Solid First Quarter Performance Driven by Strong Double-Digit

Residential Sell-Through Growth Year Over Year

FIRST QUARTER FISCAL 2025 FINANCIAL HIGHLIGHTS

- Consolidated Net Sales increased 19% year-over-year to $285.4

million

- Residential Segment Net Sales increased 22% year-over-year to

$272.0 million

- Gross profit margin of 36.3%; Adjusted Gross Profit Margin of

37.4%

- Net Income decreased 28% year-over-year to $18.1 million

reflecting the prior year gain on sale from the divestiture of

Vycom; EPS decreased $0.05 year-over-year to $0.12 per share; Net

profit margin compressed 420 basis points year-over-year to

6.3%

- Adjusted Net Income, which excludes the Vycom divestiture gain

on sale in the prior year, increased 67% year-over-year to $25.1

million; Adjusted Diluted EPS increased $0.07 year-over-year to

$0.17 per share

- Adjusted EBITDA increased 20% year-over-year to $65.9 million;

Residential Segment Adjusted EBITDA increased 24% year-over-year to

$64.4 million; Adjusted EBITDA Margin expanded 30 basis points

year-over-year to 23.1%

RAISING FISCAL YEAR 2025 OUTLOOK

AZEK provides certain of its outlook on a non-GAAP basis, as the

Company cannot predict some elements that are included in reported

GAAP results, including the impact of acquisition costs and other

costs. Refer to the Outlook section in the discussion of non-GAAP

financial measures below for more details.

- Expecting consolidated net sales between $1.52 to $1.55 billion

(vs. $1.51 to $1.54 billion prior), representing approximately 5%

to 8% year-over-year growth, assuming a relatively flat repair

& remodel market and mid-single digit Residential sell through

growth for the remainder of the year

- Adjusted EBITDA is expected to be in the range of $403 to $418

million (vs. $400 to $415 million prior), representing an increase

of 6% to 10% year-over-year

The AZEK Company Inc. (NYSE: AZEK) (“AZEK” or the “Company”),

the industry-leading manufacturer of beautiful, low-maintenance and

environmentally sustainable outdoor living products, including

TimberTech® Decking and Railing, Versatex® and AZEK® Trim and

StruXure® pergolas, today announced financial results for its

fiscal first quarter ended December 31, 2024.

CEO COMMENTS

“The AZEK team delivered another strong quarter of growth from

our initiatives and disciplined operational execution,” said AZEK

CEO Jesse Singh. “Our Residential segment grew net sales by 22%

year-over-year driven by double digit sell-through growth in the

quarter and expanded market presence across our Deck, Rail &

Accessories and Exteriors product categories. Our focus on wood

conversion, product innovation, improving the consumer journey,

brand and channel expansion continues to drive our success and our

market outperformance. AZEK's multi-year track record of success

would not be possible without the dedication, collaboration, and

support of our team members and business partners,” continued Mr.

Singh.

“Our 2025 new product launches continue to generate excitement

from our contractor and dealer partners, including TimberTech

Fulton Rail®, TimberTech Reliance Rail™, Versatex XCEED™ siding and

TrimLogic™ – an exterior trim product made with up to 95% recycled

PVC material. During the quarter, we invested in and began ramping

up production of these products, modestly impacting our margins

during the quarter. We expect these investments to continue during

our second quarter as we scale and position these exciting new

platforms to drive future growth. The breadth, depth, value and

innovation of products across our portfolio continue to unlock new

channel and dealer opportunities for AZEK, increasing our material

conversion away from wood and expanding our market presence,” said

Mr. Singh.

“TimberTech decking remains a cornerstone of our business growth

and a brand that continues to gain momentum and relevance as a

leader in outdoor living. In December, TimberTech was named one of

Fast Company’s 2024 Brands That Matter in the Benchmark Brands

category. This prestigious recognition celebrates TimberTech’s

success in marketing its innovative decking and railing products in

ways that resonate deeply with consumers, redefining expectations

around outdoor living,” stated Mr. Singh.

“We are also excited to celebrate the 25th anniversary of AZEK

Trim, the product that pioneered the PVC trim category. For 25

years, it has set the standard for durability, low maintenance, and

design flexibility—offering a superior alternative to wood and

other materials. Today, we continue to lead with innovative,

sustainable solutions across our entire portfolio as we seek to

revolutionize the industry. At the same time, we remain disciplined

in our financial priorities of delivering profitable double-digit

net sales growth, investing in the future, and creating long-term

value for our shareholders,” continued Mr. Singh.

FIRST QUARTER FISCAL 2025 CONSOLIDATED RESULTS

Net sales for the three months ended December 31, 2024 increased

by $45.0 million, or 19%, to $285.4 million from $240.4 million for

the three months ended December 31, 2023. The increase was

primarily due to higher sales volume in our Residential segment

attributable to strong consumer demand and new stocking locations,

partially offset by the sale of the Vycom business and weaker end

market demand in our Commercial segment. Net sales for the three

months ended December 31, 2024 increased for our Residential

segment by $49.0 million, or 22%, and decreased for our Commercial

segment by $4.0 million, or 23%, respectively, as compared to the

prior year period. The decrease in our Commercial segment was

primarily due to the sale of the Vycom business. Vycom net sales

were $3.3 million for the three months ended December 31, 2023.

Gross profit increased by $12.9 million to $103.6 million for

the three months ended December 31, 2024, compared to $90.7 million

for the three months ended December 31, 2023. Gross profit margin

declined by 140 basis points to 36.3% for the three months ended

December 31, 2024 compared to 37.7% for the three months ended

December 31, 2023.

Adjusted Gross Profit increased by $12.2 million to $106.7

million for the three months ended December 31, 2024, compared to

$94.5 million for the three months ended December 31, 2023.

Adjusted Gross Profit Margin declined by 190 basis points to 37.4%

for the three months ended December 31, 2024 compared to 39.3% for

the three months ended December 31, 2023.

Net income decreased by $7.0 million to $18.1 million, or $0.12

per share, for the three months ended December 31, 2024, compared

to $25.1 million, or $0.17 per share, for the three months ended

December 31, 2023 reflecting the impact from the Vycom divestiture

gain on sale. Net profit margin declined 420 basis points to 6.3%

for the three months ended December 31, 2024, as compared to net

profit margin of 10.5% for the three months ended December 31,

2023.

Adjusted Net Income, which excludes the impact of the Vycom

divestiture in the prior year, increased by $10.1 million to $25.1

million, or Adjusted Diluted EPS of $0.17 per share, for the three

months ended December 31, 2024, compared to Adjusted Net Income of

$15.0 million, or Adjusted Diluted EPS of $0.10 per share, for the

three months ended December 31, 2023.

Adjusted EBITDA increased by $11.0 million to $65.9 million for

the three months ended December 31, 2024, compared to Adjusted

EBITDA of $54.9 million for the three months ended December 31,

2023. Adjusted EBITDA Margin expanded 30 basis points to 23.1% from

22.8% for the prior year period.

BALANCE SHEET, CASH FLOW and LIQUIDITY

As of December 31, 2024, AZEK had cash and cash equivalents of

$148.1 million and approximately $372.7 million available for

future borrowings under its Revolving Credit Facility. Total gross

debt, including finance leases, as of December 31, 2024, was $534.2

million.

Net Cash Provided by Operating Activities for the three months

ended December 31, 2024, increased by $29.9 million year-over-year

to $13.6 million. Purchases of property, plant and equipment

increased by $3.9 million year-over-year to $21.6 million, and AZEK

also acquired a regional recycling facility as part of its strategy

to expand its recycling network and capabilities. Free Cash Flow

for the three months ended December 31, 2024, improved by $25.9

million year-over-year to $(8.0) million.

OUTLOOK

“We are encouraged by the start to our fiscal year with

continued positive Residential sell-through growth and positive

demand signals from digital metrics and customer surveys,”

continued Mr. Singh. “We ended the quarter with channel inventory

levels again conservatively below historical averages, and we

continue to have ample manufacturing capacity to effectively

service our customers. Given the first quarter performance, we are

raising our full-year fiscal 2025 outlook. Our fiscal year 2025

planning assumptions continue to assume a relatively flat repair

& remodel market and mid-single digit Residential sell-through

growth for the remainder of the year, driven by AZEK-specific

growth initiatives,” said Mr. Singh.

For the full-year fiscal 2025, AZEK now expects consolidated net

sales in the range of $1.52 to $1.55 billion, representing an

increase of approximately 5% to 8% year over year and from the

prior planning assumption range of $1.51 to $1.54 billion. Adjusted

EBITDA is now expected to be in the range of $403 to $418 million,

representing an increase of 6% to 10% year over year and from the

prior planning assumptions range of $400 to $415 million. Adjusted

EBITDA Margin is expected to be in the range of 26.5% to 27.0%.

Capital expenditures for fiscal year 2025 are expected to be in the

range of $85 to $95 million.

AZEK expects Residential segment net sales in the range of

$1.452 to $1.479 billion, representing approximately 6% to 8%

year-over-year growth, and Segment Adjusted EBITDA in the range of

$392 to $405 million, representing approximately 7% to 11%

year-over-year growth. Residential segment Adjusted EBITDA Margin

is expected to be in the range of 27.0% to 27.4%. AZEK expects the

Commercial segment’s Scranton Products business to deliver net

sales in the range of $68 to $71 million, representing a 2% to 6%

year-over-year decline, and Segment Adjusted EBITDA in the range of

$11 to $13 million, representing an approximately 8% to 22%

year-over-year decline. The Scranton Products business has

experienced some material input cost pressure that is expected to

be offset in the second half of fiscal year 2025. Commercial

segment Adjusted EBITDA Margin is expected to be in the range of

16.0% to 18.0%.

For the second quarter of fiscal 2025, AZEK expects Residential

segment net sales in the range of $422 to $432 million,

representing an increase of 5% to 7% year-over-year growth, and

Segment Adjusted EBITDA in the range of $114 to $118.5 million,

representing an increase of 3% to 7% year over year. AZEK expects

consolidated net sales between $437 to $448 million, representing

approximately 4% to 7% year-over-year growth, and Adjusted EBITDA

between $115 to $120 million, representing approximately 2% to 6%

year-over-year growth.

“Our strategy combines disciplined short-term execution with

long-term investments in innovation, capabilities, and talent. By

building on our proven track record, we are positioning AZEK to

lead in any environment. We remain excited about the opportunities

ahead and are committed to both investing to strengthen our market

leadership and delivering long-term double-digit net sales growth

and our annual Adjusted EBITDA Margin target of 27.5%,” concluded

Mr. Singh.

CONFERENCE CALL AND WEBSITE INFORMATION

AZEK will hold a conference call to discuss the results today,

Tuesday, February 4, 2025, at 4:00 p.m. (CT). To access the live

conference call, please register for the call in advance by

visiting https://registrations.events/direct/Q4I1084072.

Registration will also be available during the call. After

registering, a confirmation e-mail will be sent including dial-in

details and unique conference call codes for entry. To ensure you

are connected for the full call please register at least 10 minutes

before the start of the call.

Interested investors and other parties can also listen to a

webcast of the live conference call by logging onto the Investor

Relations section of the AZEK’s website at

investors.azekco.com/events-and-presentations/. AZEK uses its

investor relations website at investors.azekco.com as a means of

disclosing material non-public information and for complying with

its disclosure obligations under Regulation FD.

For those unable to listen to the live conference call, a replay

will be available approximately two hours after the call through

the archived webcast on the AZEK website or by dialing (800) 770-

2030 or (609) 800-9909. The conference ID for the replay is 10840.

The replay will be available until 11:59 p.m. (CT) on February 18,

2025. In addition, an earnings presentation will be posted and

available on the AZEK investor relations website prior to the

conference call.

ABOUT THE AZEK® COMPANY

The AZEK Company Inc. (NYSE: AZEK) is the industry-leading

designer and manufacturer of beautiful, low maintenance and

environmentally sustainable outdoor living products, including

TimberTech® Decking and Railing, Versatex® and AZEK® Trim, and

StruXure® pergolas. Consistently awarded and recognized as the

market leader in innovation, quality, aesthetics and

sustainability, our products are made from up to 85% recycled

material and primarily replace wood on the outside of homes,

providing a long-lasting, eco-friendly, and stylish solution to

consumers. Leveraging the talents of its approximately 2,000

employees and the strength of relationships across its value chain,

The AZEK Company is committed to accelerating the use of recycled

material in the manufacturing of its innovative products, keeping

hundreds of millions of pounds of waste and scrap out of landfills

each year, and revolutionizing the industry to create a more

sustainable future. The AZEK Company has recently been named one of

America’s Most Responsible Companies by Newsweek, a Top Workplace

by the Chicago Tribune and U.S. News and World Report, one of

TIME’s World’s Best Companies in Sustainable Growth for 2025, and

celebrated in Fast Company’s 2024 Brands That Matter list, where

TimberTech was highlighted as a benchmark brand. Headquartered in

Chicago, Illinois, the company operates manufacturing and recycling

facilities in Ohio, Pennsylvania, Idaho, Georgia, Nevada, New

Jersey, Michigan, Minnesota and Texas. For additional information,

please visit azekco.com.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This earnings release contains forward-looking statements within

the meaning of applicable securities laws. All statements other

than statements of historical facts, including statements regarding

future operations, are forward-looking statements. In some cases,

forward-looking statements may be identified by words such as

"believe," "may," "will," "estimate," "continue," "anticipate,"

"intend," "could," "would," "expect," "objective," "plan,"

"potential," "seek," "grow," "target," "if," or the negative of

these terms and similar expressions. Projected financial

information and performance, including our guidance and outlook as

well as statements about our future growth and margin expansion

goals and factors, assumptions and variables underlying these

projections and goals, are forward-looking statements. Other

forward-looking statements may include, without limitation,

statements with respect to our ability to meet the future targets

and goals we establish, including our sustainability-related

targets and the ultimate impact of our actions on our business as

well as the expected benefits to the environment, our employees,

and our communities; statements about our future expansion plans,

capital investments, capacity targets and other future strategic

initiatives; statements about any stock repurchase plans;

statements about potential new products and product innovation;

statements regarding the potential impact of global events;

statements about future pricing for our products or our raw

materials and our ability to offset increases to our raw material

costs and other inflationary pressures; statements about the

markets in which we operate and the economy more generally,

including inflation and interest rates, supply and demand balance,

growth of our various markets and growth in the use of engineered

products as well as our ability to share in such growth; statements

about our production levels; and all other statements with respect

to our expectations, beliefs, plans, strategies, objectives,

prospects, assumptions or future events or performance contained in

this earnings release are forward-looking statements. These

forward-looking statements are subject to a number of risks,

uncertainties and assumptions, including those described in our

Annual Reports on Form 10-K and Form 10-K/A, Quarterly Reports on

Form 10-Q and in our other filings with the U.S. Securities and

Exchange Commission. Moreover, new risks emerge from time to time.

It is not possible for our management to predict all risks, nor can

we assess the impact of all factors on our business or the extent

to which any factor, or combination of factors, may cause actual

results to differ materially and adversely from those contained in

any forward-looking statements we may make. You should read this

earnings release with the understanding that our actual future

results, levels of activity, performance and events and

circumstances may be materially different from what we expect and

should not place undue reliance on forward-looking statements.

These statements are based on information available to us as of

the date of this earnings release. While we believe that such

information provides a reasonable basis for these statements, such

information may be limited or incomplete. Our statements should not

be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all relevant information. We disclaim any

intention and undertake no obligation to update or revise any of

our forward-looking statements after the date of this release,

except as required by law.

NON-GAAP FINANCIAL MEASURES

To supplement our earnings release and consolidated financial

statements prepared and presented in accordance with generally

accepted accounting principles in the United States, or (“GAAP”),

we use certain non-GAAP financial measures, as described within

this earnings release, to provide investors with additional useful

information about our financial performance, to enhance the overall

understanding of our past performance and future prospects and to

allow for greater transparency with respect to important metrics

used by our management for financial and operational

decision-making. We are presenting these non-GAAP financial

measures to assist investors in seeing our financial performance

and liquidity from management’s view and because we believe they

provide an additional tool for investors to use in comparing our

core financial performance and liquidity over multiple periods with

other companies in our industry.

- Adjusted Gross Profit: Defined as gross profit before

amortization, acquisition costs and certain other costs. Adjusted

Gross Profit Margin is equal to Adjusted Gross Profit divided by

net sales.

- Adjusted Net Income: Defined as net income (loss) before

amortization, share-based compensation costs, acquisition and

divestiture costs, initial public offering and secondary offering

costs and certain other items of expense and income.

- Adjusted Diluted EPS: Defined as Adjusted Net Income

divided by weighted average common shares outstanding – diluted, to

reflect the conversion or exercise, as applicable, of all

outstanding shares of restricted stock awards, restricted stock

units and options to purchase shares of our common stock.

- Adjusted EBITDA: Defined as net income (loss) before

interest expense, net, income tax (benefit) expense and

depreciation and amortization and by adding to or subtracting

therefrom items of expense and income as described above. Adjusted

EBITDA Margin is equal to Adjusted EBITDA divided by net

sales.

- Adjusted SG&A: Defined as selling, general and

administrative expenses before amortization, share-based

compensation costs, acquisition and divestiture costs and certain

other costs.

- Net Leverage: Equal to gross debt less cash and cash

equivalents, divided by trailing twelve month Adjusted EBITDA.

- Free Cash Flow: Defined as net cash provided by (used

in) operating activities less purchases of property, plant and

equipment.

In addition, we provide Adjusted Net Sales excluding Vycom,

which is a non-GAAP measure that we define as Consolidated Net

Sales excluding the impact from the divested Vycom business. We

believe Adjusted Net Sales excluding Vycom is useful to investors

because it reflects the ongoing trends in our business following

the divestiture of Vycom.

These non-GAAP financial measures have limitations as analytical

tools, and you should not consider them in isolation or as a

substitute for analysis of our results as reported under GAAP.

Non-GAAP financial measures may be calculated differently from, and

therefore may not be directly comparable to, similarly titled

measures used by other companies. See the accompanying earnings

tables for a reconciliation of these non-GAAP measures to their

most directly comparable GAAP measures.

Segment Adjusted EBITDA

Depending on certain circumstances, Segment Adjusted EBITDA and

Segment Adjusted EBITDA Margin may be calculated differently, from

time to time, than our Adjusted EBITDA and Adjusted EBITDA Margin,

which are further discussed under the heading “Non-GAAP Financial

Measures.” Segment Adjusted EBITDA and Segment Adjusted EBITDA

Margin represent measures of segment profit reported to our chief

operating decision maker for the purpose of making decisions about

allocating resources to a segment and assessing its performance.

For more information regarding how Segment Adjusted EBITDA and

Segment Adjusted EBITDA Margin are determined, see the section

titled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations—Segment Results of Operations” set forth

in Part II, Item 7 of our Annual Report on Form 10-K for fiscal

2024 and our Consolidated Financial Statements and related notes

included therein.

The AZEK Company Inc.

Consolidated Balance

Sheets

(In thousands of U.S. dollars,

except for share and per share amounts)

December 31,

2024

September 30,

2024

ASSETS:

Current assets:

Cash and cash equivalents

$

148,134

$

164,025

Trade receivables, net of allowances

33,680

49,922

Inventories

256,755

223,682

Prepaid expenses

17,021

9,876

Other current assets

22,565

23,872

Total current assets

478,155

471,377

Property, plant and equipment - net

459,660

462,201

Goodwill

973,950

967,816

Intangible assets - net

146,295

154,518

Other assets

115,514

111,799

Total assets

$

2,173,574

$

2,167,711

LIABILITIES AND STOCKHOLDERS'

EQUITY:

Current liabilities:

Accounts payable

$

47,725

$

57,909

Accrued rebates

72,592

68,211

Current portion of long-term debt

obligations

3,300

3,300

Accrued expenses and other liabilities

62,867

87,618

Total current liabilities

186,484

217,038

Deferred income taxes

42,518

42,342

Long-term debt—less current portion

428,819

429,668

Other non-current liabilities

128,112

121,798

Total liabilities

785,933

810,846

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.001 par value;

1,000,000 shares authorized and no shares issued or outstanding at

December 31, 2024 and September 30, 2024, respectively

—

—

Class A common stock, $0.001 par value;

1,100,000,000 shares authorized, 157,849,527 shares issued at

December 31, 2024 and 157,148,821 shares issued at September 30,

2024, respectively

158

157

Class B common stock, $0.001 par value;

100,000,000 shares authorized and no shares issued or outstanding

at December 31, 2024 and at September 30, 2024, respectively

—

—

Additional paid‑in capital

1,714,191

1,694,066

Retained earnings (accumulated

deficit)

107,126

89,002

Accumulated other comprehensive income

(loss)

(566

)

(1,682

)

Treasury stock, at cost, 14,294,005 and

14,134,558 shares at December 31, 2024 and September 30, 2024,

respectively

(433,268

)

(424,678

)

Total stockholders' equity

1,387,641

1,356,865

Total liabilities and stockholders'

equity

$

2,173,574

$

2,167,711

The AZEK Company Inc.

Consolidated Statements of

Comprehensive Income

(In thousands of U.S. dollars,

except for share and per share amounts)

Three Months Ended December

31,

in thousands

2024

2023

Net sales

$

285,429

$

240,444

Cost of sales

181,878

149,794

Gross profit

103,551

90,650

Selling, general and administrative

expenses

74,887

77,246

Loss on disposal of property, plant and

equipment

1,414

2,185

Operating income

27,250

11,219

Other income and expenses:

Interest expense, net

7,663

7,910

Gain on sale of business

—

(38,515

)

Total other (income) and expenses

7,663

(30,605

)

Income before income taxes

19,587

41,824

Income tax expense

1,463

16,676

Net income

$

18,124

$

25,148

Other comprehensive income (loss):

Unrealized gain (loss) due to change in

fair value of derivatives, net of tax

$

1,116

$

(3,095

)

Total other comprehensive income

(loss)

1,116

(3,095

)

Comprehensive income

$

19,240

$

22,053

Net income per common share:

Basic

$

0.13

$

0.17

Diluted

0.12

0.17

Weighted-average common shares

outstanding:

Basic

143,345,740

147,297,662

Diluted

145,380,814

148,876,282

The AZEK Company Inc.

Consolidated Statements of

Cash Flows

(In thousands of U.S.

dollars)

Three Months Ended December

31,

2024

2023

Operating activities:

Net income

$

18,124

$

25,148

Adjustments to reconcile net income to net

cash flows provided by (used in) operating activities:

Depreciation

24,332

21,773

Amortization of intangibles

8,723

10,164

Non-cash interest expense

406

412

Non-cash lease expense

2

(48

)

Deferred income tax benefit

(193

)

(8,192

)

Non-cash compensation expense

4,890

8,422

Loss on disposition of property, plant and

equipment

1,414

2,185

Gain on sale of business

—

(38,515

)

Changes in certain assets and

liabilities:

Trade receivables

16,242

21,151

Inventories

(33,073

)

(61,344

)

Prepaid expenses and other currents

assets

(5,838

)

(1,920

)

Accounts payable

(5,515

)

(9,319

)

Accrued expenses and interest

(17,770

)

15,125

Other assets and liabilities

1,821

(1,330

)

Net cash provided by (used in) operating

activities

13,565

(16,288

)

Investing activities:

Purchases of property, plant and

equipment

(21,596

)

(17,681

)

Proceeds from disposition of fixed

assets

254

122

Divestiture, net of cash disposed

—

133,089

Acquisitions, net of cash acquired

(11,000

)

—

Net cash provided by (used in) investing

activities

(32,342

)

115,530

Financing activities:

Payments on 2024 Term Loan Facility

(1,100

)

—

Payments on Term Loan Agreement

—

(1,500

)

Principal payments of finance lease

obligations

(865

)

(713

)

Exercise of vested stock options

11,672

3,238

Cash paid for shares withheld for

taxes

(4,941

)

(3,822

)

Purchases of treasury stock

—

(100,000

)

Excise taxes for share repurchase

(1,880

)

—

Net cash provided by (used in) financing

activities

2,886

(102,797

)

Net increase in cash and cash

equivalents

(15,891

)

(3,555

)

Cash and cash equivalents – Beginning of

period

164,025

278,314

Cash and cash equivalents – End of

period

$

148,134

$

274,759

Supplemental cash flow

disclosure:

Cash paid for interest, net of amounts

capitalized

$

8,907

$

11,403

Cash paid for income taxes, net

613

1,351

Supplemental non-cash investing and

financing disclosure:

Capital expenditures in accounts payable

at end of period

$

4,825

$

2,603

Right-of-use operating and finance lease

assets obtained in exchange for lease liabilities

7,090

2,460

Segment Results from Operations

Residential Segment

The following table summarizes certain financial information

relating to the Residential segment results that have been derived

from our unaudited Consolidated Financial Statements for the three

months ended December 31, 2024 and 2023.

Three Months Ended December

31,

(U.S. dollars in thousands)

2024

2023

$ Variance

% Variance

Net sales

$

271,999

$

223,000

$

48,999

22.0

%

Segment Adjusted EBITDA

64,380

51,979

12,401

23.9

%

Segment Adjusted EBITDA Margin

23.7

%

23.3

%

N/A

N/A

Commercial Segment

The following table summarizes certain financial information

relating to the Commercial segment results that have been derived

from our unaudited Consolidated Financial Statements for the three

months ended December 31, 2024 and 2023.

Three Months Ended December

31,

(U.S. dollars in thousands)

2024

2023

$ Variance

% Variance

Net sales

$

13,430

$

17,444

$

(4,014

)

(23.0

)%

Segment Adjusted EBITDA

1,488

2,905

(1,417

)

(48.8

)%

Segment Adjusted EBITDA Margin

11.1

%

16.7

%

N/A

N/A

Adjusted Net Sales Excluding Vycom

Reconciliation

Three Months Ended December

31,

(U.S. dollars in thousands)

2024

2023

Net sales

$

285,429

$

240,444

Impact from sale of Vycom business

—

(3,319

)

Adjusted net sales excluding Vycom

$

285,429

$

237,125

Adjusted EBITDA and Adjusted EBITDA

Margin Reconciliation

Three Months Ended December

31,

(U.S. dollars in thousands)

2024

2023

Net Income

$

18,124

$

25,148

Interest expense, net

7,663

7,910

Depreciation and amortization

33,055

31,937

Income tax expense

1,463

16,676

Stock-based compensation costs

4,890

8,468

Acquisition and divestiture costs(1)

149

492

Gain on sale of business(2)

—

(38,515

)

Other costs(3)

524

2,768

Total adjustments

47,744

29,736

Adjusted EBITDA

$

65,868

$

54,884

Three Months Ended December

31,

2024

2023

Net Profit Margin

6.3

%

10.5

%

Interest expense, net

2.7

%

3.3

%

Depreciation and amortization

11.6

%

13.2

%

Income tax expense

0.5

%

6.9

%

Stock-based compensation costs

1.7

%

3.5

%

Acquisition and divestiture costs

0.1

%

0.2

%

Gain on sale of business

—

%

(16.0

)%

Other costs

0.2

%

1.2

%

Total adjustments

16.8

%

12.3

%

Adjusted EBITDA Margin

23.1

%

22.8

%

(1) Acquisition and divestiture costs

reflect costs related to acquisitions of $0.1 million in the three

months ended December 31, 2024, and costs related to divestitures

of $0.5 million in the three months ended December 31, 2023.

(2) Gain on sale of business relates to

the sale of the Vycom business.

(3) Other costs include costs related to

the restatement of AZEK’s consolidated financial statements and

condensed consolidated interim financial information for each of

the quarters within fiscal years ended September 30, 2023 and 2022,

and for the fiscal quarter ended December 31, 2023 (the

“Restatement”) of $0.2 million in the three months ended December

31, 2024, costs related to the removal of dispensable equipment

resulting from a modification of the Company's manufacturing

process of $2.4 million in the three months ended December 31,

2023, reduction in workforce costs of $0.3 million in the three

months ended December 31, 2023, costs for legal expenses of $0.1

million in the three months ended December 31, 2023, and other

costs of $0.3 million for the three months ended December 31,

2024.

Adjusted Gross Profit

Reconciliation

Three Months Ended December

31,

(U.S. dollars in thousands)

2024

2023

Gross Profit

$

103,551

$

90,650

Amortization

3,132

3,869

Adjusted Gross Profit

$

106,683

$

94,519

Three Months Ended December

31,

2024

2023

Gross Margin

36.3

%

37.7

%

Amortization

1.1

%

1.6

%

Adjusted Gross Profit Margin

37.4

%

39.3

%

Adjusted Net Income and Adjusted

Diluted EPS Reconciliation

Three Months Ended December

31,

(U.S. dollars in thousands, except per

share amounts)

2024

2023

Net Income

$

18,124

$

25,148

Amortization

8,723

10,164

Stock-based compensation costs(1)

90

2,925

Acquisition and divestiture costs(2)

149

492

Gain on sale of business(3)

—

(38,515

)

Other costs(4)

524

2,768

Tax impact of adjustments(5)

(2,514

)

12,049

Adjusted Net Income

$

25,096

$

15,031

Three Months Ended December

31,

2024

2023

Net Income

$

0.12

$

0.17

Amortization

0.07

0.07

Stock-based compensation costs

—

0.02

Acquisition and divestiture costs

—

—

Gain on sale of business

—

(0.26

)

Other costs

—

0.02

Tax impact of adjustments

(0.02

)

0.08

Adjusted Diluted EPS(6)

$

0.17

$

0.10

(1) Stock-based compensation costs reflect

expenses related to our initial public offering. Expenses related

to our recurring awards granted each fiscal year are excluded from

the Adjusted Net Income reconciliation.

(2) Acquisition and divestiture costs

reflect costs related to acquisitions of $0.1 million in the three

months ended December 31, 2024, and costs related to divestitures

of $0.5 million in the three months ended December 31, 2023.

(3) Gain on sale of business relates to

the sale of the Vycom business.

(4) Other costs include costs related to

the Restatement of $0.2 million in the three months ended December

31, 2024, costs related to the removal of dispensable equipment

resulting from a modification of the Company's manufacturing

process of $2.4 million in the three months ended December 31,

2023, reduction in workforce costs of $0.3 million in the three

months ended December 31, 2023, costs for legal expenses of $0.1

million in the three months ended December 31, 2023, and other

costs of $0.3 million for the three months ended December 31,

2024.

(5) Tax impact of adjustments, except for

gain on sale of business, are based on applying a combined U.S.

federal and state statutory tax rate of 26.5% for the three months

ended December 31, 2024 and 2023, respectively. Tax impact of

adjustment for gain on sale of business is based on applying a

combined U.S. federal and state statutory tax rate of 42.1% for the

three months ended December 31, 2023.

(6) Weighted average common shares

outstanding used in computing diluted net income per common share

of 145,380,814 and 148,876,282 for the three months ended December

31, 2024 and 2023, respectively.

Adjusted SG&A

Three Months Ended December

31,

2024

2023

SG&A

$

74,887

$

77,246

Amortization

5,591

6,295

Share-based compensation costs

4,890

8,468

Acquisition and divestiture costs(1)

149

492

Other costs(2)

524

349

Adjusted SG&A

$

63,733

$

61,642

(1) Acquisition and divestiture costs

reflect costs related to acquisitions of $0.1 million in the three

months ended December 31, 2024, and costs related to divestitures

of $0.5 million in the three months ended December 31, 2023.

(2) Other costs include costs related to

the Restatement of $0.2 million in the three months ended December

31, 2024, reduction in workforce costs of $0.3 million in the three

months ended December 31, 2023, costs for legal expenses of $0.1

million in the three months ended December 31, 2023, and other

costs of $0.3 million for the three months ended December 31,

2024.

Free Cash Flow Reconciliation

Three Months Ended December

31,

(U.S. dollars in thousands)

2024

2023

Net cash provided by (used in) operating

activities

$

13,565

$

(16,288

)

Less: Purchases of property, plant and

equipment

(21,596

)

(17,681

)

Free Cash Flow

$

(8,031

)

$

(33,969

)

Net cash provided by (used in) investing

activities

$

(32,342

)

$

115,530

Net cash provided by (used in) financing

activities

$

2,886

$

(102,797

)

Net Leverage Reconciliation

Twelve Months Ended December

31,

(In thousands)

2024

Net income

$

146,355

Interest expense, net

40,006

Depreciation and amortization

130,160

Income tax expense

40,932

Stock-based compensation costs

22,257

Acquisition and divestiture costs

941

Loss on sale of business

827

Other costs

8,847

Total adjustments

243,970

Adjusted EBITDA

$

390,325

Long-term debt — less current portion

$

428,819

Current portion

3,300

Unamortized deferred financing fees

2,955

Unamortized original issue discount

3,826

Finance leases

95,334

Gross debt

$

534,234

Cash and cash equivalents

(148,134

)

Net debt

$

386,100

Net leverage

1.0x

OUTLOOK

We have not reconciled either of Adjusted EBITDA or Adjusted

EBITDA Margin guidance to its most comparable GAAP measure as a

result of the uncertainty regarding and the potential variability

of, reconciling items such as the costs of acquisitions, which are

a core part of our ongoing business strategy, and other costs. Such

reconciling items that impact Adjusted EBITDA and Adjusted EBITDA

Margin have not occurred, are outside of our control or cannot be

reasonably predicted. Accordingly, a reconciliation of each of

Adjusted EBITDA and Adjusted EBITDA Margin to its most comparable

GAAP measure is not available without unreasonable effort. However,

it is important to note that material changes to these reconciling

items could have a significant effect on our Adjusted EBITDA and

Adjusted EBITDA Margin guidance and future GAAP results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204542565/en/

Investor Relations Contact: Eric Robinson 312-809-1093

ir@azekco.com Media Contact: Amanda Cimaglia 312-809-1093

media@azekco.com

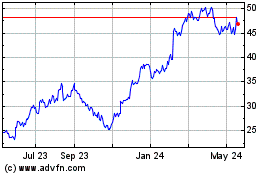

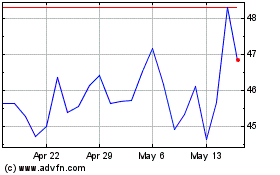

AZEK (NYSE:AZEK)

Historical Stock Chart

From Jan 2025 to Feb 2025

AZEK (NYSE:AZEK)

Historical Stock Chart

From Feb 2024 to Feb 2025