Colgate-Palmolive Company (NYSE:CL):

- Net sales increased 2.4%; Organic sales* increased 6.8%

- GAAP EPS increased 5% to $0.90; Base Business EPS* increased 6%

to $0.91

- GAAP Gross profit margin increased 260 basis points to 61.1%;

Base Business Gross profit margin* increased 270 basis points to

61.3%

- Net cash provided by operations was $2,838 million for the

first nine months of 2024

- Colgate’s leadership in toothpaste continued with its global

market share at 41.6% year to date

- Colgate’s leadership in manual toothbrushes continued with its

global market share at 32.3% year to date

- The Company updated its financial guidance for full year

2024

Third Quarter Total Company Results

(GAAP)

($ in millions except per share

amounts)

2024

2023

Change

Net Sales

$5,033

$4,915

+2.4%

EPS (diluted)

$0.90

$0.86

+5%

Third Quarter Total Company Results

(Base Business - Non-GAAP)*

2024

2023

Change

Organic Sales Growth

+6.8%

Base Business EPS (diluted)

$0.91

$0.86

+6%

*Indicates a non-GAAP financial measure.

Please refer to “Non-GAAP Financial Measures” later in this release

for definitions of non-GAAP financial measures and to “Table 6 -

Geographic Sales Analysis Percentage Changes” and “Table 8 -

Non-GAAP Reconciliations” included with this release for a

reconciliation of these non-GAAP financial measures to the related

GAAP measures.

Colgate-Palmolive Company (NYSE:CL) today reported results for

third quarter 2024. Noel Wallace, Chairman, President and Chief

Executive Officer, commented on the Base Business third quarter

results, “We are very pleased to have delivered another quarter of

strong top and bottom line results with earnings exceeding our

expectations. Net sales increased 2.4% and organic sales grew 6.8%

(on top of 8.8% organic sales growth in the year ago quarter)

driven by a healthy balance of volume growth and higher pricing.

Every operating division delivered positive volume growth for the

second consecutive quarter as we focus on increasing household

penetration to drive category growth and market shares.

“We are particularly pleased with the quality of our results

this quarter on top of our strong first half results. This is our

sixth consecutive quarter delivering gross margin expansion along

with growth in operating profit, net income and earnings per share.

Advertising increased 16% in the quarter behind science-led, core

and premium innovation across price tiers. We expect continued

strong advertising investment through the remainder of the year as

we focus on building brand health and scaling the capabilities

needed to drive growth.

“Our strong results this quarter and year to date add to our

confidence that we are executing the right strategies to deliver on

our updated 2024 organic sales and Base Business earnings growth

expectations, drive cash flow and generate consistent, compounded

earnings per share growth.”

Full Year 2024 Guidance

Based on current spot rates:

- The Company now expects net sales growth of 3% to 5% (versus 2%

to 5% previously) including a mid-single-digit negative impact from

foreign exchange.

- The Company now expects organic sales growth of 7% to 8%

(versus 6% to 8% previously).

- On a GAAP basis, the Company still expects gross profit margin

expansion, increased advertising investment and double-digit

earnings per share growth.

- On a non-GAAP (Base Business) basis, the Company still expects

gross profit margin expansion and increased advertising investment

and now expects earnings per share growth of 10% to 11% (versus 8%

to 11% previously).

Divisional Performance

See attached "Table 6 - Geographic Sales Analysis Percentage

Changes" and "Table 5 - Segment Information" for additional

information on net sales and operating profit by division.

Third Quarter Sales Growth By

Division (% change 3Q 2024 vs. 3Q 2023 except % of Total

Company Sales)

% of Total Company Sales

Net Sales

Organic Sales*

As Reported Volume

Organic Volume

Pricing

FX

North America(1)

20%

-2.1%

-1.9%

+1.2%

+1.2%

-3.2%

-0.2%

Latin America

23%

-3.2%

+14.2%

+3.3%

+3.3%

+10.9%

-17.4%

Europe(1)

15%

+8.0%

+6.3%

+4.1%

+4.1%

+2.2%

+1.6%

Asia Pacific

14%

+6.3%

+6.1%

+6.5%

+6.5%

-0.3%

+0.2%

Africa/Eurasia

6%

+4.8%

+10.8%

+6.9%

+6.9%

+3.9%

-6.0%

Hill’s

22%

+6.3%

+6.5%

+3.6%

+3.6%

+2.8%

-0.1%

Total Company

100%

+2.4%

+6.8%

+3.7%

+3.7%

+3.1%

-4.4%

Note: Table may not sum due to

rounding.

(1) The Company has recast its historical

geographic segment information to conform to the reporting

structure effective as of July 1, 2024. The results of the skin

health business previously reported within the Europe reportable

operating segment are reported with the other skin health

businesses in the North America reportable operating segment.

Recast historical geographic segment information can be found on

the Company's website.

*Indicates a non-GAAP financial measure.

Please refer to “Non-GAAP Financial Measures” later in this release

for definitions of non-GAAP financial measures and to “Table 6 -

Geographic Sales Analysis Percentage Changes” included with this

release for a reconciliation of these non-GAAP financial measures

to the related GAAP measures.

Third Quarter Operating Profit By

Division ($ in millions)

3Q 2024

% Change vs 3Q 2023

% to Net Sales

Change in basis points vs 3Q 2023

% to Net Sales

North America(1)

$206

-9%

20.5%

-170

Latin America

$365

-2%

31.6%

+40

Europe(1)

$181

10%

24.3%

+30

Asia Pacific

$199

3%

27.4%

-90

Africa/Eurasia

$65

-1%

23.4%

-140

Hill’s

$258

28%

22.9%

+390

Total Company, As Reported

$1,065

4%

21.2%

+30

Total Company, Base Business*

$1,080

5%

21.5%

+50

(1) The Company has recast its historical

geographic segment information to conform to the reporting

structure effective as of July 1, 2024.

*Indicates a non-GAAP financial measure.

Please refer to “Non-GAAP Financial Measures” later in this release

for definitions of non-GAAP financial measures and to “Table 8 -

Non-GAAP Reconciliations” included with this release for a

reconciliation of these non-GAAP financial measures to the related

GAAP measures.

Prepared Materials and Webcast

Information

At approximately 7:00 a.m. ET today, Colgate will post its

prepared materials (in PDF format) regarding third quarter results

to the Investor Center section of its website at

https://investor.colgatepalmolive.com/events-and-presentations.

At 8:30 a.m. ET today, Colgate will host a conference call

regarding third quarter results. To access this call as a webcast,

please go to Colgate’s website at www.colgatepalmolive.com.

About Colgate-Palmolive

Colgate-Palmolive Company is a caring, innovative growth company

that is reimagining a healthier future for all people, their pets

and our planet. Focused on Oral Care, Personal Care, Home Care and

Pet Nutrition, we sell our products in more than 200 countries and

territories under brands such as Colgate, Palmolive, elmex, hello,

meridol, Sorriso, Tom’s of Maine, EltaMD, Filorga, Irish Spring,

Lady Speed Stick, PCA SKIN, Protex, Sanex, Softsoap, Speed Stick,

Ajax, Axion, Fabuloso, Murphy, Soupline and Suavitel, as well as

Hill’s Science Diet and Hill’s Prescription Diet. The Company is

recognized for its leadership and innovation in promoting

sustainability and community wellbeing, including its achievements

in decreasing plastic waste and promoting recyclability, saving

water, conserving natural resources and improving children’s oral

health through the Colgate Bright Smiles, Bright Futures program,

which has reached approximately 1.7 billion children and their

families since 1991. For more information about Colgate’s global

business and how the Company is building a future to smile about,

visit www.colgatepalmolive.com. CL-E

Market Share Information

Management uses market share information as a key indicator to

monitor business health and performance. References to market share

in this press release are based on a combination of consumption and

market share data provided by third-party vendors, primarily

Nielsen, and internal estimates. All market share references

represent the percentage of the dollar value of sales of our

products, relative to all product sales in the category in the

countries in which the Company competes and purchases data

(excluding Venezuela from all periods).

Market share data is subject to limitations on the availability

of up-to-date information. In particular, market share data is

currently not generally available for certain retail channels, such

as eCommerce and certain club retailers and discounters. The

Company measures year-to-date market shares from January 1 of the

relevant year through the most recent period for which market share

data is available, which typically reflects a lag time of one or

two months. The Company believes that the third-party vendors it

uses to provide data are reliable, but it has not verified the

accuracy or completeness of the data or any assumptions underlying

the data. In addition, market share information reported by the

Company may be different from market share information reported by

other companies due to differences in category definitions, the use

of data from different countries, internal estimates and other

factors.

Cautionary Statement on Forward-Looking

Statements

This press release and the related webcast may contain

forward-looking statements (as that term is defined in the U.S.

Private Securities Litigation Reform Act of 1995 or by the

Securities and Exchange Commission (SEC) in its rules, regulations

and releases) that set forth anticipated results based on

management’s current plans and assumptions. Such statements may

relate, for example, to sales or volume growth, net selling price

increases, organic sales growth, profit or profit margin levels,

earnings per share levels, financial goals, the impact of foreign

exchange, the impact of the wars in Ukraine and the Middle East,

cost-reduction plans (including the 2022 Global Productivity

Initiative), tax rates, interest rates, new product introductions,

digital capabilities, commercial investment levels, acquisitions,

divestitures, share repurchases or legal or tax proceedings, among

other matters. These statements are made on the basis of the

Company’s views and assumptions as of this time and the Company

undertakes no obligation to update these statements whether as a

result of new information, future events or otherwise, except as

required by law or by the rules and regulations of the SEC.

Moreover, the Company does not, nor does any other person, assume

responsibility for the accuracy and completeness of these

statements. The Company cautions investors that any such

forward-looking statements are not guarantees of future performance

and that actual events or results may differ materially from those

statements. For more information about factors that could impact

the Company’s business and cause actual results to differ

materially from forward-looking statements, investors should refer

to the Company’s filings with the SEC (including, but not limited

to, the information set forth under the captions “Risk Factors” and

“Cautionary Statement on Forward-Looking Statements” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 and subsequent filings with the SEC). Copies of these

filings may be obtained upon request from the Company’s Investor

Relations Department or on the Company’s website at

www.colgatepalmolive.com.

Non-GAAP Financial

Measures

The following provides definitions and other information

regarding the non-GAAP financial measures used in this press

release and the related prepared materials and webcast, which may

not be the same as or comparable to similar measures presented by

other companies:

- Base Business: Base Business refers to non-GAAP measures of

operating results that exclude certain items. Base Business

operating results exclude, as applicable, charges related to an

ERISA litigation matter, a foreign tax matter and the 2022 Global

Productivity Initiative and product recall costs.

- Organic sales growth: Net sales growth excluding the impact of

foreign exchange, acquisitions and divestments.

- Free cash flow before dividends: Net cash provided by

operations less Capital expenditures.

This press release discusses Net sales growth (GAAP) and Organic

sales growth (non-GAAP). Management believes the organic sales

growth measure provides investors and analysts with useful

supplemental information regarding the Company’s underlying sales

trends by presenting sales growth excluding the external factor of

foreign exchange as well as the impact from acquisitions and

divestments. See “Geographic Sales Analysis Percentage Changes” for

the three and nine months ended September 30, 2024 versus 2023

included with this release for a comparison of Organic sales growth

to Net sales growth in accordance with GAAP.

Gross Profit, Gross Profit margin, Selling, general and

administrative expenses, Selling, general and administrative

expenses as a percentage of Net sales, Other (income) expense, net,

Operating profit, Operating profit margin, Non-service related

postretirement costs, Effective income tax rate, Net income

attributable to Colgate-Palmolive Company and Diluted earnings per

common share are disclosed on both an as reported (GAAP) and Base

Business (non-GAAP) basis. These non-GAAP financial measures

exclude items that, either by their nature or amount, management

would not expect to occur as part of the Company’s normal business

on a regular basis, such as restructuring charges, charges for

certain litigation and tax matters, acquisition-related costs,

gains and losses from certain divestitures and certain other

unusual, non-recurring items. Investors and analysts use these

financial measures in assessing the Company’s business performance,

and management believes that presenting these financial measures on

a non-GAAP basis provides them with useful supplemental information

to enhance their understanding of the Company’s underlying business

performance and trends. These non-GAAP financial measures also

enhance the ability to compare period-to-period financial results.

See “Non-GAAP Reconciliations” for the three and nine months ended

September 30, 2024 and 2023 included with this release for a

reconciliation of these financial measures to the related GAAP

measures.

The Company uses these financial measures internally in its

budgeting process, to evaluate segment and overall operating

performance and as factors in determining compensation. While the

Company believes that these financial measures are useful in

evaluating the Company’s underlying business performance and

trends, this information should be considered as supplemental in

nature and is not meant to be considered in isolation or as a

substitute for the related financial information prepared in

accordance with GAAP.

As management uses free cash flow before dividends to evaluate

the Company’s ability to satisfy current and future obligations,

pay dividends, fund future business opportunities and repurchase

stock, the Company believes that it provides useful information to

investors. Free cash flow before dividends is not a measure of cash

available for discretionary expenditures since the Company has

certain non-discretionary obligations such as debt service that are

not deducted from the measure. See “Condensed Consolidated

Statements of Cash Flows” for the nine months ended September 30,

2024 and 2023 for a comparison of free cash flow before dividends

to Net cash provided by operations as reported in accordance with

GAAP.

(See attached tables for third quarter

results.)

Table 1

Colgate-Palmolive

Company

Condensed Consolidated

Statements of Income

For the Three Months Ended

September 30, 2024 and 2023

(Dollars in Millions Except

Per Share Amounts) (Unaudited)

2024

2023

Net sales

$

5,033

$

4,915

Cost of sales

1,959

2,038

Gross profit

3,074

2,877

Gross profit margin

61.1

%

58.5

%

Selling, general and administrative

expenses

1,979

1,822

Other (income) expense, net

30

26

Operating profit

1,065

1,029

Operating profit margin

21.2

%

20.9

%

Non-service related postretirement

costs

23

15

Interest (income) expense, net

56

58

Income before income taxes

986

956

Provision for income taxes

210

209

Effective tax rate

21.3

%

21.9

%

Net income including noncontrolling

interests

776

747

Less: Net income attributable to

noncontrolling interests

39

39

Net income attributable to

Colgate-Palmolive Company

$

737

$

708

Earnings per common share

Basic

$

0.90

$

0.86

Diluted

$

0.90

$

0.86

Supplemental Income Statement

Information

Average common shares outstanding

Basic

817.7

825.6

Diluted

822.5

827.3

Advertising

$

694

$

598

Table 2

Colgate-Palmolive

Company

Condensed Consolidated

Statements of Income

For the Nine Months Ended

September 30, 2024 and 2023

(Dollars in Millions Except

Per Share Amounts) (Unaudited)

2024

2023

Net sales

$

15,156

$

14,507

Cost of sales

5,977

6,131

Gross profit

9,179

8,376

Gross profit margin

60.6

%

57.7

%

Selling, general and administrative

expenses

5,833

5,348

Other (income) expense, net

141

116

Operating profit

3,205

2,912

Operating profit margin

21.1

%

20.1

%

Non-service related postretirement

costs

67

338

Interest (income) expense, net

175

170

Income before income taxes

2,963

2,404

Provision for income taxes

693

709

Effective tax rate

23.4

%

29.5

%

Net income including noncontrolling

interests

2,270

1,695

Less: Net income attributable to

noncontrolling interests

120

113

Net income attributable to

Colgate-Palmolive Company

$

2,150

$

1,582

Earnings per common share

Basic(1)

$

2.62

$

1.91

Diluted(1)

$

2.61

$

1.90

Supplemental Income Statement

Information

Average common shares outstanding

Basic

820.1

828.8

Diluted

824.2

830.5

Advertising

$

2,072

$

1,778

Note:

(1) Basic and diluted earnings per share

are computed independently for each quarter and any year-to-date

period presented. As a result of changes in shares outstanding

during the year and rounding, the sum of the quarters' earnings per

share may not equal the earnings per share for any year-to-date

period.

Table 3

Colgate-Palmolive

Company

Condensed Consolidated Balance

Sheets

As of September 30, 2024,

December 31, 2023 and September 30, 2023

(Dollars in Millions)

(Unaudited)

September 30,

December 31,

September 30,

2024

2023

2023

Cash and cash equivalents

$

1,234

$

966

$

951

Receivables, net

1,712

1,586

1,577

Inventories

2,041

1,934

1,931

Other current assets

819

793

898

Property, plant and equipment, net

4,421

4,582

4,409

Goodwill

3,389

3,410

3,327

Other intangible assets, net

1,834

1,887

1,861

Other assets

1,324

1,235

1,089

Total assets

$

16,774

$

16,393

$

16,043

Total debt

$

8,436

$

8,549

$

8,724

Other current liabilities

5,038

4,411

4,568

Other non-current liabilities

2,464

2,476

2,345

Total liabilities

15,938

15,436

15,637

Total Colgate-Palmolive Company

shareholders’ equity

435

609

(9

)

Noncontrolling interests

401

348

415

Total liabilities and equity

$

16,774

$

16,393

$

16,043

Supplemental Balance Sheet

Information

Debt less cash, cash equivalents and

marketable securities(1)

$

6,942

$

7,404

$

7,526

Working capital % of sales

(3.6

)%

(1.4

)%

(2.1

)%

Note:

(1) Marketable securities of $260, $179

and $247 as of September 30, 2024, December 31, 2023 and September

30, 2023, respectively, are included in Other current assets.

Table 4

Colgate-Palmolive

Company

Condensed Consolidated

Statements of Cash Flows

For the Nine Months Ended

September 30, 2024 and 2023

(Dollars in Millions)

(Unaudited)

2024

2023

Operating Activities

Net income including noncontrolling

interests

$

2,270

$

1,695

Adjustments to reconcile Net income

including noncontrolling interests to Net cash provided by

operations:

Depreciation and amortization

457

417

ERISA litigation matter

—

267

Restructuring and termination benefits,

net of cash

54

(17

)

Stock-based compensation expense

108

97

Deferred income taxes

(98

)

(109

)

Cash effects of changes in:

Receivables

(184

)

(62

)

Inventories

(94

)

150

Accounts payable and other accruals

327

168

Other non-current assets and

liabilities

(2

)

3

Net cash provided by (used in)

operations

2,838

2,609

Investing Activities

Capital expenditures

(377

)

(508

)

Purchases of marketable securities and

investments

(358

)

(324

)

Proceeds from sale of marketable

securities and investments

260

264

Other investing activities

21

(31

)

Net cash provided by (used in) investing

activities

(454

)

(599

)

Financing Activities

Short-term borrowing (repayment) less than

90 days, net

337

(564

)

Principal payments of debt

(502

)

(903

)

Proceeds from issuance of debt

2

1,497

Dividends paid

(1,275

)

(1,243

)

Purchases of treasury shares

(1,284

)

(883

)

Proceeds from exercise of stock

options

611

325

Other financing activities

1

(30

)

Net cash provided by (used in) financing

activities

(2,110

)

(1,801

)

Effect of exchange rate changes on Cash

and cash equivalents

(6

)

(33

)

Net increase (decrease) in Cash and cash

equivalents

268

176

Cash and cash equivalents at beginning of

the period

966

775

Cash and cash equivalents at end of the

period

$

1,234

$

951

Supplemental Cash Flow

Information

Free cash flow before dividends (Net cash

provided by operations less Capital expenditures)

Net cash provided by operations

$

2,838

$

2,609

Less: Capital expenditures

(377

)

(508

)

Free cash flow before dividends

$

2,461

$

2,101

Income taxes paid

$

762

$

726

Interest paid

$

267

$

243

Table 5

Colgate-Palmolive

Company

Segment Information

For the Three and Nine Months

Ended September 30, 2024 and 2023

(Dollars in Millions)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net Sales

Oral, Personal and Home Care

North America(1)

$

1,004

$

1,025

$

3,076

$

3,044

Latin America

1,156

1,194

3,676

3,447

Europe(1)

744

690

2,102

1,935

Asia Pacific

725

682

2,133

2,084

Africa/Eurasia

278

266

827

822

Total Oral, Personal and Home Care

3,907

3,857

11,814

11,332

Pet Nutrition

1,126

1,058

3,342

3,175

Total Net Sales

$

5,033

$

4,915

$

15,156

$

14,507

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Operating Profit

Oral, Personal and Home Care

North America(1)

$

206

$

227

$

633

$

640

Latin America

365

372

1,187

1,050

Europe(1)

181

165

502

422

Asia Pacific

199

193

602

564

Africa/Eurasia

65

66

195

196

Total Oral, Personal and Home Care

1,016

1,024

3,119

2,873

Pet Nutrition

258

201

691

575

Corporate(2)

(208

)

(196

)

(605

)

(536

)

Total Operating Profit

$

1,065

$

1,029

$

3,205

$

2,912

Notes: Tables may not sum due to rounding.

(1) The Company has recast its historical

geographic segment information to conform to the reporting

structure effective as of July 1, 2024.

(2) Corporate operations include costs

related to stock options and restricted stock units, research and

development costs, Corporate overhead costs, restructuring and

related implementation charges and gains and losses on sales of

non-core product lines and assets.

Corporate Operating profit (loss) for the

three months ended September 30, 2024 and September 30,

2023 included charges resulting from the 2022 Global Productivity

Initiative of $15 and $2, respectively.

Corporate Operating profit (loss) for the

nine months ended September 30, 2024 included charges resulting

from the 2022 Global Productivity Initiative of $77.

Corporate Operating profit (loss) for the

nine months ended September 30, 2023 included product recall costs

of $25 and charges resulting from the 2022 Global Productivity

Initiative of $25.

Table 6

Colgate-Palmolive

Company

Geographic Sales Analysis

Percentage Changes

For the Three Months Ended

September 30, 2024 vs. 2023

(Unaudited)

COMPONENTS OF SALES

CHANGE

Pricing

Coupons

Sales

Consumer &

Change

Organic

As Reported

Organic

Trade

Foreign

Region

As

Reported

Sales

Change

Volume

Volume

Incentives

Exchange

Total Company

2.4

%

6.8

%

3.7

%

3.7

%

3.1

%

(4.4

)%

North America(1)

(2.1

)%

(1.9

)%

1.2

%

1.2

%

(3.2

)%

(0.2

)%

Latin America

(3.2

)%

14.2

%

3.3

%

3.3

%

10.9

%

(17.4

)%

Europe(1)

8.0

%

6.3

%

4.1

%

4.1

%

2.2

%

1.6

%

Asia Pacific

6.3

%

6.1

%

6.5

%

6.5

%

(0.3

)%

0.2

%

Africa/Eurasia

4.8

%

10.8

%

6.9

%

6.9

%

3.9

%

(6.0

)%

Total CP Products

1.3

%

6.8

%

3.7

%

3.7

%

3.1

%

(5.5

)%

Hill’s

6.3

%

6.5

%

3.6

%

3.6

%

2.8

%

(0.1

)%

Emerging Markets(2)

1.0

%

11.1

%

4.6

%

4.6

%

6.5

%

(10.1

)%

Developed Markets

3.6

%

3.2

%

3.0

%

3.0

%

0.2

%

0.4

%

Notes: Table may not sum due to

rounding.

(1) The Company has recast its historical

geographic segment information to conform to the reporting

structure effective as of July 1, 2024.

(2) Emerging Markets include Latin

America, Asia (excluding Japan), Africa/Eurasia and Central

Europe.

Table 7

Colgate-Palmolive

Company

Geographic Sales Analysis

Percentage Changes

For the Nine Months Ended

September 30, 2024 vs. 2023

(Unaudited)

COMPONENTS OF SALES

CHANGE

Pricing

Coupons

Sales

Consumer &

Change

Organic

As Reported

Organic

Trade

Foreign

Region

As

Reported

Sales

Change

Volume

Volume

Incentives

Exchange

Total Company

4.5

%

8.5

%

3.3

%

3.3

%

5.2

%

(4.0

)%

North America(1)

1.1

%

1.1

%

2.8

%

2.8

%

(1.7

)%

(0.1

)%

Latin America

6.6

%

19.4

%

5.0

%

5.0

%

14.5

%

(12.8

)%

Europe(1)

8.6

%

7.4

%

4.9

%

4.9

%

2.5

%

1.3

%

Asia Pacific

2.4

%

4.1

%

2.2

%

2.2

%

2.0

%

(1.8

)%

Africa/Eurasia

0.7

%

14.5

%

6.4

%

6.4

%

8.2

%

(13.8

)%

Total CP Products

4.3

%

9.3

%

4.0

%

4.0

%

5.3

%

(5.0

)%

Hill’s

5.2

%

5.6

%

0.7

%

0.7

%

4.9

%

(0.4

)%

Emerging Markets(2)

4.8

%

13.8

%

4.1

%

4.1

%

9.7

%

(9.0

)%

Developed Markets

4.2

%

4.2

%

2.6

%

2.6

%

1.6

%

—

%

Notes: Table may not sum due to

rounding.

(1) The Company has recast its historical

geographic segment information to conform to the reporting

structure effective as of July 1, 2024.

(2) Emerging Markets include Latin

America, Asia (excluding Japan), Africa/Eurasia and Central

Europe.

Table 8

Colgate-Palmolive

Company

Non-GAAP

Reconciliations

For the Three Months Ended

September 30, 2024 and 2023

(Dollars in Millions Except

Per Share Amounts) (Unaudited)

Gross Profit

2024

2023

Gross profit, GAAP

$

3,074

$

2,877

2022 Global Productivity Initiative

9

1

Gross profit, non-GAAP

$

3,083

$

2,878

Basis Point

Gross Profit Margin

2024

2023

Change

Gross profit margin, GAAP

61.1

%

58.5

%

260

2022 Global Productivity Initiative

0.2

%

0.1

%

Gross profit margin, non-GAAP

61.3

%

58.6

%

270

Selling, General and Administrative

Expenses

2024

2023

Selling, general and administrative

expenses, GAAP

$

1,979

$

1,822

2022 Global Productivity Initiative

(3

)

—

Selling, general and administrative

expenses, non-GAAP

$

1,976

$

1,822

Other (Income) Expense, Net

2024

2023

Other (income) expense, net, GAAP

$

30

$

26

2022 Global Productivity Initiative

(3

)

(1

)

Other (income) expense, net, non-GAAP

$

27

$

25

Operating Profit

2024

2023

% Change

Operating profit, GAAP

$

1,065

$

1,029

4

%

2022 Global Productivity Initiative

15

2

Operating profit, non-GAAP

$

1,080

$

1,031

5

%

Basis Point

Operating Profit Margin

2024

2023

Change

Operating profit margin, GAAP

21.2

%

20.9

%

30

2022 Global Productivity Initiative

0.3

%

0.1

%

Operating profit margin, non-GAAP

21.5

%

21.0

%

50

Table 8

Continued

Colgate-Palmolive

Company

Non-GAAP

Reconciliations

For the Three Months Ended

September 30, 2024 and 2023

(Dollars in Millions Except

Per Share Amounts) (Unaudited)

2024

Income Before Income

Taxes

Provision For Income

Taxes(1)

Net Income

Including Noncontrolling Interests

Less: Income Attributable to

Noncontrolling Interests

Net Income Attributable

To Colgate- Palmolive Company

Effective Income Tax

Rate(2)

Diluted Earnings Per

Share

As Reported GAAP

$

986

$

210

$

776

$

39

$

737

21.3

%

$

0.90

2022 Global Productivity Initiative

15

2

13

—

13

(0.1

)%

0.01

Non-GAAP

$

1,001

$

212

$

789

$

39

$

750

21.2

%

$

0.91

2023

Income Before Income

Taxes

Provision For Income

Taxes(1)

Net Income

Including Noncontrolling Interests

Less: Income Attributable to

Noncontrolling Interests

Net Income Attributable

To Colgate- Palmolive Company

Effective Income Tax

Rate(2)

Diluted Earnings Per

Share

As Reported GAAP

$

956

$

209

$

747

$

39

$

708

21.9

%

$

0.86

2022 Global Productivity Initiative

2

—

2

—

2

(0.1

)%

—

Non-GAAP

$

958

$

209

$

749

$

39

$

710

21.8

%

$

0.86

Notes: The impact of non-GAAP adjustments

may not necessarily equal the difference between “GAAP” and

“non-GAAP” as a result of rounding.

(1) The income tax effect on non-GAAP

items is calculated based upon the tax laws and statutory income

tax rates applicable in the tax jurisdiction(s) of the underlying

non-GAAP adjustment.

(2) The impact of non-GAAP items on the

Company’s effective tax rate represents the difference in the

effective tax rate calculated with and without the non-GAAP

adjustment on Income before income taxes and Provision for income

taxes.

Table 9

Colgate-Palmolive

Company

Non-GAAP

Reconciliations

For the Nine Months Ended

September 30, 2024 and 2023

(Dollars in Millions Except

Per Share Amounts) (Unaudited)

Gross Profit

2024

2023

Gross profit, GAAP

$

9,179

$

8,376

2022 Global Productivity Initiative

19

1

Gross profit, non-GAAP

$

9,198

$

8,377

Gross Profit Margin

2024

2023

Change

Gross profit margin, GAAP

60.6

%

57.7

%

290

2022 Global Productivity Initiative

0.1

%

—

%

Gross profit margin, non-GAAP

60.7

%

57.7

%

300

Selling, General and Administrative

Expenses

2024

2023

Selling, general and administrative

expenses, GAAP

$

5,833

$

5,348

2022 Global Productivity Initiative

(4

)

(2

)

Selling, general and administrative

expenses, non-GAAP

$

5,829

$

5,346

Other (Income) Expense, Net

2024

2023

Other (income) expense, net, GAAP

$

141

$

116

2022 Global Productivity Initiative

(54

)

(22

)

Product recall costs

—

(25

)

Other (income) expense, net, non-GAAP

$

87

$

69

Operating Profit

2024

2023

% Change

Operating profit, GAAP

$

3,205

$

2,912

10

%

2022 Global Productivity Initiative

77

25

Product recall costs

—

25

Operating profit, non-GAAP

$

3,282

$

2,962

11

%

Basis Point

Operating Profit Margin

2024

2023

Change

Operating profit margin, GAAP

21.1

%

20.1

%

100

2022 Global Productivity Initiative

0.6

%

0.1

%

Product recall costs

—

%

0.2

%

Operating profit margin, non-GAAP

21.7

%

20.4

%

130

Non-Service Related Postretirement

Costs

2024

2023

Non-service related postretirement costs,

GAAP

$

67

$

338

ERISA litigation matter

—

(267

)

2022 Global Productivity Initiative

—

(4

)

Non-service related postretirement costs,

non-GAAP

$

67

$

67

Table 9

Continued

Colgate-Palmolive

Company

Non-GAAP

Reconciliations

For the Nine Months Ended

September 30, 2024 and 2023

(Dollars in Millions Except

Per Share Amounts) (Unaudited)

2024

Income Before Income

Taxes

Provision For Income

Taxes(1)

Net Income

Including Noncontrolling Interests

Less: Income Attributable to

Noncontrolling Interests

Net Income Attributable

To

Colgate- Palmolive

Company

Effective Income Tax

Rate(2)

Diluted Earnings Per

Share

As Reported GAAP

$

2,963

$

693

$

2,270

$

120

$

2,150

23.4

%

$

2.61

2022 Global Productivity Initiative

77

10

67

—

67

(0.3

)%

0.08

Non-GAAP

$

3,040

$

703

$

2,337

$

120

$

2,217

23.1

%

$

2.69

2023

Income Before Income

Taxes

Provision For Income

Taxes(1)

Net Income

Including Noncontrolling Interests

Less: Income Attributable to

Noncontrolling Interests

Net Income Attributable

To

Colgate- Palmolive

Company

Effective Income Tax

Rate(2)

Diluted Earnings Per

Share

As Reported GAAP

$

2,404

$

709

$

1,695

$

113

$

1,582

29.5

%

$

1.90

ERISA litigation matter

267

55

212

—

212

(0.9

)%

0.26

Foreign tax matter

—

(126

)

126

—

126

(4.7

)%

0.15

2022 Global Productivity Initiative

29

5

24

1

23

(0.1

)%

0.03

Product recall costs

25

6

19

—

19

—

%

0.02

Non-GAAP

$

2,725

$

649

$

2,076

$

114

$

1,962

23.8

%

$

2.36

Notes: The impact of non-GAAP adjustments

may not necessarily equal the difference between “GAAP” and

“non-GAAP” as a result of rounding.

(1) The income tax effect on non-GAAP

items is calculated based upon the tax laws and statutory income

tax rates applicable in the tax jurisdiction(s) of the underlying

non-GAAP adjustment.

(2) The impact of non-GAAP items on the

Company’s effective tax rate represents the difference in the

effective tax rate calculated with and without the non-GAAP

adjustments on Income before income taxes and Provision for income

taxes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241025832799/en/

Investor Relations: investor_relations@colpal.com

Communications: colgate_palmolive_media_inquiry@colpal.com

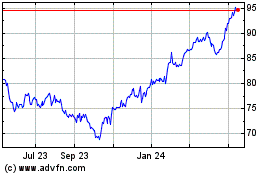

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Dec 2024 to Jan 2025

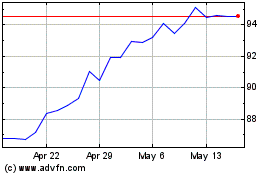

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Jan 2024 to Jan 2025