Chimera Investment Corporation (NYSE:CIM) today announced its

financial results for the fourth quarter and full year ended

December 31, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250212755125/en/

Financial Highlights(1):

- 4TH QUARTER GAAP NET LOSS OF $2.04 PER DILUTED COMMON

SHARE

- 4TH QUARTER EARNINGS AVAILABLE FOR DISTRIBUTION(2) OF $0.37 PER

DILUTED COMMON SHARE

- FULL YEAR GAAP NET INCOME OF $90 MILLION, OR $1.10 PER DILUTED

COMMON SHARE

- FULL YEAR EARNINGS AVAILABLE FOR DISTRIBUTION(1) OF $121

MILLION, OR $1.48 PER DILUTED COMMON SHARE

- GAAP BOOK VALUE OF $19.72 PER COMMON SHARE AT DECEMBER 31, 2024

AND ECONOMIC RETURN(3) OF 4.40% FOR THE YEAR ENDED DECEMBER 31,

2024

“In 2024, we made progress on our initiative towards building a

more durable and diversified portfolio. We expect the acquisition

of Palisades to strengthen our existing business and provide

additional opportunities to add value for our shareholders in 2025

and over the long term,” said Phillip J. Kardis II, President and

CEO.

(1) All per share amounts, common shares

outstanding and restricted shares for all periods presented reflect

the Company's 1-for-3 reverse stock split, which was effective

after the close of trading on May 21, 2024.

(2) Earnings available for distribution

per adjusted diluted common share is a non-GAAP measure. See

additional discussion on page 5.

(3) Our economic return is measured by the

change in GAAP book value per common share plus common stock

dividend.

Other Information

Chimera is a publicly traded real estate investment trust, or

REIT, that is primarily engaged in the business of investing for

itself and for unrelated third parties through its investment

management and advisory services in a diversified portfolio of real

estate assets, including residential mortgage loans, Non-Agency

RMBS, Agency RMBS, business purpose and investor loans, including

RTLs, and other real estate-related assets such as Agency CMBS.

CHIMERA INVESTMENT

CORPORATION

CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION

(dollars in thousands, except

share and per share data)

(Unaudited)

December 31, 2024

December 31, 2023

Cash and cash equivalents

$

83,998

$

221,684

Non-Agency RMBS, at fair value (net of

allowance for credit losses of $28 million and $19 million,

respectively)

1,064,169

1,043,806

Agency MBS, at fair value

519,218

102,484

Loans held for investment, at fair

value

11,196,678

11,397,046

Accrued interest receivable

81,386

76,960

Other assets

170,924

87,018

Derivatives, at fair value

117

—

Total assets (1)

$

13,116,490

$

12,928,998

Liabilities:

Secured financing agreements ($4.1 billion

and $3.6 billion pledged as collateral, respectively, and includes

$319 million and $350 million at fair value, respectively)

$

2,824,371

$

2,432,115

Securitized debt, collateralized by

Non-Agency RMBS ($229 million and $249 million pledged as

collateral, respectively)

71,247

75,012

Securitized debt at fair value,

collateralized by Loans held for investment ($10.2 billion and

$10.7 billion pledged as collateral, respectively)

6,984,495

7,601,881

Long term debt

134,646

—

Payable for investments purchased

454,730

158,892

Accrued interest payable

41,472

38,272

Dividends payable

34,265

54,552

Accounts payable and other liabilities

45,075

9,355

Total liabilities (1)

$

10,590,301

$

10,370,079

Stockholders' Equity:

Preferred Stock, par value of $0.01 per

share, 100,000,000 shares authorized:

8.00% Series A cumulative redeemable:

5,800,000 shares issued and outstanding, respectively ($145,000

liquidation preference)

$

58

$

58

8.00% Series B cumulative redeemable:

13,000,000 shares issued and outstanding, respectively ($325,000

liquidation preference)

130

130

7.75% Series C cumulative redeemable:

10,400,000 shares issued and outstanding, respectively ($260,000

liquidation preference)

104

104

8.00% Series D cumulative redeemable:

8,000,000 shares issued and outstanding, respectively ($200,000

liquidation preference)

80

80

Common stock: par value $0.01 per share;

166,666,667 shares authorized, 80,922,221 and 80,453,552 shares

issued and outstanding, respectively

809

804

Additional paid-in-capital

4,390,516

4,370,130

Accumulated other comprehensive income

159,449

185,668

Cumulative earnings

4,341,111

4,165,046

Cumulative distributions to

stockholders

(6,366,068

)

(6,163,101

)

Total stockholders' equity

$

2,526,189

$

2,558,919

Total liabilities and stockholders'

equity

$

13,116,490

$

12,928,998

(1) The Company's consolidated statements

of financial condition include assets of consolidated variable

interest entities, or VIEs, that can only be used to settle

obligations and liabilities of the VIE for which creditors do not

have recourse to the primary beneficiary (Chimera Investment

Corporation). As of December 31, 2024, and December 31, 2023, total

assets of consolidated VIEs were $9,970,094 and $10,501,840,

respectively, and total liabilities of consolidated VIEs were

$6,766,505 and $7,349,109, respectively.

Net Income (Loss)

(dollars in thousands, except

share and per share data)

(Unaudited)

For the Years Ended

December 31, 2024

December 31, 2023

December 31, 2022

Net interest income:

Interest income (1)

$

760,950

$

772,904

$

773,121

Interest expense (2)

496,274

509,541

333,293

Net interest income

264,676

263,363

439,828

Increase (decrease) in provision for

credit losses

9,838

11,371

7,037

Other income (losses):

Net unrealized gains (losses) on

derivatives

2,963

(6,411

)

(1,482

)

Realized gains (losses) on derivatives

(21,540

)

(40,957

)

(561

)

Periodic interest cost of swaps, net

23,780

17,167

(1,752

)

Net gains (losses) on

derivatives

5,203

(30,201

)

(3,795

)

Investment management and advisory

fees

2,710

—

—

Net unrealized gains (losses) on financial

instruments at fair value

10,811

34,373

(736,899

)

Net realized gains (losses) on sales of

investments

(5,219

)

(31,234

)

(76,473

)

Gains (losses) on extinguishment of

debt

—

3,875

(2,897

)

Other investment gains (losses)

9,543

1,091

(1,866

)

Total other income (losses)

23,048

(22,096

)

(821,930

)

Other expenses:

Compensation and benefits (3)

41,364

30,570

49,378

General and administrative expenses

23,201

25,117

22,651

Servicing and asset manager fees

29,795

32,624

36,005

Amortization of intangibles and

depreciation expenses

321

—

—

Transaction expenses

7,091

15,379

16,146

Total other expenses

101,772

103,690

124,180

Income (loss) before income

taxes

176,114

126,206

(513,319

)

Income taxes

49

102

(253

)

Net income (loss)

$

176,065

$

126,104

$

(513,066

)

Dividends on preferred stock

85,736

73,750

73,765

Net income (loss) available to common

shareholders

$

90,329

$

52,354

$

(586,831

)

Net income (loss) per share available

to common shareholders:

Basic

$

1.12

$

0.68

$

(7.53

)

Diluted

$

1.10

$

0.68

$

(7.53

)

Weighted average number of common

shares outstanding:

Basic

80,976,745

76,685,785

77,979,582

Diluted

82,157,622

77,539,289

77,979,582

(1) Includes interest income of

consolidated VIEs of $640,499, $593,384 and $551,253 for the years

ended December 31, 2024, 2023, and 2022.

(2) Includes interest expense of

consolidated VIEs of $293,509, $282,542 and $197,823 for the years

ended December 31, 2024, 2023, and 2022.

(3) Includes a related-party, non-cash

imputed compensation expense from Palisades Acquisition of $10

million for the year ended December 31, 2024.

CHIMERA INVESTMENT

CORPORATION

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except

share and per share data)

(Unaudited)

For the Years Ended

December 31, 2024

December 31, 2023

December 31, 2022

Comprehensive income (loss):

Net income (loss)

$

176,065

$

126,104

$

(513,066

)

Other comprehensive income:

Unrealized gains (losses) on

available-for-sale securities, net

(26,219

)

(44,990

)

(175,709

)

Reclassification adjustment for net

realized losses (gains) included in net income

—

1,313

—

Other comprehensive income (loss)

$

(26,219

)

$

(43,677

)

$

(175,709

)

Comprehensive income (loss) before

preferred stock dividends

$

149,846

$

82,427

$

(688,775

)

Dividends on preferred stock

$

85,736

$

73,750

$

73,765

Comprehensive income (loss) available

to common stock shareholders

$

64,110

$

8,677

$

(762,540

)

Earnings available for distribution

Earnings available for distribution is a non-GAAP measure and is

defined as GAAP net income excluding (i) unrealized gains or losses

on financial instruments carried at fair value with changes in fair

value recorded in earnings, (ii) realized gains or losses on the

sales of investments, (iii) gains or losses on the extinguishment

of debt, (iv) changes in the provision for credit losses, (v)

unrealized gains or losses on derivatives, (vi) realized gains or

losses on derivatives, (vii) transaction expenses, (viii) stock

compensation expenses for retirement eligible awards, (ix)

amortization of intangibles and depreciation expenses, (x) non-cash

imputed compensation expense related to business acquisitions, and

(xi) other gains and losses on equity investments.

Non-cash imputed compensation expense reflects the portion of

the consideration paid in the Palisades Acquisition that pursuant

to the seller’s contractual arrangements is distributable to the

seller’s legacy employees (who are now our employees) and that for

GAAP purposes is recorded as non-cash imputed compensation expense

with an offsetting entry recorded as non-cash contribution from a

related party to our shareholder’s equity. The excluded amounts do

not include any normal, recurring compensation paid to our

employees.

Transaction expenses are primarily comprised of costs only

incurred at the time of execution of our securitizations, certain

structured secured financing agreements, and business combination

transactions and include costs such as underwriting fees, legal

fees, diligence fees, accounting fees, bank fees and other similar

transaction-related expenses. These costs are all incurred prior to

or at the execution of the transaction and do not recur. Recurring

expenses, such as servicing fees, custodial fees, trustee fees and

other similar ongoing fees are not excluded from earnings available

for distribution. We believe that excluding these costs is useful

to investors as it is generally consistent with our peer group’s

treatment of these costs in their non-GAAP measures presentation,

mitigates period to period comparability issues tied to the timing

of securitization and structured finance transactions, and is

consistent with the accounting for the deferral of debt issue costs

prior to the fair value election option made by us. In addition, we

believe it is important for investors to review this metric which

is consistent with how management internally evaluates the

performance of the Company. Stock compensation expense charges

incurred on awards to retirement eligible employees is reflected as

an expense over a vesting period (generally 36 months) rather than

reported as an immediate expense.

We view Earnings available for distribution as one measure of

our investment portfolio's ability to generate income for

distribution to common stockholders. Earnings available for

distribution is one of the metrics, but not the exclusive metric,

that our Board of Directors uses to determine the amount, if any,

of dividends on our common stock. Other metrics that our Board of

Directors may consider when determining the amount, if any, of

dividends on our common stock include, among others, REIT taxable

income, dividend yield, book value, cash generated from the

portfolio, reinvestment opportunities and other cash needs. To

maintain our qualification as a REIT, U.S. federal income tax law

generally requires that we distribute at least 90% of our REIT

taxable income annually, determined without regard to the deduction

for dividends paid and excluding net capital gains. Earnings

available for distribution, however, is different than REIT taxable

income, and the determination of whether we have met the

requirement to distribute at least 90% of our annual REIT taxable

income is not based on Earnings available for distribution.

Therefore, Earnings available for distribution should not be

considered as an indication of our REIT taxable income, a guaranty

of our ability to pay dividends, or as a proxy for the amount of

dividends we may pay. We believe Earnings available for

distribution helps us and investors evaluate our financial

performance period over period without the impact of certain

non-recurring transactions. Therefore, Earnings available for

distribution should not be viewed in isolation and is not a

substitute for or superior to net income or net income per basic

share computed in accordance with GAAP. In addition, our

methodology for calculating Earnings available for distribution may

differ from the methodologies employed by other REITs to calculate

the same or similar supplemental performance measures, and

accordingly, our Earnings available for distribution may not be

comparable to the Earnings available for distribution reported by

other REITs.

The following table provides GAAP measures of net income and net

income per diluted share available to common stockholders for the

periods presented and details with respect to reconciling the line

items to Earnings available for distribution and related per

average diluted common share amounts. Earnings available for

distribution is presented on an adjusted dilutive shares basis.

For the Quarters Ended

December 31, 2024

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

(dollars in thousands, except per

share data)

GAAP Net income (loss) available to

common stockholders

$

(168,275

)

$

113,672

$

33,913

$

111,016

$

12,104

Adjustments (1):

Net unrealized (gains) losses on financial

instruments at fair value

181,197

(104,012

)

(11,231

)

(76,765

)

(6,815

)

Net realized (gains) losses on sales of

investments

1,468

—

—

3,750

3,752

(Gains) losses on extinguishment of

debt

—

—

—

—

2,473

Increase (decrease) in provision for

credit losses

4,448

358

3,684

1,347

2,330

Net unrealized (gains) losses on

derivatives

(276

)

14,457

(11,955

)

(5,189

)

15,871

Realized (gains) losses on derivatives

(641

)

4,864

17,317

—

—

Transaction expenses

4,707

2,317

—

67

425

Stock Compensation expense for retirement

eligible awards

(307

)

(424

)

(419

)

1,024

(391

)

Amortization of intangibles and

depreciation expenses (2)

321

—

—

—

—

Non-cash imputed compensation related to

business acquisition

10,296

—

—

—

—

Other investment (gains) losses

(2,490

)

(1,366

)

(1,001

)

(4,686

)

986

Earnings available for

distribution

$

30,448

$

29,866

$

30,308

$

30,564

$

30,735

GAAP net income (loss) per diluted

common share

$

(2.04

)

$

1.39

$

0.41

$

1.36

$

0.16

Earnings available for distribution per

adjusted diluted common share

$

0.37

$

0.36

$

0.37

$

0.37

$

0.40

(1) As a result of the Palisades

Acquisition, we updated the determination of earnings available for

distribution to exclude non-recurring acquisition-related

transaction expenses, non-cash amortization of intangibles and

depreciation expenses, and non-cash imputed compensation expenses.

These expenses are excluded as they relate to the Palisades

Acquisition and are not directly related to generation of our

portfolio’s investment income.

(2) Non-cash amortization of intangibles

and depreciation expenses related to Palisades Acquisition

The following tables provide a summary of the Company’s MBS

portfolio at December 31, 2024 and December 31, 2023.

December 31, 2024

Principal or Notional

Value

at Period-End

(dollars in thousands)

Weighted Average

Amortized

Cost Basis

Weighted Average Fair

Value

Weighted Average

Coupon

Weighted Average Yield at

Period-End (1)

Non-Agency RMBS

Senior

$

1,010,128

$

45.11

60.83

5.7

%

17.6

%

Subordinated

648,977

59.18

57.99

4.5

%

8.0

%

Interest-only

2,644,741

5.81

2.77

0.7

%

6.6

%

Agency RMBS

CMO

464,640

99.97

99.36

5.8

%

5.8

%

Interest-only

380,311

5.15

4.41

0.7

%

6.9

%

Agency CMBS

Project loans

40,882

101.51

84.07

3.5

%

3.4

%

Interest-only

449,437

1.36

1.43

0.5

%

8.9

%

(1) Bond Equivalent Yield at period

end.

December 31, 2023

Principal or Notional Value at

Period-End

(dollars in thousands)

Weighted Average

Amortized

Cost Basis

Weighted Average Fair

Value

Weighted Average

Coupon

Weighted Average Yield at

Period-End (1)

Non-Agency RMBS

Senior

$

1,073,632

$

45.69

$

62.98

5.7

%

17.3

%

Subordinated

583,049

50.92

47.49

3.3

%

6.7

%

Interest-only

2,874,680

5.49

3.16

0.5

%

4.2

%

Agency RMBS

Interest-only

392,284

4.90

3.83

0.1

%

5.7

%

Agency CMBS

Project loans

86,572

101.44

91.46

4.0

%

3.8

%

Interest-only

478,239

1.62

1.73

0.5

%

8.2

%

(1) Bond Equivalent Yield at period

end.

At December 31, 2024 and December 31, 2023, the secured

financing agreements collateralized by MBS and Loans held for

investment had the following remaining maturities and borrowing

rates.

December 31, 2024

December 31, 2023

(dollars in thousands)

Principal

Weighted Average Borrowing

Rates

Range of

Borrowing Rates

Principal

Weighted Average Borrowing

Rates

Range of

Borrowing Rates

Overnight

$

—

N/A

NA

$

—

N/A

NA

1 to 29 days

642,358

5.61

%

4.66% - 7.52%

272,490

7.35

%

6.30% - 8.22%

30 to 59 days

959,559

7.79

%

5.34% - 12.50%

495,636

6.68

%

5.58% - 7.87%

60 to 89 days

318,750

5.58

%

4.87% - 7.02%

305,426

7.17

%

5.93% - 7.85%

90 to 119 days

51,416

6.38

%

5.51% - 6.77%

54,376

7.46

%

6.59% - 7.80%

120 to 180 days

123,072

6.15

%

5.82% - 6.77%

105,727

7.09

%

6.72% - 7.80%

180 days to 1 year

409,760

6.79

%

5.80% - 7.49%

39,620

7.06

%

6.66% - 7.39%

1 to 2 years

—

N/A

NA

808,601

9.36

%

8.36% - 12.50%

2 to 3 years

337,245

5.02

%

5.02% - 5.02%

—

N/A

N/A

Greater than 3 years

—

N/A

NA

362,215

5.11

%

5.10% - 7.15%

Total

$

2,842,160

6.48

%

$

2,444,091

7.51

%

The following table summarizes certain characteristics of our

portfolio at December 31, 2024 and December 31, 2023.

December 31, 2024

December 31, 2023

GAAP Leverage at period-end

4.0:1

4.0:1

GAAP Leverage at period-end (recourse)

1.2:1

1.0:1

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Portfolio Composition

Amortized Cost

Fair Value

Non-Agency RMBS

7.9

%

7.5

%

8.3

%

8.3

%

Senior

3.7

%

4.0

%

4.8

%

5.4

%

Subordinated

3.0

%

2.3

%

2.9

%

2.2

%

Interest-only

1.2

%

1.2

%

0.6

%

0.7

%

Agency RMBS

3.7

%

0.2

%

3.7

%

0.1

%

CMO

3.6

%

—

%

3.6

%

—

%

Interest-only

0.1

%

0.2

%

0.1

%

0.1

%

Agency CMBS

0.4

%

0.7

%

0.4

%

0.7

%

Project loans

0.3

%

0.6

%

0.3

%

0.6

%

Interest-only

0.1

%

0.1

%

0.1

%

0.1

%

Loans held for investment

88.0

%

91.6

%

87.6

%

90.9

%

Fixed-rate percentage of portfolio

87.9

%

96.5

%

87.3

%

95.9

%

Adjustable-rate percentage of

portfolio

12.1

%

3.5

%

12.7

%

4.1

%

Economic Net Interest Income

Our Economic net interest income is a non-GAAP financial measure

that equals GAAP net interest income adjusted for net periodic

interest cost of interest rate swaps and excludes interest earned

on cash. For the purpose of computing economic net interest income

and ratios relating to cost of funds measures throughout this

section, interest expense includes net payments on our interest

rate swaps, which is presented as a part of Net gains (losses) on

derivatives in our Consolidated Statements of Operations. Interest

rate swaps are used to manage the increase in interest paid on

secured financing agreements in a rising rate environment.

Presenting the net contractual interest payments on interest rate

swaps with the interest paid on interest-bearing liabilities

reflects our total contractual interest payments. We believe this

presentation is useful to investors because it depicts the economic

value of our investment strategy by showing all components of

interest expense and net interest income of our investment

portfolio. However, Economic net interest income should not be

viewed in isolation and is not a substitute for net interest income

computed in accordance with GAAP. Where indicated, interest

expense, adjusting for any interest earned on cash, is referred to

as Economic interest expense. Where indicated, net interest income

reflecting net periodic interest cost of interest rate swaps and

any interest earned on cash, is referred to as Economic net

interest income.

The following table reconciles the Economic net interest income

to GAAP net interest income and Economic interest expense to GAAP

interest expense for the periods presented.

GAAP

Interest

Income

GAAP

Interest

Expense

Periodic Interest Cost of

Interest Rate Swaps

Economic Interest

Expense

GAAP Net Interest

Income

Periodic Interest Cost of

Interest Rate Swaps

Other (1)

Economic

Net

Interest

Income

For the Year Ended December 31, 2024

$

760,950

$

496,274

$

(23,780

)

$

472,494

$

264,676

$

23,780

$

(7,352

)

$

281,104

For the Year Ended December 31, 2023

$

772,904

$

509,541

$

(17,167

)

$

492,374

$

263,363

$

17,167

$

(9,871

)

$

270,659

For the Year Ended December 31, 2022

$

773,121

$

333,293

$

1,752

$

335,045

$

439,828

$

(1,752

)

$

(2,505

)

$

435,571

For the Quarter Ended December 31,

2024

$

192,364

$

126,540

$

(4,542

)

$

121,997

$

65,824

$

4,542

$

(1,169

)

$

69,197

For the Quarter Ended September 30,

2024

$

195,295

$

128,844

$

(6,789

)

$

122,054

$

66,451

$

6,789

$

(1,729

)

$

71,511

For the Quarter Ended June 30, 2024

$

186,717

$

119,422

$

(6,971

)

$

112,451

$

67,295

$

6,971

$

(1,872

)

$

72,394

For the Quarter Ended March 31, 2024

$

186,574

$

121,468

$

(5,476

)

$

115,992

$

65,106

$

5,476

$

(2,581

)

$

68,001

(1) Primarily interest income on cash and

cash equivalents

The table below shows our average earning assets held, interest

earned on assets, yield on average interest earning assets, average

debt balance, economic interest expense, economic average cost of

funds, economic net interest income, and net interest rate spread

for the periods presented.

For the Quarters Ended

December 31, 2024

September 30, 2024

December 31, 2023

(dollars in thousands)

(dollars in thousands)

(dollars in thousands)

Average

Balance

Interest

Average

Yield/Cost

Average

Balance

Interest

Average

Yield/Cost

Average

Balance

Interest

Average

Yield/Cost

Assets:

Interest-earning assets (1):

Agency RMBS (3)

$

682,811

$

10,505

6.1

%

$

627,966

$

10,343

6.6

%

$

19,136

$

303

6.3

%

Agency CMBS

41,906

507

4.8

%

44,236

502

4.5

%

105,270

1,138

4.3

%

Non-Agency RMBS

1,000,496

29,508

11.8

%

978,811

30,365

12.4

%

950,366

29,611

12.5

%

Loans held for investment

11,107,918

150,674

5.4

%

11,260,536

152,355

5.4

%

11,882,662

158,501

5.3

%

Total

$

12,833,131

$

191,194

6.0

%

$

12,911,549

$

193,565

6.1

%

$

12,957,434

$

189,553

5.9

%

Liabilities and stockholders' equity:

Interest-bearing liabilities

(2):

Secured financing agreements

collateralized by:

Agency RMBS (3)

$

637,645

$

7,438

5.0

%

$

537,265

$

7,563

5.7

%

$

—

$

—

—

%

Agency CMBS

29,194

366

5.0

%

31,001

423

5.5

%

75,847

1,071

5.6

%

Non-Agency RMBS

657,762

10,537

6.4

%

649,412

11,088

6.8

%

710,550

13,561

7.6

%

Loans held for investment

1,745,522

27,973

6.4

%

1,699,744

26,643

6.3

%

1,761,188

30,298

6.9

%

Securitized debt

7,670,967

72,209

3.8

%

7,887,609

73,867

3.7

%

8,422,017

76,327

3.6

%

Long term debt (3)

139,750

3,474

9.9

%

99,938

2,470

9.9

%

—

—

—

%

Total

$

10,880,840

$

121,997

4.5

%

$

10,904,969

$

122,054

4.5

%

$

10,969,602

$

121,257

4.4

%

Economic net interest income/net

interest rate spread

$

69,197

1.5

%

$

71,511

1.6

%

$

68,296

1.5

%

Net interest-earning assets/net

interest margin

$

1,952,291

2.2

%

$

2,006,580

2.2

%

$

1,987,832

2.1

%

Ratio of interest-earning assets to

interest bearing liabilities

1.18

1.18

1.18

(1) Interest-earning assets at amortized

cost.

(2) Interest includes periodic net

interest cost on swaps.

(3) These amounts have been adjusted to

reflect the daily outstanding averages for which the financial

instruments were held during the period.

The table below shows our Net Income and Economic net interest

income as a percentage of average stockholders' equity and Earnings

available for distribution as a percentage of average common

stockholders' equity. Return on average equity is defined as our

GAAP net income (loss) as a percentage of average equity. Average

equity is defined as the average of our beginning and ending

stockholders' equity balance for the period reported. Economic Net

Interest Income and Earnings available for distribution are

non-GAAP measures as defined in previous sections.

Return on Average Equity

Economic Net Interest

Income/Average Equity

Earnings available for

distribution/Average Common Equity

(Ratios have been annualized)

For the Year Ended December 31, 2024

6.72

%

10.72

%

7.16

%

For the Year Ended December 31, 2023

4.87

%

10.45

%

7.19

%

For the Year Ended December 31, 2022

(16.69

)%

14.17

%

11.96

%

For the Quarter Ended December 31,

2024

(22.27

)%

10.52

%

7.16

%

For the Quarter Ended September 30,

2024

20.30

%

10.64

%

6.79

%

For the Quarter Ended June 30, 2024

8.57

%

11.06

%

7.08

%

For the Quarter Ended March 31, 2024

19.90

%

10.45

%

7.31

%

The following table presents changes to Accretable Discount (net

of premiums) as it pertains to our Non-Agency RMBS portfolio,

excluding premiums on interest-only investments, during the

previous five quarters.

For the Quarters Ended

(dollars in thousands)

Accretable Discount (Net of

Premiums)

December 31,

2024

September 30,

2024

June 30, 2024

March 31, 2024

December 31,

2023

Balance, beginning of period

$

123,953

$

125,881

$

130,624

$

139,737

$

147,252

Accretion of discount

(8,855

)

(10,949

)

(11,142

)

(8,179

)

(12,840

)

Purchases

—

2,834

919

1,848

—

Sales

—

—

—

—

—

Elimination in consolidation

—

—

—

—

—

Transfers from/(to) credit reserve,

net

2,105

6,187

5,480

(2,782

)

5,325

Balance, end of period

$

117,203

$

123,953

$

125,881

$

130,624

$

139,737

Disclaimer

In this press release references to “we,” “us,” “our” or “the

Company” refer to Chimera Investment Corporation and its

subsidiaries unless specifically stated otherwise or the context

otherwise indicates. This press release includes “forward-looking

statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995.

Actual results may differ from expectations, estimates and

projections and, consequently, readers should not rely on these

forward-looking statements as predictions of future events. Words

such as “goal,” “expect,” “target,” “assume,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “would,” “will,” “could,” “should,” “believe,” “predict,”

“potential,” “continue,” or similar expressions are intended to

identify such forward-looking statements. These forward-looking

statements involve significant risks and uncertainties that could

cause actual results to differ materially from expected results,

including, among other things, those described in our most recent

Annual Report on Form 10-K, and any subsequent Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K, under the caption “Risk

Factors.” Factors that could cause actual results to differ

include, but are not limited to: our ability to obtain funding on

favorable terms and access the capital markets; our ability to

achieve optimal levels of leverage and effectively manage our

liquidity; changes in inflation, the yield curve, interest rates

and mortgage prepayment rates; our ability to manage credit risk

related to our investments and comply with the Risk Retention

Rules; rates of default, delinquencies, forbearance, deferred

payments or decreased recovery rates on our investments; the

concentration of properties securing our securities and residential

loans in a small number of geographic areas; our ability to execute

on our business and investment strategy; our ability to determine

accurately the fair market value of our assets; changes in our

industry, the general economy or geopolitical conditions; our

ability to successfully integrate and realize the anticipated

benefits of any acquisitions, including the Palisades Acquisition;

our ability to operate our investment management and advisory

services and manage any regulatory rules and conflicts of interest;

the degree to which our hedging strategies may or may not be

effective; our ability to effect our strategy to securitize

residential mortgage loans; our ability to compete with competitors

and source target assets at attractive prices; our ability to find

and retain qualified executive officers and key personnel; the

ability of servicers and other third parties to perform their

services at a high level and comply with applicable law and

expanding regulations; our dependence on information technology and

its susceptibility to cyber-attacks; our ability to comply with

extensive government regulation; the impact of and changes in

governmental regulations, tax law and rates, accounting guidance,

and similar matters; our ability to maintain our exemption from

registration under the Investment Company Act of 1940, as amended;

our ability to maintain our classification as a real estate

investment trust for U.S. federal income tax purposes; the

volatility of the market price and trading volume of our shares;

and our ability to make distributions to our stockholders in the

future.

Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Chimera does not undertake or accept any obligation to release

publicly any updates or revisions to any forward-looking statement

to reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is based.

Additional information concerning these, and other risk factors, is

contained in Chimera’s most recent filings with the Securities and

Exchange Commission (SEC). All subsequent written and oral

forward-looking statements concerning Chimera or matters

attributable to Chimera or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

above.

Readers are advised that any financial information in this press

release is based on Company data available at the time of this

presentation and, in certain circumstances, may not have been

audited by the Company’s independent auditors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212755125/en/

Investor Relations 888-895-6557 www.chimerareit.com

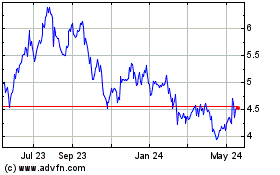

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

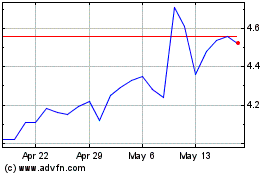

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Feb 2024 to Feb 2025