already at full capacity.

At the industry level, we processed 81.3 million liters of raw milk during 1Q24, 5.9% higher than last year. Out of this volume, approximately 51% came from our dairy farm operations whereas the balance was sourced from local producers in nearby areas or supplied by partners to whom we provide tolling services. We continue working on product development for the domestic and export market, offering higher value added products as well as commoditized products, and being present across different price tiers with our consumer product brands.

Adjusted EBITDA was $6.4 million in 1Q24, 5.3% higher than the previous year despite a 3.3% decline in sales driven by a 7.7% reduction in volume. Results were positively impacted by (i) a year-over-year decline in our cost structure, mainly related to the cost of feed (corn silage and soy pellets) as our in-house production recovered the volume lost during the prior year given normal weather conditions experienced throughout the development of our summer crops; (ii) our continuous focus on achieving efficiencies in our vertically integrated operations and increasing our productivity levels in every stage of the value chain; and (iii) our above-mentioned flexibility to divert milk to the production of a variety of dairy products, as well as to shift sales across markets.

Adjusted EBIT was $5.3 million in 1Q24. However, once interest expense and the foreign exchange loss related to the financial debt are considered, overall results decrease to negative $5.6 million.

| | | | | | | | | | | | | | | | | | | | |

| CORPORATE EXPENSES | | | | | | |

| $ thousands | 1Q24 | 1Q23 | Chg % |

| Corporate Expenses | (5,753) | (6,048) | (4.9)% |

Adecoagro’s corporate expenses include items that are not allocated to a specific business segment, such as the remuneration of executive officers and headquarters staff, certain professional services and office lease expenses, among others. As shown in the table above, corporate expenses for 1Q24 were $5.8 million, 4.9% lower than in 1Q23. The year-over-year reduction is mainly explained by (i) our continuous focus on reducing expenses and generating savings, as stated in the Company's action plan set during 2023; coupled with (ii) lower costs in U.S. dollar terms. | | | | | | | | | | | | | | |

| Net Income & Adjusted Net Income |

Net Income amounted to $47.3 million during 1Q24, marking a $24.3 million increase compared to the same period of last year. This was mostly explained by a $44.4 million year-over-year gain in inflation accounting driven by the net exposure of our monetary position (51.5% inflation in 1Q24 vs. 21.7% during 1Q23). It is worth highlighting that inflation accounting results are non-cash in nature.

Adjusted Net Income reached $23.3 million during 1Q24, $15.6 million lower than in 1Q23, mainly as last year's figure reflects gains from blue chip swap transactions.

| | | | | | | | | | | | | | | | | | | | |

ADJUSTED NET INCOME (1) | | | | | | |

| $ thousands | 1Q24 | 1Q23 | Chg % |

| Profit for the period | 47,344 | 23,006 | 105.8% |

| Foreign exchange losses/(gains), net | (5,624) | (5,780) | (2.7)% |

| Cash flow hedge - transfer from equity | — | 8,861 | (100.0)% |

| Inflation accounting effects | (32,717) | 11,729 | (378.9)% |

| Net results from Fair Value adjustment of Investment Property | 14,302 | 1,061 | n.m |

| Adjusted Net Income | 23,305 | 38,877 | (40.1)% |

(1) Please see “Reconciliation of Non-IFRS measures” starting on page 22 for a reconciliation of Adjusted Net Income.

| | | | | | | | | | | | | | | | | |

| NET DEBT BREAKDOWN | | | | | |

| $ thousands | 1Q24 | 4Q23 | Chg % | 1Q23 | Chg % |

| Farming | 100,579 | 171,501 | (41.4)% | 280,253 | (64.1)% |

| Short term Debt | 86,696 | 157,629 | (45.0)% | 219,688 | (60.5)% |

| Long term Debt | 13,884 | 13,873 | 0.1% | 60,565 | (77.1)% |

| Sugar, Ethanol & Energy | 720,231 | 733,447 | (1.8)% | 702,404 | 2.5% |

| Short term Debt | 40,035 | 49,477 | (19.1)% | 12,172 | 228.9% |

| Long term Debt | 680,196 | 683,970 | (0.6)% | 690,232 | (1.5)% |

| Total Short term Debt | 126,731 | 207,106 | (38.8)% | 231,860 | (45.3)% |

| Total Long term Debt | 694,079 | 697,843 | (0.5)% | 750,797 | (7.6)% |

| Gross Debt | 820,810 | 904,949 | (9.3)% | 982,657 | (16.5)% |

| Cash & Equivalents | 135,511 | 339,781 | (60.1)% | 85,867 | 57.8% |

Short-Term Investments(1) | 46,109 | 62,637 | (26.4)% | 66,960 | (31.1)% |

| Net Debt | 639,190 | 502,531 | 27.2% | 829,830 | (23.0)% |

| EOP Net Debt / Adj. EBITDA LTM | 1.3x | 1.1x | 26.9% | 1.9x | (29.7)% |

| | | | | |

(1) It includes US T-Bills with maturity from the date of acquisition longer than 90 days for US$ 44,806 thousand and US$ 1,303 thousand of BOPREAL (Bonos para la Reconstrucción de una Argentina Libre). As of March 31, 2024, nil (US$ 59,475 thousand as of December 31, 2023) of these US T-bills are used as collateral for short-term borrowings and are not available for use by other entities of the Group.

As of March 31, 2024, Adecoagro's net debt amounted to $639.2 million, 27.2% higher compared to the previous quarter. As stated in prior releases, the first semester of the year has the highest working capital requirements as we are undergoing planting/harvesting activities for all our crops. On the other hand, cash generation is concentrated in the second half of the year, as we start collecting income from most of our products sold.

On a year-over-year basis, net debt was 23.0% lower compared to 1Q23, fully explained by a significant reduction in the gross debt position of our Farming business, coupled with a genuine increase in our cash position. Total debt in our Farming business was down 64.1% versus 1Q24 as we took debt in Argentine Peso, against dollarized assets, therefore benefiting from the sharp depreciation of the currency (311% in 1Q24 LTM). Furthermore, total cash increased by 18.8% compared to the previous year, mainly explained by an year-over-year increase in our net cash from operations generated during the last twelve months, which, in turn, enabled us to (i) reduce our net debt position; (ii) invest in growth projects; and (iii) distribute profits with shareholders via cash dividend and share repurchase, as stated in our distribution policy.

Consequently, our net leverage (Net Debt to LTM EBITDA) as of 1Q24 was 1.3x, 29.7% lower than the same period of last year, but 26.9% higher than in 4Q23 due to the aforementioned seasonality. Furthermore, our Liquidity ratio (Cash & Equivalents + Marketable Inventories / Short Term Debt), reached 2.9x, showing the Company's full capacity to repay short term debt with its cash balances.

We believe that our balance sheet is in a healthy position based not only on the adequate overall debt levels but also on the terms of our indebtedness, most of which is long-term debt.

| | | | | | | | | | | | | | | | | | | | |

| CAPITAL EXPENDITURES | | | | | | |

| $ thousands | 1Q24 | 1Q23 | Chg % |

| Farming & Land Transformation | 21,451 | 11,741 | 82.7% |

| Expansion | 15,565 | 8,797 | 76.9% |

| Maintenance | 5,886 | 2,944 | 100.0% |

| Sugar, Ethanol & Energy | 85,694 | 72,994 | 17.4% |

| Maintenance | 72,582 | 59,720 | 21.5% |

| Planting | 19,622 | 15,713 | 24.9% |

| Industrial & Agricultural Machinery | 52,960 | 44,007 | 20.3% |

| Expansion | 13,112 | 13,274 | (1.2)% |

| Planting | 11,027 | 7,513 | 46.8% |

| Industrial & Agricultural Machinery | 2,085 | 5,761 | (63.8)% |

| Total | 107,145 | 84,735 | 26.4% |

| Total Maintenance Capex | 78,467 | 62,664 | 25.2% |

| Total Expansion Capex | 28,677 | 22,071 | 29.9% |

Adecoagro's capital expenditures amounted to $107.1 million in 1Q24, 26.4% higher compared to last year.

The Sugar, Ethanol and Energy business accounted for 80% or $85.7 million of total capex in 1Q24, marking a 17.4% increase compared to the same period of last year. Maintenance capex amounted to $72.6 million, 21.5% higher than the previous year. This was explained by a 24.9% increase in renewal planting due to more hectares being planted (8,646 hectares in 1Q24 vs. 4,583 hectares in 1Q23), coupled with a 20.3% increase the renewal of our harvest and industrial equipment. Expansion capex, in turn, remained in line compared to the prior year, reaching $13.1 million. Investments on this front were related to (i) expansion planting as we continue to increase the size of our sugarcane plantation; as well as to (ii) small projects including our biogas unit in Ivinhema, where our biomethane production takes place.

Farming & Land Transformation businesses accounted for 20%, or $21.5 million of total capex in 1Q24, presenting a year-over-year increase of 82.7%. Maintenance capex was $5.9 million, $2.9 million higher than the previous year, mainly due to the replacement of vehicles and machinery. Expansion capex, in turn, amounted to $15.6 million and was focused on paying the third (and final) installment of Viterra's rice mills in Argentina and Uruguay, which we acquired in mid-2022 to expand our geographic footprint and rice portfolio.

◦Sugar prices traded within a range of 20.6 cts/lb to 24.5 cts/lb during 1Q24. From a supply & demand perspective, a year-over-year reduction in sugarcane crushing in Brazil is expected, due to irregular and below average rainfalls received in the Center-South region since November 2023. Moreover, production estimates for Mexico and Central America had also been revised downward. On the other hand, the tail of the harvest in Thailand and India surprised with higher sugarcane crushing, therefore balancing the trade flow in the short term as well as the end-of-period stocks in both countries. During 1Q24, demand in Brazil was stable-to-high and the loading in the ports was boosted by the dry weather. Looking ahead, the market will be focused on weather development, especially in the main producing countries such as Brazil, India and Thailand, as well as in how demand will react to lower sugar prices. However, the market still heavily depends on Brazil's sugar production, so milling and sugar production will be followed closely, as well as productivity indicators. Logistics once again will be a challenge and could also put upward pressure on sugar prices.

◦According to ESALQ index, hydrous and anhydrous ethanol prices in 1Q24 decreased on average 23% and 25% versus the same period of last year, respectively. Compared to 4Q23, prices for hydrous ethanol remained unchanged while anhydrous ethanol was down by 2%. Nevertheless, prices started to react by the end of 1Q24, mainly supported by the late beginning of harvesting activities in Brazil's Center-South region, coupled with an active demand driven by the low parity at the pump vs. technical (70%). As reported by UNICA (Brazil's sugarcane association), total ethanol sales continued to post impressive results during 1Q24, with a 34% year-over-year increase and a 3% quarter-over-quarter increase. Looking forward, we expect a more constructive scenario for ethanol prices in 2024 due to (i) higher international oil prices; (ii) higher demand for this type of fuel and (iii) all Brazilian mills maximizing sugar production, consequently decreasing the production of ethanol.

◦Brazil's carbon credit market under the RenovaBio program presented a 12% year-over-year increase in 1Q24, reaching an average price of 106 BRL/CBio (approximately 21 USD/CBio).

◦In 1Q24, energy spot prices in the southeast region of Brazil continued at levels of 61.1 BRL/MWh, 11.4% lower than 1Q23. Despite a record increase in demand for energy (+5.7% year-over-year), as well as lower than average precipitations, prices continued to be impacted by the level of water in the southeast reservoirs (more than 60%). Nevertheless, energy prices could see an upside if "La Niña" weather event materializes (dry weather), potentially impacting the water levels in the reservoirs for the upcoming months.

◦During 1Q24, both soybean and corn traded 12% lower at CBOT compared to 4Q23. The decrease in prices was driven by (i) solid production figures coming from Brazil and Argentina; (ii) higher end-of-period stocks in USA; as well as (iii) higher planted area in USA for the 2024/25 harvest compared to the previous one (although lower than originally expected for 24/25). Moreover, macroeconomic indicators in the USA such as inflation, dollar and the delay in decreasing interest rates put some pressure in the commodities market in Chicago. During 1Q24, funds maintained a short position on wheat, corn and all soybean complex. Prices at the local market traded 5% lower for soybean and 1% lower for corn compared to 4Q23. Local price reduction was lower than CBOT as weather was warmer and more humid than expected, which translated into lower yields for some crops, such as corn.

| | |

| Other Operational & Financial Metrics |

2023/24 Harvest Season

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FARMING PRODUCTION DATA(4) | | | | | | | | |

| Planting & Production | Planted Area (hectares) | | 2023/24 Harvested Area | | Yields (Tons per hectare) |

| 2023/24 | 2022/23 | Chg % | | Hectares | % Harvested | Production | | 2023/24 | 2022/23 | Chg % |

| Soybean | 64,753 | 51,942 | 24.7% | | 24,241 | 37.4% | 79,881 | | 3.3 | 2.0 | 64.8% |

| Soybean 2nd Crop | 23,935 | 29,756 | (19.6)% | | 571 | 2.4% | 1,667 | | 2.9 | 1.5 | 97.3% |

Corn (1) | 57,160 | 41,510 | 37.7% | | 14,141 | 24.7% | 110,252 | | 7.8 | 4.9 | 59.5% |

| Corn 2nd Crop | 2,652 | 2,898 | (8.5)% | | — | —% | — | | — | — | n.a. |

Wheat (2) | 28,142 | 35,789 | (21.4)% | | 28,142 | 100.0% | 88,235 | | 3.1 | 2.3 | 34.8% |

| Sunflower | 10,832 | 18,131 | (40.3)% | | 10,797 | 99.7% | 18,671 | | 1.7 | 1.9 | (9.1)% |

| Cotton | 5,199 | 10,266 | (49.4)% | | — | —% | — | | — | 0.5 | n.a. |

| Peanut | 24,282 | 19,813 | 22.6% | | 1,101 | 4.5% | 4,099 | | 3.7 | 2.1 | 79.6% |

Other (3) | 3,692 | 2,634 | 40.2% | | 825 | 22.3% | 468 | | | | |

| Total Crops | 220,648 | 212,737 | 3.7% | | 79,816 | 36.2% | 303,273 | | | | |

| Rice | 58,452 | 55,648 | 5.0% | | 51,255 | 87.7% | 335,272 | | 6.5 | 6.4 | 3.0% |

| Total Farming | 279,100 | 268,385 | 4.0% | | 131,071 | 47.0% | 638,545 | | | | |

| Owned Croppable Area | 99,474 | 102,127 | (2.6)% | | | | | | | | |

| Leased Area | 153,038 | 133,605 | 14.5% | | | | | | | | |

| Second Crop Area | 26,587 | 32,653 | (18.6)% | | | | | | | | |

| Total Farming Area | 279,100 | 268,385 | 4.0% | | | | | | | | |

| | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Includes sorghum; (2) Includes barley and peas; (3) Includes chia, sesame, potatoes and beans; (4) Crop yields with harvesting activities below 50% advanced are not representative.

During the second half of 2023, we began planting activities for the 2023/24 harvest season, which continued throughout early 2024. We have planted a total of 279,100 hectares, which represents a 4.0% increase compared to the previous season. We are currently undergoing harvesting activities for most of our grains. As of the end of April 2024, we harvested 131,071 hectares, or 47.0% of total area, and produced 638,545 tons of aggregate grains.

Soybean 1st crop: As of the end of April, we harvested 37% (24,241 hectares) of the planted area obtaining an average yield of 3.3 Tn/Ha. Rainfalls received throughout summertime, especially during the period of yield definition of our soybean, favored crop development and enabled us to reach yields in line with our expectations. We are still undergoing harvesting activities for soybean, with some minor delays caused by rains.

Corn: As of the end of April, we harvested 25% (14,141 hectares) of planted area. Although we received good precipitations throughout the different development stages of our corn plantation (early and late corn), late corn planted in the northern region of Argentina was negatively impacted by spiroplasma, conducted by a leafhopper. High temperatures coupled with high humidity in the north, created the perfect atmosphere for the development of this bacteria, which reproduces in tropical climates and affects corn production.

Nevertheless, only a small portion of our total production was impacted (∼15% of our expected corn volume). Our geographic diversification enables us not only to mitigate weather risk but also its potential secondary effects. Consequently, we are still forecasting yields to be in line with historical average.

Peanut: We have recently begun harvesting activities for our peanut production, having already harvested 4.5% of the total area planted with very good results. We had good conditions during the growing period for this crop, therefore we expect to achieve yields in line with historical average.

Wheat: As explained in our previous report, harvesting activities for wheat have already been completed by beginning of 2024. Despite presenting a year-over-year decline in planted area due to dry weather experienced throughout planting activities (South American winter), yields presented a significant recovery versus the prior campaign. This was explained by the rainfalls received throughout its yield definition stage as the weather pattern shifted to a rainier season, favoring crop development.

Rice: We have already harvested 87.7% of the total planted area, reaching an average yield of 6.5 ton/ha. In terms of productivity, it was a challenging campaign given the evolution of weather conditions throughout the different growth stages of our rice. Firstly, we started planting activities with low water levels in our reservoirs as weather forecast was still under "La Niña"-to-"Neutral" and rainfalls had not yet materialized. Then, excessive rainfalls caused some delays in planting activities, resulting in some hectares being planted outside the optimal planting window. Furthermore, above average precipitations during the crop's development also negatively impacted yields. Despite this, yields are showing a 3.0% year-over-year improvement.

Inventories

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| END OF PERIOD INVENTORIES | | | | | | | | |

| | Volume | | thousand $ |

| Product | Metric | 1Q24 | 1Q23 | % Chg | | 1Q24 | 1Q23 | % Chg |

| Soybean | tons | 8,213 | 21,108 | (61.1)% | | 2,568 | 9,670 | (73.4)% |

Corn (1) | tons | 47,729 | 13,725 | 247.8% | | 7,485 | 3,067 | 144.0% |

Wheat (2) | tons | 39,750 | 35,823 | 11.0% | | 7,286 | 9,465 | (23.0)% |

| Sunflower | tons | 2,526 | 12,795 | (80.3)% | | 1,328 | 4,739 | (72.0)% |

| Cotton | tons | 1,507 | 976 | 54.4% | | 808 | 1,597 | (49.4)% |

Rice (3) | tons | 49,257 | 36,493 | 35.0% | | 22,545 | 13,149 | 71.5% |

| Peanut | tons | 5,536 | 8,681 | (36.2)% | | 8,096 | 8,134 | (0.5)% |

| Organic Sugar | tons | 870 | 1,547 | (43.8)% | | 394 | 695 | (43.3)% |

| Sugar | tons | 76,118 | 42,077 | 80.9% | | 25,671 | 14,258 | 80.0% |

| Ethanol | m3 | 194,424 | 115,070 | 69.0% | | 97,452 | 57,616 | 69.1% |

| Hydrous Ethanol | m3 | 160,628 | 83,408 | 92.6% | | 79,632 | 41,557 | 91.6% |

| Anhydrous Ethanol | m3 | 33,796 | 31,663 | 6.7% | | 17,820 | 16,059 | 11.0% |

| Fluid Milk | Th Lts | 5,411 | 4,139 | 30.7% | | 3,495 | 2,459 | 42.1% |

| Powdered Milk | tons | 1,412 | 1,549 | (8.8)% | | 5,696 | 5,952 | (4.3)% |

| Cheese | tons | 322 | 205 | 57.3% | | 1,472 | 955 | 54.1% |

| Butter | tons | 61 | 100 | (38.8)% | | 308 | 451 | (31.8)% |

| Cbios | units | 44,109 | 33,102 | 33.3% | | 781 | 535 | 46.0% |

| Fuel | m3 | 201 | 92 | 119.2% | | 203 | 90 | 125.6% |

| Others | | 1,641 | 4,057 | (59.6)% | | 1,021 | 2,601 | (60.8)% |

| Total | | | | | | 186,609 | 135,432 | 37.8% |

(1) Includes sorghum.

(2) Includes barley.

(3) Expressed in white rice equivalent.

Variations in inventory levels between 1Q24 and 1Q23 are attributable to changes in (i) production volumes resulting from changes in planted area, (ii) production mix between different crops and in yields obtained, (iii) different percentage of area harvested during the period, and (iv) commercial strategy or selling pace for each product.

Commodity Hedging

Adecoagro’s financial performance is affected by the volatile price environment inherent in agricultural commodities. The company uses forward and derivative markets to mitigate swings in commodity prices and stabilize cash flows.

The table below shows the average selling price of our hedged production volumes, including volumes that have already been invoiced and delivered, forward contracts with fixed-price and volumes hedged through derivative instruments.

| | | | | | | | | | | | | | | |

| COMMODITY HEDGE POSITION - As of March 31, 2024 |

| | Consolidated Hedge Position |

| Farming | | | Avg. FAS Price | CBOT FOB | |

| | Volume | USD/Ton | USD/Bu | Hedge (%) |

| 2023/2024 Harvest season | | | | |

| Soybeans | | 98,178 | 322.1 | 1,291.6 | 46% |

| Corn | | 112,256 | 178.9 | 574.5 | 38% |

| Wheat | | 41,482 | 222.2 | 707.7 | 63% |

| 2024/2025 Harvest season | | | | |

| Soybeans | | — | — | — | —% |

| Corn | | — | — | — | —% |

| Wheat | | — | — | — | —% |

| | Consolidated Hedge Position |

| Sugar, Ethanol & Energy | | Avg. FOB Price | ICE FOB | |

| | Volume | USD/Unit | Cents/Lb | Hedge (%) |

| FY 2024 | | | | |

| Sugar (tons) | | 381,108 | 529.0 | 24.0 | 47% |

| Ethanol (m3) | | — | — | — | —% |

Energy (MW/h) (1) | 585,160 | 45.0 | n.a. | 73% |

| FY 2025 | | | | |

| Sugar (tons) | | — | — | — | —% |

| Ethanol (m3) | | — | — | — | —% |

Energy (MW/h) (1) | 437,088 | 49.8 | n.a | 55% |

(1) Energy prices in 2024 and 2025 were converted to USD at an exchange rate of BRL/USD 5.15.

| | |

| Forward-looking Statements |

This press release contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. These forward-looking statements can be identified by words or phrases such as “anticipate,” “forecast”, “believe,” “continue,” “estimate,” “expect,” “intend,” “is/are likely to,” “may,” “plan,” “should,” “would,” or other similar expressions.

The forward-looking statements included in this press release relate to, among others: (i) our business prospects and future results of operations; (ii) weather and other natural phenomena; (iii) developments in, or changes to, the laws, regulations and governmental policies governing our business, including limitations on ownership of farmland by foreign entities in certain jurisdictions in which we operate, environmental laws and regulations; (iv) the implementation of our business strategy; (v) the correlation between petroleum, ethanol and sugar prices; (vi) our plans relating to acquisitions, joint ventures, strategic alliances or divestitures, and to consolidate our position in different businesses; (vii) the efficiencies, cost savings and competitive advantages resulting from acquisitions; (viii) the implementation of our financing strategy, capital expenditure plan; (ix) the maintenance of our relationships with customers; (x) the competitive nature of the industries in which we operate; (xi) the cost and availability of financing; (xii) future demand for the commodities we produce; (xiii) international prices for commodities; (xiv) the condition of our land holdings; (xv) the development of the logistics and infrastructure for transportation of our products in the countries where we operate; (xvi) the length and severity of the coronavirus (COVID-19) pandemic or any other pandemic outbreak; (xvii) the performance of the South American and world economies; and (xviii) the relative value of the Brazilian Reais, the Argentine Peso, and the Uruguayan Peso compared to other currencies.

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this press release might not occur, and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

The forward-looking statements made in this press release relate only to events or information as of the date on which the statements are made in this press release. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

| | |

| Reconciliation of Non-IFRS measures |

To supplement our consolidated financial statements, which are prepared and presented in accordance with IFRS, we use the following non-IFRS financial measures in this press release:

•Adjusted EBITDA

•Adjusted EBIT

•Adjusted EBITDA margin

•Net Debt

•Net Debt to Adjusted EBITDA

•Adjusted Net Income

In this section, we provide an explanation and a reconciliation of each of our non-IFRS financial measures to their most directly comparable IFRS measures. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS.

We believe these non-IFRS financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management for financial and operational decision making.

There are limitations associated with the use of non-IFRS financial measures as an analytical tool. In particular, many of the adjustments to our IFRS financial measures reflect the exclusion of items, such as depreciation and amortization, changes in fair value, the related income tax effects of the aforementioned exclusions and exchange differences generated by the net liability monetary position in USD in the countries where the functional currency is the local currency, that are recurring and will be reflected in our financial results for the foreseeable future. In addition, these measures may be different from non-IFRS financial measures used by other companies, limiting their usefulness for comparison purposes.

Adjusted EBITDA & Adjusted EBIT

Adjusted Consolidated EBITDA equals the sum of our Adjusted Segment EBITDA for each of our operating segments. We define “Adjusted Consolidated EBITDA” as (i) consolidated net profit (loss) for the year, as applicable, before interest expense, income taxes, depreciation of property, plant and equipment and amortization of intangible assets, net gain from fair value adjustments of investment property land foreign exchange gains or losses, other net financial results and bargain purchase gain on acquisition (ii) adjusted by those items, that do not impact profit and loss, but are recorded directly in shareholders’ equity, including (a) the gains or losses from disposals of noncontrolling interests in subsidiaries whose main underlying asset is farmland, reflected under the line item: "Reserve from the sale of noncontrolling interests in subsidiaries” and (b) the net increase in value of sold farmland, which has been recognized in either revaluation surplus or retained earnings; and (iii) net of the combined effect of the application of IAS 29 and IAS 21 from the Argentine operations included in profit from operations.

We define “Adjusted Consolidated EBITDA” as (i) consolidated net profit (loss) for the year, as applicable, before interest expense, income taxes, depreciation of property, plant and equipment and amortization of intangible assets, net gain from fair value adjustments of investment property land foreign, exchange gains or losses, other net financial results and bargain purchase gain on acquisition (ii) adjusted by those items, that do not impact profit and loss, but are recorded directly in shareholders’ equity, including (a) the gains or losses from disposals of noncontrolling interests in subsidiaries whose main underlying asset is farmland, reflected under the line item: "Reserve from the sale of noncontrolling interests in subsidiaries” and (b) the net increase in value of sold farmland, which has been recognized in either revaluation surplus or retained earnings; and (iii) net of the combined effect of the application of IAS 29 and IAS 21 from the Argentine operations included in profit from operations.

We believe that Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are important measures of operating performance for our company and each operating segment, respectively, because they allow investors to evaluate and compare our consolidated operating results and to evaluate and compare the operating performance of our segments, respectively, including our return on capital and operating efficiencies, from period to period by removing the impact of our capital structure (interest expense from our outstanding debt), asset base (depreciation and amortization), tax consequences (income taxes), bargain purchase gain, foreign exchange gains or losses and other financial results. In addition, by including the gains or losses from disposals of noncontrolling interests in subsidiaries whose main underlying asset is farmland, investors can also evaluate and compare the full value and returns generated by our land transformation activities. Other companies may calculate Adjusted Consolidated EBITDA and Adjusted

Segment EBITDA differently, and therefore our Adjusted Consolidated EBITDA and Adjusted Segment EBITDA may not be comparable to similar measures used by other companies. Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are not measures of financial performance under IFRS, and should not be considered in isolation or as an alternative to consolidated net profit (loss), cash flows from operating activities, segment profit from operations and other measures determined in accordance with IFRS. Items excluded from Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are significant and necessary components to the operations of our business, and, therefore, Adjusted Consolidated EBITDA and Adjusted Segment EBITDA should only be used as a supplemental measure of our company’s operating performance, and of each of our operating segments, respectively. We also believe Adjusted Consolidated EBITDA and Adjusted Segment EBITDA are useful for securities analysts, investors and others to evaluate and compare the financial performance of our company and other companies in the agricultural industry. These non-IFRS measures should be considered in addition to, but not as a substitute for or superior to, the information contained in either our statements of income or segment information.

Our Adjusted Consolidated EBIT equals the sum of our Adjusted Segment EBITs for each of our operating segments. We define “Adjusted Consolidated EBIT” as (i) consolidated net profit (loss) for the year, as applicable, before interest expense, income taxes, net gain from fair value adjustments of investment property land foreign, exchange gains or losses, other net financial results and bargain purchase gain on acquisition (ii) adjusted by those items, that do not impact profit and loss, but are recorded directly in shareholders’ equity, including (a) the gains or losses from disposals of noncontrolling interests in subsidiaries whose main underlying asset is farmland, reflected under the line item: "Reserve from the sale of noncontrolling interests in subsidiaries” and (b) the net increase in value of sold farmland, which has been recognized in either revaluation surplus or retained earnings; and (iii) net of the combined effect of the application of IAS 29 and IAS 21 from the Argentine operations included in profit from operations.

We believe that Adjusted Consolidated EBIT and Adjusted Segment EBIT are important measures of operating performance, for our company and each operating segment, respectively, because they allow investors to evaluate and compare our consolidated operating results and to evaluate and compare the operating performance of our segments, from period to period by including the impact of depreciable fixed assets and removing the impact of our capital structure (interest expense from our outstanding debt), tax consequences (income taxes), foreign exchange gains or losses and other financial results. In addition, by including the gains or losses from disposals of noncontrolling interests in subsidiaries whose main underlying asset is farmland and also the sale of farmlands, investors can evaluate the full value and returns generated by our land transformation activities. Other companies may calculate Adjusted Consolidated EBIT and Adjusted Segment EBIT differently, and therefore our Adjusted Consolidated EBIT and Adjusted Segment EBIT may not be comparable to similar measures used by other companies. Adjusted Consolidated EBIT and Adjusted Segment EBIT are not measures of financial performance under IFRS, and should not be considered in isolation or as an alternative to consolidated net profit (loss), cash flows from operating activities, segment profit from operations and other measures determined in accordance with IFRS. Items excluded from Adjusted Consolidated EBIT and Adjusted Segment EBIT are significant and necessary components to the operations of our business, and, therefore, Adjusted Consolidated EBIT and Adjusted Segment EBIT should only be used as a supplemental measure of the operating performance of our company, and of each of our operating segments, respectively.

Reconciliations of both Adjusted EBITDA and Adjusted EBIT start on page 25.

Net Debt & Net Debt to Adjusted EBITDA

Net debt is defined as the sum of non-current and current borrowings less cash and cash equivalents and short-term investments (namely US-Treasury Bills use as collateral of short-term borrowings). This measure is widely used by management. Management is consistently tracking our leverage position and our ability to repay and service our debt obligations over time. We have therefore set a leverage ratio target that is measured by net debt divided by Adjusted Consolidated EBITDA.

We believe that the ratio net debt to Adjusted Consolidated EBITDA provides useful information to investors because management uses it to manage our debt-equity ratio in order to promote access to capital markets and our ability to meet scheduled debt service obligations.

| | | | | | | | | | | | | | | | | |

| RECONCILIATION - NET DEBT | | | | | |

| $ thousands | 1Q24 | 4Q23 | Chg % | 1Q23 | Chg % |

| Total Borrowings | 820,810 | 904,949 | (9.3)% | 982,657 | (16.5)% |

| Cash and Cash equivalents | 135,511 | 339,781 | (60.1)% | 85,867 | 57.8% |

Short-term investments (1) | 46,109 | 62,637 | (26.4)% | 66,960 | (31.1)% |

| Net Debt | 639,190 | 502,531 | 27.2% | 829,830 | (23.0)% |

(1) It includes US T-Bills with maturity from the date of acquisition longer than 90 days for US$ 44,806 thousand and US$ 1,303 thousand of BOPREAL (Bonos para la Reconstrucción de una Argentina Libre). As of March 31, 2024, nil (US$ 59,475 thousand as of December 31, 2023) of these US T-bills are used as collateral for short-term borrowings and are not available for use by other entities of the Group.

Adjusted Net Income

We define Adjusted Net Income as (i) profit / (loss) of the period/year before net gain / (losses) from fair value adjustments of investment property land and bargain purchase gain on acquisition; plus (ii) any non-cash finance costs resulting from foreign exchange gain/losses for such period, which are composed by both exchange differences and cash flow hedge transfer from equity, included in Financial Results, net, in our statement of income; net of the related income tax effects, plus (iii) gains or losses from disposals of non-controlling interests in subsidiaries whose main underlying asset is farmland, which are reflected in our shareholders’ equity under the line item “Reserve from the sale of non-controlling interests in subsidiaries” if any, plus (iv) the reversal of the aforementioned income tax effect, plus (v) inflation accounting effect; plus (vi) the net increase in value of sold farmland, which has been recognized in either revaluation surplus or retained earnings, if any.

We believe that Adjusted Net Income is an important measure of performance for our company allowing investors to properly assess the impact of the results of our operations in our equity. In fact, results arising from the revaluation effect of our net monetary position held in foreign currency in the countries where our functional currency is the local currency do not affect the equity of the Company, when measured in foreign / reporting currency. Conversely, the tax effect resulting from the aforementioned revaluation effect does impact the equity of the Company, since it reduces/increases the income tax to be paid in each country. Accordingly we have added back the income tax effect to Adjusted Net Income.

In addition, by including the gains or losses from disposals of non-controlling interests in subsidiaries whose main underlying asset is farmland, investors can also include the full value and returns generated by our land transformation activities.

Other companies may calculate Adjusted Net Income differently, and therefore our Adjusted Net Income may not be comparable to similar measures used by other companies. Adjusted Net Income is not a measure of financial performance under IFRS, and should not be considered in isolation or as an alternative to consolidated net profit (loss). This non-IFRS measure should be considered in addition to, but not as a substitute for or superior to, the information contained in our financial statements.

| | | | | | | | | | | | | | | | | | | | |

| ADJUSTED NET INCOME | | | | | | |

| $ thousands | 1Q24 | 1Q23 | Chg % |

| Profit for the period | 47,344 | 23,006 | 105.8% |

| Foreign exchange losses/(gains), net | (5,624) | (5,780) | (2.7)% |

| Cash flow hedge - transfer from equity | — | 8,861 | (100.0)% |

| Inflation accounting effects | (32,717) | 11,729 | (378.9)% |

| Net results from Fair Value adjustment of Investment Property | 14,302 | 1,061 | n.m |

| | | |

| Adjusted Net Income | 23,305 | 38,877 | (40.1)% |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED EBITDA & ADJUSTED EBITDA RECONCILIATION TO PROFIT/LOSS - 1Q24 | | | | | | | |

| $ thousands | | Crops | Rice | Dairy | Farming | | Sugar, Ethanol & Energy | | Corporate | | Total |

| Revenue | | 31,959 | 57,939 | 56,694 | 146,592 | | 107,207 | | — | | 253,799 |

| Cost of revenue | | (30,274) | (40,445) | (46,899) | (117,618) | | (82,173) | | — | | (199,791) |

| Initial recog. and changes in FV of BA and agricultural produce | | 14,101 | 21,702 | 357 | 36,160 | | 23,152 | | — | | 59,312 |

| Changes in net realizable value of agricultural produce after harvest | | (8,499) | 17 | — | (8,482) | | 355 | | — | | (8,127) |

| Margin on Manufacturing and Agricultural Act. Before Opex | | 7,287 | 39,213 | 10,152 | 56,652 | | 48,541 | | — | | 105,193 |

| General and administrative expenses | | (2,373) | (3,756) | (2,394) | (8,523) | | (5,903) | | (6,533) | | (20,959) |

| Selling expenses | | (2,533) | (6,726) | (5,181) | (14,440) | | (13,285) | | (80) | | (27,805) |

| Other operating income, net | | (10,596) | (598) | 1,267 | (9,927) | | (9,813) | | 541 | | (19,199) |

| | | | | | | | | | | |

| Profit from Operations Before Financing and Taxation | | (8,215) | 28,133 | 3,844 | 23,762 | | 19,540 | | (6,072) | | 37,230 |

| Net results from Fair value adjustment of Investment property | | 11,274 | 1,549 | — | 12,823 | | — | | — | | 12,823 |

| | | | | | | | | | | |

| Adjusted EBIT | | 3,059 | 29,682 | 3,844 | 36,585 | | 19,540 | | (6,072) | | 50,053 |

| (-) Depreciation and Amortization | | 1,723 | 3,103 | 2,603 | 7,429 | | 32,315 | | 319 | | 40,063 |

| Adjusted EBITDA | | 4,782 | 32,785 | 6,447 | 44,014 | | 51,855 | | (5,753) | | 90,116 |

| Reconciliation to Profit/(Loss) | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | 90,116 |

| (+) Depreciation and Amortization | | | | | | | | | | | (40,063) |

| (+) Financial result, net | | | | | | | | | | | 20,487 |

| (+) Net results from Fair value adjustment of Investment property | | | | | | | | | | | (12,823) |

| (+) Income Tax (Charge)/Benefit | | | | | | | | | | | (12,921) |

| | | | | | | | | | | |

| (+) Translation Effect (IAS 21) | | | | | | | | | | | 2,548 |

| Profit/(Loss) for the Period | | | | | | | | | | | 47,344 |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED EBITDA & ADJUSTED EBITDA RECONCILIATION TO PROFIT/LOSS - 1Q23 | | | | | | | |

| $ thousands | | Crops | Rice | Dairy | Farming | | Sugar, Ethanol & Energy | | Corporate | | Total |

| Revenue | | 34,562 | 55,357 | 58,608 | 148,527 | | 98,746 | | — | | 247,273 |

| Cost of revenue | | (30,386) | (42,243) | (51,102) | (123,731) | | (71,867) | | — | | (195,598) |

| Initial recog. and changes in FV of BA and agricultural produce | | (1,015) | 8,983 | 5,480 | 13,448 | | 48,256 | | — | | 61,704 |