Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 24 2024 - 3:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

|

|

| Filed by the Registrant ☒ |

|

|

|

| Filed by a Party other than the Registrant ☐ |

|

|

| Check the appropriate box: |

|

|

|

|

| ☐ Preliminary Proxy Statement

☐ Definitive

Proxy Statement |

|

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| ☒ Definitive Additional Materials |

|

| ☐ Soliciting Material Pursuant to § 240.14a-12 |

BLACKROCK CALIFORNIA MUNICIPAL INCOME TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

YOUR Vote Matters BlackRock California Municipal Income Trust (NYSE: BFZ) BlackRock has taken shareholder-friendly actions across its closed-end funds to narrow discounts, enhance distributions and deliver long-term value. But activist hedge fund Saba Capital Management L.P. (“Saba”) is threatening your investment by attempting to oust

the expert management that BlackRock provides. Vote today, defend your fund—and your financial future—from falling into the wrong hands. Real actions have real impact. While 2022 was a challenging year, BlackRock has taken meaningful

actions to drive significant performance improvements and substantial discount reductions. Total Market Price Discount to NAV Narrowing Fund v. Index Return Return 12/31/22 5/20/24 % Improvement 12/31/22 – 5/20/24 12/31/22 – 5/20/24 ECAT

19.19% 8.14% 57.58% 32.78% 19.36% BIGZ 22.79% 13.51% 40.72% 19.91% 1.16% BCAT 17.73% 7.75% 56.29% 25.18% 11.75% BMEZ 17.75% 12.67% 28.62% 10.28% 8.24% BSTZ 19.92% 14.19% 28.77% 26.70% 0.80% BFZ 14.72% 7.82% 46.88% 11.26% 7.28% MHN 12.30% 10.44%

15.12% 7.85% 3.88% MYN 13.27% 10.17% 23.36% 9.31% 5.33% BNY 13.19% 9.86% 25.25% 9.37% 5.39% MPA 14.52% 7.40% 49.04% 10.99% 7.02% What you need to do: Vote Defend today your . fund, save your income. BlackRock is fighting for YOU. Vote today ONLY on

the WHITE proxy card: “FOR” the BlackRock Board nominees “AGAINST” Saba’s proposal to terminate the investment management agreement with BlackRock IMPORTANT: DO NOT RETURN ANY GOLD CARD YOU RECEIVE FROM SABA.

*Morningstar/BlackRock data as of 5/20/2024. Returns for time periods greater than 1 year are annualized. *Benchmarks for the funds are as follows: BIGZ (Russell 2500 Growth Index); BMEZ (MSCI Custom ACWI SMID Growth HC Call Overwrite Index); BSTZ

(MSCI Custom ACWI SMID Growth IT Call Overwrite Index); BNY/MHN/MYN/MPA/BFZ (Bloomberg Municipal Bond Index); BCAT/ECAT (50% MSCI ACWI Index + 50% Bloomberg US AGG Bond Index)

We ask that all shareholders vote on the enclosed WHITE proxy card today to preserve YOUR Fund: “FOR” the BlackRock Board

nominees “AGAINST” Saba’s proposal to terminate the investment management agreement with BlackRock How do I vote? Vote online Vote by phone Vote by mail Using the website provided By calling the toll-free By completing and on YOUR

enclosed WHITE number on YOUR enclosed returning YOUR enclosed proxy card and following WHITE proxy card and WHITE card in the the simple instructions following the simple postage paid envelope instructions provided Please do NOT send back any proxy

card you may receive from Saba If you have already sent back the proxy card received from Saba, you can still change your vote by promptly voting on the WHITE proxy card, which will replace the proxy card you previously completed. If you have any

questions about the proposals to be voted, please feel free to contact Georgeson LLC (“Georgeson”), toll free at

1-866-529-0071. Important information about the Fund This material is not an advertisement and is intended for existing

shareholder use only. This document and the information contained herein relates solely to BlackRock California Municipal Income Trust (BFZ). The information contained herein does not relate to, and is not relevant to, any other fund or product

sponsored or distributed by BlackRock or any of its affiliates. This document is not an offer to sell any securities and is not a solicitation of an offer to buy any securities. Common shares for the

closed-end fund identified above are only available for purchase and sale at current market price on a stock exchange. A closed-end fund’s dividend yield, market

price and NAV will fluctuate with market conditions. The information for this Fund is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares. Performance results reflect past

performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All returns assume reinvestment of all dividends. The market value and net asset value (NAV) of a fund’s shares

will fluctuate with market conditions. Closed-end funds may trade at a premium to NAV but often trade at a discount. © 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK is a trademark

of BlackRock, Inc., or its affiliates. All other trademarks are those of their respective owners. May 2024 | BlackRock California Municipal Income Trust (BFZ) Not FDIC Insured • May Lose Value • No Bank Guarantee BFZ_2024_FL4

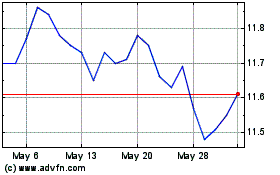

BlackRock California Mun... (NYSE:BFZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

BlackRock California Mun... (NYSE:BFZ)

Historical Stock Chart

From Dec 2023 to Dec 2024