false

0001433270

0001433270

2025-02-12

2025-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

February 12, 2025

ANTERO RESOURCES CORPORATION

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36120 |

|

80-0162034 |

(State or Other

Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

1615 Wynkoop Street

Denver, Colorado 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s

Telephone Number, Including Area Code: (303)

357-7310

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading symbol(s) |

Name

of each exchange on which

registered |

| Common

Stock, par value $0.01 Per Share |

AR |

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition |

On February 12,

2025, Antero Resources Corporation issued a press release, a copy of which is attached hereto as Exhibit 99.1 and incorporated by

reference herein, announcing its financial and operational results for the quarter and year ended December 31, 2024.

The information

in this Current Report, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of

1933, as amended, or the Exchange Act unless specifically identified therein as being incorporated therein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANTERO RESOURCES CORPORATION |

| |

|

| |

By: |

/s/ Michael

N. Kennedy |

| |

|

Michael N. Kennedy |

| |

|

Chief Financial Officer and Senior Vice President – Finance |

Dated: February 12, 2025

Exhibit 99.1

Antero Resources Announces Fourth Quarter 2024

Results, Year End Reserves and 2025 Guidance

Denver, Colorado, February 12, 2025—Antero

Resources Corporation (NYSE: AR) (“Antero Resources,” “Antero,” or the “Company”) today announced

its fourth quarter 2024 financial and operating results, year end 2024 estimated proved reserves and 2025 guidance. The relevant consolidated

financial statements are included in Antero Resources’ Annual Report on Form 10-K for the year ended December 31, 2024.

Fourth Quarter

2024 Highlights:

| · | Net

production averaged 3.4 Bcfe/d |

| o | Natural

gas production averaged 2.1 Bcf/d, a 7% decrease from the year ago period |

| o | Liquids

production averaged 217 MBbl/d, a 14% increase from the year ago period |

| · | Realized

a pre-hedge natural gas equivalent price of $3.64 per Mcfe, an $0.85 per Mcfe premium to

NYMEX |

| · | Realized

a pre-hedge C3+ NGL price of $44.29 per barrel, a $3.09 per barrel premium to Mont Belvieu |

| · | Net

income was $150 million and Adjusted Net Income was $181 million (Non-GAAP) |

| · | Adjusted

EBITDAX was $332 million (Non-GAAP); net cash provided by operating activities was $278 million |

| · | Drilling

and completion capital was $120 million, 27% below the prior year period |

| · | Free

Cash Flow was $159 million (Non-GAAP) |

| · | Averaged

a quarterly company record of 13.2 completion stages per day |

Full Year 2024 Highlights:

| · | Net

Production averaged 3.4 Bcfe/d, an increase of 1% from the prior year |

| o | Natural

gas production averaged 2.2 Bcf/d, a decrease of 3% from the prior year |

| o | Liquids

production averaged 209 MBbl/d, an increase of 8% from the prior year |

| · | Drilling

and completion capital was $620 million, a 32% decline from the prior year |

| · | Completion

stages per day averaged 12.2 stages per day, a 14% increase compared to 2023 |

| · | Estimated

proved reserves were 17.9 Tcfe at year end 2024 and proved developed reserves were 13.7 Tcfe

(77% proved developed) |

| · | Estimated

future development cost for 4.2 Tcfe of proved undeveloped reserves is $0.44 per Mcfe |

2025 Guidance Highlights:

| · | Raised

previously communicated maintenance production targets by 50 MMcfe/d to 3.35 to 3.45 Bcfe/d,

driven by growth in liquids production |

| · | Realized

natural gas price is expected to average a premium of $0.10 to $0.20 per Mcf to NYMEX |

| · | Realized

C3+ NGL price is expected to average a premium of $1.50 to $2.50 per barrel to Mont Belvieu |

| · | Reduced

previously communicated drilling and completion capital budget, by $25 million at the midpoint

to $650 million to $700 million |

Paul Rady, Chairman, CEO and President of Antero

Resources commented, “Our 2024 development program delivered production that was 2% above the midpoint of the initial guidance

range and capital that was 8% below the midpoint of the initial guidance range. This exceptional performance highlights the strength

of our asset base and the significant capital efficiency gains we made throughout the year. Our 2025 budget reflects an increase to our

maintenance production targets driven by our liquids. This development program positions us to capture a significant increase in Free

Cash Flow year-over-year with the greatest exposure to higher natural gas prices.”

Michael Kennedy, CFO of Antero Resources said,

“Antero’s 2024 financial results reflect the company’s peer-leading Free Cash Flow breakeven level driven by our significant

liquids production and firm transportation portfolio. These attributes enabled us to generate Free Cash Flow of $73 million in 2024 despite

being unhedged with Henry Hub averaging $2.27 per Mcf. Looking ahead to 2025, our firm transportation portfolio delivers 75% of our natural

gas to the LNG corridor along the Gulf Coast, and is expected to result in higher premium price realizations to NYMEX following the recent

start-up of two large LNG export terminals in the Gulf.”

For a discussion of the non-GAAP financial

measures including Adjusted Net Income, Adjusted EBITDAX, Free Cash Flow and Net Debt please see “Non-GAAP Financial Measures.”

2025 Guidance

Antero’s 2025 drilling and completion capital

budget is $650 to $700 million. Net production is expected to average between 3.35 and 3.45 Bcfe/d during 2025. The Company’s land

capital guidance is $75 million to $100 million.

The following is a summary of Antero

Resources’ 2025 capital budget.

| Capital Budget ($ in Millions) | |

Low | | |

High | |

| Drilling & Completion | |

$ | 650 | | |

$ | 700 | |

| Land | |

$ | 75 | | |

$ | 100 | |

| Total E&P Capital | |

$ | 725 | | |

$ | 800 | |

#

of Wells | |

Net

Wells | | |

Average

Lateral

Length (Feet) | |

| Drilled Wells (Net) | |

| 50

to 55 | | |

| 13,100 | |

| Completed Wells (Net) | |

| 60 to 65 | | |

| 13,700 | |

The following is a summary of Antero Resources’

2025 production, pricing and cash expense guidance:

| Production Guidance | |

Low | | |

High | |

| Net Daily Natural Gas Equivalent Production

(Bcfe/d) | |

| 3.35 | | |

| 3.45 | |

| Net Daily Natural Gas Production

(Bcf/d) | |

| 2.16 | | |

| 2.2 | |

| Total Net Daily Liquids Production

(MBbl/d): | |

| 198 | | |

| 208 | |

| Net Daily C3+ NGL Production (MBbl/d) | |

| 113 | | |

| 117 | |

| Net Daily Ethane Production (MBbl/d) | |

| 76 | | |

| 80 | |

| Net Daily Oil Production (MBbl/d) | |

| 9 | | |

| 11 | |

| Realized Pricing Guidance

(Before Hedges) | |

Low | | |

High | |

| Natural Gas Realized Price Premium vs. NYMEX

Henry Hub ($/Mcf) | |

$ | 0.10 | | |

$ | 0.20 | |

| C3+ NGL Realized Price Premium vs. Mont Belvieu ($/Bbl) | |

$ | 1.50 | | |

$ | 2.50 | |

| Ethane Realized Price Premium vs. Mont Belvieu ($/Bbl) | |

$ | 1.00 | | |

$ | 2.00 | |

| Oil Realized Price Differential vs. WTI Oil ($/Bbl) | |

$ | (12.00 | ) | |

$ | (16.00 | ) |

| Cash Expense Guidance | |

Low | | |

High | |

| Cash

Production Expense ($/Mcfe)(1) | |

$ | 2.45 | | |

$ | 2.55 | |

| Marketing Expense, Net of Marketing Revenue ($/Mcfe) | |

$ | 0.04 | | |

$ | 0.06 | |

| G&A

Expense ($/Mcfe)(2) | |

$ | 0.12 | | |

$ | 0.14 | |

| (1) | Includes lease operating, gathering,

compression, processing and transportation expenses (“GP&T”) and production

and ad valorem taxes. |

| (2) | Excludes equity-based compensation. |

Commodity Derivative Positions

Antero added new natural gas hedges for 2025

and 2026 with amounts tied to the completion of two lean (approximately 1200 BTU gas) drilled but uncompleted (“DUC”) pads

that were deferred in 2024. Antero’s portfolio includes lean gas development in its capital budget for high gas productivity and

midstream infrastructure availability. The hedges were added to lock in attractive rates of returns on the two deferred pads. Antero

expects to turn-to-sales the first DUC pad during the first quarter of 2025 and the second DUC pad in the third quarter of 2025. Antero

did not enter into any new liquids hedges during the fourth quarter of 2024. For more detail please see the presentation titled “Hedge

and Guidance Presentation” on Antero’s website.

| | |

Natural Gas

MMBtu/d | | |

Weighted

Average Index

Price ($/MMBtu) | | |

% of Estimated

Natural Gas

Production (1) | |

| 2025 NYMEX Henry Hub Swap | |

| 100,000 | | |

$ | 3.12 | | |

| 4 | % |

| | |

| | |

Weighted Average Index | | |

| |

| | |

Natural

Gas

MMBtu/d | | |

Ceiling Price

($/MMBtu) | | |

Floor Price

($/MMBtu) | | |

% of Estimated

Natural Gas

Production (1) | |

| 2026 NYMEX Henry Hub Collars | |

| 30,000 | | |

$ | 4.27 | | |

$ | 3.25 | | |

| 1 | % |

| (1) | Based on the midpoint of 2025

natural gas guidance (including BTU upgrade) |

Fourth Quarter 2024 Financial Results

Net daily natural gas equivalent production in

the fourth quarter averaged 3.4 Bcfe/d, including 217 MBbl/d of liquids. Antero’s average realized natural gas price before hedges

was $2.77 per Mcf, a $0.02 per Mcf discount to the benchmark index price. Antero’s average realized C3+ NGL price before hedges

was $44.29 per barrel, a $3.09 per barrel premium to the benchmark index price.

The following table details average net production

and average realized prices for the three months ended December 31, 2024:

| | |

Three Months Ended

December 31, 2024 | |

| | |

Natural

Gas | | |

Oil | | |

C3+ NGLs | | |

Ethane | | |

Combined

Natural Gas

Equivalent

| |

| | |

(MMcf/d) | | |

(Bbl/d) | | |

(Bbl/d) | | |

(Bbl/d) | | |

(MMcfe/d) | |

| Average Net Production | |

| 2,131 | | |

| 9,239 | | |

| 114,815 | | |

| 92,587 | | |

| 3,431 | |

| | |

Three Months Ended

December 31, 2024 | |

| | |

Natural

Gas | | |

Oil | | |

C3+ NGLs | | |

Ethane | | |

Combined

Natural Gas

Equivalent

| |

| Average Realized Prices | |

($/Mcf) | | |

($/Bbl) | | |

($/Bbl) | | |

($/Bbl) | | |

($/Mcfe) | |

| Average realized prices before settled derivatives | |

$ | 2.77 | | |

| 57.80 | | |

| 44.29 | | |

| 10.31 | | |

| 3.64 | |

| Index price | |

$ | 2.79 | | |

| 70.27 | | |

| 41.20 | | |

| 9.24 | | |

| 2.79 | |

| Premium / (Discount) to Index price | |

$ | (0.02 | ) | |

| (12.47 | ) | |

| 3.09 | | |

| 1.07 | | |

| 0.85 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Settled commodity derivatives | |

$ | (0.01 | ) | |

| (0.11 | ) | |

| 0.14 | | |

| — | | |

| (0.01 | ) |

| Average realized prices after settled derivatives | |

$ | 2.76 | | |

| 57.69 | | |

| 44.43 | | |

| 10.31 | | |

| 3.63 | |

| Premium / (Discount) to Index price | |

$ | (0.03 | ) | |

| (12.58 | ) | |

| 3.23 | | |

| 1.07 | | |

| 0.84 | |

All-in cash expense, which includes lease operating,

gathering, compression, processing and transportation and production and ad valorem taxes was $2.45 per Mcfe in the fourth quarter, as

compared to $2.32 per Mcfe during the fourth quarter of 2023. The increase was due primarily to higher gathering, compression and processing

costs related to CPI-based adjustments in 2024 and an increase in ad valorem taxes that is based on higher commodity prices in 2022.

Net marketing expense was $0.06 per Mcfe in the fourth quarter, compared to $0.05 per Mcfe during the fourth quarter of 2023.

Free Cash Flow

During the fourth quarter of 2024, Free Cash

Flow was $159 million.

| | |

Three Months Ended | |

| | |

December 31, | |

| | |

2023 | | |

2024 | |

| Net cash provided by operating activities | |

$ | 312,175 | | |

| 278,002 | |

| Less: Capital expenditures (1) | |

| (219,817 | ) | |

| (128,315 | ) |

| Less: Distributions to non-controlling interests in Martica | |

| (24,578 | ) | |

| (15,651 | ) |

| Free Cash Flow | |

$ | 67,780 | | |

| 134,036 | |

| Changes in Working Capital (2) | |

| 29,203 | | |

| 24,845 | |

| Free Cash Flow before Changes in Working

Capital | |

$ | 96,983 | | |

| 158,881 | |

| (1) | Capital expenditures includes additions to unproved properties, drilling and completion costs and additions to other property and equipment. |

| (2) | Working capital adjustments include changes in current assets and liabilities

and changes in accounts payable and accrued liabilities for additions to property and equipment. |

Fourth Quarter 2024 Operating Results

| · | Antero

placed 5 horizontal Marcellus wells to sales during the fourth quarter with an average lateral

length of 17,950 feet |

| · | These

wells have been on line for approximately 60 days with an average rate per well of 34 MMcfe/d,

including 1,650 Bbl/d of liquids per well assuming 25% ethane recovery |

Fourth Quarter 2024 Capital Investment

Antero’s drilling and completion capital

expenditures for the three months ended December 31, 2024, were $120 million. In addition to capital invested in drilling and completion

activities, the Company invested $22 million in land during the fourth quarter. During the quarter, Antero added approximately 4,200

net acres, representing 15 incremental drilling locations at an average cost of approximately $950,000 per location. During 2024, Antero

added 59 locations at an average cost of approximately $900,000 per location. These additions more than offset the wells Antero turned-to-sales

during the year.

Year End Proved Reserves

At December 31, 2024, Antero’s estimated

proved reserves were 17.9 Tcfe, flat from the prior year before sales of reserves in place. Estimated proved reserves were comprised

of 59% natural gas, 40% NGLs and 1% oil.

Estimated proved developed reserves were 13.7

Tcfe, flat from the prior year. The percentage of estimated proved reserves classified as proved developed increased to 77% at year end

2024. At year end 2024, Antero’s five year development plan included 289 gross PUD locations. Antero's proved undeveloped locations

have an average estimated BTU of 1259, with an average lateral length of 13,800 feet.

Antero's 4.2 Tcfe of estimated proved undeveloped

reserves will require an estimated $1.8 billion of future development capital over the next five years, resulting in an estimated average

future development cost for proved undeveloped reserves of $0.44 per Mcfe.

The following table presents a summary of changes

in estimated proved reserves (in Tcfe).

| Proved reserves, December 31, 2023 | |

| 18.1 | |

| Extensions, discoveries and other additions | |

| 0.8 | |

| Revisions of previous estimates | |

| 0.3 | |

| Revisions to five-year development plan | |

| 0.2 | |

| Price revisions | |

| (0.1 | ) |

| Sales of reserves in place | |

| (0.2 | ) |

| Production | |

| (1.2 | ) |

| Proved reserves, December 31, 2024 | |

| 17.9 | |

Conference Call

A conference call is scheduled on Thursday, February 13,

2025 at 9:00 am MT to discuss the financial and operational results. A brief Q&A session for security analysts will immediately follow

the discussion of the results. To participate in the call, dial in at 877-407-9079 (U.S.), or 201-493-6746 (International) and reference

“Antero Resources.” A telephone replay of the call will be available until Thursday, February 20, 2025 at 9:00 am MT

at 877-660-6853 (U.S.) or 201-612-7415 (International) using the conference ID: 13750392. To access the live webcast and view the related

earnings conference call presentation, visit Antero's website at www.anteroresources.com. The webcast will be archived for replay until

Thursday, February 20, 2025 at 9:00 am MT.

Presentation

An updated presentation will be posted to the

Company's website before the conference call. The presentation can be found at www.anteroresources.com on the homepage. Information

on the Company's website does not constitute a portion of, and is not incorporated by reference into this press release.

Non-GAAP Financial Measures

Adjusted Net Income (Loss)

Adjusted Net Income as set forth in this release

represents net income, adjusted for certain items. Antero believes that Adjusted Net Income is useful to investors in evaluating operational

trends of the Company and its performance relative to other oil and gas producing companies. Adjusted Net Income is not a measure of

financial performance under GAAP and should not be considered in isolation or as a substitute for net income (loss) as an indicator of

financial performance. The GAAP measure most directly comparable to Adjusted Net Income is net income. The following table reconciles

net income to Adjusted Net Income (in thousands):

| | |

Three Months Ended December 31, | |

| | |

2023 | | |

2024 | |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 81,839 | | |

| 149,649 | |

| Net income and comprehensive income attributable to noncontrolling interests | |

| 21,169 | | |

| 9,164 | |

| Unrealized commodity derivative (gains) losses | |

| (37,272 | ) | |

| 20,122 | |

| Amortization of deferred revenue, VPP | |

| (7,700 | ) | |

| (6,812 | ) |

| Loss on sale of assets | |

| — | | |

| 1,989 | |

| Impairment of property and equipment | |

| 6,556 | | |

| 28,475 | |

| Equity-based compensation | |

| 14,531 | | |

| 17,169 | |

| Loss on convertible note inducement | |

| 288 | | |

| — | |

| Equity in earnings of unconsolidated affiliate | |

| (23,966 | ) | |

| (23,925 | ) |

| Contract termination, loss contingency and settlements | |

| 4,956 | | |

| 937 | |

| Tax effect of reconciling items (1) | |

| 9,538 | | |

| (8,257 | ) |

| | |

| 69,939 | | |

| 188,511 | |

| Martica adjustments (2) | |

| (11,473 | ) | |

| (7,858 | ) |

| Adjusted Net Income | |

$ | 58,466 | | |

| 180,653 | |

| | |

| | | |

| | |

| Diluted Weighted Average Common Shares Outstanding (3) | |

| 311,956 | | |

| 314,165 | |

| (1) | Deferred taxes were approximately 22% for

2023 and 2024, respectively. |

| (2) | Adjustments reflect noncontrolling interest

in Martica not otherwise adjusted in amounts above. |

| (3) | Diluted weighted average shares outstanding

does not include securities that would have had an anti-dilutive effect on the computation

of diluted earnings per share. Anti-dilutive weighted average shares outstanding for the

three months ended December 31, 2023 and 2024 were 0.7 million and 0.3 million, respectively. |

Net Debt

Net Debt is calculated as total long-term debt

less cash and cash equivalents. Management uses Net Debt to evaluate the Company’s financial position, including its ability to

service its debt obligations.

The following table reconciles consolidated total

long-term debt to Net Debt as used in this release (in thousands):

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2024 | |

| Credit Facility | |

$ | 417,200 | | |

| 393,200 | |

| 8.375% senior notes due 2026 | |

| 96,870 | | |

| 96,870 | |

| 7.625% senior notes due 2029 | |

| 407,115 | | |

| 407,115 | |

| 5.375% senior notes due 2030 | |

| 600,000 | | |

| 600,000 | |

| 4.250% convertible senior notes due 2026 | |

| 26,386 | | |

| — | |

| Unamortized debt issuance costs | |

| (9,975 | ) | |

| (7,955 | ) |

| Total long-term debt | |

$ | 1,537,596 | | |

| 1,489,230 | |

| Less: Cash and cash equivalents | |

| — | | |

| — | |

| Net Debt | |

$ | 1,537,596 | | |

| 1,489,230 | |

Free Cash Flow

Free Cash Flow is a measure of financial performance not calculated

under GAAP and should not be considered in isolation or as a substitute for cash flow from operating, investing, or financing activities,

as an indicator of cash flow or as a measure of liquidity. The Company defines Free Cash Flow as net cash provided by operating activities,

less capital expenditures, which includes additions to unproved properties, drilling and completion costs and additions

to other property and equipment, less net derivative monetizations

and distributions to non-controlling interests in Martica.

The Company has not provided projected net cash

provided by operating activities or a reconciliation of Free Cash Flow to projected net cash provided by operating activities, the most

comparable financial measure calculated in accordance with GAAP. The Company is unable to project net cash provided by operating activities

for any future period because this metric includes the impact of changes in operating assets and liabilities related to the timing of

cash receipts and disbursements that may not relate to the period in which the operating activities occurred. The Company is unable to

project these timing differences with any reasonable degree of accuracy without unreasonable efforts.

Free Cash Flow is a useful indicator of the Company’s

ability to internally fund its activities, service or incur additional debt and estimate our ability to return capital to shareholders.

There are significant limitations to using Free Cash Flow as a measure of performance, including the inability to analyze the effect

of certain recurring and non-recurring items that materially affect the Company’s net income, the lack of comparability of results

of operations of different companies and the different methods of calculating Free Cash Flow reported by different companies. Free Cash

Flow does not represent funds available for discretionary use because those funds may be required for debt service, land acquisitions

and lease renewals, other capital expenditures, working capital, income taxes, exploration expenses, and other commitments and obligations.

Adjusted EBITDAX

Adjusted EBITDAX is a non-GAAP financial measure

that we define as net income, adjusted for certain items detailed below.

Adjusted EBITDAX as used and defined by us, may

not be comparable to similarly titled measures employed by other companies and is not a measure of performance calculated in accordance

with GAAP. Adjusted EBITDAX should not be considered in isolation or as a substitute for operating income or loss, net income or loss,

cash flows provided by operating, investing, and financing activities, or other income or cash flow statement data prepared in accordance

with GAAP. Adjusted EBITDAX provides no information regarding our capital structure, borrowings, interest costs, capital expenditures,

working capital movement, or tax position. Adjusted EBITDAX does not represent funds available for discretionary use because those funds

may be required for debt service, capital expenditures, working capital, income taxes, exploration expenses, and other commitments and

obligations. However, our management team believes Adjusted EBITDAX is useful to an investor in evaluating our financial performance

because this measure:

| · | is

widely used by investors in the oil and natural gas industry to measure operating performance

without regard to items excluded from the calculation of such term, which may vary substantially

from company to company depending upon accounting methods and the book value of assets, capital

structure and the method by which assets were acquired, among other factors; |

| · | helps

investors to more meaningfully evaluate and compare the results of our operations from period

to period by removing the effect of our capital and legal structure from our operating structure; |

| · | is

used by our management team for various purposes, including as a measure of our operating

performance, in presentations to our Board of Directors, and as a basis for strategic planning

and forecasting: and |

| · | is

used by our Board of Directors as a performance measure in determining executive compensation. |

There are significant limitations to using Adjusted

EBITDAX as a measure of performance, including the inability to analyze the effects of certain recurring and non-recurring items that

materially affect our net income or loss, the lack of comparability of results of operations of different companies, and the different

methods of calculating Adjusted EBITDAX reported by different companies.

The GAAP measures most directly comparable to

Adjusted EBITDAX are net income and net cash provided by operating activities. The following table represents a reconciliation of Antero’s

net income, including noncontrolling interest, to Adjusted EBITDAX and a reconciliation of Antero’s Adjusted EBITDAX to net cash

provided by operating activities per our condensed consolidated statements of cash flows, in each case, for the three months and years

ended December 31, 2023 and 2024 (in thousands). Adjusted EBITDAX also excludes the noncontrolling interests in Martica, and these

adjustments are disclosed in the table below as Martica related adjustments.

| | |

Three Months Ended | | |

Year Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Reconciliation of net income to Adjusted EBITDAX: | |

| | | |

| | | |

| | | |

| | |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 81,839 | | |

| 149,649 | | |

| 198,404 | | |

| 57,226 | |

| Net income and comprehensive income attributable to noncontrolling interests | |

| 21,169 | | |

| 9,164 | | |

| 98,925 | | |

| 36,471 | |

| Unrealized commodity derivative (gains) losses | |

| (37,272 | ) | |

| 20,122 | | |

| (394,046 | ) | |

| 9,423 | |

| Payments for derivative monetizations | |

| — | | |

| — | | |

| 202,339 | | |

| — | |

| Amortization of deferred revenue, VPP | |

| (7,700 | ) | |

| (6,812 | ) | |

| (30,552 | ) | |

| (27,101 | ) |

| Gain (loss) on sale of assets | |

| — | | |

| 1,989 | | |

| (447 | ) | |

| 862 | |

| Interest expense, net | |

| 32,608 | | |

| 27,061 | | |

| 117,870 | | |

| 118,207 | |

| Loss on early extinguishment of debt | |

| — | | |

| — | | |

| — | | |

| 528 | |

| Loss on convertible note inducements | |

| 288 | | |

| — | | |

| 374 | | |

| — | |

| Income tax expense (benefit) | |

| 26,390 | | |

| (104,170 | ) | |

| 63,626 | | |

| (118,185 | ) |

| Depletion, depreciation, amortization and accretion | |

| 191,508 | | |

| 194,899 | | |

| 750,093 | | |

| 765,827 | |

| Impairment of property and equipment | |

| 6,556 | | |

| 28,475 | | |

| 51,302 | | |

| 47,433 | |

| Exploration expense | |

| 603 | | |

| 702 | | |

| 2,691 | | |

| 2,618 | |

| Equity-based compensation expense | |

| 14,531 | | |

| 17,169 | | |

| 59,519 | | |

| 66,462 | |

| Equity in earnings of unconsolidated affiliate | |

| (23,966 | ) | |

| (23,925 | ) | |

| (82,952 | ) | |

| (93,787 | ) |

| Dividends from unconsolidated affiliate | |

| 31,284 | | |

| 31,314 | | |

| 125,138 | | |

| 125,197 | |

| Contract termination, loss contingency, transaction expense and other | |

| 4,981 | | |

| 1,404 | | |

| 55,491 | | |

| 4,933 | |

| | |

| 342,819 | | |

| 347,041 | | |

| 1,217,775 | | |

| 996,114 | |

| Martica related adjustments (1) | |

| (20,373 | ) | |

| (15,105 | ) | |

| (97,257 | ) | |

| (63,789 | ) |

| Adjusted EBITDAX | |

$ | 322,446 | | |

| 331,936 | | |

| 1,120,518 | | |

| 932,325 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of our Adjusted EBITDAX to net cash provided by operating activities: | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDAX | |

$ | 322,446 | | |

| 331,936 | | |

| 1,120,518 | | |

| 932,325 | |

| Martica related adjustments (1) | |

| 20,373 | | |

| 15,105 | | |

| 97,257 | | |

| 63,789 | |

| Interest expense, net | |

| (32,608 | ) | |

| (27,061 | ) | |

| (117,870 | ) | |

| (118,207 | ) |

| Amortization of debt issuance costs and other | |

| (337 | ) | |

| 520 | | |

| 2,264 | | |

| 2,420 | |

| Exploration expense | |

| (603 | ) | |

| (702 | ) | |

| (2,691 | ) | |

| (2,618 | ) |

| Changes in current assets and liabilities | |

| 9,259 | | |

| (39,944 | ) | |

| 143,278 | | |

| (24,806 | ) |

| Contract termination, loss contingency, settlements, transaction expense and other | |

| (4,782 | ) | |

| (1,203 | ) | |

| (43,391 | ) | |

| 411 | |

| Payments for derivative monetizations | |

| — | | |

| — | | |

| (202,339 | ) | |

| — | |

| Other items | |

| (1,573 | ) | |

| (649 | ) | |

| (2,305 | ) | |

| (4,026 | ) |

| Net cash provided by operating activities | |

$ | 312,175 | | |

| 278,002 | | |

| 994,721 | | |

| 849,288 | |

| (1) | Adjustments reflect noncontrolling interests

in Martica not otherwise adjusted in amounts above. |

Drilling and Completion Capital Expenditures

For a reconciliation between cash paid for drilling

and completion capital expenditures and drilling and completion accrued capital expenditures during the period, please see the capital

expenditures section below (in thousands):

| | |

Three Months Ended

December 31, | |

| | |

2023 | | |

2024 | |

| Drilling and completion costs (cash basis) | |

$ | 204,494 | | |

| 105,552 | |

| Change in accrued capital costs | |

| (40,265 | ) | |

| 14,912 | |

| Adjusted drilling and completion costs (accrual basis) | |

$ | 164,229 | | |

| 120,464 | |

Notwithstanding their use for comparative purposes,

the Company’s non-GAAP financial measures may not be comparable to similarly titled measures employed by other companies.

Antero Resources is an independent natural

gas and natural gas liquids company engaged in the acquisition, development and production of unconventional properties located in the

Appalachian Basin in West Virginia and Ohio. In conjunction with its affiliate, Antero Midstream Corporation (NYSE: AM), Antero is one

of the most integrated natural gas producers in the U.S. The Company’s website is located at www.anteroresources.com.

This release includes "forward-looking

statements." Such forward-looking statements are subject to a number of risks and uncertainties, many of which are not under Antero

Resources’ control. All statements, except for statements of historical fact, made in this release regarding activities, events

or developments Antero Resources expects, believes or anticipates will or may occur in the future, such as those regarding our strategy,

future operations, financial position, estimated revenues and losses, projected costs, estimated realized natural gas, NGL and oil prices,

anticipated reductions in letters of credit and interest expense, prospects, plans and objectives of management, return of capital, expected

results, impacts of geopolitical and world health events, future commodity prices, future production targets, including those related

to certain levels of production, future earnings, leverage targets and debt repayment, future capital spending plans, improved and/or

increasing capital efficiency, expected drilling and development plans, projected well costs and cost savings initiatives, operations

of Antero Midstream, future financial position, the participation level of our drilling partner and the financial and production results

to be achieved as a result of that drilling partnership, the other key assumptions underlying our projections, and future marketing opportunities,

are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All forward-looking statements speak only as of the date of this release. Although Antero Resources believes that

the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance

that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially differ from what

is expressed, implied or forecast in such statements. Except as required by law, Antero Resources expressly disclaims any obligation

to and does not intend to publicly update or revise any forward-looking statements.

Antero Resources cautions you that these forward-looking

statements are subject to all of the risks and uncertainties, incident to the exploration for and development, production, gathering

and sale of natural gas, NGLs and oil, most of which are difficult to predict and many of which are beyond the Antero Resources’

control. These risks include, but are not limited to, commodity price volatility, inflation, supply chain or other disruption, availability

and cost of drilling, completion and production equipment and services, environmental risks, drilling and completion and other operating

risks, marketing and transportation risks, regulatory changes or changes in law, the uncertainty inherent in estimating natural gas,

NGLs and oil reserves and in projecting future rates of production, cash flows and access to capital, the timing of development expenditures,

conflicts of interest among our stockholders, impacts of geopolitical and world health events, cybersecurity risks, the state of markets

for, and availability of, verified quality carbon offsets and the other risks described under the heading " Risk Factors" in

Antero Resources’ Annual Report on Form 10-K for the year ended December 31, 2024.

For more information, contact Daniel Katzenberg,

Director - Finance and Investor Relations of Antero Resources at (303) 357-7219 or dkatzenberg@anteroresources.com.

ANTERO RESOURCES CORPORATION

Consolidated Balance Sheets

(In thousands, except per share amounts)

| | |

December 31, | |

| | |

2023 | | |

2024 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Accounts receivable | |

$ | 42,619 | | |

| 34,413 | |

| Accrued revenue | |

| 400,805 | | |

| 453,613 | |

| Derivative instruments | |

| 5,175 | | |

| 1,050 | |

| Prepaid expenses | |

| 12,901 | | |

| 12,423 | |

| Other current assets | |

| 14,192 | | |

| 6,047 | |

| Total current assets | |

| 475,692 | | |

| 507,546 | |

| Property and equipment: | |

| | | |

| | |

| Oil and gas properties, at cost (successful efforts method): | |

| | | |

| | |

| Unproved properties | |

| 974,642 | | |

| 879,483 | |

| Proved properties | |

| 13,908,804 | | |

| 14,395,680 | |

| Gathering systems and facilities | |

| 5,802 | | |

| 5,802 | |

| Other property and equipment | |

| 98,668 | | |

| 105,871 | |

| | |

| 14,987,916 | | |

| 15,386,836 | |

| Less accumulated depletion, depreciation and amortization | |

| (5,165,449 | ) | |

| (5,699,286 | ) |

| Property and equipment, net | |

| 9,822,467 | | |

| 9,687,550 | |

| Operating leases right-of-use assets | |

| 2,965,880 | | |

| 2,549,398 | |

| Derivative instruments | |

| 5,570 | | |

| 1,296 | |

| Investment in unconsolidated affiliate | |

| 222,255 | | |

| 231,048 | |

| Other assets | |

| 25,375 | | |

| 33,212 | |

| Total assets | |

$ | 13,517,239 | | |

| 13,010,050 | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 38,993 | | |

| 62,213 | |

| Accounts payable, related parties | |

| 86,284 | | |

| 111,066 | |

| Accrued liabilities | |

| 381,340 | | |

| 402,591 | |

| Revenue distributions payable | |

| 361,782 | | |

| 315,932 | |

| Derivative instruments | |

| 15,236 | | |

| 31,792 | |

| Short-term lease liabilities | |

| 540,060 | | |

| 493,894 | |

| Deferred revenue, VPP | |

| 27,101 | | |

| 25,264 | |

| Other current liabilities | |

| 1,295 | | |

| 3,175 | |

| Total current liabilities | |

| 1,452,091 | | |

| 1,445,927 | |

| Long-term liabilities: | |

| | | |

| | |

| Long-term debt | |

| 1,537,596 | | |

| 1,489,230 | |

| Deferred income tax liability, net | |

| 811,981 | | |

| 693,341 | |

| Derivative instruments | |

| 32,764 | | |

| 17,233 | |

| Long-term lease liabilities | |

| 2,428,450 | | |

| 2,050,337 | |

| Deferred revenue, VPP | |

| 60,712 | | |

| 35,448 | |

| Other liabilities | |

| 59,431 | | |

| 62,001 | |

| Total liabilities | |

| 6,383,025 | | |

| 5,793,517 | |

| Commitments and contingencies | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value; authorized - 50,000 shares; none issued | |

| — | | |

| — | |

| Common stock, $0.01 par value; authorized - 1,000,000 shares; 303,544 and 311,165 shares issued and outstanding as of December 31, 2023 and December 31, 2024, respectively | |

| 3,035 | | |

| 3,111 | |

| Additional paid-in capital | |

| 5,846,541 | | |

| 5,909,373 | |

| Retained earnings | |

| 1,051,940 | | |

| 1,109,166 | |

| Total stockholders' equity | |

| 6,901,516 | | |

| 7,021,650 | |

| Noncontrolling interests | |

| 232,698 | | |

| 194,883 | |

| Total equity | |

| 7,134,214 | | |

| 7,216,533 | |

| Total liabilities and equity | |

$ | 13,517,239 | | |

| 13,010,050 | |

ANTERO RESOURCES CORPORATION

Condensed Consolidated Statements of Operations

and Comprehensive Income

(In thousands, except per share amounts)

| | |

(Unaudited) | | |

| | |

| |

| | |

Three Months Ended | | |

Year Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Revenue and other: | |

| | | |

| | | |

| | | |

| | |

| Natural gas sales | |

$ | 570,690 | | |

| 543,794 | | |

| 2,192,349 | | |

| 1,818,297 | |

| Natural gas liquids sales | |

| 461,212 | | |

| 555,722 | | |

| 1,836,950 | | |

| 2,066,975 | |

| Oil sales | |

| 74,744 | | |

| 49,128 | | |

| 247,146 | | |

| 230,027 | |

| Commodity derivative fair value gains (losses) | |

| 28,400 | | |

| (21,498 | ) | |

| 166,324 | | |

| 731 | |

| Marketing | |

| 50,732 | | |

| 33,971 | | |

| 206,122 | | |

| 179,069 | |

| Amortization of deferred revenue, VPP | |

| 7,700 | | |

| 6,812 | | |

| 30,552 | | |

| 27,101 | |

| Other revenue and income | |

| 665 | | |

| 822 | | |

| 2,529 | | |

| 3,396 | |

| Total revenue | |

| 1,194,143 | | |

| 1,168,751 | | |

| 4,681,972 | | |

| 4,325,596 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Lease operating | |

| 26,888 | | |

| 30,216 | | |

| 118,441 | | |

| 118,693 | |

| Gathering, compression, processing and transportation | |

| 661,325 | | |

| 682,024 | | |

| 2,642,358 | | |

| 2,702,930 | |

| Production and ad valorem taxes | |

| 41,163 | | |

| 60,147 | | |

| 158,855 | | |

| 207,671 | |

| Marketing | |

| 67,887 | | |

| 52,142 | | |

| 284,965 | | |

| 244,906 | |

| Exploration and mine expenses | |

| 603 | | |

| 702 | | |

| 2,700 | | |

| 2,618 | |

| General and administrative (including equity-based compensation expense) | |

| 54,929 | | |

| 59,421 | | |

| 224,516 | | |

| 229,338 | |

| Depletion, depreciation and amortization | |

| 191,235 | | |

| 193,694 | | |

| 746,849 | | |

| 762,068 | |

| Impairment of property and equipment | |

| 6,556 | | |

| 28,475 | | |

| 51,302 | | |

| 47,433 | |

| Accretion of asset retirement obligations | |

| 273 | | |

| 1,205 | | |

| 3,244 | | |

| 3,759 | |

| Contract termination, loss contingency

and settlements | |

| 4,956 | | |

| 937 | | |

| 52,606 | | |

| 4,468 | |

| Loss (gain) on sale of assets | |

| — | | |

| 1,989 | | |

| (447 | ) | |

| 862 | |

| Other operating expense | |

| — | | |

| 20 | | |

| 336 | | |

| 390 | |

| Total operating expenses | |

| 1,055,815 | | |

| 1,110,972 | | |

| 4,285,725 | | |

| 4,325,136 | |

| Operating income | |

| 138,328 | | |

| 57,779 | | |

| 396,247 | | |

| 460 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (32,608 | ) | |

| (27,061 | ) | |

| (117,870 | ) | |

| (118,207 | ) |

| Equity in earnings of unconsolidated affiliate | |

| 23,966 | | |

| 23,925 | | |

| 82,952 | | |

| 93,787 | |

| Loss on early extinguishment of debt | |

| — | | |

| — | | |

| — | | |

| (528 | ) |

| Loss on convertible note inducements | |

| (288 | ) | |

| — | | |

| (374 | ) | |

| — | |

| Total other expense | |

| (8,930 | ) | |

| (3,136 | ) | |

| (35,292 | ) | |

| (24,948 | ) |

| Income before income taxes | |

| 129,398 | | |

| 54,643 | | |

| 360,955 | | |

| (24,488 | ) |

| Income tax benefit (expense) | |

| (26,390 | ) | |

| 104,170 | | |

| (63,626 | ) | |

| 118,185 | |

| Net income and comprehensive income including noncontrolling interests | |

| 103,008 | | |

| 158,813 | | |

| 297,329 | | |

| 93,697 | |

| Less: net income and comprehensive income attributable to noncontrolling interests | |

| 21,169 | | |

| 9,164 | | |

| 98,925 | | |

| 36,471 | |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 81,839 | | |

| 149,649 | | |

| 198,404 | | |

| 57,226 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per common share—basic | |

$ | 0.27 | | |

| 0.48 | | |

| 0.66 | | |

| 0.18 | |

| Net income per common share—diluted | |

$ | 0.26 | | |

| 0.48 | | |

| 0.64 | | |

| 0.18 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 301,825 | | |

| 311,145 | | |

| 299,793 | | |

| 309,489 | |

| Diluted | |

| 311,956 | | |

| 314,165 | | |

| 311,597 | | |

| 313,414 | |

ANTERO RESOURCES CORPORATION

Consolidated Statements of Cash Flows

(In thousands)

| | |

Year Ended December 31, | |

| | |

2022 | | |

2023 | | |

2024 | |

| Cash flows provided by (used in) operating activities: | |

| | | |

| | | |

| | |

| Net income including noncontrolling interests | |

$ | 1,998,837 | | |

| 297,329 | | |

| 93,697 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | | |

| | |

| Depletion, depreciation, amortization and accretion | |

| 719,790 | | |

| 750,093 | | |

| 765,827 | |

| Impairments | |

| 149,731 | | |

| 51,302 | | |

| 47,433 | |

| Commodity derivative fair value losses (gains) | |

| 1,615,836 | | |

| (166,324 | ) | |

| (731 | ) |

| Settled commodity derivative gains (losses) | |

| (1,911,065 | ) | |

| (25,383 | ) | |

| 10,154 | |

| Payments for derivative monetizations | |

| — | | |

| (202,339 | ) | |

| — | |

| Deferred income tax expense (benefit) | |

| 440,417 | | |

| 62,039 | | |

| (118,640 | ) |

| Equity-based compensation expense | |

| 35,443 | | |

| 59,519 | | |

| 66,462 | |

| Equity in earnings of unconsolidated affiliate | |

| (72,327 | ) | |

| (82,952 | ) | |

| (93,787 | ) |

| Dividends of earnings from unconsolidated affiliate | |

| 125,138 | | |

| 125,138 | | |

| 125,197 | |

| Amortization of deferred revenue | |

| (37,603 | ) | |

| (30,552 | ) | |

| (27,101 | ) |

| Amortization of debt issuance costs and other | |

| 4,336 | | |

| 2,264 | | |

| 2,420 | |

| Settlement of asset retirement obligations | |

| (1,050 | ) | |

| (718 | ) | |

| (3,571 | ) |

| Contract termination, loss contingency and settlements | |

| — | | |

| 12,100 | | |

| 5,344 | |

| Loss (gain) on sale of assets | |

| 471 | | |

| (447 | ) | |

| 862 | |

| Loss on early extinguishment of debt | |

| 46,027 | | |

| — | | |

| 528 | |

| Loss on convertible note inducements | |

| 169 | | |

| 374 | | |

| — | |

| Changes in current assets and liabilities: | |

| | | |

| | | |

| | |

| Accounts receivable | |

| 43,510 | | |

| 7,550 | | |

| 25,410 | |

| Accrued revenue | |

| (116,243 | ) | |

| 306,880 | | |

| (52,808 | ) |

| Prepaid expenses and other current assets | |

| (27,530 | ) | |

| 14,890 | | |

| 8,680 | |

| Accounts payable including related parties | |

| 32,374 | | |

| (16,837 | ) | |

| 35,301 | |

| Accrued liabilities | |

| (5,620 | ) | |

| (62,419 | ) | |

| 1,280 | |

| Revenue distributions payable | |

| 23,337 | | |

| (106,429 | ) | |

| (45,849 | ) |

| Other current liabilities | |

| (12,636 | ) | |

| (357 | ) | |

| 3,180 | |

| Net cash provided by operating activities | |

| 3,051,342 | | |

| 994,721 | | |

| 849,288 | |

| Cash flows provided by (used in) investing activities: | |

| | | |

| | | |

| | |

| Additions to unproved properties | |

| (149,009 | ) | |

| (151,135 | ) | |

| (90,995 | ) |

| Drilling and completion costs | |

| (780,649 | ) | |

| (964,346 | ) | |

| (614,855 | ) |

| Additions to other property and equipment | |

| (14,313 | ) | |

| (16,382 | ) | |

| (10,929 | ) |

| Proceeds from asset sales | |

| 2,747 | | |

| 447 | | |

| 9,499 | |

| Change in other assets | |

| (2,388 | ) | |

| (9,351 | ) | |

| (6,873 | ) |

| Net cash used in investing activities | |

| (943,612 | ) | |

| (1,140,767 | ) | |

| (714,153 | ) |

| Cash flows provided by (used in) financing activities: | |

| | | |

| | | |

| | |

| Repurchases of common stock | |

| (873,744 | ) | |

| (75,355 | ) | |

| — | |

| Repayment of senior notes | |

| (1,027,559 | ) | |

| — | | |

| — | |

| Borrowings on Credit Facility | |

| 6,308,900 | | |

| 4,501,400 | | |

| 4,130,900 | |

| Repayments on Credit Facility | |

| (6,274,100 | ) | |

| (4,119,000 | ) | |

| (4,154,900 | ) |

| Payment of debt issuance costs | |

| (814 | ) | |

| (605 | ) | |

| (6,138 | ) |

| Distributions to noncontrolling interests | |

| (173,537 | ) | |

| (128,823 | ) | |

| (74,286 | ) |

| Employee tax withholding for settlement of equity-based compensation awards | |

| (66,132 | ) | |

| (30,367 | ) | |

| (29,605 | ) |

| Convertible note inducements | |

| (169 | ) | |

| (374 | ) | |

| — | |

| Other | |

| (575 | ) | |

| (830 | ) | |

| (1,106 | ) |

| Net cash provided by (used in) financing activities | |

| (2,107,730 | ) | |

| 146,046 | | |

| (135,135 | ) |

| Net increase in cash and cash equivalents | |

| — | | |

| — | | |

| — | |

| Cash and cash equivalents, beginning of period | |

| — | | |

| — | | |

| — | |

| Cash and cash equivalents, end of period | |

$ | — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 155,006 | | |

| 113,910 | | |

| 120,058 | |

| Increase (decrease) in accounts payable and accrued liabilities for additions to property and equipment | |

$ | 38,035 | | |

| (60,762 | ) | |

| 10,525 | |

The following table sets forth selected financial data for the three

months ended December 31, 2023 and 2024:

| | |

(Unaudited) | | |

| | |

| |

| | |

Three Months Ended | | |

Amount of | | |

| |

| | |

December 31, | | |

Increase | | |

Percent | |

| | |

2023 | | |

2024 | | |

(Decrease) | | |

Change | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Natural gas sales | |

$ | 570,690 | | |

| 543,794 | | |

| (26,896 | ) | |

| (5 | )% |

| Natural gas liquids sales | |

| 461,212 | | |

| 555,722 | | |

| 94,510 | | |

| 20 | % |

| Oil sales | |

| 74,744 | | |

| 49,128 | | |

| (25,616 | ) | |

| (34 | )% |

| Commodity derivative fair value gains (losses) | |

| 28,400 | | |

| (21,498 | ) | |

| (49,898 | ) | |

| * | |

| Marketing | |

| 50,732 | | |

| 33,971 | | |

| (16,761 | ) | |

| (33 | )% |

| Amortization of deferred revenue, VPP | |

| 7,700 | | |

| 6,812 | | |

| (888 | ) | |

| (12 | )% |

| Other revenue and income | |

| 665 | | |

| 822 | | |

| 157 | | |

| 24 | % |

| Total revenue | |

| 1,194,143 | | |

| 1,168,751 | | |

| (25,392 | ) | |

| (2 | )% |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Lease operating | |

| 26,888 | | |

| 30,216 | | |

| 3,328 | | |

| 12 | % |

| Gathering and compression | |

| 217,732 | | |

| 225,267 | | |

| 7,535 | | |

| 3 | % |

| Processing | |

| 249,880 | | |

| 267,538 | | |

| 17,658 | | |

| 7 | % |

| Transportation | |

| 193,713 | | |

| 189,219 | | |

| (4,494 | ) | |

| (2 | )% |

| Production and ad valorem taxes | |

| 41,163 | | |

| 60,147 | | |

| 18,984 | | |

| 46 | % |

| Marketing | |

| 67,887 | | |

| 52,142 | | |

| (15,745 | ) | |

| (23 | )% |

| Exploration | |

| 603 | | |

| 702 | | |

| 99 | | |

| 16 | % |

| General and administrative (excluding equity-based compensation) | |

| 40,398 | | |

| 42,252 | | |

| 1,854 | | |

| 5 | % |

| Equity-based compensation | |

| 14,531 | | |

| 17,169 | | |

| 2,638 | | |

| 18 | % |

| Depletion, depreciation and amortization | |

| 191,235 | | |

| 193,694 | | |

| 2,459 | | |

| 1 | % |

| Impairment of property and equipment | |

| 6,556 | | |

| 28,475 | | |

| 21,919 | | |

| 334 | % |

| Accretion of asset retirement obligations | |

| 273 | | |

| 1,205 | | |

| 932 | | |

| 341 | % |

| Contract termination and loss contingency | |

| 4,956 | | |

| 937 | | |

| (4,019 | ) | |

| (81 | )% |

| Loss on sale of assets | |

| — | | |

| 1,989 | | |

| 1,989 | | |

| * | |

| Other operating expense | |

| — | | |

| 20 | | |

| 20 | | |

| * | |

| Total operating expenses | |

| 1,055,815 | | |

| 1,110,972 | | |

| 55,157 | | |

| 5 | % |

| Operating income | |

| 138,328 | | |

| 57,779 | | |

| (80,549 | ) | |

| (58 | )% |

| Other earnings (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (32,608 | ) | |

| (27,061 | ) | |

| 5,547 | | |

| (17 | )% |

| Equity in earnings of unconsolidated affiliate | |

| 23,966 | | |

| 23,925 | | |

| (41 | ) | |

| * | |

| Loss on convertible note inducement | |

| (288 | ) | |

| — | | |

| 288 | | |

| * | |

| Total other expense | |

| (8,930 | ) | |

| (3,136 | ) | |

| 5,794 | | |

| (65 | )% |

| Income before income taxes | |

| 129,398 | | |

| 54,643 | | |

| (74,755 | ) | |

| (58 | )% |

| Income tax (expense) benefit | |

| (26,390 | ) | |

| 104,170 | | |

| 130,560 | | |

| * | |

| Net income and comprehensive income including noncontrolling interests | |

| 103,008 | | |

| 158,813 | | |

| 55,805 | | |

| 54 | % |

| Less: net income and comprehensive income attributable to noncontrolling interests | |

| 21,169 | | |

| 9,164 | | |

| (12,005 | ) | |

| (57 | )% |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 81,839 | | |

| 149,649 | | |

| 67,810 | | |

| 83 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDAX | |

$ | 322,446 | | |

| 331,936 | | |

| 9,490 | | |

| 3 | % |

* Not meaningful

The following table sets forth selected financial data for the three

months ended December 31, 2023 and 2024:

| | |

(Unaudited) | | |

| | |

| |

| | |

Three Months Ended | | |

Amount of | | |

| |

| | |

December 31, | | |

Increase | | |

Percent | |

| | |

2023 | | |

2024 | | |

(Decrease) | | |

Change | |

| Production data (1) (2): | |

| | | |

| | | |

| | | |

| | |

| Natural gas (Bcf) | |

| 210 | | |

| 196 | | |

| (14 | ) | |

| (7 | )% |

| C2 Ethane (MBbl) | |

| 5,406 | | |

| 8,518 | | |

| 3,112 | | |

| 58 | % |

| C3+ NGLs (MBbl) | |

| 10,918 | | |

| 10,563 | | |

| (355 | ) | |

| (3 | )% |

| Oil (MBbl) | |

| 1,154 | | |

| 850 | | |

| (304 | ) | |

| (26 | )% |

| Combined (Bcfe) | |

| 315 | | |

| 316 | | |

| 1 | | |

| * | |

| Daily combined production (MMcfe/d) | |

| 3,420 | | |

| 3,431 | | |

| 11 | | |

| * | |

| Average prices before effects of derivative settlements (3): | |

| | | |

| | | |

| | | |

| | |

| Natural gas (per Mcf) | |

$ | 2.72 | | |

| 2.77 | | |

| 0.05 | | |

| 2 | % |

| C2 Ethane (per Bbl) (4) | |

$ | 9.13 | | |

| 10.31 | | |

| 1.18 | | |

| 13 | % |

| C3+ NGLs (per Bbl) | |

$ | 37.72 | | |

| 44.29 | | |

| 6.57 | | |

| 17 | % |

| Oil (per Bbl) | |

$ | 64.77 | | |

| 57.80 | | |

| (6.97 | ) | |

| (11 | )% |

| Weighted Average Combined (per Mcfe) | |

$ | 3.52 | | |

| 3.64 | | |

| 0.12 | | |

| 3 | % |

| Average realized prices after effects of derivative settlements (3): | |

| | | |

| | | |

| | | |

| | |

| Natural gas (per Mcf) | |

$ | 2.68 | | |

| 2.76 | | |

| 0.08 | | |

| 3 | % |

| C2 Ethane (per Bbl) (4) | |

$ | 9.13 | | |

| 10.31 | | |

| 1.18 | | |

| 13 | % |

| C3+ NGLs (per Bbl) | |

$ | 37.68 | | |

| 44.43 | | |

| 6.75 | | |

| 18 | % |

| Oil (per Bbl) | |

$ | 64.58 | | |

| 57.69 | | |

| (6.89 | ) | |

| (11 | )% |

| Weighted Average Combined (per Mcfe) | |

$ | 3.49 | | |

| 3.63 | | |

| 0.14 | | |

| 4 | % |

| Average costs (per Mcfe): | |

| | | |

| | | |

| | | |

| | |

| Lease operating | |

$ | 0.09 | | |

| 0.10 | | |

| 0.01 | | |

| 11 | % |

| Gathering and compression | |

$ | 0.69 | | |

| 0.71 | | |

| 0.02 | | |

| 3 | % |

| Processing | |

$ | 0.79 | | |

| 0.85 | | |

| 0.06 | | |

| 8 | % |

| Transportation | |

$ | 0.62 | | |

| 0.60 | | |

| (0.02 | ) | |

| (3 | )% |

| Production and ad valorem taxes | |

$ | 0.13 | | |

| 0.19 | | |

| 0.06 | | |

| 46 | % |

| Marketing expense, net | |

$ | 0.05 | | |

| 0.06 | | |

| 0.01 | | |

| 20 | % |

| General and administrative (excluding equity-based compensation) | |

$ | 0.13 | | |

| 0.13 | | |

| — | | |

| * | |

| Depletion, depreciation, amortization and accretion | |

$ | 0.61 | | |

| 0.62 | | |

| 0.01 | | |

| 2 | % |

* Not meaningful

| (1) | Production data excludes volumes related to VPP transaction. |

| (2) | Oil and NGLs production was converted at 6 Mcf per Bbl to calculate total

Bcfe production and per Mcfe amounts. This ratio is an estimate of the equivalent energy

content of the products and may not reflect their relative economic value. |

| (3) | Average sales prices shown in the table reflect both the before and after

effects of the Company’s settled commodity derivatives. The calculation of such after

effects includes gains on settlements of commodity derivatives, which do not qualify for

hedge accounting because the Company does not designate or document them as hedges for accounting

purposes. Oil and NGLs production was converted at 6 Mcf per Bbl to calculate total Bcfe

production and per Mcfe amounts. This ratio is an estimate of the equivalent energy content

of the products and does not necessarily reflect their relative economic value. |

| (4) | The average realized price for the three months ended December 31,

2023 includes $2 million of proceeds related to a take-or-pay contract. Excluding the effect

of these proceeds, the average realized price for ethane before the effects of derivatives

for the three months ended December 31, 2023 would have been $8.78 per Bbl. |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

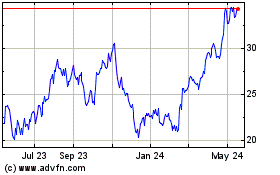

Antero Resources (NYSE:AR)

Historical Stock Chart

From Jan 2025 to Feb 2025

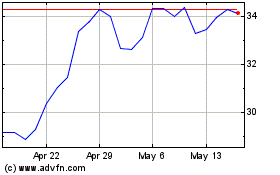

Antero Resources (NYSE:AR)

Historical Stock Chart

From Feb 2024 to Feb 2025