Black Rifle Coffee Company (NYSE: BRCC) (“Black Rifle” or “the

Company”), a veteran-founded premium lifestyle brand and coffee

company supporting the service community, will present today at the

27th Annual ICR Conference. The presentation will outline the

Company’s opportunities for multi-year growth in large and

attractive beverage categories, as well as its profitability

goals.

Investor Day Financial Highlights

- Growth Outlook:

- Black Rifle expects a 3-year revenue CAGR through 2027 of

10–15% and an adjusted EBITDA CAGR of 15–25%, compared to 2024

results. The Company projects a gross margin rate above 40%.

- With the launch of Black Rifle Energy in 2025, we expect

revenue growth to fall below the guided 3-year rate and gross

margin to dip below 40% for the year. While these expenses may

temporarily impact EBITDA, they are expected to set the stage for

stronger growth in 2026 and 2027 as distribution expands and

launch-related costs taper off.

- 2024 Guidance Reaffirmed: The Company reaffirms all components

of its 2024 guidance, previously updated on November 4, 2024,

including:

- Net revenue of $390 million–$395 million

- Gross margin rate between 40–42%

- Adjusted EBITDA in the range of $35 million–$40 million

Presentation Details

- Date and Time: Tuesday, January 14, 2025, at 8:00 AM Eastern

Time.

- Webcast: The audio portion of the event will be webcast and

accessible here. A replay will be available for 90 days following

the conclusion of the event.

- Supporting Materials: Presentation materials are available on

the Investor Relations page of the Company’s website at

ir.blackriflecoffee.com.

ABOUT BLACK RIFLE COFFEE COMPANY

Black Rifle Coffee Company is a Veteran-founded lifestyle brand

and coffee company serving premium coffee and other beverages to

people who love America. Founded in 2014 by Green Beret Evan Hafer,

Black Rifle develops their explosive roast profiles with the same

mission focus they learned while serving in the military. Black

Rifle is committed to supporting Veterans, active-duty military,

first responders and the American way of life.

To learn more, visit www.blackriflecoffee.com, subscribe to the

Black Rifle Coffee Company newsletter, or follow along on social

media.

Non-GAAP Financial Measures

This press release contains a non-U.S. generally accepted

accounting principles (“GAAP”) financial measure for Adjusted

EBITDA. We define Adjusted EBITDA, as net income (loss) before

interest, tax expense, depreciation and amortization expense as

adjusted for equity-based compensation, system implementation

costs, executive, recruiting, relocation and sign-on bonus,

write-off of site development costs, strategic initiative related

costs, non-routine legal expenses, RTD start-up production issues,

contract termination costs, restructuring fees and related costs,

RTD transformation costs, and impairment for assets held for sale.

This non-GAAP financial measure is not defined or calculated under

principles, standards or rules that comprise GAAP. Accordingly, the

non-GAAP financial measure we use and refer to should not be viewed

as a substitute for performance measures derived in accordance with

GAAP or as a substitute for a measure of liquidity. Our definition

of Adjusted EBITDA is specific to our business and you should not

assume that it is comparable to similarly titled financial measures

of other companies. To evaluate the performance of our business, we

rely on both our results of operations recorded in accordance with

GAAP and certain non-GAAP financial measures, including Adjusted

EBITDA.

When used in conjunction with GAAP financial measures, we

believe that Adjusted EBITDA is a useful supplemental measure of

operating performance and liquidity because this measure

facilitates comparisons of historical performance by excluding

non-cash items such as equity-based payments and other amounts not

directly attributable to our primary operations, such as the impact

of system implementation, acquisitions, disposals, litigation and

settlements. Adjusted EBITDA is also a key metric used internally

by our management to evaluate performance and develop internal

budgets and forecasts. Adjusted EBITDA has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for analyzing our results as reported under GAAP and may

not provide a complete understanding of our operating results as a

whole. Some of these limitations are (i) it does not reflect

changes in, or cash requirements for, our working capital needs,

(ii) it does not reflect our interest expense or the cash

requirements necessary to service interest or principal payments on

our debt, (iii) it does not reflect our tax expense or the cash

requirements to pay our taxes, (iv) it does not reflect historical

capital expenditures or future requirements for capital

expenditures or contractual commitments, (v) although equity-based

compensation expenses are non-cash charges, we rely on equity

compensation to compensate and incentivize employees, directors and

certain consultants, and we may continue to do so in the future and

(vi) although depreciation, amortization and impairments are

non-cash charges, the assets being depreciated and amortized will

often have to be replaced in the future, and this non-GAAP measure

does not reflect any cash requirements for such replacements.

The guidance provided above constitutes forward-looking

statements and actual results may differ materially. Refer to the

“Forward-Looking Statements” safe harbor section below for

information on the factors that could cause our actual results to

differ materially from these forward-looking statements.

We have not reconciled forward-looking Adjusted EBITDA to its

most directly comparable GAAP measure, net income (loss), in

reliance on the unreasonable efforts exception provided under Item

10(e)(1)(i)(B) of Regulation S-K. We cannot predict with reasonable

certainty the ultimate outcome of certain components of such

reconciliation, including market-related assumptions that are not

within our control, or others that may arise, without unreasonable

effort. For these reasons, we are unable to assess the probable

significance of the unavailable information, which could materially

impact the amount of future net income (loss).

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements about the

Company and its industry that involve substantial risks and

uncertainties. All statements other than statements of historical

fact contained in this press release, including statements

regarding the Company’s intentions, beliefs or current expectations

concerning, among other things, the Company’s financial condition,

liquidity, prospects, growth, strategies, future market conditions,

developments in the capital and credit markets and expected future

financial performance, as well as any information concerning

possible or assumed future results of operations, are

forward-looking statements. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar

expressions, but the absence of these words does not mean that a

statement is not forward-looking.

The events and circumstances reflected in the Company’s

forward-looking statements may not be achieved or occur and actual

results could differ materially from those projected in the

forward-looking statements. Factors that may cause such

forward-looking statements to differ from actual results include,

but are not limited to: competition and our ability to grow and

manage growth sustainably and retain our key employees; failure to

achieve sustained profitability; negative publicity affecting our

brand and reputation, or the reputation of key employees; failure

to manage our debt obligations; failure to effectively make use of

assets received under bartering transactions; failure by us to

maintain our message as a supportive member of the Veteran and

military communities and any other factors which may negatively

affect the perception of our brand; our limited operating history,

which may make it difficult to successfully execute our strategic

initiatives and accurately evaluate future risks and challenges;

failed marketing campaigns, which may cause us to incur costs

without attracting new customers or realizing higher revenue;

failure to attract new customers or retain existing customers;

risks related to the use of social media platforms, including

dependence on third-party platforms; failure to provide

high-quality customer experience to retail partners and end users,

including as a result of production defaults, or issues, including

due to failures by one or more of our co-manufacturers, affecting

the quality of our products, which may adversely affect our brand;

decrease in success of the direct to consumer revenue channel; loss

of one or more co-manufacturers, or delays, quality, or other

production issues, including labor-related production issues at any

of our co-manufacturers; failure to manage our supply chain, and

accurately forecast our raw material and co-manufacturing

requirements to support our needs; failure to effectively manage or

distribute our products through our Wholesale business partners,

especially our key Wholesale business partners; failure by third

parties involved in the supply chain of coffee, store supplies or

merchandise to produce or deliver products, including as a result

of ongoing supply chain disruptions, or our failure to effectively

manage such third parties; changes in the market for high-quality

coffee beans and other commodities; fluctuations in costs and

availability of real estate, labor, raw materials, equipment,

transportation or shipping; failure to successfully compete with

other producers and retailers of coffee; failure to successfully

open new Black Rifle Coffee Outposts, including failure to timely

proceed through permitting and other development processes, or the

failure of any new or existing Outposts to generate sufficient

sales; failure to properly manage our rapid growth, inventory

needs, and relationships with various business partners; failure to

protect against software or hardware vulnerabilities; failure to

build brand recognition using our intellectual properties or

otherwise; shifts in consumer spending, lack of interest in new

products or changes in brand perception upon evolving consumer

preferences and tastes; failure to adequately maintain food safety

or quality and comply with food safety regulations; failure to

successfully integrate into new domestic and international markets;

risks related to leasing space subject to long-term non-cancelable

leases and with respect to real property; failure of our franchise

partners to successfully manage their franchises; failure to raise

additional capital to develop the business; risks related to supply

chain disruptions; risks related to unionization of employees;

failure to comply with federal state and local laws and

regulations, or failure to prevail in civil litigation matters; and

other risks and uncertainties indicated in our Annual Report on

Form 10-K for the year ended December 31, 2023 filed with the

Securities and Exchange Commission (the “SEC”) on March 6, 2024

including those set forth under “Item 1A. Risk Factors” included

therein, as well as in our other filings with the SEC. Such

forward-looking statements are based on information available as of

the date of this press release and the Company’s current beliefs

and expectations concerning future developments and their effects

on the Company. Because forward-looking statements are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified, you should not place undue reliance on

these forward-looking statements as predictions of future events.

Although the Company believes that it has a reasonable basis for

each forward-looking statement contained in this press release, the

Company cannot guarantee that the future results, growth,

performance or events or circumstances reflected in these

forward-looking statements will be achieved or occur at all. These

forward-looking statements speak only as of the date of this press

release. The Company does not undertake any obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

under applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114168237/en/

Investor Relations: IR@blackriflecoffee.com

Public Relations: press@blackriflecoffee.com

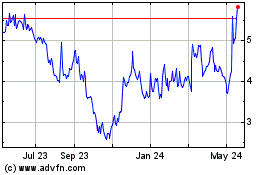

BRC (NYSE:BRCC)

Historical Stock Chart

From Feb 2025 to Mar 2025

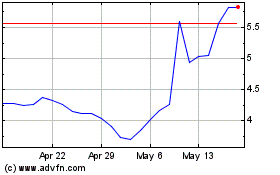

BRC (NYSE:BRCC)

Historical Stock Chart

From Mar 2024 to Mar 2025