0001862993

false

0001862993

2023-07-07

2023-07-07

0001862993

APCA:UnitsEachConsistingOfOneClassAOrdinarySharedollar0.0001parValueAndOnehalfOfOneRedeemableWarrantMember

2023-07-07

2023-07-07

0001862993

us-gaap:CommonClassAMember

2023-07-07

2023-07-07

0001862993

APCA:RedeemableWarrantsIncludedAsPartOfTheUnitsEachWholeWarrantExercisableForOneClassAOrdinaryShareAtAnExercisePriceOfDollar11.50Member

2023-07-07

2023-07-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 7, 2023

AP Acquisition Corp

(Exact name of registrant as specified in its

charter)

| Cayman

Islands |

|

001-41176

|

|

98-1601227 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification Number) |

10 Collyer Quay,

#37-00 Ocean Financial Center

Singapore |

N/A |

| (Address

of principal executive offices) |

(Zip

Code) |

852 2918-0050

Registrant’s telephone number, including

area code

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| x |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which registered |

| Units,

each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

APCA-U |

|

New

York Stock Exchange |

| Class

A ordinary shares included as part of the units |

|

APCA |

|

New

York Stock Exchange |

| Redeemable

warrants included as part of the units, each whole warrant exercisable for one Class A ordinary share at an exercise price of

$11.50 |

|

APCA-W |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act

of 1934.

Emerging

growth company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On July 7, 2023, AP Acquisition Corp, an

exempted company limited by shares incorporated under the laws of the Cayman Islands (“SPAC”) , entered into a deed of

non-redemption (“Deed”) with TOKYO CENTURY CORPORATION, a Japanese corporation incorporated under the laws of Japan and

a strategic partner of SPAC (the “Non-Redeeming Shareholder”), in connection with the extraordinary general meeting of

the SPAC’s shareholders to be called by SPAC (the “Extraordinary General Meeting”) to consider and approve, among

other proposals, the transactions (the “Business Combination”) contemplated by the Business Combination Agreement, dated

June 16, 2023, by and among SPAC, JEPLAN Holdings, Inc., a Japanese corporation (kabushiki kaisha) incorporated under the laws of

Japan (“PubCo”), JEPLAN MS, Inc., an exempted company limited by shares incorporated under the laws of the Cayman

Islands and a direct wholly-owned subsidiary of PubCo, and JEPLAN, Inc., a Japanese corporation (kabushiki kaisha) incorporated

under the laws of Japan (“JEPLAN”). All capitalized terms used but not defined herein shall have the respective

meanings specified in the Business Combination Agreement.

Pursuant to the Deed, the Non-Redeeming Shareholder

agreed that it will not elect to redeem, tender or submit for redemption, or otherwise exercise its SPAC Shareholder Redemption Right

with respect to, 500,000 Class A ordinary shares of SPAC (the “Subject Shares”) either in connection with the Business

Combination or in connection with any other meeting of SPAC’s shareholders or other event which would enable the Non-Redeeming Shareholder

to exercise its SPAC Shareholder Redemption Right at any time prior to the Closing. In addition, the Deed provides that the Non-Redeeming

Shareholder, from the date of the Deed until the date of its termination, shall not, directly or indirectly, sell, transfer, tender, grant,

pledge, assign or otherwise dispose of (including by gift, tender or exchange offer, merger or operation of law), encumber, hedge or utilize

a derivative to transfer the economic interest in (each a “Transfer”), or enter into any Contracts, option or other arrangement

(including any profit sharing arrangement) with respect to the Transfer of, any Subject Shares to any Person other than pursuant to the

Business Combination Agreement at Closing.

The Deed is expected to increase the amount

of funds that will remain in the Trust Account following the Extraordinary General Meeting, relative to the amount of funds that would

be expected to be remaining in the Trust Account following the Extraordinary General Meeting had the Deed not been entered into the and

Subject Shares had been redeemed.

The foregoing description is qualified in

its entirety by reference to the Deed attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Forward-Looking Statements

This

Current Report, including the exhibit, contains certain forward-looking statements within the meaning of the federal securities laws,

including statements regarding the expected benefits of the Deed. These forward-looking

statements generally are identified by the words “believe,” “project,” “forecast,” “predict,”

“expect,” “anticipate,” “estimate,” “intend,” “seek,” “strategy,”

“future,” “outlook,” “target,” “opportunity,” “plan,” “potential,”

“may,” “seem,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions that predict or indicate future events or trends or that are

not statements of historical matters. These forward-looking statements are provided for illustrative purposes only and are not intended

to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or

probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events

and circumstances are beyond the control of JEPLAN, PubCo, and SPAC. Many factors could cause actual future events to differ materially

from the forward-looking statements in this Current Report, including, but not limited to: (i) the risk that the Business Combination

may not be completed in a timely manner or at all, which may adversely affect the price of PubCo’s securities, (ii) the risk

that the Business Combination may not be completed by SPAC’s business combination deadline and the potential failure to obtain an

extension of the business combination deadline if sought by SPAC, (iii) the failure to satisfy the conditions to the consummation

of the Business Combination, including the adoption of the business combination agreement by the respective shareholders of SPAC and JEPLAN,

the satisfaction of the minimum cash amount following redemptions by SPAC’s public shareholders and the receipt of certain governmental

and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the Business Combination,

(v) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination

agreement, (vi) the effect of the announcement or pendency of the Business Combination on JEPLAN’s business relationships,

performance, and business generally, (vii) risks that the Business Combination disrupts current plans of JEPLAN and potential difficulties

in its employee retention as a result of the Business Combination, (viii) the outcome of any legal proceedings that may be instituted

against JEPLAN or SPAC related to the business combination agreement or the Business Combination, (ix) failure to realize the anticipated

benefits of the Business Combination, (x) the inability to maintain the listing of SPAC’s securities or to meet listing requirements

and maintain the listing of PubCo’s securities on the New York Stock Exchange, (xi) the risk that the price of PubCo’s

securities may be volatile due to a variety of factors, including changes in the highly competitive industries in which PubCo plans to

operate, variations in performance across competitors, changes in laws, regulations, technologies, natural disasters or health epidemics/pandemics, national

security tensions, and macro-economic and social environments affecting its business, and changes in the combined capital

structure, (xii) the inability to implement business plans, forecasts, and other expectations after the completion of the Business

Combination, identify and realize additional opportunities, and manage its growth and expanding operations, (xiii) the risk that

JEPLAN may not be able to successfully expand its products and services domestically and internationally, (xiv) the risk that JEPLAN

and its current and future collaborative partners are unable to successfully market or commercialize JEPLAN’s proposed licensing

solutions, or experience significant delays in doing so, (xv) the risk that JEPLAN may never achieve or sustain profitability, (xvi) the

risk that JEPLAN will need to raise additional capital to execute its business plan, which many not be available on acceptable terms or

at all, (xvii) the risk relating to scarce or poorly collected raw materials for JEPLAN’s PET recycling business; (xviii) the

risk that JEPLAN may not be able to consummate planned strategic acquisitions, including joint ventures in connection with its proposed

licensing business, or fully realize anticipated benefits from past or future acquisitions, joint ventures, or investments; (xix) the

risk that JEPLAN’s patent applications may not be approved or may take longer than expected, and that JEPLAN may incur substantial

costs in enforcing and protecting its intellectual property; and (xx) the risk that JEPLAN may be subject to competition from current

collaborative partners in the use of jointly developed technology once applicable collaborative arrangements expire. The foregoing list

of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the

“Risk Factors” sections of SPAC’s Annual Report on Form 10-K for the year ended December, 31, 2022, which was filed

with the SEC on March 3, 2023 (the “2022 Form 10-K”), as such factors may be updated from time to time in SPAC’s

filings with the SEC, the Registration Statement and proxy statement/prospectus contained therein. These filings identify and address

other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. There may be additional risks that neither JEPLAN, PubCo, or SPAC presently know or that JEPLAN, PubCo, and SPAC currently

believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Forward-looking

statements reflect SPAC’s expectations, plans, or forecasts of future events and views only as of the date they are made, and subsequent

events and developments are anticipated to cause such assessments to change. However, while SPAC may elect to update these forward-looking

statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not

be relied upon as representing SPAC’s assessments of any date subsequent to the date of this Current Report. Accordingly, readers

are cautioned not to put undue reliance on forward-looking statements, and SPAC assumes no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required to by applicable

securities law.

Additional Information and Where to Find It

If the Business Combination is pursued, PubCo

intends to file with the SEC a registration statement on Form F-4 relating to the Business Combination (the “Registration Statement”)

that will include a proxy statement/prospectus of SPAC. The proxy statement/prospectus will be sent to all SPAC and JEPLAN shareholders.

PubCo and SPAC also will file other documents regarding the Business Combination with the SEC. Before making any voting decision, investors

and security holders of SPAC and JEPLAN are urged to read the Registration Statement, the proxy statement/prospectus contained therein

and all other relevant documents filed or that will be filed with the SEC in connection with the Business Combination as they become available

because they will contain important information about JEPLAN, SPAC, PubCo, and the Business Combination.

Investors

and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that

will be filed with the SEC by PubCo and SPAC through the website maintained by the SEC at www.sec.gov. In addition, the documents

filed by PubCo and SPAC may be obtained free of charge by written request to PubCo at 12-2 Ogimachi, Kawasaki-ku, Kawasaki-shi, Kanagawa,

Japan or by telephone at +81 44-223-7898, and to SPAC at 10 Collyer Quay, #37-00 Ocean

Financial Center, Singapore or by telephone at +65 6808-6510.

Participants in Solicitation

JEPLAN, PubCo, and SPAC and their respective directors and officers and other members of management may, under SEC rules, be deemed to

be participants in the solicitation of proxies from SPAC’s shareholders with the Business Combination and the other matters set

forth in the Registration Statement. Information about SPAC’s directors and executive officers and their ownership of SPAC’s

securities is set forth in SPAC’s filings with the SEC, including SPAC’s 2022 Form 10-K. To the extent that holdings of SPAC’s

securities by its directors and executive officers have changed since the amounts reflected in the 2022 Form 10-K, such changes will be

reflected in the Registration Statement. Additional information regarding the interests of those persons and other persons who may be

deemed participants in the Business Combination may be obtained by reading the proxy statement/prospectus regarding the Business Combination

when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This Current Report shall not constitute a “solicitation”

as defined in Section 14 of the Exchange Act. This Current Report shall not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities in the

Business Combination shall be made except by means of a prospectus meeting the requirements of the Securities Act.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 12, 2023

| |

AP Acquisition Corp |

| |

|

| |

/s/ Keiichi Suzuki |

| |

Name: |

Keiichi Suzuki |

| |

Title: |

Chief Executive Officer and Director |

Exhibit 10.1

DEED OF NON-REDEMPTION

This DEED OF NON-REDEMPTION

(this “Deed”) is dated as of July 7, 2023

BY

TOKYO CENTURY CORPORATION, a Japanese corporation incorporated under

the laws of Japan (the “Investor”)

IN FAVOR OF

AP ACQUISITION CORP, an exempted

company limited by shares incorporated under the laws of the Cayman Islands (the “Company”).

RECITALS

WHEREAS, the Company is a

special purpose acquisition company whose Class A ordinary shares (“Company Shares”) are traded on the New York

Stock Exchange under the ticker symbol “APCA”, among other securities of the Company;

WHEREAS, the Company, JEPLAN

Holdings, Inc., a Japanese corporation (kabushiki kaisha) incorporated under the laws of Japan (“PubCo”),

JEPLAN MS, Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands and a direct wholly-owned

subsidiary of PubCo and JEPLAN, Inc., a Japanese corporation (kabushiki kaisha) incorporated under the laws of Japan have

entered into a business combination agreement, dated as of June 16, 2023 (as may be amended and/or restated from time to time, the

“Business Combination Agreement”);

WHEREAS, the Investor is

delivering this Deed in favor of the Company in anticipation of the closing of the business combination contemplated by the Business Combination

Agreement (the “Business Combination”);

WHEREAS, as of the date hereof

the Investor is the record and beneficial owner of the Subject Shares (as defined below);

WHEREAS, pursuant to the

terms of this Deed and in connection with the Business Combination, the Investor desires to undertake to refrain from exercising its SPAC

Shareholder Redemption Right with respect to the Subject Shares; and

WHEREAS, all capitalized

terms used but not defined herein shall have the respective meanings specified in the Business Combination Agreement.

NOW, THEREFORE, in consideration

of the mutual agreements set forth herein, the Investor hereby irrevocably undertakes as follows:

1. Non-Redemption

Undertaking. Subject to the terms and conditions set forth in this Deed, the Investor hereby irrevocably and unconditionally undertakes

that it will not elect to redeem, tender or submit for redemption, or otherwise exercise its SPAC Shareholder Redemption Right with respect

to, 500,000 Company Shares (the “Subject Shares”) either in connection with the Business Combination or in connection

with any other meeting of Company shareholders or other event which would enable the Investor to exercise its SPAC Shareholder Redemption

Right at any time prior to the Closing.

2. Restrictions.

The Investor hereby undertakes that from the date hereof until the date of termination of this Deed, it shall not, directly or indirectly,

sell, transfer, tender, grant, pledge, assign or otherwise dispose of (including by gift, tender or exchange offer, merger or operation

of law), encumber, hedge or utilize a derivative to transfer the economic interest in (each a “Transfer”), or enter

into any Contracts, option or other arrangement (including any profit sharing arrangement) with respect to the Transfer of, any Subject

Shares to any Person other than pursuant to the Business Combination Agreement at Closing.

3. Representations

and Warranties. Each of the parties hereto represents and warrants to the other party that: (a) it is a validly existing company

or corporation under the laws of the jurisdiction of its formation or incorporation; (b) this Deed constitutes a valid and legally

binding obligation on it in accordance with its terms, subject to laws relating to bankruptcy, insolvency and relief of debtors, and laws

governing specific performance, injunctive relief and other equitable remedies; (c) the execution, delivery and performance of this

Deed by it has been duly authorized by all necessary corporate action, and (d) the execution, delivery and performance of this Deed

will not result in a violation of its Organizational Documents or conflict with, or constitute a default (or an event that with notice

or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation

of, any Contracts to which it is a party or by which it is bound. The Investor represents and warrants to the Company that, as of the

date hereof, the Investor beneficially owns the Subject Shares.

4. Termination.

This Deed and all of its provisions shall terminate and be of no further force or effect upon the earliest to occur of (a) the termination

of the Business Combination Agreement in accordance with its terms, (b) the mutual written consent of the parties hereto and (c) the

Merger Effective Time. Upon any termination of this Deed, all obligations of the parties under this Deed will terminate, without any liability

or other obligation on the part of any party hereto to any Person in respect hereof or the transactions contemplated hereby; provided

that, notwithstanding the foregoing or anything to the contrary in this Deed, the termination of this Deed pursuant to sub-clauses

(a) and (c) above shall not affect any liability on the part of any party for breach of this Deed prior to such termination.

This Section 4 through and including Section 7 of this Deed will survive the termination of this Deed. The Company

hereby undertakes that it shall notify the Investor of the termination of this Deed immediately after it occurs.

5. Expenses.

Each party shall be responsible for its own fees and expenses related to this Deed and the transactions contemplated hereby.

6. Trust

Account Waiver. The Investor acknowledges that pursuant to the SPAC Prospectus, including the Trust Agreement, the Company has established

the Trust Account for the benefit of the Company’s public shareholders and that disbursements from the Trust Account are available

only in the limited circumstances set forth therein. The Investor further acknowledges and agrees that the Company’s sole assets

consist of the cash proceeds of the Company’s IPO and private placements of its securities occurring simultaneously with the IPO,

and that substantially all of these proceeds have been deposited in the Trust Account for the benefit of its public shareholders. Accordingly,

the Investor (on behalf of itself and its Affiliates) hereby waives any past, present or future claim of any kind arising out of this

Deed against, and any right to access, the Trust Account, any trustee of the Trust Account and the Company, to collect from the Trust

Account any monies that may be owed to them by the Company or any of its Affiliates for any reason whatsoever, and will not seek recourse

against the Trust Account at any time for any reason. Notwithstanding the foregoing, nothing herein shall serve to limit or prohibit the

Investor’s right to pursue a claim against the Company pursuant to this Deed for legal relief against monies or other assets of

the Company held outside the Trust Account or for specific performance or other equitable relief in connection with the transactions contemplated

in this Deed or for intentional fraud in the making of the representations and warranties in Section 3. This Section 6

shall survive the termination of this Deed for any reason.

7. Governing

Law; Dispute Resolution. This Deed shall be governed by and construed in accordance with the laws of Hong Kong without giving effect

to any choice or conflict of law provision or rule thereof. Any dispute, controversy, claim or difference of any kind whatsoever

arising out of, relating to or in connection with this Deed, including the existence, validity, interpretation, performance, breach or

termination thereof, the validity, scope and enforceability of this arbitration provision and any dispute regarding non-contractual obligations

arising out of or relating to it (each, a “Dispute”) shall be referred to and finally resolved by arbitration administered

by the Hong Kong International Arbitration Centre (the “HKIAC”) in accordance with the HKIAC Administered Arbitration

Rules in force at the time of the commencement of the arbitration. The seat of arbitration shall be Hong Kong. The number of arbitrators

shall be three (3). The arbitrators shall be nominated and appointed in accordance with the HKIAC Administered Arbitration Rules. The

language of the arbitration proceedings (including but not limited to all correspondence, submissions and written decisions) shall be

English. During the course of the arbitral tribunal’s adjudication of the Dispute, this Deed shall continue to be performed except

with respect to the part in dispute and under adjudication. The award shall be final and binding upon the parties to the arbitration.

Judgment upon the award may be entered by any court having jurisdiction over the award or having jurisdiction over the relevant party

or its assets.

8. Additional

Covenants. The Investor hereby covenants and agrees that, except for this Deed, the Investor shall not, at any time while this Deed

remains in effect, enter into any Contract or take any action that would make any representation or warranty of the Investor contained

herein untrue or inaccurate in any material respect or have the effect of preventing or disabling the Investor from performing any of

its obligations under this Deed.

9. Non-Reliance.

The Investor has had the opportunity to consult its own advisors, including legal, financial and tax advisors, regarding this Deed or

the arrangements contemplated hereunder and the Investor hereby acknowledges that neither the Company nor any representative or Affiliate

of the Company has provided or will provide the Investor with any legal, financial, tax or other advice relating to this Deed or the arrangements

contemplated hereunder.

10. No

Third Party Beneficiaries. This Deed shall be for the sole benefit of the parties and their respective successors and permitted assigns.

This Deed is not intended, nor shall be construed, to give any Person, other than the parties and their respective successors and assigns,

any legal or equitable right, benefit or remedy of any nature whatsoever by reason of this Deed. Other than the Company and the Investor,

a Person who is not a party to this Deed shall not have any right under the Contracts (Rights of Third Parties) Ordinance (Cap. 623 of

the Laws of Hong Kong) to enforce any term of this Deed.

11. Assignment.

This Deed and all of the provisions hereof will be binding upon and inure to the benefit of the parties hereto and their respective successors

and permitted assigns. Neither this Deed nor any of the rights, interests or obligations hereunder will be assigned (including by operation

of law) without the prior written consent of the non-assigning party hereto.

12. Specific

Performance. The parties hereto agree that irreparable damage may occur in the event that any of the provisions of this Deed are not

performed in accordance with their specific terms or are otherwise breached. It is accordingly agreed that monetary damages may not be

an adequate remedy for such breach and the non-breaching party shall be entitled to seek injunctive relief, in addition to any other remedy

that such party may have in law or in equity.

13. Amendment.

This Deed may not be amended, changed, supplemented, waived or otherwise modified, except upon the execution and delivery of a written

agreement executed by the parties hereto.

14. Severability.

If any provision of this Deed is held invalid or unenforceable by any court of competent jurisdiction, the other provisions of this Deed

will remain in full force and effect. Any provision of this Deed held invalid or unenforceable only in part or degree will remain in full

force and effect to the extent not held invalid or unenforceable.

15. No

Partnership, Agency or Joint Venture. This Deed is intended to create a contractual relationship between the Investor, on the one

hand, and the Company, on the other hand, and is not intended to create, and does not create, any agency, partnership, joint venture or

any like relationship between the parties.

16. Notices.

All general notices, demands or other communications required or permitted to be given or made hereunder shall be in writing and delivered

personally or sent by courier or sent by registered post or sent by electronic mail to the intended recipient thereof at its address or

at its email address set out below (or to such other address or email address as a party may from time to time notify the other parties).

Any such notice, demand or communication shall be deemed to have been duly served (a) if given personally or sent by courier, upon

delivery during normal business hours at the location of delivery or, if later, then on the next Business Day after the day of delivery;

(b) if sent by electronic mail during normal business hours at the location of delivery, immediately, or, if later, then on the next

Business Day after the day of delivery; (c) the third Business Day following the day sent by reputable international overnight courier

(with written confirmation of receipt), and (d) if sent by registered post, five days after posting. The initial addresses and email

addresses of the parties for the purpose of this Deed are:

If

to the Company:

AP Acquisition Corp

10 Collyer Quay

#37-00 Ocean Financial Center, Singapore

Attention: Keiichi Suzuki

Email: keiichi.suzuki@advantagepartners.com

with a copy (which will not constitute notice) to:

Kirkland & Ellis

26th Floor, Gloucester Tower, The Landmark

15 Queen’s Road Central, Hong Kong

Attention: Jesse Sheley; Joseph Raymond Casey

Email: jesse.sheley@kirkland.com; joseph.casey@kirkland.com

If

to the Investor:

Tokyo Century Corporation

[●]

Attention: [●]

Email: [●]

17. Counterparts.

This Deed may be executed in two or more counterparts (any of which may be delivered by electronic transmission), each of which shall

constitute an original, and all of which taken together shall constitute one and the same instrument, and shall include images of manually

executed signatures transmitted by electronic format (including, without limitation, “pdf”, “tif” or “jpg”)

and other electronic signatures (including, without limitation, DocuSign and AdobeSign). The use of electronic signatures and electronic

records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic

means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping

system to the fullest extent permitted by applicable law.

18. Entire

Agreement. This Deed and the agreements referenced herein constitute the entire agreement and understanding of the parties hereto

in respect of the subject matter hereof and supersede all prior understandings, agreements or representations by or among the parties

hereto to the extent that they relate in any way to the subject matter hereof.

[Signature page follows]

IN WITNESS WHEREOF, the undersigned has executed

and delivered this Deed of Non-Redemption as a deed as of the date first written above.

| SIGNED, SEALED AND DELIVERED AS A DEED in the name

of |

) |

|

/s/

Yoshimasa Kaneko |

|

| TOKYO CENTURY CORPORATION |

) |

|

| by its duly authorized representative |

) |

|

| |

) |

|

| |

) |

|

| |

) |

|

| |

|

|

| in the presence of: |

|

|

By executing this document the signatory warrants that

the signatory is duly authorized to execute this document on behalf of Tokyo Century Corporation |

| |

|

|

|

| /s/ Shunji Uchida |

|

|

|

| Signature of Witness |

|

|

|

| Name: Shunji Uchida |

|

|

|

[Signature Page to Deed

of Non-Redemption]

IN WITNESS WHEREOF, the undersigned has executed

and delivered this Deed of Non-Redemption as a deed as of the date first written above.

SIGNED,

SEALED AND DELIVERED AS A DEED in the name

of AP ACQUISITION CORP by its duly authorized representative

|

)

) |

|

/s/ Keiichi Suzuki |

|

| |

) |

|

| |

) |

|

| |

) |

|

| |

) |

|

| in the presence of: |

|

|

By executing this document the signatory warrants that the signatory is duly authorized to execute this document on behalf of AP Acquisition Corp |

| |

|

|

|

| /s/ Shinya Takizawa |

|

|

|

| Signature of Witness |

|

|

|

| Name: Shinya Takizawa |

|

|

|

[Signature Page to Deed

of Non-Redemption]

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=APCA_UnitsEachConsistingOfOneClassAOrdinarySharedollar0.0001parValueAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=APCA_RedeemableWarrantsIncludedAsPartOfTheUnitsEachWholeWarrantExercisableForOneClassAOrdinaryShareAtAnExercisePriceOfDollar11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

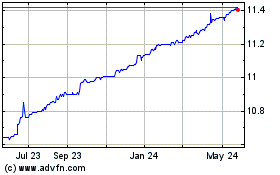

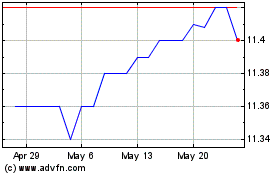

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Dec 2023 to Dec 2024