BorgWarner Brings Higher Profit - Analyst Blog

May 02 2011 - 9:00AM

Zacks

BorgWarner Inc. (BWA) showed a 54% increase in

profit to $1.00 per share in the first quarter of 2011 from 65

cents per share (excluding a non-recurring item) in the same

quarter of the prior year led by higher sales. The profit surpassed

the Zacks Consensus Estimate by a narrow margin of 4 cents per

share.

Revenues in the quarter soared 34% to $1.73 billion, exceeding

the Zacks Consensus Estimate by $100 million. The company has been

witnessing a rising demand for its advanced powertrain technology.

Operating profit was $179.3 million (10.4%) versus $106.6 million

(8.3% of sales) a year ago.

Revenues in the Engine segment surged 38% to

$1.25 billion on strong global sales growth in nearly all major

product groups and the acquisition of Dytech ENSA. Adjusted

earnings before interest, income taxes and non-controlling interest

were $186.1 million, up 74% from $106.7 million in the first

quarter of 2010.

Revenues in the Drivetrain segment escalated

26% to $486.4 million due to strong four-wheel drive system sales

in Asia, higher dual clutch transmission module sales in Europe,

higher traditional automatic transmission component sales globally

and the acquisition of Haldex Traction Systems.

Adjusted earnings before interest, income taxes and

non-controlling interest in the segment were $32.0 million, down

13% from $36.7 million in the first quarter of 2010, primarily

driven by transaction costs related to the Haldex acquisition,

increased research and development expenses and operational

inefficiencies in its European operations.

BorgWarner had cash amounting to $222.9 million as of March 31,

2011, a decrease from $449.9 million as of December 31, 2010.

Long-term debt amounted to $1.26 billion as of March 31, 2011.

Long-term debt-to-capitalization ratio stood at 35%, up by 3

percentage points from the period ended December 31, 2010.

In the quarter, the company had a cash outflow of $41.4 million

based on operating activities compared with an inflow of $64.1

million driven by lower deferred income tax benefit. Capital

expenditures, including tooling outlays, increased to $70.2 million

from $55.3 million a year ago.

For full year 2011, BorgWarner expects sales to grow by 19% to

23%, up from the previous outlook of a growth of 16% to 20%. The

company reiterated its forecasted range of $3.85 to $4.15 per

diluted share.

Despite the better results and impressive outlook, we believe

strong competition and pricing pressure from the OEMs (about 75% of

the company’s sales are to OEMs) will undermine the company’s

results in the near term. As a result, the company retains a Zacks

#3 Rank on its stock, which translates to a short-term (1 to 3

months) rating of “Hold”.

BORG WARNER INC (BWA): Free Stock Analysis Report

Zacks Investment Research

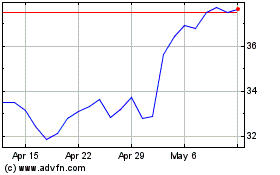

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jun 2024 to Jul 2024

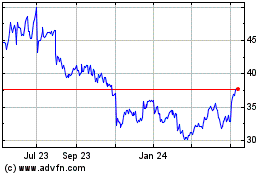

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jul 2023 to Jul 2024